Uncategorized

Crypto for Advisors: Trends in Tokenizing Real-World Assets

Thank you to our sponsor of this week’s newsletter, Grayscale. For financial advisors near Chicago, Grayscale is hosting an exclusive event, Crypto Connect, on Thursday, May 22. Learn more.

In today’s Crypto for Advisors, Tedd Strazimiri from Evolve ETFs writes about the evolution of tokenization and the value it brings to investors.

Then, Peter Gaffney from Inveniam answers questions about what tokenization can do for wealth managers and their clients in Ask an Expert.

The Tokenization Boom: Why Ethereum Remains the Rails for Real-World Asset Tokenization

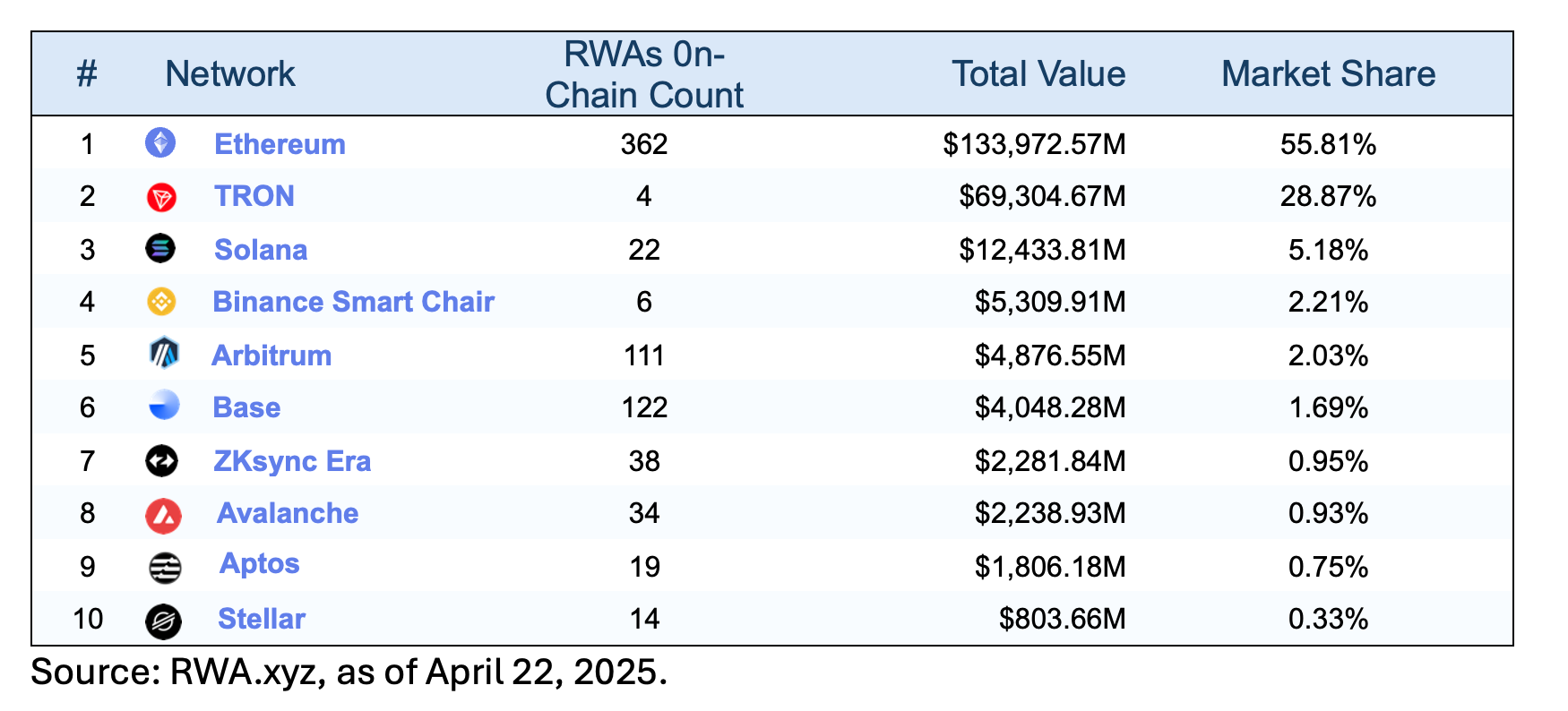

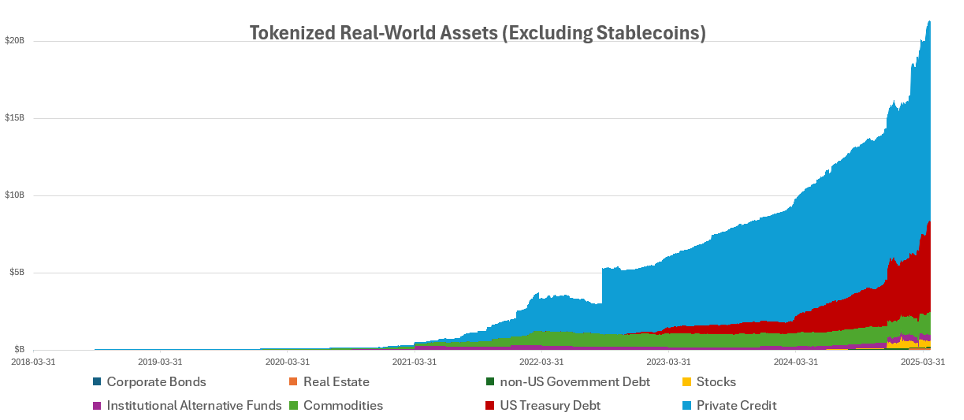

The tokenization of real-world assets (RWAs) has moved beyond buzzword status to become a multi-billion-dollar reality, led by Ethereum. Of the more than $250 billion in tokenized assets, Ethereum commands approximately 55% of the market. From stablecoins and U.S. Treasuries to real estate, private credit, commodities and equities, Ethereum has emerged as the preferred blockchain infrastructure for institutions aiming to bridge traditional finance with the digital asset world.

Why tokenization matters

At its core, tokenization is the process of converting ownership rights in RWAs into digital tokens that live on a blockchain. This transformation introduces unprecedented efficiencies in settlement speed, liquidity and accessibility. Tokenized assets can be traded 24/7, settled instantly and fractionalized to reach a broader range of investors. For institutions, tokenization reduces costs tied to custody, middlemen and manual processes, while offering transparency and programmability.

But while tokenization is a trend that can take root across multiple blockchains, Ethereum’s dominance is no accident. Its established infrastructure, widespread developer ecosystem and proven security have made it the go-to platform for major players entering the space.

Ranked: Blockchain Networks Supporting RWA Tokenization

BlackRock’s BUIDL and the rise of institutional tokenization

One of the best examples of institutional adoption of tokenization is BlackRock’s BUIDL, a tokenized U.S. Treasury fund built on Ethereum. Launched in early 2024, BUIDL allows investors to access U.S. Treasuries via blockchain, offering real-time settlement and transparency into holdings. The fund has rapidly scaled to over $2.5 billion in assets under management, securing a 41% market share in the tokenized U.S. Treasury space. Ethereum remains the dominant chain for tokenized Treasuries, accounting for 74% of the $6.2 billion tokenized US treasuries market. BUIDL isn’t just a product; it’s a signal that TradFi sees Ethereum as the backbone of the next financial era.

Stablecoins: the foundation layer

No discussion of tokenization is complete without stablecoins. U.S. dollar-pegged assets like USDC and USDT represent the vast majority (95%) of all tokenized assets. Stablecoins alone account for more than $128 billion of Ethereum’s tokenized economy1 and serve as the primary medium of exchange across DeFi, cross-border settlements and remittance platforms.

In many developing economies, like Nigeria or Venezuela, stablecoins provide access to the U.S. dollar without needing a bank. Whether shielding savings from inflation or enabling seamless international trade, stablecoins show the real-world value of tokenized dollars, backstopped by the Ethereum network.

Tokenized Stocks and beyond

Tokenized stocks on Ethereum represent a growing but still nascent segment of the tokenized asset space. These digital assets mirror the price of real-world equities and ETFs, offering 24/7 trading, fractional ownership, global accessibility and instant settlement. Key benefits include increased liquidity, lower transaction costs and democratized access to markets traditionally limited by geography or account type. Popular tokenized stocks include Nvidia, Coinbase and MicroStrategy, as well as ETFs like SPY. As regulatory clarity improves, tokenized equities on Ethereum could reshape how investors access and trade stocks, especially in underserved or emerging markets.

Additionally, real estate, private credit, commodities and even art are finding their way onto Ethereum in tokenized formats, proving the chain’s adaptability for diverse asset classes.

Tokenized RWAs (excluding Stablecoins)

Source: RWA.xyz, as of April 22, 2025.

Conclusion

Ethereum’s dominance in tokenized assets isn’t just about being first — it’s about being built for permanence. As the infrastructure underpinning real-world asset tokenization matures, Ethereum’s role as the financial layer of the internet becomes more pronounced. While newer chains like Solana will carve out niches in the space, Ethereum continues to be the platform where regulation meets innovation, and where finance finds its next form.

— Tedd Strazimiri, product research associate, Evolve ETFs

Ask an Expert

Q. What are the value drivers of tokenization for a wealth manager?

A. The tokenization of assets should come with newfound utility. Financial advisors, wealth managers and other fiduciaries already have access to a wide universe of investment products. Where tokenization adds value is through the infrastructure emerging around tokenized real-world assets, particularly applications enabling the collateralization and margining of asset-backed tokens.

Blockchain-based data management systems, like Inveniam, are designed to enable real-time, asset-level reporting to facilitate private asset-backed stablecoin loans, with the same integrity and traceability that exists elsewhere in the crypto space. This allows legacy private asset classes — like real estate and credit — to function similarly to how $30 billion in crypto loans are currently collateralized on platforms like Aave. This new utility is a significant value-add and a differentiating service factor that advisors can offer clients beyond traditional crypto allocations.

Q. How does tokenization help advisors achieve their portfolio management goals?

A. Alongside benefits like collateralization, advisors also gain greater control over client portfolio allocations through second-order tokenization benefits. Many investment funds across private equity, hedge funds, private credit and commercial real estate have high minimum investment requirements and illiquid secondary trading activity. This “set it and forget it” mentality leads to inefficient portfolio management, in which advisors either overallocate or underallocate due to the “lumpiness” of the underlying asset.

By contrast, tokenized funds can be fractionalized far more efficiently than existing offerings, meaning advisors can buy in at much lower minimums, such as $10,000 increments, versus millions of dollars at a time. Then as client preferences, positions and portfolios shift, advisors can reallocate accordingly, making use of secondary liquidity venues and ongoing low-minimum subscriptions. This improves an advisor’s ability to meet client demands and achieve return targets without being inhibited by outdated practices.

— Peter Gaffney, director of DeFi & digital trading, Inveniam

Keep Reading

- SEC Commissioner Hester Peirce stated that “tokenization is a technology that could significantly impact financial markets.

- New Hampshire makes history and becomes the first U.S. state to bring into law state investment in bitcoin and digital assets.

- Morgan Stanley is developing plans to offer direct crypto trading on its E*Trade platform by 2026.

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Gemini Shares Slide 6%, Extending Post-IPO Slump to 24%

Gemini Space Station (GEMI), the crypto exchange founded by Cameron and Tyler Winklevoss, has seen its shares tumble by more than 20% since listing on the Nasdaq last Friday.

The stock is down around 6% on Tuesday, trading at $30.42, and has dropped nearly 24% over the past week. The sharp decline follows an initial surge after the company raised $425 million in its IPO, pricing shares at $28 and valuing the firm at $3.3 billion before trading began.

On its first day, GEMI spiked to $45.89 before closing at $32 — a 14% premium to its offer price. But since hitting that high, shares have plunged more than 34%, erasing most of the early enthusiasm from public market investors.

The broader crypto equity market has remained more stable. Coinbase (COIN), the largest U.S. crypto exchange, is flat over the past week. Robinhood (HOOD), which derives part of its revenue from crypto, is down 3%. Token issuer Circle (CRCL), on the other hand, is up 13% over the same period.

Part of the pressure on Gemini’s stock may stem from its financials. The company posted a $283 million net loss in the first half of 2025, following a $159 million loss in all of 2024. Despite raising fresh capital, the numbers suggest the business is still far from turning a profit.

Compass Point analyst Ed Engel noted that GEMI is currently trading at 26 times its annualized first-half revenue. That multiple — often used to gauge whether a stock is expensive — means investors are paying 26 dollars for every dollar the company is expected to generate in sales this year. For a loss-making company in a volatile sector, that’s a steep price, and could be fueling investor skepticism.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars