Uncategorized

Crypto Daybook Americas: Bitcoin Reclaims $105K as Iran Tensions Ease, Bulls Regroup

By Omkar Godbole (All times ET unless indicated otherwise)

«Always fade geopolitics,» the founders of the LondonCryptoClub newsletter said Monday as bitcoin BTC fell below $100,000 after Iran fired missiles at U.S. airbases in the Middle East.

It looks like they were right. BTC quickly reversed its drop and has since topped $105,000, restoring spirits in the broader market, where VIRTUAL, JUP and SEI are flashing gains of over 20%, according to CoinDesk data.

The path of least resistance appears to be to the higher side, with President Donald Trump announcing a ceasefire between Israel and Iran, although unconfirmed reports of fresh aggression by Tehran and a response from Jerusalem introduce a note of caution.

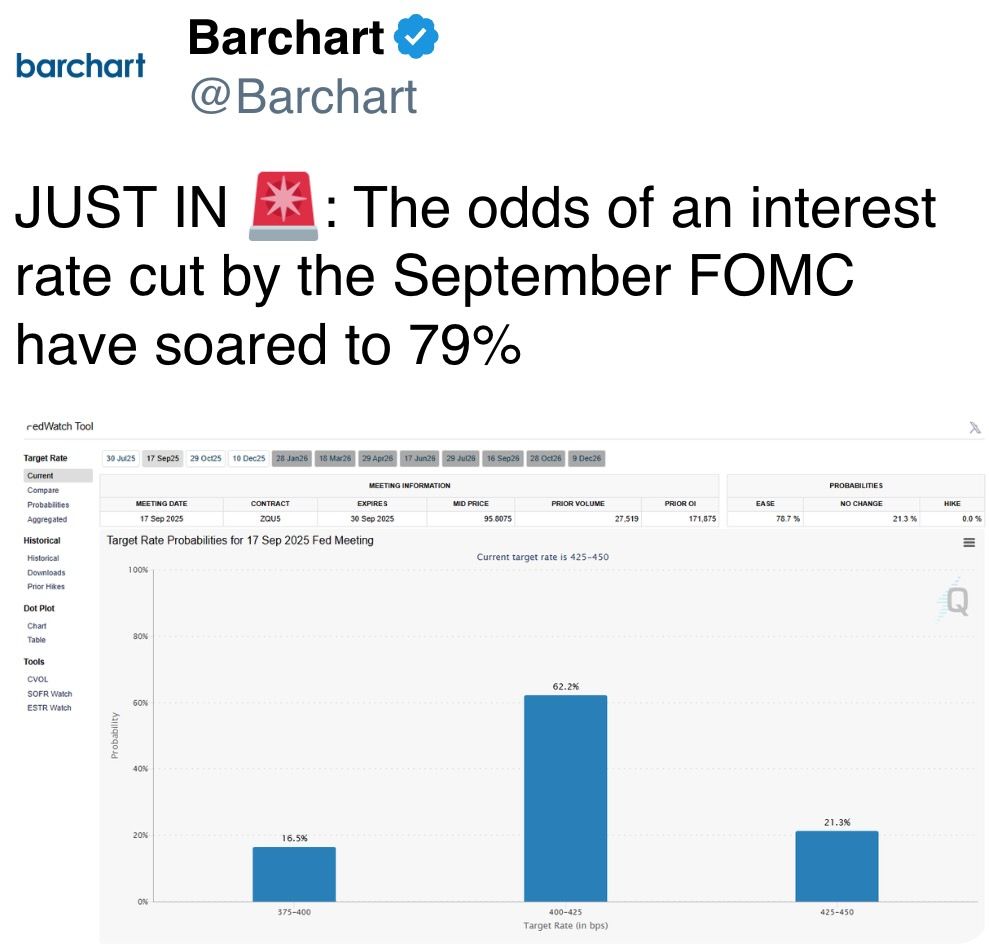

Also supporting a gain: At least two Fed members appointed by Trump are now leaning in favor of a rate cut next month and the U.S. Federal Housing Finance Agency is studying the use of crypto holdings in the mortgage qualification process.

Anthony Pompliano’s ProCap Financial plans to go public through a merger with Columbus Circle Capital, with a focus on bitcoin asset management and revenue generation.

«While the ceasefire optimism is driving short-term gains, the risk of renewed tensions remains elevated,» Valentin Fournier, the lead research analyst at BRN, said in an email. «That said, ETF inflows and ProCap’s IPO signal growing institutional demand, even near cycle highs — a strong vote of confidence for long-term upside.»

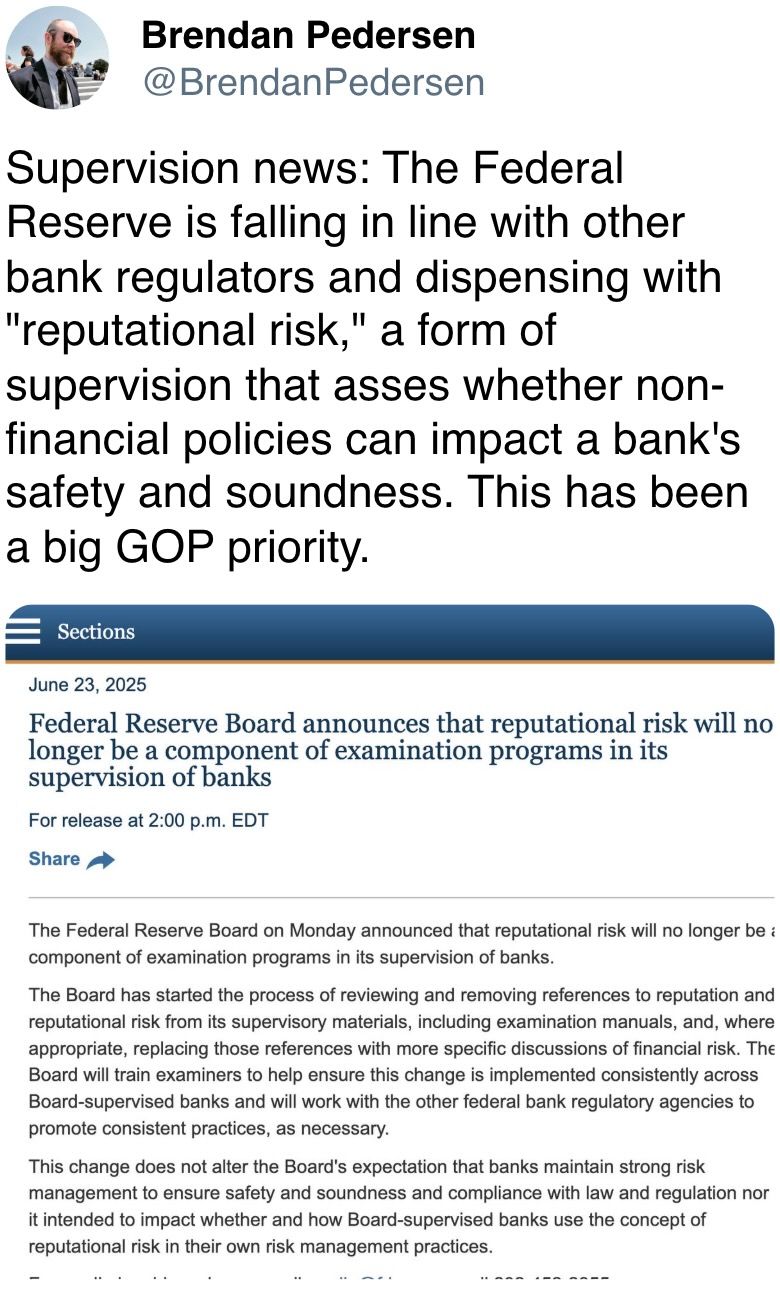

The U.S. Federal Reserve removed the concept of “reputational risk” from its formal bank supervision program, supposedly easing crypto banking restrictions. Bloomberg reported that VMS Group, a multifamily office with just under $4 billion in assets under management, is considering a $10 million allocation to strategies managed by decentralized finance hedge fund Re7 Capital.

In traditional markets, the dollar index fell to 98, extending Monday’s sell-off, while the price of gold dropped to its 50-day simple moving average at $3,318. Nasdaq futures chalked out a golden crossover, offering bullish cues to the crypto market. Stay alert!

What to Watch

- Crypto

- June 25: ZIGChain (ZIG) mainnet will go live.

- June 30: CME Group will introduce spot-quoted futures, pending regulatory approval, allowing trading in bitcoin, ether and major U.S. equity indices with contracts holdable for up to five years.

- Macro

- June 24, 8:30 a.m.: Statistics Canada releases May consumer price inflation data.

- Core Inflation Rate MoM Prev. 0.5%

- Core Inflation Rate YoY Prev. 2.5%

- Inflation Rate MoM Est. 0.5% vs. Prev. -0.1%

- Inflation Rate YoY Est. 1.7% vs. Prev. 1.7%

- June 24, 10 a.m.: Fed Chair Jerome H. Powell testifies before the U.S. House Financial Services Committee on the semiannual monetary policy report. Livestream link.

- June 24, 10 a.m.: The Conference Board (CB) releases June U.S. consumer confidence data.

- CB Consumer Confidence Est. 99.8 vs. Prev. 98

- Day 1 of 2: North Atlantic Treaty Organization (NATO) Summit in The Hague, the Netherlands, where heads of state, foreign and defense ministers of 32 allies and partners will meet to discuss security, defense spending and cooperation.

- June 25, 10 a.m.: Fed Chair Jerome H. Powell testifies before the U.S. Senate Committee on Banking, Housing, and Urban Affairs on the semiannual monetary policy report. Livestream link.

- June 26, 8:30 a.m.: The U.S. Census Bureau releases May manufactured durable goods orders data.

- Durable Goods Orders MoM Est. 7.2% vs. Prev. -6.3%

- Durable Goods Orders Ex Defense MoM Prev. -7.5%

- Durable Goods Orders Ex Transportation MoM Est. 0.1% vs. Prev. 0.2%

- June 26, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases (final) Q1 GDP data.

- GDP Growth Rate QoQ Final Est. -0.2% vs. Prev. 2.4%

- GDP Price Index QoQ Final Est. 3.7% vs. Prev. 2.3%

- GDP Sales QoQ Final Est. -2.9% vs. Prev. 3.3%

- June 26, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended June 21.

- Initial Jobless Claims Est. 247K vs. Prev. 245K

- Continuing Jobless Claims Prev. 1945K

- June 26, 3 p.m.: Mexico’s central bank, the Bank of Mexico, announces its interest rate decision.

- Overnight Interbank Target Rate Est. 8% Prev. 8.5%

- June 24, 8:30 a.m.: Statistics Canada releases May consumer price inflation data.

- Earnings (Estimates based on FactSet data)

- None in the near future.

Token Events

- Governance votes & calls

- ApeCoin DAO is voting on whether to sunset the decentralized autonomous organization and launch ApeCo, a new entity established by Yuga Labs with a mission to “supercharge the APE ecosystem.” Voting ends June 24.

- Arbitrum DAO is voting on lowering the constitutional quorum threshold from 5% to 4.5% of votable tokens. This aims to match decreased voter participation and help well-supported proposals pass more easily, without affecting non-constitutional proposals, which remain at a 3% quorum. Voting ends July 4.

- Polkadot Community is voting on launching a non-custodial Polkadot branded payment card to “to bridge the gap between digital assets in the Polkadot ecosystem and everyday spending.” Voting ends July 9.

- June 25, 5:30 p.m.: A BNB Super Meetup is being hosted in New York.

- Unlocks

- June 30: Optimism (OP) to unlock 1.79% of its circulating supply worth $15.48 million.

- July 1: Sui (SUI) to unlock 1.3% of its circulating supply worth $109.99 million.

- July 2: Ethena (ENA) to unlock 0.67% of its circulating supply worth $988 million.

- July 12: Aptos (APT) to unlock 1.76% of its circulating supply worth $45.24 million.

- July 15: Starknet (STRK) to unlock 3.79% of its circulating supply worth $13.29 million.

- Token Launches

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

- June 26: Sahara AI (SAHARA) to be listed on OKX, Bitget, MEXC, CoinW, and others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through July 17.

- Day 1 of 3: Blockworks’ Permissionless IV (New York)

- June 24: Finnovex Qatar 2025 (Doha)

- June 24: ETHMilan 2025 (Milan)

- June 24: Africa Fintech Forum 2025 (Cairo)

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 25-26: CDAO Government 2025 (Washington)

- June 25-26: FinTech Summit Africa 2025 (Johannesburg)

- June 25-26: Money Expo Colombia 2025 (Bogota)

- June 25-26: NFY.NYC 2025 (New York)

- June 25-27: 7th Blockchain and Internet of Things Conference (Tsukuba, Japan)

- June 25-27: 7th International Congress on Blockchain and Applications (Lille, France)

- June 25-28: Solana Solstice 2025 (New York)

- June 26: The Injective Summit (New York)

- June 26: Webit 2025 (Sofia, Bulgaria)

- June 26-27: Istanbul Blockchain Week

- June 26-27: Seoul Meta Week 2025 (Seoul)

- June 28: Cyprus Blockchain Summit 2025 (Limmasol)

- June 28-29: The Bitcoin Rodeo (Calgary, Canada)

- June 30: RWA Cannes Summit 2025 (Cannes, France)

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

- June 30 to July 5: World Venture Forum 2025 (Kitzbühel, Austria)

Token Talk

By Shaurya Malwa

- Ethereum developer Barnabé Monnot proposed EIP-7782, halving slot times from 12 seconds to 6 seconds to boost network speed and user experience.

- Faster blocks mean faster confirmations, with more frequent data updates for wallets, DeFi apps, and L2s — creating a smoother, more responsive blockchain.

- DeFi efficiency could improve as a result of tighter arbitrage windows, faster price discovery and lower trading fees due to higher liquidity in AMMs.

- Key timing changes include reducing block proposal time to 3 seconds, attestations to 1.5 seconds and aggregation to 1.5 seconds.

- Monnot argues Ethereum’s “service price” will rise, making it more competitive as a global settlement and confirmation layer.

- Potential drawbacks include bandwidth pressure, validator performance issues, and network instability if poorly implemented.

- The proposal targets the 2026 Glamsterdam upgrade, which focuses on gas optimizations and protocol-level speedups across the Ethereum blockchain.

Derivatives Positioning

- Cumulative open interest in BTC standard and perpetual futures listed worldwide dropped to 650K BTC on Monday, the lowest since May 18, before bouncing slightly early today. ETH futures showed similar trends.

- BNB, BCH, DOT see negative funding rates in a bias for bearish short positions in perpetual futures markets. BTC, ETH funding rates held moderately positive.

- SHIB, ETH, HBAR have seen the most growth in the positive cumulative volume delta, implying net buying pressure.

- On Deribit, put skews have weakened at the front-end, with ETH puts still pricier than BTC.

- Block flows on OTC network Paradigm have been mixed.

Market Movements

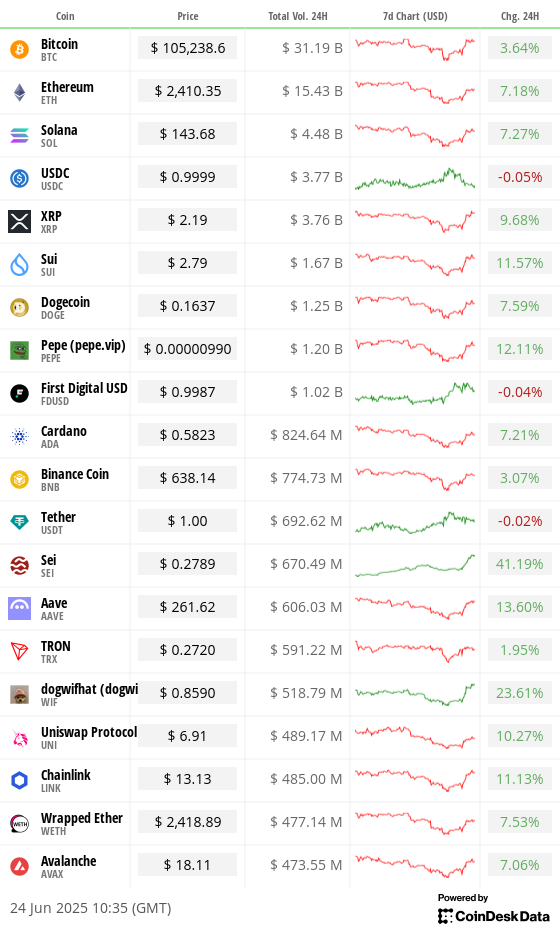

- BTC is up 1.43% from 4 p.m. ET Monday at $105,285.37 (24hrs: +3.78%)

- ETH is up 2.96% at $2,417.93 (24hrs: +7.67%)

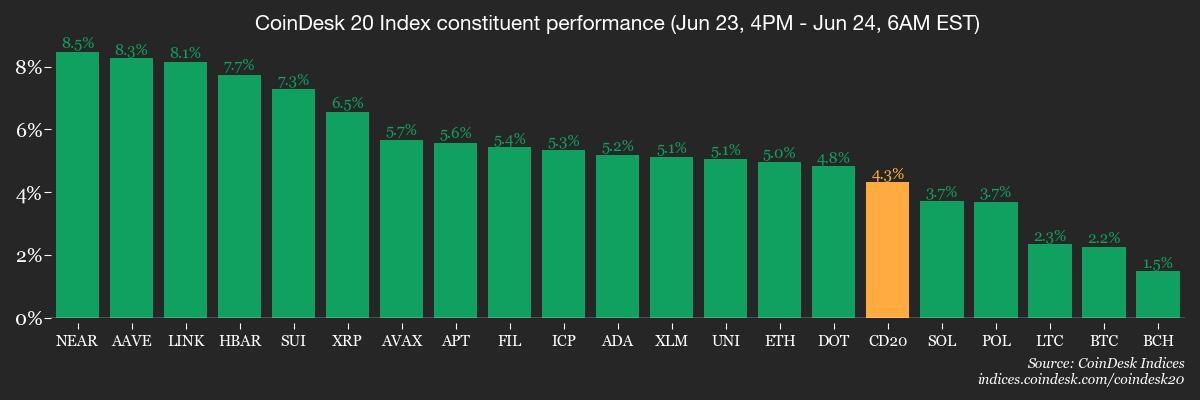

- CoinDesk 20 is up 2.89% at 2,970.00 (24hrs: +6.84%)

- Ether CESR Composite Staking Rate is down 1 bps at 3.12%

- BTC funding rate is at 0.0035% (3.804% annualized) on Binance

- DXY is down 0.48% at 97.94

- Gold futures are down 1.75% at $3,335.50

- Silver futures are down 0.38% at $36.05

- Nikkei 225 closed up 1.14% at 38,790.56

- Hang Seng closed up 2.06% at 24,177.07

- FTSE is up 0.41% at 8,793.55

- Euro Stoxx 50 is up 1.77% at 5,314.14

- DJIA closed on Monday up 0.89% at 42,581.78

- S&P 500 closed up 0.96% at 6,025.17

- Nasdaq Composite closed up 0.94% at 19,630.97

- S&P/TSX Composite closed up 0.42% at 26,609.36

- S&P 40 Latin America closed down 0.27% at 2,585.46

- U.S. 10-Year Treasury rate is unchanged at 4.35%

- E-mini S&P 500 futures are up 0.92% at 6,133.00

- E-mini Nasdaq-100 futures are up 1.19% at 22,337.00

- E-mini Dow Jones Industrial Average Index are up 0.80% at 43,246.00

Bitcoin Stats

- BTC Dominance: 65.3 (-0.12%)

- Ethereum to bitcoin ratio: 0.02298 (0.31%)

- Hashrate (seven-day moving average): 799 EH/s

- Hashprice (spot): $53.3

- Total Fees: 4.89 BTC / $500,494

- CME Futures Open Interest: 149,575 BTC

- BTC priced in gold: 31.1 oz

- BTC vs gold market cap: 8.82%

Technical Analysis

- DOGE’s daily chart shows prices are looking to bounce from April lows under 15 cents, hinting at a potential double bottom pattern.

- A rise beyond the horizontal resistance (neckline) is needed to confirm the double bottom breakout and signal bullish trend reversal.

Crypto Equities

Effective June 30, the price for Galaxy will be for its Nasdaq listing denominated in U.S. dollars rather than the Canadian-dollar-denominated listing on the TSX.

- Strategy (MSTR): closed on Monday at $367.18 (-0.68%), +1.87% at $374.05 in pre-market

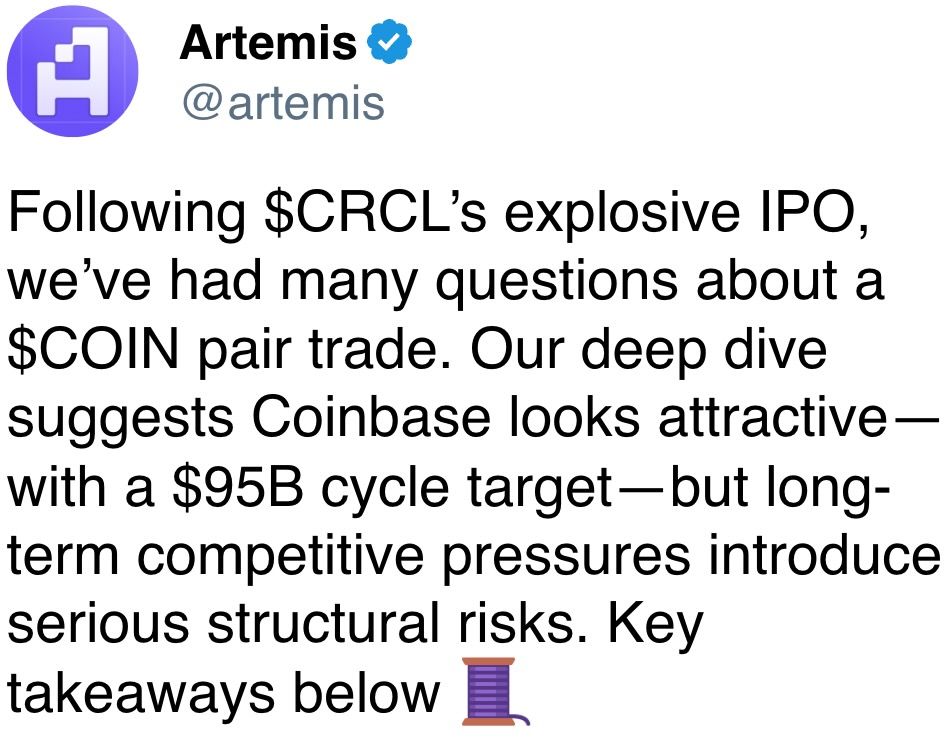

- Coinbase Global (COIN): closed at $307.59 (-0.26%), +3.09% at $317.10

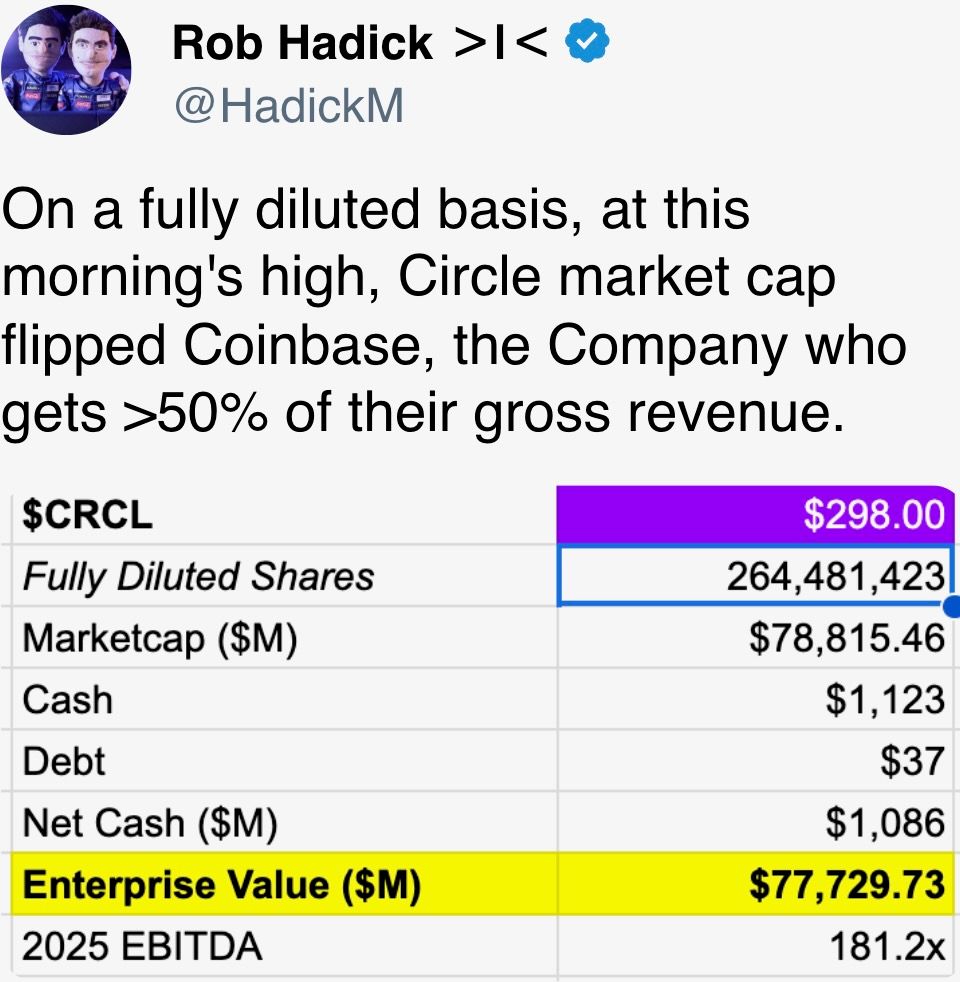

- Circle (CRCL): closed at $263.45 (+9.64%), +0.46% at $264.66

- Galaxy Digital Holdings (GLXY): closed at C$25.38 (-1.63%)

- MARA Holdings (MARA): closed at $14.18 (-0.98%), +2.61% at $14.55

- Riot Platforms (RIOT): closed at $9.27 (-3.03%), +2.91% at $9.54

- Core Scientific (CORZ): closed at $11.35 (-4.3%), +2.82% at $11.67

- CleanSpark (CLSK): closed at $8.85 (-1.67%), +2.82% at $9.10

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $18.09 (-2.64%)

- Semler Scientific (SMLR): closed at $41.98 (+16.17%), +1.94% at $42.80

- Exodus Movement (EXOD): closed at $28.77 (-9.07%), +6.6% at $30.67

ETF Flows

Spot BTC ETFs

- Daily net flow: $350.6 million

- Cumulative net flows: $47.0 billion

- Total BTC holdings ~ 1.23 million

Spot ETH ETFs

- Daily net flow: $ 100.7 million

- Cumulative net flows: $4.0 billion

- Total ETH holdings ~ 3.98 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart shows the number of active or open BTC/USD longs (bullish bets) on crypto exchange Bitfinex.

- The tally is rising again.

- Historically, there has been an inverse correlation between the longs and bitcoin’s price.

While You Were Sleeping

- Israel Says It Agreed to Bilateral Ceasefire With Iran, Will ‘Respond Forcefully’ to Any Violation (The Times of Israel): The Israel Defense Forces (IDF) met and surpassed all the operation’s objectives, eliminating nuclear and ballistic missile threats deemed immediately existential, according to the prime minister’s office.

- Bitcoin Could Spike to $120K, Here Are 4 Factors Boosting the Case for a BTC Bull Run (CoinDesk): Bitcoin’s resilience throughout the Iran-Israel war, falling oil prices, potential Fed rate cuts and bullish technical signals are reinforcing the case for further gains.

- Metaplanet Plans to Inject $5B Into U.S. Unit to Accelerate Bitcoin Buying Strategy (CoinDesk): The Japanese firm will use its Florida-based unit, launched May 1, to accelerate bitcoin accumulation toward a 210,000-coin goal by the end of 2027, leveraging U.S. financial infrastructure for efficient large-scale acquisition.

- Ark Invest Continues to Dump Circle Shares, Buys Robinhood and Coinbase (CoinDesk): ARK sold 415,855 Circle (CRCL) shares across three ETFs on Monday, following last week’s 609,175-share sale, after the stock surged more than sevenfold since its IPO.

- Trump’s Iran Attack Spurs Concerns of Retaliation in the U.S. (The Wall Street Journal): FBI offices in major U.S. cities were ordered to refocus on Iran-related threats, while Department of Homeland Security flagged increased risks of cyberattacks and hate crimes targeting Jewish and pro-Israel communities.

- Starmer and Zelenskiy Agree Military Production Project in London (Reuters): Under the new three-year agreement, Ukraine will share battlefield drone data with the U.K., enabling British factories to rapidly produce and supply large numbers of drones for use against Russia.

In the Ether

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Gemini Shares Slide 6%, Extending Post-IPO Slump to 24%

Gemini Space Station (GEMI), the crypto exchange founded by Cameron and Tyler Winklevoss, has seen its shares tumble by more than 20% since listing on the Nasdaq last Friday.

The stock is down around 6% on Tuesday, trading at $30.42, and has dropped nearly 24% over the past week. The sharp decline follows an initial surge after the company raised $425 million in its IPO, pricing shares at $28 and valuing the firm at $3.3 billion before trading began.

On its first day, GEMI spiked to $45.89 before closing at $32 — a 14% premium to its offer price. But since hitting that high, shares have plunged more than 34%, erasing most of the early enthusiasm from public market investors.

The broader crypto equity market has remained more stable. Coinbase (COIN), the largest U.S. crypto exchange, is flat over the past week. Robinhood (HOOD), which derives part of its revenue from crypto, is down 3%. Token issuer Circle (CRCL), on the other hand, is up 13% over the same period.

Part of the pressure on Gemini’s stock may stem from its financials. The company posted a $283 million net loss in the first half of 2025, following a $159 million loss in all of 2024. Despite raising fresh capital, the numbers suggest the business is still far from turning a profit.

Compass Point analyst Ed Engel noted that GEMI is currently trading at 26 times its annualized first-half revenue. That multiple — often used to gauge whether a stock is expensive — means investors are paying 26 dollars for every dollar the company is expected to generate in sales this year. For a loss-making company in a volatile sector, that’s a steep price, and could be fueling investor skepticism.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars