Uncategorized

Crypto Daybook Americas: Gold’s Historic Rally Brings Back BTC’s ‘Store of Value’ Debate

By James Van Straten (All times ET unless indicated otherwise)

The recent market turmoil might have given gold the bragging rights of being the «store of value» while «digital gold» struggles, at least for now.

Gold futures for April delivery have surpassed $3,000 an ounce for the first time ever, marking a historic milestone for the precious metal. Spot gold is consolidating just below $3,000 an ounce, up 15% year-to-date, while its digital counterpart, bitcoin (BTC), is struggling—down 12% this year and hovering around $80,000.

This divergence underscores gold’s role as the ultimate safe-haven asset in the current economic environment.

Since mid-February, U.S. spot bitcoin ETFs have experienced only three days of inflows, causing total net inflows to decline from $40 billion to approximately $35 billion, according to Eric Balchunas, a senior Bloomberg ETF analyst.

Meanwhile, the S&P 500 has entered correction territory, falling over 10% and struggling to reclaim its 200-day moving average amid escalating geopolitical tensions. Further tariffs imposed by former President Trump and stalled ceasefire negotiations between President Putin and Ukraine have exacerbated global uncertainty.

Andre Dragosch, Head of Research at Bitwise in Europe, attributes gold’s record highs and the U.S. equity sell-off to rising short- and medium-term inflation expectations, coupled with declining consumer confidence.

“The recent rally in gold to new all-time highs likely reflects both increasing inflation expectations and a broader flight to safety,” Dragosch explains. “In fact, both short- and medium-term inflation expectations in the University of Michigan consumer survey have risen to multi-decade highs. U.S. consumers are growing increasingly concerned about inflation, likely due to the Trump administration’s new tariff policies.”

He further notes, “Meanwhile, U.S. equities have been selling off due to mounting economic uncertainty driven by these trade policies, as well as rising recession risks amid a slowdown in the labor market. Both factors have significantly buoyed the price of gold.”

What to Watch

Crypto:

March 15: Athene Network (ATH) mainnet launch.

March 15: Reploy will close its V1 RAI staking program to new users as it transitions to a fully automated revenue-sharing protocol.

March 17: CME Group launches solana (SOL) futures.

March 17: Ethereum (ETH) testnet Hoodi goes live. The Pectra upgrade will be applied to this testnet on March 26 and to the mainnet “30+ days after Hoodi forks successfully, pending infra and client testing.”

March 18: Zano (ZANO) hard fork network upgrade; this activates “ETH Signature support for off-chain signing and asset operations.”

March 20: Pascal hard fork network upgrade goes live on the BNB Smart Chain (BSC) mainnet.

March 21, 1:00 p.m.: The U.S. SEC’s Crypto Task Force hosts a roundtable, which is open to the public, that will focus on the definition of a security.

Macro

March 14, 8:00 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases January producer price inflation data.

PPI MoM Prev. 1.48%

PPI YoY Prev. 9.42%

March 14, 10:00 a.m.: The University of Michigan’s March (U.S.) Consumer Sentiment (preliminary) index Est. 63.1 vs. Prev. 64.7.

March 14, 3:00 p.m.: Argentina’s National Institute of Statistics and Census releases February inflation data.

Inflation Rate MoM Est. 2.4% vs. Prev. 2.2%

Inflation Rate YoY Est. 66.8 vs. Prev. 84.5%

March 16, 10:00 p.m.: The National Bureau of Statistics of China releases February employment data.

Unemployment Rate Prev. 5.1%

Earnings (Estimates based on FactSet data)

March 14: Bit Digital (BTBT), pre-market, $-0.05

March 24 (TBC): Galaxy Digital Holdings (TSE: GLXY), C$0.38

Token Events

Governance votes & calls

ApeCoin DAO is discussing the establishment of an APE base in Lhasa, Tibet Autonomous Region, China. It’s also discussing the creation of ApeSites, which aims to provide the BAYC community an “easy-to-use tool to create personalized websites.”

Aave DAO is discussing the launch of Horizon, a licensed instance of the Aave Protocol to allow institutions to “access permissionless stablecoin liquidity while meeting issuer requirements.”

Balancer DAO is discussing the deployment of Balancer V3 on OP Mainnet.

March 14: CoW DAO’s vote on the incorporation of a 4-entity legal structure for the organization ends.

March 14, 10 a.m.: Representatives from Lombard, Etherfi, Coinbase and Curve to participate in an X Spaces session

Unlocks

March 14: Starknet (STRK) to unlock 2.33% of its circulating supply worth $11.15 million.

March 15: Sei (SEI) to unlock 1.19% of its circulating supply worth $10.06 million.

March 16: Arbitrum (ARB) to unlock 2.1% of its circulating supply worth $32.29 million.

March 18: Fasttoken (FTN) to unlock 4.66% of its circulating supply worth $79.80 million.

March 21: Immutable (IMX) to unlock 1.39% of circulating supply worth $12.91 million.

March 23: Metars Genesis (MRS) to unlock 11.87% of its circulating supply worth $102.6 million.

March 23: Mantra (OM) to unlock 0.51% of its circulating supply worth $31.2 million.

Token Listings

March 18: Paws (PAWS) to be listed on Bybit.

March 31: Binance to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 2 of 2: Web3 Amsterdam ‘25

March 16: Solana AI Summit (San Jose, Calif.)

March 18-20: Digital Asset Summit 2025 (New York)

March 18-20: Fintech Americas Miami 2025

March 19-20: Next Block Expo (Warsaw)

March 24-26: Merge Buenos Aires

March 25-26: PAY360 2025 (London)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

March 26-28: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

March 28: Solana APEX (Cape Town)

Token Talk

By Oliver Knight

In an otherwise muted day for altcoins, HyperLiquid’s native token is leading the pack, having risen by 9.5% in the past 24 hours. The boost comes as the decentralized exchange topped $1 trillion in cumulative volume this month, with $4.8 billion worth of derivatives in the past day alone.

The same cannot be said for other DeFi tokens like AAVE, LIDO and PYTH, which have all been between 19% and 21% down over the past seven days after failing to recover from a market-wide plunge over the weekend.

One trader profited a cool $108k after buying Base memecoin doginme on Thursday only for Coinbase to list the token on Friday, spurring a 150% rally.

Derivatives Positioning

Earlier this morning, the price of Bitcoin bounced to $82,895 from levels below $80,000, hitting a cluster of short liquidations leverage worth $52.1mn, according to CoinGlass. The next significant liquidations leverage level is $79,760, holding liquidations worth $41.9mn.

Among the assets with over $100mn in open interest, Chainlink saw the highest 1D percentage gain, rising 35.8% to $409.5mn. PNUT, Near Protocol, Stellar and Trump complete the top five, with their open interest rising 19.7%, 15.8%, 14.8% and 11.8% on the day. Layer-1 Network Sei (SEI) saw the highest decline in open interest, falling 17.2% to $101mn.

In the bitcoin options market on Deribit, call options at a $100,000 strike price hold the highest open interest, with a notional value of $1.5 billion, followed by $1.35 billion in open interest at the $120,000 strike. However, the Put-to-Call ratio, currently at 0.52, signals significant put-side interest, with the largest put contracts holding $800 million and $700 million in open interest at strike prices of $80,000 and $75,000, respectively.

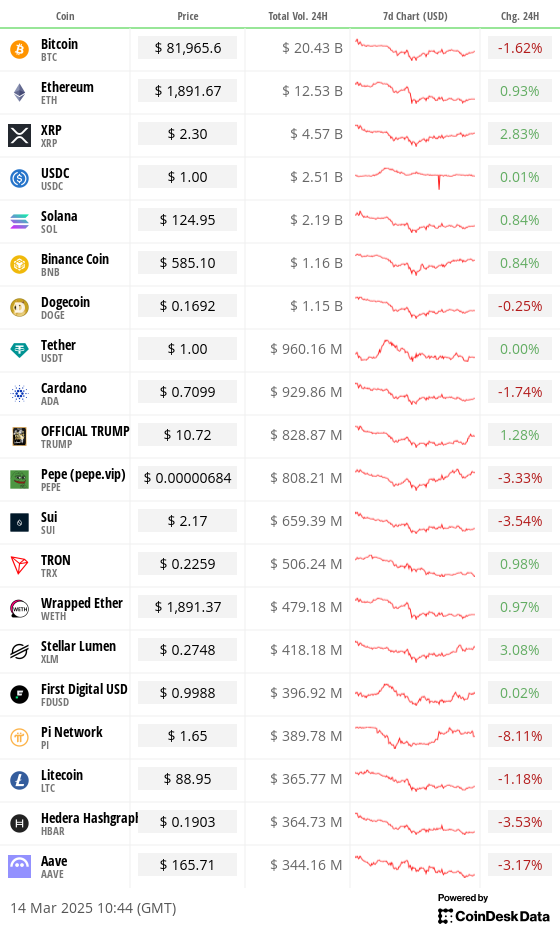

Market Movements:

BTC is up 2.93% from 4 p.m. ET Thursday at $82,739.17 (24hrs: -0.57%)

ETH is up 2.38% at $1,890.23 (24hrs: -0.55%)

CoinDesk 20 is up 3.36% at 2,592.81 (24hrs: -0.14%)

Ether CESR Composite Staking Rate is down 17 bps at 2.99%

BTC funding rate is at 0.0025% (2.79% annualized) on Binance

DXY is unchanged at 103.88

Gold is up 0.71% at $3,000.95/oz

Silver is up 0.83% at $33.97/oz

Nikkei 225 closed +0.72% at 37,053.10

Hang Seng closed +2.12% at 23,959.98

FTSE is up 0.49% at 8,584.53

Euro Stoxx 50 is up 0.69% at 5,365.00

DJIA closed on Thursday -1.3% at 40,813.57

S&P 500 closed -1.39% at 5,521.52

Nasdaq closed -1.96% at 17,303.01

S&P/TSX Composite Index closed -0.9% at 24,203.23

S&P 40 Latin America closed +0.73% at 2,343.21

U.S. 10-year Treasury rate is up 2bps at 4.3%

E-mini S&P 500 futures are up 0.67% at 5,564.75

E-mini Nasdaq-100 futures are up 0.9% at 19,421.50

E-mini Dow Jones Industrial Average Index futures are up 0.42% at 41,036.00

Bitcoin Stats:

BTC Dominance: 61.82 (0.26%)

Ethereum to bitcoin ratio: 0.02288 (-0.48%)

Hashrate (seven-day moving average): 825 EH/s

Hashprice (spot): $47.3

Total Fees: 5.55 BTC / $456,716

CME Futures Open Interest: 144,785 BTC

BTC priced in gold: 27.7 oz

BTC vs gold market cap: 7.86%

Technical Analysis

Bitcoin has rebounded off its weekly 50-day EMA, a historically significant support level during past uptrends. In previous cycles, this touchpoint often led to a consolidation phase lasting 6 to 9 weeks before resuming momentum.

For bulls, maintaining a weekly close above the 50-day EMA is crucial, as sustained price action below this level could signal deeper weakness. Additionally, reclaiming the yearly open—aligned with previous range lows—would strengthen bullish conviction.

Without this reclaim, any short-term bounces may risk turning into bearish retests, reinforcing the breakdown in market structure on the weekly timeframe.

Crypto Equities

Strategy (MSTR): closed on Thursday at $263.26 (+0.27%), up 3.34% at $272.04 in pre-market

Coinbase Global (COIN): closed at $177.49 (-7.43%), up 2.89% at $182.62

Galaxy Digital Holdings (GLXY): closed at C$16.62 (-5.03%)

MARA Holdings (MARA): closed at $12.16 (-7.25%), up 3.37% at $12.57

Riot Platforms (RIOT): closed at $7.31 (-6.88%), up 2.74% at $7.51

Core Scientific (CORZ): closed at $8.66 (-3.24%), down 2.89% at $8.91

CleanSpark (CLSK): closed at $7.69 (-5.06%), up 3.25% at $7.94

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.57 (-4.71%)

Semler Scientific (SMLR): closed at $32.62 (-2.92%)

Exodus Movement (EXOD): closed at $26.08 (-4.92%), down 3.6% at $25.14

ETF Flows

Spot BTC ETFs:

Daily net flow: -$135.2 million

Cumulative net flows: $35.35 billion

Total BTC holdings ~ 1,115 million.

Spot ETH ETFs

Daily net flow: -$73.6 million

Cumulative net flows: $2.58 billion

Total ETH holdings ~ 3.545 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

With Gold reaching a new all-time high of $3,000, the Gold/BTC ratio has reached 0.037, the highest level since the U.S. elections on Nov. 5th.

While You Were Sleeping

Russia Leans on Cryptocurrencies for Oil Trade, Sources Say (Reuters): Some Russian oil firms reportedly use cryptocurrencies to bypass sanctions and streamline converting yuan and rupees from China and India into rubles.

BofA Says US Stocks Rout Is Correction, Not Start of Bear Market (Bloomberg): Strategist Michael Hartnett suggests buying the S&P 500 if it nears 5,300, provided investor cash reserves rise above 4%, bond risk premiums widen, and stock sell-offs accelerate.

Trump-backed World Liberty Financial (WLFI) Completes $590M Token Sale (CoinDesk); Despite early reports of sluggish sales, the Trump-associated crypto project raised $590 million in a token sale restricted to accredited investors, with Justin Sun’s investment helping to boost demand.

AI’s Lead Over Crypto for VC Dollars Increased in Q1’25, But Does This Race Really Matter? (CoinDesk): AI funding this quarter nears $20 billion, led by Databricks’ $15.3 billion raise, while the largest crypto deal so far is Binance securing $2 billion in funding.

A New Hope for Europe’s Ailing Economies: the Military (The Wall Street Journal): The European Commission’s €800 billion defense initiative could fuel technological advancements, stimulate job creation, and strengthen industrial capacity, particularly in sectors like robotics, satellite networks, and autonomous systems.

UK Economy Unexpectedly Contracted 0.1% in January (Financial Times): The British pound fell 0.2% against the dollar after weak GDP data. Chancellor Rachel Reeves is expected to announce potential spending cuts in the March 26 Spring Statement.

In the Ether

Uncategorized

Is Ethereum’s DeFi Future on L2s? Liquidity, Innovation Say Perhaps Yes

Ethereum is in the midst of a paradox. Even as ether hit record highs in late August, decentralized finance (DeFi) activity on Ethereum’s layer-1 (L1) looks muted compared to its peak in late 2021. Fees collected on mainnet in August were just $44 million, a 44% drop from the prior month.

Meanwhile, layer-2 (L2) networks like Arbitrum and Base are booming, with $20 billion and $15 billion in total value locked (TVL) respectively.

This divergence raises a crucial question: are L2s cannibalizing Ethereum’s DeFi activity, or is the ecosystem evolving into a multi-layered financial architecture?

AJ Warner, the chief strategy officer of Offchain Labs, the developer firm behind layer-2 Arbitrum, argues that the metrics are more nuanced than just layer-2 DeFi chipping at the layer 1.

In an interview with CoinDesk, Warner said that focusing solely on TVL misses the point, and that Ethereum is increasingly functioning as crypto’s “global settlement layer,” a foundation for high-value issuance and institutional activity. Products like Franklin Templeton’s tokenized funds or BlackRock’s BUIDL product launch directly on Ethereum L1 — activity that isn’t fully captured in DeFi metrics but underscores Ethereum’s role as the bedrock of crypto finance.

Ethereum as a layer-1 blockchain is the secure but relatively slow and expensive base network. Layer-2s are scaling networks built on top of it, designed to handle transactions faster and at a fraction of the cost before ultimately settling back to Ethereum for security. That’s why they’ve become so appealing to traders and builders alike. Metrics like TVL, the amount of crypto deposited in DeFi protocols, highlight this shift, as activity is moved to L2s where lower fees and quicker confirmations make everyday DeFi far more practical.

Warner likens Ethereum’s place in the ecosystem to a wire transfer in traditional finance: trusted, secure and used for large-scale settlement. Everyday transactions, however, are migrating to L2s — the Venmos and PayPals of crypto.

“Ethereum was never going to be a monolithic blockchain with all the activity happening on it,” Warner told CoinDesk. Instead, it’s meant to anchor security while enabling rollups to execute faster, cheaper and more diverse applications.

Layer 2s, which have exploded over the last few years because they are seen as the faster and cheaper alternative to Ethereum, enable whole categories of DeFi that don’t function as well on mainnet. Fast-paced trading strategies, like arbitraging price differences between exchanges or running perpetual futures, don’t work well on Ethereum’s slower 12-second blocks. But on Arbitrum, where transactions finalize in under a second, those same strategies become possible, Warner explained. This is apparent, as Ethereum has had fewer than 50 million transactions over the last month, compared to Base’s 328 million transactions and Arbitrum’s 77 million transactions, according to L2Beat.

Builders also see L2s as an ideal testing ground. Alice Hou, a research analyst at Messari, pointed to innovations like Uniswap V4’s hooks, customizable features that can be iterated far more cheaply on L2s before going mainstream. For developers, quicker confirmations and lower costs are more than a convenience: they expand what’s possible.

“L2s provide a natural playground to test these kinds of innovations, and once a hook achieves breakout popularity, it could attract new types of users who engage with DeFi in ways that weren’t feasible on L1,” Hou said.

But the shift isn’t just about technology. Liquidity providers are responding to incentives. Hou said that data shows smaller liquidity providers increasingly prefer L2s where yield incentives and lower slippage amplify returns. Larger liquidity providers, however, still cluster on Ethereum, prioritizing security and depth of liquidity over bigger yields.

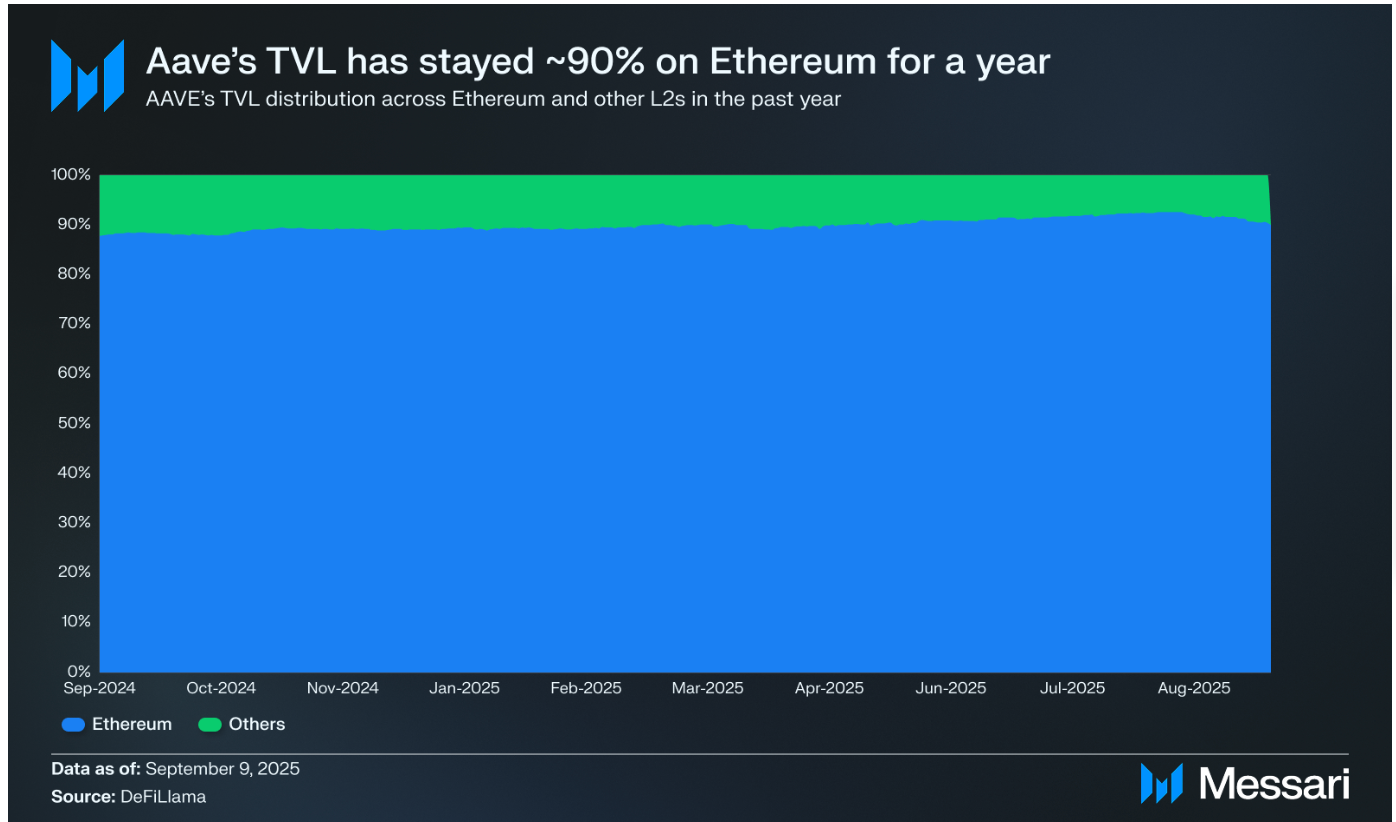

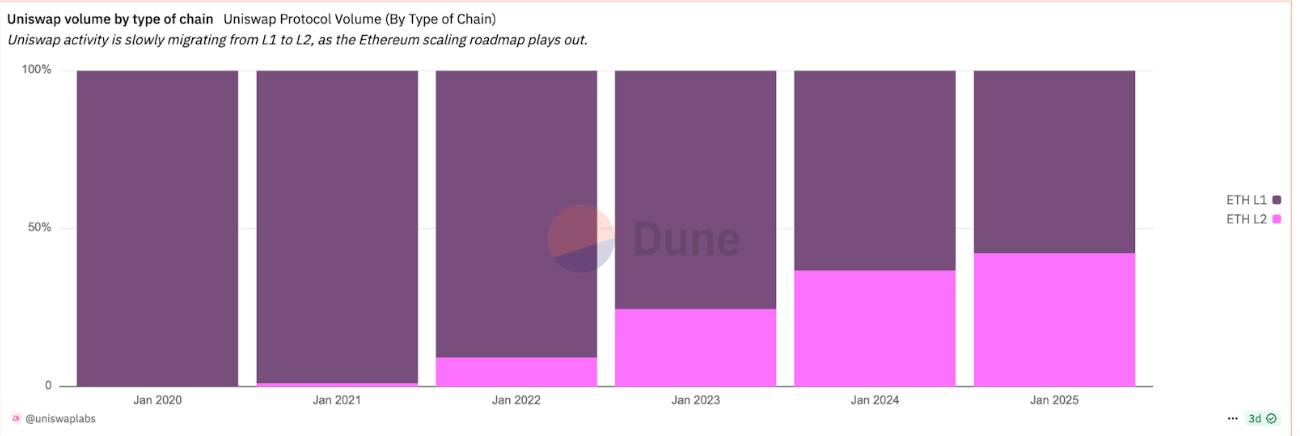

Interestingly, while L2s are capturing more activity, flagship DeFi protocols like Aave and Uniswap still lean heavily on mainnet. Aave has consistently kept about 90% of its TVL on Ethereum. With Uniswap however, there’s been an incremental shift towards L2 activity.

Another factor accelerating L2 adoption is user experience. Wallets, bridges and fiat on-ramps increasingly steer newcomers directly to L2s, Hou said. Ultimately, the data suggests the L1 vs. L2 debate isn’t zero-sum.

As of September 2025, about a third of L2 TVL still comes bridged from Ethereum, another third is natively minted, and the rest comes via external bridges.

“This mix shows that while Ethereum remains a key source of liquidity, L2s are also developing their own native ecosystems and attracting cross-chain assets,” Hou said.

Ethereum thus as a base layer appears to be cementing itself as the secure settlement engine for global finance, while rollups like Arbitrum and Base are emerging as execution layers for fast, cheap and creative DeFi applications.

“Most payments I make use something like Zelle or PayPal… but when I bought my home, I used a wire. That’s somewhat parallel to what’s happening between Ethereum layer one and layer twos,” Warner of Offchain Labs said.

Read more: Ethereum DeFi Lags Behind, Even as Ether Price Crossed Record Highs

Uncategorized

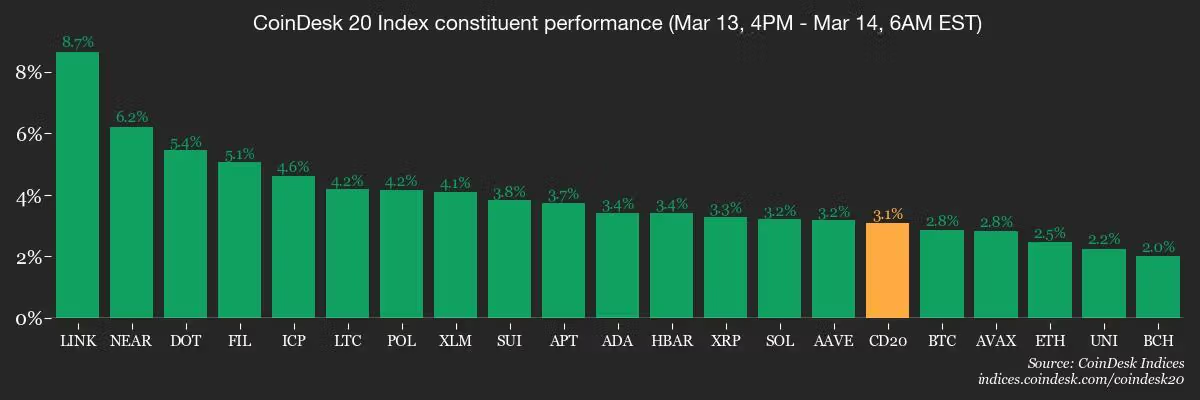

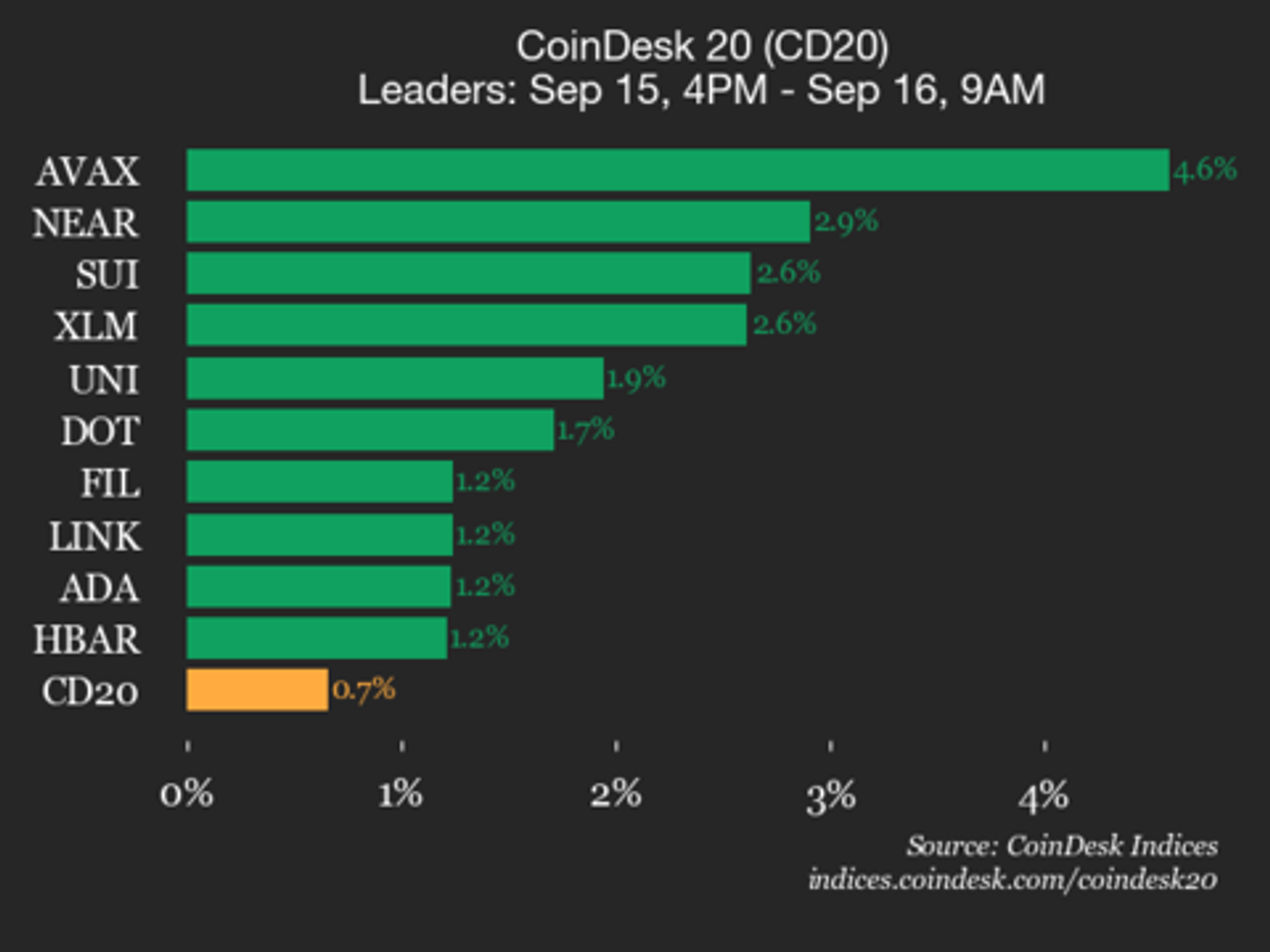

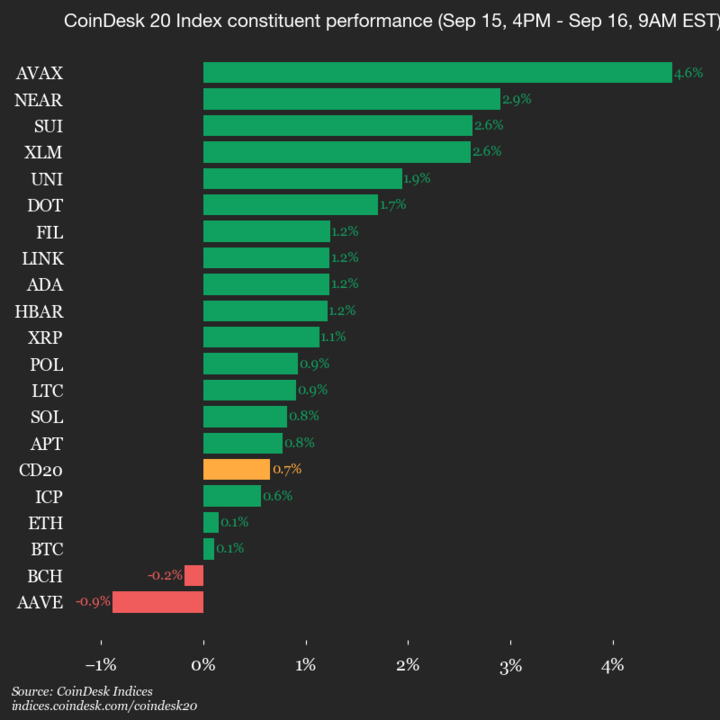

CoinDesk 20 Performance Update: Avalanche (AVAX) Gains 4.6% as Index Moves Higher

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 4267.12, up 0.7% (+27.81) since 4 p.m. ET on Monday.

Eighteen of 20 assets is trading higher.

Leaders: AVAX (+4.6%) and NEAR (+2.9%).

Laggards: AAVE (-0.9%) and BCH (-0.2%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Uncategorized

Santander’s Openbank Starts Offering Crypto Trading in Germany, Spain Coming Soon

The digital banking arm of Spanish financial giant Santander Group, Openbank, opened cryptocurrency trading for customers in Germany, with plans to add its home market in the next few weeks.

The new service allows users to buy, sell and hold five popular cryptocurrencies: bitcoin (BTC), ether (ETH), litecoin (LTC), polygon (MATIC) and cardano (ADA), according to a press release. The cryptocurrencies are available alongside stocks, ETFs and investment funds.

Customers can trade without moving funds to an external platform, keeping all investments in one place under Santander’s umbrella, the bank said.

“By incorporating the main cryptocurrencies into our investment platform, we are responding to the demand of some of our customers,” said Coty de Monteverde, head of crypto at Grupo Santander.

The bank charges a 1.49% fee per transaction, with a 1 euro ($1.2) minimum, and does not include custody fees. The bank said it plans to add more cryptocurrencies and new features, such as crypto-to-crypto conversions, in coming months.

Santander Private Bank was back in 2023 making headlines when it started letting clients with accounts in Switzerland trade BTC and ETH. It selected crypto safekeeping technology firm Taurus for custody.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars