Uncategorized

Crypto Daybook Americas: Inflation Data May Shake Out Bitcoin’s Doldrums as Demand for BTC Picks Up

By Francisco Rodrigues (All times ET unless indicated otherwise)

The U.S. inflation report due later today might shift bitcoin (BTC) out of the doldrums that have mired it this week.

In recent years, the January figure has tended to show significant price hikes. Last year, for example, the month’s data put an end to a series of lower readings, repeating a pattern also seen in 2023. That’s because businesses often evaluate their costs and raise prices at the start of the year, as the Wall Street Journal points out.

A higher-than-expected inflation report could suggest “monetary policy has more work to do” Dallas Fed President Lorie Logan said in a speech last week. The Federal Reserve has already indicated it isn’t rushing to adjust interest rates after 100 basis points of reductions last year.

Also playing into the consideration are the Trump administration’s tariffs, with the Federal Reserve Bank of Boston pointing to a potential rise as high as 0.8% to core PCE, the inflation measure the Fed focuses on. Still, in 2018 and 2019 tariffs had negligible effects.

On the other hand, a soft inflation report could be beneficial for risks assets including bitcoin. A lower-than-expected figure will probably raise interest-rate cut expectations, potentially weakening the U.S. dollar index and lowering Treasury yields, CoinDesk’s Omkar Godbole has reported.

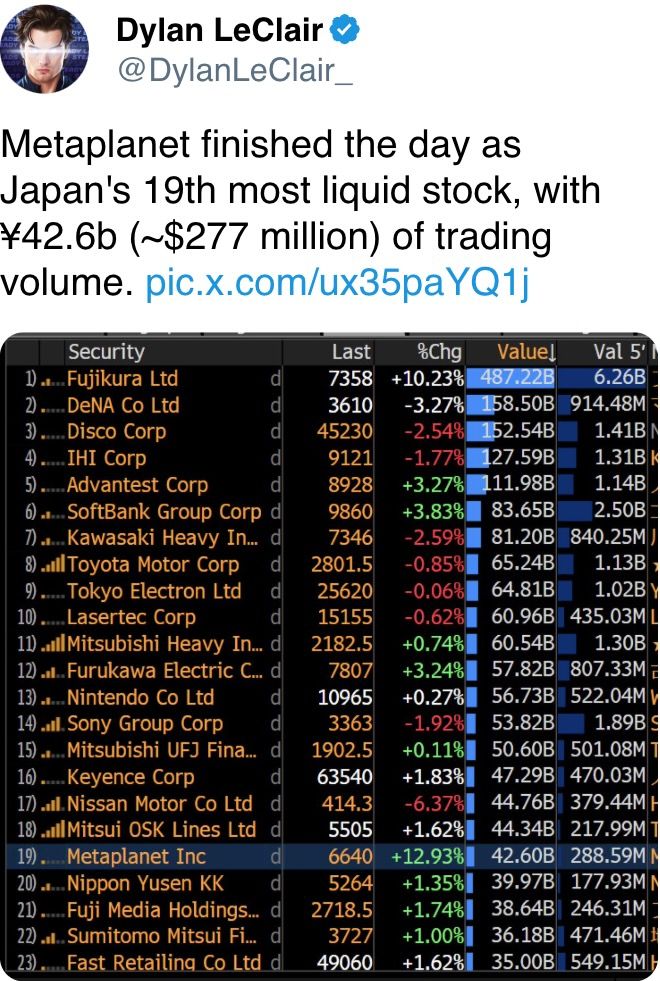

Meanwhile, demand for the largest cryptocurrency holds strong. Just this week, Japanese mobile-game studio Gumi revealed plans to accumulate around $6.6 million worth of BTC, while KULR Technology Group increased its crypto holdings to 610.3 bitcoin.

Similarly, Goldman Sachs’ 13F filing shows the banking giant significantly increased its exposure to spot bitcoin and ether ETFs in the fourth quarter. And don’t forget Strategy’s near-weekly bitcoin purchases.

Bitcoin’s Coinbase premium, which measures the difference between BTC’s price on the U.S. exchange and Binance, recently turned negative, suggesting U.S. traders are cautious about the upcoming inflation report.

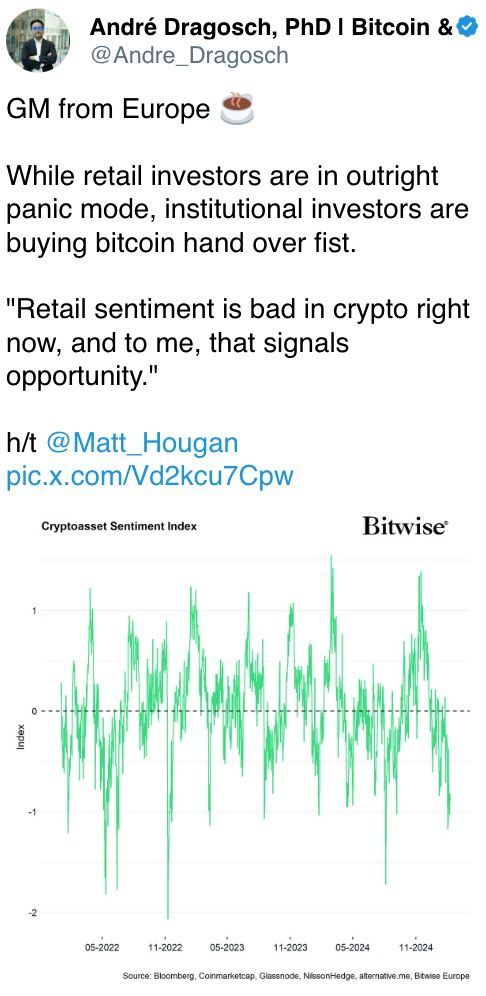

The caution comes amid growing headwinds for the crypto market, which may have reached the top of its cycle. Research firm BCA Research has recently shared a note with clients suggesting the record ETF inflows and the memecoin craze are warning signals.

Warning signals are present elsewhere, with a recent JPMorgan report pointing out that crypto ecosystem growth slowed last month, while total trading volumes dropped 24%. Activity is nevertheless ahead of where it was before the U.S. elections. Stay alert!

What to Watch

Crypto:

Feb. 13: Start of Kraken’s gradual delisting of the USDT, PYUSD, EURT, TUSD, UST stablecoins for EEA clients. The process ends March. 31.

Feb. 13: Story (IP) mainnet launch.

Feb. 14: Dynamic TAO (DTAO) network upgrade goes live on the Bittensor (TAO) mainnet.

Feb. 14, 2:30 a.m.: Qtum (QTUM) hard fork network upgrade.

Feb. 18, 10:00 a.m.: FTX Digital Markets, the Bahamas-based subsidiary of FTX, starts reimbursing creditors.

Feb. 21: TON (The Open Network) becomes the exclusive blockchain infrastructure for messaging platform Telegram’s Mini App ecosystem.

Macro

Feb. 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases January’s Consumer Price Index (CPI) report.

Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.2%

Core Inflation Rate YoY Est. 3.1% vs Prev. 3.2%

Inflation Rate MoM Est. 0.3% vs. Prev. 0.4%

Inflation Rate YoY Est. 2.9% vs. Prev. 2.9%

Feb. 12, 10:00 a.m.: Fed Chair Jerome Powell presents his semi-annual report to the U.S. House Committee on Financial Services. Livestream link.

Feb. 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases January’’s Producer Price Index (PPI) report.

Core PPI MoM Est. 0.3% vs. Prev. 0%

Core PPI YoY Est. 3.3% vs. Prev. 3.5%

PPI MoM Est. 0.3% vs. Prev. 0.2%

PPI YoY Prev. 3.3%

Feb. 13, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims report for the week ended Feb. 8.

Initial Jobless Claims Est. 216K vs. Prev. 219K

Earnings

Feb. 12: Hut 8 (HUT), pre-market, $0.05

Feb. 12: IREN (IREN), post-market, $-0.01

Feb. 12: Reddit (RDDT), post-market, $0.25

Feb. 12: Robinhood Markets (HOOD), post-market, $0.41

Feb. 13: Coinbase Global (COIN), post-market, $1.89

Feb. 14: Remixpoint (TYO: 3825)

Feb. 18: CoinShares International (STO: CS), pre-market

Feb. 18: Semler Scientific (SMLR), post-market

Token Events

Governance votes & calls

Morpho DAO is discussing a 25% reduction in MORPHO rewards on both Ethereum and Base after another reduction took effect on Jan. 30.

DYdX DAO is voting on the dYdX Treasury subDAO taking control over the stDYDX within the protocol’s Community Treasury and any tokens accrued through auto compounding staking rewards.

Curve DAO is voting on increasing 3pool’s amplification coefficient to 8,000 over 30 days and raise admin fees to 100%. To optimize liquidity, as part of an experiment, 3pool will have higher fees while Strategic Reserves will offer lower fees.

Feb. 12 2 p.m. : Render (RENDER) to host an AI Scout Discord AMA session.

Unlocks

Feb. 12: Aethir (ATH) to unlock 10.21% of circulating supply worth $23.80 million.

Feb. 14: The Sandbox (SAND) to unlock 8.4% of circulating supply worth $80.2 million.

Feb. 16: Arbitrum (ARB) to unlock 2.13% of circulating supply worth $42.93 million.

Feb. 21: Fast Token (FTN) to unlock 4.66% of circulating supply worth $78.8 million.

Token Launches

Feb. 12: Avalon (AVL) to be listed on Bybit.

Feb. 12: Game7 (G7) to be listed on Bybit, Gate.io, HashKey, MEXC, XT, and KuCoin.

Feb. 13: EthereumPoW (ETHW) and Polygon (MATIC) to no longer be supported at Deribit.

Conferences:

CoinDesk’s Consensus to take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Feb. 12-13: Frankfurt Digital Finance (FDF) 2025

Feb. 13-14: The 4th Edition of NFT Paris.

Feb. 18-20: Consensus Hong Kong

Feb. 19: Sui Connect: Hong Kong

Feb. 23 to March 2: ETHDenver 2025 (Denver, Colorado)

Feb. 24: RWA London Summit 2025

Feb. 25: HederaCon 2025 (Denver)

Token Talk

By Shaurya Malwa

The Central African Republic’s CAR token is down 95% from Monday’s peak prices, with a market capitalization now around $40 million.

CAR was issued late Sunday and promoted by the republic’s President

Faustin-Archange Touadéra as an asset that could help fund public facilities in the impoverished nation.

Touadéra claimed proceeds from CAR token are being used to rebuild and furnish a high school, whose details are not yet public.

Derivatives Positioning

Following Fed Chair Jerome Powell’s remarks hinting at a potential delay in quantitative easing until interest rates approach zero, market sentiment turned more cautious, leading to a sharp decline in open interest across altcoins.

Rocket Pool, Venice Token and TST experienced the most significant drops, with open interest plunging 44%, 32%, and 30%, respectively, over the past 24 hours.

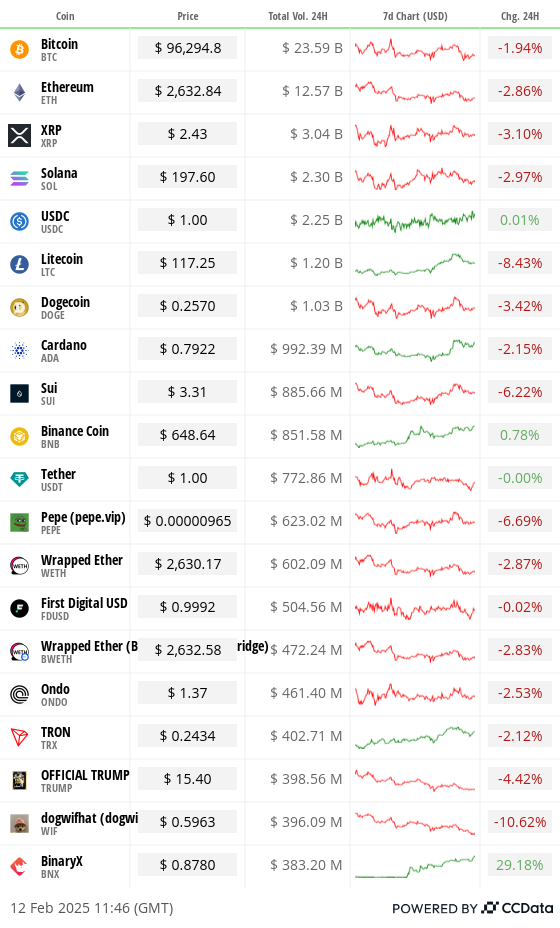

On the other hand, Binance ecosystem tokens gained momentum, with BNX the standout performer. Open interest in BNX surged 57% to $166 million within a day, while its price jumped 18% to $0.868.

Market Movements:

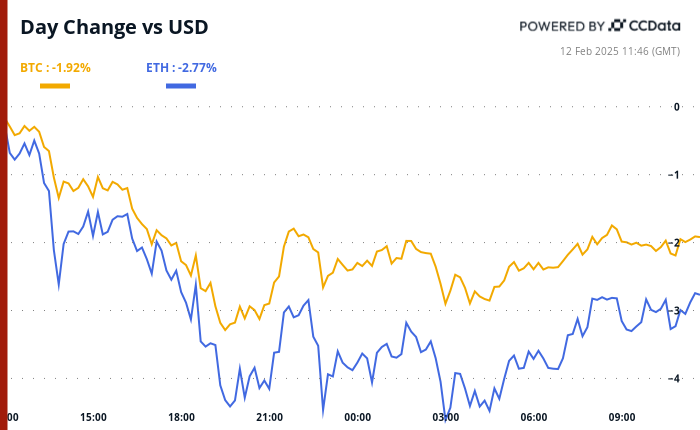

BTC is down 0.4% from 4 p.m. ET Tuesday to $96,029.62 (24hrs: -1.97%)

ETH is down 0.17% at $2,619.27 (24hrs: -2.87%)

CoinDesk 20 is up 0.66% to 3,178.54 (24hrs: -2.74%)

Ether CESR Composite Staking Rate is up 5 bps to 3.1%

BTC funding rate is at 0.01% (10.95% annualized) on Binance

DXY is unchanged at 107.99

Gold is down 0.15% at $2908.1/oz

Silver is down 0.22% to $32.16/oz

Nikkei 225 closed up 0.42% at 38,963.7

Hang Seng closed +2.64% at 21,857.92

FTSE is unchanged at 8,781.91

Euro Stoxx 50 is up 0.1% to 5,396.36

DJIA closed Tuesday +0.28% at 44,593.65

S&P 500 closed unchanged at 6,068.5

Nasdaq closed -0.36% at 19,643.86

S&P/TSX Composite Index closed -0.11% at 25,631.8

S&P 40 Latin America closed +0.65% at 2,444.58

U.S. 10-year Treasury rate was up 1 bps at 4.54%

E-mini S&P 500 futures are down 0.16% to 6,082.5

E-mini Nasdaq-100 futures are unchanged at 21,777

E-mini Dow Jones Industrial Average Index futures are down 0.21% at 44,616

Bitcoin Stats:

BTC Dominance: 61.32% (+0.06%)

Ethereum to bitcoin ratio: 0.02728 (+0.33%)

Hashrate (seven-day moving average): 800 EH/s

Hashprice (spot): $53.56

Total Fees: 5.25 BTC / $505,060

CME Futures Open Interest: 167,470 BTC

BTC priced in gold: 33.1 oz

BTC vs gold market cap: 9.4%

Technical Analysis

Dogecoin reaches a critical point support and resistance at 25 cents, with prices coiling around that level since Feb.3.

Traders may watch DOGE’s Moving Average Convergence Divergence (MACD) indicator, which tracks the relative changes in prices across specific time periods.

The indicator is trending upward with net buying volumes since Feb. 3, indicative of a rally if the MACD line crosses above zero.

Crypto Equities

MicroStrategy (MSTR): closed on Tuesday at $319.46 (-4.53%), up 0.82% at $322.30 in pre-market.

Coinbase Global (COIN): closed at $266.90 (-4.75%), up 0.88% at $269.25 in pre-market.

Galaxy Digital Holdings (GLXY): closed at C$26.54 (-2.57%)

MARA Holdings (MARA): closed at $16.02 (-4.42%), up 1% at $16.18 in pre-market.

Riot Platforms (RIOT): closed at $11.14 (-4.21%), up 0.81% at $11.23 in pre-market.

Core Scientific (CORZ): closed at $12.26 (-4.37%), up 0.24% at $12.29 in pre-market.

CleanSpark (CLSK): closed at $10.28 (-8.05%), up 0.39% at $10.32 in pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.34 (-4.94%), up 0.12% at $22.46 in pre-market.

Semler Scientific (SMLR): closed at $46.98 (-5.3%), unchanged in pre-market.

Exodus Movement (EXOD): closed at $49.16 (-3.95%), unchanged in pre-market.

ETF Flows

Spot BTC ETFs:

Daily net flow: -$56.7 million

Cumulative net flows: $40.46 billion

Total BTC holdings ~ 1.174 million.

Spot ETH ETFs

Daily net flow: $12.6 million

Cumulative net flows: $3.17 billion

Total ETH holdings ~ 3.785 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

Ethereum has dropped down to 17th in terms of weekly revenues across all blockchains and applications, with a relatively small $7 million pocketed by network validators.

While You Were Sleeping

Bitcoin May See Gains from Soft U.S. CPI, Major Risk-On Surge in BTC Appears Unlikely (CoinDesk): Bitcoin and other risk assets may get a boost if today’s CPI report shows soft inflation, but Trump’s tariffs are likely to curb further rate cuts and put the brakes on a sustained rally.

Trump to Tap Former CFTC Commissioner, a16z Policy Head Brian Quintenz for CFTC Head (CoinDesk): Brian Quintenz, a former commissioner of the Commodity Futures Trading Commission (CFTC) and a crypto advocate, has reportedly been chosen by President Trump to be the agency’s chairman.

Crypto Custody Firm BitGo Said to Weigh IPO as Soon as This Year (Bloomberg): Crypto custodian BitGo is considering an IPO for the second half of 2025, joining firms such as Gemini and Kraken, which are also expected to go public this year.

Why Today’s Inflation Report Is Especially Important (The Wall Street Journal): January’s U.S. inflation data — with the CPI released today, PPI tomorrow, and PCE on Feb. 28 — is important for predicting the Fed’s monetary policy because businesses typically raise prices at the start of the year.

Stocks Steady; Sanguine Powell Knocks Bonds and Gold (Reuters): Fed Chari Powell’s Senate testimony on Tuesday, downplaying rate-cut urgency unless inflation falls or job market weakens, boosted Treasury yields and the dollar, while sending oil and gold prices lower.

China’s Tech Stocks Enter Bull Market After DeepSeek Breakthrough (Financial Times): Chinese tech stocks have surged 20% in one month after DeepSeek’s AI breakthrough revived investor confidence in internet companies, helping the Hang Seng Tech index to outpace the Nasdaq 100.

In the Ether

UPDATE (Feb. 12, 12:03 UTC): Adds Derivatives Positioning section.

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts