Uncategorized

Crypto Daybook Americas: Carnage in BTC and Altcoins May be a Warning Sign for Equities

By James Van Straten (All times ET unless indicated otherwise)

The CME bitcoin (BTC) futures chart is in focus once again as bitcoin’s recent 12% retracement has filled the latest CME gap—caused by the exchange’s weekend closure and bitcoin’s price run up to $95,000.

According to RiggsBTC, a post on X highlights a striking statistic: since bitcoin futures launched in December 2017, there have been 80 CME gaps, with only one unfilled at $21,000.

Zooming out to the macroeconomic picture, the U.S. economy faces slower growth due to fiscal cuts, trade uncertainties, and a weakening housing market. Inflation is expected to trend lower, with the Federal Reserve prioritizing employment over price control, according to Professor Satoshi, an analyst at Greeks Live Options Trader, told CoinDesk exclusively.

Professor Satoshi also views equities as overvalued, predicting a potential S&P 500 drop to 5700–5500. Meanwhile, the crypto market is experiencing de-risking, which often precedes downturns in equities.

«You can see altcoins got de-risked. This means majors get de-risked afterward. Typically, it’s the crypto market down first, then equities follow», according to Professor Satoshi.

Additionally, Professor Satoshi expects the Fed to likely skip a rate cut in March and the potential for a larger 50 bps cut in May. A potential return of quantitative easing in 2025, one he has been anticipating since last year’s growth scare.

«The Federal Reserve are always behind because they are data driven. On my bingo cards for 2025 is return of quantitative easing. Which no one thinks is possible but have been thinking this for sometime because ever since the growth scare last year, we managed to kick the can down the curb until now».

However, the strengthening Japanese Yen could be the canary in the coal mine, which is currently at its strongest level this year against the U.S. dollar at 148. Stay Alert!

What to Watch

Crypto:

March 5, 2:29 a.m.: Ethereum testnet Sepolia receives the Pectra hard fork network upgrade at epoch 222464.

March 5, 11:00 a.m.: Circle hosts a live webinar titled “State of the USDC Economy 2025” featuring Circle Chief Strategy Officer and Head of Global Policy Dante Disparte and three other executives from Bridge, Nubank and Cumberland.

March 6: Ethereum-based L2 blockchain MegaETH deploys its public testnet, with user onboarding starting on March 10.

March 7: President Trump will host the inaugural White House Crypto Summit, bringing together top cryptocurrency founders, CEOs and investors.

Macro

March 4, 8:00 p.m.: China’s 14th National People’s Congress (NPC) Third Annual Session starts.

March 4, 8:30 p.m.: Bank of Japan Governor Kazuo Ueda speech at the IMF event «Asia and the IMF: Resilience through Cooperation» in Tokyo.

March 4, 8:45 p.m.: Caixin Media releases February China economic activity data.

Services PMI Est. 50.8 vs. Prev. 51

Composite PMI Prev. 51.1

March 5, 4:00 a.m.: HCOB (Hamburg Commercial Bank) releases (final) February eurozone PMI business activity data.

Composite PMI Est. 50.2 vs. Prev. 50.2

Services PMI Est. 50.7 vs. Prev. 51.3

March 5, 5:00 a.m.: Eurostat releases January eurozone wholesale inflation data.

PPI MoM Est. 0.3% vs. Prev. 0.4%

PPI YoY Prev. 0%

March 5, 8:00 a.m.: S&P Global releases February Brazil economic activity data.

Services PMI Prev. 47.6

Composite PMI Prev. 48.2

March 5, 8:15 a.m.: Automatic Data Processing (ADP) releases February U.S. non-farm private sector employment data.

ADP Employment Change Est. 140K vs. Prev. 183K

March 5, 9:30 a.m.: S&P Global releases February Canada economic activity data.

Services PMI Prev. 49

Composite PMI Prev. 49.5

March 5, 9:45 a.m.: S&P Global releases February U.S. economic activity data.

Services PMI Est. 49.7 vs. Prev. 52.9

Composite PMI Est. vs. 50.4 vs. Prev. 52.7

March 5, 10:00 a.m.: Institute for Supply Management (ISM) releases February U.S. economic activity data.

Services PMI Est. 52.9 vs. Prev. 52.8

Earnings (Ests. based on FactSet data)

March 6 (TBC): Bitfarms (BITF), $-0.04

March 17 (TBC): Bit Digital (BTBT), $-0.05

March 18 (TBC): TeraWulf (WULF), $-0.04

March 24 (TBC): Galaxy Digital Holdings (TSE: GLXY), C$0.38

Token Events

Governance votes & calls

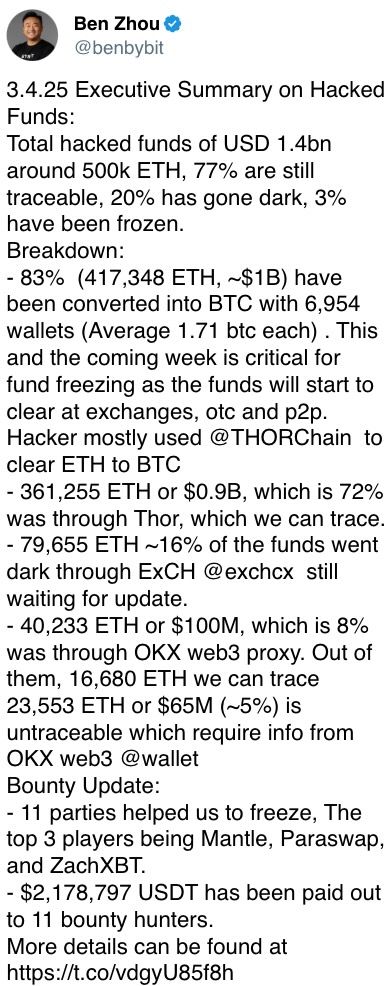

Paraswap DAO is discussing the return of 44.67 wrapped ether (wETH) to hacked cryptocurrency exchange Bybit that were collected by the DAO since the security breach.

Ampleforth DAO is discussing authorizing the Ampleforth Foundation to borrow 800,000 FORTH tokens from the treasury over 12 months to provide liquidity on major centralized exchanges.

Morpho DAO is voting on adjusting MORPHO token rewards on various networks by granting the Morpho Association the ability to alter rewards within predefined limits.

March 4, 12 p.m.: Lido to host a Node Operator Call.

March 5, 11 a.m.: Circle to host a call on The State of the USDC Economy.

Unlocks

March 2: Ethena (ENA) to unlock 66.19% of circulating supply worth $715.55 million.

March 7: Kaspa (KAS) to unlock 0.63% of circulating supply worth $12.27 million.

March 9: Movement (MOVE) to unlock 2.08% of its circulating supply worth $19.57 million.

March 12: Aptos (APT) to unlock 1.93% of circulating supply worth $61.07 million.

March 15: Starknet (STRK) to unlock 2.33% of its circulating supply worth $11.99 million.

Token Listings

March 4: Livepeer (LPT) to be listed on Bitbank.

March 6: Roam ($ROAM) to be listed on KuCoin and MEXC.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

March 8: Bitcoin Alive (Sydney, Australia)

March 10-11: MoneyLIVE Summit (London)

March 13-14: Web3 Amsterdam ‘25 (Netherlands)

March 19-20: Next Block Expo (Warsaw, Poland)

March 26: DC Blockchain Summit 2025 (Washington)

March 28: Solana APEX (Cape Town, South Africa)

Token Talk

By Shaurya Malwa

Ether (ETH) investors narrowly avoided a catastrophic cascade of liquidations within the MakerDAO ecosystem as ETH prices came within $80 of triggering the first liquidation at a critical price point of $1,929, according to data from MakerDAO vaults.

The vaults, including Vault 26949, Vault 22025, and Vault 1985, are collateralized with ETH and hold a combined value of over $348 million. However, they face liquidation risks if ETH’s price drops to $1,929, $1,844, or $1,796, respectively.

Market watchers are closely monitoring these levels, as a breach could destabilize the DAI stablecoin and ripple through the broader DeFi ecosystem, potentially causing significant volatility.

The slide comes as ETH grapples with its worst price action in recent years—down 12% in the past 24 hours to reach levels last seen in late 2023.

Derivatives Positioning

The price swoon continues to shake out leverage traders. Bitcoin and ether futures open interest on Binance has hit the lowest level since August last year. Open interest in BTC and ETH futures listed on the CME has declined to levels seen in November.

The CME basis, however, has recovered above 5%, hinting at renewed bullish flows.

Top 25 cryptocurrencies are down on a 24-hour basis, but only HYPE, BCH, XMR, SUI, OM, BNB, UNI and TON have seen a concurrent rise in open interest. That’s a sign of traders shorting the decline in these tokens.

On Deribit, BTC and ETH options show a renewed bias for puts. A market participant paid over $2 million in premium to purchase the $85,000 BTC put expiring at the end of April.

Market Movements:

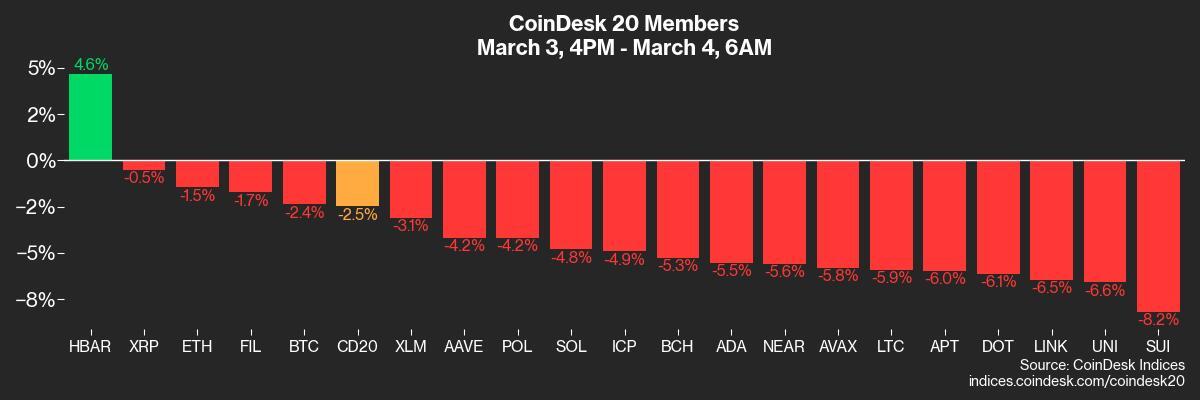

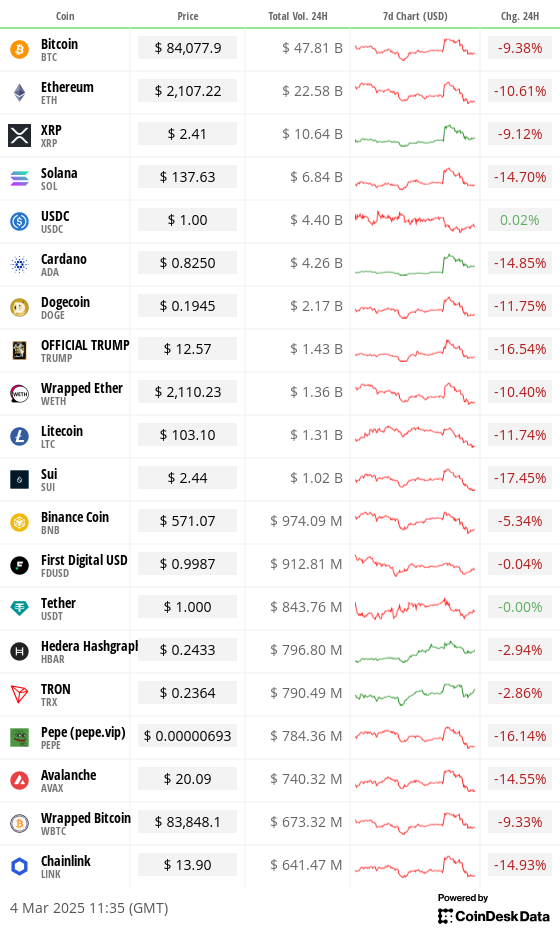

BTC is down 1.62% from 4 p.m. ET Monday at $84,001.60 (24hrs: -9.49%)

ETH is down 0.48% at $2,101.37 (24hrs: -0.48%)

CoinDesk 20 is down 2.7% at 2,734.47 (24hrs: -10.9%)

Ether CESR Composite Staking Rate is down 7 bps at 3.07%

BTC funding rate is at 0.0035% (3.89% annualized) on Binance

DXY is down 0.43% at 106.29

Gold is up 1.18% at $2,924.2/oz

Silver is up 1.28% at $32.44/oz

Nikkei 225 closed -1.2% at 37,331.18

Hang Seng closed -0.28% at 22,941.77

FTSE is down 0.3% at 8,856.47

Euro Stoxx 50 is down 2.02% at 5,428.65

DJIA closed on Monday -1.48% at 43,191.24

S&P 500 closed -1.76% at 5,849.72

Nasdaq closed -2.64% at 18,350.19

S&P/TSX Composite Index closed -1.54% at 25,001.6

S&P 40 Latin America closed -0.53% at 2,286.64

U.S. 10-year Treasury rate is up 1 bps at 4.17%

E-mini S&P 500 futures are down 0.11% at 5,854.25

E-mini Nasdaq-100 futures are unchanged at 20,464.25

E-mini Dow Jones Industrial Average Index futures are down 0.1% at 43,202.00

Bitcoin Stats:

BTC Dominance: 60.98 (-0.82%)

Ethereum to bitcoin ratio: 0.02511 (0.72%)

Hashrate (seven-day moving average): 810 EH/s

Hashprice (spot): $52.2

Total Fees: 6.06 BTC / $550,672

CME Futures Open Interest: 139,245 BTC

BTC priced in gold: 29.1 oz

BTC vs gold market cap: 8.27%

Technical Analysis

XRP/BTC’s weekly chart. (TradingView)

The XRP-bitcoin (XRP/BTC) pair is pushing against the upper end of a four-year-long sideways channel.

Breakouts from such prolonged consolidation patterns often yield sharp rallies.

Crypto Equities

MicroStrategy (MSTR): closed on Friday at $250.92 (-1.77%), down 1.63% at $246.82 in pre-market

Coinbase Global (COIN): closed at $205.75 (-4.58%), down 1.01% at $203.68

Galaxy Digital Holdings (GLXY): closed at C$20.76 (-3.58%)

MARA Holdings (MARA): closed at $13.79 (-0.93%), down 2.61% at $13.43

Riot Platforms (RIOT): closed at $8.86 (-4.53%), down 1.58% at $8.72

Core Scientific (CORZ): closed at $10.14 (-9.14%), down 0.89% at $10.05

CleanSpark (CLSK): closed at $7.79 (-2.5%), down 1.8% at $7.65

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $16.50 (-7.41%)

Semler Scientific (SMLR): closed at $38.89 (-9.39%), down 3.5% at $37.53

Exodus Movement (EXOD): closed -2.91% at $40.97

ETF Flows

Spot BTC ETFs:

Daily net flow: -$74.2 million

Cumulative net flows: $36.87 billion

Total BTC holdings ~ 1,131 million.

Spot ETH ETFs

Daily net flow: -$12.1 million

Cumulative net flows: $2.81 billion

Total ETH holdings ~ 3.636 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

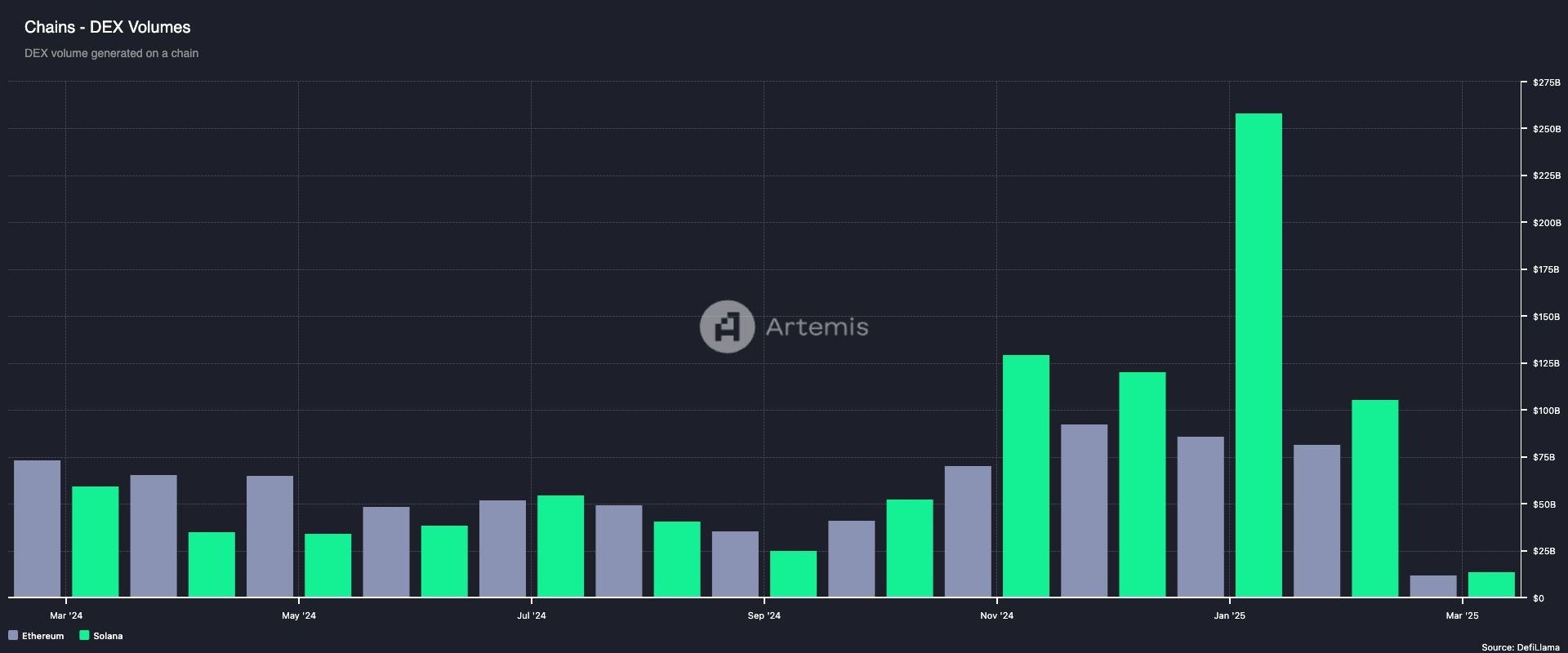

The Solana-based DEXes registered $105.9 billion in trading volume in February, comfortably outdoing Ethereum’s tally of $82 billion.

Solana ‘s winning trend began in October, largely due to the frenzied trading in memecoins.

While You Were Sleeping

Tom Lee Predicts Market Bottom This Week, Still Sees Bitcoin Closing the Year at $150K (CoinDesk): Fundstrat’s Head of Research recently said Bitcoin could drop to $62,000 in the short term but still expects it to reach $150,000 by the end of 2025.

Bitcoin Price Support Near $82K Under Threat as Nasdaq Triggers ‘Double Top’ (CoinDesk): Despite the past weekend’s crypto rally, Bitcoin’s long-term rebound may depend on Nasdaq’s trajectory, according to research firm Ecoinometrics.

THORChain Sees Record $4.6B Volume After Bybit’s $1.4B Hack (CoinDesk): DefiLlama data shows THORChain processed record swaps in the week ending March 2, while blockchain analysis suggests hackers may have used the platform to move a significant amount of funds stolen from Bybit.

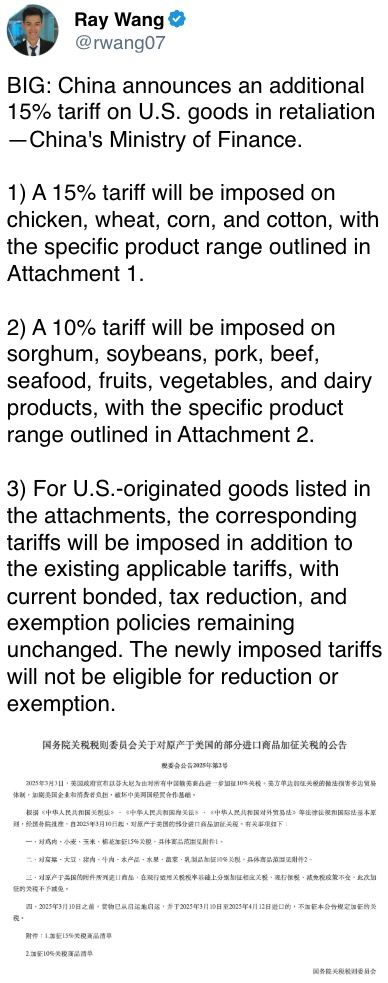

China Retaliates Against U.S. With Tariffs, Controls on U.S. Companies (The Wall Street Journal): On Tuesday, China retaliated against Trump’s additional 10% tariffs on Chinese imports by imposing up to 15% tariffs on U.S. agricultural goods, set to take effect March 10.

Canada Retaliates, Puts Tariffs on $107 Billion of US Products (Bloomberg): Canada’s 25% tariffs on $20.6 billion in U.S. goods are now in effect, with a second round in three weeks targeting an additional $86.4 billion in exports, including cars, trucks, steel and aluminum.

Global Government Borrowing Set To Hit Record $12.3Tn (Financial Times): Global sovereign debt will rise 3% this year as defense spending, high interest rates and deficits drive borrowing, while investors like Pimco cut exposure to long-term government bonds over sustainability concerns.

In the Ether

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoDisney\’s live-action Aladdin finally finds its stars