Uncategorized

Crypto Daybook Americas: Bitcoin Traders Deleverage on Steady Fed Rate Outlook

By Francisco Rodrigues (All times ET unless indicated otherwise)

Crypto traders are deleveraging after Wednesday’s FOMC minutes showed the Fed is looking to hold rates steady until inflation improves and discussed pausing or slowing the balance sheet runoff.

Still, the yield on the 10-year Treasury dropped and the dollar weakened. Cryptocurrencies are higher, with the CoinDesk 20 Index up 1.4% and bitcoin 1.2% over 24 hours. The gains follow remarks by Czech National Bank Governor Ales Michl, who reiterated the case for bitcoin as a reserve asset, and President Donald Trump saying he’d ended “Joe Biden’s war on Bitcoin and crypto.”

Bitcoin traders are taking a wait-and-see approach as waning demand, a lack of blockchain activity and faltering liquidity inflows point to potential pullback to $86,000. It’s currently over $97,000. Their stance is visible not only in declining volatility, but also a significant drop in open interest.

Open interest on bitcoin futures contracts has fallen below $60 billion from nearly $70 billion in late January, Coinglass data shows. The decline comes amid what appears to be an unraveling of the memecoin craze as recent struggles, such as Argentina’s Libra debacle, dampened enthusiasm.

“Right now, the market is in a bit of a cooldown phase,” David Gogel, VP of strategy and operations at the dYdX Foundation, told CoinDesk. “Bitcoin’s been holding up, but after failing to break past $105k in January, we’ve seen capital inflows slow down and speculative assets like Solana and memecoins take a hit.”

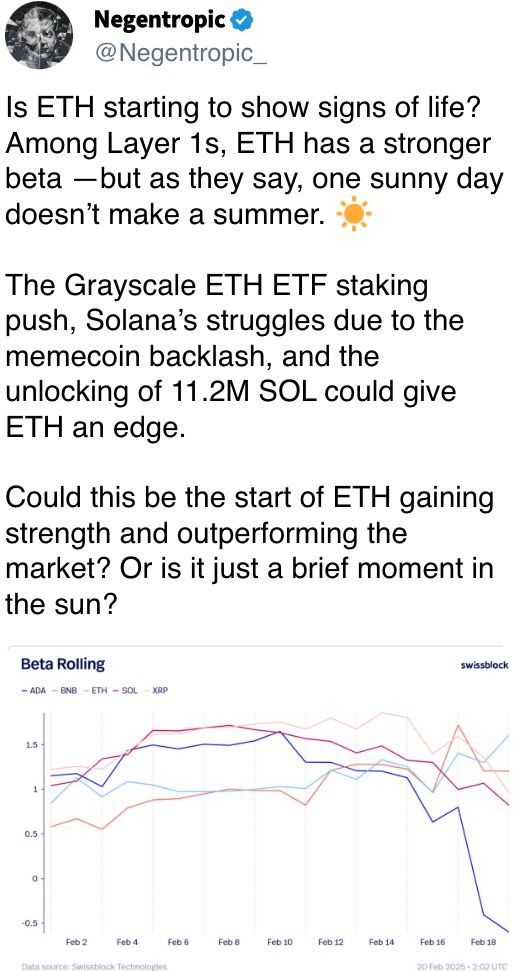

That hit is visible in the aggregate open interest for futures contracts for SOL, the Solana blockchain’s native token. OI dropped from around $6 billion late last month to around $4.3 billion now, according to data from TheTie. Solana is one of the leading networks for memecoins.

“The market should stay attuned to broader macro-drivers and geopolitical developments that could trigger moves,” Wintermute OTC trader Jake O told CoinDesk. These geopolitical developments include rising tensions between Trump and Ukrainian President Volodymyr Zelensky that led to a not-so-subtle public exchange.

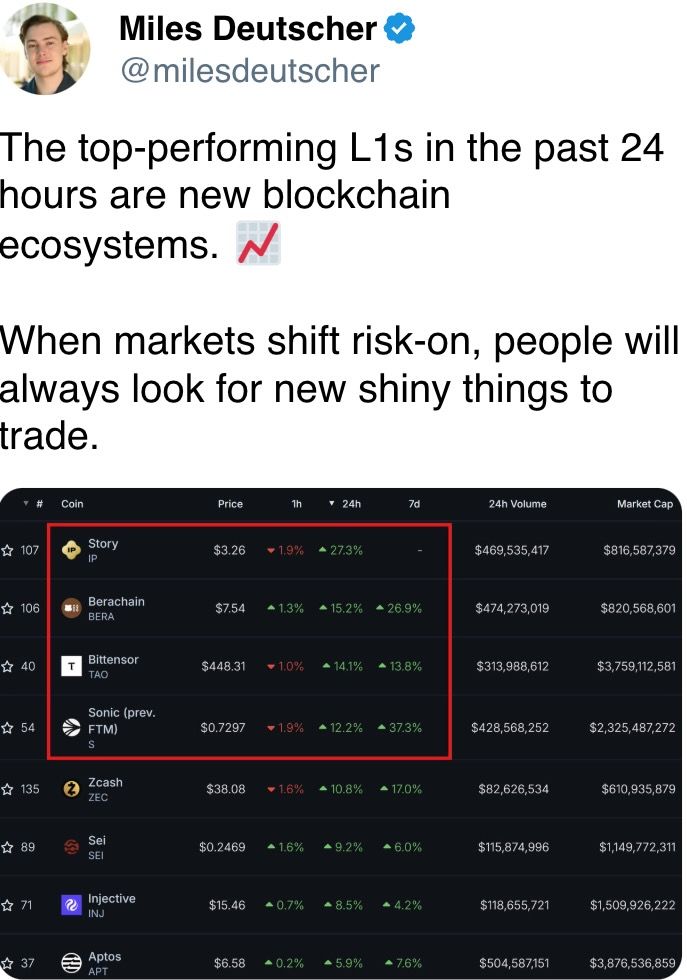

Declining leverage and a shift away from riskier plays suggest the market may be entering a new phase. What that actually entails remains to be seen. Stay alert!

What to Watch

Crypto:

Feb. 21: TON (The Open Network) becomes the exclusive blockchain infrastructure for messaging platform Telegram’s Mini App ecosystem.

Feb. 24: At epoch 115968, testing of Ethereum’s Pecta upgrade on the Holesky testnet starts.

Feb. 25, 9:00 a.m.: Ethereum Foundation research team Reddit AMA.

Feb. 27: Solana-based L2 Sonic SVM (SONIC) mainnet launch (“Mobius”).

Macro

Feb. 20, 8:30 a.m.: Statistics Canada reports January’s producer price inflation data.

PPI MoM Est. 0.8% vs. Prev. 0.2%

PPI YoY Prev. 4.1%

Feb. 20, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims report for the week ended Feb. 15.

Initial Jobless Claims Est. 215K vs. Prev. 213K

Feb. 20, 5:00 p.m.: Fed Governor Adriana D. Kugler gives a speech titled «Navigating Inflation Waves While Riding on the Phillips Curve» in Washington. Livestream link.

Feb. 20, 6:30 p.m.: Japan’s Ministry of Internal Affairs & Communications reports January’s consumer price inflation data.

Core Inflation Rate YoY Est. 3.1% vs. Prev. 3%

Inflation Rate YoY Prev. 3.6%

Inflation Rate MoM Prev. 0.6%

Feb. 21, 9:45 a.m.: S&P Global releases February’s U.S. Purchasing Managers’ Index (Flash) reports.

Composite PMI Prev. 52.7

Manufacturing PMI Est. 51.5 vs. Prev. 51.2

Services PMI Est. 53 vs Prev. 52.9

Earnings

Feb. 20: Block (XYZ), post-market, $0.88

Feb. 24: Riot Platforms (RIOT), post-market, $-0.18

Feb. 25: Bitdeer Technologies Group (BTDR), pre-market, $-0.17

Feb. 25: Cipher Mining (CIFR), pre-market, $-0.09

Feb. 26: MARA Holdings (MARA), post-market, $-0.13

Token Events

Governance votes & calls

Sky DAO is discussing withdrawing a portion of the Smart Burn Engine’s LP tokens to stop malicious actors from acquiring the tokens.

DYdX DAO is discussing increasing the limit on the maximum notional value of liquidations that can occur within a given block on the dYdX protocol to enhance the protocol’s speed and efficiency of risk reduction during liquidations.

Unlocks

Feb. 21: Fast Token (FTN) to unlock 4.66% of circulating supply worth $78.6 million.

Feb. 28: Optimism (OP) to unlock 1.92% of circulating supply worth $34.23 million.

Mar. 1: Sui (SUI) to unlock 0.74% of circulating supply worth $81.07 million.

Token Launches

Feb. 20: Pi Network (PI) to be listed on MEXC, OKX, Bitget, Gate.io, CoinW, DigiFinex and others.

Conferences:

CoinDesk’s Consensus to take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 3 of 3: Consensus Hong Kong

Feb. 23-March 2: ETHDenver 2025 (Denver)

Feb. 24: RWA London Summit 2025

Feb. 25: HederaCon 2025 (Denver)

March 2-3: Crypto Expo Europe (Bucharest, Romania)

March 8: Bitcoin Alive (Sydney, Australia)

Token Talk

By Oliver Knight

PI, the native token of the Pi Network, debuted at $1.70 and immediately rose to $2.00 before losing 50% of its value in the next two hours.

The network claims to have 60 million users. There are fewer than 1 million active wallets.

Based on a self-reported circulating supply figure of 6.3 billion, PI currently has a market cap of $7.8 billion.

The premise behind Pi Network is a blockchain that allows users to mine tokens on their smartphones. It captured a considerable amount of attention from retail traders and has drawn comparison to viral tokens from previous cycles like SafeMoon.

Token holders face the risk of a lack of liquidity. The token’s most liquid exchange is OKX, but 2% market depth — the amount of capital required to move the price by 2% in either direction — is between $33K and $60K. This means an order of say $100K would shift the market considerably to present volatile trading conditions.

Derivatives Positioning

BTC volatility on derivatives has reached a monthly low, declining from an annualized 36.09% to 28.43%.

That contrasts with ETH, which has seen its annualized volatility rise from 49.43% to 74.72%, according to data published by Deribit.

Roughly $1.5 billion worth of BTC and ETH options are set to expire tomorrow, with almost $5 billion expiring in a week’s time.

The total open interest across all trading pairs on retail centralized exchanges has risen by 2.10% on the day to $80.8 billion.

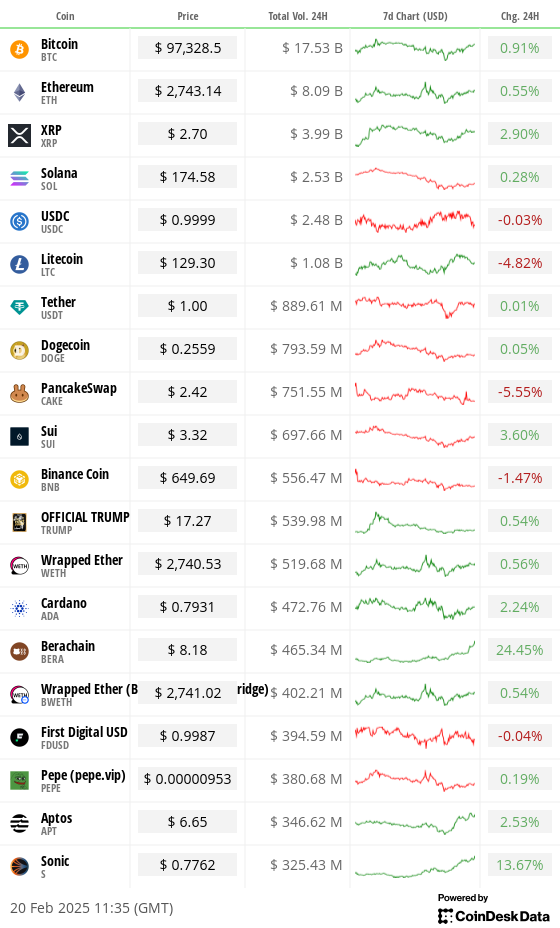

Market Movements:

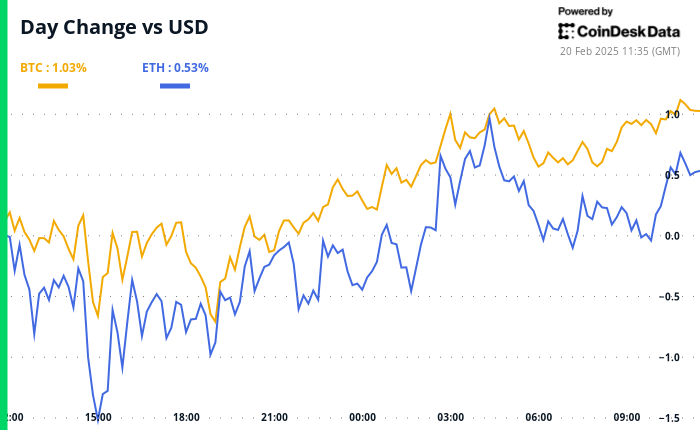

BTC is up 1.10% from 4 p.m. ET Wednesday to $97,300.67 (24hrs: +1.09%)

ETH is up 0.60% at $2,738.90 (24hrs: +0.51%)

CoinDesk 20 is up 1.72% to 3,250.68 (24hrs: +1.67%)

Ether CESR Composite Staking Rate is down 6 bps to 2.99%

BTC funding rate is at 0.0037% (4.0920% annualized) on Binance

DXY is down 0.18% at 106.98

Gold is up 0.60% at $2,950,84/oz

Silver is up 1.52% to $33.19/oz

Nikkei 225 closed -1.24% at 38,678.04

Hang Seng closed -1.60% at 22,576.98

FTSE is down 0.24% at 8,690.90

Euro Stoxx 50 is up 0.62% at 5,494.99

DJIA closed Wednesday up 0.16% at 44,627.59

S&P 500 closed +0.24% at 6,144.15

Nasdaq closed +0.07% at 20,056.25

S&P/TSX Composite Index closed unchanged at 25,626.16

S&P 40 Latin America closed -1.35% at 2,463.68

U.S. 10-year Treasury rate was down 1 bps at 4.53%

E-mini S&P 500 futures are down 0.2% to 6,150.50

E-mini Nasdaq-100 futures are down 0.22% at 22,200.75

E-mini Dow Jones Industrial Average Index futures are down 0.15% to 44,643

Bitcoin Stats:

BTC Dominance: 61.10 (0.04%)

Ethereum to bitcoin ratio: 0.02819 (0.28%)

Hashrate (seven-day moving average): 831 EH/s

Hashprice (spot): $54.24

Total Fees: 5.127 BTC / $499,118

CME Futures Open Interest: 172,360 BTC

BTC priced in gold: 32.8 oz

BTC vs gold market cap: 9.32%

Technical Analysis

Bitcoin has rebounded from the yearly open at $93,385, reclaiming the 100-day exponential moving average on the daily timeframe.

Over the last three deep sell-offs, the price has formed higher lows, indicating strong buyer interest at the current range lows.

However, the short-term 20-day and 50-day EMAs on the daily timeframe recently crossed for the first time since August 5th, signalling a need for caution in the near term.

Crypto Equities

MicroStrategy (MSTR): closed on Wednesday at $318.67 (-4.58%), up 2.01% at $325.08 in pre-market

Coinbase Global (COIN): closed at $258.67 (-2.25%), up 1.76% at $263.22

Galaxy Digital Holdings (GLXY): closed at C$25.32 (-3.76%)

MARA Holdings (MARA): closed at $15.78 (-1.68%), up 1.33% at $15.99.

Riot Platforms (RIOT): closed at $11.56 (unchanged), up 1.04% at $11.68

Core Scientific (CORZ): closed at $12.02 (-2.99%), up 1.41% at $12.19

CleanSpark (CLSK): closed at $9.89 (-1.88%), up 1.81% at $10.07

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.78 (-0.26%), unchanged

Semler Scientific (SMLR): closed at $52.22 (+2.96%), up 0.06% at $52.25

Exodus Movement (EXOD): closed at $48.41 (+4.00%), unchanged

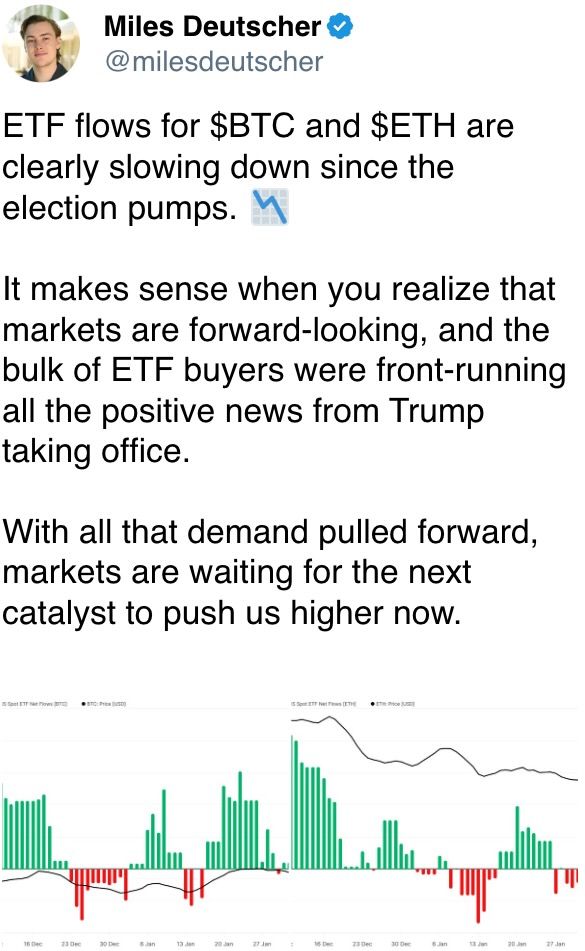

ETF Flows

Spot BTC ETFs:

Daily net flow: -$64.1 million

Cumulative net flows: $40.00 billion

Total BTC holdings ~ 1.170 million.

Spot ETH ETFs

Daily net flow: $19 million

Cumulative net flows: $3.18 billion

Total ETH holdings ~ 3.795 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

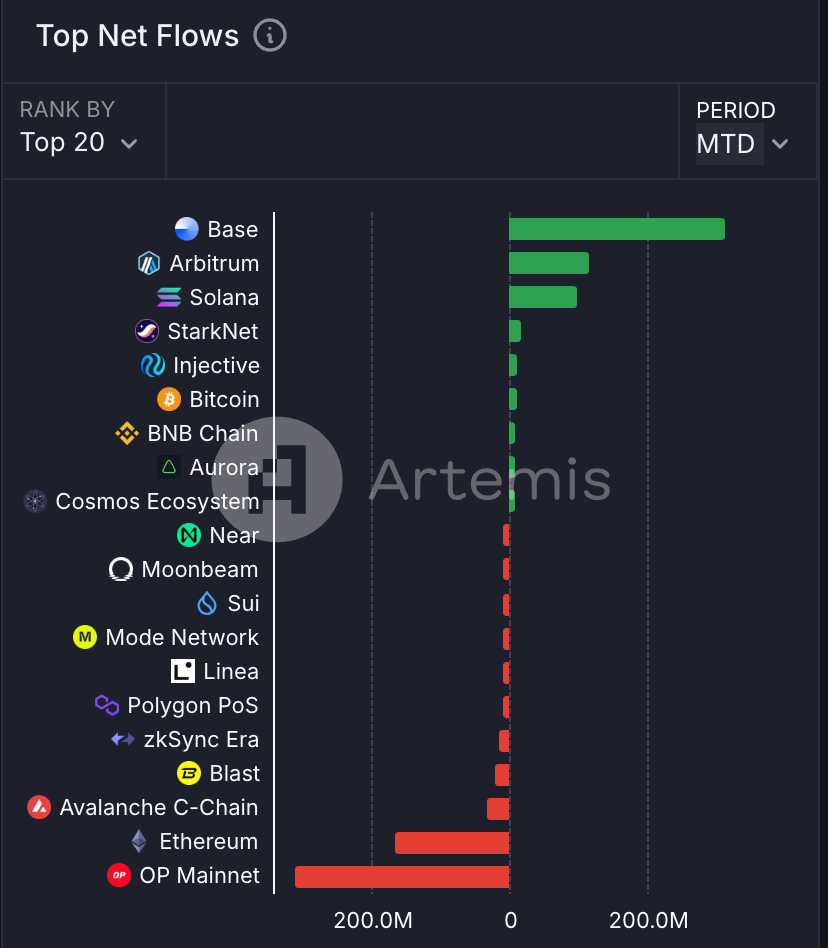

Month-to-date data for top bridged netflows by network highlights a strong capital inflow into the Base network since the start of the month.

The layer-2 blockchain had a net inflow of $314 million, more than twice the amount of the second-placed Arbitrum, which has seen an inflow of $115 million.

Inflows to Solana slowed amid liquidity drains caused by multiple high-profile celebrity memecoin launches over the past month.

While You Were Sleeping

LIBRA Memecoin Fiasco Destroyed $251M in Investor Wealth, Research Shows (CoinDesk): Nansen’s on-chain analysts say 86% of people who traded the LIBRA token lost money, with the total loss of $251 million. The winners enjoyed a total profit of $180 million.

HK to Expand, Open Up Virtual Assets Market (The Standard): At Consensus Hong Kong, SFC CEO Julia Leung announced ASPIRe — a 12-point roadmap to correct market imbalances with improved licensing, custody, token frameworks, derivatives trading and margin lending for professional investors.

MANTRA Launches Program for Real-World Asset Startups With Google Cloud Support (CoinDesk): Layer-1 blockchain MANTRA’s RWAccelerator backs startups working on tokenizing real-world assets by providing mentorship, with technical support and cloud credits coming from Google.

China Is Likely to Cut Its Benchmark Policy Rate Next Month (CNBC): China’s central bank held its key lending rates steady on Thursday, prompting expectations of a policy easing in March.

Bank of England’s Gold-Diggers Grapple With Trump-Fueled Frenzy (Bloomberg): Speculation over impending U.S. tariffs has forced a small BoE team to extract 12.5 kg gold bars as traders exploit gaps between London spot and U.S. futures prices.

‘Stagflation’ Fears Haunt U.S. Markets Despite Trump’s Pro-Growth Agenda (Reuters): While investors have largely remained bullish on U.S. stocks, some worry that the president’s new tariff measures might drive up prices and stifle economic growth.

In the Ether

Business

Strategy Bought $27M in Bitcoin at $123K Before Crypto Crash

Strategy (MSTR), the world’s largest corporate owner of bitcoin (BTC), appeared to miss out on capitalizing on last week’s market rout to purchase the dip in prices.

According to Monday’s press release, the firm bought 220 BTC at an average price of $123,561. The company used the proceeds of selling its various preferred stocks (STRF, STRK, STRD), raising $27.3 million.

That purchase price was well above the prices the largest crypto changed hands in the second half of the week. Bitcoin nosedived from above $123,000 on Thursday to as low as $103,000 on late Friday during one, if not the worst crypto flash crash on record, liquidating over $19 billion in leveraged positions.

That move occurred as Trump said to impose a 100% increase in tariffs against Chinese goods as a retaliation for tightening rare earth metal exports, reigniting fears of a trade war between the two world powers.

At its lowest point on Friday, BTC traded nearly 16% lower than the average of Strategy’s recent purchase price. Even during the swift rebound over the weekend, the firm could have bought tokens between $110,000 and $115,000, at a 7%-10% discount compared to what it paid for.

With the latest purchase, the firm brought its total holdings to 640,250 BTC, at an average acquisition price of $73,000 since starting its bitcoin treasury plan in 2020.

MSTR, the firm’s common stock, was up 2.5% on Monday.

Business

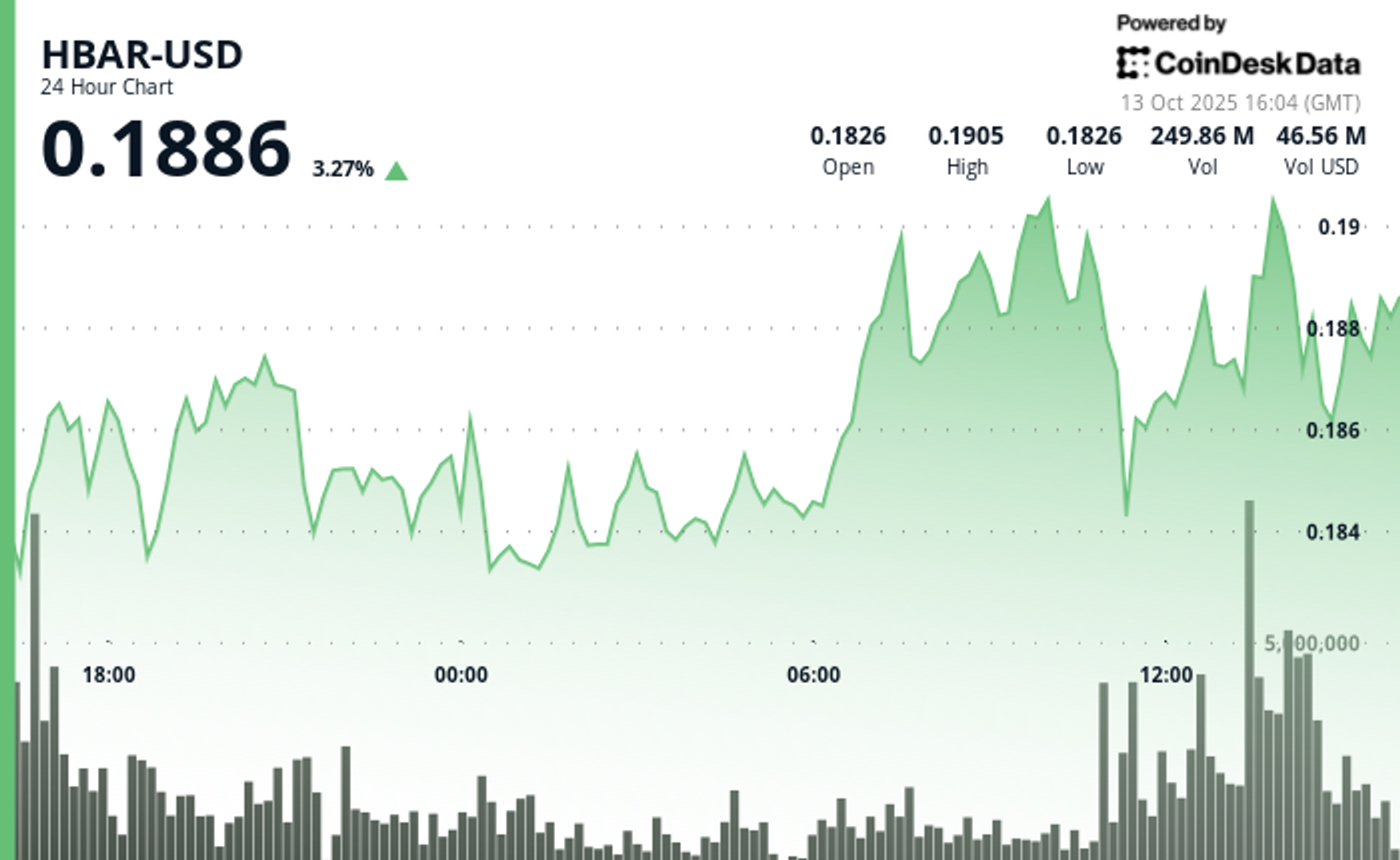

HBAR Rises Past Key Resistance After Explosive Decline

HBAR (Hedera Hashgraph) experienced pronounced volatility in the final hour of trading on Oct. 13, soaring from $0.187 to a peak of $0.191—a 2.14% intraday gain—before consolidating around $0.190.

The move was driven by a dramatic surge in trading activity, with a standout 15.65 million tokens exchanged at 13:31, signaling strong institutional participation. This decisive volume breakout propelled the asset beyond its prior resistance range of $0.190–$0.191, establishing a new technical footing amid bullish momentum.

The surge capped a broader 23-hour rally from Oct. 12 to 13, during which HBAR advanced roughly 9% within a $0.17–$0.19 bandwidth. This sustained upward trajectory was characterized by consistent volume inflows and a firm recovery from earlier lows near $0.17, underscoring robust market conviction. The asset’s ability to preserve support above $0.18 throughout the period reinforced confidence among traders eyeing continued bullish action.

Strong institutional engagement was evident as consecutive high-volume intervals extended through the breakout window, suggesting renewed accumulation and positioning for potential continuation. HBAR’s price structure now shows resilient support around $0.189–$0.190, signaling the possibility of further upside if momentum persists and broader market conditions remain favorable.

Technical Indicators Highlight Bullish Sentiment

- HBAR operated within a $0.017 bandwidth (9%) spanning $0.174 and $0.191 throughout the previous 23-hour period from 12 October 15:00 to 13 October 14:00.

- Substantial volume surges reaching 179.54 million and 182.77 million during 11:00 and 13:00 sessions on 13 October validated positive market sentiment.

- Critical resistance materialized at $0.190-$0.191 thresholds where price movements encountered persistent selling activity.

- The $0.183-$0.184 territory established dependable support through volume-supported bounces.

- Extraordinary volume explosion at 13:31 registering 15.65 million units signaled decisive breakout event.

- High-volume intervals surpassing 10 million units through 13:35 substantiated significant institutional engagement.

- Asset preserved support above $0.189 despite moderate profit-taking activity.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Business

Crypto Markets Today: Bitcoin and Altcoins Recover After $500B Crash

The crypto market staged a recovery on Monday following the weekend’s $500 billion bloodbath that resulted in a $10 billion drop in open interest.

Bitcoin (BTC) rose by 1.4% while ether (ETH) outperformed with a 2.5% gain. Synthetix (SNX, meanwhile, stole the show with a 120% rally as traders anticipate «perpetual wars» between the decentralized trading venue and HyperLiquid.

Plasma (XPL) and aster (ASTER) both failed to benefit from Monday’s recovery, losing 4.2% and 2.5% respectively.

Derivatives Positioning

- The BTC futures market has stabilized after a volatile period. Open interest, which had dropped from $33 billion to $23 billion over the weekend, has now settled at around $26 billion. Similarly, the 3-month annualized basis has rebounded to the 6-7% range, after dipping to 4-5% over the weekend, indicating that the bullish sentiment has largely returned. However, funding rates remain a key area of divergence; while Bybit and Hyperliquid have settled around 10%, Binance’s rate is negative.

- The BTC options market is showing a renewed bullish lean. The 24-hour Put/Call Volume has shifted to be more in favor of calls, now at over 56%. Additionally, the 1-week 25 Delta Skew has risen to 2.5% after a period of flatness.

- These metrics indicate a market with increasing demand for bullish exposure and upside protection, reflecting a shift away from the recent «cautious neutrality.»

- Coinglass data shows $620 million in 24 hour liquidations, with a 34-66 split between longs and shorts. ETH ($218 million), BTC ($124 million) and SOL ($43 million) were the leaders in terms of notional liquidations. Binance liquidation heatmap indicates $116,620 as a core liquidation level to monitor, in case of a price rise.

Token Talk

By Oliver Knight

- The crypto market kicked off Monday with a rebound in the wake of a sharp weekend leverage flush. According to data from CoinMarketCap, the total crypto market cap climbed roughly 5.7% in the past 24 hours, with volume jumping about 26.8%, suggesting those liquidated at the weekend are repurchasing their positions.

- A total of $19 billion worth of derivatives positions were wiped out over the weekend with the vast majority being attributed to those holding long positions, in the past 24 hours, however, $626 billion was liquidated with $420 billion of that being on the short side, demonstrating a reversal in sentiment, according to CoinGlass.

- The recovery has been tentative so far; the dominance of Bitcoin remains elevated at about 58.45%, down modestly from recent highs, which implies altcoins may still lag as capital piles back into safer large-cap names.

- The big winner of Monday’s recovery was synthetix (SNX), which rose by more than 120% ahead of a crypto trading competition that will see it potentially start up «perpetual wars» with HyperLiquid.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton