Uncategorized

Crypto Daybook Americas: Powell Will Set the Tone While Markets Eye Asia Battles, Trade

By Francisco Rodrigues (All times ET unless indicated otherwise)

It’s Federal Open Market Committee day in the U.S., and while there’s little expectation of a change in interest rates, the market’s attention will be focused on Federal Reserve Chair Jerome Powell’s comments at the FOMC’s press conference.

The CME’s FedWatch tool is pointing to a 97.6% chance of rates remaining unchanged and Polymarket traders are weighing a 98.3% chance, so it’s the outlook that will take center stage.

Spanish bank Bankinter said in a note that a potential rally attempt for risk assets would for now be “naive,” pointing to indicators showing main U.S. ports are seeing a reduction in containers from China, while Powell is “likely to strike a chilly tone on both future cuts and the inflation cycle.”

“We are entering a phase of unclear direction, probably sideways but with a weakening bias that may last for several weeks,” Bankinter analysts wrote.

Adding to the cautionary tone is the military flare-up between India and Pakistan. India’s “Operation Sindoor’ kicked off during Asian hours with strikes in parts of Pakistan, which has vowed to retaliate.

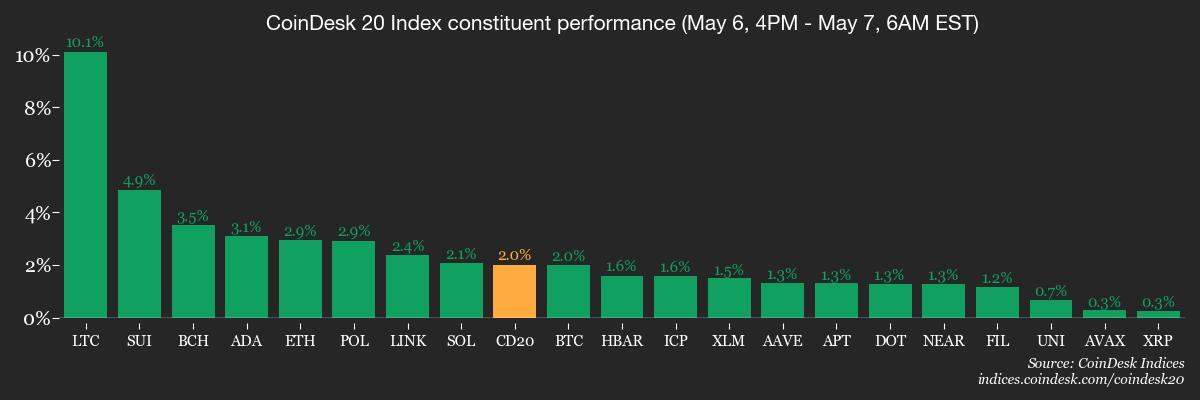

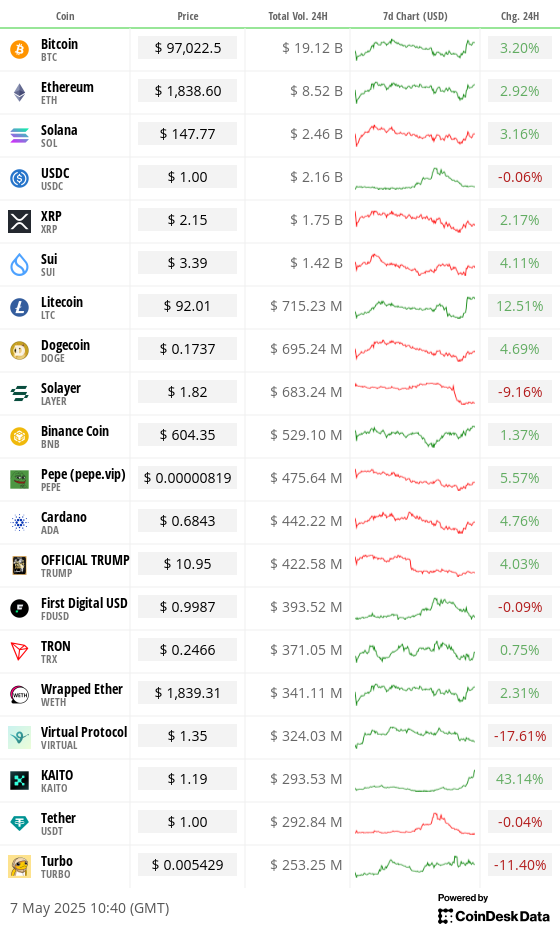

Still, spot gold retreated more than 1.7% as traders took an optimistic stance on a U.S.-China trade deal and cryptocurrency prices are rising after New Hampshire became the first state to allow the investment of public funds into crypto. Bitcoin (BTC) has added 3% in the past 24 hours and the broader crypto market, as measured via the CoinDesk 20 (CD20) index, rose 2.57%. That’s in contrast with equity markets, which fell Tuesday.

It’s still too early to say whether markets will focus more on the need for safe havens as international belligerence ramps up, or on the desire to lock in a bit more volatility as trade tensions ease. One possible signal: The largest bitcoin ETF, BlackRock’s IBIT has attracted greater net inflows than the largest gold ETF, SPDR Gold Trust (GLD), since the start of the year.

Ethereum’s Pectra upgrade went live, the network’s biggest upgrade since 2022. The upgrade includes 11 major improvement proposals (EIPs), but whether it can reverse ETH’s decline against BTC remains to be seen.

Year-to-date, ether has lost around 47% of its value to the leading cryptocurrency, with the ETH/BTC ratio now sitting at 0.019. Stay alert!

What to Watch

- Crypto:

- May 8: Judge John G. Koeltl will sentence Alex Mashinsky, the founder and former CEO of the now-defunct crypto lending firm Celsius Network, at the U.S. District Court for the Southern District of New York.

- May 12, 1 p.m. to 5:30 p.m.: A U.S. SEC Crypto Task Force Roundtable on «Tokenization: Moving Assets Onchain: Where TradFi and DeFi Meet» will be held at the SEC’s headquarters in Washington.

- Macro

- May 7, 2 p.m.: The Federal Reserve announces its interest-rate decision. The FOMC press conference is livestreamed 30 minutes later.

- Federal Funds Rate Target Range Est. 4.25%-4.5% vs. Prev. 4.25%-4.5%

- May 8, 7 a.m.: The Bank of England announces its interest-rate decision. The Monetary Policy Report Press Conference is livestreamed 30 minutes later.

- Bank Rate Est. 4.25% vs. Prev. 4.5%

- May 8, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended May 3.

- Initial Jobless Claims Est. 230K vs. Prev. 241K

- May 9-12: Chinese Vice Premier He Lifeng will hold trade talks with U.S. Treasury Secretary Scott Bessent during his visit to Switzerland.

- May 7, 2 p.m.: The Federal Reserve announces its interest-rate decision. The FOMC press conference is livestreamed 30 minutes later.

- Earnings (Estimates based on FactSet data)

Token Events

- Governance votes & calls

- Arbitrum DAO is voting on whether to put the last $10.7 million from its 35 million ARB diversification plan into three low‑risk, dollar‑based funds from WisdomTree, Spiko, and Franklin Templeton. Voting ends on May 8.

- Compound DAO is voting on which new collateral type to prioritize on Compound V3. Voting ends May 8.

- May 7, 7:30 a.m.: PancakeSwap to host an X Spaces Ask Me Anything (AMA) session on the future of trading.

- May 7, 9 a.m.: Binance to host an AMA on its Binance Seeds program.

- May 7, 11 a.m.: Pendle to host a Pendle Yield Talk: Stablecoin Alpha X Spaces session.

- May 8, 10 a.m.: Balancer and Euler to host an Ask Me Anything (AMA) session.

- Unlocks

- May 9: Movement (MOVE) to unlock 2.04% of its circulating supply worth $7.75 million.

- May 11: Solayer (LAYER) to unlock 12.87% of its circulating supply worth $47.82 million.

- May 12: Aptos (APT) to unlock 1.82% of its circulating supply worth $54.17 million.

- May 13: WhiteBIT Coin (WBT) to unlock 27.41% of its circulating supply worth $1.13 billion.

- May 15: Starknet (STRK) to unlock 4.09% of its circulating supply worth $16.74 million.

- Token Launches

- May 7: Obol (OBOL) to be listed on Binance, Bitget, Bybit, Gate.io, MEXC and others.

- May 8: Space and Time (SXT) to be listed on Binance, MEXC, BingX, KuCoin, Bitget and others.

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN) and PARSIQ (PRQ) to be delisted from Coinbase.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 2 of 2: Financial Times Digital Assets Summit (London)

- Day 2 of 3: Stripe Sessions (San Francisco)

- Day 1 of 3: SALT’s Bermuda Digital Finance Forum 2025 (Hamilton, Bermuda)

- May 9-10: Stanford Blockchain Governance Summit (San Francisco)

- May 11-17: Canada Crypto Week (Toronto)

- May 12-13: Dubai FinTech Summit

- May 12-13: Filecoin (FIL) Developer Summit (Toronto)

- May 12-13: Latest in DeFi Research (TLDR) Conference (New York)

- May 12-14: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum on Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

- May 14-16: CoinDesk’s Consensus 2025 (Toronto)

Token Talk

By Shaurya Malwa

- MOG Coin, an Ethereum and Base-based memecoin, is gaining traction on tech Twitter by fusing «mogging» (being better) with accelerationism (tech progress at all costs), birthing an internet-native ideology of mog/acc.

- Technology entrepreneurs and investors such as Elon Musk and Garry Tan have joined the trend, switching their profile pics to Pit Viper sunglasses — a symbol of the mog/acc ideology — and Solana firms like Jupiter and Raydium have followed suit.

- The mog/acc aesthetic is spreading fast thanks to viral tools like an auto-Pit Viper bot that converts profile pictures to the signature look of the movement.

- Mog/acc differs from e/acc or d/acc by skipping intellectual or moral discourse and leaning into meme culture, performance and raw ambition as a form of techno-optimism.

- Widespread adoption of mog/acc and the signature Pit Viper sunglasses could lead to increased mindshare for the MOG Coin token, which could boost demand and prices.

Derivatives Positioning

- BTC and ETH annualized CME futures basis has retreated to 6% from 8%.

- On offshore exchanges, BTC perpetual funding rates hold marginally positive while ETH’s funding rates have risen to near 10%, indicating renewed interest in taking bullish long bets.

- On Deribit, BTC front-end skew flipped negative to suggest a bias for short-term puts. A block trade involved a large long position in the $90K put expiring on May 16.

Market Movements

- BTC is up 2.11% from 4 p.m. ET Tuesday at $96.997.82 (24hrs: +2.88%)

- ETH is up 3.31% at $1,844.39 (24hrs: +2.51%)

- CoinDesk 20 is up 2.18% at 2,749.824 (24hrs: +3.35%)

- Ether CESR Composite Staking Rate is down 1 bp at 2.955%

- BTC funding rate is at -0.0006% (-0.6406% annualized) on Binance

- DXY is up 0.31% at 99.54

- Gold is down 1.2% at $3,374.49/oz

- Silver is down 1.29% at $32.76/oz

- Nikkei 225 closed -0.14% at 36,779.66

- Hang Seng closed +0.13% at 22,691.88

- FTSE is down 0.32% at 8,569.76

- Euro Stoxx 50 is down 0.2% at 5,252.95

- DJIA closed on Tuesday -0.95% at 40,829.00

- S&P 500 closed -0.77% at 5,606.91

- Nasdaq closed -0.87% at 17,689.66

- S&P/TSX Composite Index closed unchanged at 24,974.72

- S&P 40 Latin America closed -2.94% at 2,517.04

- U.S. 10-year Treasury rate is up 2 bps at 4.325%

- E-mini S&P 500 futures are up 0.53% at 5,657.00

- E-mini Nasdaq-100 futures are up 0.54% at 19,984.75

- E-mini Dow Jones Industrial Average Index futures are up 0.5% at 41,123.00

Bitcoin Stats

- BTC Dominance: 65.19 (-0.12%)

- Ethereum to bitcoin ratio: 0.0190 (+1.28%)

- Hashrate (seven-day moving average): 897 EH/s

- Hashprice (spot): $51.79

- Total Fees: 5.23 BTC / $494,601

- CME Futures Open Interest: 142,100 BTC

- BTC priced in gold: 28.3 oz

- BTC vs gold market cap: 8.04%

Technical Analysis

- ETH’s daily chart shows the cryptocurrency has exited the prolonged downtrend.

- However, the sideways move past the trendline doesn’t quality as a bullish breakout and the lower high of $2,104 created on March 24 is the new level to beat for the bulls.

Crypto Equities

- Strategy (MSTR): closed on Tuesday at $385.60 (-0.24%), up 2.7% at $396 in pre-market

- Coinbase Global (COIN): closed at $196.89 (-1.26%), up 1.88% at $200.60

- Galaxy Digital Holdings (GLXY): closed at C$25.90 (-2.3%)

- MARA Holdings (MARA): closed at $13.15 (+0.46%), up 2.74% at $13.51

- Riot Platforms (RIOT): closed at $7.86 (-0.51%), up 3.05% at $8.10

- Core Scientific (CORZ): closed at $8.99 (+2.74%), up 2.22% at $9.19

- CleanSpark (CLSK): closed at $8.09 (+0.0%), up 2.6% at $8.30

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.54 (+1.96%)

- Semler Scientific (SMLR): closed at $33.09 (-1.46%), up 4.2% at $34.48

- Exodus Movement (EXOD): closed at $39.48 (-4.36%), unchanged in pre-market

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$85.7 million

- Cumulative net flows: $40.54 billion

- Total BTC holdings ~ 1.17 million

Spot ETH ETFs

- Daily net flow: -$17.9 million

- Cumulative net flows: $2.50 billion

- Total ETH holdings ~ 3.46 million

Source: Farside Investors

Overnight Flows

Chart of the Day

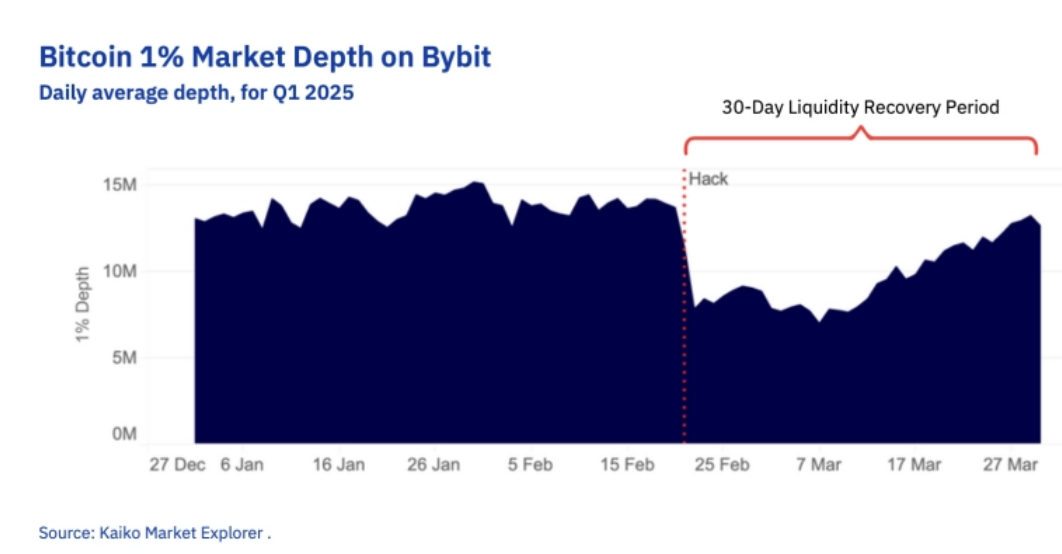

- BTC’s 1% market depth on Bybit, the collection of buy and sell orders within 1% from the going price, has recovered to levels last seen before the exchange was hacked in February.

- The recovery represents an improvement in the order book liquidity.

While You Were Sleeping

- India Strikes Pakistan Over Tourist Killings, Pakistan Says Indian Jets Downed (Reuters): India launched its heaviest strikes on Pakistan in over 20 years, prompting Islamabad to call the action a blatant act of war and vow retaliation amid global calls for restraint.

- U.S. and Chinese Officials to Meet for Trade Talks (Wall Street Journal): U.S. Treasury Secretary Scott Bessent said his weekend talks with Chinese Vice Premier He Lifeng in Switzerland will focus on easing tensions, not securing a major trade deal.

- Ethereum Activates ‘Pectra’ Upgrade, Raising Max Stake to 2,048 ETH (CoinDesk): The long-awaited “Pectra” upgrade went live, marking the blockchain’s most significant overhaul since the Merge in 2022.

- BlackRock’s Spot Bitcoin ETF Tops World’s Largest Gold Fund in Inflows This Year (CoinDesk): IBIT’s outperformance signals institutional confidence in bitcoin’s long-term outlook, even as the cryptocurrency lags in recent price performance.

- Forecasting Fed-Induced Price Swings in Bitcoin, Ether, Solana and XRP (CoinDesk): On Fed day, Volmex’s implied volatility indices suggest modest moves following the interest-rate decision, with bitcoin’s 24-hour swing at 2.56% and ether’s at 3.45%.

- Dollar Faces $2.5 Trillion ‘Avalanche’ of Asian Sales, Jen Says (Bloomberg): Eurizon SLJ Capital analysts said rising trade tensions could prompt Asian investors to repatriate funds or hedge against a weaker dollar, risking a major sell-off.

- China Keeps Adding Gold to Reserves as Challenges Stack Up (Bloomberg): The People’s Bank of China added 70,000 ounces of gold in April, lifting its six-month total to nearly 1 million, while futures trading volumes recently reached all-time highs in Shanghai.

In the Ether

Uncategorized

Chart of the Week: Crypto May Now Have Its Own ‘Inverse Cramer’ and Profits Are in the Millions

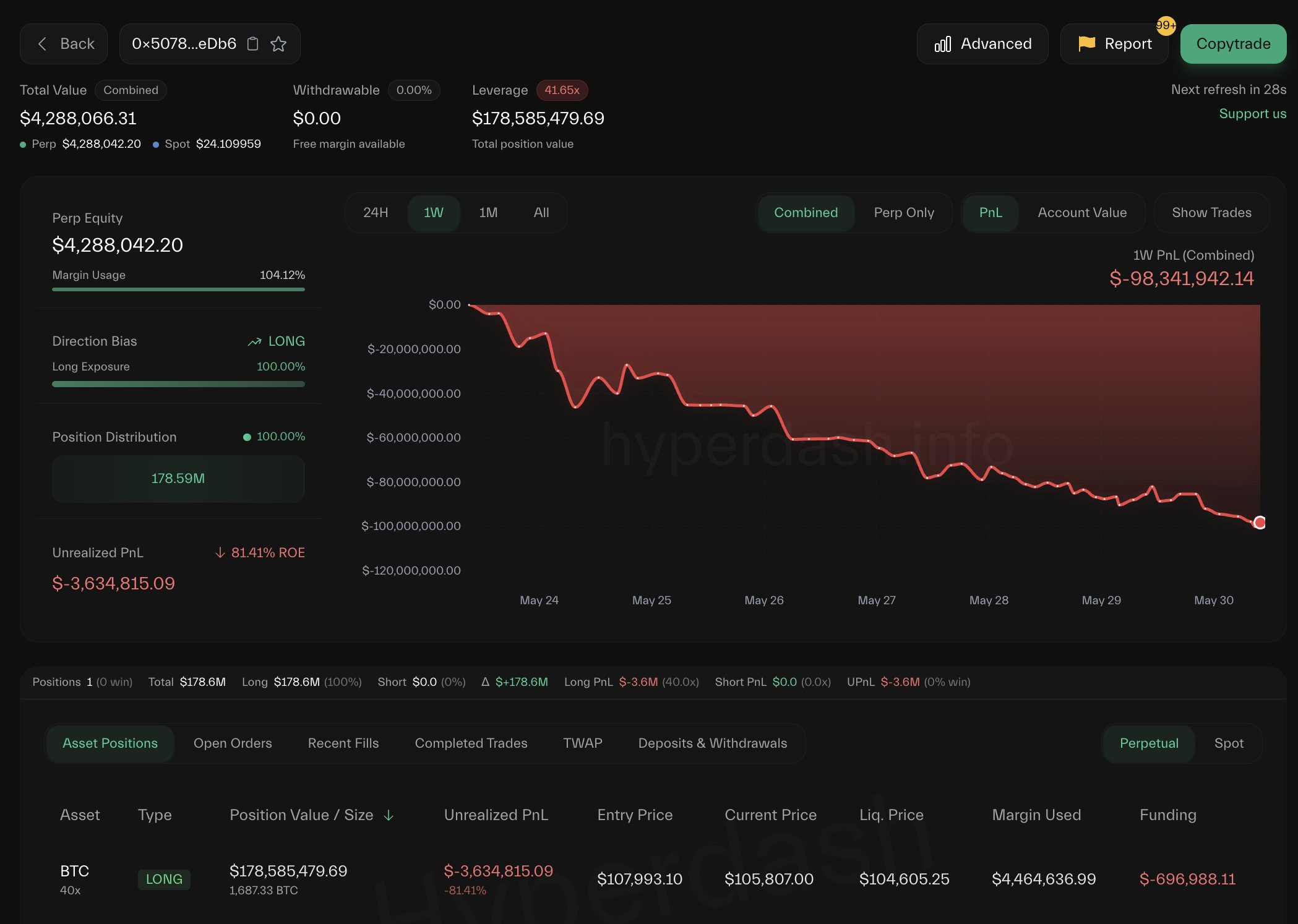

Meet James Wynn, the pseudonymous trader on Hyperliquid who became famous for his $1 billion bitcoin short bet, could now be gaining a new kind of fame: as crypto’s own “Inverse Cramer.”

For those unfamiliar with the Cramer lore: he’s the high-octane, loud-money mascot of CNBC’s Mad Money, a former hedge fund manager turned stock picker with a hit-or-miss track record that turned into a meme. Many retail traders started doing the exact opposite of his recommendations, and the idea became so famous that an “Inverse Cramer ETF” was launched (it was later shut down, but the meme lives on).

Now, crypto traders might have found their new «Inverse Jim Cramer» in James Wynn’s trading wallet.

«The winning strategy lately? Do the opposite of James Wynn,» said blockchain sleuth Lookonchain in an X post, pointing to a trader who has been making millions by doing exactly the opposite of James Wynn’s trades.

«0x2258 has been counter-trading James Wynn—shorting when James Wynn goes long, and going long when James Wynn shorts. In the past week, 0x2258 has made ~$17M, while James Wynn has lost ~$98M,» Lookonchain said in the post.

Seventeen million dollars in a week just by inverse-betting on one trader is not a bad payday. However, this might be a short-term trade, and one should be very cautious as things can change lightning fast in the trading world, leaving punters millions in losses if not hedged properly.

Even James Wynn said, «I’ll run it back, I always do. And I’ll enjoy doing it. I like playing the game,” after the trader got fully liquidated over the weekend.

So, maybe this Reddit gem: «How much money would you have made if you did the exact opposite of Jim Cramer?» would never translate to include James Wynn. But the sentiments, though, are loud and clear: in a market where perception is half the trade, even your PnL can get memed!

A bonus read: Jim Cramer Doesn’t Know Bitcoin«

Uncategorized

XRP’s Indecisive May vs. Bullish Bets – A Divergence Worth Watching

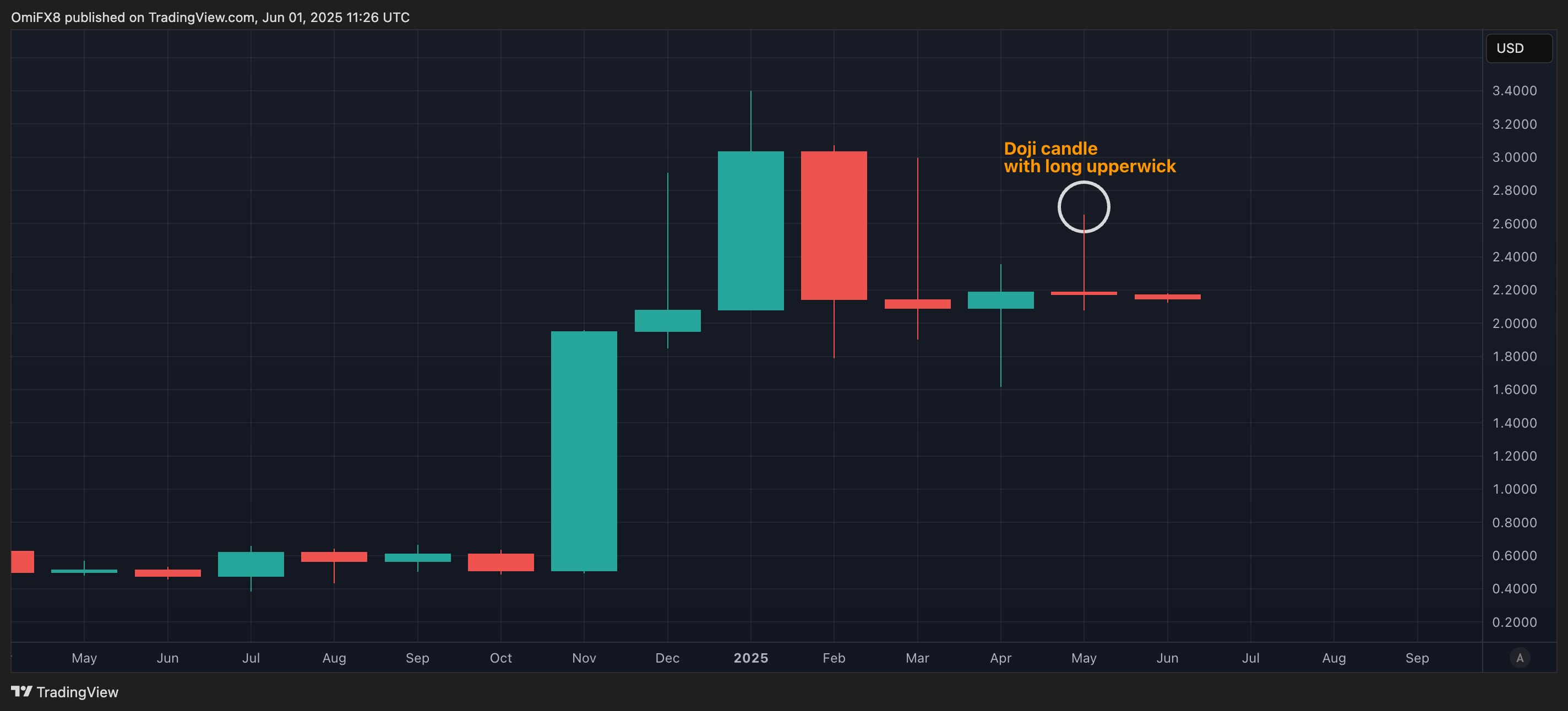

XRP, used by Ripple to facilitate cross-border transactions, ended May with signs of indecision. Still, activity on the dominant crypto options exchange, Deribit, suggests that bulls aren’t ready to back down yet.

The payments-focused cryptocurrency formed a «doji» with a long upper shadow in May, a classic sign of indecision in the market, according to charting platform TradingView.

The long upper wick suggests that bulls pushed prices higher to $2.65, but bears stepped in and rejected those levels, driving prices down to near the level seen at the start of the month.

The appearance of the doji suggests the recovery rally from the early April lows near $1.60 has likely run out of steam. Doji candles appearing after uptrends often prompt technical analysts to call for bull exhaustion and a potential turn lower.

Accordingly, last week, some traders purchased the $ 2.40 strike put option expiring on May 30. A put option offers insurance against price drops.

Bullish options open interest

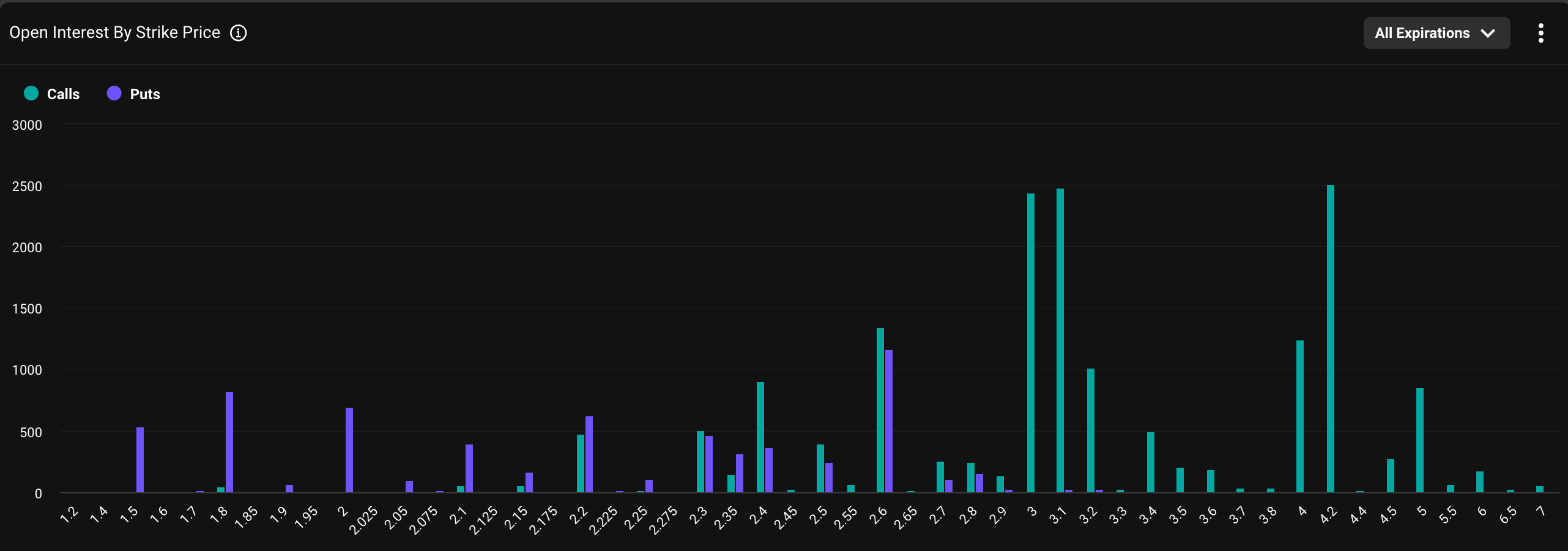

The overall picture remains bullish, with options open interest concentrated in higher-strike calls in a sign of persistent positive sentiment. Open interest refers to the number of active contracts at a given time. A call option gives the purchaser an asymmetric upside exposure to the underlying asset, in this case, XRP, representing a bullish bet.

«XRP open interest on Deribit is steadily increasing, with the highest concentration of strikes clustered on the upside between $2.60 and $3.0+, reflecting a notably bullish sentiment while the spot price currently trades at $2.16,» Luuk Strijers, CEO of Deribit, told CoinDesk.

The chart shows that the $4 call option is the most popular, with a notional open interest of $5.39 million. Calls at the $3 and $3.10 strikes have an open interest (OI) of over $5 million each. Notional open interest refers to the dollar value of the number of active contracts.

«XRP option open interest is split across June and September expiries, with monthly notional volumes approximating $65–$70 million, of which over 95% is traded on Deribit,» Strijers said.

The bullish mood likely stems from XRP’s positioning as a cross-border payments solution and mounting expectations of a spot XRP ETF listing in the U.S. Furthermore, the cryptocurrency is gaining traction as a corporate treasury asset.

Ripple, which uses XRP to facilitate cross-border transactions, recently highlighted its potential to address inefficiencies in SWIFT-based cross-border payments. The B2B cross-border payments market is projected to increase to $50 trillion by 2031, up 58% from $31.6 trillion in 2024.

Uncategorized

ETH Price Dips Below $2,500 on Whale Exit Fears, Then Bounces Back Above Key Level

Ethereum (ETH) faced renewed downside pressure in late trading, tumbling below the $2,500 level as selling volume surged and broader risk sentiment weakened. Global trade tensions and renewed U.S. tariff risks have triggered risk-off flows, with digital assets increasingly mirroring traditional markets in their reaction to geopolitical uncertainty.

On-chain data revealed sizable inflows to centralized exchanges — most notably 385,000 ETH to Binance —a dding to speculation that institutional players may be trimming positions. Although ETH has since recovered modestly to trade around $2,506, market observers are closely watching whether buyers can defend this level or if another leg lower is imminent.

Technical Analysis Highlights

- ETH traded within a volatile $48.61 range (1.95%) between $2,551.09 and $2,499.09.

- Price action formed a bullish ascending channel before breaking down in the final hour.

- Heavy selling emerged near $2,550, with profit-taking accelerating into a sharp reversal.

- ETH dropped from $2,521.35 to $2,499.09 between 01:53 and 01:54, with combined volume exceeding 48,000 ETH across two minutes.

- Volume normalized shortly after, and price recovered slightly, consolidating around the $2,504–$2,508 band.

- The $2,500 level is now acting as interim support, though momentum remains fragile with signs of distribution still evident in recent volume patterns.

External References

- «Ethereum Price Analysis: Is ETH Dumping to $2K Next as Momentum Fades?«, CryptoPotato, published May 31, 2025.

- «Ethereum Bulls Defend Support – Key Indicator Hints At Short-Term Rally«, NewsBTC, published May 31, 2025.

-

Fashion8 месяцев ago

Fashion8 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion8 месяцев ago

Fashion8 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoThe old and New Edition cast comes together to perform

-

Business8 месяцев ago

Business8 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports8 месяцев ago

Sports8 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment8 месяцев ago

Entertainment8 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoDisney\’s live-action Aladdin finally finds its stars