Uncategorized

Crypto Daybook Americas: China’s Economic Woes Offer Hope as Fed Rate Talk Crashes BTC

By Omkar Godbole (All times ET unless indicated otherwise)

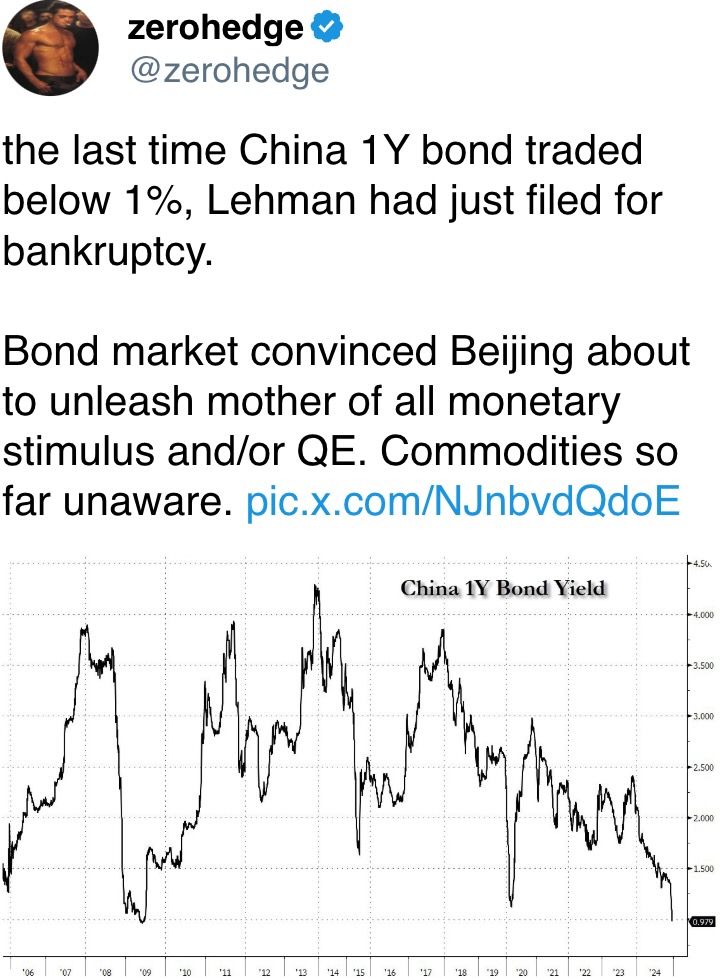

Keeping an eye on the Far East has been our mantra lately, and the latest news from the Chinese bond market shows why. Just today, China’s one-year government bond yield dropped below 1% for the first time since the Great Financial Crisis, adding to the year-to-date downturn. The benchmark 10-year yield slipped to 1.7%.

How does that play out for risk assets like bitcoin, which slumped overnight? Well, there are two key reasons to feel optimistic. For a start, the continued decline in yields suggests Beijing will have to roll out more aggressive stimulus measures than we saw earlier this year.

Jeroen Blokland, the founder and manager of the Blokland Smart Multi-Asset Fund, put it succinctly: “This indicates that China’s economic troubles are far from over, and the government will do what aging economies often do: ramp up government spending, allow for larger deficits and higher debt levels, and drive interest rates down toward zero.”

And there’s more to consider. This situation in China also raises questions about Fed Chairman Jerome Powell’s recent alarm over interest rates, which sent bitcoin tumbling to $95,000 from $105,000.

China, the world’s factory, is facing worsening deflation having already experienced the longest stretch of falling prices since the late 1990s. That could cap PPI and CPI readings worldwide, including in the U.S., a major trading partner.

BNP Paribas noted this phenomenon earlier this year, with analysts saying that China has already contributed to lowering core inflation in the eurozone and the U.S. by about 0.1 percentage point and core goods inflation by roughly 0.5 percentage point.

What this means is that Powell’s concerns about stubborn inflation may be unfounded and begs the question whether he will really stick to just two rate cuts for 2025 as he implied on Wednesday? Many experts think there might be more.

“Fed concerns on inflation are misguided. Interest rates are still too high in the U.S., and liquidity is about to increase, driving Bitcoin higher,” said Dan Tapiero, CEO and CIO of 10T Holdings, on X, alluding to China’s declining bond yields.

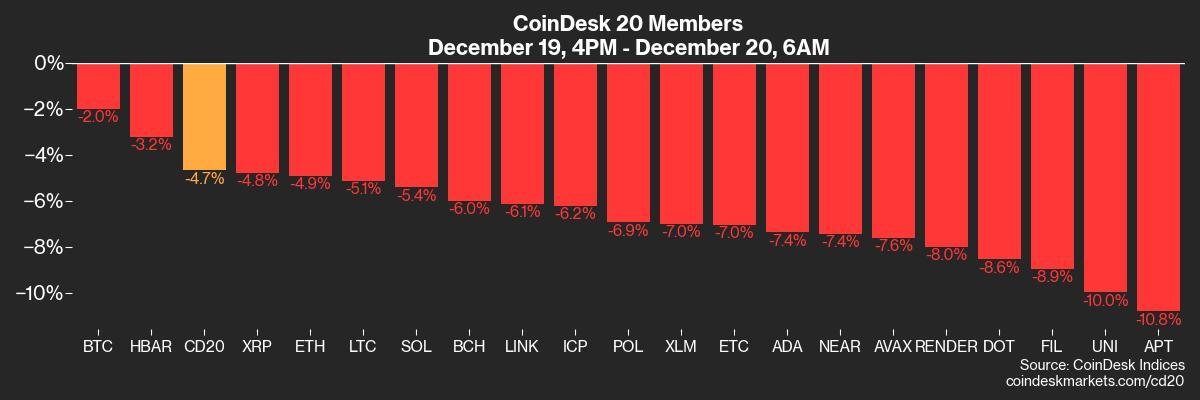

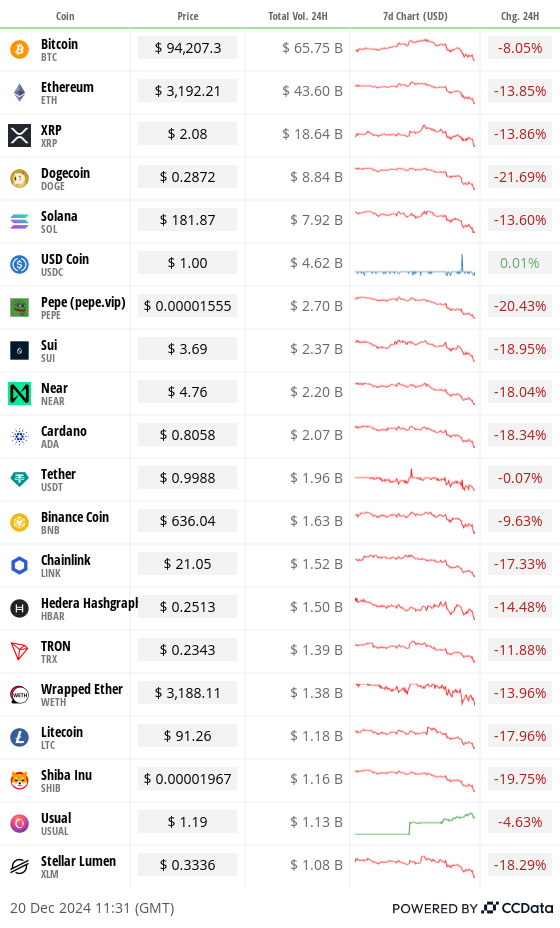

For now, markets aren’t considering this bullish angle. BTC has dropped below $95,000 and ETH has slipped to $3,200. All the 100 biggest coins are flashing red. Futures tied to the S&P 500 are down 0.5%, indicating a negative open and continuation of the post-Fed risk-off.

Sentiment may worsen if the core PCE, the Fed’s preferred inflation gauge, comes in hotter than expected later today. That might see markets price out another rate cut, leaving just one on the table for 2025. Stay alert!

What to Watch

Crypto:

Dec. 23: MicroStrategy (MSTR) stock will be added to the Nasdaq-100 Index before the market opens, making it part of funds like the Invesco QQQ Trust ETF that track the index.

Dec. 25, 10:00 p.m.: Binance plans to delist the WazirX (WRX) token. Two other tokens being delisted at the same time are Kaon (AKRO) and Bluzelle (BLZ).

Dec. 30: The European Union’s Markets in Crypto-Assets (MiCA) Regulation becomes fully effective. The stablecoin provisions came into effect on June 30.

Dec. 31: Crypto exchange Gemini is shutting its operations in Canada. In an email sent out on Sept. 30, it said all customer accounts in the country would be closed at the end of the year.

Jan 3: Bitcoin Genesis Day. The 16th anniversary of the mining of Bitcoin’s first block, or Genesis Block, by the blockchain’s pseudonymous inventor Satoshi Nakamoto. This came roughly two months after he published the Bitcoin white paper in an online cryptography mailing list.

Macro

Dec. 20, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases November’s Personal Income and Outlays report.

PCE Price Index YoY Est. 2.5% vs Prev. 2.3%.

Core PCE Price Index YoY Est. 2.9% vs Prev. 2.8%.

Dec. 24, 1:00 p.m. The Fed releases November’s H.6 (Money Stock Measures) report. Money Supply M2 Prev. $23.31T.

Token Events

Token Launches

Binance Alpha announced the fourth batch of tokens, including BANANA, KOGE, BOB, MGP, PSTAKE, GNON, Shoggoth, LUCE and ODOS. Binance Alpha is the pre-selected pool for Binance listings.

Conferences:

Jan. 13-24: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

Jan. 17: Unchained: Blockchain Business Forum 2025 (Los Angeles)

Jan. 18: BitcoinDay (Naples, Florida)

Jan. 20-24: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

Jan. 21: Frankfurt Tokenization Conference 2025

Jan 30-31: Plan B Forum (San Salvador, El Salvador)

Feb. 3: Digital Assets Forum (London)

Feb. 18-20: Consensus Hong Kong

Token Talk

By Shaurya Malwa

Fartcoin (FART) just touched $1 billion.

The scatologically named AI agent token jumped over $1.1 billion in market cap early Friday even as the broader market saw a second-straight day of losses, becoming one of the few tokens in the green.

FART’s rise is as much about human psychology as economics. In a market where fundamental investments are faltering, it has become a symbol of the absurd, a light-hearted rebellion against the grim financial forecasts.

Its platform allows users to potentially submit related-theme memes or jokes to earn tokens. It features a unique transactional system where each trade produces a digital flatuence sound.

People are investing not for the promise of utility or groundbreaking technology but for the joy of the moment, the shared giggle over a coin whose name alone is enough to break the tension of the day.

It isn’t all about the jokes, though. The token is part of the rising AI agent crypto sector, one that claims to use AI-powered entities to perform tasks on blockchain networks autonomously under a memecoin branding.

Derivatives Positioning

The BTC one-month basis has pulled back to 10% on the CME while the three-month basis has dropped to around 12% on offshore exchanges. ETH futures display similar behavior.

Most major tokens are showing negative perpetual cumulative volume deltas for the past 24 hours, a sign of net selling pressure. DOGE has seen the most intense selling.

Front-end BTC and ETH show a strong put bias, but calls expiring on Jan. 31 and beyond continue to trade at a premium.

Block trades in options leaned slightly bearish, with large transactions involving a standalone long position in the $75K put expiring on Jan. 31.

Someone sold a large amount of ETH $3K put.

Market Movements:

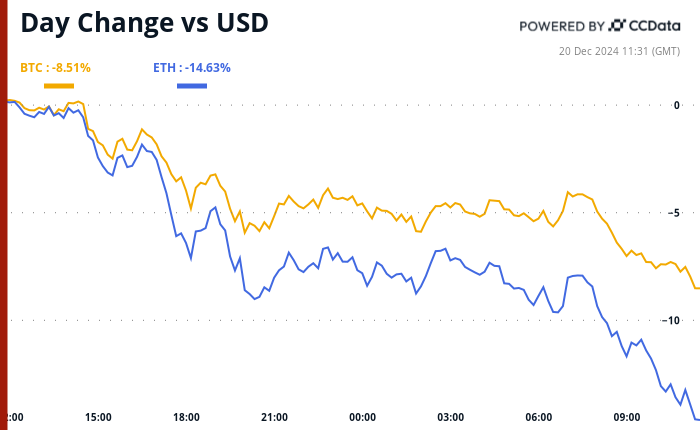

BTC is down 2.55% from 4 p.m. ET Thursday to $94,947.95 (24hrs: -7.92%)

ETH is down 5.41% at $3,232.19 (24hrs: -14.06%)

CoinDesk 20 is down 5.14% to 3,196.80 (24hrs: -13.12%)

Ether staking yield is up 7 bps to 3.19%

BTC funding rate is at 0.01% (10.95% annualized) on Binance

DXY is down 0.25% at 108.14

Gold is up 1.11% at $2,621.1/oz

Silver is up 0.65% to $29.28/oz

Nikkei 225 closed -0.29% at 38,701.90

Hang Seng closed -0.16% at 19,720.70

FTSE is down 1.05% at 8,020.42

Euro Stoxx 50 is down 1.36% at 4,812.53

DJIA closed on Thursday unchanged at 42,342.24

S&P 500 closed unchanged at 5,867.08

Nasdaq closed -0.1% at 19,372.77

S&P/TSX Composite Index closed -0.58% at 24,413.90

S&P 40 Latin America closed +0.40% at 2,187.98

U.S. 10-year Treasury is down 0.03% at 4.54%

E-mini S&P 500 futures are down 0.79% to 5,822.25

E-mini Nasdaq-100 futures are unchanged at 21,112.25

E-mini Dow Jones Industrial Average Index futures are down 0.53% at 42,134.00

Bitcoin Stats:

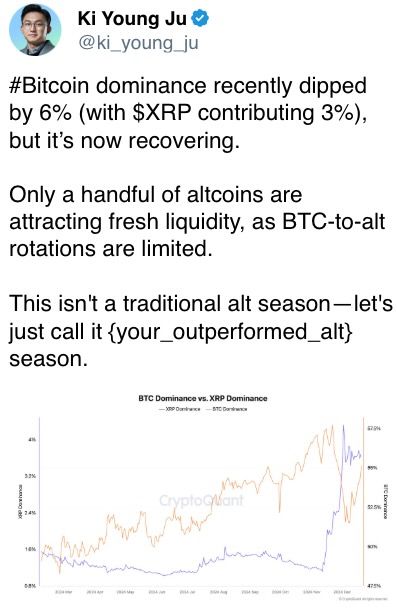

BTC Dominance: 59.21 (24hrs: +0.58%)

Ethereum to bitcoin ratio: 0.034 (24hrs: -1.37%)

Hashrate (seven-day moving average): 785 EH/s

Hashprice (spot): $62.5

Total Fees: $2.3 million

CME Futures Open Interest: 211,885 BTC

BTC priced in gold: 36.3 oz

BTC vs gold market cap: 10.34%

Bitcoin sitting in over-the-counter desk balances: 409,300 BTC

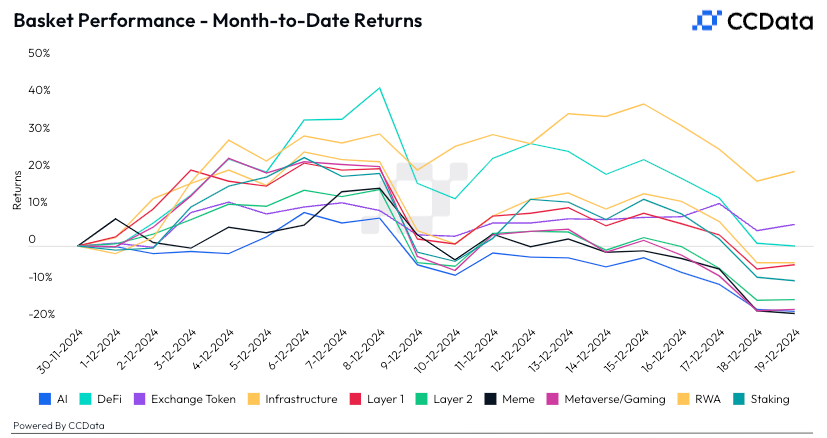

Basket Performance

Technical Analysis

BTC is fast approaching the lower end of the recent expanding channel pattern.

A UTC close below the support line could entice more chart-driven sellers to the market, potentially leading to a deeper drop to $80,000, a level widely watched after the U.S. election.

Crypto Equities

MicroStrategy (MSTR): closed on Thursday at $326.46 (-6.63%), down 5.35% at $309.00 in pre-market.

Coinbase Global (COIN): closed at $273.92 (-2.12%), down 5.65% at $258.43

in pre-market.

Galaxy Digital Holdings (GLXY): closed at C$24.75 (-5.93%)

MARA Holdings (MARA): closed at $20.37 (-5.74%), down 4.52% at $19.41 in pre-market.

Riot Platforms (RIOT): closed at $11.19 (-6.36%), down 4.2% at $10.72 in pre-market.

Core Scientific (CORZ): closed at $14.48 (+0.21%), down 4.42% at $13.84 in pre-market.

CleanSpark (CLSK): closed at $10.91 (-3.62%), down 3.94% at $10.48 in pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $24.45 (-5.56%), down 2.66% at $23.80 in pre-market.

Semler Scientific (SMLR): closed at $61.34 (-5.66%), down 4.22% at $58.75 in pre-market.

Exodus Movement (EXOD): closed at $50.95 (-4.05%), unchanged in pre-market.

ETF Flows

Spot BTC ETFs:

Daily net flow: -$671.9 million

Cumulative net flows: $36.310 billion

Total BTC holdings ~ 1.142 million.

Spot ETH ETFs

Daily net flow: -$60.5 million

Cumulative net flows: $2.406 billion

Total ETH holdings ~ 3.565 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

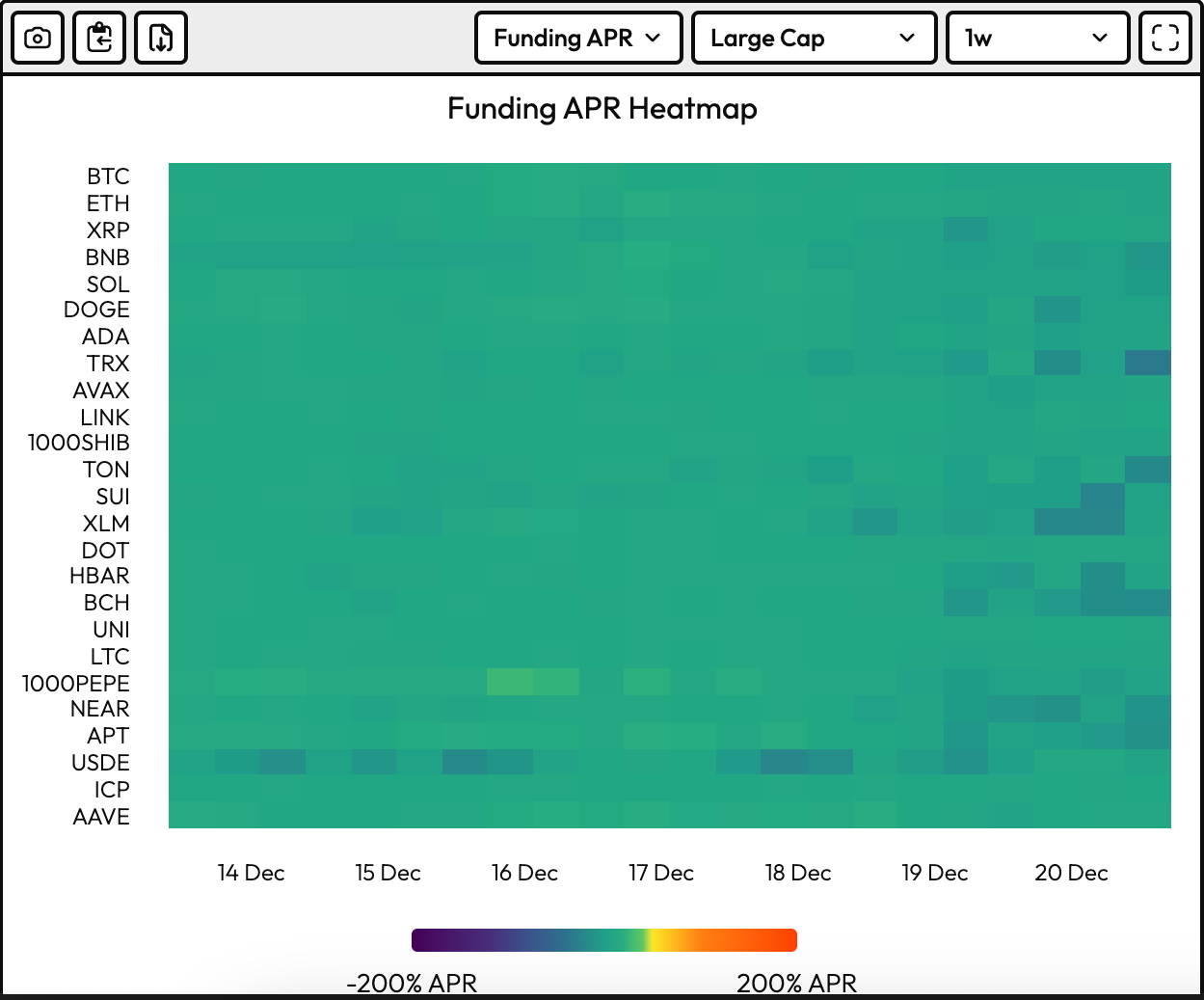

The chart shows annualized perpetual funding rates for major cryptocurrencies have been reset to healthier levels below 10%.

The market swoon has cleared out over-leveraged bets.

While You Were Sleeping

Dogecoin’s 11% Drop Leads Losses in Crypto Majors as Bitcoin Sours Festive Mood (CoinDesk): Bitcoin fell early Friday, extending its three-day post-FOMC slump as hawkish Fed signals and overbought conditions triggered a sell-off. DOGE led declines among the 10 biggest cryptocurrencies.

Dozens of House Republicans Defy Trump in Test of His Grip on GOP (The New York Times): President-elect Donald Trump’s influence over his party failed a test on Thursday as 38 conservative House Republicans ignored his threats and rejected a bill to extend federal spending into 2025 and suspend the debt limit until 2027.

As Bitcoin’s Post-Fed Price Dip Extends, This Key Contrary Indicator Offers Fresh Hope: Godbole (CoinDesk): Bitcoin’s drop below $96,000 triggered a key contrary indicator—the 50-hour SMA crossing below the 200-hour SMA—suggesting potential for a renewed rally above $100,000, though risks of further declines remain.

Hedge Funds Cash In on Trump-Fuelled Crypto Boom (Financial Times): Crypto hedge funds surged in November with 46 percent monthly and 76 percent year-to-date gains, as Trump’s election win fueled bitcoin’s rise past $100,000, making Brevan Howard and Galaxy Digital standout performers.

EM Central Banks Ramp Up Currency Defense as Dollar Surges Ahead (Bloomberg): Emerging-market central banks are deploying aggressive measures, like Brazil’s $14 billion intervention and South Korea’s eased FX rules, to counter a surging dollar that’s raising import costs and escalating debt risks.

Japan Consumer Prices Rise Faster as Rate Hike Timing Under Scrutiny (The Wall Street Journal): Japan’s inflation rose to 2.9 percent in November, driven by energy and food prices and fueling rate hike expectations, though subdued service inflation and cautious BOJ messaging could delay action until March.

In the Ether

Uncategorized

Ethereum Surges After Holding $2,477, Fueled by Very Heavy Trading Volume

Global economic tensions and trade disputes continue to influence cryptocurrency markets, with ETH showing resilience despite broader market uncertainty.

The second-largest cryptocurrency is currently navigating a critical technical zone between $2,500-$2,530, which analysts identify as immediate resistance that must be overcome for continued upward movement.

Institutional interest remains strong, with spot Ethereum ETFs recording consecutive days of positive inflows, signaling growing confidence from larger investors despite the recent volatility.

Technical Analysis Highlights

- 24-hour ETH price action revealed a substantial 3.5% range ($99.85).

- Sharp sell-off during midnight hour saw price plummet to $2,477.40, establishing a key support zone.

- Extraordinary volume (291,395 units, nearly 3x average) confirmed the significance of the support level.

- Buyers stepped in at the $2,467-$2,480 support band, confirmed by high-volume accumulation during the 08:00-09:00 period.

- Recent price action shows bullish momentum with ETH reclaiming the $2,515 level.

- Potential higher low pattern suggests the correction may have found its bottom.

- $2,520-$2,530 area remains the immediate resistance to overcome for continued upward movement.

- Significant bullish surge at 13:35 saw price jump from $2,515.85 to $2,521.79, accompanied by exceptional volume (5,839 units).

- Sharp reversal occurred at 14:00, with price dropping 5.07 points to $2,508.02 on heavy volume (4,043 units).

- Hourly range of 14.46 points ($2,508.02-$2,522.48) demonstrates market indecision.

External References

- «Ethereum Holds Above Key Prices – Data Points To $2,900 Level As Bullish Trigger«, NewsBTC, published May 24, 2025.

- «Ethereum Forms Inverse H&S – Bulls Eye Breakout Above $2,700 Level«, Bitcoinist, published May 25, 2025.

- «Ethereum Price Analysis: Is ETH Primed for a ‘Healthy’ Correction?«, CryptoPotato, published May 25, 2025.

Uncategorized

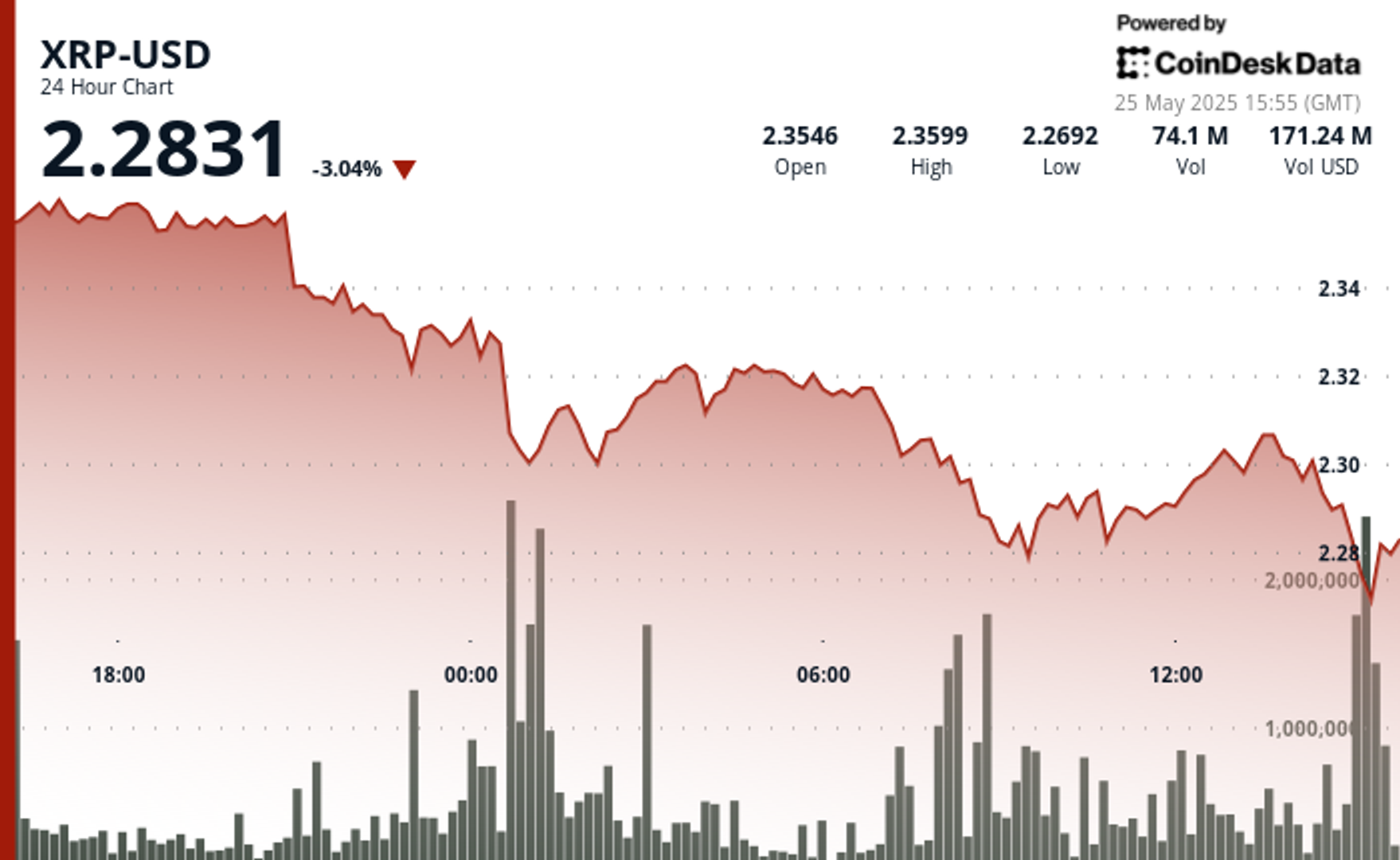

XRP Plunges Below $2.30 Amid Heavy Selling Pressure

Global economic tensions are weighing heavily on cryptocurrency markets as XRP experiences a significant correction amid heavy selling pressure.

The recent announcement of potential 50% tariffs on European Union imports by the US government has triggered widespread market uncertainty, with XRP falling alongside most major cryptocurrencies despite Bitcoin recently reaching new all-time highs.

Technical analysts point to critical support at the $2.25-$2.26 range, with market watchers warning that a break below this level could trigger deeper corrections toward the $1.55-$1.90 zone.

Meanwhile, institutional interest remains strong with Volatility Shares launching an XRP futures ETF and leveraged ETF inflows surging despite the price dip, suggesting Wall Street continues accumulating positions during market weakness.

Technical Analysis Highlights

- XRP underwent a notable 3.46% correction over the 24-hour period, with price declining from $2.361 to $2.303, creating an overall range of $0.084 (3.57%).

- The most significant price action occurred during the midnight hour (00:00), when XRP plummeted to $2.297 on exceptionally high volume (37.1M), establishing a strong volume-based support zone.

- A secondary sell-off at 08:00 saw price touch the period low of $2.280 with the highest volume spike (39.9M), confirming a double-bottom formation.

- In the last hour, XRP experienced significant volatility with a recovery attempt following the earlier correction.

- After reaching a low of $2.297 at 13:11, price formed a base around $2.298 before staging a substantial rally beginning at 13:27, peaking at $2.307 at 13:36-13:39 with exceptionally high volume (627K-480K).

- This bullish momentum created a clear resistance zone at $2.307, which was tested multiple times.

- The final 15 minutes saw profit-taking pressure emerge, with price retracing to $2.300, establishing a short-term support level that aligns with the psychological $2.30 threshold.

External References

- «XRP Price Watch: Consolidation or Collapse? Market Holds Breath Near $2.35«, Bitcoin.com News, published May 24, 2025.

- «XRP Price Prediction For May 25«, CoinPedia, published May 25, 2025.

- «XRP Risks Fall To $1.55 If This Support Level Fails – Analyst«, NewsBTC, published May 25, 2025.

Uncategorized

Bitcoin Drops Below $107.5K as Trump Tariff Threat Triggers Crypto Sell-Off

Bitcoin’s recent pullback has established strong volume-based resistance near $108,300, with support forming in the $106,700-$107,000 zone.

The correction accelerated with a notable price surge from $107,373 to $107,671 between 13:06-13:36, followed by a sharp reversal.

Technical analysis suggests Bitcoin is now trading within a compression zone, trapped between two major fair value gaps that will determine the upcoming market direction.

If bulls reclaim the $109K to $110K area, price could push toward resistance beyond $112K, while a break below $107,000 might test liquidity around $106K.

Technical Analysis Breakdown

- The decline accelerated during the 22:00-23:00 hour on May 24th with exceptionally high volume (16,335 BTC), establishing a strong volume-based resistance near $108,300.

- Support has formed in the $106,700-$107,000 zone where buyers emerged during the 09:00-10:00 period on May 25th, though recovery attempts have been modest with price consolidating around $107,500.

- The overall technical structure suggests a short-term bearish trend with potential for further consolidation before directional clarity emerges.

- Bitcoin experienced significant volatility with a notable price surge from $107,373 to $107,671 between 13:06-13:36, followed by a sharp reversal that saw prices decline to $107,393 by 14:00.

- The most substantial price movement occurred during the 13:35 minute candle where BTC jumped nearly $150 with exceptionally high volume (148.76 BTC), establishing temporary resistance around $107,630.

- Support formed near $107,400 where buyers emerged during the final minutes of the period, though the overall technical structure suggests continued consolidation within the broader correction from the $109,239 high.

External References

- «Bitcoin Price Prediction for May 25: Will Bulls Defend $108K or Is a Deeper Drop Ahead?«, Coin Edition, published May 24, 2025.

- «Why is Bitcoin Price Dropping Now? Will BTC Price Go Down to $100K?«, CoinPedia, published May 24, 2025.

- «Bitcoin Price Analysis: BTC Displays Signs of Weakness Following New All-Time High«, CryptoPotato, published May 25, 2025.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors