Uncategorized

Crypto for Advisors: Trump: What’s Changed for Crypto?

As the Trump administration appears to fully embrace digital assets in the U.S., there are plenty of reasons to be optimistic about crypto’s future, but also many areas of uncertainty.

In today’s issue, Beth Haddock from Warburton Advisers takes us through the first 30 days of Trump’s term and analyzes the far-reaching impact his administration could have on the crypto industry.

Then, DJ Windle from Windle Wealth answers questions you may have from the article in Ask and Expert.

30 Days of Trump: What’s Changed for Crypto?

A year ago, skepticism and stalled policy progress stunted crypto’s growth. Trump’s election win has shifted the Overton window (referring to the change in political policies that people are willing to accept) on crypto’s acceptance, but will that lead to sustainable growth and regulatory clarity?

His January 23 Executive Order (EO) addressing crypto prioritizes «responsible growth,» a shift from President Biden’s 2022 EO focused on «responsible development.» Early actions — rescinding SAB 121, ending Operation Chokepoint 2.0, pardoning Ross Ulbricht and appointing new leaders — signal change.

One month in, progress is clear, but obstacles remain. A divided Congress, slow legislation and market speculation — seen in memecoins like $TRUMP and $MELANIA — complicate the path forward. The key question: Are we just moving past FTX, or will crypto be recognized as critical to Web3 innovation?

Three Key Trends to Watch

1. Acceleration of Product Innovation

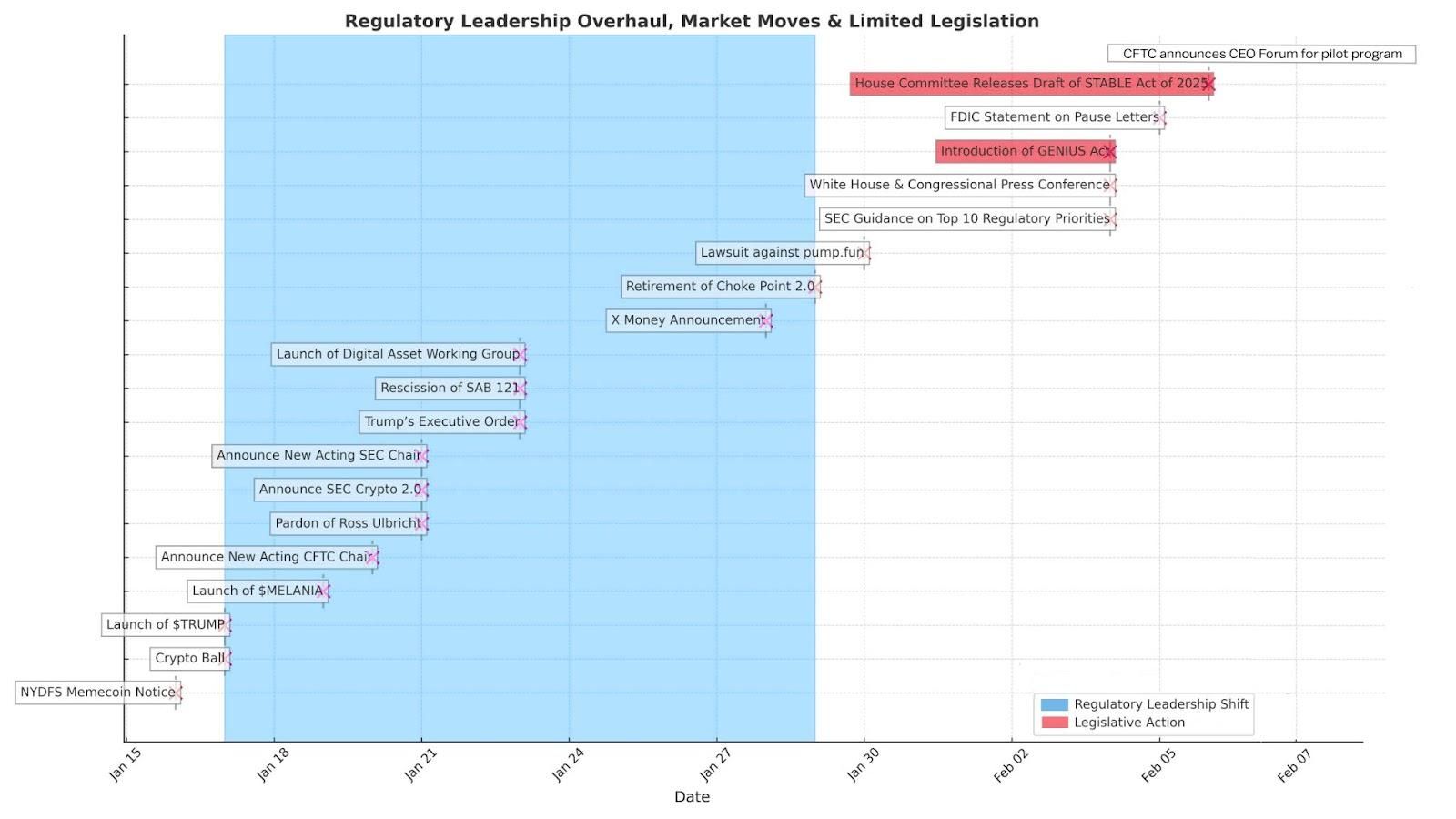

The chart above clearly illustrates the Trump administration’s early focus on leadership changes and rollbacks of enforcement-driven policies. With regulatory enforcement easing, U.S. crypto development no longer needs to wait — or move offshore.

The SEC’s Crypto 2.0 initiative, led by Commissioner Peirce, shifts from enforcement-first policies to a new Crypto Taskforce. Meanwhile, the President’s Working Group on Digital Asset Markets, chaired by crypto advocate David Sacks, signals a more supportive stance. These shifts create space for innovation, allowing blockchain to prove its value before regulations catch up.

Key areas for progress include stablecoin regulation, clearer digital asset custody requirements, hybrid TradFi-crypto products (such as expected Solana and ETH ETFs) and global payments advancements through partnerships like those with X Money and Visa. Resolving complex policy priorities will take time, as reflected in a16z’s 11 priorities and the Crypto Bar’s open letter, highlighting the breadth of influential voices.

As adoption grows, the network effect of successful crypto products will push for consensus-driven regulation. But without meaningful legislative action, the industry risks a return to uncertainty when Washington’s leadership inevitably shifts again.

2. Speculation vs. Sustainable Growth

Amid all this optimism, crypto still struggles to establish credibility and prove itself as a force for responsible innovation. The opportunity to revolutionize finance is here — but is market speculation part of the growth or is it hindering sustainable growth?

Memecoins like $TRUMP and $MELANIA surged just before the inauguration, reflecting demand for high-risk, culturally driven assets, while also raising regulatory concerns about volatility and integrity. The class action lawsuit against pump.fun underscores skepticism of growth untethered to sustainable utility.

To maintain credibility, crypto must distinguish real-world and potential wealth creation applications from speculative assets. Fraud and misrepresentation remain illegal, whether in memecoins, penny stocks or collectibles. As the market evolves, businesses and investors must prioritize due diligence to separate hype from lasting potential.

3. The Urgent Need for Regulatory Clarity

Despite leadership changes, there remains an urgent need for clear, enforceable crypto regulation. Key unresolved issues include:

Addressing fraud and consumer protections without stifling innovation and decentralized finance

Defining digital asset regulatory authority among agencies

Establishing fit-for-purpose AML frameworks for stablecoins and other innovations

With crypto-friendly leaders now at the SEC and CFTC, regulatory progress is likely, but legislative action will take time. While Congress is considering proposals like the GENIUS Act, the STABLE Act, and new rules for market structure, pragmatic change isn’t guaranteed this year.

For now, the industry must keep shifting the Overton window toward recognizing crypto’s role in U.S. tech leadership, public policy and economic security. Until comprehensive laws emerge, regulatory leadership — seen with the CFTC pilot program and recent Federal Reserve speech — must guide a stable path for growth.

The Path Forward

This year is pivotal — not just because toxic policies are fading and leadership has shifted, but because momentum is driving Web3 and blockchain forward.

The goal isn’t just «responsible growth» but sustainable growth anchored in regulatory clarity. If the industry balances innovation with strong protections against fraud and theft, crypto’s resilience and credibility will be strengthened. With tech-neutral regulations, the U.S. won’t just lead in crypto and AI policy — we’ll also be ready for whatever else is next, from quantum computing to future breakthroughs. Sustainable innovation matters because technological progress is inevitable.

—Beth Haddock, managing partner and founder, Warburton Advisers

Ask an Expert

Q: Who is Ross Ulbricht?

A: Ross Ulbricht created Silk Road, an early bitcoin-powered marketplace that demonstrated crypto’s potential for decentralized commerce — both legally and illegally. His life sentence became a rallying cry in the crypto community, with many arguing it was excessive and highlighting broader debates on financial privacy and government control. His recent pardon has reignited discussions on justice reform and crypto’s role in the future of digital trade.

Q: What are the risks of memecoins?

A: Memecoins like $TRUMP and $MELANIA are highly speculative, with prices driven more by social media hype than real utility. While they can generate quick profits, they also carry extreme volatility and risks of manipulation. Many lack long-term viability, so investors should approach them with caution and avoid putting more in them than they can afford to lose.

Q: How could state bitcoin investments impact adoption?

A: If states allocate reserves to bitcoin, it could legitimize crypto as a store of value, encouraging institutional investors and policymakers to take it more seriously. This could accelerate regulatory clarity, enhance calls for clearer tax guidelines and integrate bitcoin into broader financial infrastructure, helping solidify its role in the economy.

—DJ Windle, founder and portfolio manager, Windle Wealth

Keep Reading

Abu Dhabi’s sovereign wealth fund, Mubadala, has invested approximately $437 million into BlackRock’s bitcoin ETF.

Google looks to simplify bitcoin adoption with wallet integration alongside existing authentication protocols.

FTX’s initial $1.2 billion payout is underway, with creditors with claims of less than $50,000 starting to receive payouts.

Business

Strategy Bought $27M in Bitcoin at $123K Before Crypto Crash

Strategy (MSTR), the world’s largest corporate owner of bitcoin (BTC), appeared to miss out on capitalizing on last week’s market rout to purchase the dip in prices.

According to Monday’s press release, the firm bought 220 BTC at an average price of $123,561. The company used the proceeds of selling its various preferred stocks (STRF, STRK, STRD), raising $27.3 million.

That purchase price was well above the prices the largest crypto changed hands in the second half of the week. Bitcoin nosedived from above $123,000 on Thursday to as low as $103,000 on late Friday during one, if not the worst crypto flash crash on record, liquidating over $19 billion in leveraged positions.

That move occurred as Trump said to impose a 100% increase in tariffs against Chinese goods as a retaliation for tightening rare earth metal exports, reigniting fears of a trade war between the two world powers.

At its lowest point on Friday, BTC traded nearly 16% lower than the average of Strategy’s recent purchase price. Even during the swift rebound over the weekend, the firm could have bought tokens between $110,000 and $115,000, at a 7%-10% discount compared to what it paid for.

With the latest purchase, the firm brought its total holdings to 640,250 BTC, at an average acquisition price of $73,000 since starting its bitcoin treasury plan in 2020.

MSTR, the firm’s common stock, was up 2.5% on Monday.

Business

HBAR Rises Past Key Resistance After Explosive Decline

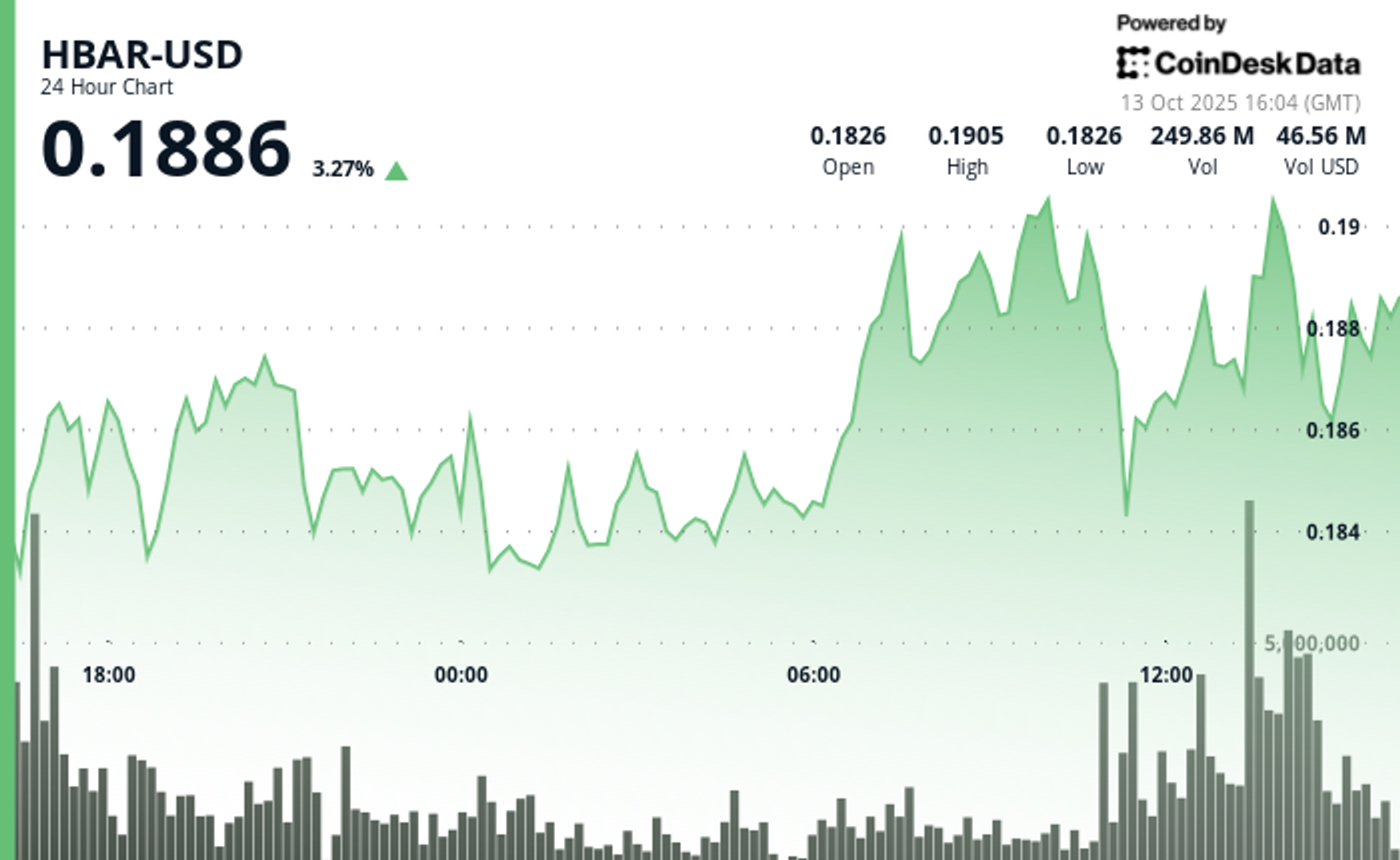

HBAR (Hedera Hashgraph) experienced pronounced volatility in the final hour of trading on Oct. 13, soaring from $0.187 to a peak of $0.191—a 2.14% intraday gain—before consolidating around $0.190.

The move was driven by a dramatic surge in trading activity, with a standout 15.65 million tokens exchanged at 13:31, signaling strong institutional participation. This decisive volume breakout propelled the asset beyond its prior resistance range of $0.190–$0.191, establishing a new technical footing amid bullish momentum.

The surge capped a broader 23-hour rally from Oct. 12 to 13, during which HBAR advanced roughly 9% within a $0.17–$0.19 bandwidth. This sustained upward trajectory was characterized by consistent volume inflows and a firm recovery from earlier lows near $0.17, underscoring robust market conviction. The asset’s ability to preserve support above $0.18 throughout the period reinforced confidence among traders eyeing continued bullish action.

Strong institutional engagement was evident as consecutive high-volume intervals extended through the breakout window, suggesting renewed accumulation and positioning for potential continuation. HBAR’s price structure now shows resilient support around $0.189–$0.190, signaling the possibility of further upside if momentum persists and broader market conditions remain favorable.

Technical Indicators Highlight Bullish Sentiment

- HBAR operated within a $0.017 bandwidth (9%) spanning $0.174 and $0.191 throughout the previous 23-hour period from 12 October 15:00 to 13 October 14:00.

- Substantial volume surges reaching 179.54 million and 182.77 million during 11:00 and 13:00 sessions on 13 October validated positive market sentiment.

- Critical resistance materialized at $0.190-$0.191 thresholds where price movements encountered persistent selling activity.

- The $0.183-$0.184 territory established dependable support through volume-supported bounces.

- Extraordinary volume explosion at 13:31 registering 15.65 million units signaled decisive breakout event.

- High-volume intervals surpassing 10 million units through 13:35 substantiated significant institutional engagement.

- Asset preserved support above $0.189 despite moderate profit-taking activity.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Business

Crypto Markets Today: Bitcoin and Altcoins Recover After $500B Crash

The crypto market staged a recovery on Monday following the weekend’s $500 billion bloodbath that resulted in a $10 billion drop in open interest.

Bitcoin (BTC) rose by 1.4% while ether (ETH) outperformed with a 2.5% gain. Synthetix (SNX, meanwhile, stole the show with a 120% rally as traders anticipate «perpetual wars» between the decentralized trading venue and HyperLiquid.

Plasma (XPL) and aster (ASTER) both failed to benefit from Monday’s recovery, losing 4.2% and 2.5% respectively.

Derivatives Positioning

- The BTC futures market has stabilized after a volatile period. Open interest, which had dropped from $33 billion to $23 billion over the weekend, has now settled at around $26 billion. Similarly, the 3-month annualized basis has rebounded to the 6-7% range, after dipping to 4-5% over the weekend, indicating that the bullish sentiment has largely returned. However, funding rates remain a key area of divergence; while Bybit and Hyperliquid have settled around 10%, Binance’s rate is negative.

- The BTC options market is showing a renewed bullish lean. The 24-hour Put/Call Volume has shifted to be more in favor of calls, now at over 56%. Additionally, the 1-week 25 Delta Skew has risen to 2.5% after a period of flatness.

- These metrics indicate a market with increasing demand for bullish exposure and upside protection, reflecting a shift away from the recent «cautious neutrality.»

- Coinglass data shows $620 million in 24 hour liquidations, with a 34-66 split between longs and shorts. ETH ($218 million), BTC ($124 million) and SOL ($43 million) were the leaders in terms of notional liquidations. Binance liquidation heatmap indicates $116,620 as a core liquidation level to monitor, in case of a price rise.

Token Talk

By Oliver Knight

- The crypto market kicked off Monday with a rebound in the wake of a sharp weekend leverage flush. According to data from CoinMarketCap, the total crypto market cap climbed roughly 5.7% in the past 24 hours, with volume jumping about 26.8%, suggesting those liquidated at the weekend are repurchasing their positions.

- A total of $19 billion worth of derivatives positions were wiped out over the weekend with the vast majority being attributed to those holding long positions, in the past 24 hours, however, $626 billion was liquidated with $420 billion of that being on the short side, demonstrating a reversal in sentiment, according to CoinGlass.

- The recovery has been tentative so far; the dominance of Bitcoin remains elevated at about 58.45%, down modestly from recent highs, which implies altcoins may still lag as capital piles back into safer large-cap names.

- The big winner of Monday’s recovery was synthetix (SNX), which rose by more than 120% ahead of a crypto trading competition that will see it potentially start up «perpetual wars» with HyperLiquid.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton