Uncategorized

Crypto Daybook Americas: Trump’s Looming Tariff Escalation Fails to Rattle Bitcoin

By Omkar Godbole (All times ET unless indicated otherwise)

Despite the increasing rhetoric surrounding President Donald Trump’s tariffs, bitcoin (BTC) is holding steady alongside positive cues from foreign exchange risk barometers like AUD/JPY. Later today, Trump is due to impose 25% tariffs on steel and aluminum imports on top of additional metal duties.

This market stance ahead of an impending tariff escalation contrasts starkly with the risk aversion observed a week ago, when Trump fired the first tariff shot. Perhaps market participants think he’s using aggressive tactics to negotiate trade deals rather than committing to sustained tariffs. This notion has gained traction following lat Monday’s decision to suspend tariffs on Mexico and Canada for 30 days, hinting at a more strategic approach to trade negotiations.

According to QCP Capital, the current market stability could embolden Trump to take a tougher stance. «A feedback loop is emerging — President Trump, highly sensitive to market reactions, is facing a market increasingly calling his bluff. This could embolden him further, adding another layer of volatility,» QCP said in a Telegram broadcast.

It will be interesting to see how this develops.

There’s a social media post doing the rounds that shows record open short positions in the CME-listed cash-settled ether futures. Those shorts are not necessarily outright bearish bets and are likely components of carry trades, where investors hold long positions in ETFs while shorting CME futures. Note that the ETH ETF inflows surged last week. It’s possible some of the shorts are investors hedging against long altcoin bets amid concerns over the number of coins and impending large unlocks.

Over the weekend, Base member Kabir.Base.eth refuted claims that the sequencer Coinbase had been selling ETH earned as fees, adding a layer of transparency to its operations.

In another notable development, Archange Touadéra, president of the Central African Republic, reportedly issued a new memecoin that saw a trader turn $5,000 into an astonishing $12 million in less than three hours, achieving a remarkable return of 2,450x, according to LookOnChain data.

Meanwhile, litecoin (LTC) continues to shine as the top-performing cryptocurrency of the past 24 hours, up 9%.

On the macroeconomic front, the surge in the U.S. consumer inflation expectations raises concerns about the likelihood of a prolonged pause in Federal Reserve’s rate cuts. Plus, the U.S. Consumer Price Index (CPI) is due for release on Wednesday. Stay alert!

What to Watch

Crypto:

Feb. 13: Start of Kraken’s gradual delisting of the USDT, PYUSD, EURT, TUSD, UST stablecoins for EEA clients. The process ends March. 31.

Feb. 14: Dynamic TAO (DTAO) network upgrade goes live on the Bittensor (TAO) mainnet.

Feb. 14, 2:30 a.m. (Estimate): Qtum (QTUM) hard fork network upgrade.

Feb. 18, 10:00 a.m.: FTX Digital Markets, the Bahamas-based subsidiary of FTX, will start reimbursing creditors.

Feb. 21: TON (The Open Network) will become the exclusive blockchain infrastructure for messaging platform Telegram’s Mini App ecosystem.

Macro

Feb. 11, 2:30 p.m.: U.S. House Financial Services Subcommittee («Digital Assets, Financial Technology, and Artificial Intelligence») hearing titled «A Golden Age of Digital Assets: Charting a Path Forward.» Witness include Jonathan Jachym, who is Kraken’s deputy general counsel. Livestream link.

Feb. 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases January’s Consumer Price Index (CPI) report.

Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.2%

Core Inflation Rate YoY Prev. 3.2%

Inflation Rate MoM Est. 0.3% vs. Prev. 0.4%

Inflation Rate YoY Est. 2.9% vs. Prev. 2.9%

Feb. 12, 10:00 a.m.: Fed Chair Jerome Powell presents his semi-annual report to the U.S. House Financial Services Committee. Livestream link.

Feb. 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases January’’s Producer Price Index (PPI) report.

Core PPI MoM Est. 0.3% vs. Prev. 0%

Core PPI YoY Prev. 3.5%

PPI MoM Est. 0.2% vs. Prev. 0.2%

PPI YoY Prev. 3.3%

Feb. 13, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims report for the week ended Feb. 8.

Initial Jobless Claims Est. 215K vs. Prev. 219K

Earnings

Feb. 10: Canaan (CAN), pre-market, $-0.08

Feb. 11: HIVE Digital Technologies (HIVE), post-market, $-0.15

Feb. 11: Exodus Movement (EXOD), post-market, $0.14 (2 ests.)

Feb. 12: Hut 8 (HUT), pre-market, $0.05

Feb. 12: IREN (IREN), post-market, $-0.01

Feb. 12 (TBA): Metaplanet (TYO:3350)

Feb. 12: Reddit (RDDT), post-market, $0.25

Feb. 12: Robinhood Markets (HOOD), post-market, $0.41

Feb. 13: Coinbase Global (COIN), post-market, $1.89

Token Events

Governance votes & calls

Aave DAO is discussing recognizing HyperLend as a friendly fork of Aave deployed on the Hyperliquid EVM chain, as well as the deployment of Aave v3 on Ink, Kraken’s layer-2 rollup network.

Sky DAO is discussing, among other things, onboarding Arbitrum One to the Spark Liquidity layer, increasing the PSM2 rate limits on Base, and minting 100 million USDS worth of sUSDS into Base to accommodate for growth on the network.

Feb. 10, 10:30 a.m.: OKX to hold a listings AMA with Chief Marketing Officer Haider Rafique and Head of Product Marketing Matthew Osofisan.

Feb. 12, 2 p.m. : Render (RENDER) to host an AI Scout Discord AMA session.

Unlocks

Feb. 10: Aptos (APT) to unlock 1.97% of circulating supply worth $71.14 million.

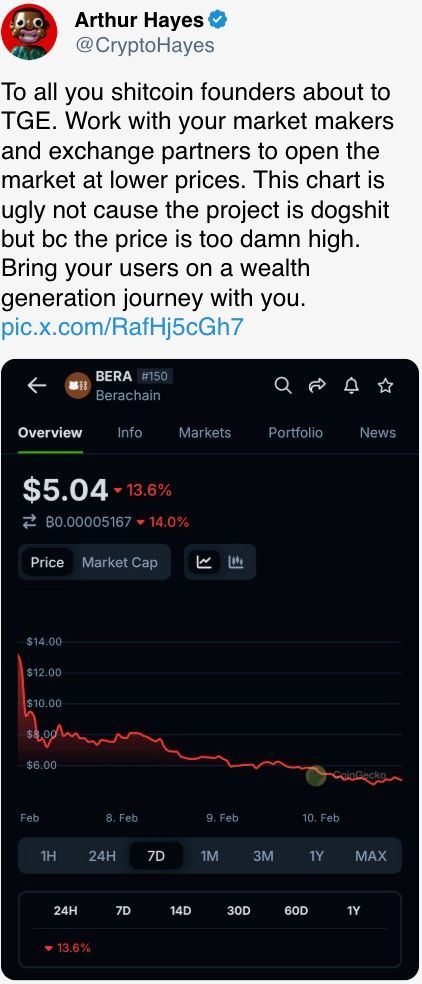

Feb. 10: Berachain (BERA) to unlock 12.08% of circulating supply worth $66.07 million.

Feb. 12: Aethir (ATH) to unlock 10.21% of circulating supply worth $23.80 million.

Feb. 14: The Sandbox (SAND) to unlock 8.4% of circulating supply worth $80.2 million.

Token Launches

Feb. 10: Analog (ANLOG) to be listed on Bitget, Gate.io, MEXC and KuCoin.

Feb. 12: Avalon (AVL) and Game 7 (G7) to be listed on Bybit.

Feb. 13: EthereumPoW (ETHW) and Polygon (MATIC) to no longer be supported at Deribit.

Conferences:

CoinDesk’s Consensus to take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Feb. 13-14: The 4th Edition of NFT Paris.

Feb. 18-20: Consensus Hong Kong

Feb. 19: Sui Connect: Hong Kong

Feb. 23 to March 2: ETHDenver 2025 (Denver, Colorado)

Feb. 25: HederaCon 2025 (Denver)

Token Talk

By Shaurya Malwa

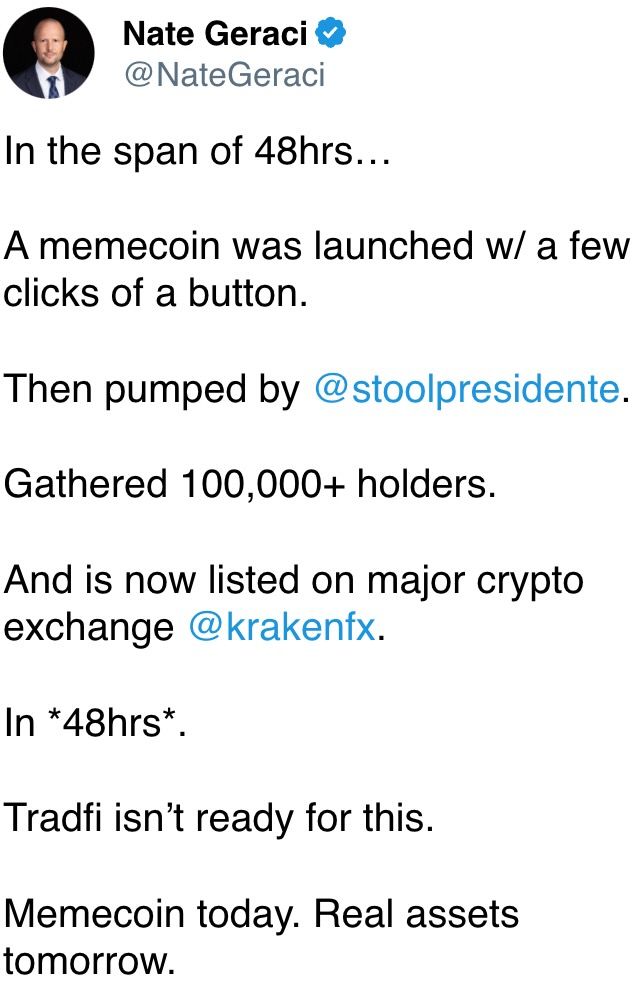

Various memecoins raffled around the world from Asia to America, bringing back signs of a frenzy that tends to grip the crypto market every few months.

BNB Chain’s TST token, originally created in a tutorial, skyrocketed to a $300 million market cap following mentions by Binance founder Changpeng Zhao. The token gained popularity in Chinese communities, posts show.

David Portnoy of U.S.-based Barstool Sports promoted JAILSTOOL as market watchers accused him of using his social influence to pump the lowcap token, which peaked at over $200 million before settling at a $78 million market cap.

The Central African Republic issued its own memecoin, CAR, aiming to support national development and increase the country’s global visibility.

Derivatives Positioning

Basis in BTC and ETH CME futures dipped below 10%, which may translate into slower inflows into the ETFs.

Perpetual funding rates on offshore exchanges for most major coins remain marginally bullish between an annualized 5% to 10%. XLM stands out as having the most negative funding rate — in excess of -20% — reflecting a bias for shorts.

Front-end ETH puts trade a vol premium of two to five points relative to calls, exhibiting downside fears. BTC front-end options also show a put bias, according to data source Amberdata.

Market Movements:

BTC is up 1.80% from 4 p.m. ET Friday to $97,805.98 (24hrs: -1.01%)

ETH is down 0.79% at $2,647.53 (24hrs: -0.63%)

CoinDesk 20 is up 2.92% to 3,209.42 (24hrs: +0.19%)

CESR Composite Staking Rate is down 3 bps to 2.97%

BTC funding rate is at 0.0087% (9.48% annualized) on Binance

DXY is up 0.12% at 108.16

Gold is up 1.44% at $2,902.17/oz

Silver is up 1.29% to $32.22/oz

Nikkei 225 closed unchanged at 38,801.17

Hang Seng closed up 1.84% at 21,521.98

FTSE is up 0.53% at 8,746.63

Euro Stoxx 50 is up 0.34% at 5,343.63

DJIA closed -0.99% to 44,303.40

S&P 500 closed -0.95% at 6,025.99

Nasdaq closed -1.36% at 19,523.40

S&P/TSX Composite Index closed -0.36% at 25,442.91

S&P 40 Latin America closed -1.10% at 2,410.24

U.S. 10-year Treasury went up 4 bps to 4.48%

E-mini S&P 500 futures are up 0.46% at 6,077

E-mini Nasdaq-100 futures are up 0.70% at 21,742

E-mini Dow Jones Industrial Average Index futures are up 0.35% at 44,576

Bitcoin Stats:

BTC Dominance: 61.70% (0.05%)

Ethereum to bitcoin ratio: 0.02717 (-0.22%)

Hashrate (seven-day moving average): 808 EH/s

Hashprice (spot): $54.1

Total Fees: 5.04 BTC / $337,318

CME Futures Open Interest: 164,510

BTC priced in gold: 33.5 oz

BTC vs gold market cap: 9.52%

Technical Analysis

Shares of Strategy (MSTR) have dived out of a mini rising channel, hinting at an end of the bounce from the Dec. 31 low and potential resumption of a broader pullback from late 2024 highs.

Prices have found acceptance below the 38.2% Fibonacci retracement of the fourfold rally seen from September to November.

A golden rule of technical analysis is that for a market to maintain its current trend, it must hold above the 38.2% level. If it fails to do so, the bull trend is said to have ended.

Crypto Equities

MicroStrategy (MSTR): closed on Friday at $327.56 (+0.56%), up 2.27% at $334.98 in pre-market.

Coinbase Global (COIN): closed at $274.49 (+1.52%), up 1.83% at $279.52 in pre-market.

Galaxy Digital Holdings (GLXY): closed at C$26.89 (-0.66%)

MARA Holdings (MARA): closed at $16.77 (-0.18%), up 1.97% at $17.10 in pre-market.

Riot Platforms (RIOT): closed at $11.64 (+0.26%), up 1.89% at $11.86 in pre-market.

Core Scientific (CORZ): closed at $12.56 (+0.24%), up 0.88% at $12.67 in pre-market.

CleanSpark (CLSK): closed at $11.33 (+9.15%), up 1.5% at 11.50 in pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $23.15 (+1.71%), up 0.52% at $23.27 in pre-market.

Semler Scientific (SMLR): closed at $49.20 (-1.44%), up 2.20% at $50.28 in pre-market.

Exodus Movement (EXOD): closed at $48.37 (+0.75%), +0.52% at 48.62 in pre-market.

ETF Flows

Spot BTC ETFs:

Daily net flow: $171.3 million

Cumulative net flows: $40.70 billion

Total BTC holdings ~ 1.176 million.

Spot ETH ETFs

Daily net flow: No flows reported.

Cumulative net flows: $3.18 billion

Total ETH holdings ~ 3.793 million.

Source: Farside Investors

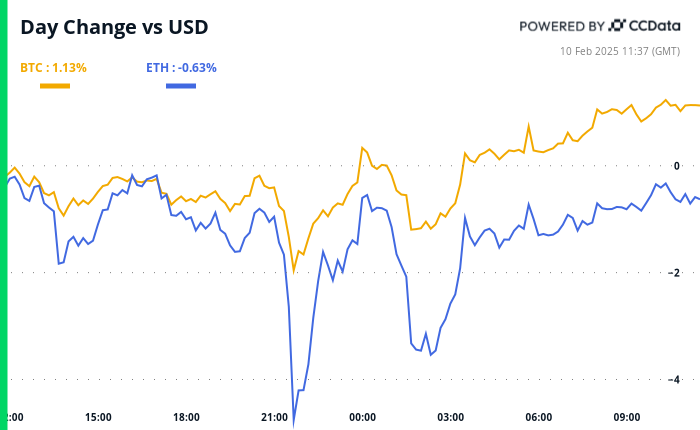

Overnight Flows

Chart of the Day

The yield on 10-year U.S. inflation-indexed securities, the so-called real yield, has dropped by 34 basis points in just over three weeks.

A continued decline could trigger a search for higher returns, galvanizing demand for risk assets, including BTC.

While You Were Sleeping

Bitcoin HODLer Metaplanet Achieves $35M Unrealized Gains in 2024 Thanks to BTC Treasury (CoinDesk): The Japanese company, which already holds 1,761 bitcoin, said it plans to have 10,000 BTC by year end.

Bitcoin Indicator That Signaled $70K Breakout Turns Bearish as Trump’s Trade War Rhetoric Grows (CoinDesk): A popular technical indicator is showing bitcoin weakness amid rising U.S. trade-tariff rhetoric. A drop below $90K would confirm persistent bearish momentum.

US Endowments Join Crypto Rush by Building Bitcoin Portfolios (Financial Times): U.S. foundations and university endowments are ramping up cryptocurrency investments, driven by FOMO and Trump’s pro-crypto stance, despite concerns over price volatility and a lack of regulatory clarity.

Trump Unveils Plans for 25% Tariffs on Steel, Aluminum Imports (Bloomberg): The U.S. is set to announce 25% tariffs on steel and aluminum imports, and reciprocal tariffs on nations taxing U.S. goods will follow this week.

Inflation Rises Amid Lunar New Year Spending As European Stocks Benefit (Euronews): China’s January inflation climbed 0.5% YoY, fueled by Lunar New Year spending and stimulus. Persistent PPI deflation and U.S.-China trade tensions remain a concern.

China’s Strategy in Trade War: Threaten U.S. Tech Companies (The Wall Street Journal): China is reportedly planning to target more U.S. tech giants like Apple and Broadcom with antitrust investigations, aiming to bolster its bargaining position in trade negotiations with the U.S.

In the Ether

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts