Uncategorized

Crypto’s Estate Planning Problem: A Wake-Up Call

As 2024 draws to a close, cryptocurrency stands at a turning point. Bitcoin has crossed the $100,000 mark and digital assets have solidified their place in investment portfolios of all sizes. Yet, amid these milestones, a critical, yet overlooked issue remains: the estate planning challenges unique to cryptocurrency and other digital assets.

A Looming Crisis: Estate Planning in a Digital Era

Unlike traditional assets, cryptocurrencies and digital assets operate outside established estate planning frameworks. Their decentralized nature, reliance on private keys, and pseudonymity make them revolutionary. Butwithout proper planning, crypto holdings can be lost forever, become embroiled in legal disputes, or heavily taxed.

This vulnerability is not hypothetical. Chainalysis reports that nearly 20% of all bitcoin is lost or stranded, much of it likely due to the misplacement of private keys or owners dying without a plan for the now-valuable assets transferring to their heirs. As billions of dollars in digital wealth continues to accumulate, the risks tied to inadequate planning grow exponentially.

With the Tax Cuts and Jobs Act (TCJA) of 2017 set to sunset in 2025, legal frameworks surrounding wealth transfer may undergo significant changes (while Congress appears likely to act, it is not assured). For cryptocurrency holders, this moment represents both a wake-up call and an opportunity to reassess their plans to protect and pass on digital assets to future generations.

2025 Tax Law Changes: A Catalyst for Action

The TCJA temporarily doubled the federal estate, gift, and generation-skipping transfer (GST) tax exemptions, allowing individuals to transfer up to $13.99 million, tax-free, in 2025. Without new legislation, however, these exemptions will revert to approximately $7 million per individual on January 1, 2026 (adjusted for inflation). This reduction will subject a greater share of estates to federal taxes, making planning for cryptocurrency even more urgent.

Additionally, the IRS’s new reporting requirements for digital assets, which will go into effect on January 1, 2025, will increase reporting requirements and scrutiny. Pursuant to the Inflation Reduction Act of 2022, Congress has allocated billions of dollars to the IRS, including a bolstering of the agency’s staff and an increased focus on the pursuit of crypto enforcement.

Legal Strategies for Cryptocurrency Estate Planning

To address these challenges and seize opportunities before the tax law changes, cryptocurrency holders should consider these strategies:

1. Draft Digital Asset-Specific Estate Plans

Traditional wills and trusts often fall short when dealing with cryptocurrency. Comprehensive estate plans must create a succession plan, including instructions for accessing private keys, wallets, and recovery phrases (without creating security vulnerabilities). A secure, regularly updated inventory of digital assets is critical to ensure heirs can locate, access and manage holdings effectively.

2. Capitalize on Gift Exclusions and Lifetime Gifting

With the current high exemption levels, now is the time to transfer digital assets out of taxable estates. Gifting cryptocurrency to heirs or placing it in irrevocable trusts can lock in tax savings before exemptions are reduced in 2026. Charitable remainder trusts also allow for tax-advantaged transfers, benefiting both heirs and philanthropic causes.

Additionally, the annual gift tax exclusion will rise to $19,000 per recipient in 2025. Married couples can gift up to $38,000 per recipient tax-free. Regular use of these exclusions allows incremental reductions of taxable estates over time.

3. Embrace Multi-Signature Wallets and Collaborative Custody

Strategic use of multi-signature wallets and collaborative custody can enhance both security and estate planning. By collaborating with multiple parties (such as an executor and trusted family members) to authorize transactions, these wallets prevent unauthorized access while ensuring heirs can access funds when needed.

4. Move Digital Assets to LLCs or Establish Asset Protection Trusts

Placing cryptocurrency in an LLC and transferring ownership to a trust can shield assets from creditors and legal claimants. This structure also bypasses probate courts, ensuring a smoother transition to heirs while safeguarding wealth from lawsuits or creditor claims.

5. Stay Ahead of Regulatory Changes

The IRS’s rules on cryptocurrency transactions are rapidly evolving and will demand more meticulous record-keeping and compliance measures. Sophisticated tools and legal and accounting expertise will be crucial to navigate this environment and ensure tax-efficient wealth transfers.

Looking Forward to 2025

This year underscored the transformative potential of cryptocurrency as an investment class — but also exposed its vulnerabilities. Estate planning remains an afterthought for many crypto holders, even as the value of digital assets climbs and tax law changes loom on the horizon. For 2025, the crypto community must confront these realities. Regulators, estate planners, accountants, financial advisors and investors alike need to prioritize creating and implementing solutions that address the unique challenges of the rise of digital wealth.

A Call to Action

The close of 2024 is not just a moment to celebrate cryptocurrency’s successes but also a chance to prepare for its future. By taking proactive steps now — whether through establishing estate plans, creating trusts, or implementing gifting strategies — investors can secure their digital wealth and pass it on as a lasting legacy.

As the saying goes, failing to plan is planning to fail. For cryptocurrency holders, 2025 offers a rare window to act decisively before tax laws change and vulnerabilities deepen. The time to protect your digital fortune is now.

This article is for informational purposes only and does not constitute legal, tax or financial advice. Consult with qualified professionals for personalized guidance.

Uncategorized

Ethereum Surges After Holding $2,477, Fueled by Very Heavy Trading Volume

Global economic tensions and trade disputes continue to influence cryptocurrency markets, with ETH showing resilience despite broader market uncertainty.

The second-largest cryptocurrency is currently navigating a critical technical zone between $2,500-$2,530, which analysts identify as immediate resistance that must be overcome for continued upward movement.

Institutional interest remains strong, with spot Ethereum ETFs recording consecutive days of positive inflows, signaling growing confidence from larger investors despite the recent volatility.

Technical Analysis Highlights

- 24-hour ETH price action revealed a substantial 3.5% range ($99.85).

- Sharp sell-off during midnight hour saw price plummet to $2,477.40, establishing a key support zone.

- Extraordinary volume (291,395 units, nearly 3x average) confirmed the significance of the support level.

- Buyers stepped in at the $2,467-$2,480 support band, confirmed by high-volume accumulation during the 08:00-09:00 period.

- Recent price action shows bullish momentum with ETH reclaiming the $2,515 level.

- Potential higher low pattern suggests the correction may have found its bottom.

- $2,520-$2,530 area remains the immediate resistance to overcome for continued upward movement.

- Significant bullish surge at 13:35 saw price jump from $2,515.85 to $2,521.79, accompanied by exceptional volume (5,839 units).

- Sharp reversal occurred at 14:00, with price dropping 5.07 points to $2,508.02 on heavy volume (4,043 units).

- Hourly range of 14.46 points ($2,508.02-$2,522.48) demonstrates market indecision.

External References

- «Ethereum Holds Above Key Prices – Data Points To $2,900 Level As Bullish Trigger«, NewsBTC, published May 24, 2025.

- «Ethereum Forms Inverse H&S – Bulls Eye Breakout Above $2,700 Level«, Bitcoinist, published May 25, 2025.

- «Ethereum Price Analysis: Is ETH Primed for a ‘Healthy’ Correction?«, CryptoPotato, published May 25, 2025.

Uncategorized

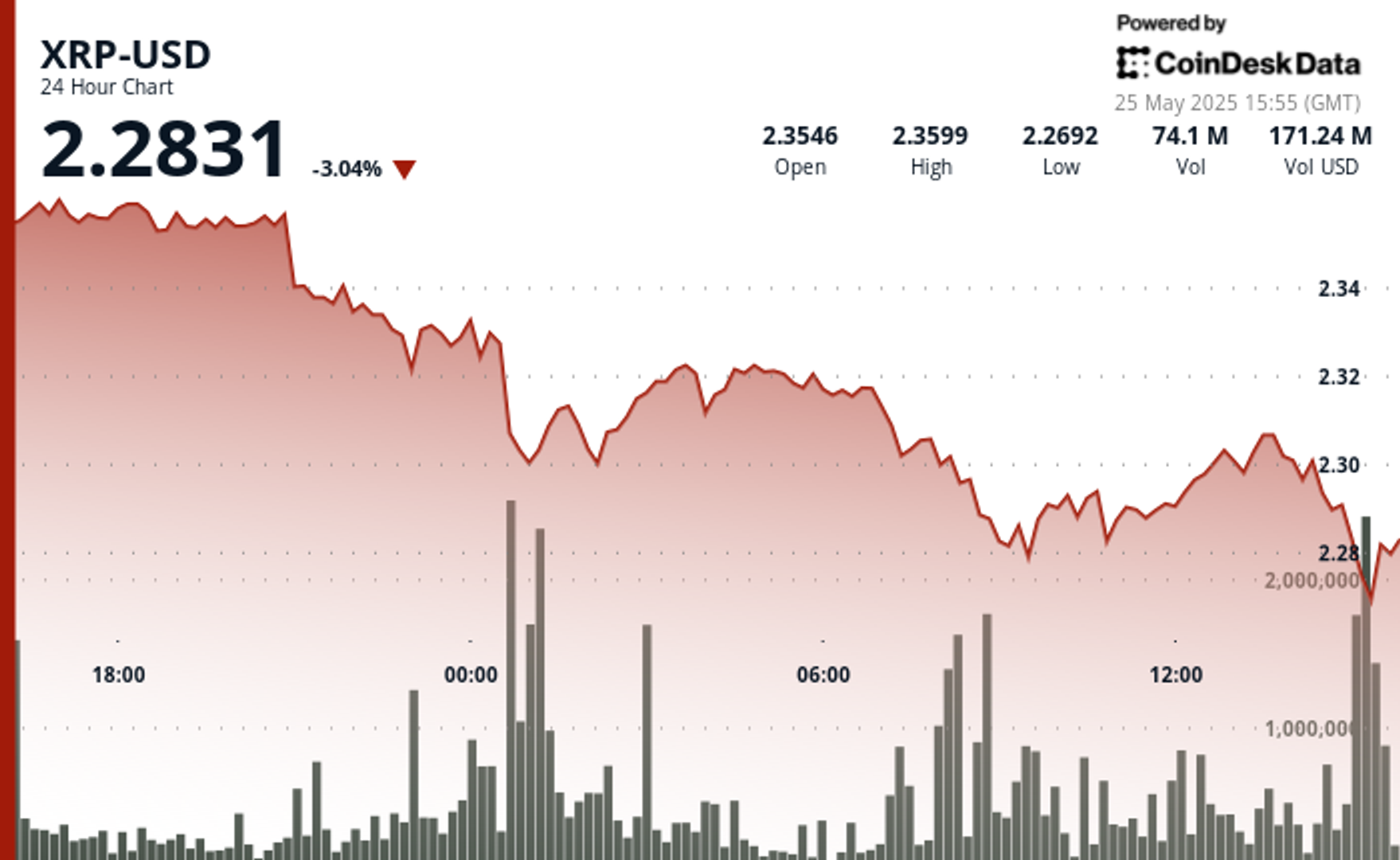

XRP Plunges Below $2.30 Amid Heavy Selling Pressure

Global economic tensions are weighing heavily on cryptocurrency markets as XRP experiences a significant correction amid heavy selling pressure.

The recent announcement of potential 50% tariffs on European Union imports by the US government has triggered widespread market uncertainty, with XRP falling alongside most major cryptocurrencies despite Bitcoin recently reaching new all-time highs.

Technical analysts point to critical support at the $2.25-$2.26 range, with market watchers warning that a break below this level could trigger deeper corrections toward the $1.55-$1.90 zone.

Meanwhile, institutional interest remains strong with Volatility Shares launching an XRP futures ETF and leveraged ETF inflows surging despite the price dip, suggesting Wall Street continues accumulating positions during market weakness.

Technical Analysis Highlights

- XRP underwent a notable 3.46% correction over the 24-hour period, with price declining from $2.361 to $2.303, creating an overall range of $0.084 (3.57%).

- The most significant price action occurred during the midnight hour (00:00), when XRP plummeted to $2.297 on exceptionally high volume (37.1M), establishing a strong volume-based support zone.

- A secondary sell-off at 08:00 saw price touch the period low of $2.280 with the highest volume spike (39.9M), confirming a double-bottom formation.

- In the last hour, XRP experienced significant volatility with a recovery attempt following the earlier correction.

- After reaching a low of $2.297 at 13:11, price formed a base around $2.298 before staging a substantial rally beginning at 13:27, peaking at $2.307 at 13:36-13:39 with exceptionally high volume (627K-480K).

- This bullish momentum created a clear resistance zone at $2.307, which was tested multiple times.

- The final 15 minutes saw profit-taking pressure emerge, with price retracing to $2.300, establishing a short-term support level that aligns with the psychological $2.30 threshold.

External References

- «XRP Price Watch: Consolidation or Collapse? Market Holds Breath Near $2.35«, Bitcoin.com News, published May 24, 2025.

- «XRP Price Prediction For May 25«, CoinPedia, published May 25, 2025.

- «XRP Risks Fall To $1.55 If This Support Level Fails – Analyst«, NewsBTC, published May 25, 2025.

Uncategorized

Bitcoin Drops Below $107.5K as Trump Tariff Threat Triggers Crypto Sell-Off

Bitcoin’s recent pullback has established strong volume-based resistance near $108,300, with support forming in the $106,700-$107,000 zone.

The correction accelerated with a notable price surge from $107,373 to $107,671 between 13:06-13:36, followed by a sharp reversal.

Technical analysis suggests Bitcoin is now trading within a compression zone, trapped between two major fair value gaps that will determine the upcoming market direction.

If bulls reclaim the $109K to $110K area, price could push toward resistance beyond $112K, while a break below $107,000 might test liquidity around $106K.

Technical Analysis Breakdown

- The decline accelerated during the 22:00-23:00 hour on May 24th with exceptionally high volume (16,335 BTC), establishing a strong volume-based resistance near $108,300.

- Support has formed in the $106,700-$107,000 zone where buyers emerged during the 09:00-10:00 period on May 25th, though recovery attempts have been modest with price consolidating around $107,500.

- The overall technical structure suggests a short-term bearish trend with potential for further consolidation before directional clarity emerges.

- Bitcoin experienced significant volatility with a notable price surge from $107,373 to $107,671 between 13:06-13:36, followed by a sharp reversal that saw prices decline to $107,393 by 14:00.

- The most substantial price movement occurred during the 13:35 minute candle where BTC jumped nearly $150 with exceptionally high volume (148.76 BTC), establishing temporary resistance around $107,630.

- Support formed near $107,400 where buyers emerged during the final minutes of the period, though the overall technical structure suggests continued consolidation within the broader correction from the $109,239 high.

External References

- «Bitcoin Price Prediction for May 25: Will Bulls Defend $108K or Is a Deeper Drop Ahead?«, Coin Edition, published May 24, 2025.

- «Why is Bitcoin Price Dropping Now? Will BTC Price Go Down to $100K?«, CoinPedia, published May 24, 2025.

- «Bitcoin Price Analysis: BTC Displays Signs of Weakness Following New All-Time High«, CryptoPotato, published May 25, 2025.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors