Uncategorized

Crypto for Advisors: Crypto Universe

In today’s Crypto for Advisors, Fabian Dori, Chief Investment Officer at Sygnum Bank, explores why crypto is more than just an asset class and looks at the institutional adoption of decentralized finance.

Then, Abhishek Pingle, co-founder of Theo, answers questions about how risk-adverse investors can approach decentralized finance and what to look for in Ask an Expert.

Crypto Is Not an Asset Class — It’s an Asset Universe

Moody’s recently warned that public blockchains pose a risk to institutional investors. At the same time, U.S. bitcoin ETFs are drawing billions in inflows. We’re seeing the start of a long-awaited shift in institutional adoption. But crypto’s real potential lies far beyond passive bitcoin exposure. It’s not just an asset class — it’s an asset universe, spanning yield-generating strategies, directional plays, and hedge fund-style alpha. Most institutions are only scratching the surface of what’s possible.

Institutional investors may enhance their risk-return profile by moving beyond a monolithic view of crypto and recognizing three distinct segments: yield-generating strategies, directional investments, and alternative strategies.

Like traditional fixed income, yield-generating strategies offer limited market risk with low volatility. Typical strategies range from tokenized money market funds that earn traditional yields to approaches engaging with the decentralized crypto finance ecosystem, which deliver attractive returns without traditional duration or credit risk.

These crypto yield strategies may boast attractive Sharpe ratios, rivalling high-yield bonds’ risk premia but with different mechanics. For example, returns can be earned from protocol participation, lending and borrowing activities, funding rate arbitrage strategies, and liquidity provisioning. Unlike bonds that face principal erosion in rising rate environments, many crypto yield strategies function largely independently of central bank policy and provide genuine portfolio diversification precisely when it’s most needed. However, there is no such thing as a free lunch. Crypto yield strategies entail risks, mainly centered around the maturity and security of the protocols and platforms a strategy engages with.

The path to institutional adoption typically follows three distinct approaches aligned with different investor profiles:

- Risk-averse institutions begin with yield-generating strategies that limit direct market exposure while capturing attractive returns. These entry points enable traditional investors to benefit from the unique yields available in the crypto ecosystem without incurring the volatility associated with directional exposure.

- Mainstream institutions often adopt a bitcoin-first approach before gradually diversifying into other assets. Starting with bitcoin provides a familiar narrative and established regulatory clarity before expanding into more complex strategies and assets.

- Sophisticated players like family offices and specialized asset managers explore the entire crypto ecosystem from the outset and build comprehensive strategies that leverage the full range of opportunities across the risk spectrum.

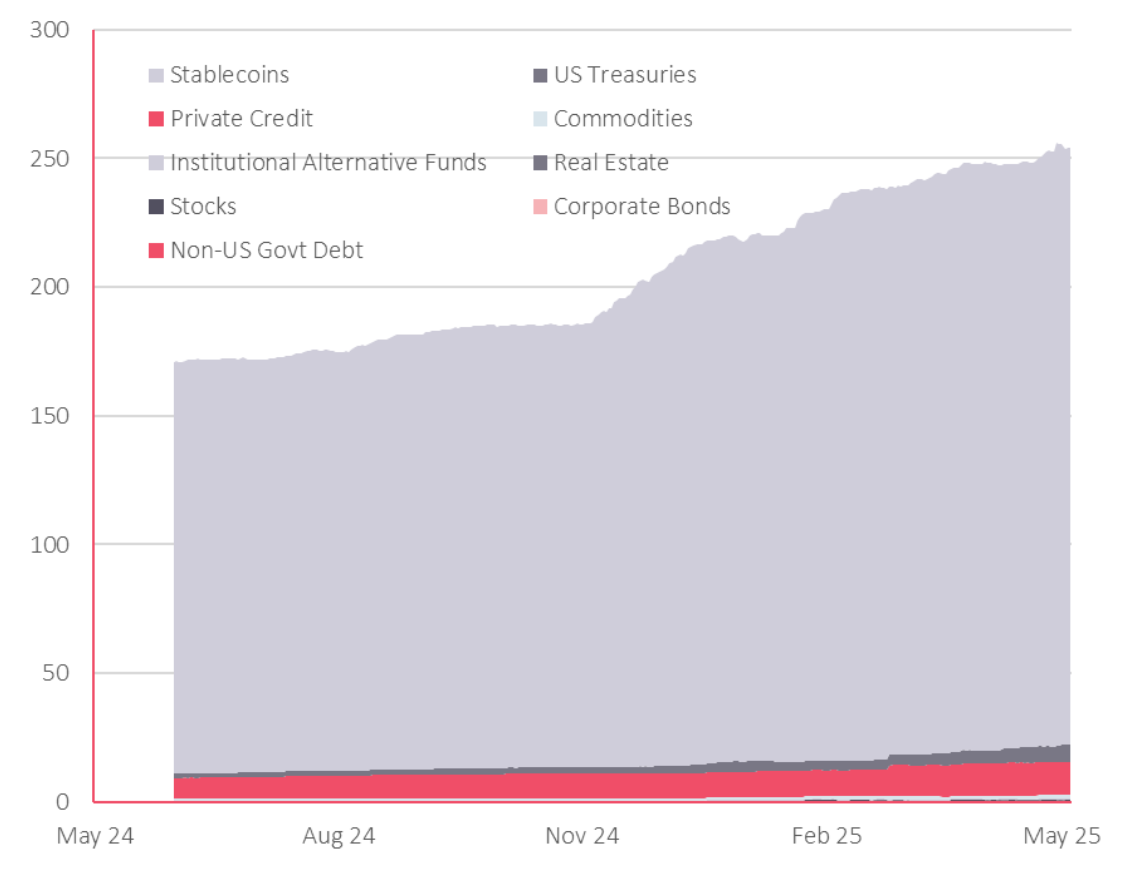

Contrary to early industry predictions, tokenization is progressing from liquid assets like stablecoins and money market funds upward, driven by liquidity and familiarity, not promises of democratizing illiquid assets. More complex assets are following suit, revealing a pragmatic adoption curve.

Moody’s caution about protocol risk exceeding traditional counterparty risk deserves scrutiny. This narrative may deter institutions from crypto’s yield layer, yet it highlights only one side of the coin. While blockchain-based assets introduce technical risks, these risks are often transparent and auditable, unlike the potentially opaque risk profiles of counterparties in traditional finance.

Smart contracts, for example, offer new levels of transparency. Their code can be audited, stress-tested, and verified independently. This means risk assessment can be conducted with fewer assumptions and greater precision than financial institutions with off-balance-sheet exposures. Major decentralized finance platforms now undergo multiple independent audits and maintain significant insurance reserves. They have, at least partially, mitigated risks in the public blockchain environment that Moody’s warned against.

While tokenization doesn’t eliminate the inherent counterparty risk associated with the underlying assets, blockchain technology provides a more efficient and resilient infrastructure for accessing them.

Ultimately, institutional investors should apply traditional investment principles to these novel asset classes while acknowledging the vast array of opportunities within digital assets. The question isn’t whether to allocate to crypto but rather which specific segments of the crypto asset universe align with particular portfolio objectives and risk tolerances. Institutional investors are well-positioned to develop tailored allocation strategies that leverage the unique characteristics of different segments of the crypto ecosystem.

— Fabian Dori, chief investment officer, Sygnum Bank

Ask an Expert

Q: What yield-generating strategies are institutions using on-chain today?

A: The most promising strategies are delta-neutral, meaning they are neutral to price movements. This includes arbitrage between centralized and decentralized exchanges, capturing funding rates, and short-term lending across fragmented liquidity pools. These generate net yields of 7–15% without wider market exposure.

Q: What structural features of DeFi enable more efficient capital deployment compared to traditional finance?

A: We like to think of decentralized finance (DeFi) as “on-chain markets”. On-chain markets unlock capital efficiency by removing intermediaries, enabling programmable strategies, and offering real-time access to on-chain data. Unlike traditional finance, where capital often sits idle due to batch processing, counterparty delays, or opaque systems, on-chain markets provide a world where liquidity can be routed dynamically across protocols based on quantifiable risk and return metrics. Features like composability and permissionless access enable assets to be deployed, rebalanced, or withdrawn in real-time, often with automated safeguards. This architecture supports strategies that are both agile and transparent, particularly important for institutions that optimize across fragmented liquidity pools or manage volatility exposure.

Q: How should a risk-averse institution approach yield on-chain?

A: Many institutions exploring DeFi take a cautious first step by evaluating stablecoin-based, non-directional strategies, as explained above, that aim to offer consistent yields with limited market exposure. These approaches are often framed around capital preservation and transparency, with infrastructure that supports on-chain risk monitoring, customizable guardrails, and secure custody. For firms seeking yield diversification without the duration risk of traditional fixed income, these strategies are gaining traction as a conservative entry point into on-chain markets.

— Abhishek Pingle, co-founder, Theo

Keep Reading

- Bitcoin reached a new all-time high of $111,878 last week.

- Texas Strategic Bitcoin Reserve Bill passed the legislature and advances to the governor’s desk for signature.

- U.S. Whitehouse Crypto Czar David Sacks said regulation is coming in the crypto space in August.

Uncategorized

XRP Down 4% as Global Economic Tensions Trigger Market Selloff

XRP fell as much as 6% over the past 24 hours as global economic tensions rattled financial markets, triggering a wave of liquidations and pushing prices below key support levels.

The token dropped from $2.20 to $2.14 as the broader crypto market shed 3.81% of its value, settling at a total market cap of $3.3 trillion.

The volatility comes in the wake of the U.S. Court of International Trade’s decision to overturn Trump’s trade tariffs, reigniting trade policy concerns and sending ripples across risk assets.

XRP wasn’t immune, with over $29.68 million in long positions liquidated as traders scrambled to adjust their exposure.

News Background

- China-based Webus International said Friday it plans to raise up to $300 million through non-equity financing to support its global chauffeur payment network with an XRP reserve.

- The initiative aims to integrate XRP’s cross-border settlement capabilities into Webus’ ecosystem, including on-chain booking records and a Web3-based loyalty program.

- Webus is renewing its partnership with Tongcheng Travel Holdings to use the XRP Ledger for settling cross-border rides and driver payouts.

- Bitget listed Ripple’s RLUSD stablecoin late Thusday.

- Ripple published a cross-border payments report on Friday. Cross-border payments underpin the $31.6 trillion B2B market, projected to hit $50 trn by 2032. Traditional multi-intermediary rails are slow, costly and opaque, facing regulatory and transparency hurdles.

- Blockchain-based solutions like Ripple’s stablecoin network promise near-instant, cheaper, visible settlement, enhancing liquidity, global expansion, talent payments and customer trust, while reducing failed transfers, the report said.

Price-Action

Technically, XRP found strong selling pressure at the $2.21 resistance level, failing to mount a sustained recovery. A notable support zone emerged near $2.11, with high-volume buying during the 03:00 hour preventing further downside.

Recent consolidation between $2.13 and $2.14 suggests potential stabilization — though the pattern of lower highs indicates sellers remain in control.

In the final trading hour, XRP formed a higher-low pattern around $2.135, signaling potential short-term support.

However, the token also faced resistance at $2.144-$2.145, forming a tight range that traders will be watching closely for the next breakout or breakdown.

Technical Analysis Recap

- XRP dropped 5.7% from $2.20 to $2.14 over the past 24 hours.

- A price range of $0.13 (5.9%) was observed between a high of $2.22 and a low of $2.09.

- Significant resistance formed at $2.21 during the 16:00 and 22:00 hours, triggering heavy selling.

- Strong buying at $2.11 during the 03:00 hour prevented further downside.

- Recent consolidation between $2.13 and $2.14 suggests potential stabilization, though lower highs persist.

- A higher low at $2.135 formed in the last hour, with resistance at $2.144-$2.145 capping any rebound.

- XRP closed the session at $2.137, indicating consolidation after a volatile day.

As XRP navigates the crosswinds of macroeconomic tensions and technical headwinds, traders will be closely watching for any signs of sustained support or further breakdown.

Uncategorized

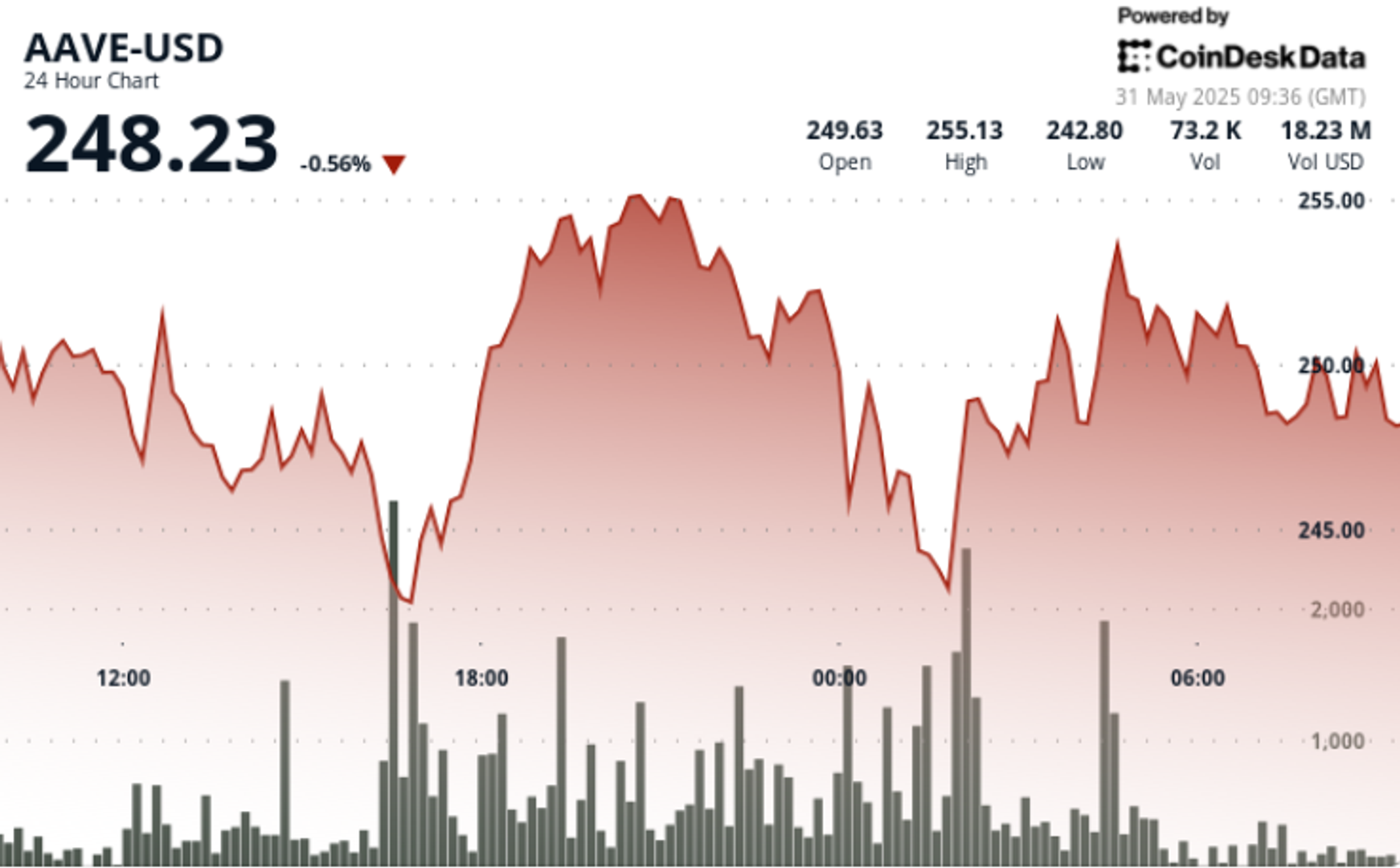

AAVE Rebounds From 15% Drop as DeFi Yield Markets Gain Momentum

AAVE has demonstrated remarkable resilience in the face of global market turbulence, rebounding from a 15% price drop over four days as buyers stepped in to capitalize on DeFi’s growing momentum.

The protocol’s price climbed from $240 to above $250, buoyed by expanding tokenized yield markets that are drawing increased institutional and retail interest.

The price action comes as global trade tensions and new tariff uncertainties — including reports of China violating its trade agreement with the U.S. — injected volatility across risk assets.

Despite these headwinds, the DeFi sector is showing renewed strength, with total value locked (TVL) surging to $178.52 billion. AAVE remains a key leader in the space, commanding a TVL of $25.41 billion.

News Background

- A key driver of AAVE’s recent rebound has been its integration with Pendle’s tokenized yield markets, which saw new markets reach their supply caps within hours of launch, underscoring the strong demand for yield-generating products in the DeFi ecosystem.

- The Ethereum Foundation (EF) borrowed $2 million in GHO, Aave’s decentralized stablecoin pegged to the U.S. Dollar, earlier this week.

- This move, facilitated by supplying ETH as collateral, highlighted EF’s strategy of leveraging its crypto holdings to fund operations while supporting Aave’s protocol.

- Aave’s GHO stablecoin is fully overcollateralized within the Aave ecosystem, with EF’s loan backed by 1,403,519.94 Gwei of ETH (valued at $0.01 in the transaction).

- Interest payments on this loan support Aave’s DAO treasury, reinforcing a community-driven financial model that incentivizes participation and governance.

- Aave’s lending dominance is underscored by its 45% market share from January 2023 to May 2025, according to IntoTheBlock data.

- This figure highlights Aave’s steady recovery from the 2023 DeFi dip and cements its status as the largest decentralized lending protocol by volume and activity.

Technical Analysis Recap

- AAVE established a high-volume support zone around $242.70 during the 16:00-17:00 and 01:00-02:00 hours, attracting strong buying with volumes exceeding 90,000 units.

- A bullish ascending triangle pattern formed, with higher lows indicating accumulation despite recent resistance.

- After peaking at $255.96 at 20:00, AAVE set resistance at $253.75 before stabilizing at $248-$250.

- A notable volume spike between 07:51-07:52 coincided with a sharp rise from $248.98 to $249.82, creating a new resistance level.

- A cup-and-handle pattern formed, with the handle developing between 07:56-08:00, suggesting accumulation after the recent pullback.

- Short-term consolidation near $249, coupled with increasing volume on upward moves, hints at potential bullish momentum building for a test of $250 resistance.

As DeFi yield markets continue to expand, AAVE’s ability to integrate new products and sustain high-volume support levels positions it as a key player in the sector’s growth — despite the broader market’s macroeconomic challenges.

Disclaimer: Portions of this article were generated with the assistance of AI tools and reviewed by CoinDesk’s editorial team for accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

BNB Down 4% as Global Trade Tensions Overshadow SEC Victory

Binance Coin (BNB) dropped nearly 4% over the past 24 hours, rattled by renewed global trade tensions and broad market volatility that overshadowed positive regulatory news.

The token fell from $672.53 to a low of $646.27, with selling accelerating during high-volume trading hours as traders reacted to macroeconomic developments.

News Background

- President Trump’s announcement of new tariffs on Canada and Mexico reignited fears of a trade war, sending shockwaves across financial markets.

- The crypto market wasn’t immune, with BNB underperforming despite the SEC’s voluntary dismissal of its lawsuit against Binance and founder Changpeng Zhao.

- That case, which had alleged Binance facilitated trading of unregistered securities, had hung over the exchange for nearly two years.

- BNB Chain saw an active week with BSC recording 1.93 million daily active users and opBNB surpassing 2 million. Total weekly trading volume hit $69.75B, while TVL stands at $10.5 billion.

- Key projects launched include UpTop (DeFi), Volare Finance (options trading), and WeApe by Wello (stablecoin payments).

- The chain also launched an incentive program for real-world assets, went live with its AI Bot, and activated the Maxwell Hardfork on testnet for faster block times.

- The BNB AI Hack announced winners for its latest batch, and the Featured Activities Series now offers upward of $60,000 in rewards on DappBay.

Price-Action

Technically, BNB established a high-volume resistance zone around $669.68 after repeated failures to sustain bullish momentum. A second wave of selling hit during the midnight hour, with volume spiking to 81,409 units as prices broke below the $650 support level. Although BNB has managed a modest recovery from its cycle lows, forming potential support between $646-$648, the overall trend remains bearish with lower highs and lower lows.

Technical Analysis Recap

- BNB fell from $672.53 to $646.27, a 3.91% decline over the 24-hour period.

- Most dramatic selling occurred at 16:00 with volume spiking to 100,471 units, establishing key resistance at $669.68.

- Additional selling pressure hit at midnight, with volume reaching 81,409 units as prices fell below $650.

- A modest support zone formed between $646-$648, though the broader trend remains bearish.

- The hourly chart shows higher lows forming an ascending support trendline, suggesting a short-term bullish attempt that could stall further downside.

As global trade tensions weigh on risk assets, BNB’s resilience will be tested as traders weigh regulatory clarity against macroeconomic headwinds.

Disclaimer: Portions of this article were generated with the assistance of AI tools and reviewed by CoinDesk’s editorial team for accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

-

Fashion8 месяцев ago

Fashion8 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion8 месяцев ago

Fashion8 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoThe old and New Edition cast comes together to perform

-

Business8 месяцев ago

Business8 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports8 месяцев ago

Sports8 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment8 месяцев ago

Entertainment8 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoDisney\’s live-action Aladdin finally finds its stars