Uncategorized

Crypto Daybook Americas: Market in Sea of Red, BTC Seen Diving to $80K

By Omkar Godbole (All times ET unless indicated otherwise)

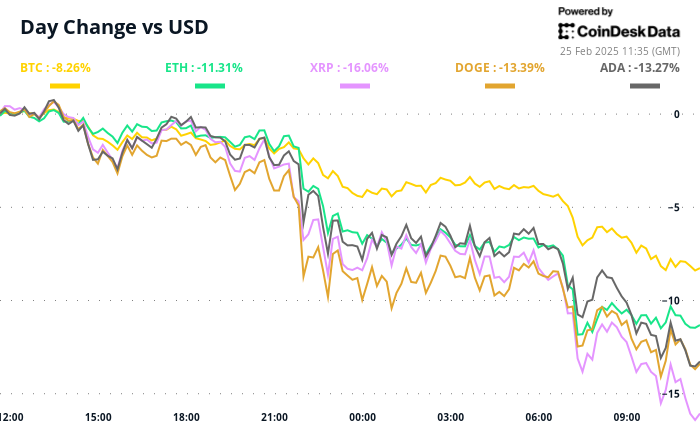

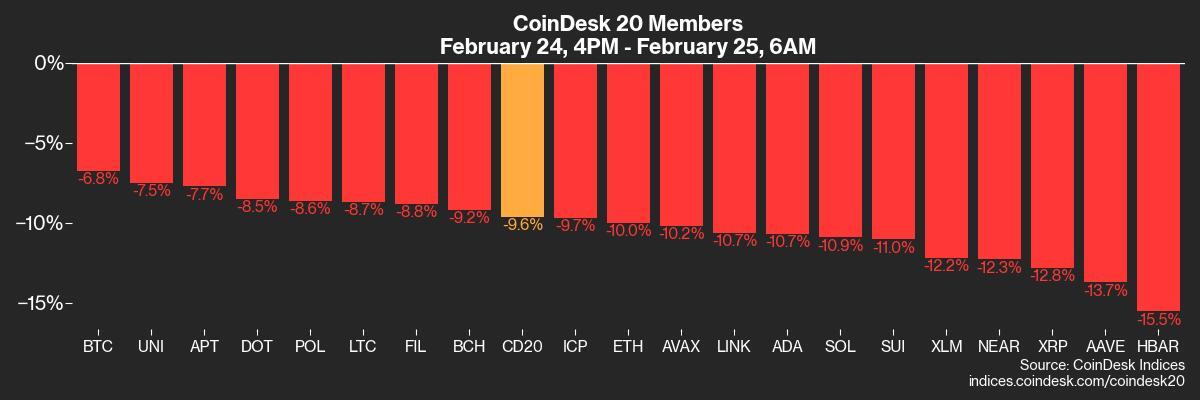

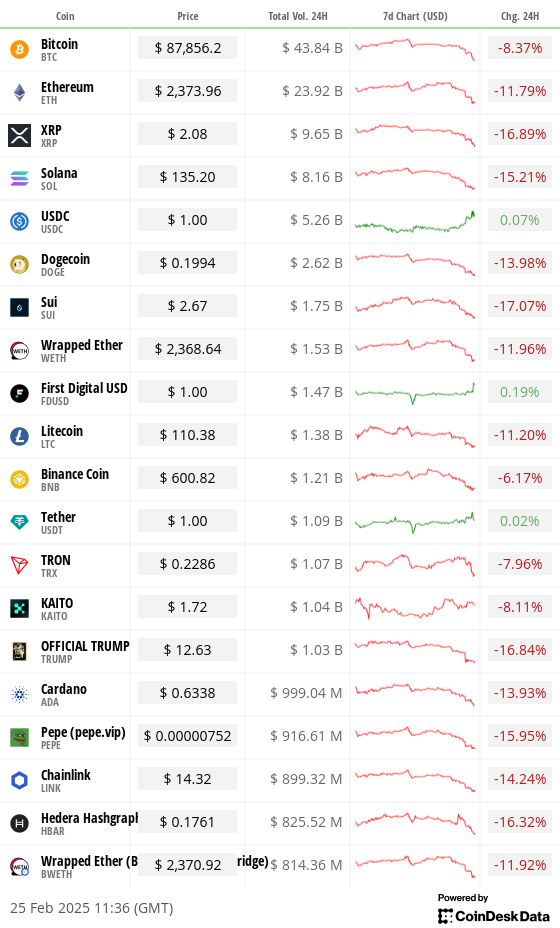

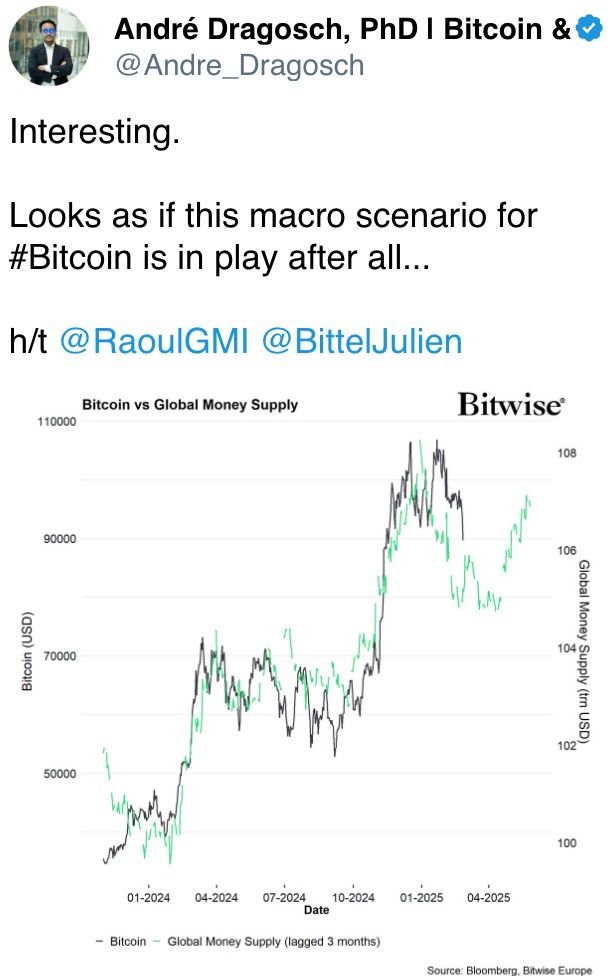

The crypto market is a sea of red, with bitcoin trading at three-month lows under $88,000 and the CoinDesk 20 Index down more than 10% in 24 hours. There are several catalysts for the swoon, including risk-off sentiment in traditional markets and influence from memecoins, especially the recent trading in TRUMP and LIBRA.

As we discussed Monday, market makers attending the Consensus Hong Kong conference last week were worried the memecoin frenzy had sucked liquidity from the productive crypto sub-sectors, leaving the broad market vulnerable.

Another reason is President Donald Trump’s inaction. Although he made significant promises in the lead-up to the elections, concrete action has been scarce. The anticipated strategic BTC reserve remains absent, and even state-level reserves are proving challenging to implement.

«The industry is still waiting for this to manifest in a tangible way in the form of measures such as a mooted Bitcoin Strategic Reserve,» Petr Kozyakov, co-founder and CEO at Mercuryo told CoinDesk. «In the meantime, sentiment has been hit hard by the biggest ever hack at the Bybit exchange, leaking 401,000 ETH, and a memecoin sector plagued with high-profile pump and dump schemes.»

Lastly, renewed concerns about the U.S. economy are zapping demand for riskier assets.

«There is also some concern about the slowdown in U.S. growth since last week’s U.S. Services PMI release, the lowest in 22 months and consistent with GDP growth tracking at 0.6% only,» Nansen’s principal research analyst Aurelie Barthere said. «Our Nansen Risk Barometer also just turned Risk-off from Neutral today.»

Together, they sent BTC diving out of its two-month-long range play between $90,000 and $110,000. Technical analysis theory suggests it could drop to $70,000, though the maximum open interest in BTC put options listed on Deribit sits at the $80,000 strike, indicating that this level could provide some support.

What could stabilize prices? Perhaps an announcement from Trump regarding a strategic reserve or a sharp reversal by the Nasdaq 100. However, that index has fallen below its 50-day SMA, while the yen, a risk-aversion signal, continues to strengthen against G7 currencies, including the dollar.

The next major catalysts for risk assets are Nvidia’s earnings on Feb. 26 and core PCE inflation on Feb. 28. Stay alert!

What to Watch

Crypto:

Feb. 25, 9:00 a.m.: Ethereum Foundation research team AMA on Reddit.

Feb. 25: Pascal hard fork network upgrade goes live on the BNB Smart Chain (BSC) testnet.

Feb. 25, 9:00 a.m. (approximate): Reactive Network mainnet launch, as well as the initial creation and distribution of the REACT token.

Feb. 26, 9:00 a.m. (approximate): Cosmos (ATOM) network upgrade.

Feb. 26: RedStone (RED) farming starts on Binance Launchpool.

Feb. 27, 4:00 a.m.: Alchemy Pay (ACH) community AMA on Discord.

Feb. 27: Solana-based L2 Sonic SVM (SONIC) mainnet launch (“Mobius”).

Macro

Feb. 25, 10:00 a.m.: The Conference Board (CB) releases February’s Consumer Confidence Index.

CB Consumer Confidence Est. 102.5 vs. Prev. 104.1

Feb. 25, 1:00 p.m.: Richmond Fed President Tom Barkin delivers a speech titled “Inflation Then and Now.”

Feb. 25, 7:30 p.m.: The Australian Bureau of Statistics releases January’s Consumer Price Index.

Monthly CPI Indicator Est. 2.6% vs. Prev. 2.5%

Feb. 26, 10:00 a.m.: The U.S. Census Bureau releases January’s New Residential Sales report.

New Home Sales Est. 0.68M vs. Prev. 0.698M

New Home Sales MoM Prev. 3.6%

Feb. 26-27: 2025’s first G20 finance ministers and central bank governors meeting (Cape Town).

Earnings

Feb. 25: Bitdeer Technologies Group (BTDR), pre-market, $-0.17

Feb. 25: Cipher Mining (CIFR), pre-market, $-0.09

Feb. 26: MARA Holdings (MARA), post-market, $-0.13

Feb. 26: NVIDIA (NVDA), post-market

Token Events

Governances votes & calls

Ampleforth DAO is voting on reducing the Flash Mint fee to 0.5% and the Flash Redeem fee to 5% to increase the system’s adaptability.

DYdX DAO is discussing the establishment of a DYDX buyback program. Its initial step would allocate 25% of the dYdX’s protocol net revenue to buy back token.

Frax DAO is discussing upgrading the protocol by renaming FXS to FRAX, making it the gas token on Fraxtal, implementing the Frax North Star Hardfork, and introducing a Tail Emission Plan with gradually decreasing emissions, among other enhancements.

Unlocks

Feb. 28: Optimism (OP) to unlock 2.32% of circulating supply worth $30.21 million.

Mar. 1: DYdX to unlock 1.14% of circulating supply worth $5.36 million.

Mar. 1: ZetaChain (ZETA) to unlock 6.48% of circulating supply worth $11.86 million.

Mar. 1: Sui (SUI) to unlock 0.74% of circulating supply worth $61.32 million.

Mar. 7: Kaspa (KAS) to unlocked 0.63% of circulating supply worth $14.02 million.

Mar. 8: Berachain (BERA) to unlock 9.28% of circulating supply worth $61.6 million.

Mar. 12: Aptos (APT) to unlock 1.93% of circulating supply worth $69.89 million.

Token Listings

Feb. 25: Zoo (ZOO) to be listed on KuCoin.

Feb. 25: Ethena (ENA) to be listed on Bithumb.

Feb. 26: Moonwell (WELL) to be listed on Kraken.

Feb. 27: Venice token (VVV) to be listed on Kraken.

Feb. 28: Worldcoin (WLD) to be listed on Kraken.

Conferences:

CoinDesk’s Consensus to take place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 3 of 8: ETHDenver 2025 (Denver)

Feb. 25: HederaCon 2025 (Denver)

March 2-3: Crypto Expo Europe (Bucharest, Romania)

March 8: Bitcoin Alive (Sydney, Australia)

March 10-11: MoneyLIVE Summit (London)

March 13-14: Web3 Amsterdam ‘25 (Netherlands)

March 19-20: Next Block Expo (Warsaw, Poland)

March 26: DC Blockchain Summit 2025 (Washington)

March 28: Solana APEX (Cape Town, South Africa)

Token Talk

By Shaurya Malwa

A token tied to a fake Sam Bankman-Fried account became the rug-pull of the day.

The scam started with the account “Comune Guardiagrele,” a small Italian city with a verified grey checkmark indicating it’s an official government or organization account, based on web results on identity verification.

Scammers probably hijacked or bought the account and changed the name to “@SBF_Doge» mimicking Sam Bankman-Fried (SBF), the disgraced crypto mogul jailed for the FTX fraud.

The account then launched a memecoin, likely tricking unsuspecting traders or bots into thinking it was legitimate due to the verification badge.

The memecoin’s market capitalization rose to $10 million before its creators pulled liquidity, crashing it to a $100,000 capitalization and pocketing fees and proceeds gained from the sale.

Derivatives Positioning

The top 25 cryptocurrencies by market value, excluding stablecoins, have registered price losses in the past 24 hours. At the same time, most have seen increases in open interest in perpetual futures and negative cumulative volume deltas, indicating an influx of bearish short positions. Perhaps there is more pain ahead.

On Deribit, XRP’s February expiry puts trade at a 8 vol premium relative to calls. Talk about sentiment being notably bearish.

BTC, ETH options show downside concerns till mid-to-late March, with subsequent expiries retaining the bullish call bias.

Market Movements:

BTC is down 6.23% from 4 p.m. ET Monday at $88,118.16 (24hrs: -7.7%)

ETH is down 9.4% at $2,393.03 (24hrs: -10.6%)

CoinDesk 20 is down 9.19% at 2,750.01 (24hrs: -11.61%)

Ether CESR Composite Staking Rate is unchanged at 2.99%

BTC funding rate is at 0.0008% (0.84% annualized) on Binance

DXY is unchanged at 106.7

Gold is down 0.28% at $2,937.90/oz

Silver is down 0.43% at $32.14/oz

Nikkei 225 closed -1.39% at 38,237.79

Hang Seng closed -1.32% at 23,034.02

FTSE is up 0.34% at 8,688.48

Euro Stoxx 50 is unchanged at 5,449.69

DJIA closed on Monday unchanged at 43,461.21

S&P 500 closed -0.5% at 5,983.25

Nasdaq closed -1.21% at 19,286.93

S&P/TSX Composite Index closed unchanged at 25,151.26

S&P 40 Latin America closed -0.92% at 2,386.34

U.S. 10-year Treasury rate is down 6 bps at 4.35%

E-mini S&P 500 futures are down 0.78% at 5,981.75

E-mini Nasdaq-100 futures are down 0.53% at 21,306.25

E-mini Dow Jones Industrial Average Index futures are down 0.13% at 43,479.00

Bitcoin Stats:

BTC Dominance: 61.81% (-0.15%)

Ethereum to bitcoin ratio: 0.02720 (-0.95%)

Hashrate (seven-day moving average): 745 EH/s

Hashprice (spot): $56.8

Total Fees: 7.5 BTC / $1.3 million

CME Futures Open Interest: 166,510 BTC

BTC priced in gold: 29.7 oz

BTC vs gold market cap: 8.42%

Technical Analysis

BTC’s daily chart shows the cryptocurrency has triggered a double top bearish reversal pattern.

The shift in trend supports the case for a protracted weakness to the 200-day simple moving average, presently stationed below $82,000.

Crypto Equities

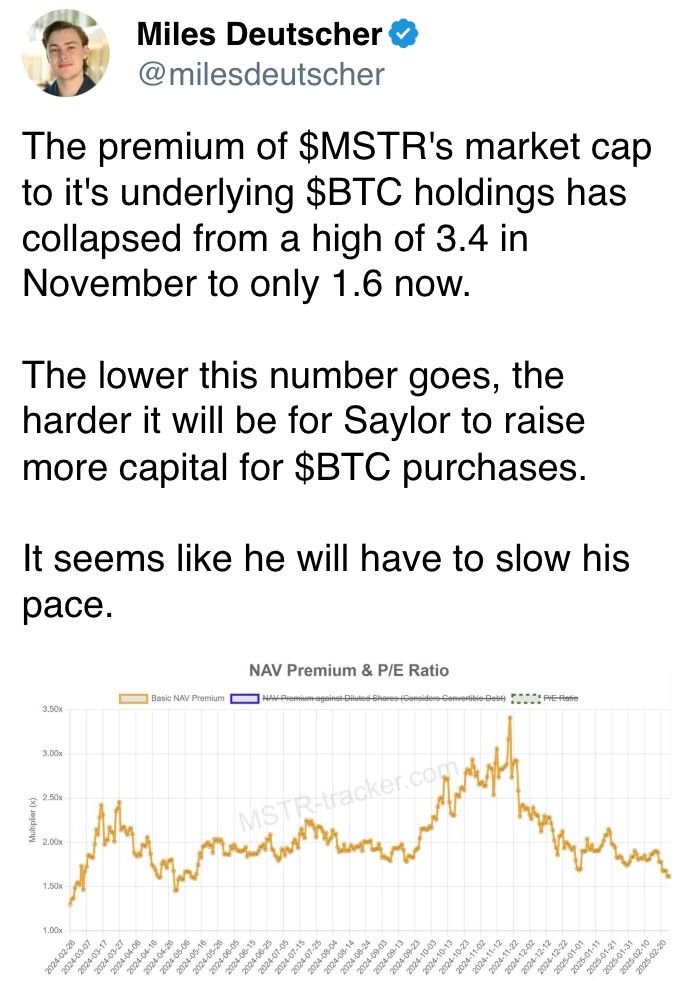

MicroStrategy (MSTR): closed on Monday at $282.76 (-5.65%), down 6.35% at $264.81 in pre-market

Coinbase Global (COIN): closed at $227.07 (-3.53%), down 5.6% at $214.14

Galaxy Digital Holdings (GLXY): closed at C$21.80 (-4.22%)

MARA Holdings (MARA): closed at $13.25 (-4.68%), down 5.76% at $13.09

Riot Platforms (RIOT): closed at $9.99 (-4.49%), down 5.01% at $9.49

Core Scientific (CORZ): closed at $9.86 (-8.7%), down 5.58% at $9.31

CleanSpark (CLSK): closed at $8.90 (-3.78%), down 5.39% at $8.42

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $19.20 (-6.43%), down 5.21% at $18.20

Semler Scientific (SMLR): closed at $44.38 (-7.04%), down 1.8% at $43.58

Exodus Movement (EXOD): closed at $41.16 (-13.91%), unchanged in pre-market

ETF Flows

Spot BTC ETFs:

Daily net flow: -$516.4 million

Cumulative net flows: $39.05 billion

Total BTC holdings ~ 1,105 million.

Spot ETH ETFs

Daily net flow: -$78 million

Cumulative net flows: $3.07 billion

Total ETH holdings ~ 3.331 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

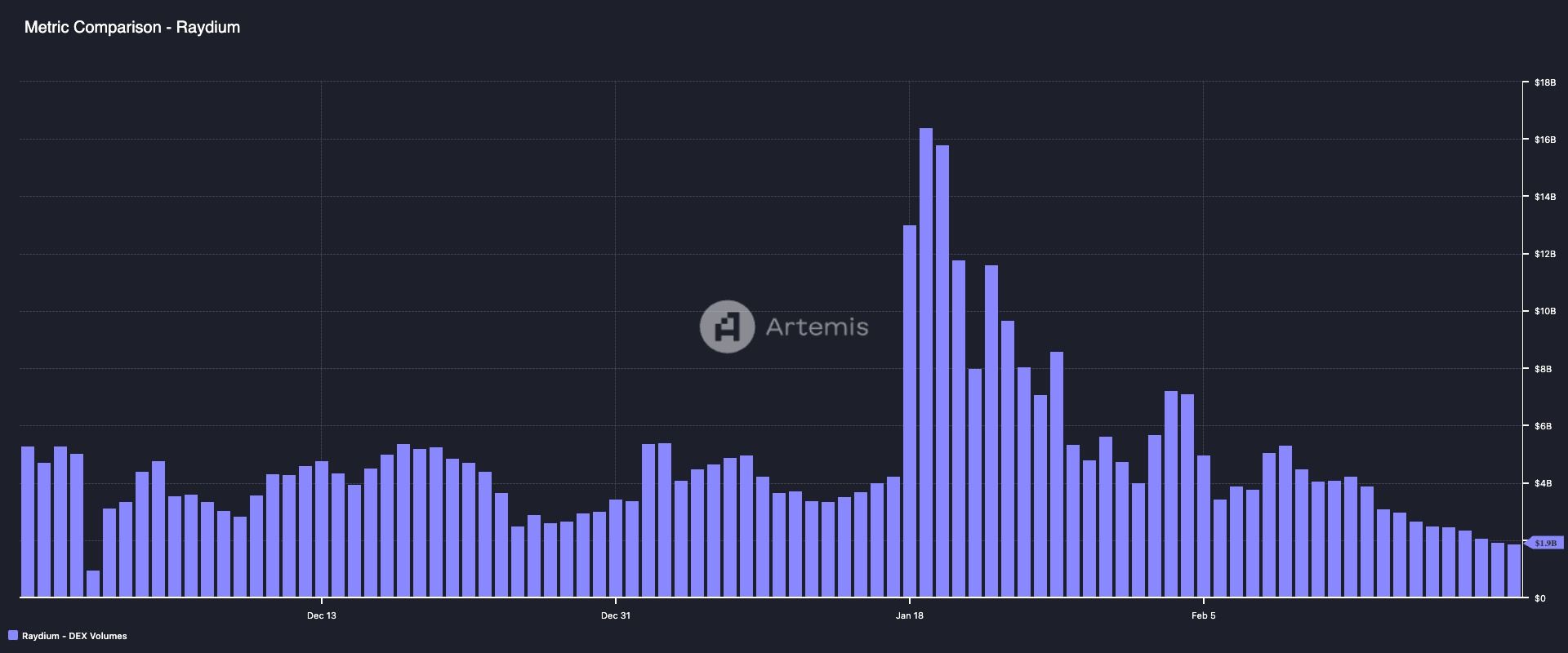

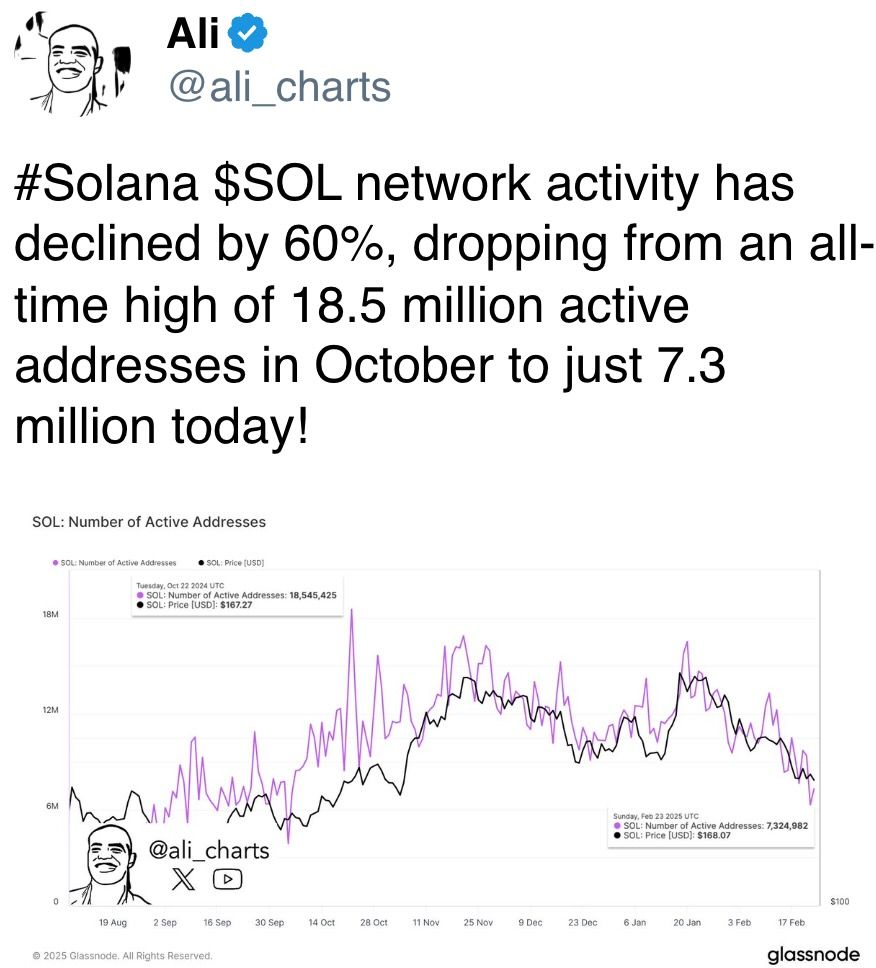

Raydium registered a cumulative trading volume of $1.9 billion on Monday, the lowest since Nov. 29, according to Artemis.

The slowdown partly explains the recent decline the value of the RAY token and Solana’s SOL token.

While You Were Sleeping

Bitcoin Slides Below $89K to 3-Month Low as Nasdaq Futures Dip, Yen Sparks Risk-Off Fears (CoinDesk): Bitcoin fell below $89,000 as Nasdaq futures signaled further tech losses and a strong yen raised concerns of risk aversion similar to August 2024.

U.S. Bitcoin ETFs Post Year’s 2nd-Biggest Outflows as Basis Trade Drops Below 5% (CoinDesk): U.S.-listed spot BTC ETFs saw $516 million in outflows on Monday and the bitcoin CME annualized basis fell to 4%, the lowest since the ETFs began trading in January 2024.

USDe Issuer Ethena Labs Integrates Chaos Labs’ Edge Proof of Reserves Oracles to Strengthen Risk Management (CoinDesk): Ethena Labs has enhanced USDe’s risk management by adopting independent data oracles from Chaos Labs.

Forget MAGA, Investors Want MEGA: Make Europe Great Again (The Wall Street Journal): Once lagging behind U.S. markets, Europe is staging a robust comeback, with Euro Stoxx 50 up 12% since Trump’s victory, spurred by record inflows and mounting calls for regulatory reform.

China Learned to Embrace What the U.S. Forgot: The Virtues of Creative Destruction (Bloomberg): Amid rising U.S. tariffs and a faltering property market, China is cutting back on government spending, letting weaker sectors collapse so resources can shift to tech and innovation.

Asian Shares Slide as U.S. Curbs China Investment, Euro Gain Fades (Reuters): Asian shares fell Tuesday amid U.S. restrictions on Chinese investments. MSCI’s Asia-Pacific index dropped 1% and Japan’s Nikkei fell 1.3%.

In the Ether

Business

Strategy Bought $27M in Bitcoin at $123K Before Crypto Crash

Strategy (MSTR), the world’s largest corporate owner of bitcoin (BTC), appeared to miss out on capitalizing on last week’s market rout to purchase the dip in prices.

According to Monday’s press release, the firm bought 220 BTC at an average price of $123,561. The company used the proceeds of selling its various preferred stocks (STRF, STRK, STRD), raising $27.3 million.

That purchase price was well above the prices the largest crypto changed hands in the second half of the week. Bitcoin nosedived from above $123,000 on Thursday to as low as $103,000 on late Friday during one, if not the worst crypto flash crash on record, liquidating over $19 billion in leveraged positions.

That move occurred as Trump said to impose a 100% increase in tariffs against Chinese goods as a retaliation for tightening rare earth metal exports, reigniting fears of a trade war between the two world powers.

At its lowest point on Friday, BTC traded nearly 16% lower than the average of Strategy’s recent purchase price. Even during the swift rebound over the weekend, the firm could have bought tokens between $110,000 and $115,000, at a 7%-10% discount compared to what it paid for.

With the latest purchase, the firm brought its total holdings to 640,250 BTC, at an average acquisition price of $73,000 since starting its bitcoin treasury plan in 2020.

MSTR, the firm’s common stock, was up 2.5% on Monday.

Business

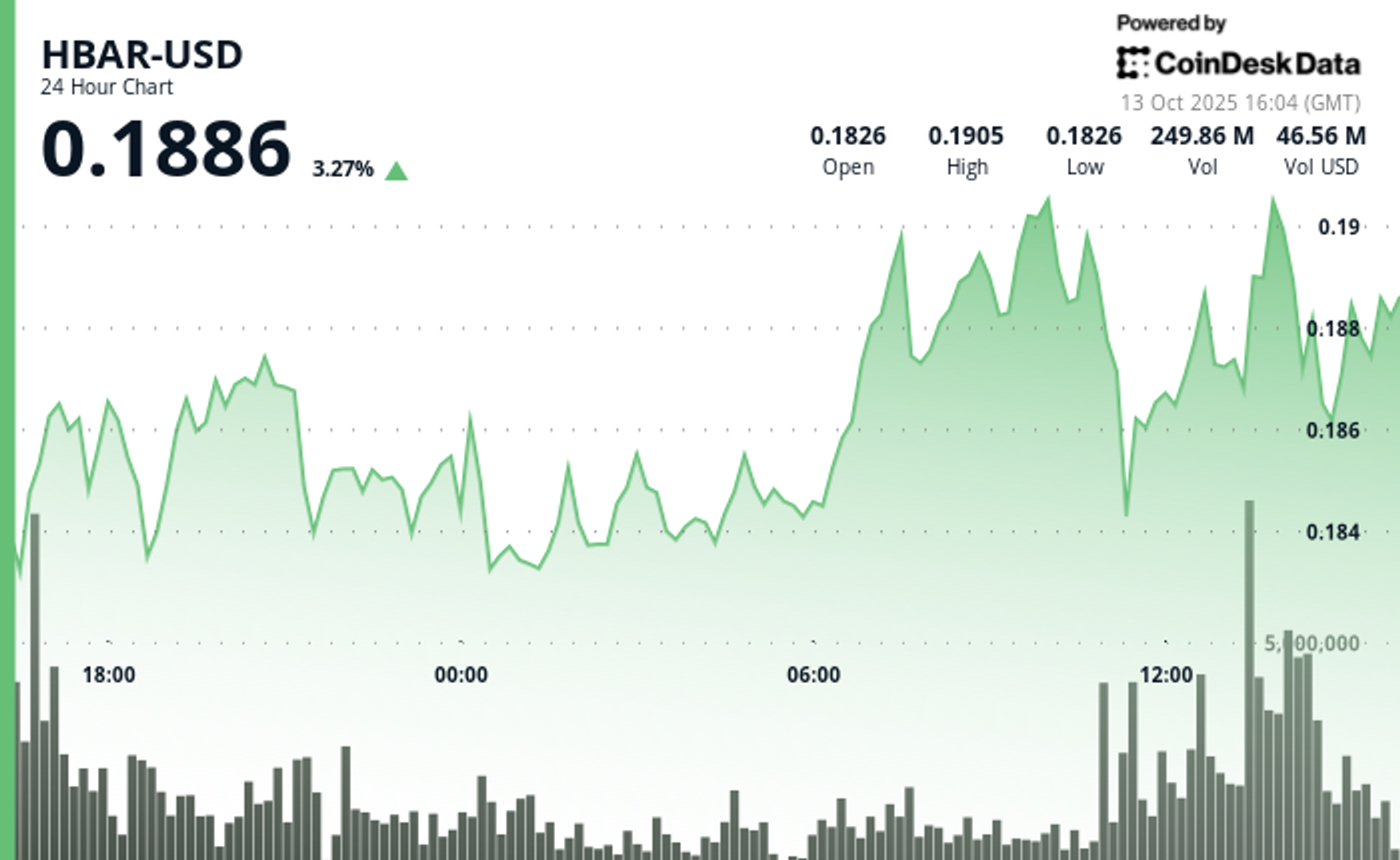

HBAR Rises Past Key Resistance After Explosive Decline

HBAR (Hedera Hashgraph) experienced pronounced volatility in the final hour of trading on Oct. 13, soaring from $0.187 to a peak of $0.191—a 2.14% intraday gain—before consolidating around $0.190.

The move was driven by a dramatic surge in trading activity, with a standout 15.65 million tokens exchanged at 13:31, signaling strong institutional participation. This decisive volume breakout propelled the asset beyond its prior resistance range of $0.190–$0.191, establishing a new technical footing amid bullish momentum.

The surge capped a broader 23-hour rally from Oct. 12 to 13, during which HBAR advanced roughly 9% within a $0.17–$0.19 bandwidth. This sustained upward trajectory was characterized by consistent volume inflows and a firm recovery from earlier lows near $0.17, underscoring robust market conviction. The asset’s ability to preserve support above $0.18 throughout the period reinforced confidence among traders eyeing continued bullish action.

Strong institutional engagement was evident as consecutive high-volume intervals extended through the breakout window, suggesting renewed accumulation and positioning for potential continuation. HBAR’s price structure now shows resilient support around $0.189–$0.190, signaling the possibility of further upside if momentum persists and broader market conditions remain favorable.

Technical Indicators Highlight Bullish Sentiment

- HBAR operated within a $0.017 bandwidth (9%) spanning $0.174 and $0.191 throughout the previous 23-hour period from 12 October 15:00 to 13 October 14:00.

- Substantial volume surges reaching 179.54 million and 182.77 million during 11:00 and 13:00 sessions on 13 October validated positive market sentiment.

- Critical resistance materialized at $0.190-$0.191 thresholds where price movements encountered persistent selling activity.

- The $0.183-$0.184 territory established dependable support through volume-supported bounces.

- Extraordinary volume explosion at 13:31 registering 15.65 million units signaled decisive breakout event.

- High-volume intervals surpassing 10 million units through 13:35 substantiated significant institutional engagement.

- Asset preserved support above $0.189 despite moderate profit-taking activity.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Business

Crypto Markets Today: Bitcoin and Altcoins Recover After $500B Crash

The crypto market staged a recovery on Monday following the weekend’s $500 billion bloodbath that resulted in a $10 billion drop in open interest.

Bitcoin (BTC) rose by 1.4% while ether (ETH) outperformed with a 2.5% gain. Synthetix (SNX, meanwhile, stole the show with a 120% rally as traders anticipate «perpetual wars» between the decentralized trading venue and HyperLiquid.

Plasma (XPL) and aster (ASTER) both failed to benefit from Monday’s recovery, losing 4.2% and 2.5% respectively.

Derivatives Positioning

- The BTC futures market has stabilized after a volatile period. Open interest, which had dropped from $33 billion to $23 billion over the weekend, has now settled at around $26 billion. Similarly, the 3-month annualized basis has rebounded to the 6-7% range, after dipping to 4-5% over the weekend, indicating that the bullish sentiment has largely returned. However, funding rates remain a key area of divergence; while Bybit and Hyperliquid have settled around 10%, Binance’s rate is negative.

- The BTC options market is showing a renewed bullish lean. The 24-hour Put/Call Volume has shifted to be more in favor of calls, now at over 56%. Additionally, the 1-week 25 Delta Skew has risen to 2.5% after a period of flatness.

- These metrics indicate a market with increasing demand for bullish exposure and upside protection, reflecting a shift away from the recent «cautious neutrality.»

- Coinglass data shows $620 million in 24 hour liquidations, with a 34-66 split between longs and shorts. ETH ($218 million), BTC ($124 million) and SOL ($43 million) were the leaders in terms of notional liquidations. Binance liquidation heatmap indicates $116,620 as a core liquidation level to monitor, in case of a price rise.

Token Talk

By Oliver Knight

- The crypto market kicked off Monday with a rebound in the wake of a sharp weekend leverage flush. According to data from CoinMarketCap, the total crypto market cap climbed roughly 5.7% in the past 24 hours, with volume jumping about 26.8%, suggesting those liquidated at the weekend are repurchasing their positions.

- A total of $19 billion worth of derivatives positions were wiped out over the weekend with the vast majority being attributed to those holding long positions, in the past 24 hours, however, $626 billion was liquidated with $420 billion of that being on the short side, demonstrating a reversal in sentiment, according to CoinGlass.

- The recovery has been tentative so far; the dominance of Bitcoin remains elevated at about 58.45%, down modestly from recent highs, which implies altcoins may still lag as capital piles back into safer large-cap names.

- The big winner of Monday’s recovery was synthetix (SNX), which rose by more than 120% ahead of a crypto trading competition that will see it potentially start up «perpetual wars» with HyperLiquid.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton