Uncategorized

Crypto for Advisors: Blockchain and the Music Industry

Blockchain is reshaping industries beyond finance. In this Crypto for Advisors newsletter, we shift focus from traditional investments to explore a disruptive blockchain use case in the music industry. Inder Phull, CEO and Co-Founder of Pixelynx and creator of KOR Protocol, explains how on-chain music rights and royalties are transforming ownership and why this matters for artists and investors.

Then, Ronald Elliot Yung from RaveDAO answers questions about these changes and how they impact investments in Ask an Expert.

Remix, Rights & Revenue: Why Onchain Music Infrastructure Is the Future

A fundamental shift, redefining how music is protected, managed, and monetized.

Introduction: A Broken Symphony

The digital revolution has empowered musicians with unprecedented tools to create, collaborate, and reach global audiences. Unfortunately, this rapid evolution has come with its own set of challenges. While the Internet has rewritten the rules of creation, distribution, and consumption, the methods we use to protect and monetize creative content, such as copyright laws, licensing models, and royalty structures, have not kept pace. In this environment, artists struggle to maintain control of their work, with inadequate attribution and a lack of fair compensation.

For advisors, you may have clients in the music industry or investors seeking to invest in these assets. Understanding the evolution of this industry could be a strategic advantage as assets move on-chain.

The systems that governed the industry were originally designed in a pre-Internet era when the concepts of global digital rights and licences were yet to be considered. We now find ourselves in a situation where TikTok hits are often born from unauthorized samples, AI-generated music is flooding streaming platforms, and artists struggle to make a living.

Legal pathways to capitalize on emerging opportunities, such as AI or UGC virality, remain locked behind gatekeepers, legacy contracts, and unclear ownership data. Enter onchain rights infrastructure: a shift that could rewire how we protect, manage, and monetize music.

The Problem: Rights Are Fragmented, and Creators Lose

There is a reason why music on social media has yet to generate a revenue stream for artists, why the “Metaverse” lacks music, and why AI is perceived as a threat. Existing copyright systems do not adequately address the complex web of ownership and usage rights associated with modern applications of music, such as remixing or user-generated content on social media platforms.

The current complexity costs the industry billions, as this system often leaves creators underpaid and legally vulnerable. Creators are shifting to owner-created content, where they can track the usage of their creations and consumption, and get paid regardless of where their assets are consumed.

The Future: Onchain Rights Infrastructure

Onchain rights infrastructure redefines the backend of the music industry. It provides rightsholders with undisputed, verifiable ownership of their work, with rights transparently programmed into the registration. This transparency and programmability enable music to move effortlessly across platforms, applications, and media, automatically tracking attribution, verifying provenance, and eliminating the friction of traditional licensing processes. Artists receive payment instantly, and their rights are enforced in real-time.

Imagine if every track came with a smart contract, one that listed the rights holders, the ownership percentages, and the licensing terms in code. If you wanted to use the song in a remix, a sync, or a sample, the contract would tell you what’s allowed and automatically distribute royalties.

That’s what on-chain rights infrastructure makes possible.

On a blockchain, rights can be:

- Transparent — anyone can see who owns what

- Programmable — remix terms, splits, and conditions are encoded

- Traceable — derivatives and remixes are tracked in real time

- Compositional — rights become building blocks, not walls

If the music industry wants to capitalize on emerging technology and cater to tomorrow’s digital consumers, it will need a more agile and forward-looking approach to music rights management and licensing. Onchain rights infrastructure is the answer.

Understanding the shift to on-chain rights infrastructure is no longer niche; it’s a key part of the future. Whether you’re advising IP holders navigating their royalty flows or helping investors explore music IP as an emerging asset class, being fluent in how rights and revenue can be transparently encoded onchain is vital. Just as streaming reshaped consumption models, on-chain infrastructure is reshaping the ownership system; those who understand it early will be best positioned to grow in the evolving digital economy.

— Inder Phull, CEO and co-founder, Pixelynx

Ask an Expert

Q. In a world of corporate festivals and algorithm-driven playlists, how can decentralized models enable new music scenes, community leadership, and fan ownership?

Music has always thrived in pockets: underground clubs, bedroom producers, DIY scenes. Blockchain now offers a chance to bring these microcultures to the world, placing influence in the hands of those who live the culture, not just those who monetize it.

For investors, the upside is early access to untapped cultural capital and the energy of self-organizing communities. Most users still crave experiences, not just technology. No protocol can manufacture authenticity, and it’s easy for on-chain “ownership” to become performative if it’s disconnected from what’s happening on the ground. The winning models will get the “local-to-global” flywheel right: using technology to empower people, not just platforms, and ensuring new voices and collectives receive the recognition and support they need before being absorbed by the next algorithmic trend.

Q. What persistent problems can blockchain and AI fix in live events, and what’s still unsolved for the music economy?

Blockchain finally addresses ticket fraud, opaque splits, and the lack of fan ownership in events. On-chain tickets are tamper-proof and traceable, making resale and royalty flows transparent. AI is cutting through noise by personalizing experiences, automating support, and making sense of the huge, messy flood of fan data most venues still ignore. However, technology alone won’t solve the music industry’s most profound issues. Scene-building, trust, and curation remain deeply human challenges. No blockchain replaces the hustle of earning credibility, or the magic of a local scene bubbling up in defiance of the mainstream. Even the best AI can’t spot next year’s genre-defining artist without a pulse on culture itself. For investors and advisors, the risk is buying into the illusion that data and automation alone can drive engagement and loyalty. The most compelling opportunities will blend digital tools with real-world understanding, creating systems that empower communities rather than just optimize transactions.

Q. What are the blind spots in the current “Web3 x Music” hype cycle, and where should advisors exercise caution?

There’s no shortage of pitch decks promising to “revolutionize” music with tokens and NFTs. But hype alone can’t replace authentic connection, or build the grassroots energy that makes festivals last. Advisors should look beyond user counts or Discord noise and ask: Are local communities actually thriving? Is community governance a real process or just a buzzword? Can this model attract and retain both serious talent and loyal fans? The winners will be platforms that treat culture as a living ecosystem, not a quick flip, and that balance on-chain innovation with the off-chain work of building trust.

— Ronald Elliot Yung, core contributor at RaveDAO

Keep Reading

- Charles Schwab CEO says crypto trading is coming soon for clients.

- President Trump signed the first U.S. cryptocurrency bill into law during “crypto week”.

- JP Morgan is planning to offer bitcoin-backed loans.

Uncategorized

Wall Street Bank Citigroup Sees Ether Falling to $4,300 by Year-End

Wall Street giant Citigroup (C) has launched new ether (ETH) forecasts, calling for $4,300 by year-end, which would be a decline from the current $4,515.

That’s the base case though. The bank’s full assessment is wide enough to drive an army regiment through, with the bull case being $6,400 and the bear case $2,200.

The bank analysts said network activity remains the key driver of ether’s value, but much of the recent growth has been on layer-2s, where value “pass-through” to Ethereum’s base layer is unclear.

Citi assumes just 30% of layer-2 activity contributes to ether’s valuation, putting current prices above its activity-based model, likely due to strong inflows and excitement around tokenization and stablecoins.

A layer 1 network is the base layer, or the underlying infrastructure of a blockchain. Layer 2 refers to a set of off-chain systems or separate blockchains built on top of layer 1s.

Exchange-traded fund (ETF) flows, though smaller than bitcoin’s (BTC), have a bigger price impact per dollar, but Citi expects them to remain limited given ether’s smaller market cap and lower visibility with new investors.

Macro factors are seen adding only modest support. With equities already near the bank’s S&P 500 6,600 target, the analysts do not expect major upside from risk assets.

Read more: Ether Bigger Beneficiary of Digital Asset Treasuries Than Bitcoin or Solana: StanChart

Uncategorized

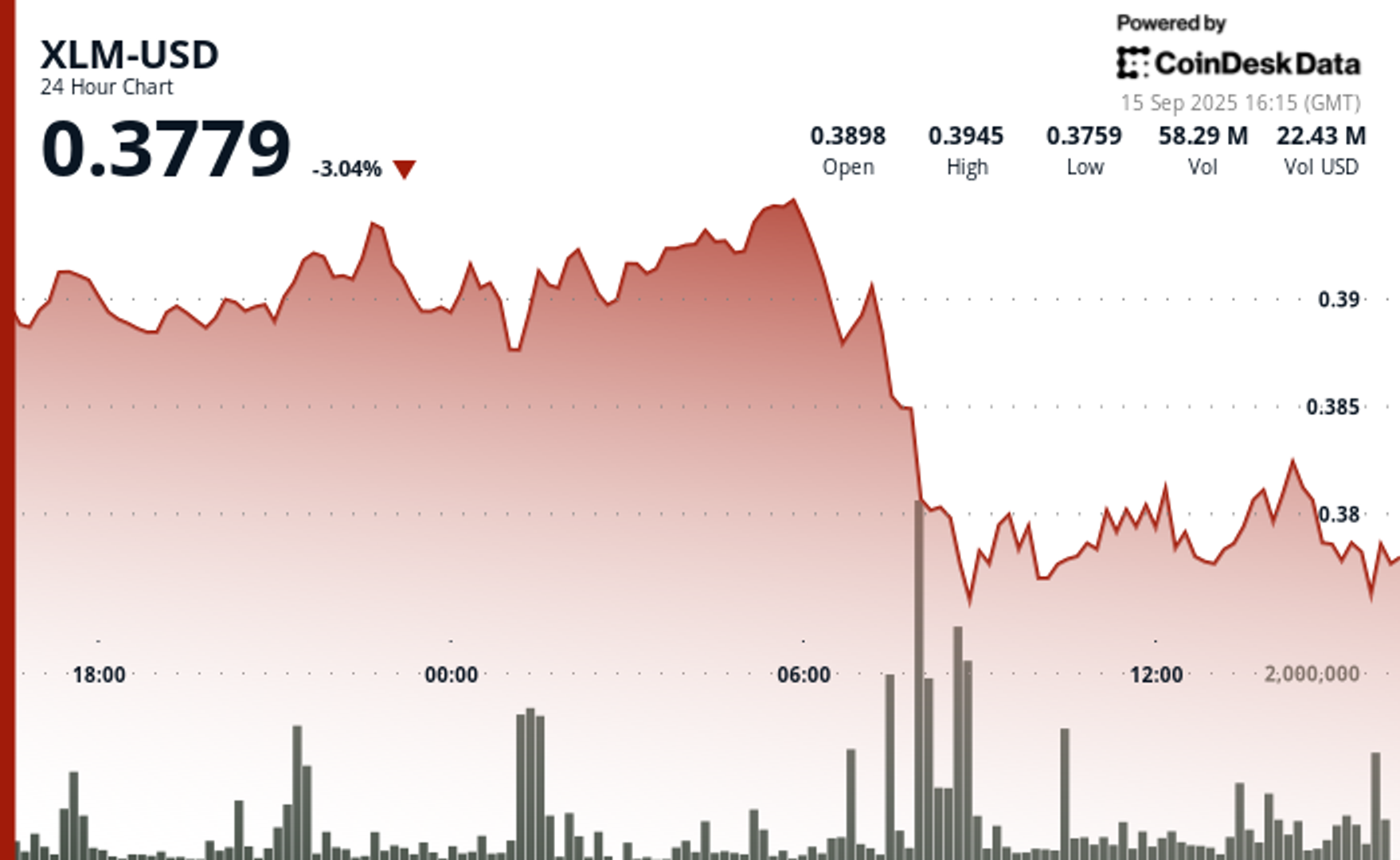

XLM Sees Heavy Volatility as Institutional Selling Weighs on Price

Stellar’s XLM token endured sharp swings over the past 24 hours, tumbling 3% as institutional selling pressure dominated order books. The asset declined from $0.39 to $0.38 between September 14 at 15:00 and September 15 at 14:00, with trading volumes peaking at 101.32 million—nearly triple its 24-hour average. The heaviest liquidation struck during the morning hours of September 15, when XLM collapsed from $0.395 to $0.376 within two hours, establishing $0.395 as firm resistance while tentative support formed near $0.375.

Despite the broader downtrend, intraday action highlighted moments of resilience. From 13:15 to 14:14 on September 15, XLM staged a brief recovery, jumping from $0.378 to a session high of $0.383 before closing the hour at $0.380. Trading volume surged above 10 million units during this window, with 3.45 million changing hands in a single minute as bulls attempted to push past resistance. While sellers capped momentum, the consolidation zone around $0.380–$0.381 now represents a potential support base.

Market dynamics suggest distribution patterns consistent with institutional profit-taking. The persistent supply overhead has reinforced resistance at $0.395, where repeated rally attempts have failed, while the emergence of support near $0.375 reflects opportunistic buying during liquidation waves. For traders, the $0.375–$0.395 band has become the key battleground that will define near-term direction.

Technical Indicators

- XLM retreated 3% from $0.39 to $0.38 during the previous 24-hours from 14 September 15:00 to 15 September 14:00.

- Trading volume peaked at 101.32 million during the 08:00 hour, nearly triple the 24-hour average of 24.47 million.

- Strong resistance established around $0.395 level during morning selloff.

- Key support emerged near $0.375 where buying interest materialized.

- Price range of $0.019 representing 5% volatility between peak and trough.

- Recovery attempts reached $0.383 by 13:00 before encountering selling pressure.

- Consolidation pattern formed around $0.380-$0.381 zone suggesting new support level.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

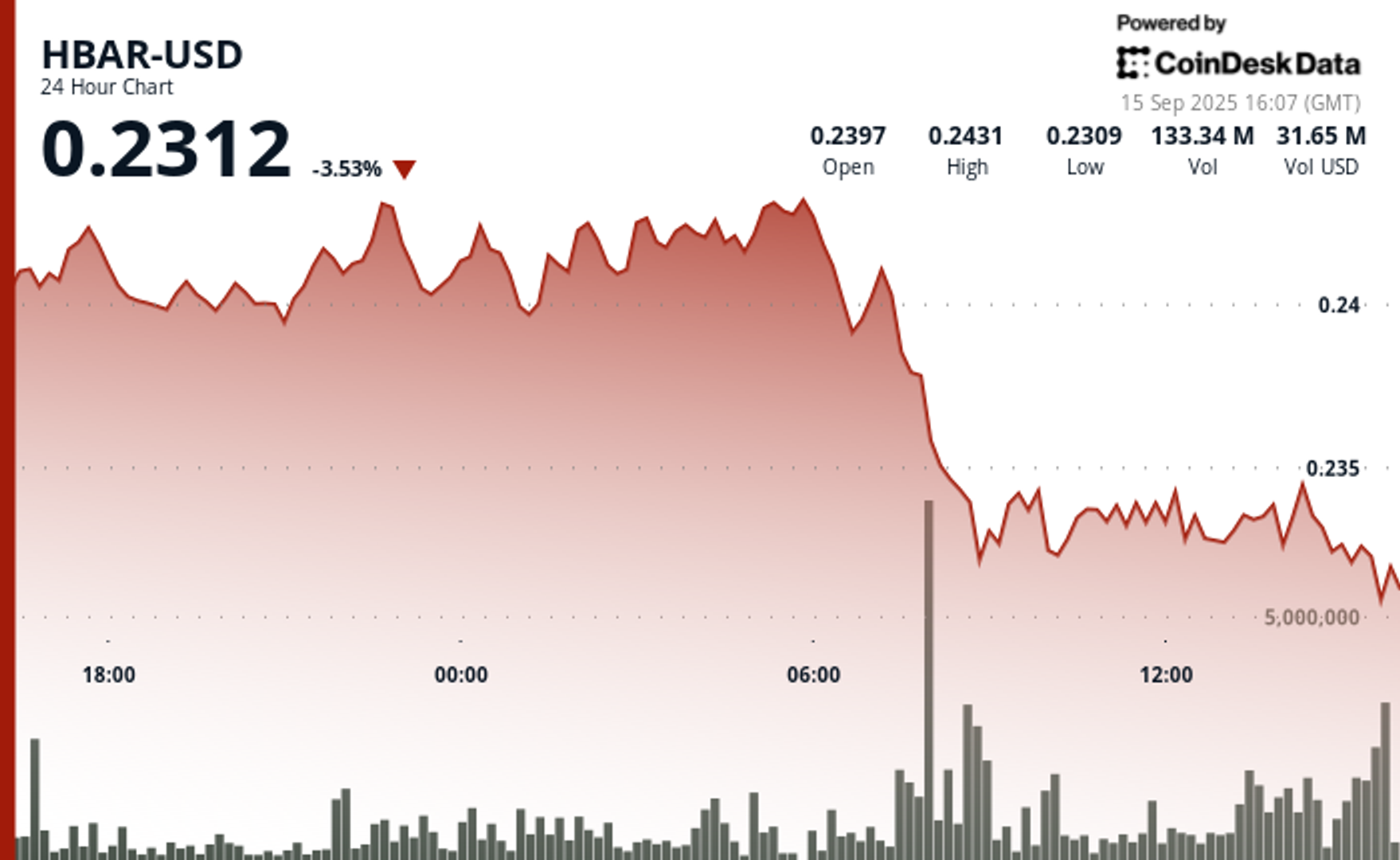

HBAR Tumbles 5% as Institutional Investors Trigger Mass Selloff

Hedera Hashgraph’s HBAR token endured steep losses over a volatile 24-hour window between September 14 and 15, falling 5% from $0.24 to $0.23. The token’s trading range expanded by $0.01 — a move often linked to outsized institutional activity — as heavy corporate selling overwhelmed support levels. The sharpest move came between 07:00 and 08:00 UTC on September 15, when concentrated liquidation drove prices lower after days of resistance around $0.24.

Institutional trading volumes surged during the session, with more than 126 million tokens changing hands on the morning of September 15 — nearly three times the norm for corporate flows. Market participants attributed the spike to portfolio rebalancing by large stakeholders, with enterprise adoption jitters and mounting regulatory scrutiny providing the backdrop for the selloff.

Recovery efforts briefly emerged during the final hour of trading, when corporate buyers tested the $0.24 level before retreating. Between 13:32 and 13:35 UTC, one accumulation push saw 2.47 million tokens deployed in an effort to establish a price floor. Still, buying momentum ultimately faltered, with HBAR settling back into support at $0.23.

The turbulence underscores the token’s vulnerability to institutional distribution events. Analysts point to the failed breakout above $0.24 as confirmation of fresh resistance, with $0.23 now serving as the critical support zone. The surge in volume suggests major corporate participants are repositioning ahead of regulatory shifts, leaving HBAR’s near-term outlook dependent on whether enterprise buyers can mount sustained defenses above key support.

Technical Indicators Summary

- Corporate resistance levels crystallized at $0.24 where institutional selling pressure consistently overwhelmed enterprise buying interest across multiple trading sessions.

- Institutional support structures emerged around $0.23 levels where corporate buying programs have systematically absorbed selling pressure from retail and smaller institutional participants.

- The unprecedented trading volume surge to 126.38 million tokens during the 08:00 morning session reflects enterprise-scale distribution strategies that overwhelmed corporate demand across major trading platforms.

- Subsequent institutional momentum proved unsustainable as systematic selling pressure resumed between 13:37-13:44, driving corporate participants back toward $0.23 support zones with sustained volumes exceeding 1 million tokens, indicating ongoing institutional distribution.

- Final trading periods exhibited diminishing corporate activity with zero recorded volume between 13:13-14:14, suggesting institutional participants adopted defensive positioning strategies as HBAR consolidated at $0.23 amid enterprise uncertainty.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars