Uncategorized

Crypto’s Market Penetration Tipping Point

The digital assets market has transformed from a niche experiment into a global force reshaping finance, commerce, and technology. In May 2025, the global crypto market is valued at $3.05 trillion, growing at a pace on par with the internet boom in the 90s.

A look at the growth curve

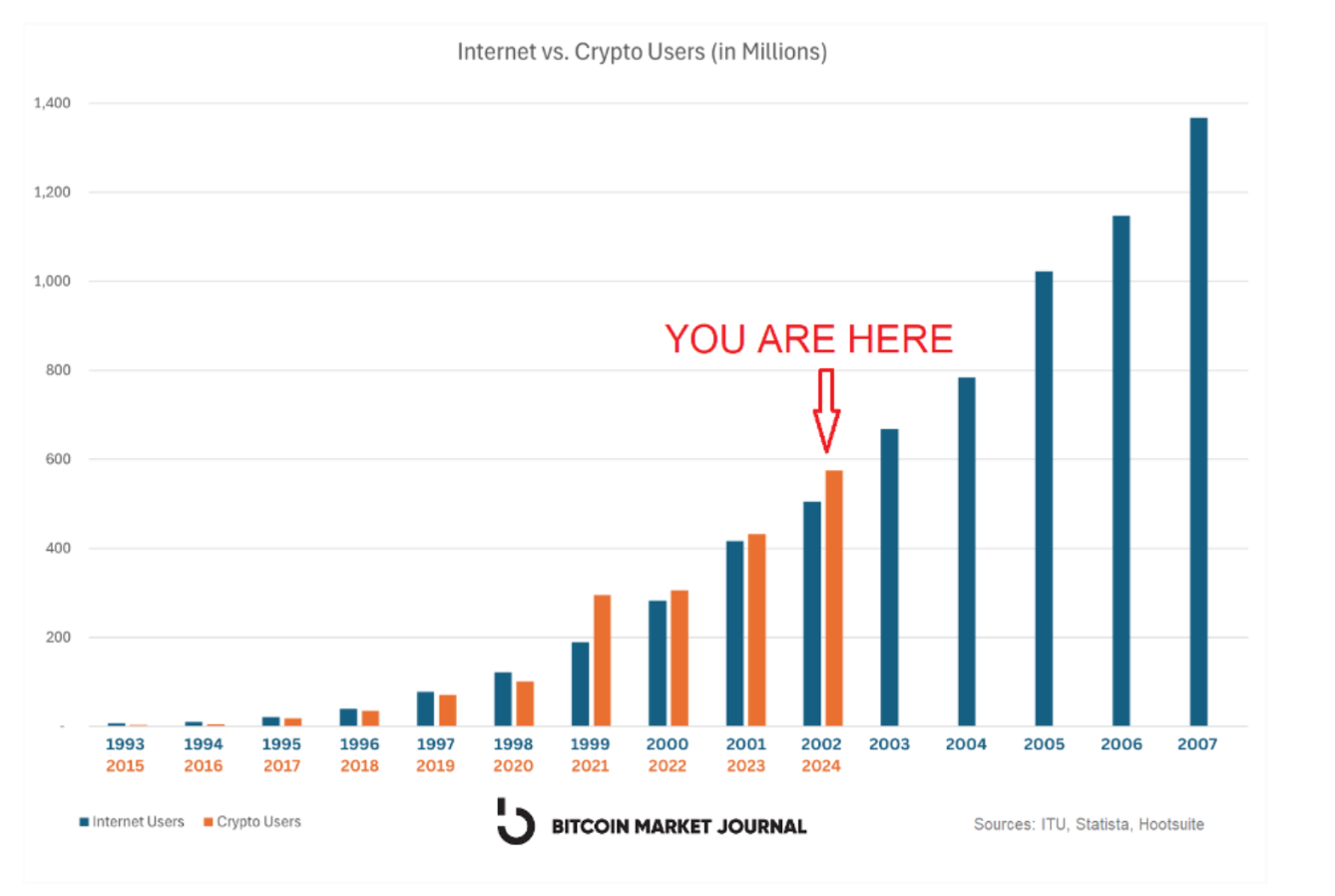

Historical adoption curves for technologies like the internet and smartphones demonstrate that 10% penetration often marks a tipping point, after which growth accelerates exponentially due to network effects and mainstream acceptance. Digital assets are now on this trajectory, driven by rising user adoption, institutional investment and innovative use cases. After years of public uncertainty, a pivotal milestone may be achieved this year: cryptocurrency user penetration can surpass the critical 10% threshold, estimated to reach 11.02% globally in 2025 by Statista, up from 7.41% in 2024.

The chart below compares the early user adoption curves of cryptocurrency and the internet. It highlights that crypto is growing at a significantly faster rate than the internet did in its early years.

The 10% threshold: a catalyst for exponential growth

With crypto expected to cross the 10% threshold of adoption in 2025, it is important to note that the 10% mark is not arbitrary —- it’s a well-documented tipping point in technology diffusion, rooted in Everett Rogers’ diffusion of innovations theory. This model shows that adoption shifts from early adopters (13.5%) to the early majority (34%) at around 10–15% penetration, marking the transition from niche to mainstream.

Crossing 10% market penetration triggers rapid growth as infrastructure, accessibility and social acceptance align. Two very recent examples of this are the smartphone and the internet.

For cryptocurrencies, surpassing 10% penetration in 2025 would signal a similar inflection point, with network effects amplifying adoption — more users increase liquidity, merchant acceptance and developer activity, making crypto more practical for everyday transactions like payments and remittances.

In the U.S., 28% of adults (approximately 65 million people) own cryptocurrencies in 2025, nearly doubling from 15% in 2021. Additionally, 14% of non-owners plan to enter the market this year, and 66% of current owners intend to buy more, reflecting significant momentum. Globally, two out of three American adults are familiar with digital assets, signaling a sharp departure from its earlier speculative reputation. These figures underscore the growing mainstream acceptance of digital assets, aligning with the post-10% adoption surge observed in other transformative technologies.

Crypto’s economic impact spans remittances, cross-border trade, and financial inclusion, particularly in Africa and Asia, where it empowers the unbanked.

Drivers of accelerated penetration

Several factors are propelling crypto past the 10% threshold:

- Blockchain technology: Its transparency and security support remittances, supply chain tracking, and fraud prevention, with Ethereum handling over 1.5 million daily transactions.

- Financial inclusion: Crypto enables financial access for unbanked populations, especially in Africa and Asia, via mobile and fintech platforms.

- Regulatory clarity: Pro-crypto policies in the UAE, Germany, and El Salvador (where bitcoin is legal tender) boost adoption, though uncertainty in India and China poses challenges.

- AI integration: Nearly 90 AI-based crypto tokens in 2024 enhance blockchain functionality for governance and payments.

- Economic instability: Crypto’s role as a hedge against inflation drives adoption in markets like Brazil ($90.3 billion in stablecoin transactions) and Argentina ($91.1 billion).

Institutional and business adoption

Institutional and business involvement is accelerating digital assets’ mainstream integration. Major financial players like BlackRock and Fidelity are going all in on crypto services and have launched crypto exchange-traded funds (ETFs), with 72 ETFs awaiting SEC approval in 2025.

Businesses are adopting crypto payments to cut fees and reach global customers, particularly in retail and e-commerce. Examples include Burger King in Germany accepting bitcoin since 2019 and PayPal’s 2024 partnership with MoonPay for U.S. crypto purchases. Platforms like Coinbase Commerce and Triple-A, alongside partnerships like Ingenico and Crypto.com, enable merchants to accept crypto with local currency settlements, reducing volatility risks.

DeFi activity has increased significantly in Sub-Saharan Africa, Latin America, and Eastern Europe. In Eastern Europe, DeFi accounted for over 33% of total crypto received, with the region placing third globally in year-over-year DeFi growth.

Challenges and acceleration ahead

Despite its momentum, digital assets face hurdles:

- Volatility: Crypto is a very volatile asset, often too volatile for institutional investors.

- Security concerns: Hacks, lost private keys and third party risks all contribute to uncertainty among investors.

- Regulatory scrutiny: Despite a very friendly U.S. government stance toward crypto and increasingly tolerant governments around the world, there are questions about how crypto will be treated across jurisdictions, specifically as they relate to securities.

Still, the trajectory is promising.

Bullish sentiment and crypto-friendly regulators, coupled with ETF momentum and payment integrations, underscore this trajectory. If innovation continues to balance out with trust, digital assets are likely to follow the internet and smartphone playbook — and grow even faster.

Uncategorized

Ether Surges Toward $3K on Tentative U.S.–China Trade Pact and Soft U.S. CPI Report

Ether (ETH) ETH drifted around $2,770 for most of Tuesday until roughly 8 p.m. ET, when officials said negotiators in London had forged a draft U.S.–China trade framework. The outline — till awaiting presidential approval — would see Beijing resume rare-earth exports while Washington eases curbs on advanced-technology sales.

At 8:04 a.m. ET on Wednesday, former U.S. president Donald Trump posted on Truth Social that “OUR DEAL WITH CHINA IS DONE,” pending his and President Xi’s formal approval. Trump claimed the accord would leave U.S. tariffs on Chinese imports effectively at 55 percent versus Beijing’s 10 percent, promised that China would front-load supplies of magnets and other rare-earth materials, and said Washington would uphold concessions such as continued access for Chinese students to American universities, describing the bilateral relationship as “excellent.”

Hopes for a thaw in the multi-year tariff dispute sparked an initial risk-on bid: global equity futures firmed, bitcoin ticked higher and ether pushed to about $2,780 on expanding spot turnover.

Risk appetite intensified eleven hours later, around 8:30 a.m. ET on Wednesday, after the U.S. Labor Department reported that May headline and core CPI each rose just 0.1 percent month on month, undercutting economists’ 0.2 percent forecasts. The cooler print fueled expectations the Federal Reserve could trim rates later this year, driving Treasury yields and the dollar lower while extending gains in equities.

Against that macro backdrop, ether vaulted from the upper-$2,780s to an intraday high of $2,873.46, with spot volume swelling to roughly 527,000 coins (~$1.47 billion), according to CoinDesk Research’s technical analysis model.

Structural tailwinds remain strong. Staked ETH climbed to a record 34.65 million tokens (≈28.7 percent of supply), exchange-traded funds logged a 16-day inflow streak near $900 million, and futures open interest printed a fresh high above $21.7 billion — all underscoring steady institutional engagement. BlackRock’s reported $500 million accumulation over the past ten days exemplifies that theme.

Traders now look for a decisive close above $2,900 to open a potential run at the psychological $3,000 mark, while guarding against a pullback toward the newly established $2,750–$2,760 support band.

Technical Analysis Highlights

- Trend: Series of higher lows since June 9 and a fresh higher high at $2,873 confirm an accelerating up-channel.

- Volume confirmation: CPI-triggered candle printed the day’s largest bar (≈527 K ETH), validating Tuesday’s breakout above $2,800.

- Support / resistance: Immediate support sits at $2,750–$2,760; upside targets are $2,900 and the psychological $3,000 zone, followed by a secondary hurdle near $3,120.

- Momentum: Hourly RSI holds above 60, indicating room to extend before overbought conditions emerge.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

Digital Assets Are One Step Closer to Regulatory Clarity

The United States is on the brink of a new technological frontier – one powered by blockchain and digital assets. These assets are not just the next phase of the internet, but lay the foundation for a more secure, decentralized, and inclusive financial future. From reimagining global payments to protecting data privacy, the potential of blockchain-based systems is endless.

Despite the promise of this technology, the United States remains without a clear, comprehensive federal regulatory framework for digital assets. This absence has created uncertainty for innovators, consumers and investors alike.

Entrepreneurs operating in the digital asset operating in the digital asset space face ambiguous rules and unclear jurisdictional boundaries between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Investors lack the transparency and protection they deserve. Under the Biden Administration, the SEC chose to regulate through enforcement, rather than through clear guidance or collaboration. The agency’s approach has led to lawsuits, confusion, and the offshoring of promising American companies seeking regulatory certainty abroad.

For years, Congress has worked under both Republican and Democratic leadership to close this gap and create a tailored, modern regulatory framework. That work reached a milestone in May 2024 when the U.S. House of Representatives passed the Financial Innovation and Technology for the 21st Century (FIT21) Act with bipartisan support as 71 Democrats voted in favor of the bill. FIT21 laid the groundwork for how digital assets should be treated under U.S. law, clarified the roles of the CFTC and SEC, and provided pathways for registration, disclosure, and compliance.

This Congress, we are building on that momentum and continue to push for smart, tailored policy that fosters innovation while protecting consumers.

In April, the House Financial Services Committee passed the bipartisan STABLE Act, which would establish a clear and comprehensive set of rules for the issuance and regulation of payment stablecoins that have the potential to modernize the way we transact by making payments faster, cheaper, and more inclusive.

Yesterday, we took another major step forward. The Financial Services Committee and the House Agriculture Committee passed the CLARITY Act, a landmark bipartisan bill that was carefully crafted between our committees. The CLARITY Act establishes a functional framework for the classification of digital assets, provides builders and firms with clear regulatory obligations, and ensures robust consumer protections against fraud and bad actors.

The STABLE and CLARITY Acts form the most comprehensive digital asset regulatory framework Congress has ever advanced. Collectively, these bills will ensure that the United States sets the global standard for the future of digital assets.

We are committed to working with our colleagues in both chambers to enact comprehensive digital asset legislation into law. The rest of the world is not waiting to lead in blockchain innovation. If we fail to act, we risk ceding leadership in one of the most transformative technologies in modern history.

Congress has the opportunity and responsibility to establish a regulatory framework that unlocks the next era of American innovation. It is time for the United States to lead in the new digital frontier.

Uncategorized

Stripe to Acquire Crypto Wallet Startup Privy in Bid to Expand Web3 Capabilities

Stripe is acquiring crypto wallet infrastructure provider Privy, as part of its broader plan to make blockchain tools easier to integrate into mainstream digital products.

Privy creates embedded wallets for apps and websites, sparing users from having to sign up for external crypto wallets like MetaMask. Terms of the transaction, which was first reported by Bloomberg and confirmed by Privy, weren’t disclosed.

The firm’s technology is used by decentralized exchange Hyperliquid, restaurant loyalty firm Blackbird, and HR platform Toku to simplify onboarding and reduce user drop-off.

Privy revealed that since it was launched in 2021, it has grown to power over 75 million accounts across over 1,000 teams “enabling billions in transactions across wallets, apps, and users.”

The New York-based firm has raised over $40 million from investors including Paradigm, Coinbase, and Sequoia Capital, according to data from TheTie.

The acquisition comes after Stripe purchased Bridge, a stablecoin infrastructure firm, for $1.1 billion. That deal led to Stripe launching stablecoin-funded accounts, enabling businesses to hold and move funds abroad using tokens like USDC.

Privy will continue to operate independently but will be integrated into Stripe’s suite of crypto tools.The acquisition is expected to close in the coming weeks.

-

Business8 месяцев ago

Business8 месяцев ago3 Ways to make your business presentation more relatable

-

Entertainment8 месяцев ago

Entertainment8 месяцев ago10 Artists who retired from music and made a comeback

-

Fashion8 месяцев ago

Fashion8 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment8 месяцев ago

Entertainment8 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Business8 месяцев ago

Business8 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Tech8 месяцев ago

Tech8 месяцев ago5 Crowdfunded products that actually delivered on the hype

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time