Uncategorized

Crypto Daybook Americas: Bitcoin’s $100K+ Run Is Just Early Days

By Omkar Godbole (All times ET unless indicated otherwise)

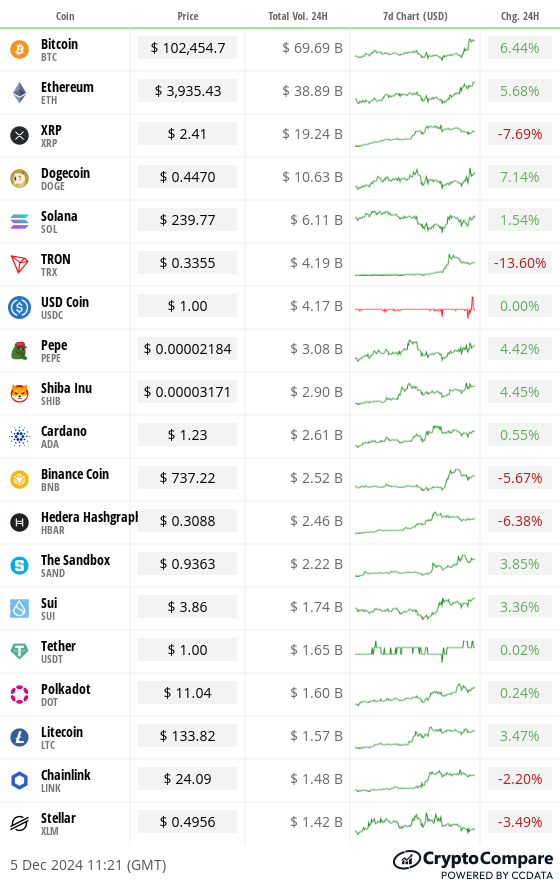

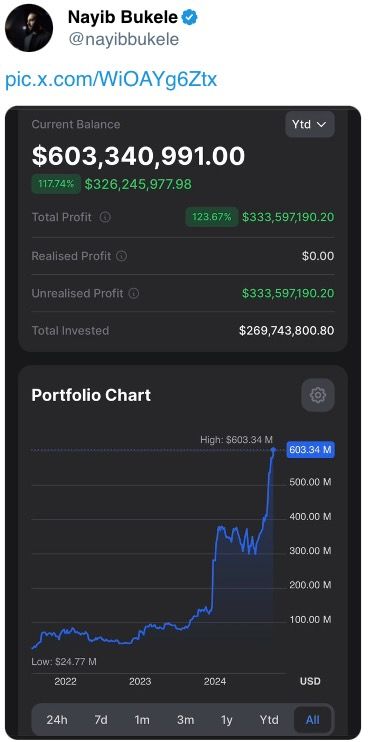

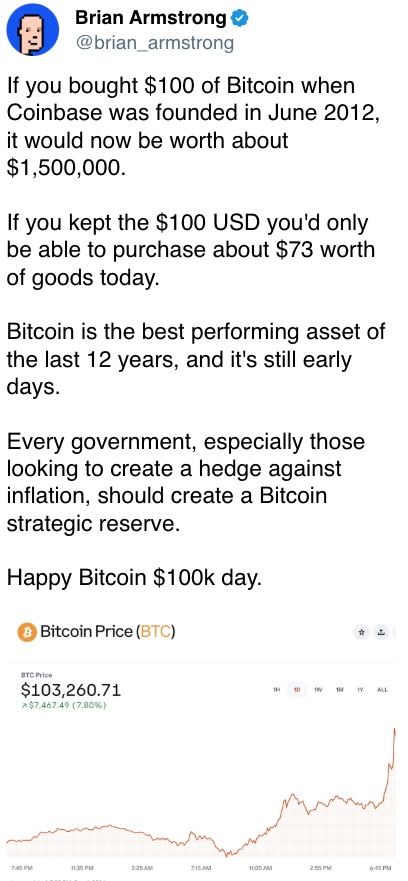

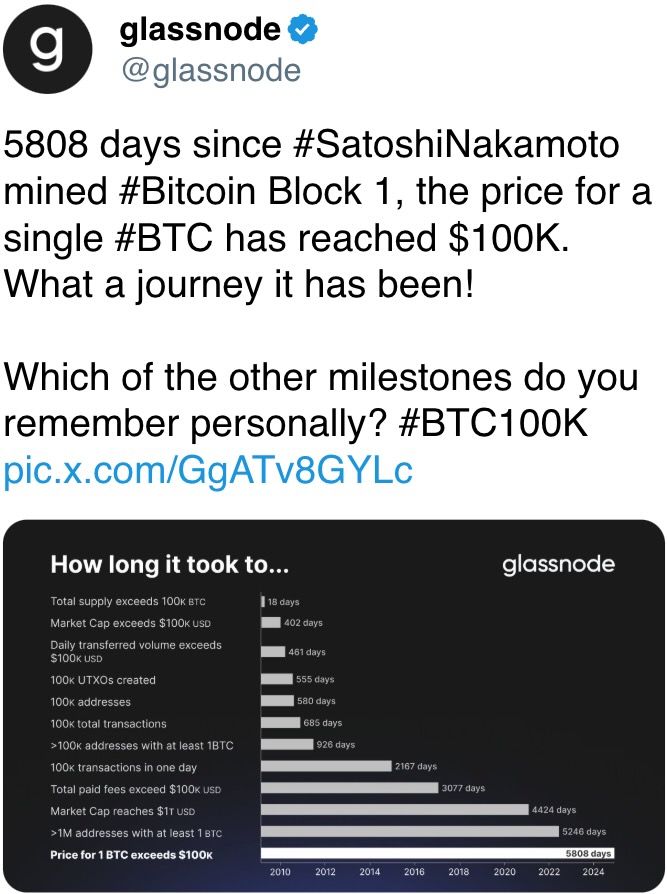

The wait is over. Bitcoin has surged past $100,000, driven by a number of factors, including President-elect Donald Trump’s appointment of supposedly crypto-friendly Paul Atkins to lead the SEC.

Most analysts are bullish, anticipating further gains toward $120,000 and higher, and it’s not hard to see why. As Newton’s first law states, an object in motion maintains its speed and direction unless acted on by an outside force.

The wider market is poised to benefit from bitcoin’s milestone, especially as the six-digit price may be too steep for many retail investors, prompting them to consider alternative cryptocurrencies.

Ether, in particular, is likely to benefit because the spread between the Ethereum staking yield and the yield on the U.S. 10-year Treasury has narrowed recently, with the Treasury’s return dropping to 4.2% from 4.5% in the past two weeks. Note, however, that a whale address moved 11,753 ETH to exchanges in the past 24 hours, raising price volatility risks.

Additionally, the Bitcoin layer-2 network Stacks’ STX token is gaining considerable attention on social media, with one observer referring to the SEC-compliant token as a «de facto BTC staking provider.» STX has surged 56% this quarter, though at $2.80 it remains well below its record $3.84. Keep an eye on this one.

In traditional markets, BTC’s rise has lifted spirts of crypto-related equities, with self-described bitcoin development company MicroStrategy up over 6% in pre-market trading. Copycat Semler Scientific has gained over 7% and MARA Holdings more than 6%.

Still, there are several external forces that may stall BTC’s momentum.

«Risks are centered around escalating conflicts in Ukraine and the Middle East, along with dramatic shifts in interest rate expectations from the Fed,» trading firm Zerocap’s CIO Jonathan de Wet told CoinDesk, adding that the Fed’s potential hawkish turn next year may take the wind out of BTC’s sails.

Sergei Gorev, head of risk at YouHodler, said risks could emerge from an «overheated» S&P 500.

«While the price increase may continue, it likely won’t be significant,» he said. Many» technical indicators suggest a potential correction, prompting algorithmic traders to seek entry points for short positions to address divergences on the charts.»

Valentin Fournier, an analyst at BRN, and several others say the crypto market itself looks overheated and is at risk of correction.

«The Fear and Greed Index has climbed above 80, signaling extreme greed among investors. Smaller-cap assets are seeing explosive gains, drawing in retail participants eager to capitalize on the bull run. While this strategy could be lucrative, it carries significant risks in such unpredictable conditions,» Fournier told CoinDesk.

So, stay alert out there!

What to Watch

Crypto:

Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02.

Macro

Dec. 5, 2 p.m.: French President Emmanuel Macron will deliver a televised speech from the Élysée Palace following the collapse of Prime Minister Michel Barnier’s government.

Dec. 6, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November’s Employment Situation Report.

Nonfarm Payrolls (NFP) Est. 183K vs Prev. 12K.

Unemployment Rate Est. 4.1% vs Prev. 4.1%.

Average Hourly Earnings MoM Est. 0.3% vs Prev. 0.4%.

Average Hourly Earnings YoY Prev. 4%.

Dec. 11, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November’s Consumer Price Index (CPI) data.

Core Inflation Rate YoY Prev. 3.3%.

Inflation Rate YoY Prev. 2.6%

Dec. 11, 9:45 a.m.: The Bank of Canada announces its policy interest rate (also known as overnight target rate and overnight lending rate). Prev. 3.75%.

Token Events

Governance votes & calls

Mars Protocol to hold community call at 9 a.m. to discuss launch of a perpetual trading product.

Stellar to upgrade its mainnet to protocol version 22 following validator vote, time unspecified.

Unlocks

Solana’s Jito to release 105% of JTO circulating supply on Dec. 7 at 10 a.m., worth nearly $500 million at current prices.

Token Launches

StrawberryAI is to launch mainnet on Dec. 5, time unspecified.

Conferences:

Dec. 4 — 5: India Blockchain Week 2024 Conference (Bangalore, India)

Dec. 4 — 5: W3N 2024 (Narva, Estonia)

Dec. 6: Digital Finance Summit Summit 2024 (Brussels)

Dec. 7: Bitcoin Baden 2024 (Baden, Switzerland)

Dec. 9 — 12: Abu Dhabi Finance Week 2024 (Abu Dhabi, UAE)

Dec. 9 — 13: Luxembourg Blockchain Week 2024

Dec. 12 — 13: Global Blockchain Show (Dubai)

Dec. 12 — 14: Taipei Blockchain Week 2024 (Taipei, Taiwan)

Dec. 16 — 17: Blockchain Association’s Policy Summit (Washington)

Token Talk

By Shaurya Malwa

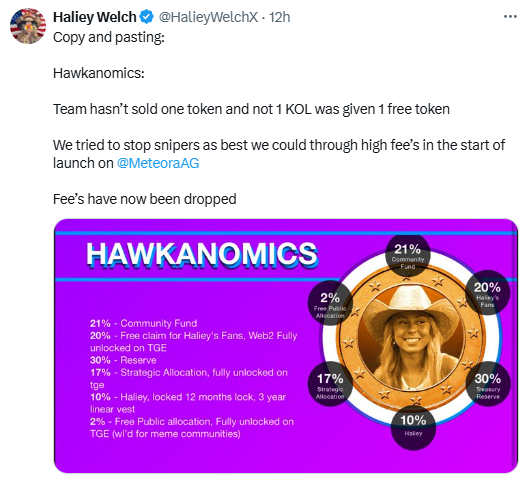

“Hailey is lying and will likely have to ‘talk tuah’ judge about this,” reads a widely shared community note on X today.

Viral sensation Haliey Welch launched a token on Solana late Wednesday. The token, backed by a management team, a foundation in the Cayman Islands, and a SAFT agreement with private investors who all claimed to ensure the longevity of HAWK — a token themed after Welch’s popular “hawk tuah” catchphrase.

The token initially saw its market cap soar to $490 million before dramatically crashing to less than $40 million with 20 minutes.

The wild price action drew parallels to a classic “rug pull,” or a token that benefits early buyers by pumping several multiples after issuance only to drop more than 90% in the hours or days afterward.

On-chain sleuths such as Bubblemaps allege over 96% of HAWK tokens were held in a single cluster — or a collection of related wallets — that sold tokens when prices rose.

Welch and her team have responded to some of these allegations, denying that insiders sold tokens at launch and claiming that the initial high trading fees were implemented to prevent snipers — or bots that purchase large amounts of a token after issuances to corner supply.

Several messages sent to Welch’s team to shed light on the allegations were unanswered in Asian hours.

Derivatives Positioning

The market looks overheated and faces pullback risks, with BTC’s perpetual funding rates more expensive than those of speculative tokens such as DOGE.

Traders are increasingly focusing on ETH, as evidenced by the new high of 6.86 million ETH in ether futures and perpetual futures open interest. BTC’s OI is yet to confirm the new spot-price high.

BTC calls, however, are more expensive than ETH on Deribit, according to 24-delta risk reversals sourced from Amberdata. Long dealer gamma at the $105,000 strike options suggests potential for range play.

BTC, ETH options flows mostly leaned bullish, but a large block trade saw an ETH trader sell the December expiry straddle at $3,800, collecting over $2 million in premium. Selling straddle represents expectations for price consolidation and volatility drop.

Market Movements:

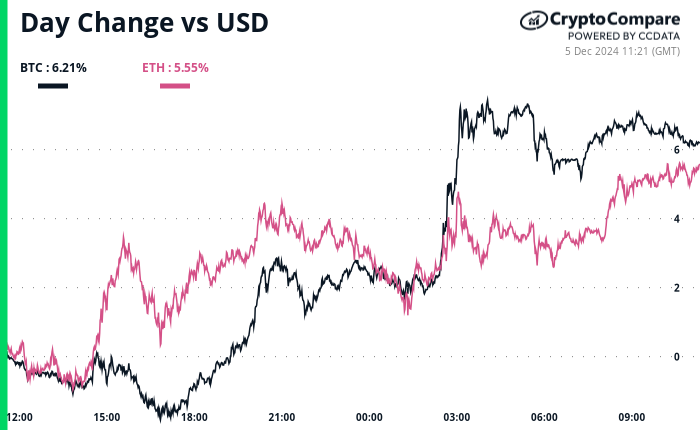

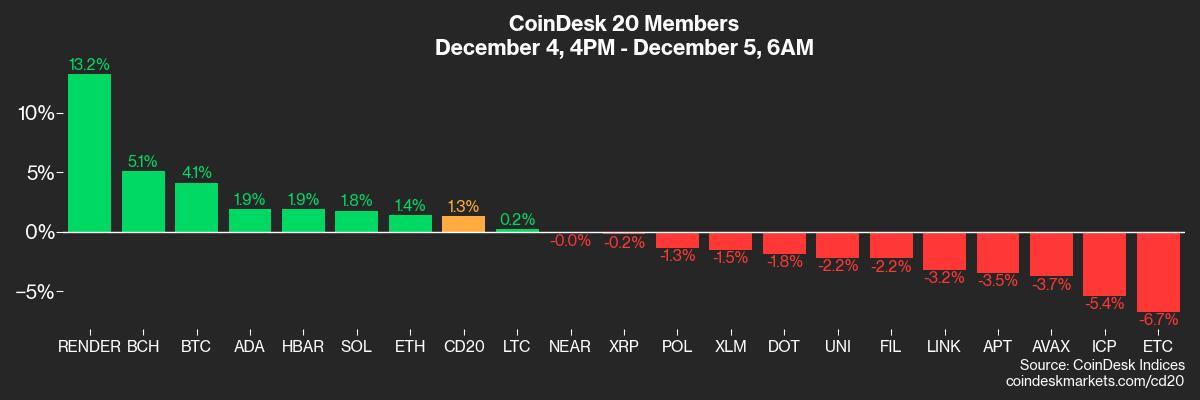

BTC is up 4.83% from 4 p.m. ET Wednesday to $102,565.99 (24hrs: +6.22%)

ETH is up 2.36% at $3,935.20 (24hrs: +5.24%)

CoinDesk 20 is up 1.4% to 3,956.08 (24hrs: +0.21%)

Ether staking yield is down 19 bps to 3.27%

BTC funding rate is at 0.045% (49.3% annualized) on Binance

DXY is down 0.11% at 106.21

Gold is up 0.69% at $2672.20/oz

Silver is up 1.14% to $31.86/oz

Nikkei 225 closed +0.3% at 39,395.60

Hang Seng closed -0.92% at 19,560.44

FTSE is unchanged at 8339.32

Euro Stoxx 50 is up 0.54% at 4,945.57

DJIA closed on Wednesday +0.69% to 45,014.04

S&P 500 closed +0.61% at 6086.49

Nasdaq closed +1.3% at 19,735.12

S&P/TSX Composite Index closed unchanged at 25,641.2

S&P 40 Latin America closed +0.38% at 2,336.15

U.S. 10-year Treasury was unchanged at 4.205%

E-mini S&P 500 futures are unchanged at 6094.50

E-mini Nasdaq-100 futures are down 0.14% to 21,505.75

E-mini Dow Jones Industrial Average Index futures are unchanged at 45,069.

Bitcoin Stats:

BTC Dominance: 56.60% (-0.61%)

Ethereum to bitcoin ratio: 0.03800 (1.78%)

Hashrate (seven-day moving average): 741 EH/s

Hashprice (spot): $61.12

Total Fees: 14.8 BTC/ $1.4 million

CME Futures Open Interest: 188,135 BTC

BTC priced in gold: 39.0 oz

BTC vs gold market cap: 11.12%

Bitcoin sitting in over-the-counter desk balances: 423,913

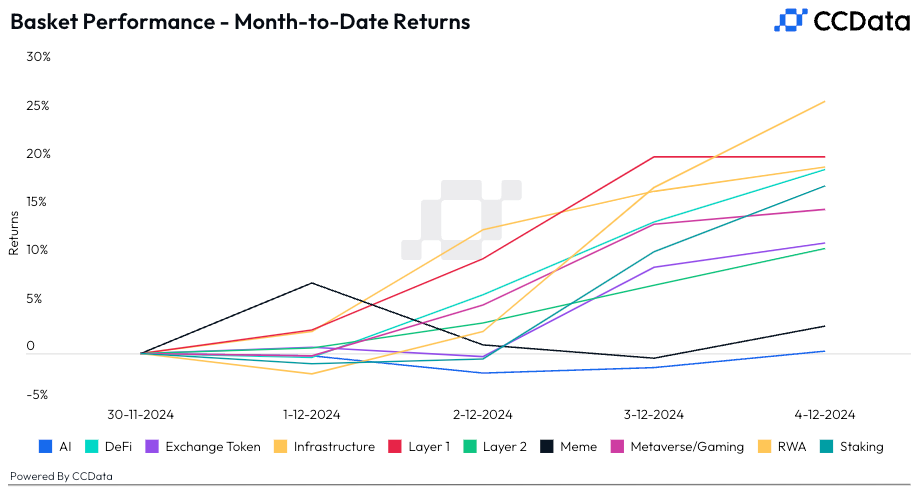

Basket Performance

Technical Analysis

The chart shows bitcoin’s Mayer multiple, which measures the difference between an asset’s going market value and its 200-day simple moving average (SMA).

As of writing, the Mayer multiple stands well below the 2.4 threshold that has marked previous bull market tops.

TradFi Assets

MicroStrategy (MSTR): closed on Wednesday at $406 (+8.72%), up 6.38% at $431.90 in pre-market.

Coinbase Global (COIN): closed at $330.94 (+6.98%), up 3.04% at $341.01 in pre-market.

Galaxy Digital Holdings (GLXY): closed at C$27.71 (+6.2+5%)

MARA Holdings (MARA): closed at $25.96 (+3.3%), up 5.51% at $27.39 in pre-market.

Riot Platforms (RIOT): closed at $12.95 (+6.67%), up 4.72% at $13.56 in pre-market.

Core Scientific (CORZ): closed at $17.47 (+6.39%), up 2.63% at $17.93 in pre-market.

CleanSpark (CLSK): closed at $14.68 (+5.23%), up 3.47% at $15.19 in pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $29.52 (+7.11%), up 3.15% at $30.45 in pre-market.

Semler Scientific (SMLR): closed at $63.40 (-0.36%), up 7.37% at $68.07 in pre-market.

ETF Flows

Spot BTC ETFs:

Daily net inflow: $556.8 million

Cumulative net inflows: $32.26 billion

Total BTC holdings ~ 1.086 million.

Spot ETH ETFs

Daily net inflow: $167.7 million

Cumulative net inflows: $901.3 million

Total ETH holdings ~ 3.113 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

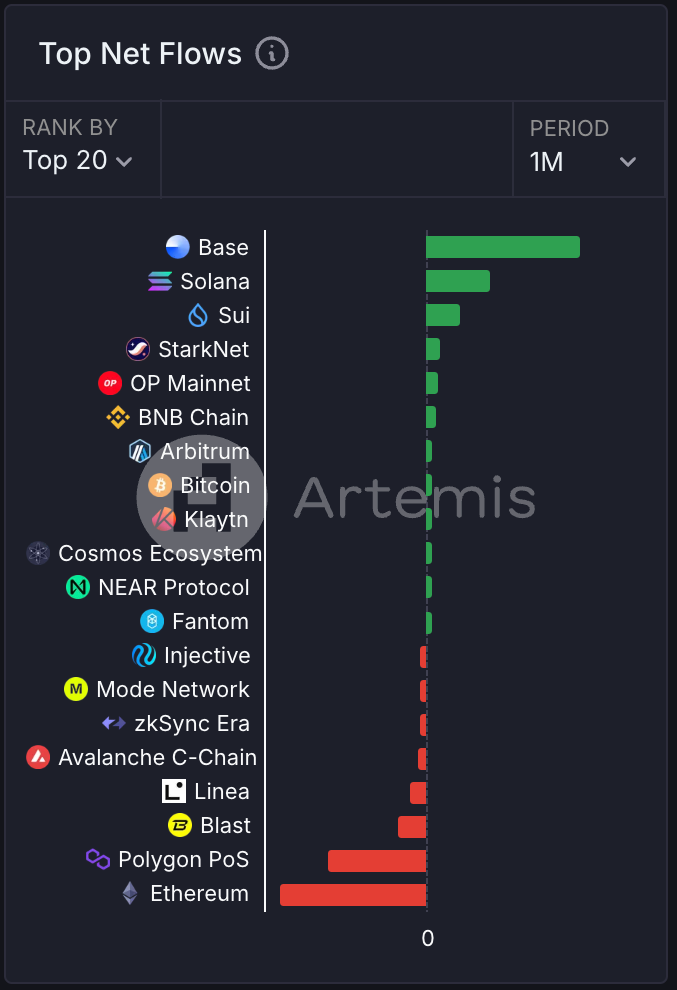

The chart shows the top 20 chains of the past month in terms of the net volume of assets received using a crypto bridge.

Coinbase’s layer-2 scaling product BASE and programmable blockchain Solana are the highest recipients. Ethereum is the worst performer.

The data supports the bull case in SOL and layer 2 tokens.

While You Were Sleeping

Traders See Even More Bitcoin Buying Pressure as BTC Sets New Record at $103K (CoinDesk): Bitcoin crossed $100,000 for the first time on Thursday, reaching $103,670 before easing to $102,500. The 50 percent monthly gain reflects higher institutional interest, record ETF inflows, growing acceptance from traditional finance and optimism about Donald Trump’s presidency, which is expected to create a more favorable environment for bitcoin in the United States.

Euro’s Outlook Gets Even Murkier After French Government Falls (Bloomberg): The euro faces pressure after Prime Minister Michel Barnier’s government was ousted in a no-confidence vote, increasing fears of political instability and fiscal uncertainty in France. Rising borrowing costs, a widening deficit, and uncertainty over the budget are compounding risks for the single currency, which has fallen 2.7% against the dollar since June.

South Korea President Replaces Defence Minister and Battles Impeachment (Financial Times): South Korean President Yoon Suk Yeol accepted Defense Minister Kim Yong-hyun’s resignation on Thursday amid backlash over the failed attempt to impose martial law. With public protests growing and 70 percent of South Koreans supporting impeachment, opposition lawmakers are pushing for a Saturday vote while Yoon’s party works to block the motion.

Binance’s BNB Hits Fresh Record, Breaks Out of 3-Year Range as Altcoin Rotation Accelerates (CoinDesk): BNB, the native token of the BNB Chain, climbed to an all-time high of $793 on Wednesday, driven by growing interest in altcoins and hopes for Trump’s pro-crypto agenda. The rally was also supported by reduced regulatory pressure on Binance, token supply cuts through burns, and rising activity on the BNB Chain.

Dovish BOJ Member Strikes Cautious Tone on Inflation, Wages (The Wall Street Journal): Bank of Japan board member Toyoaki Nakamura downplayed expectations for an imminent rate hike, citing doubts about reaching the 2 percent inflation target. His comments weakened the yen to 150.70 per dollar. Economists are divided on whether the BOJ will act at its Dec. 18-19 meeting or wait because of U.S. leadership changes.

Ethereum’s Justin Drake Sees No Threat From Solana, Says Its ‘Golden Era’ Will End (CoinDesk): In a CoinDesk interview, Ethereum developer Justin Drake said that his recent Beam Chain proposal focuses on enhancing the long-term security of Ethereum’s layer-1, not competing with Solana. He suggested that Ethereum’s layer-2 solutions, such as Arbitrum and Optimism, are designed to handle performance demands like those Solana targets.

In the Ether

Business

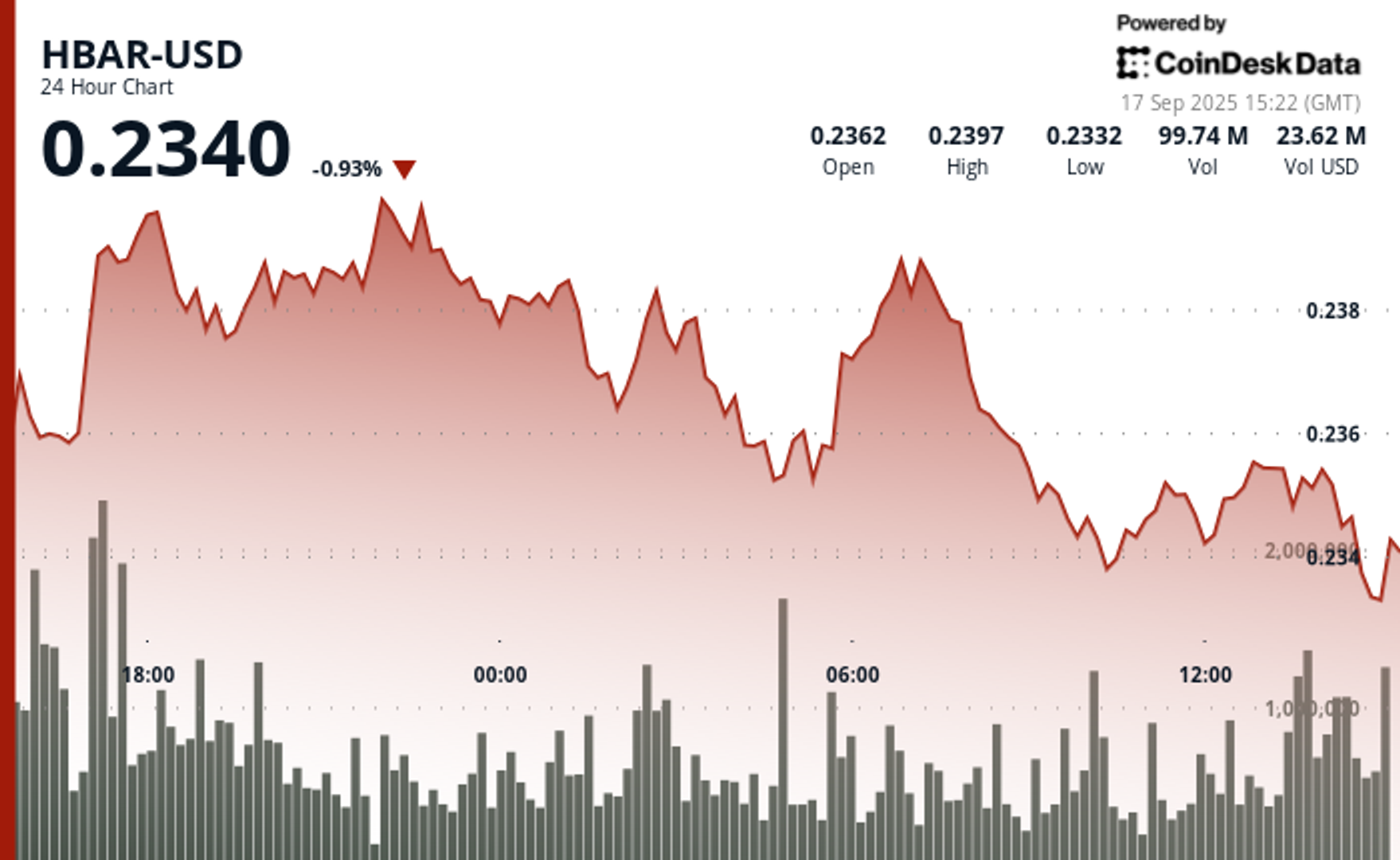

HBAR Retreats Amid Constrained Range Trading and Diminishing Volumes

HBAR spent much of the past 23 hours locked in a narrow range, oscillating between $0.23 and $0.24 in what amounted to just 2% volatility. The token briefly touched session highs at $0.24 on Sept. 16 around 18:00 UTC before sliding lower, ultimately finding repeated support near $0.23. Multiple rebound attempts from that level throughout Sept. 17’s morning trading hinted at a potential price floor, though conviction remained limited.

Market activity tapered alongside the price drift. Trading volumes fell steadily after an early spike, underscoring weakening participation and suggesting that bullish momentum has largely faded. The constrained range and muted volatility reinforced the impression of indecision, with buyers and sellers unwilling to press for a breakout.

The final hour of the observed period offered a sharper display of market sentiment. At 13:33 UTC on Sept. 17, HBAR sold off abruptly from $0.24 to $0.23, accompanied by an outsized 2.56 million in volume just three minutes later. Yet the coin staged a measured recovery, climbing back to end near session highs, encapsulating the day’s push and pull between sellers and opportunistic dip buyers.

Overall, HBAR slipped 1% across the 23-hour window. While the establishment of support around $0.23 provides some stability, declining volumes and sustained downward pressure leave the market vulnerable. The swift sell-off and subsequent rebound illustrate the uncertainty still shaping HBAR’s outlook, with bearish sentiment prevailing but tempered by signs of technical resilience.

Technical Indicators Assessment

- Price action demonstrated consolidation within a 2% range between $0.23-$0.24 resistance and support thresholds.

- Volume contracted from 45.7 million to 4.7 million tokens indicating deteriorating market participation.

- Multiple rebounds at $0.23 support level suggest potential price floor establishment.

- Acute sell-off at 13:33 followed by recovery indicates volatile intraday sentiment fluctuations.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Business

The Protocol: ETH Exit Queue Gridlocks As Validators Pile Up

Welcome to The Protocol, CoinDesk’s weekly wrap of the most important stories in cryptocurrency tech development. I’m Margaux Nijkerk, a reporter at CoinDesk.

In this issue:

- Ethereum Faces Validator Bottleneck With 2.5M ETH Awaiting Exit

- Is Ethereum’s DeFi Future on L2s? Liquidity, Innovation Say Perhaps Yes

- Ethereum Foundation Starts New AI Team to Support Agentic Payments

- American Express Introduces Blockchain-Based ‘Travel Stamps’

Network News

ETHEREUM VALIDATOR EXIT QUEUE FACES BOTTLENECK: Ethereum’s proof-of-stake system is facing its largest test yet. As of mid-September, roughly 2.5 million ETH — valued at roughly $11.25 billion — is waiting to leave the validator set, according to validator queue dashboards. The backlog pushed exit wait times to more than 46 days on Sept. 14, the longest in Ethereum’s short staking history, dashboards show. The last peak, in August, put the exit queue at 18 days. The initial spark came on Sept. 9, when Kiln, a large infrastructure provider, chose to exit all of its validators as a safety precaution. The move, triggered by recent security incidents including the NPM supply-chain attack and the SwissBorg breach, pushed around 1.6 million ETH into the queue at once. Though unrelated to Ethereum’s staking protocol itself, the hacks rattled confidence enough for Kiln to hit pause, highlighting how events in the broader crypto ecosystem can cascade into Ethereum’s validator dynamics. In a blog post from staking provider Figment, Senior Analyst Benjamin Thalman noted that the current exit queue build up isn’t only about security. After ETH has rallied more than 160% since April, some stakers are simply taking profits. Others, especially institutional players, are shifting their portfolios’ exposure. At the same time, the number of validators entering the Ethereum staking ecosystem has been steadily rising. Ethereum’s churn limit, which is a protocol safeguard that caps how many validators can enter or exit over a certain time period, is currently capped at 256 ETH per epoch (about 6.4 minutes), restricting how quickly validators can join or leave the network. The churn limit is meant to keep the network stable. With more than 2.5M ETH lined up, stakers on Sept. 16 face 44 days before even reaching the cooldown step. — Margaux Nijkerk Read more.

IS L2 DEFI EATING AT ETHEREUM’S L1 DEFI?: Ethereum is in the midst of a paradox. Even as ether hit record highs in late August, decentralized finance (DeFi) activity on Ethereum’s layer-1 (L1) looks muted compared to its peak in late 2021. Fees collected on mainnet in August were just $44 million, a 44% drop from the prior month. Meanwhile, layer-2 (L2) networks like Arbitrum and Base are booming, with $20 billion and $15 billion in total value locked (TVL) respectively. This divergence raises a crucial question: are L2s cannibalizing Ethereum’s DeFi activity, or is the ecosystem evolving into a multi-layered financial architecture? AJ Warner, the chief strategy officer of Offchain Labs, the developer firm behind layer-2 Arbitrum, argues that the metrics are more nuanced than just layer-2 DeFi chipping at the layer 1.In an interview with CoinDesk, Warner said that focusing solely on TVL misses the point, and that Ethereum is increasingly functioning as crypto’s “global settlement layer,” a foundation for high-value issuance and institutional activity. Products like Franklin Templeton’s tokenized funds or BlackRock’s BUIDL product launch directly on Ethereum L1 — activity that isn’t fully captured in DeFi metrics but underscores Ethereum’s role as the bedrock of crypto finance. Ethereum as a layer-1 blockchain is the secure but relatively slow and expensive base network. Layer-2s are scaling networks built on top of it, designed to handle transactions faster and at a fraction of the cost before ultimately settling back to Ethereum for security. That’s why they’ve become so appealing to traders and builders alike. Metrics like TVL, the amount of crypto deposited in DeFi protocols, highlight this shift as activity is moved to L2s where lower fees and quicker confirmations make everyday DeFi far more practical. — Margaux Nijkerk Read more.

EF STARTS DECENTRALIZED AI TEAM: The Ethereum Foundation (EF) is creating a dedicated artificial intelligence (AI) group to make Ethereum the settlement and coordination layer for what it calls the “machine economy,” according to research scientist Davide Crapis. Crapis, who announced the initiative on X, said the new dAI Team will pursue two priorities: enabling AI agents to pay and coordinate without intermediaries, and building a decentralized AI stack that avoids reliance on a small number of large companies. He said Ethereum’s neutrality, verifiability and censorship resistance make it a natural base layer for intelligent systems. The EF is a non-profit organization based in Zug, Switzerland, that funds and coordinates the development of the Ethereum blockchain. It does not control the network but plays a catalytic role by supporting researchers, developers and ecosystem projects. Its remit includes funding upgrades such as Ethereum 2.0, zero-knowledge proofs and layer-2 scaling, alongside community programs like the Ecosystem Support Program. The foundation also organizes events such as Devcon to foster collaboration and acts as a policy advocate for blockchain adoption. In 2025, EF restructured to handle Ethereum’s growth, emphasizing ecosystem acceleration, founder support and enterprise outreach. The new dAI Team represents a continuation of this shift toward specialized units addressing emerging technologies. — Siamak Masnavi Read more.

AMERICAN EXPRESS DABBLES IN BLOCKCHAIN TRAVEL STAMPS: American Express has introduced Ethereum-based «travel stamps» to create a commemorative record of travel experiences. The travel experience tokens, which are technically NFTs (ERC 721 tokens), are minted and stored on Coinbase’s Base network, said Colin Marlowe, vice president of Emerging Partnerships at Amex Digital Labs. The travel stamps, which can be collected anytime a traveler uses their card, are not tradable NTF tokens, Marlowe said, and neither do they function like blockchain-based loyalty points — at least for the time being. “It’s a valueless ERC-721, so technically an NFT, but we just didn’t brand it as such. We wanted to speak to it in a way that was natural for the travel experience itself, and so we talk about these things as stamps, and they’re represented as tokens,” Marlowe said in an interview. “As an identifier and representation of history the stamps could create interesting partnership angles over time. We weren’t trying to sell these or sort of generate any like short term revenue. The angle is to make a travel experience with Amex feel really rich, really different, and kind of set it apart,” he said. Fireblocks is also involved, supporting Amex as its Wallet-as-a-Service provider for the passport product, a Fireblocks representative said. The Amex travel app also includes a range of tools for travels and Centurion Lounge upgrades, the company said. – Ian Allison Read more.

In Other News

- Blockchain-based real world asset (RWA) specialists Centrifuge and Plume have launched the Anemoy Tokenized Apollo Diversified Credit Fund (ACRDX), backed by a $50 million anchor investment from Grove, a credit infrastructure protocol within the Sky Ecosystem. The fund gives blockchain investors exposure to Apollo’s diversified global credit strategy, spanning direct corporate lending, asset-backed lending and dislocated credit, a type of mispriced debt due to market stress and lack of liquidity. ACRDX will be distributed through Plume’s Nest Credit vaults under the ticker nACRDX, making the strategy accessible to institutional investors on-chain. By packaging Apollo’s portfolio in tokenized form, the fund aims to lower entry barriers and increase transparency for investors seeking exposure to private credit markets, according to a press release. — Ian Allison Read more.

- Google is taking a step toward merging artificial intelligence (AI) and digital money, rolling out a new open-source protocol that lets AI applications send and receive payments, which includes support for stablecoins, digital tokens pegged to fiat currencies such as the U.S. dollar, according to a press release. To incorporate stablecoin rails, Google teamed up with the U.S.-based crypto exchange Coinbase, which has been developing its own AI-integrated payments infrastructure. The company also worked with the Ethereum Foundation and coordinated with more than 60 other organizations, including Salesforce, American Express and Etsy, to cover traditional finance use cases. The move builds on Google’s earlier work to establish a standard for “AI agents.” These digital agents may eventually handle complex tasks, such as negotiating mortgages or shopping for clothes, without direct human input. — Oliver Knight Read more.

Regulatory and Policy

- Contrary to claims from the U.S. banking industry, stablecoins do not pose a risk to the financial system, according to the chief policy officer at crypto exchange Coinbase (COIN), Faryar Shirzad. Banks’ claims that they do are are myths crafted to defend their revenues, he wrote in a blog post. «The central claim — that stablecoins will cause a mass outflow of bank deposits — simply doesn’t hold up,» Shirzad wrote. «Recent analysis shows no meaningful link between stablecoin adoption and deposit flight for community banks and there’s no reason to believe big banks would fare any worse.» Larger lenders still hold trillions of dollars at the Federal Reserve and if deposits were really at risk, he argued, they would be competing harder for customer funds by offering higher interest rates rather than parking cash at the central bank. According to Shirzad, the real reason for banks’ opposition is the payments business. Stablecoins, digital tokens whose value is pegged to a real-life asset such as the dollar, offer faster and cheaper ways to move money, threatening an estimated $187 billion in annual swipe-fee revenue for traditional card networks and banks. He compared the current pushback to earlier battles against ATMs and online banking, when incumbents warned of systemic dangers but, he said, were ultimately trying to protect entrenched profits. — Jesse Hamilton Read more.

- U.S. SEC Chair Paul Atkins said crypto’s time has come, pledging to modernize the U.S. securities rulebook and expand “Project Crypto” to bring markets on-chain. Speaking in Paris on Sept. 10 at the OECD’s inaugural Roundtable on Global Financial Markets, Atkins said the SEC is shifting away from enforcement-driven policymaking and will provide clear rules for tokens, custody, and trading platforms. “Policy will no longer be set by ad hoc enforcement actions,” he said, calling the new approach “a golden age of financial innovation on U.S. soil.” Atkins said most tokens are not securities and promised bright-line rules for determining when crypto assets fall under SEC oversight. He said entrepreneurs must be able to raise capital on-chain without “endless legal uncertainty” and pledged a framework for platforms that integrate trading, lending, and staking under one license. Custody rules will also be updated to allow investors and intermediaries multiple options. — Siamak Masnavi Read more.

Calendar

- Sept. 22-28: Korea Blockchain Week, Seoul

- Oct. 1-2: Token2049, Singapore

- Oct. 13-15: Digital Asset Summit, London

- Oct. 16-17: European Blockchain Convention, Barcelona

- Nov. 17-22: Devconnect, Buenos Aires

- Dec. 11-13: Solana Breakpoint, Abu Dhabi

- Feb. 10-12, 2026: Consensus, Hong Kong

- Mar. 30-Apr. 2: EthCC, Cannes

- May 5-7, 2026: Consensus, Miami

Business

Bullish Shares Rise 5% Ahead of Earnings After Crypto Exchange Secures New York BitLicense

Shares of Bullish (BLSH) rose 5% to $53.12 on Tuesday after the crypto platform secured a BitLicense from the New York State Department of Financial Services, a crucial regulatory approval that opens the door to offering spot trading and custody services to institutional clients in New York.

With the license, Bullish’s U.S. arm — Bullish US Operations LLC — can now legally serve advanced traders in the financial capital of the U.S., an important step in the company’s push to expand domestically. Until now, Bullish was only regulated in Germany, Hong Kong and Gibraltar. Bullish’s global parent is also CoinDesk’s parent company.

The license comes just a day after Cathie Wood’s ARK Invest significantly increased its exposure to the company. The ARK Innovation ETF (ARKK) acquired 120,609 shares while ARK Next Generation Internet ETF (ARKW) picked up 40,574 shares, together worth about $8.21 million.

Bullish, which runs a trading platform aimed at institutional investors, will report second-quarter earnings after markets close on Wednesday.

Earlier this week, investment bank Keefe, Bruyette & Woods (KBW) initiated coverage on the company with a «market perform» rating and a $55 price target. The firm called Bullish “a rare public play” on a crypto exchange built for institutions and noted that its entry into the U.S. could drive growth. KBW sees domestic expansion as a key catalyst.

Bullish debuted on the New York Stock Exchange in August through a direct listing. Its stock surged to $104 on opening day before closing at $68. Since then, shares have fallen 22%, with today’s BitLicense announcement providing a boost.

If Bullish succeeds in expanding its footprint in the U.S., it could emerge as a legitimate competitor to Coinbase, according to brokerage firm Bernstein. The firm said success will depend on the platform’s ability to execute on its U.S. launch plans, currently targeted for 2026, Bernstein said.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars