Uncategorized

Crypto Daybook Americas: Bitcoin Retreats From $108K, But Bulls Aren’t Done

By Omkar Godbole (All times ET unless indicated otherwise)

Slowly, then suddenly. That sums up the adoption of bitcoin (BTC) and the wider cryptocurrency market by institutions.

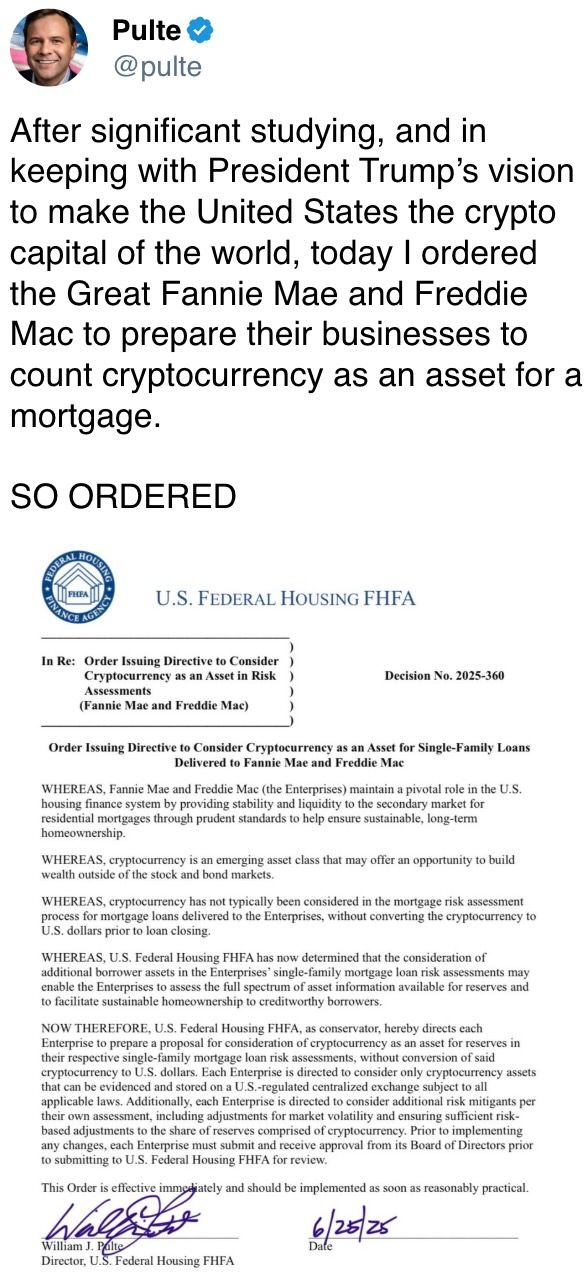

It started with Strategy, then called MicroStrategy, adopting BTC as a balance sheet asset in 2020. Now the head of the U.S. government agency overseeing Fannie Mae and Freddie Mac wants the mortgage giants to consider homebuyers’ cryptocurrency holdings in their criteria for buying mortgages from banks.

«After significant studying, and in keeping with President Trump’s vision to make the United States the crypto capital of the world, today I ordered the Great Fannie Mae and Freddie Mac to prepare their businesses to count cryptocurrency as an asset for a mortgage. SO ORDERED,» Bill Pulte, director of the Federal Housing Finance Agency, said on X.

Getting entrenched in the housing market of the world’s largest economy can only add to the ongoing bull momentum in BTC and other cryptocurrencies. And, in a move that could markedly improve big banks’ ability to create credit, the Federal Reserve advanced a long-awaited plan to overhaul bank capital requirements. That’s a positive development for risk assets.

It’s no surprise that BTC, which is most sensitive to fiat liquidity conditions, has extended gains in the past 24 hours, topping $108,000 at one point. The broader market capitalization is fast approaching a volatility threshold, according to FxPro’s analyst Alex Kuptsikevich.

«The crypto market cap increased by another 1% to $3.31 trillion, reaching the threshold of increased volatility. Just above that, in the $3.40–3.55 trillion range, is a turning point, which has activated sellers and prevented the market from consolidating higher,» Kuptsikevich said in an email, noting a rise in the Fear and Greed Index to 74, just one point below the extreme greed zone.

In other news, spot BTC ETFs recorded a net inflow of $548 million, marking 12 consecutive days of positive flows.

Metaplanet purchased another 1,234 BTC, a day after announcing a $515 million raise to fund the treasury strategy. Meanwhile, Nasdaq-listed Bit Digital announced a strategic shift to become a pure-play ether (ETH) staking and treasury company.

The Hong Kong Government issued a policy statement on the development of digital assets, focusing on streamlining regulatory aspects, expanding the suite of tokenized products, advancing use cases and cross-sectoral collaboration.

In traditional markets, futures tied to the Nasdaq index rose to record highs, pointing to continued risk-on sentiment while the dollar index continued to lose ground. Stay alert!

What to Watch

- Crypt

- June 30: CME Group will introduce spot-quoted futures, pending regulatory approval, allowing trading in bitcoin, ether and major U.S. equity indices with contracts holdable for up to five years.

- Macro

- June 26, 8:30 a.m.: The U.S. Census Bureau releases May manufactured durable goods orders data.

- Durable Goods Orders MoM Est. 8.5% vs. Prev. -6.3%

- Durable Goods Orders Ex Defense MoM Prev. -7.5%

- Durable Goods Orders Ex Transportation MoM Est. 0% vs. Prev. 0.2%

- June 26, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases (final) Q1 GDP data.

- GDP Growth Rate QoQ Final Est. -0.2% vs. Prev. 2.4%

- GDP Price Index QoQ Final Est. 3.7% vs. Prev. 2.3%

- GDP Sales QoQ Final Est. -2.9% vs. Prev. 3.3%

- June 26, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended June 21.

- Initial Jobless Claims Est. 245K vs. Prev. 245K

- Continuing Jobless Claims Est. 1950K vs. Prev. 1945K

- June 26, 3 p.m.: The Bank of Mexico announces its interest rate decision.

- Overnight Interbank Target Rate Est. 8% Prev. 8.5%

- June 27, 9:15 a.m.: Fed Governor Lisa D. Cook will deliver a speech at a Fed Listens event hosted by the Federal Reserve Bank of Cleveland. Livestream link.

- June 27, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases May unemployment rate data.

- Unemployment Rate Est. 6.4% vs. Prev. 6.6%

- June 27, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases May unemployment rate data.

- Unemployment Rate Est. 2.5% vs. Prev. 2.5%

- June 27, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases May consumer income and expenditure data.

- Core PCE Price Index MoM Est. 0.1% vs. Prev. 0.1%

- Core PCE Price Index YoY Est. 2.6% vs. Prev. 2.5%

- PCE Price Index MoM Est. 0.1% vs. Prev. 0.1%

- PCE Price Index YoY Est. 2.3% vs. Prev. 2.1%

- Personal Income MoM Est. 0.3% vs. Prev. 0.8%

- Personal Spending MoM Est. 0.1% vs. Prev. 0.2%

- June 27, 10 a.m.: The University of Michigan releases (final) June U.S. consumer sentiment data.

- Michigan Consumer Sentiment Est. 60.5 vs. Prev. 52.2

- June 26, 8:30 a.m.: The U.S. Census Bureau releases May manufactured durable goods orders data.

- Earnings (Estimates based on FactSet data)

- None in the near future.

Token Events

- Governance votes & calls

- Lido DAO is voting on updating its Block Proposer Rewards Policy to SNOP v3. The proposal sets new standards for node operators, including use of vetted APMs and clearer responsibilities to enhance decentralization, fair rewards, and operational security. Voting ends June 30.

- Arbitrum DAO is voting on lowering the constitutional quorum threshold from 5% to 4.5% of votable tokens. This aims to match decreased voter participation and help well-supported proposals pass more easily, without affecting non-constitutional proposals, which remain at a 3% quorum. Voting ends July 4.

- The Polkadot community is voting on launching a non-custodial Polkadot branded payment card to “to bridge the gap between digital assets in the Polkadot ecosystem and everyday spending.” Voting ends July 9.

- Unlocks

- June 30: Optimism OP to unlock 1.79% of its circulating supply worth $16.82 million.

- July 1: Sui SUI to unlock 1.3% of its circulating supply worth $117.91 million.

- July 2: Ethena ENA to unlock 0.67% of its circulating supply worth $10.52 million.

- July 11: Immutable IMX to unlock 1.31% of its circulating supply worth $10.11 million.

- July 12: Aptos APT to unlock 1.76% of its circulating supply worth $54.17 million.

- July 15: Starknet STRK to unlock 3.79% of its circulating supply worth $14.07 million.

- Token Launches

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render RNDR, Ribbon Finance RBN and Synapse SYN.

- June 26: Sahara AI (SAHARA) to be listed on OKX, Bitget, MEXC, CoinW, and others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through July 17.

- Day 3 of 3: Blockworks’ Permissionless IV (New York)

- Day 2 of 2: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- Day 2 of 2: CDAO Government 2025 (Washington)

- Day 2 of 2: FinTech Summit Africa 2025 (Johannesburg)

- Day 2 of 2: Money Expo Colombia 2025 (Bogota)

- Day 2 of 2: NFY.NYC 2025 (New York)

- Day 2 of 3: 7th Blockchain and Internet of Things Conference (Tsukuba, Japan)

- Day 2 of 3: 7th International Congress on Blockchain and Applications (Lille, France)

- Day 2 of 4: Solana Solstice 2025 (New York)

- June 26: The Injective Summit (New York)

- June 26: Webit 2025 (Sofia, Bulgaria)

- Day 1 of 2: Istanbul Blockchain Week

- Day 1 of 2: Seoul Meta Week 2025 (Seoul)

- June 28: Cyprus Blockchain Summit 2025 (Limmasol)

- June 28-29: The Bitcoin Rodeo (Calgary, Canada)

- June 30: RWA Cannes Summit 2025 (Cannes, France)

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

- June 30 to July 5: World Venture Forum 2025 (Kitzbühel, Austria)

Token Talk

By Shaurya Malwa

- SEI is up 50% in a week, leading all top 100 tokens, as analysts call a “clean, multi-factor rally” with smart money at the wheel.

- Wyoming named SEI as a settlement layer for its state-backed dollar pilot (WYST), giving the chain rare institutional cred and lifting visibility.

- Catalysts stacked up fast: airdrop v2 snapshot, 9% validator APY bump and zero meaningful token unlocks in the near term.

- CEX inflows topped $3M, while perp open interest rose just 9% and funding stayed flat — a classic sign of organic, spot-led buying.

- Sei’s TVL crossed $540M, with DEX volume hitting a record $60M on Wednesday, per DeFiLlama — indicating rising DeFi traction.

- Analysts warn that funding in excess of 0.05% or open interest outpacing spot would signal leverage creep and possible overextension.

- For now, momentum is clean, macro is supportive, and July could bring more upside if risk appetite holds.

Derivatives Positioning

- BTC’s slight pullback from Wednesday’s high of over $108,250 is accompanied by an uptick in perpetual futures open interest on major exchanges.

- It’s possible some market participants are taking hedges against a price drop.

- BCH, PEPE and XMR have seen the most increase in open interest in the past 24 hours.

- On the CME, BTC futures open interest jumped to a four-week high of 159.85K BTC. Still, the basis remains flat below 10%, weakening the bullish positioning narrative.

- On Deribit, risk reversals have normalized to show slight call bias in BTC options. ETH near-term tenors still show a slight put premium.

- Flows have been mixed on OTC liquidity network Paradigm, featuring risk reversals and some demand for call options.

Market Movements

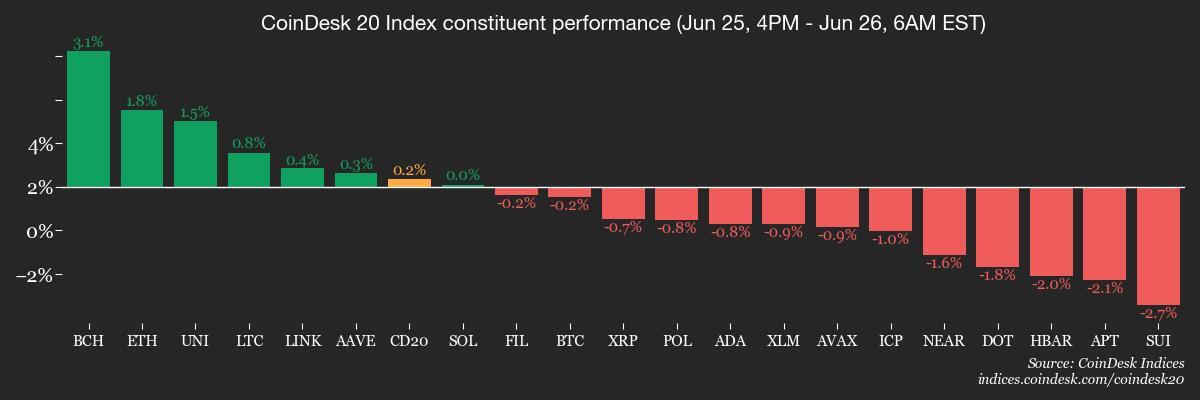

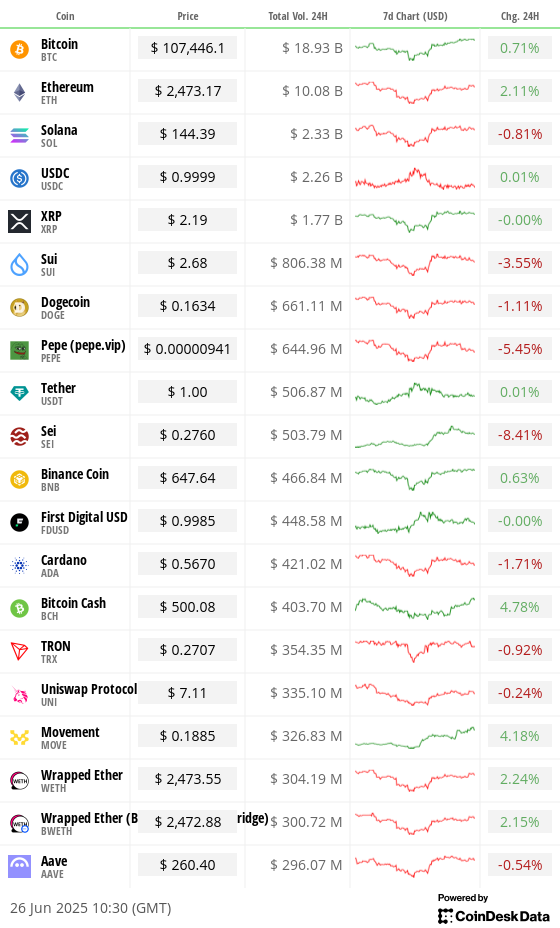

- BTC is down 0.37% from 4 p.m. ET Wednesday at $107,446.08 (24hrs: +0.17%)

- ETH is up 1.29% at $2,473.17 (24hrs: +1.41%)

- CoinDesk 20 is down 0.34% at 2,997.24 (24hrs: -0.03%)

- Ether CESR Composite Staking Rate is down 10 bps at 3.04%

- BTC funding rate is at -0.0004% (-0.4303% annualized) on Binance

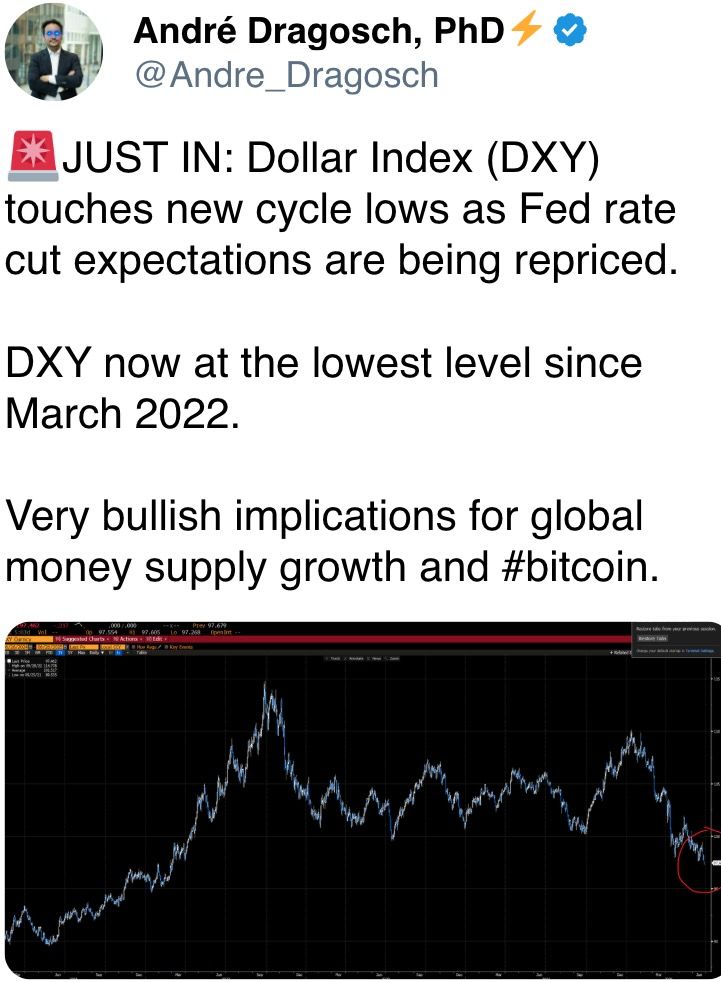

- DXY is down 0.56% at 97.14

- Gold futures are up 0.33% at $3,354.10

- Silver futures are up 1.45% at $36.63

- Nikkei 225 closed up 1.65% at 39,584.58

- Hang Seng closed down 0.61% at 24,325.40

- FTSE is up 0.14% at 8,731.26

- Euro Stoxx 50 is up 0.13% at 5,258.69

- DJIA closed on Wednesday down 0.25% at 42,982.43

- S&P 500 closed unchanged at 6,092.16

- Nasdaq Composite closed up 0.31% at 19,973.55

- S&P/TSX Composite closed down 0.57% at 26,566.32

- S&P 40 Latin America closed down 0.74% at 2,611.91

- U.S. 10-Year Treasury rate is down 2 bps at 4.28%

- E-mini S&P 500 futures are up 0.27% at 6,163.50

- E-mini Nasdaq-100 futures are up 0.41% at 22,552.75

- E-mini Dow Jones Industrial Average Index are up 0.20% at 43,392.00

Bitcoin Stats

- BTC Dominance: 65.65% (-0.11%)

- Ethereum to bitcoin ratio: 0.02297 (1.95%)

- Hashrate (seven-day moving average): 803 EH/s

- Hashprice (spot): $54.23

- Total Fees: 4.81 BTC / $515,528

- CME Futures Open Interest: 159,850 BTC

- BTC priced in gold: 32.1 oz

- BTC vs gold market cap: 9.1%

Technical Analysis

- The bullish case for the Binance-listed bitcoin-bitcoin cash pair looks strong as the 50-day simple moving average (SMA) appears on track to cross above the 200-day SMA.

- That would confirm a golden cross, a long-term bullish indicator.

Crypto Equities

Effective June 30, the price for Galaxy will be for its Nasdaq listing denominated in U.S. dollars rather than the Canadian-dollar-denominated listing on the TSX.

- Strategy (MSTR): closed on Wednesday at $388.67 (+3.09%), -0.38% at $387.20 in pre-market

- Coinbase Global (COIN): closed at $355.37 (+3.06%), +0.44% at $356.95

- Circle (CRCL): closed at $198.62 (-10.79%), -1.17% at $196.29

- Galaxy Digital Holdings (GLXY): closed at C$26.61 (-1.7%)

- MARA Holdings (MARA): closed at $14.98 (+0.67%), unchanged in pre-market

- Riot Platforms (RIOT): closed at $10 (-0.2%), +0.1% at $10.01

- Core Scientific (CORZ): closed at $12.3 (+0.74%), +0.33% at $12.34

- CleanSpark (CLSK): closed at $10.60 (+5.58%), -0.19% at $10.58

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $19.48 (+0.31%)

- Semler Scientific (SMLR): closed at $41.04 (-2.03%), -0.15% at $40.98

- Exodus Movement (EXOD): closed at $31.16 (-8.78%), unchanged in pre-market

ETF Flows

Spot BTC ETFs

- Daily net flow: $547.7 million

- Cumulative net flows: $48.12 billion

- Total BTC holdings ~ 1.23 million

Spot ETH ETFs

- Daily net flow: $60.4 million

- Cumulative net flows: $4.14 billion

- Total ETH holdings ~ 4.06 million

Source: Farside Investors

Overnight Flows

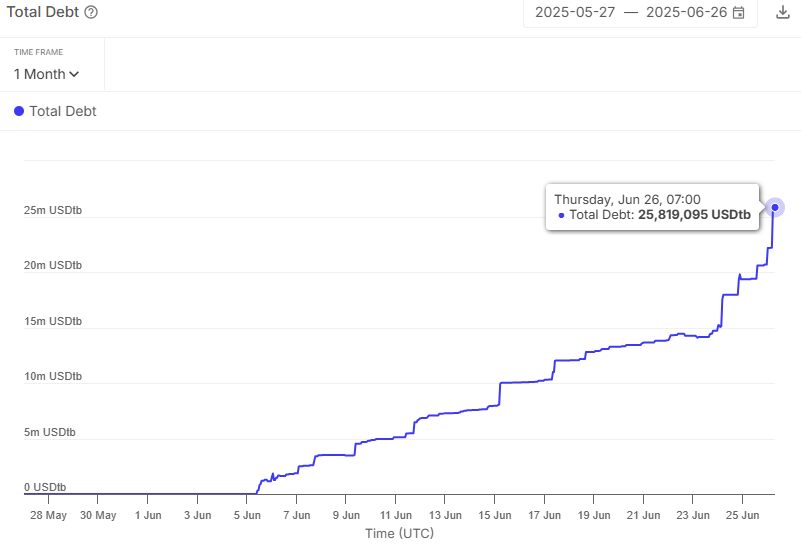

Chart of the Day

- The chart shows the amount of USDtb borrowed on decentralized lending and borrowing giant Aave. USDtb is an Ethena ecosystem stablecoin backed by Blackrock’s BUIDL.

- The tally has risen sharply to record high, signaling a pick up in demand for yield-bearing stablecoins in DeFi.

While You Were Sleeping

- Uproar Over Leaked Intelligence Underlines Murky View of Iran Strikes (The Wall Street Journal): Trump insisted the Iran strikes severely crippled its nuclear program, while experts and former officials warned that uranium stockpiles may have been relocated and key damage remains unverified.

- Bitcoin’s Bull Case Strengthens as Dollar Index Slides, Nvidia Hits Record High Amid Recession Cues (CoinDesk): Bitcoin has rebounded 10% from weekend lows amid continued dollar weakness, growing calls for a July Fed rate cut, and disappointing U.S. data on housing and consumer confidence.

- Metaplanet Overtakes Musk’s Tesla, Becomes Fifth-Largest Corporate Bitcoin Holder (CoinDesk): The Japanese firm bought 1,234 BTC for $133 million, bringing total holdings to 12,345 BTC at an average price of $98,303.

- World Liberty Makes Narrative U-Turn, Says WLFI Token Will Become Tradable Soon (CoinDesk): After initially saying its WLFI token would remain non-tradable, the Trump-linked crypto project now says a transfer function is in development, signaling a potential shift toward public trading.

- Fears Over U.S. Debt Load and Inflation Ignite Exodus From Long-Term Bonds (Financial Times): Investors worry that Trump’s trade policy will fuel inflation and his tax-and-spending bill will deepen U.S. debt, eroding the appeal of long-dated U.S. government and corporate bonds.

- Coinbase Brings Wrapped Cardano, Litecoin to Base With cbADA, cbLTC (CoinDesk): Coinbase has minted over 2.9 million cbADA and 11,300 cbLTC on Base, each fully backed by ADA and LTC held in custody, with regular proof-of-reserves to back up the claims.

In the Ether

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Gemini Shares Slide 6%, Extending Post-IPO Slump to 24%

Gemini Space Station (GEMI), the crypto exchange founded by Cameron and Tyler Winklevoss, has seen its shares tumble by more than 20% since listing on the Nasdaq last Friday.

The stock is down around 6% on Tuesday, trading at $30.42, and has dropped nearly 24% over the past week. The sharp decline follows an initial surge after the company raised $425 million in its IPO, pricing shares at $28 and valuing the firm at $3.3 billion before trading began.

On its first day, GEMI spiked to $45.89 before closing at $32 — a 14% premium to its offer price. But since hitting that high, shares have plunged more than 34%, erasing most of the early enthusiasm from public market investors.

The broader crypto equity market has remained more stable. Coinbase (COIN), the largest U.S. crypto exchange, is flat over the past week. Robinhood (HOOD), which derives part of its revenue from crypto, is down 3%. Token issuer Circle (CRCL), on the other hand, is up 13% over the same period.

Part of the pressure on Gemini’s stock may stem from its financials. The company posted a $283 million net loss in the first half of 2025, following a $159 million loss in all of 2024. Despite raising fresh capital, the numbers suggest the business is still far from turning a profit.

Compass Point analyst Ed Engel noted that GEMI is currently trading at 26 times its annualized first-half revenue. That multiple — often used to gauge whether a stock is expensive — means investors are paying 26 dollars for every dollar the company is expected to generate in sales this year. For a loss-making company in a volatile sector, that’s a steep price, and could be fueling investor skepticism.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars