Uncategorized

Crypto for Advisors: Bitcoin Mining Will Be Different in 2025

In today’s issue, Ben Harper from Luxor Technology provides an update on what’s happening with bitcoin mining this year.

Then, Colin Harper from Blockspace Media answers questions on the topic of mining and AI in Ask and Expert.

You’re reading Crypto for Advisors, CoinDesk’s weekly newsletter that unpacks digital assets for financial advisors. Subscribe here to get it every Thursday.

Bitcoin Mining Has Changed — It’s No Longer Just About the Price

The bitcoin mining investment thesis used to be simple — miners thrived when bitcoin’s price soared, and when it fell, they suffered. But in 2024, that equation changed. Bitcoin ETFs, hashrate markets and AI have fundamentally reshaped the industry, reducing miners’ dependence on bitcoin’s price. Here’s why mining is no longer just a bet on bitcoin, and what this means for investors.

2024: The Year Bitcoin Mining Diverged From Bitcoin’s Price

In 2023, Bitcoin mining stocks behaved like a high-beta proxy for Bitcoin, amplifying its moves — soaring higher when bitcoin rallied and crashing harder when it fell. But in 2024, this pattern broke down. Despite bitcoin reaching new all-time highs, mining stocks failed to reclaim their previous peaks.

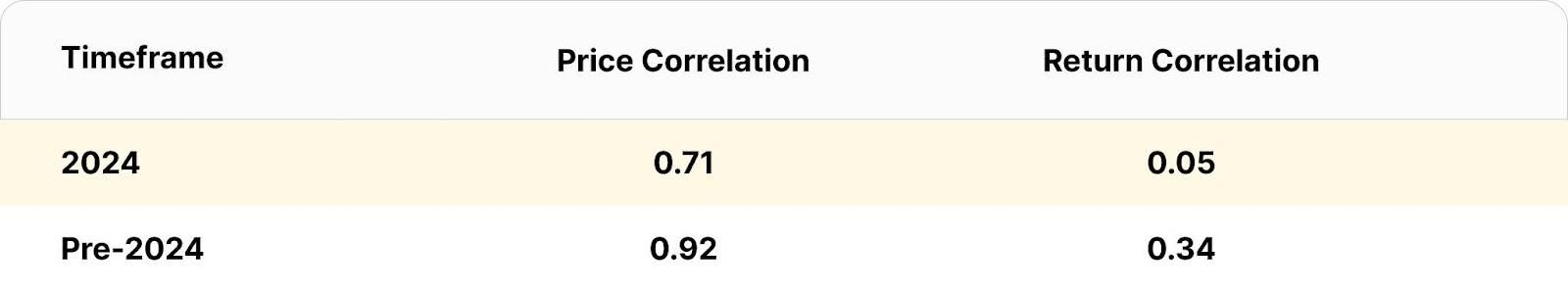

The table below illustrates the shifting correlation between Hashrate Index’s Crypto Mining Index and bitcoin’s price, comparing weekly prices and returns before and during 2024:

Source: Hashrate Index, June 2020 — December 2024

The takeaway is clear: Bitcoin mining stocks are no longer just a straightforward bet on bitcoin’s price. This divergence stems from four key trends shaping the sector:

1. Institutional Bitcoin Adoption: The Advent of Spot ETFs

The launch of spot bitcoin ETFs in January 2024 reshaped institutional investment in bitcoin. With ETFs amassing over 1.3 million BTC and surpassing $100 billion in assets under management, the appeal of mining stocks as a bitcoin proxy faded. Instead of using miners as an indirect exposure, capital flowed directly into Bitcoin via ETFs, fundamentally shifting market dynamics.

2. The Halving and Its Aftermath: A Squeeze on Miner Economics

Bitcoin’s fourth halving in April 2024 cut the block subsidy from 6.25 BTC to 3.125 BTC per block, slashing miners’ primary revenue source in half. Historically, post-halving bitcoin price surges have helped offset lower rewards, but this time, miners faced additional headwinds:

Record-high network difficulty. Rising competition reduced individual miner rewards.

Falling transaction fees. Lower demand for blockspace diminished a crucial secondary revenue stream.

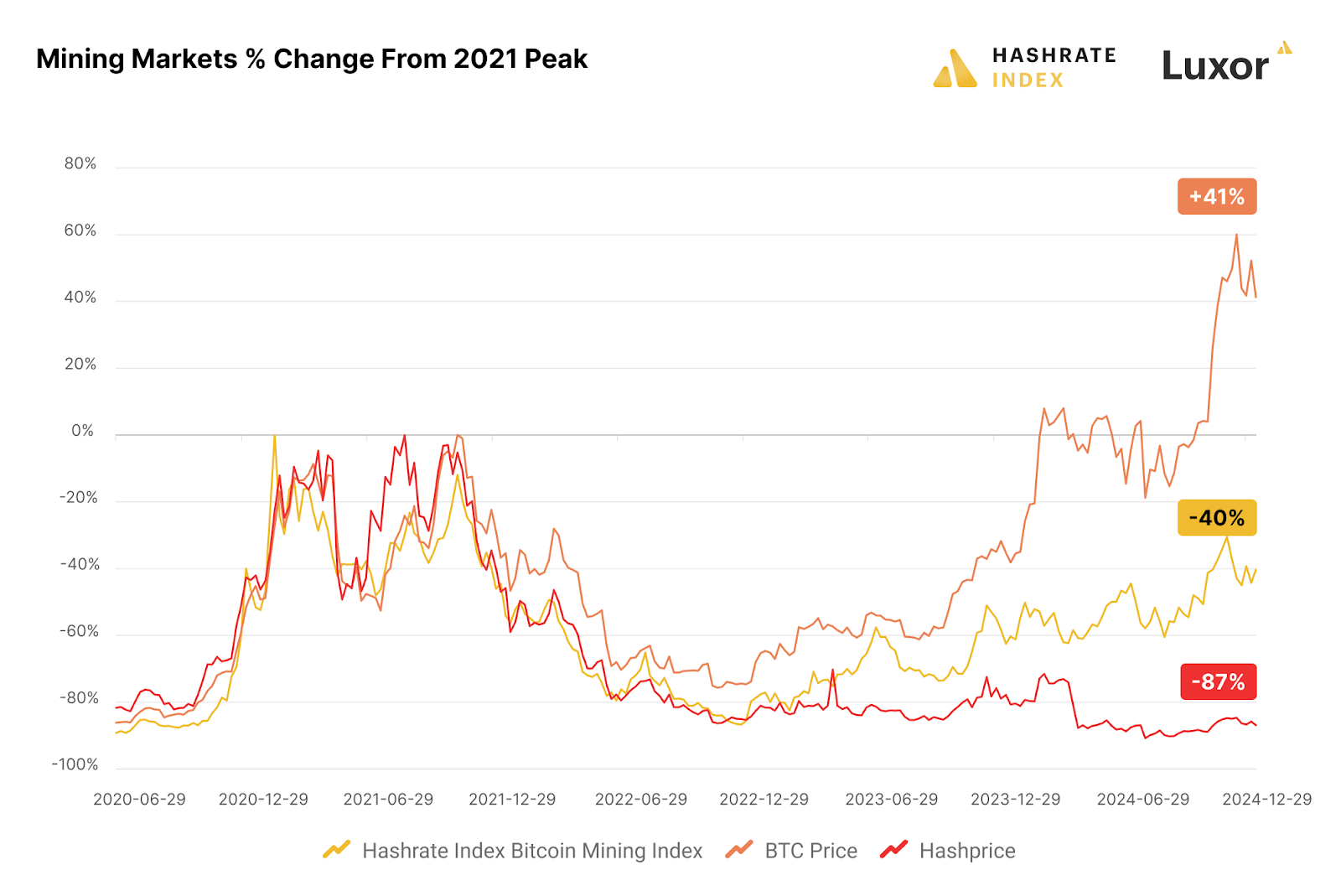

Hashprice collapse. Despite bitcoin’s rally, hashprice, an all-in measure of mining revenue per unit of computation (i.e., hashrate), plummeted 75%.

While bitcoin’s price soared 120% throughout the year, miners struggled to maintain profitability, leading to consolidation and strategic pivots within the industry.

Source: Hashrate Index

3. The Rise of Hashrate Derivatives: A Game-Changer for Miners

One of the most significant financial developments in bitcoin mining in 2024 was the rapid expansion of the hashrate derivatives market. This emerging market allowed miners to hedge future revenue streams and reduce exposure to bitcoin price volatility, fundamentally changing how they manage risk.

Traditionally, mining revenues were at the mercy of bitcoin’s daily price swings, making it difficult for operators to forecast cash flows or secure financing. However, with the rise of hashrate forward markets, miners could sell future hashrate production at a fixed price, locking in revenue months in advance. This financial instrument functions similarly to commodity futures in the energy sector, where electricity producers pre-sell power contracts to stabilize income.

In 2024, these once-nascent markets saw explosive growth. Over-the-counter (OTC) volumes surged more than 500% year-over-year on Luxor’s hashrate forward market, with contract durations extending up to 12 months. Meanwhile, regulated exchange trading took a major step forward with Bitnomial launching hashrate futures, making it the first regulated exchange to offer a bitcoin mining derivative product.

The maturation of hashrate forward markets signals a new era in mining finance — one where miners have greater control over their revenue streams, better access to capital, and improved resilience against bitcoin price volatility.

4. Bitcoin Mining Meets AI & HPC: A Convergence of Industries

With mining profits under pressure, many firms are pivoting to AI and high-performance computing (HPC) to diversify revenue. Bitcoin mining infrastructure shares key similarities with AI data centers — both require vast power and cooling capacity. However, the shift isn’t easy: AI infrastructure is more expensive per megawatt (millions vs. hundreds of thousands for bitcoin mining), requiring significant capital investment.

Some miners are embracing hybrid models, allocating some of their computing power to AI workloads while maintaining bitcoin mining operations. Firms like HIVE Digital Technologies, Hut 8, Core Scientific, and Bit Digital have already made the leap, securing lucrative AI contracts to grow and stabilize their cash flows.

Final Thoughts

Bitcoin mining in 2025 is no longer just about bitcoin’s price. Institutional capital, hashrate derivatives and AI-driven diversification are reshaping the industry, giving miners new tools to manage risk and optimize revenue. At the same time, post-halving pressures, rising competition and infrastructure costs have made efficiency and adaptability more critical than ever.

For investors and advisors, understanding these shifts is essential. Mining stocks no longer move in lockstep with bitcoin, and new financial instruments are changing how miners operate. As the industry continues to mature, those who recognize these structural changes will be better positioned to navigate the opportunities ahead.

— Ben Harper, director, Luxor Technology

Ask an Expert

Are bitcoin miners actually serious about breaking into the AI market?

Absolutely. Since 2022, bitcoin miners have been increasingly exploring AI and high-performance compute (HPC) business lines. Some of the earliest movers in this shift were Hut 8, Hive, IREN, Core Scientific and Bit Digital. More recently, Riot put its 600 MW expansion at Corsicana on pause to evaluate the site for AI load, Cipher received a $50 million investment from SoftBank for its own AI project, and Lancium and Crusoe Energy are building a multi-gigawatt campus for AI as part of Project Stargate.

How will bitcoin miners tackle their AI transitions? Is there a one-size-fits-all approach?

AI/HPC strategies vary from miner to miner. Hut 8 and Bit Digital, for example, have opted to acquire existing data center businesses rather than build their own data centers from scratch or retrofit existing infrastructure. Core Scientific, on the other hand, is converting the massive power assets and infrastructure it has on hand for AI/HPC load in its partnership with CoreWeave (Riot could follow a similar model should it decide to convert portions of its Corsicana campus into an AI data center). And others, like Hive and IREN, have purchased GPUs to operate AI/HPC cloud services within their existing facilities. Each of these strategies have tradeoffs (the Hut 8 and Bit Digital model are low risk, low reward, while Core Scientific’s approach is high risk, high reward), and we will have a better idea of which approach is the most successful over the next few years.

With strong market demand for AI, will bitcoin miners still mine bitcoin?

For now, plenty of bitcoin miners — including MARA, Cleanspark and Bitfarms — are still focusing on bitcoin mining instead of chasing the AI/HPC golden rabbit. Even if bitcoin miners convert parts of their infrastructure into AI/HPC load, they will likely still mine bitcoin, even if they reduce their focus on this pursuit. Ultimately, bitcoin mining and AI/HPC are more complementary than competitive, as miners can use bitcoin mining to monetize energy that they have already paid for when AI/HPC demand is low.

— Colin Harper, editor-in-chief, Blockspace Media

Keep Reading

The first ever bitcoin mining ETF is live, recently launched by Grayscale.

Sixteen U.S. states are eyeing bitcoin strategic reserves, along with the federal government.

At a press conference on Tuesday, U.S. crypto and AI czar David Sacks discussed regulatory clarity, fostering innovation, consumer protection, bitcoin reserves and stablecoins, among other topics.

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts