Uncategorized

Crypto for Advisors: Advisors, the Final Frontier

Today’s Crypto for Advisors newsletter is written by me! Join me as I reflect on the growth of the crypto industry. Then, Kim Klemballa from CoinDesk Indices answers questions on advisors’ minds when it comes to pricing and benchmarking the asset class in “Ask the Expert.”

I hope you enjoy our newsletter. Thank you for letting me be your steward. Thanks to all the amazing contributors who share their stories week after week. I look forward to where we will be in 2 years.

Webinar alert: Explore the digital asset market and ways to access the crypto asset class beyond bitcoin. Join Ric Edelman of DACFP, David LaValle of Grayscale Investments and Andrew Baehr of CoinDesk Indices for an informative Webinar on July 16 from 1-2 p.m. ET. Live webinar only. CE credits available. Learn more and register today.

Two Years In, and Just Getting Started

Two years ago, I took on the role of editor for Crypto for Advisors at a pivotal moment. It was mid-2023, and the cryptocurrency industry was in the midst of a deep winter. The collapse of major lending platforms and the implosion of FTX had sent shockwaves through the markets. The U.S. regulatory climate was hostile, marked by enforcement-first tactics, and confidence was shaken.

But even then, the undercurrents of something bigger were impossible to ignore. Fast forward to today, and we’re standing on the edge of what Bank of America calls a “once-in-a-millennium transformation.” They’re not talking about memes or speculation. They’re talking about the reshaping of global financial infrastructure, economic models, and digital ownership — and it’s being driven by crypto.

An Ode to Bitcoin: The Genesis

“Bitcoin belongs in the same breath as the printing press and artificial intelligence.” — Bank of America:

Bitcoin, born in the aftermath of the 2008 financial crisis, created something revolutionary: a decentralized, fixed-supply digital currency. It belonged to no government, no corporation, and no central authority.

From there, a movement began. Early adoption saw students tinkering with GPUs, developers building wallets, entrepreneurs launching exchanges, and miners chasing cheap power around the globe. A technological and economic revolution took shape.

Today, we’re seeing bitcoin ETFs from the world’s largest asset managers — BlackRock, Fidelity and Grayscale being the top three by AUM — and even nation-state adoption as countries like the U.S. and UAE race to become global crypto hubs. It’s an unparalleled acceleration of financial innovation.

The Rise of Ethereum and Smart Contracts

Bitcoin sparked the fire, but Ethereum — and the smart contract innovation it introduced — brought utility, programmability, and the ability to tokenize everything: real estate, carbon credits, fine art, identity, equities, and even yield-generating protocols.

While Bitcoin and Ethereum dominate headlines, tens of thousands of digital assets exist. And while investing grabs the spotlight, blockchain is quietly transforming supply chains, intellectual property, finance, and more.

Public companies are adding crypto to their balance sheets. Over 140 public firms have announced bitcoin reserves. Exchanges like Coinbase and Kraken will offer tokenized equities, while retail platforms like Robinhood expand their crypto products. Access points are multiplying: direct-to-consumer platforms, ETFs (now in the hundreds), tokenized funds, and direct ownership. And the list keeps growing.

The Landscape Has Changed — Are You Adopting?

Only a handful of advisors were very early adopters but that’s slowly evolving. There’s broadening recognition of the opportunity — to support clients, protect relationships, and win new business. It’s becoming increasingly common to hear from advisors that they are winning clients simply because they’re willing to talk about bitcoin.

On the other hand, the lack of regulation, prohibitive firm policies, digital assets volatility behavior and overall uncertainty with a new asset class has caused hesitancy. Moreover, advisors have a lot to pay attention to —- and now learning a new — and always changing — asset class is added to the list! Despite all of this, clients want to access digital assets. Recent Coinshares survey data highlights that clients want the help of their advisors and expect them to be knowledgeable in digital assets. More than 80% of the respondents answered that they would be more likely to work with an advisor that offers digital asset guidance, and 78% of non-crypto investors say they’d turn to an advisor if crypto support were available. Notably, almost 90% said they planned to increase their crypto exposure in 2025.

A Call to Action

Blockchain is an infrastructure, crypto is more than an asset class and the technology extends well beyond investing.

The industry is maturing,regulation is advancing andthe world’s largest institutions are developing on blockchain. As U.S. Treasury Secretary Scott Bessent said recently, “Crypto is the most important phenomenon happening in the world today.”

You don’t need to be a crypto trader or blockchain developer. But if you’re a fiduciary — a guide, a planner — you owe it to your clients to understand what’s happening. Education is key.

In two years of curating this newsletter, I’ve watched sentiment shift from skepticism to curiosity to strategic integration. And we’re just getting started. I’m thrilled to be here with you on your crypto journey. Connect with me for ideas on future topics you’d like to see addressed.

— Sarah Morton, chief strategy officer, MeetAmi Innovations Inc.

Ask an Expert

Q. Why is the same digital asset priced differently on each exchange?

A. Equities “plug in” to an exchange, allowing for one, centralized price. Crypto, on the contrary, is “decentralized.” This means there’s not one “plug” to price a digital asset. While crypto prices are based on supply and demand (as well as other factors), each exchange operates independently and therefore prices can vary between different exchanges.

Q. How can I find reliable pricing data for digital assets?

A. There are many digital asset index and data providers. Look for pricing that (1) comes from a reputable and trusted provider with a proven track record in digital assets, (2) has a transparent and rules-based approach to construction, and (3) lays out thoughtfully constructed criteria for how the pricing is captured. The index methodology is incredibly important. For example, if selection criteria of an index included “trading on more than one eligible exchange” with eligibility thoughtfully designed, then in the case of the FTX collapse, FTT (the exchange token of FTX) wouldn’t have made it into the index. Thoughtful construction can rule out bad actors.

Q. Why are people using bitcoin to measure the entire digital asset landscape?

A. While bitcoin now accounts for 65% of the total digital asset market, there were times bitcoin was less than 40% of the market. One asset should not be a benchmark for the entire asset class. Diversification is key for institutional investors to manage volatility and capture broader opportunities. Effective benchmarking must serve multiple constituencies—enabling performance evaluation, supporting investment strategies, and setting industry standards for everyone.

Indices such as CoinDesk 5 (CD5), CoinDesk 20 (CD20), CoinDesk 80 (CD80), CoinDesk 100 (CD100) and CoinDesk Memecoin (CDMEME) were constructed to meet the needs of those looking to benchmark, trade and/or invest in the ever-evolving digital asset landscape.

— Kim Klemballa, CoinDesk Indices

Keep Reading

- CoinDesk breaks down the June crypto markets and ETF/ETP flows. Brought to you by ETF Express and Trackinsight.

- Digital Assets: Quarterly Review and Outlook is now available! This report by CoinDesk includes a Q2 recap, Q3 outlook and dive into digital assets dominating headlines.

- Crypto Insights Group released, “Mapping Digital Assets in Institutional Portfolios.” This report meets you at the intersection of allocators, fund managers and data.

- VanEck CEO says more Americans have exposure to bitcoin than gold.

Uncategorized

Asia Morning Briefing: Fragility or Back on Track? BTC Holds the Line at $115K

Good Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

Bitcoin (BTC) traded just above $115k in Asia Tuesday morning, slipping slightly after a strong start to the week.

The modest pullback followed a run of inflows into U.S. spot ETFs and lingering optimism that the Federal Reserve will cut rates next week. The moves left traders divided: is this recovery built on fragile foundations, or is crypto firmly back on track after last week’s CPI-driven jitters?

That debate is playing out across research desks. Glassnode’s weekly pulse emphasizes fragility. While ETF inflows surged nearly 200% last week and futures open interest jumped, the underlying spot market looks weak.

Buying conviction remains shallow, Glassnode writes, funding rates have softened, and profit-taking is on the rise with more than 92% of supply in profit.

Options traders have also scaled back downside hedges, pushing volatility spreads lower, which Glassnode warns leaves the market exposed if risk returns. The core message: ETFs and futures are supporting the rally, but without stronger spot flows, BTC remains vulnerable.

QCP takes the other side.

The Singapore-based desk says crypto is “back on track” after CPI confirmed tariff-led inflation without major surprises. They highlight five consecutive days of sizeable BTC ETF inflows, ETH’s biggest inflow in two weeks, and strength in XRP and SOL even after ETF delays.

Traders, they argue, are interpreting regulatory postponements as inevitability rather than rejection. With the Altcoin Season Index at a 90-day high, QCP sees BTC consolidation above $115k as the launchpad for rotation into higher-beta assets.

The divide underscores how Bitcoin’s current range near $115k–$116k is a battleground. Glassnode calls it fragile optimism; QCP calls it momentum. Which side is right may depend on whether ETF inflows keep offsetting profit-taking in the weeks ahead.

Market Movement

BTC: Bitcoin is consolidating near the $115,000 level as traders square positions ahead of expected U.S. Fed policy moves; institutional demand via spot Bitcoin ETFs is supporting upside

ETH: ETH is trading near $4500 in a key resistance band; gains are being helped by renewed institutional demand, tightening supply (exchange outflows), and positive technical setups.

Gold: Gold continues to hold near record highs, underpinned by expectations of Fed interest rate cuts, inflation risk, and investor demand for safe havens; gains tempered somewhat by profit‑taking and a firmer U.S. dollar

Nikkei 225: Japan’s Nikkei 225 topped 45,000 for the first time Monday, leading Asia-Pacific gains as upbeat U.S.-China trade talks and a TikTok divestment framework lifted sentiment.

S&P 500: The S&P 500 rose 0.5% to close above 6,600 for the first time on Monday as upbeat U.S.-China trade talks and anticipation of a Fed meeting lifted stocks.

Elsewhere in Crypto

Uncategorized

Wall Street Bank Citigroup Sees Ether Falling to $4,300 by Year-End

Wall Street giant Citigroup (C) has launched new ether (ETH) forecasts, calling for $4,300 by year-end, which would be a decline from the current $4,515.

That’s the base case though. The bank’s full assessment is wide enough to drive an army regiment through, with the bull case being $6,400 and the bear case $2,200.

The bank analysts said network activity remains the key driver of ether’s value, but much of the recent growth has been on layer-2s, where value “pass-through” to Ethereum’s base layer is unclear.

Citi assumes just 30% of layer-2 activity contributes to ether’s valuation, putting current prices above its activity-based model, likely due to strong inflows and excitement around tokenization and stablecoins.

A layer 1 network is the base layer, or the underlying infrastructure of a blockchain. Layer 2 refers to a set of off-chain systems or separate blockchains built on top of layer 1s.

Exchange-traded fund (ETF) flows, though smaller than bitcoin’s (BTC), have a bigger price impact per dollar, but Citi expects them to remain limited given ether’s smaller market cap and lower visibility with new investors.

Macro factors are seen adding only modest support. With equities already near the bank’s S&P 500 6,600 target, the analysts do not expect major upside from risk assets.

Read more: Ether Bigger Beneficiary of Digital Asset Treasuries Than Bitcoin or Solana: StanChart

Uncategorized

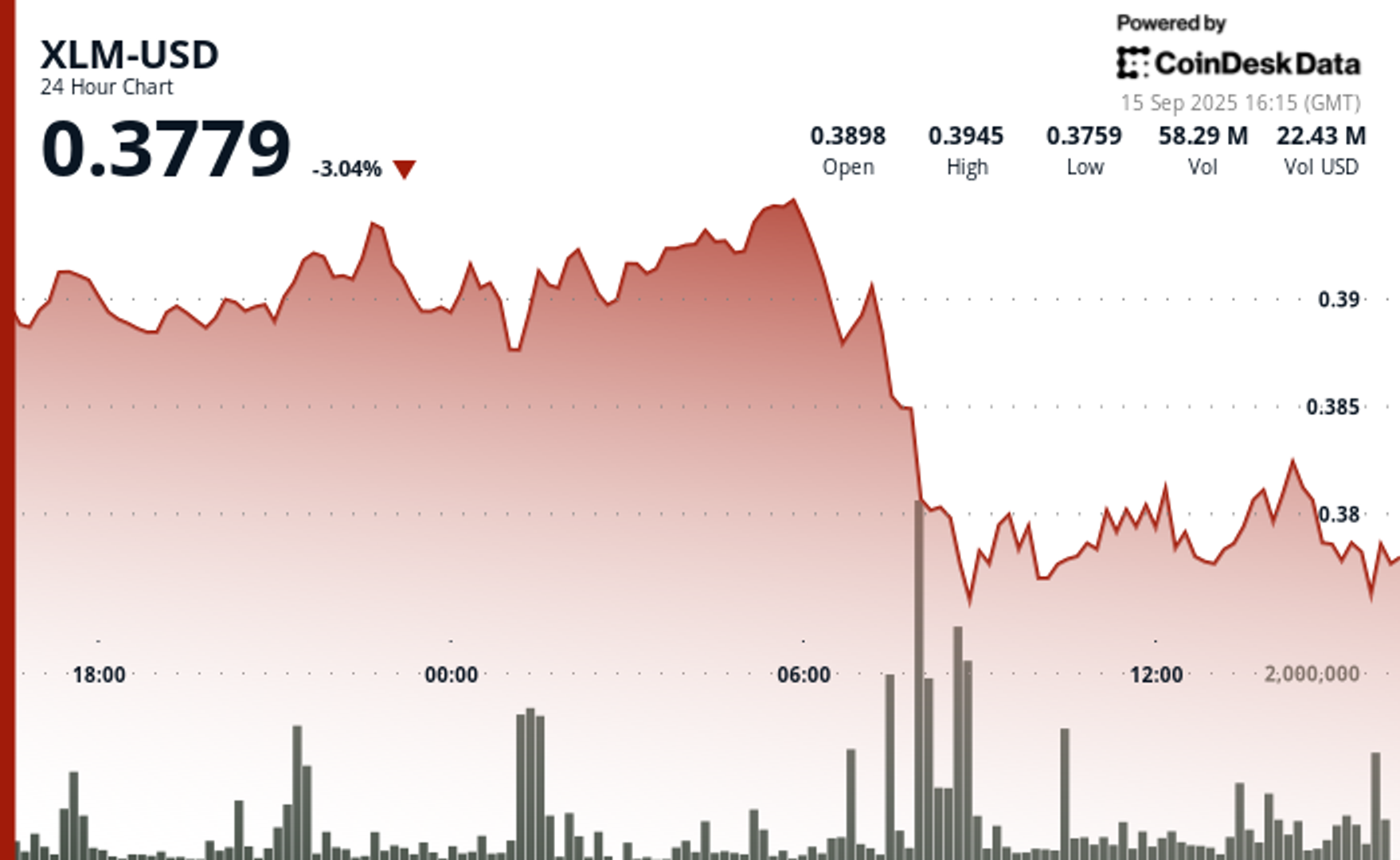

XLM Sees Heavy Volatility as Institutional Selling Weighs on Price

Stellar’s XLM token endured sharp swings over the past 24 hours, tumbling 3% as institutional selling pressure dominated order books. The asset declined from $0.39 to $0.38 between September 14 at 15:00 and September 15 at 14:00, with trading volumes peaking at 101.32 million—nearly triple its 24-hour average. The heaviest liquidation struck during the morning hours of September 15, when XLM collapsed from $0.395 to $0.376 within two hours, establishing $0.395 as firm resistance while tentative support formed near $0.375.

Despite the broader downtrend, intraday action highlighted moments of resilience. From 13:15 to 14:14 on September 15, XLM staged a brief recovery, jumping from $0.378 to a session high of $0.383 before closing the hour at $0.380. Trading volume surged above 10 million units during this window, with 3.45 million changing hands in a single minute as bulls attempted to push past resistance. While sellers capped momentum, the consolidation zone around $0.380–$0.381 now represents a potential support base.

Market dynamics suggest distribution patterns consistent with institutional profit-taking. The persistent supply overhead has reinforced resistance at $0.395, where repeated rally attempts have failed, while the emergence of support near $0.375 reflects opportunistic buying during liquidation waves. For traders, the $0.375–$0.395 band has become the key battleground that will define near-term direction.

Technical Indicators

- XLM retreated 3% from $0.39 to $0.38 during the previous 24-hours from 14 September 15:00 to 15 September 14:00.

- Trading volume peaked at 101.32 million during the 08:00 hour, nearly triple the 24-hour average of 24.47 million.

- Strong resistance established around $0.395 level during morning selloff.

- Key support emerged near $0.375 where buying interest materialized.

- Price range of $0.019 representing 5% volatility between peak and trough.

- Recovery attempts reached $0.383 by 13:00 before encountering selling pressure.

- Consolidation pattern formed around $0.380-$0.381 zone suggesting new support level.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars