Business

DOGE, XRP Get ETFs. Token Traders Say ‘Meh:’ Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)

The SEC, as market regulator, now couldn’t be more pro-crypto if it tried! On Thursday, a spot ETF tied to one of the least «serious” cryptocurrencies — dogecoin (DOGE) — debuted in the U.S. alongside payments-focused XRP.

Unlike bitcoin (BTC), ether (ETH) and stablecoins, which act as a stores of value and facilitate decentralized finance, memecoins like DOGE are driven entirely by tweets, and cult-like fandom, just like baseball or pro-wrestling cards. Some observers are understandably worried that wrapping such an asset in an ETF gives it a false veneer of legitimacy, putting investors at risk.

You might call this the “peak pro-crypto SEC” moment, when regulators become so friendly that even memecoins get their own institutional wrapper. And, coincidentally, peak liquidity moment too, because when cash flows freely, traders get more adventurous. That’s one reason why the Fed may need to go slow with rate cuts.

The crypto market seems unimpressed. DOGE dropped over 2% in 24 hours, a sharp contrast to 2021, when a single tweet from Elon Musk could send it skyrocketing. The entire meme token gang is taking a hit; names like M, PUMP, and TOSHI are down nearly 10% in the same period.

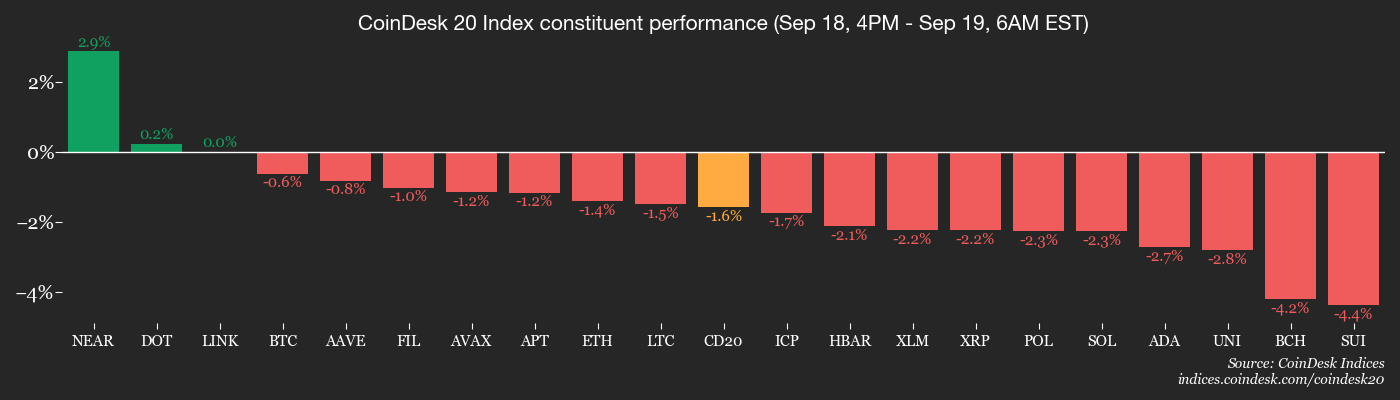

XRP isn’t getting off easily either, falling 2%. Bitcoin and ether remain under pressure too, with traders aggressively seeking downside protection in the options market. The CoinDesk 20 Index was 1.3% lower at press time.

In other news, Consensys CEO reportedly said a Metamask token is arriving sooner than expected. Popular newsletter writer Christine Kim relayed that Ethereum’s Fusaka upgrade is scheduled for Dec. 3. This upgrade bundles multiple Ethereum Improvement Proposals focused on enhancing data availability and reducing costs for layer-2 rollups.

Meanwhile, traditional markets aren’t making it easy for crypto bulls. The dollar index and Treasury yields edged higher. The Bank of Japan stayed put on rates, with two dissenters signaling hikes in the coming months. The central bank announced the gradual selling of ETFs to slim its bloated balance sheet. Stay alert!

What to Watch

- Crypto

- Sept. 19: Grayscale Digital Large Cap Fund, which became the Grayscale CoinDesk Crypto 5 ETF on Sept. 18, will uplist to the NYSE Arca Exchange and start trading under the ticker GDLC.

- Macro

- Sept. 19, 8:30 a.m.: Canada July retail sales YoY Est. N/A (Prev. 6.6%), MoM (final) Est. -0.8%.

- Sept. 19 (after market close): Quarterly S&P 500, 400 and 600 rebalancing takes effect, adding Robinhood (HOOD).

- Earnings (Estimates based on FactSet data)

- None scheduled.

Token Events

- Governance votes & calls

- Gnosis DAO is voting on a $40,000 pilot growth fund using conviction voting on Gardens to empower GNO holders and support small, community-led ecosystem initiatives. Voting ends Sept. 23.

- Balancer DAO is voting on an ecosystem roadmap and funding plan through Q2 2026. It sets growth, revenue, innovation and governance targets and requests $2.87 million in USDC and 166,250 BAL to fund initiatives. Voting ends Sept. 23.

- Unlocks

- Sept. 20: Velo (VELO) to unlock 13.63% of its circulating supply worth $43.39 million.

- Token Launches

- Sept. 19, 9 a.m.: Enosys set to introduce XRP-backed stablecoin to Flare

- Sept. 19: Lombard (BARD) to be listed on Poloniex.

- Sept. 20: Reserve Rights (RSR) to conduct a token burn.

Conferences

- Day 3 of 3: AIBC 2025 (Tokyo, Japan)

- Day 4 of 4: EDCON 2025 (Osaka, Japan)

- Sept. 19: DEF-AI 2025 (Tblisi, Georgia)

Token Talk

By Oliver Knight

- Aster, the native token of its namesake decentralized exchange, rose 33% in the past 24 hours to contribute a 650% gain since it was issued earlier this week.

- The token was touted on X by Binance founder Changpeng Zhao, who claims the token is a direct competitor to HyperLiquid’s HYPE.

- Nearly 330,000 wallets used Aster ahead of a series of exchange listings for the token, with daily trading volume hitting $420 million.

- The platform’s introduction hasn’t been without controversy, one of the Aster team members had to say «funds are safe» on Discord in response to concerns about whether funds could be withdrawn.

- It is also claimed that Aster is just a rebrand of Apollox, a decentralized perpetuals exchange that has been around for years.

- Nonetheless, the platform has proven attractive in the past 24 hours and is considered by some traders as a viable alternative to HyperLiquid, whose token has a market cap of $18.7 billion compared with Aster’s $1 billion.

Derivatives Positioning

- AVAX is the only top 20 cryptocurrency to boast an increase in perpetual futures open interest over the past 24 hours. The rest of the coins have seen flat to negative OI, a sign of capital outflows.

- According to data source Glassnode, 5,000 BTC in long positions is vulnerable to liquidation if the price drops below $117,000. There is also a build up of short positions at higher price levels, representing a sell-on-rise mentality.

- Most majors, excluding LINK, DOT and TRX, have seen net selling in futures, as evidenced by their negative 24-hour cumulative volume deltas. This indicates the possibility of a sharp drop in altcoins later today alongside a growing risk aversion on Wall Street.

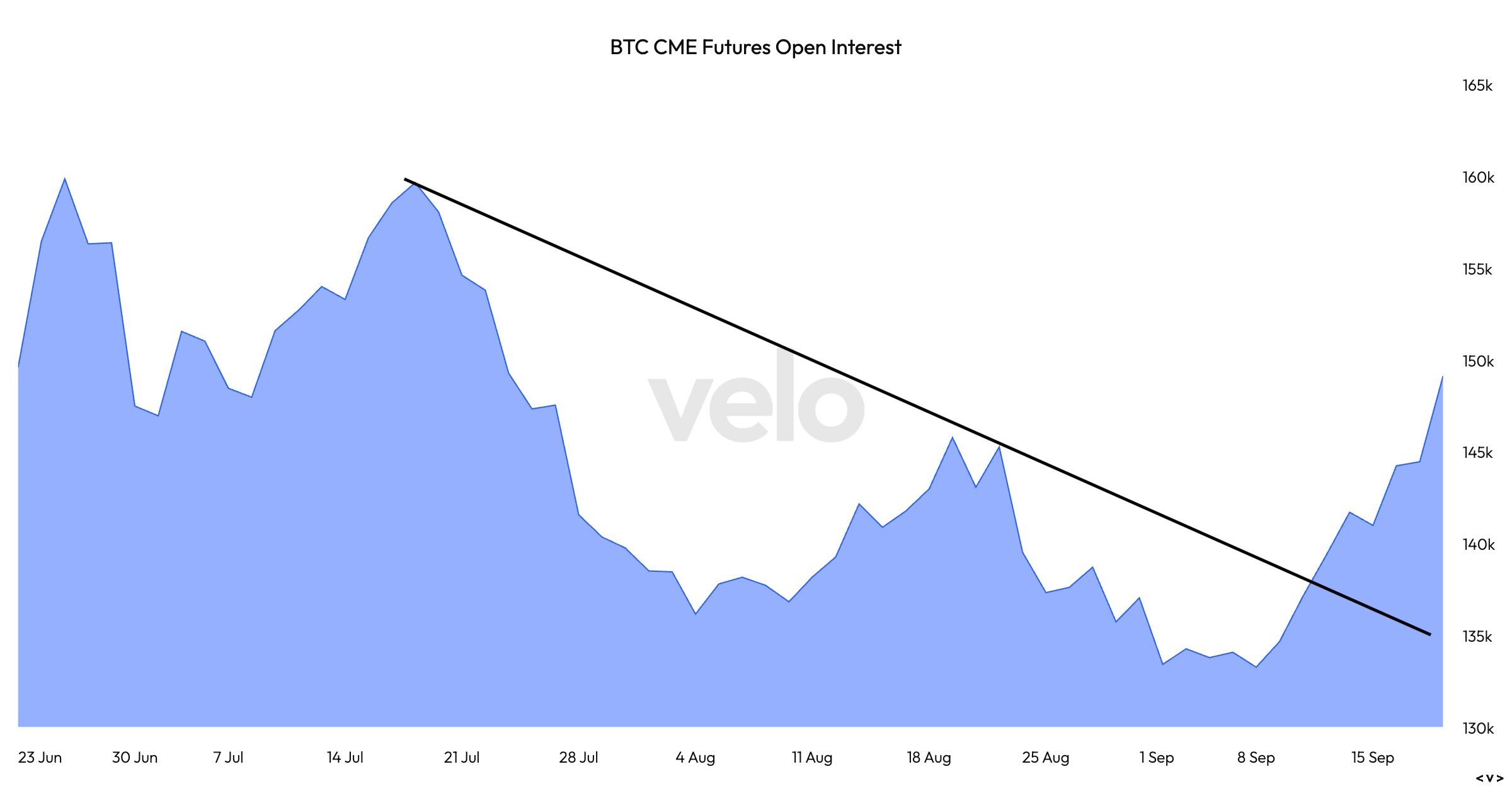

- On the CME, bitcoin futures OI has bounded to 149K BTC, ending a two-month downtrend. (Check the Technical Analysis section). Perhaps, fresh shorts are coming in, as the annualized three-month premium remains below 10% and looks to be trending south. Ether’s futures OI has risen back above 2 million ETH.

- On Deribit, traders continue to chase put options tied to BTC in a sign of lingering downside concerns. Flows over OTC network Paradigm featured calendar spreads and put writing.

Market Movements

- BTC is down 0.9% from 4 p.m. ET Thursday at $116,531.51 (24hrs: -0.61%)

- ETH is down 1.81% at $4,523.65 (24hrs: -1%)

- CoinDesk 20 is down 1.82% at 4,334.77 (24hrs: -1.27%%)

- Ether CESR Composite Staking Rate is up 3 bps at 2.92%

- BTC funding rate is at 0.0042% (4.5651% annualized) on Binance

- DXY is up 0.24% at 97.58

- Gold futures are up 0.34% at $3,690.80

- Silver futures are up 0.86% at $42.48

- Nikkei 225 closed down 0.57% at 45,045.81

- Hang Seng closed unchanged at 26,545.10

- FTSE is up 0.06% at 9,233.88

- Euro Stoxx 50 is up 0.14% at 5,464.39

- DJIA closed on Thursday up 0.27% at 46,142.42

- S&P 500 closed up 0.48% at 6,631.96

- Nasdaq Composite closed up 0.94% at 22,470.72

- S&P/TSX Composite closed up 0.45% at 29,453.53

- S&P 40 Latin America closed down 0.75% at 2,906

- U.S. 10-Year Treasury rate is up 1.4 bps at 4.118%

- E-mini S&P 500 futures are unchanged at 6,693.75

- E-mini Nasdaq-100 futures are unchanged at 24,709.50

- E-mini Dow Jones Industrial Average Index are unchanged 46,503.00

Bitcoin Stats

- BTC Dominance: 57.92% (+0.31%)

- Ether-bitcoin ratio: 0.03879 (-1.01%)

- Hashrate (seven-day moving average): 991 EH/s

- Hashprice (spot): $52.08

- Total fees: 3.69 BTC / $432,583

- CME Futures Open Interest: 149,110 BTC

- BTC priced in gold: 31.9 oz.

- BTC vs gold market cap: 9.03%

Technical Analysis

- Open interest in BTC futures listed on the CME has surged from 133K to 149K BTC, ending a two-month downtrend.

- The change shows renewed capital inflows into the market, although the direction of the flows remains unclear.

Crypto Equities

- Coinbase Global (COIN): closed on Thursday at $343.13 (+7.04%), -0.62% at $341.00 in pre-market

- Circle (CRCL): closed at $140.42 (+7.16%), +2.53% at $143.97

- Galaxy Digital (GLXY): closed at $33.08 (+0.21%), -1.75% at $32.50

- Bullish (BLSH): closed at $65.61 (+20.72%), -2.85% at $63.74

- MARA Holdings (MARA): closed at $18.5 (+6.69%), -0.65% at $18.38

- Riot Platforms (RIOT): closed at $17.51 (-0.62%), -0.69% at $17.39

- Core Scientific (CORZ): closed at $16.75 (+2.95%), -0.12% at $16.73

- CleanSpark (CLSK): closed at $13.46 (+17.66%), -1.26% at $13.29

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $41.1 (-0.12%), -1.41% at $40.52

- Exodus Movement (EXOD): closed at $29.26 (+3.61%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $349.12 (+5.89%), unchanged in pre-market

- Semler Scientific (SMLR): closed at $29.49 (+6.54%), unchanged in pre-market

- SharpLink Gaming (SBET): closed at $17.22 (+0.58%), -0.41% at $17.15

- Upexi (UPXI): closed at $6.82 (+12.08%), -1.03% at $6.75

- Lite Strategy (LITS): closed at $2.71 (+3.83%), +3.69% at $2.81

ETF Flows

Spot BTC ETFs

- Daily net flows: $163 million

- Cumulative net flows: $57.46 billion

- Total BTC holdings ~1.32 million

Spot ETH ETFs

- Daily net flows: $213.1 million

- Cumulative net flows: $13.89 billion

- Total ETH holdings ~6.6 million

Source: Farside Investors

While You Were Sleeping

- XRP and DOGE ETFs Smash Records with $54.7M Combined Day-One Volume (CoinDesk): Rex-Osprey’s XRP ETF debuted with $37.7 million in trading, the year’s largest ETF launch. The dogecoin fund ranked in the top five with $17 million.

- Bitcoin Traders Buy More Downside Protection After Fed Rate Cut: Deribit (CoinDesk): Bitcoin traders continue to eye downside volatility, hedging their bullish exposure despite recent positive signals, such as the Federal Reserve’s rate cut, according to Deribit CEO Luuk Strijers.

- ARK Doubles Down on Solmate, Buys $162M of Shares After Funding SOL Treasury Purchase (CoinDesk): Cathie Wood’s ARK bought 6.5 million Solmate (BREA) shares across three ETFs after taking part in the firm’s $300 million raise to fund its Solana (SOL) treasury strategy.

- Gilts Fall as Deficit Numbers Highlight U.K.’s Fiscal Woes (Bloomberg): The U.K.’s budget deficit hit 18 billion pounds ($24 billion) in August, the highest for the month in five years, pushing 10-year bond yields to 4.71% and weakening sterling.

Business

Crypto Exchange Ripio Reveals $100M Crypto Treasury, Second Largest in Latin America

The company’s holdings, which include bitcoin and ether, have been managed through trading and hedging strategies since 2017.

Business

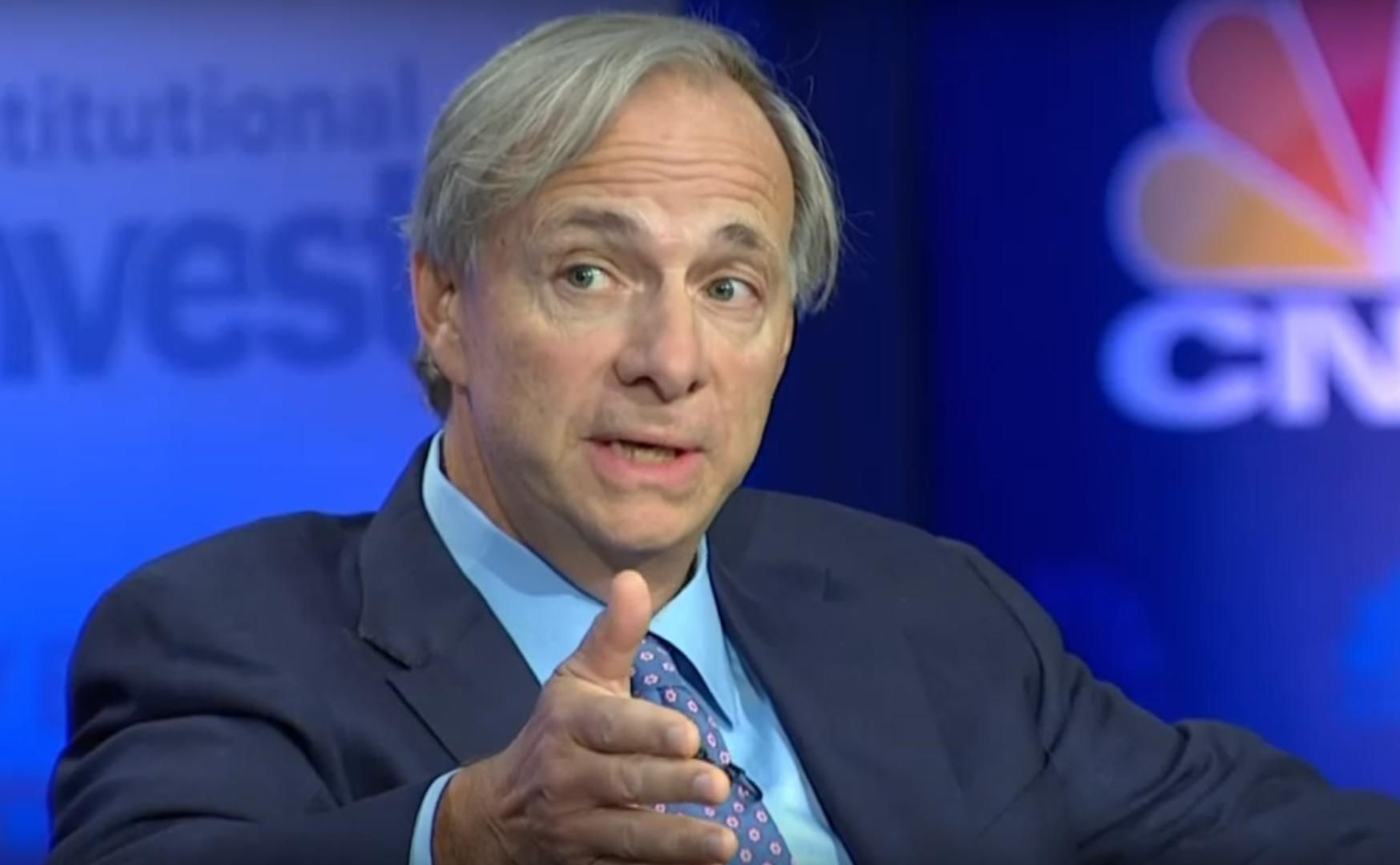

Ray Dalio Still Owns Bitcoin, but Says Traceability and Quantum Threat Are Concerns

The billionaire founder of hedge fund Bridgewater believes Bitcoin faces major hurdles before it can become a global reserve currency.

Business

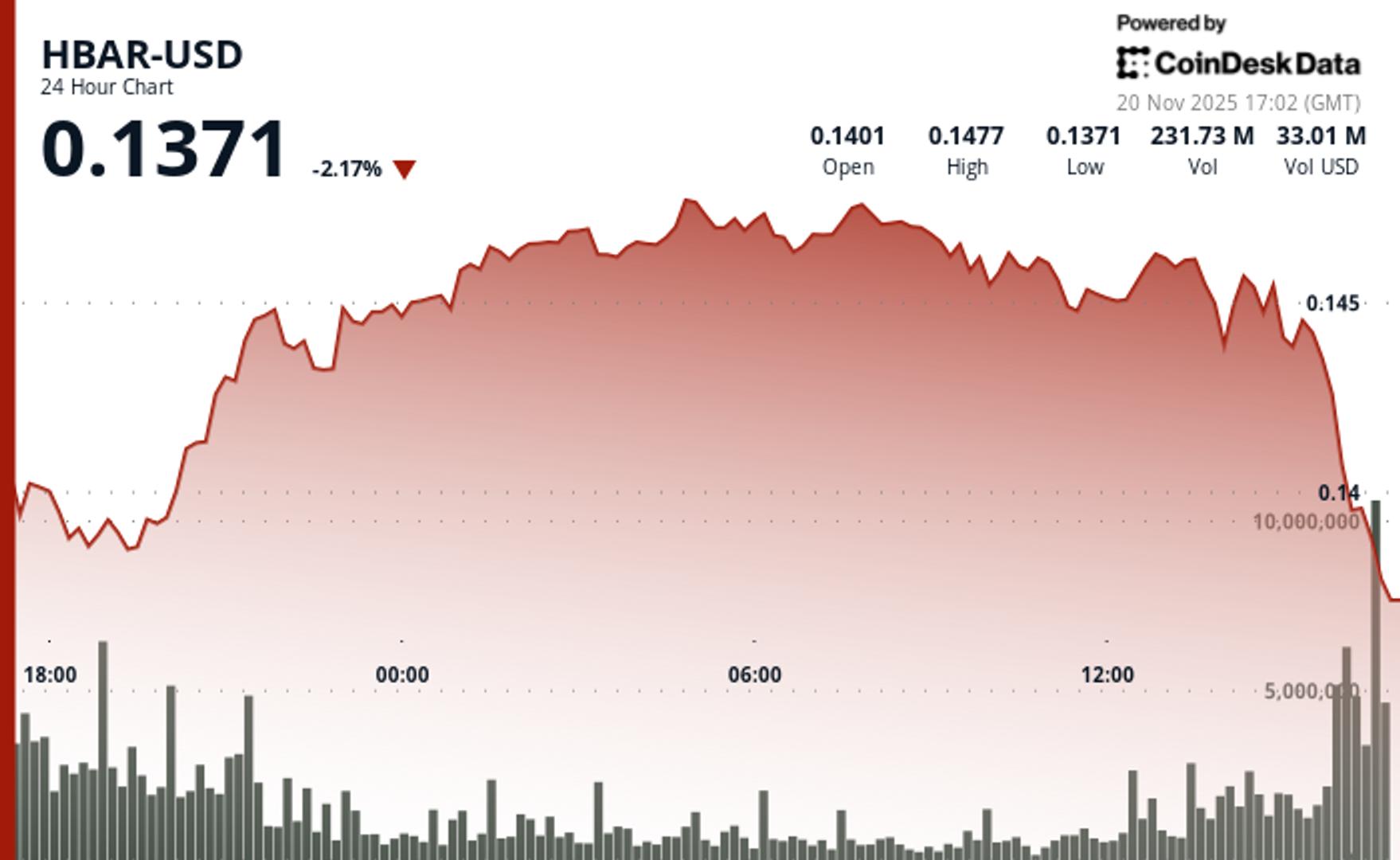

HBAR Faces Fresh Liquidity Alarms After Breakdown to $0.1373

Hedera’s token slipped below key support levels as a late-session trading halt, collapsing volume, and failed recovery attempts point to mounting structural and liquidity stress.

-

Uncategorized5 месяцев ago

Uncategorized5 месяцев agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business1 год ago

Business1 год ago3 Ways to make your business presentation more relatable

-

Fashion1 год ago

Fashion1 год agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment1 год ago

Entertainment1 год ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment1 год ago

Entertainment1 год ago10 Artists who retired from music and made a comeback

-

Business1 год ago

Business1 год ago15 Habits that could be hurting your business relationships

-

Entertainment1 год ago

Entertainment1 год agoNew Season 8 Walking Dead trailer flashes forward in time

-

Entertainment1 год ago

Entertainment1 год agoMeet Superman\’s grandfather in new trailer for Krypton