Uncategorized

Crypto Daybook Americas: PEPE Signals Altcoin Frenzy as Rampant Ether Outpaces Bitcoin

By Omkar Godbole (All times ET unless indicated otherwise)

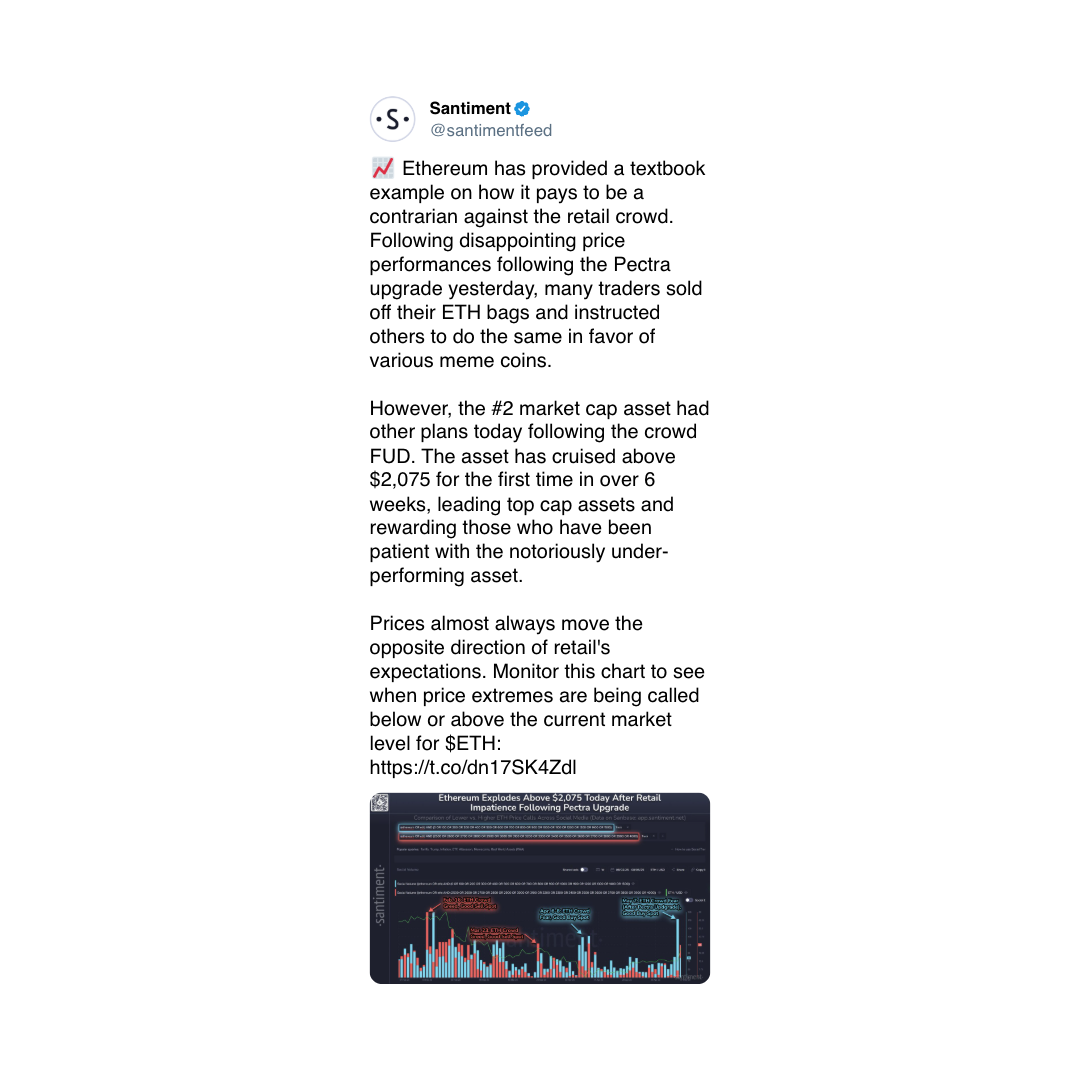

As the crypto rally gathers pace ether has widened its lead over bitcoin in terms of volatility expectations, signaling relatively greater action not just in the second-largest cryptocurrency, but in the broader digital asset market as a whole.

Deribit’s ether implied volatility index (ETH DVOL), which represents the 30-day expected price turbulence, has shot up 11% to an annualized 7% this week while the bitcoin equivalent, BTC DVOL, held steady near multimonth lows around 45%, according to data source TradingView.

The divergence has widened the spread between the two to 27%, the most in at least two years. Clearly, traders are anticipating greater volatility in ETH and the broader altcoin market.

According to some observers, ETH has turned deflationary because the Pectra upgrade implemented this week has boosted on-chain activity and led to over 38,000 ETH burned or destroyed in the past 24 hours. Some market participants are buying higher strike ETH calls on Deribit in anticipation of continued price gains.

We could be on the verge of an altcoin season, as the BTC dominance rate looks to end its five-month-long uptrend. (Check out Technical Analysis).

In key news, American fast-food chain Steak ‘n Shake said Thursday it will begin accepting BTC as a payment mode at all U.S. locations starting May 16, allowing its 100 million customers to shop with the world’s biggest digital-asset token.

T-Rex, the Web3 consumer entertainment platform, which is backed by Portal Ventures, North Island Ventures, Framework Ventures and Arbitrum Gaming Ventures, raised $17 million in pre-seed financing.

Finally, just in case you missed it, cryptocurrency exchange Coinbase agreed to buy the world’s largest crypto options exchange, Deribit, for $2.9 billion in cash and shares in the crypto industry’s largest ever M&A deal. Deribit controls over 80% of the activity, meaning Coinbase will be able to offer a full suite of spot and derivative products, boosting liquidity on the platform. Stay alert!

What to Watch

- Crypto:

- May 12, 1 p.m.-5:30 p.m.: A U.S. SEC Crypto Task Force Roundtable on «Tokenization: Moving Assets Onchain: Where TradFi and DeFi Meet» will be held at the SEC’s headquarters in Washington.

- May 13: The Singapore High Court holds a hearing to determine whether Zettai, the parent company of WazirX, can proceed with restarting the India-based crypto exchange and compensating users affected by the July 2024 hack.

- May 14: Neo (NEO) mainnet will undergo a hard fork network upgrade (version 3.8.0) at block height 7,300,000.

- May 14: Expected launch date for VanEck Onchain Economy ETF (ticker: NODE).

- May 16, 9:30 a.m.: Galaxy Digital Inc.’s Class A shares are set to begin trading on the Nasdaq under the ticker symbol GLXY.

- Macro

- May 9, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases April consumer price inflation data.

- Inflation Rate MoM Prev. 0.56%

- Inflation Rate YoY Prev. 5.48%

- May 9, 8:30 a.m.: Statistics Canada releases April employment data.

- Unemployment Rate Est. 6.8% vs. Prev. 6.7%

- Employment Change Est. 2.5K vs. Prev. -32.6K

- May 9-12: Chinese Vice Premier He Lifeng will hold trade talks with U.S. Treasury Secretary Scott Bessent during his visit to Switzerland.

- May 9, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases April consumer price inflation data.

- Earnings (Estimates based on FactSet data)

- May 9: TeraWulf (WULF), pre-market

- May 12: Exodus Movement (EXOD), post-market

- May 13: Semler Scientific (SMLR), post-market

- May 14: Bitfarms (BITF), pre-market

- May 14: IREN (IREN), post-market

- May 15: Bit Digital (BTBT), post-market

- May 15: Bitdeer Technologies Group (BTDR), pre-market

- May 15: KULR Technology Group (KULR), post-market

Token Events

- Governance votes & calls

- A Sei Network developer proposed ending support for Cosmos to simplify the blockchain and align more closely with Ethereum to reduce complexity and infrastructure overhead and boost Sei’s adoption.

- May 15, 10 a.m.: Moca Network to host a Discord townhall session discussing network updates.

- Unlocks

- May 9: Movement (MOVE) to unlock 2.04% of its circulating supply worth $8.08 million.

- May 11: Solayer (LAYER) to unlock 12.87% of its circulating supply worth $35.66 million.

- May 12: Aptos (APT) to unlock 1.82% of its circulating supply worth $57.45 million.

- May 13: WhiteBIT Coin (WBT) to unlock 27.41% of its circulating supply worth $1.14 billion.

- May 15: Starknet (STRK) to unlock 4.09% of its circulating supply worth $17.7 million.

- Token Launches

- May 9: OKX lists Jito with JITOSOL/USDT pair.

- May 9: BitMart lists Minutes Network Token with MNTX/USDT pair.

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN), and PARSIQ (PRQ) to be delisted from Coinbase.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 3 of 3: SALT’s Bermuda Digital Finance Forum 2025 (Hamilton, Bermuda)

- Day 1 of 2: Stanford Blockchain Governance Summit (San Francisco)

- May 11-17: Canada Crypto Week (Toronto)

- May 12-13: Dubai FinTech Summit

- May 12-13: Filecoin (FIL) Developer Summit (Toronto)

- May 12-13: Latest in DeFi Research (TLDR) Conference (New York)

- May 12-14: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum on Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

- May 14-16: CoinDesk’s Consensus 2025 (Toronto)

Token Talk

By Shaurya Malwa

- PEPE is up more than 40% in the past 24 hours, outperforming most major tokens as traders continue to treat it as a high-beta ETH play — a speculative vehicle to gain outsized exposure to ether (ETH).

- The memecoin has become a proxy for ETH upside since early 2024 because the PEPE price tends to react strongly to ETH narratives such as the recent Pectra upgrade, which preceded a 20% jump in the second-largest cryptocurrency.

- Trading volumes for PEPE surged past $3.5 billion in the past 24 hours, several times more than Wednesday’s $500 million.

- This marks one of the token’s strongest weeks in the past year and signals a return of risk appetite in the memecoin space.

- Derivatives data shows rising open interest and funding rates for PEPE futures, suggesting a wave of leverage-fueled bets are targeting the frog-themed token in the hope of higher volatility ahead.

- Meanwhile, Solana-based hippo token MOODENG rallied over 150%. The project, known for its absurdist branding based on a viral Thai hippo, is popular among Asian trader circles.

- Cat-themed MOG also posted double-digit gains, but PEPE remains the most liquid and visible memecoin in the current ETH-beta trade.

Derivatives Positioning

- BTC and ETH annualized futures basis on the CME has surprisingly held steady near 7% despite the price rallies. That could be a sign of market maturity as cash and carry arbitrage narrows price discrepancies.

- On off-shore exchanges, perpetual funding rates for BTC, ETH and most major tokens are hovering between annualized 10% and 14%, reflecting a bullish bias.

- In the options market, BTC and ETH risk reversals show call bias. Block flows featured a short position in the $95K put expiring on May 15 and calendar spreads in May and June expiries.

Market Movements

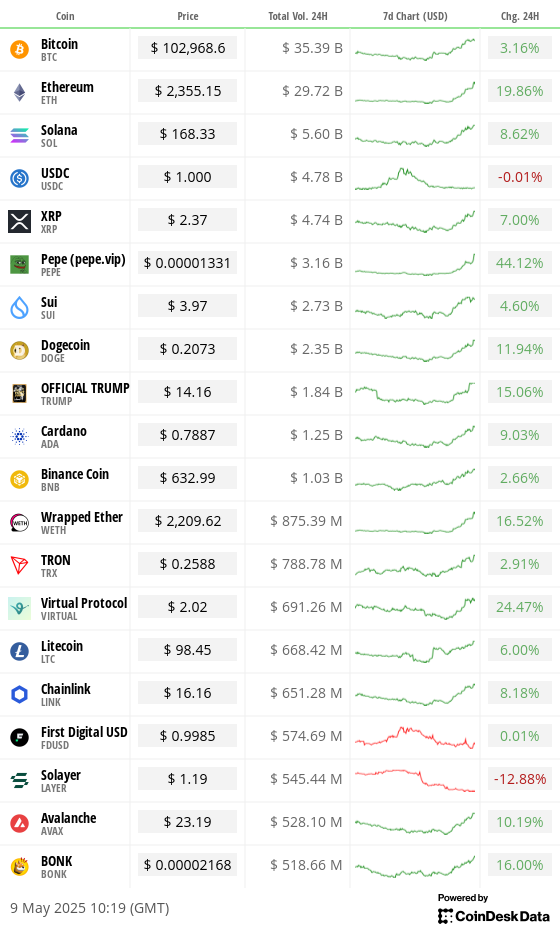

- BTC is up 1.19% from 4 p.m. ET Thursday at $102,725.44 (24hrs: +2.92%)

- ETH is up 9.9% at $2,328.10 (24hrs: +20.03%)

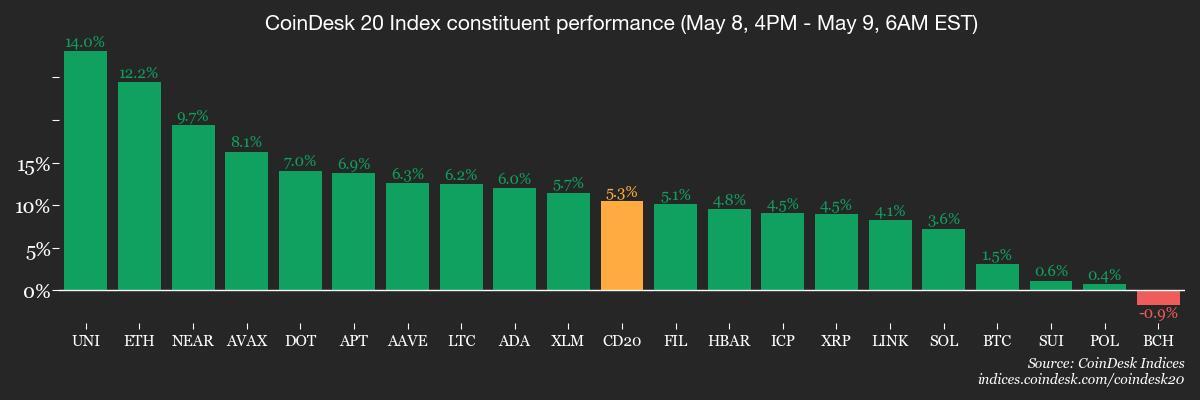

- CoinDesk 20 is up 4.59% at 3,116.42 (24hrs: +8.86%)

- Ether CESR Composite Staking Rate is up 15 bps at 3.04%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is down 0.26% at 100.38

- Gold is up 0.67% at $3,325.99/oz

- Silver is up 0.45% at $32.60/oz

- Nikkei 225 closed +1.56% at 37,503.33

- Hang Seng closed +0.4% at 22,867.74

- FTSE is up 0.48% at 8,572.92

- Euro Stoxx 50 is up 0.38% at 5,308.85

- DJIA closed on Thursday +0.62% at 41,368.45

- S&P 500 closed +0.58% at 5,663.94

- Nasdaq closed +1.07% at 17,928.14

- S&P/TSX Composite Index closed +0.37% at 25,254.06

- S&P 40 Latin America closed +1.8% at 2,557.27

- U.S. 10-year Treasury rate is unchanged at 4.38%

- E-mini S&P 500 futures are up 0.11% at 5,690.75

- E-mini Nasdaq-100 futures are up 0.23% at 20,193.50

- E-mini Dow Jones Industrial Average Index futures are unchanged at 41,445.00

Bitcoin Stats

- BTC Dominance: 63.94 (-0.80%)

- Ethereum to bitcoin ratio: 0.2282 (6.79%)

- Hashrate (seven-day moving average): 925 EH/s

- Hashprice (spot): $55.50

- Total Fees: 6.54 BTC / $655,033

- CME Futures Open Interest: 149,545 BTC

- BTC priced in gold: 31.3 oz

- BTC vs gold market cap: 8.86%

Technical Analysis

- BTC’s dominance rate, or the largest cryptocurrency’s share of the crypto market, might soon drop below a trendline, characterizing BTC outperformance relative to the broader market since December.

- The breakdown will likely mean the onset of the altcoin season.

Crypto Equities

- Strategy (MSTR): closed on Thursday at $414.38 (+5.58%), up 1.75% at $421.65 in pre-market

- Coinbase Global (COIN): closed at $206.5 (+5.06%), down 1.33% at $203.76

- Galaxy Digital Holdings (GLXY): closed at $27.67 (+4.45%)

- MARA Holdings (MARA): closed at $14.29 (+7.2%), down 1.33% at $14.10

- Riot Platforms (RIOT): closed at $8.44 (+7.65%), up 1.42% at $8.56

- Core Scientific (CORZ): closed at $9.45 (+6.18%), up 2.54% at $9.69

- CleanSpark (CLSK): closed at $8.68 (+8.09%), down 1.73% at $8.53

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $15.53 (+6.44%)

- Semler Scientific (SMLR): closed at $35.24 (+6.63%) , up 1.87% at $35.90

- Exodus Movement (EXOD): closed at $42.49 (+6.2%), unchanged in pre-market

ETF Flows

Spot BTC ETFs:

- Daily net flows: $117.4 million

- Cumulative net flows: $40.81 billion

- Total BTC holdings ~ 1.17 million

Spot ETH ETFs

- Daily net flows: -$16.1 million

- Cumulative net flows: $2.47 billion

- Total ETH holdings ~ 3.45 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The MOVE index, which measures the expected volatility in the U.S. Treasury market that underpins global finance, has nearly reversed the late March to early April spike.

- The decline supports increased risk-taking in financial markets, including cryptocurrencies.

While You Were Sleeping

- Danger Grows as India and Pakistan Appear to Escalate Military Clash (The New York Times): India said it intercepted drone and missile attacks on its military sites and struck Pakistani air defenses near Lahore. Pakistan said it downed over two dozen Indian drones.

- Bitcoin Sees Surge in Institutional Confidence, Deribit-Listed BTC Options Market Reveals (CoinDesk): Strong demand for bitcoin call options at $110,000 and calendar spreads targeting $140,000 suggests traders expect a rally to potentially extend into September.

- Metaplanet Plans a Further $21M Bond Sale to Buy More BTC (CoinDesk): The Tokyo-based company’s directors agreed to issue the zero-coupon bonds to EVO FUND, marking its third such deal in a week.

- Florida Pharma Firm Will Use XRP for Real-Time Payments in $50M Financing Deal (CoinDesk): Wellgistics Health said XRP’s 3- to 5-second settlement time will enable near real-time payments across pharmacies, suppliers and manufacturers, with blockchain records supporting compliance, rebate tracking and auditability.

- Poland to Open Way for French Nuclear Shield Talks With a Treaty (Bloomberg): Polish Prime Minister Donald Tusk and French President Emmanuel Macron will sign a treaty Friday pledging mutual military aid in the event of armed conflict.

- China’s Exports to U.S. Plunge, in Sign of Bite From Trump Tariffs (The Wall Street Journal): China’s exports to the U.S. sank 21% year over year in April, while shipments to ASEAN, Latin America, Africa and the EU surged by more than 10%.

In the Ether

Uncategorized

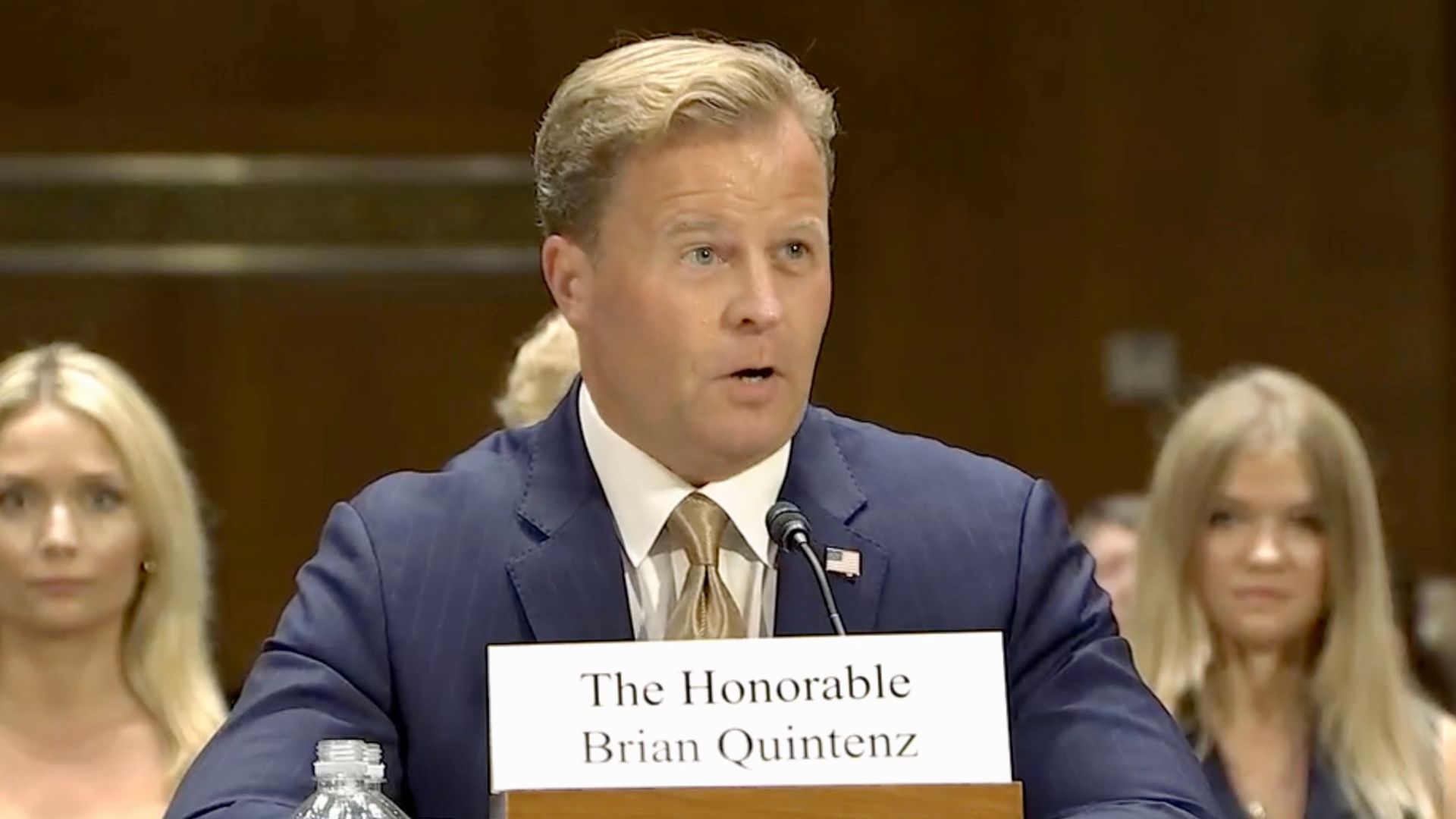

Trump’s CFTC Pick Says U.S. Can Boost Crypto Innovation and Shield Consumers

President Donald Trump’s pick to be chairman of the U.S. commodities watchdog, Brian Quintenz, fielded crypto questions more than any other topic at his Senate confirmation hearing on Tuesday, and he assured the lawmakers that the agency can walk a middle ground between unhampered innovation and robust consumer safeguards.

Even as Quintenz awaits the Senate Agriculture Committee’s vote on whether to advance his nomination as chairman of the Commodity Futures Trading Commission, Congress is working on market structure legislation that could elevate that agency as the marquee regulator of U.S. crypto activity. Quintenz, a former CFTC commissioner, is no stranger to that sector, having served as venture capital firm a16z’s head of policy.

«I have always viewed market structure legislation as an opportunity to be both pro-customer protection and pro-innovation at the same time,» he told the senators weighing his nomination, which ultimately needs to be approved by the overall Senate before he can take over the commission. He said the bill could «provide the clarity to buildings, entrepreneurs, innovators to develop products» while also ensuring the regulated firms are appropriately protecting the users of those products.

«Congress should create an appropriate market regulatory regime to ensure that this technology’s full promise can be realized, and I am fully prepared to use my experience and expertise to assist in that effort as well in executing any expanded mission should legislation pass into law,» Quintenz said, adding that he’s willing to work under the CFTC’s current powers «to provide clarity of how the agency’s statutory objectives could be successfully leveraged through this technology.»

Quintenz would join a commission that’s being abandoned by commissioners. By statute, the CFTC has five members — with three from the party in power — but the members have left or are in the process of leaving, including Acting Chairman Caroline Pham, who said she’s leaving when Quintenz starts work. The lone Democrat, Kristen Johnson, said she’ll depart «later this year,» leaving some uncertainty about her timing. So Quintenz may serve opposite a single Democrat before eventually working alone for a time, leaving potential legal vulnerability for any unilateral policies.

Some of the Democratic senators noted the Trump administration has been systematically stripping regulatory commissions of their Democratic members — described by Senator Raphael Warnock as «political purges» — and asked Quintenz if he would encourage the White House to fill both sides of the roster.

«The president is the head of the executive, and the president will make his own decisions. Quintenz said. He later added, «I don’t tell the president what to do.»

He granted that the agency may need more funding if it’s assigned the monumental new task as the regulator of digital commodities spot markets, which would include transactions of bitcoin BTC. Quintenz said that new staff would be made more efficient by «a technology-first approach» that makes the employees more efficient.

Quintenz also fielded a number of questions on the prediction markets, another area he’s had direct experience with as a board member of Kalshi, which fought a legal battle with the CFTC over the regulation of event contracts. He defended such event contracts as an appropriate «hedging tool.»

«I believe the Commodity Exchange Act is very clear about the purpose of derivatives markets, the purpose of risk management and price discovery, and that events [contracts] can serve a function in that mandate,» he said.

Read More: Trump to Tap Former CFTC Commissioner, a16z Policy Head Brian Quintenz for CFTC Head

Uncategorized

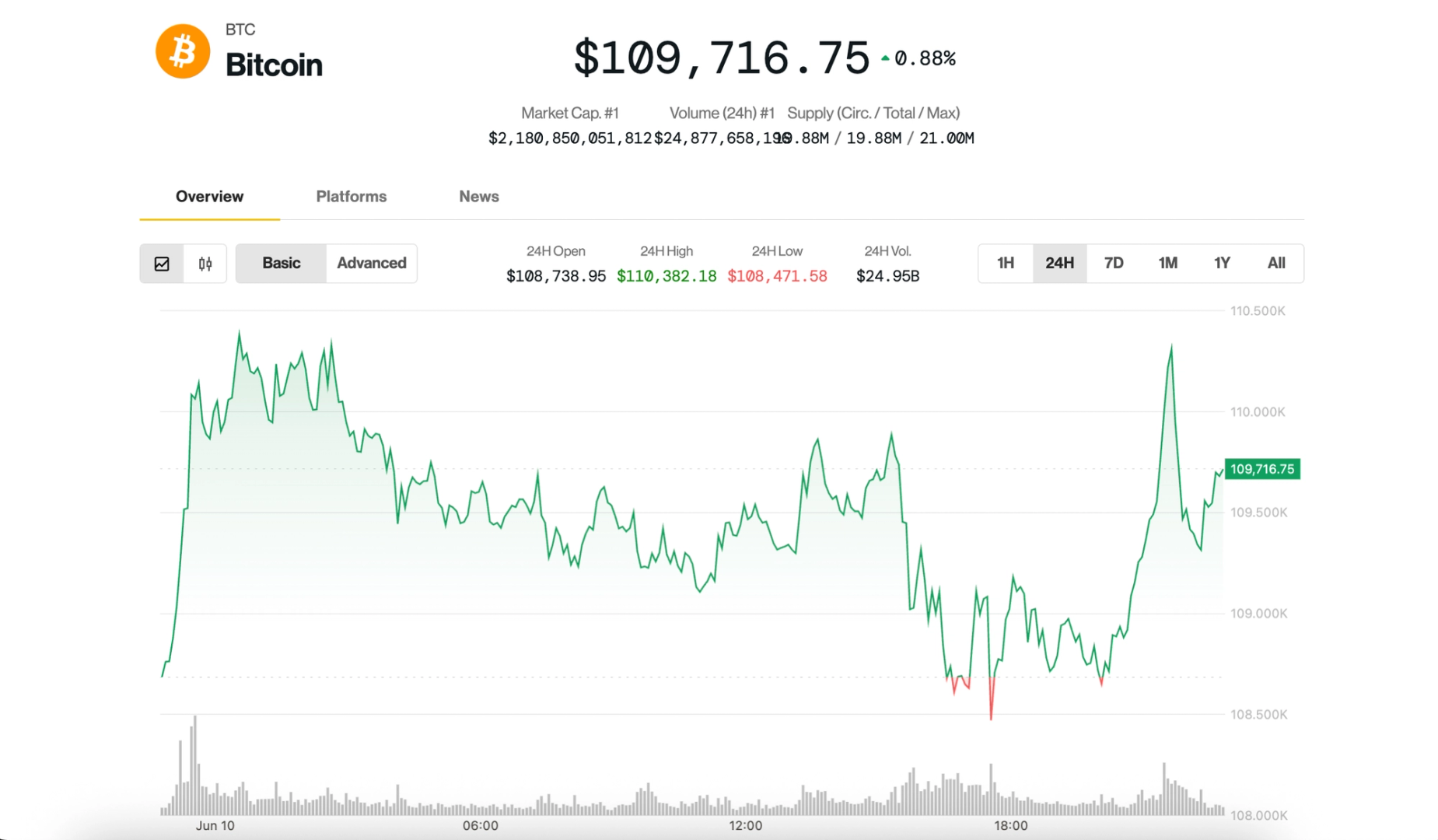

Bitcoin Rises to $110K as Altcoins Rally; Traders Skeptical of Breakout

Bitcoin recaptured the $110,000 level for the second consecutive day, perhaps dragged higher by even larger gains among altcoins.

Up 0.9% more than 1% in the last 24 hours, bitcoin was trading just above $110,000 shortly after the close of U.S. stock markets Tuesday. The CoinDesk 20 — an index of the top 20 cryptocurrencies by market capitalization, excluding stablecoins, exchange coins and memecoins — has risen 3.3% in the same period of time, mostly thanks to ether ETH, solana SOL, chainlink LINK all gaining 5%-7%.

The standout performances, however, were put on by uniswap UNI and aave AAVE, which soared a whooping 24% and 13%, respectively. The move was prompted by optimistic comments on the topic of DeFi by Securities and Exchange Commission (SEC) Chair Paul Atkins on Monday.

Things have remained relatively calm on the equities front, with most crypto stocks flat on the day. A notable exception is Semler Scientific (SMLR), a firm that aims to follow Strategy’s (MSTR) playbook and vacuum up as much bitcoin as possible. Shares fell another 10% today, with the stock now trading for less than the value of the bitcoin on its balance sheet.

Despite the day’s gains, positioning across crypto markets still reflects a largely defensive tone.

«Funding rates and other leverage proxies point toward a steadily cautious sentiment in the market,” Vetle Lunde, head of research at K33 Research, pointed out in a Tuesday report. «The broad risk appetite is remarkably weak, given that BTC is trading close to former all-time highs.»

Binance’s BTC perpetual swaps posted negative funding rates on multiple days last week, with the average annualized funding rate now sitting at just 1.3% — a level typically associated with local market bottoms rather than tops, Lunde noted.

«Bitcoin does not usually peak in environments with negative funding rates,» he wrote, adding that past instances of such positioning have more often preceded rallies than corrections.

Flows into leveraged bitcoin ETFs paint a similar picture. The ProShares 2x Bitcoin ETF (BITX) currently holds exposure equivalent to 52,435 BTC — well below its December 2023 peak of 76,755 BTC — and inflows remain muted. This defensive positioning, according to Lunde, leaves room for a potential «healthy rally» in BTC to develop.

Still, not all market watchers are convinced that the current price action marks the start of a sustainable breakout.

«Is this a true breakout that will continue? In my view, probably not,» said Kirill Kretov, senior automation expert at CoinPanel. «More likely, it’s part of the same volatility cycle where we see a rally now, followed by a sharp drop triggered by a negative announcement or some other narrative shift.»

According to Kretov, the current environment favors experienced traders who can navigate volatility-driven market structure. Technically, he sees BTC’s next key support levels at $105,000 and $100,000 — zones that could be tested if selling pressure returns.

Uncategorized

Aptos’ APT Rallies 4% Following Bullish Breakout on High Volume

Aptos’ APT token surged more than 4% following a bullish breakout, according to CoinDesk Research’s technical analysis model.

The token smashed through resistance at the $5 level and is currently 4.2% higher, trading around $5.065.

Despite facing a 19% monthly decline and competition from emerging blockchain platforms, APT’s recent price action suggests potential accumulation before its next significant move, according to the model.

The broader market gauge, the CoinDesk 20 was 3% higher at publication time.

Technical Analysis:

- APT established strong support at 4.927 after breaking through the 5.00 psychological resistance level.

- High-volume rally created a new resistance zone around 5.138, with subsequent consolidation forming a bull flag pattern between 5.00-5.10.

- Price action showed APT breaking through the 5.090 resistance on substantial volume exceeding 149,000 units.

- A pullback formed a higher low at 5.045, establishing a new support zone.

- Final 15 minutes showed price consolidation in the 5.045-5.062 range, suggesting potential accumulation.

- Total price range represented 0.261 (5.4%) from low to high during the analyzed period.

-

Business8 месяцев ago

Business8 месяцев ago3 Ways to make your business presentation more relatable

-

Entertainment8 месяцев ago

Entertainment8 месяцев ago10 Artists who retired from music and made a comeback

-

Fashion8 месяцев ago

Fashion8 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment8 месяцев ago

Entertainment8 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Business8 месяцев ago

Business8 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Tech8 месяцев ago

Tech8 месяцев ago5 Crowdfunded products that actually delivered on the hype

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time