Uncategorized

Crypto for Advisors: Crypto ETF Trends

Did you know, exchange-traded products are now the largest holders of bitcoin? In today’s Crypto for Advisors newsletter, Rony Abboud from Trackinsight and ETF Central breaks down current ETF trends.

Then, Joshua de Vos, research lead at CoinDesk answers investment questions about ETFs in «Ask an Expert.»

Thank you to our sponsor of this week’s newsletter, Grayscale Investments. For financial advisors near Minneapolis, Grayscale is hosting Crypto Connect on Thursday, September 18. Learn more.

5 Crypto ETF Charts We Thought You’d Like this Month

Crypto has officially entered the ETF mainstream, and the numbers tell the story.

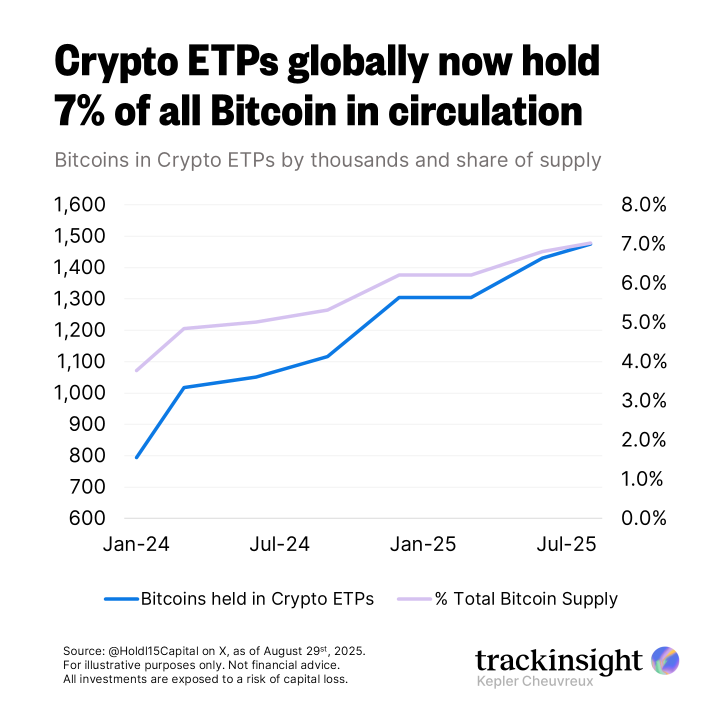

ETPs Hold the Bitcoin Crown

In case you missed it, crypto exchange-traded products (ETPs) have become the biggest holders of bitcoin, now sitting on 1.47 million coins — about 7% of the total 21 million supply, according to data compiled by Hold15Capital on X.

Public companies come next with just over 1 million, followed by governments holding around 526,000, according to bitcointreasuries.net

Looking closer, BlackRock’s iShares IBIT exchange-traded fund (ETF) leads the pack with 749,000 coins, while Fidelity’s FBTC holds 201,000 and Grayscale’s GBTC sits at 185,000. That share of supply is likely to keep climbing as more investors, especially institutions, jump in under a friendlier U.S. crypto administration.

Crypto Moves Into the ETF Mainstream

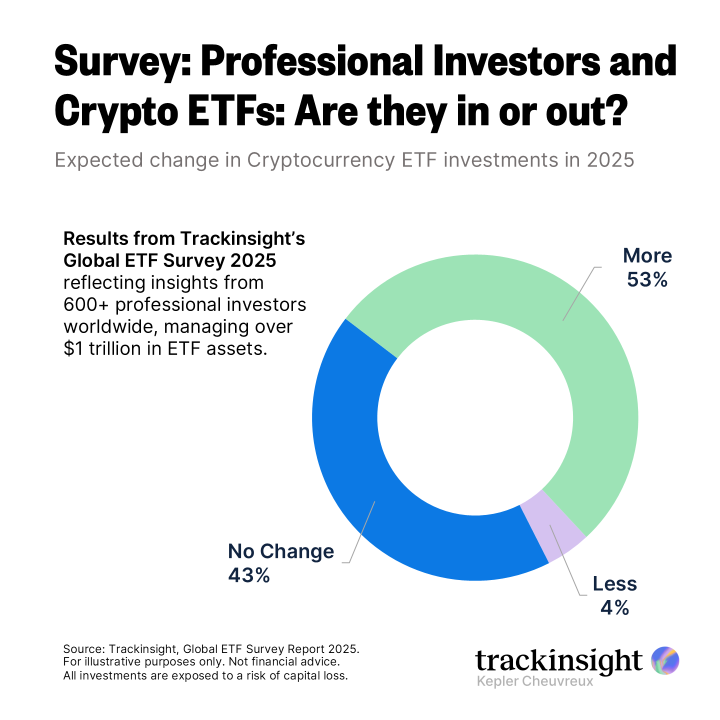

Cryptocurrency has become a key topic in the Trackinsight Global ETF Survey.

This year’s edition gathered insights from more than 600 professional investors overseeing over $1 trillion in ETF assets. They shared their views across active, thematic, ESG, fixed income and crypto segments.

When asked about their appetite for crypto ETFs in 2025, more than half said they plan to increase allocations in client portfolios.

Crypto ETFs Break Into the Big Leagues

Cryptocurrency ETFs in the U.S. ranked 8th in net inflows over the past year, according to ETF Central’s ETF segments dashboard — another sign of how powerful this asset class has become since gaining access through the ETF wrapper. The results of the Trackinsight survey reflect that shift, showing how professional investors who were once hesitant are now increasingly open to crypto.

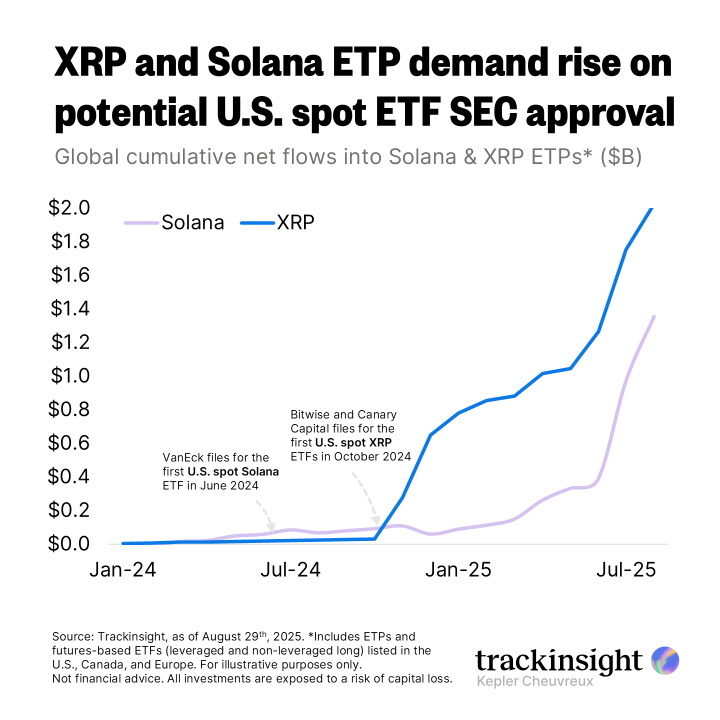

Solana and XRP ETFs Edge Closer to the Spotlight

With bitcoin and ether ETFs already established, solana and XRP are lining up for their own spot debut. Optimism is high, but the SEC has yet to approve any filings. Still, with the legal cloud around Ripple lifted and a more crypto-friendly regulatory environment in Washington, the odds of launch are looking better than ever.

In the meantime, investors have been riding the momentum through U.S. futures-based solana and XRP ETFs. North of the border, Canada has already pulled ahead with spot launches, while Europe continues to lead the charge with ETPs covering nearly every major cryptocurrency — including solana and XRP.

Since 2024, XRP and solana ETPs have attracted $2.02 billion and $1.35 billion in net inflows globally, with momentum picking up after the first related U.S. spot ETF filings.

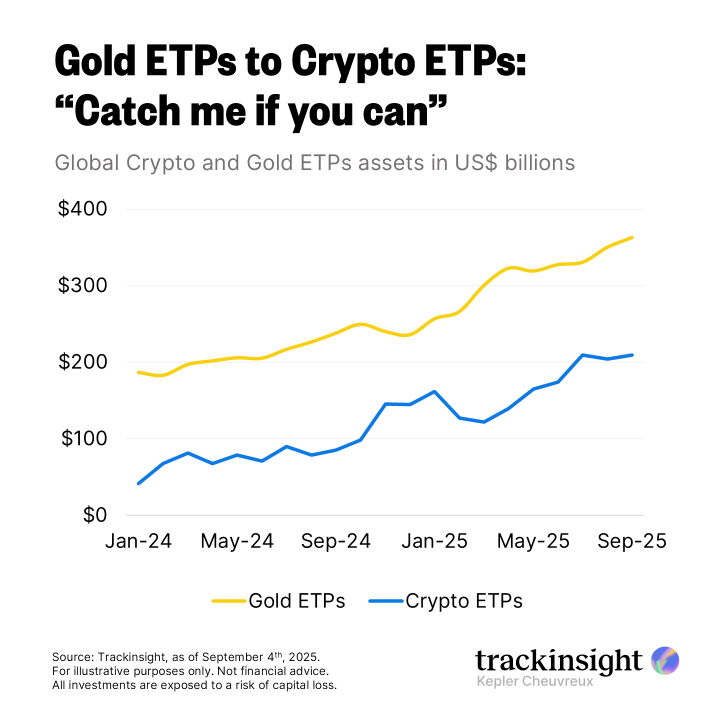

The Big Race: Gold vs. Crypto

The visual highlights a key trend in modern finance: the battle for a place in investor portfolios.

Gold, the perennial store of value, maintains its lead with ETPs nearing $400 billion in assets, as it remains a critical hedge against inflation and geopolitical turmoil.

Yet, the explosive growth of crypto ETPs, which have raced past $200 billion, signals a new era.

This isn’t a zero-sum game; instead, the chart suggests that in an uncertain world, investors are turning to both assets to provide different forms of protection and growth.

— Rony Abboud, role, chief marketing officer, Trackinsight and ETF Central

Ask an Expert

Q: What happened with global crypto ETF/ETP flows in August?

Ether-linked products attracted $4.27 billion, the strongest monthly intake this year and ~88% of August’s net inflows, driven primarily by US-listed funds.

Bitcoin products saw $169.1 million in net outflows at the category level, despite issuer-level dispersion. Solana and XRP products recorded inflows of $383.4 million and $279.7 million, respectively, signalling selective diversification beyond BTC and ETH.

Flows by geography:

- Americas: $4.92 billion in net inflows, continuing to anchor global allocations and trading.

- Europe: $108 million in net outflows, reflecting softer demand across several markets.

- APAC: $70.4 million in net inflows, with incremental gains led by Hong Kong and Australia.

Q: How has the U.S. positioned itself since the debut of listed crypto ETFs and ETPs?

Since bitcoin ETFs became available in January 2024, U.S.-listed products have become the core venue for regulated digital-asset exposure, with USD-denominated vehicles ~94% of global activity.

For investors, this scale and consistency of participation underscores the United States’ role as the primary market for price discovery and capital formation in crypto.

Q: What policy developments have continued to firm the US operating backdrop for crypto ETFs?

- The SEC’s move to permit in-kind creations/redemptions for spot bitcoin and ether products supports more efficient primary-market operations and tighter spreads.

- Major exchanges have also proposed generic listing standards for commodity-based ETPs (including digital-asset commodities), which, if adopted, would streamline future product approvals.

- In parallel, the Commission extended review periods on select single-asset proposals (including Solana), clustering several high-profile decisions into October.

Together, these steps reinforce structural clarity as the market matures.

— Joshua de Vos, research lead, CoinDesk

Keep Reading

- Global digital assets: August ETF and ETP review. Brought to you by Trackinsight and ETF Express.

- Crypto U.S. ETFs in August: Ether Steals the Show. Brought to you by Trackinsight, ETF Central and NYSE.

- Grayscale Seeks SEC Nod for bitcoin cash and hedera ETFs.

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoDisney\’s live-action Aladdin finally finds its stars