Uncategorized

Crypto Daybook Americas: Bitcoin Price Returns to Positive for the Year

By Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin (BTC) was little changed Monday, adding less than 1% amid renewed trade tensions and concerns of geopolitical instability that spread into the Indian subcontinent, where India and Pakistan are exchanging small-arms fire.

The cryptocurrency rose 0.75% in the past 24 hours, turning positive for the year and decoupling from traditional risk assets as investors questioned the durability of the U.S.’s role as the global financial anchor. The broader market, measured through the CoinDesk 20 (CD20) index, rose 2.2%.

Stock-index futures in the U.S. are pointing to a slight drop and gold fell over 1% with investors likely taking profit from the precious metal’s 25% year-to-date rally. Equities endured a sell-off after China denied talks with the U.S. to reach a tariff deal.

“Bitcoin has acted less like a liquid levered version of levered US equity beta and more like the non-sovereign issued store of value that it is,” Greg Cipolaro, the global head of research at NYDIG, wrote in a note.

While the cryptocurrency’s longer-term correlation to U.S. equities remains high, the short-term price action points to a market starting to treat BTC less like a tech stock proxy and more like a non-sovereign safe haven, according to NYDIG’s report.

Options and futures data suggest bitcoin’s rally, which saw it rise 9% last week, is still in its early stages. Funding rates for offshore perpetual swaps only recently turned positive, and call overwriting remains more popular than aggressive bullish positioning.

Bitcoin’s appeal as a politically neutral asset appears to be growing. The note shows that since President Donald Trump’s April 2 «Liberation Day,» bitcoin has outperformed U.S. Treasuries, the Swiss franc and gold.

The broader backdrop remains volatile. Measures of equity (VIX), bond (MOVE), and currency (CVIX) volatility have jumped in recent weeks. While they are expected to recede slightly, the outlook is for them to remain elevated for the foreseeable future, the note said.

Despite bitcoin’s growing appeal, macro and geopolitical events remain “the primary drivers of flow,” according to Jake O., an OTC trader at Wintermute who flagged in an email that bitcoin call calendar spreads targeting $110,000 in June remain “the preferred structure for those reaching for topside.»

This week investors will see an inflow of major corporate earnings reports, as well as the latest consumer income and expenditure report and April’s nonfarm payrolls on Friday. The data could provide further insights into a potential earlier-than-expected interest-rate cut, which Trump has been calling for. Stay alert!

What to Watch

- Crypto:

- April 28: Enjin Relaychain increases active validator slots to 25 from 15 to enhance decentralization.

- April 29, 1:05 a.m.: The Lorentz hard fork network upgrade gets activated on BNB Chain’s BSC. The upgrade reduces block time to 1.5 seconds, cutting latency, speeding up confirmations and improving user experience.

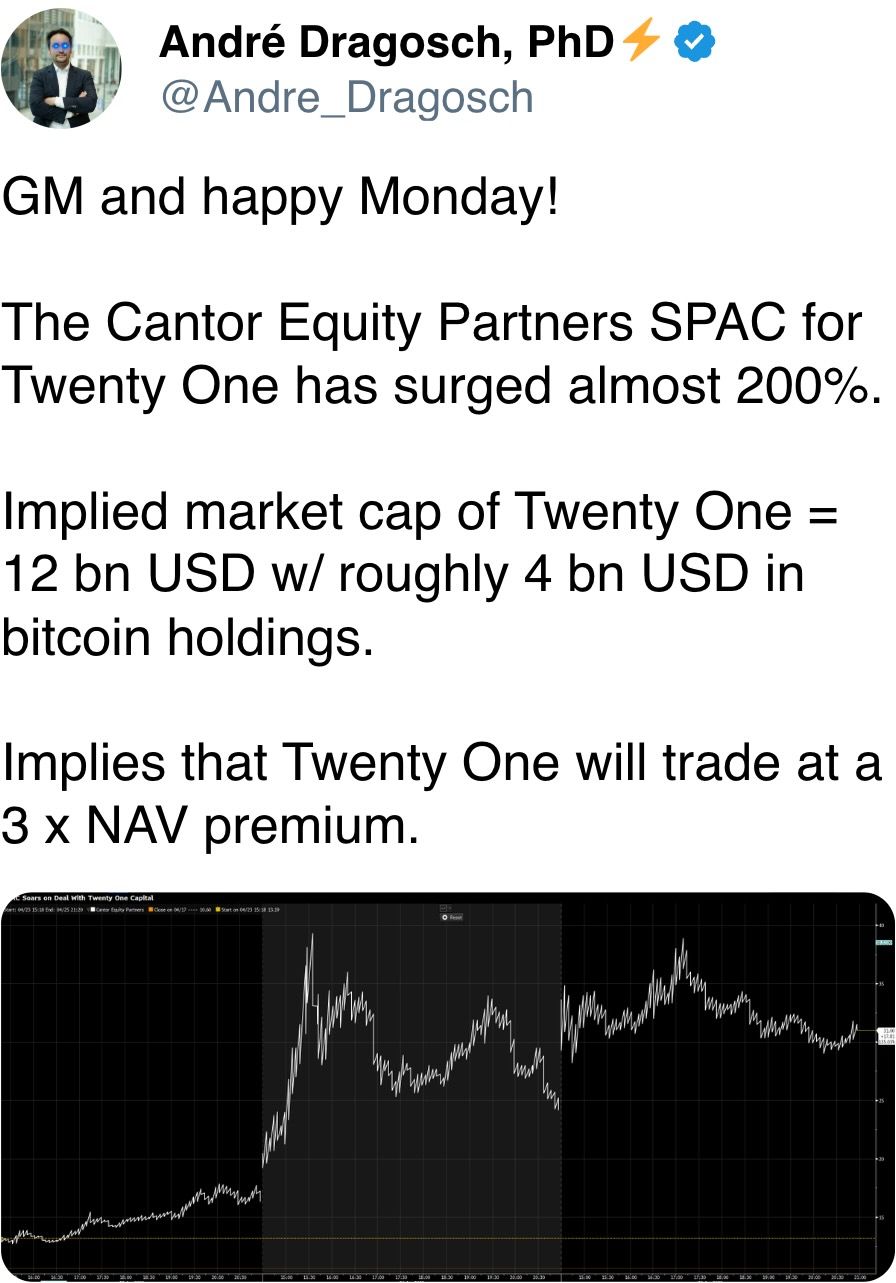

- April 30, 9:30 a.m.: ProShares will launch three ETFs that will provide leveraged and inverse exposure to XRP: the ProShares Ultra XRP ETF, the ProShares Short XRP ETF and the ProShares UltraShort XRP ETF.

- April 30, 10:03 a.m.: Gnosis Chain (GNO), an Ethereum sister chain, will activate the Pectra hard fork on its mainnet at slot 21,405,696, epoch 1,337,856.

- Macro

- April 28, 8:00 a.m.: Mexico’s National Institute of Statistics and Geography releases March unemployment data.

- Unemployment Rate Prev. 2.5%

- April 29, 4:00 a.m.: The European Central Bank (ECB) releases eurozone March M3 money supply data.

- M3 YoY Est. 4.1% vs. Prev. 4%

- April 29, 10:00 a.m.: The U.S. Bureau of Labor Statistics releases March JOLTs report (job openings, hires, and separations).

- Job Openings Est. 7.5M vs. Prev. 7.568M

- Job Quits Prev. 3.195M

- April 30, 8:00 a.m.: Brazil’s Institute of Geography and Statistics (IBGE) releases March unemployment rate data.

- Unemployment Rate Prev. 6.8%

- April 30, 8:00 a.m.: Mexico’s National Institute of Statistics and Geography releases (Preliminary) Q1 GDP growth data.

- GDP Growth Rate QoQ Prev. -0.6%

- GDP Growth Rate YoY Prev. 0.5%

- April 30, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases (Advance) Q1 GDP growth data.

- GDP Growth Rate QoQ Est. 0.4% vs. Prev. 2.4%

- April 30, 10:00 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases March consumer income and expenditure data.

- Core PCE Price Index MoM Est. 0.1% vs. Prev. 0.4%

- Core PCE Price Index YoY Prev. 2.8%

- PCE Price Index MoM Prev. 0.3%

- PCE Price Index YoY Prev. 2.5%

- Personal Income MoM Est. 0.4% vs. Prev. 0.8%

- Personal Spending MoM Est. 0.4% vs. Prev. 0.4%

- April 28, 8:00 a.m.: Mexico’s National Institute of Statistics and Geography releases March unemployment data.

- Earnings (Estimates based on FactSet data)

Token Events

- Governance votes & calls

- Uniswap DAO will vote on establishing a licensing and deployment framework for Uniswap v4 to accelerate its adoption across multiple chains. The proposal grants the Uniswap Foundation a blanket exemption to deploy v4 on any DAO-approved chain and gives the Uniswap Accountability Committee authority to update deployment records.Voting starts April 24 and ends on April 30.

- Uniswap DAO is voting on a proposal to renew the Uniswap Accountability Committee (UAC) for Season 4, extending its mandate until the end of 2025. Voting ends April 29.

- Balancer DAO is voting on allocating $250,000 worth of ARB to a multisig controlled by contributors to fund testing of new automated market maker (AMM) pool models.

- April 30, 12 p.m.: Helium to host a community call meeting.

- May 5, 4 p.m.: Livepeer (LPT) to host a Treasury Talk session on Discord.

- Unlocks

- April 30: Optimism (OP) to unlock 1.89% of its circulating supply worth $24.77 million.

- May 1: Sui (SUI) to unlock 2.28% of its circulating supply worth $277.48 million.

- May 1: ZetaChain (ZETA) to unlock 5.67% of its circulating supply worth $11.63 million.

- May 2: Ethena (ENA) to unlock 0.73% of its circulating supply worth $14.41 million.

- May 7: Kaspa (KAS) to unlock 0.56% of its circulating supply worth $13.95 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating supply worth $11.94 million.

- Token Launches

- April 28: Sign (SIGN) to be listed on Binance, BingX, BitMart, Bitget, KuCoin, Gate.io and others.

- April 28: Snek (SNEK) to be listed on Kraken.

- May 2: Binance to delist Alpaca Finance (ALPACA), PlayDapp (PDA), Viberate (VIB), and Wing Finance (WING).

- May 5: Sonic (S) to be listed on Kraken.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 2 of 4: Web Summit Rio 2025

- April 28-29: Blockchain Disrupt 2025 (Dubai)

- April 28-29: Staking Summit Dubai

- April 29: El Salvador Digital Assets Summit 2025 (San Salvador, El Salvador)

- April 29: IFGS 2025 (London)

- April 30-May 1: TOKEN2049 (Dubai)

- May 6-7: Financial Times Digital Assets Summit (London)

- May 11-17: Canada Crypto Week (Toronto)

- May 12-13: Dubai FinTech Summit

- May 12-13: Filecoin (FIL) Developer Summit (Toronto)

- May 12-13: Latest in DeFi Research (TLDR) Conference (New York)

- May 12-14: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum on Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

Token Talk

By Shaurya Malwa

- The attackers behind a $6 million hack of Solana-based Loopscale offered to return most of the stolen funds while demanding a 20% bounty.

- «We are agreeable to collaborating with you to reach a white hat agreement,» the attackers said in an on-chain message sent to Loopscale. «However, we would like to negotiate the bounty percentage; our expectation is 20%. To demonstrate our commitment to a cooperative approach, we will immediately return the 5000 wSOL funds following the transmission of this message.»

- «However, a successful collaboration is contingent on two conditions: first, a full release of liability for our actions, and second, an official reconciliation announcement from your team, along with notification to all on-chain partners to cease fund tracking and freezing,» the message added.

- The attackers stole over 5.7 million USDC and 1,200 SOL (worth around $180,000 at the time) from Loopscale’s storage pools on April 26.

- They manipulated the system Loopscale uses to set prices for its RateX PT token, which helps decide how much digital assets are worth when used as collateral (like a deposit for a loan).

- The hackers tricked the system into thinking the token’s price was different, allowing them take more money than they should have. This affected 12% of all the money Loopscale was holding, specifically hurting people who had put their money into the USDC and SOL vaults.

- Loopscale stopped all activity on the platform to prevent more theft. It initially let some users repay loans while keeping withdrawals from the vaults locked to stay safe.

- The protocol figured out the problem was in the price-checking system, not the RateX token itself. On Sunday, it offered the hacker a deal: Return 90% of the stolen money (worth $5.3 million) and keep 10% (about $592,000) with no legal trouble.

Derivatives Positioning

- Global open interest across all futures instruments on centralized exchanges currently totals $119 billion.

- According to data from Laevitas, among assets with over $100 million in open interest, the largest week-over-week increases have been recorded in MemeFi, Virtuals Protocol, Bonk, TRUMP and Worldcoin.

- Looking at the liquidations heat map of BTC/USDT pair on Binance, the next major price levels are positioned at $95,124 and $95,691, with liquidation clusters totaling $38.7 million and $31.2 million, respectively.

- Analyzing the orderbook for the same pair, the largest sell limit orders are stacked at $97,000 and $100,000, with ask sizes of 178 BTC and 242 BTC.

Market Movements:

- BTC is up 0.5% from 4 p.m. ET Friday at $95,077 (24hrs: +1.19%)

- ETH is up 0.51% at $1,812.79 (24hrs: +0.35%)

- CoinDesk 20 is up 1.2% at 2,800.46 (24hrs: +2.08%)

- Ether CESR Composite Staking Rate is down 2 bps at 2.95%

- BTC funding rate is at 0.0027% (2.9499% annualized) on Binance

- DXY is up 0.14% at 99.61

- Gold is up 0.31% at $3292.7/oz

- Silver is down 0.15% at $32.94/oz

- Nikkei 225 closed +0.38%% at 35839.99

- Hang Seng closed -0.04% at 21971.96

- FTSE is up 0.36% at 8445.32

- Euro Stoxx 50 is up 0.6% at 5185.19

- DJIA closed on Friday +0.05% at 40,113.50

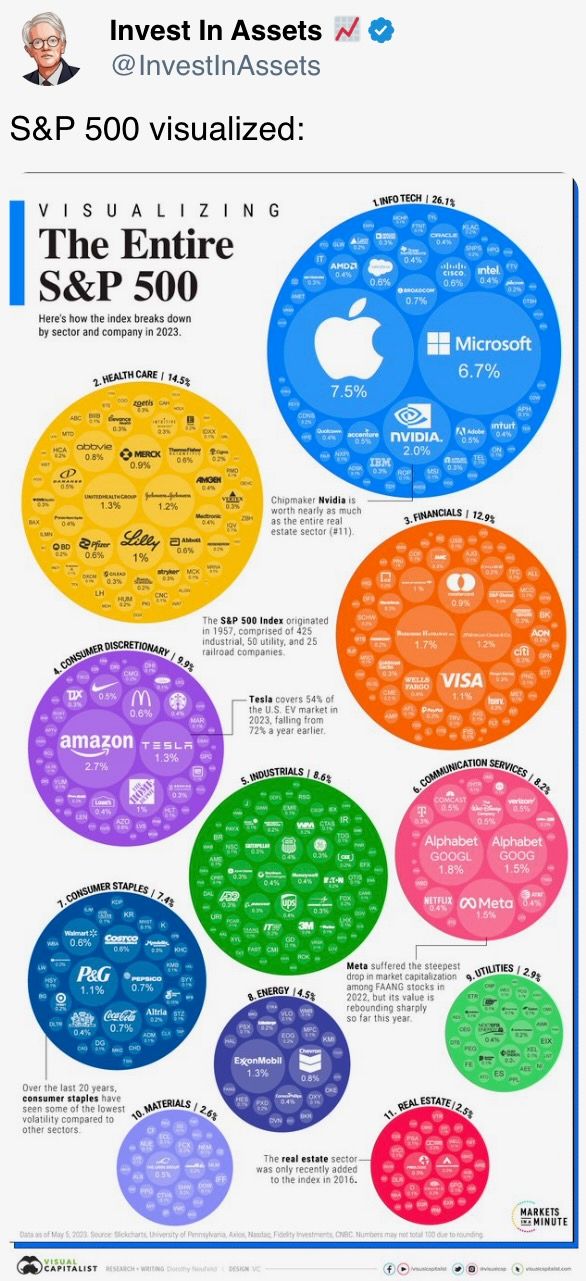

- S&P 500 closed +0.74% at 5525.21

- Nasdaq closed +1.26% at 17,382.94

- S&P/TSX Composite Index closed -0.07% at 24,710.5

- S&P 40 Latin America closed +0.37% at 2,530.65

- U.S. 10-year Treasury rate is up 39 bps at 4.28%

- E-mini S&P 500 futures are down 0.16% at 5541

- E-mini Nasdaq-100 futures are down 0.16% at 19,503

- E-mini Dow Jones Industrial Average Index futures are down 0.05% at 40,232

Bitcoin Stats:

- BTC Dominance: 64.20% (-0.11%)

- Ethereum to bitcoin ratio: 0.01907 (-0.21%)

- Hashrate (seven-day moving average): 829 EH/s

- Hashprice (spot): 49.3 PH/s

- Total Fees: 5.18 BTC / $486,920

- CME Futures Open Interest: 143,115 BTC

- BTC priced in gold: 28.6 oz

- BTC vs gold market cap: 8.10%

Technical Analysis

- Bitcoin posted its strongest weekly performance since the U.S. presidential election, rallying 10.1% to reach $93,778.

- After reclaiming the yearly open at $93,403, price action remains in a pivotal zone — trading within the weekly order block that triggered the previous breakdown from range highs.

- For further confirmation of strength, BTC will need to secure a daily close above $94,970 to avoid forming a swing failure pattern.

Crypto Equities

- Strategy (MSTR): closed on Friday at $368.71 (+5.24%), up 0.62% at $371.00 in pre-market

- Coinbase Global (COIN): closed at $209.64 (+2.83%), down 0.20% at $209.22

- Galaxy Digital Holdings (GLXY): closed at C$20.63 (-0.24%)

- MARA Holdings (MARA): closed at $14.30 (+2.07%), down 0.14% at $14.28

- Riot Platforms (RIOT): closed at $7.77 (-0.26%)

- Core Scientific (CORZ): closed at $8.31 (+10.36%), down 0.36% at $8.28

- CleanSpark (CLSK): closed at $9.01 (+1.69%), up 0.447% at $9.04

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.56 (+3.56%)

- Semler Scientific (SMLR): closed at $36.84 (+6.97%), up 0.43% at $37.00

- Exodus Movement (EXOD): closed at $45.50 (+0.64%), down 1.65% at $44.75

ETF Flows

Spot BTC ETFs:

- Daily net flow: $380 million

- Cumulative net flows: $ 38.40 billion

- Total BTC holdings ~ 1.11 million

Spot ETH ETFs

- Daily net flow: $104.1 million

- Cumulative net flows: $2.41 billion

- Total ETH holdings ~ 3.38 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- Despite dipping to new range lows of $74,458 earlier this month, bitcoin is now on track to post its largest monthly gain since November 2024.

While You Were Sleeping

- Bitcoin Turns Positive Year-to-Date as It Veers Toward Digital Gold Narrative (CoinDesk): Bitcoin has a strong correlation with gold and a weaker correlation with the Nasdaq 100, distancing itself from tech stocks and showing resilience to broader economic instability.

- ProShares Gets SEC Greenlight for Three XRP ETFs (CoinDesk): ProShares will introduce leveraged and inverse XRP ETFs on April 30. Its application for a spot XRP fund remains under review.

- China Says It Can Live Without U.S Farm and Energy Goods (Financial Times): The vice chair of the National Development and Reform Commission said the country could secure alternatives to U.S. feed grains and would face little impact from halting U.S. energy imports.

- The Russian Military Moves That Have Europe on Edge (The Wall Street Journal): Western officials and analysts say Russia is expanding bases, boosting recruitment and upgrading infrastructure along NATO’s eastern flank.

- The Dollar’s Weakness Creates an Opportunity for the Euro. Can It Last? (The New York Times): Expectations of major German borrowing and bloc-wide bonds are drawing investors, though officials say the euro will likely compete with safe havens like gold and the Swiss franc.

- Why Crypto Leaders Are Feeling Optimistic About the Future: ‘The Crypto Revolution Is Happening’ (TIME): Crypto leaders say passing focused stablecoin rules could cement U.S. financial leadership, but warn delays or loopholes favoring offshore firms risk undermining trust and competitiveness.

In the Ether

Uncategorized

XRP Price Surges After V-Shaped Recovery, Targets $3.40

Global economic tensions and regulatory developments continue to influence XRP’s price action, with the digital asset showing remarkable resilience despite recent volatility.

After experiencing a significant dip to $2.307 on high volume, XRP has established an upward trajectory with a series of higher lows, suggesting continued momentum as it approaches resistance levels.

Technical indicators point to a potential bullish breakout, with multiple analysts highlighting critical support at $2.35-$2.40 that must hold for upward continuation.

Technical Analysis Highlights

- Price experienced a 3.76% range ($2.307-$2.396) over 24 hours with a sharp sell-off at 16:00 dropping to $2.307 on high volume (77.9M).

- Strong support emerged at $2.32 level with buyers stepping in during high-volume periods, particularly during the 13:00-14:00 recovery.

- Asset established upward trajectory, forming higher lows from the bottom, with resistance around $2.39 tested during 07:00 session.

- In the last hour, XRP climbed from $2.358 to $2.368, representing a 0.42% gain with notable volume spikes at 01:52 and 01:55.

- Price surged past resistance at $2.36 to reach $2.366, later establishing new local highs at $2.369 during 02:03 session on substantial volume (539,987).

- Currently maintaining strength above $2.368 support level with decreasing volatility suggesting potential continuation of upward trajectory.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «XRP price path to $3.40 remains intact — Here is why«, Cointelegraph, published May 16, 2025.

- «XRP Price Watch: Bulls Eye $2.60 as Long-Term Trend Holds«, Bitcoin.com News, published May 17, 2025.

- «XRP Price Explosion To $5.9: Current Consolidation Won’t Stop XRP From Growing«, NewsBTC, published May 17, 2025.

Uncategorized

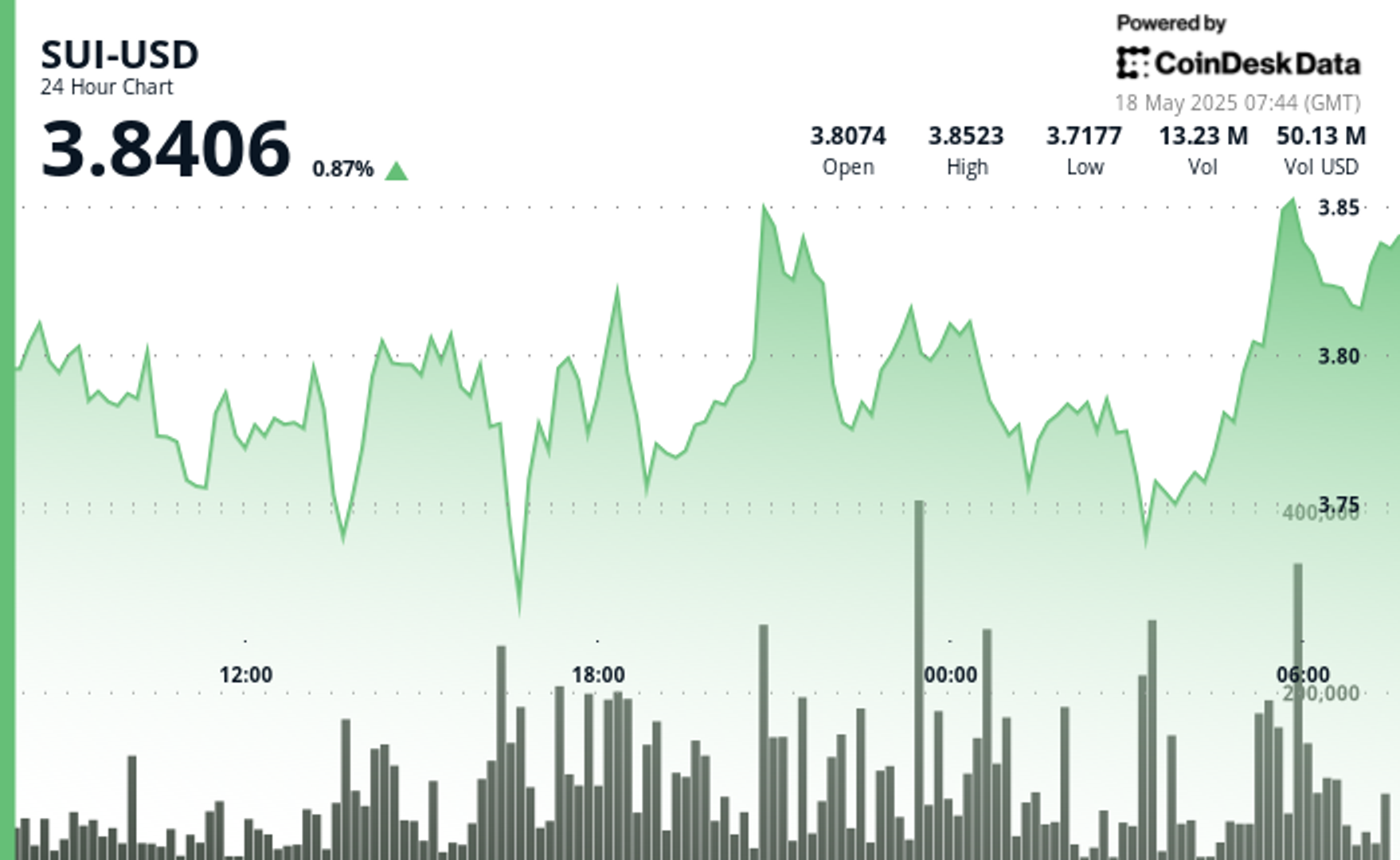

SUI Surges After Finding Strong Support at $3.75 Level

Global economic tensions and shifting trade policies continue to influence cryptocurrency markets, with SUI showing particular resilience.

The asset established a trading range of 4.46% between $3.70 and $3.86, finding strong volume support at the $3.755 level.

A notable bullish momentum emerged with price surging 1.9% on above-average volume, establishing resistance at $3.850.

The formation of higher lows throughout the latter part of the day suggests consolidation above the $3.775 support level.

Technical Analysis Highlights

- SUI established a 24-hour trading range of 0.165 (4.46%) between the low of 3.700 and high of 3.862.

- Strong volume support emerged at the 3.755 level during hours 17-18, with accumulation exceeding the 24-hour volume average by 45%.

- Notable bullish momentum occurred in the 20:00 hour with price surging 7.2 cents (1.9%) on above-average volume.

- Resistance established at 3.850 with higher lows forming throughout the latter part of the day.

- Decreasing volatility in the final hours suggests consolidation above the 3.775 support level.

- Significant buyer interest appeared between 01:27-01:30, forming a strong support zone at 3.756-3.760 with exceptionally high volume (over 300,000 units per minute).

- Decisive bullish reversal began at 01:42, establishing a series of higher lows and higher highs.

- Breakout above 3.780 occurred at 01:55, followed by consolidation near 3.785 with decreasing volume.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «Sui price up 5.16% intra-day: bullish structure remains strong«, crypto.news, published May 16, 2205.

- «SUI Set to Explode, But Don’t Sleep on XRP and Other Altcoins«, CoinPedia, May 16, 2025.

Uncategorized

Dogecoin (DOGE) Whales Accumulate 1 Billion DOGE Amid Critical Support Formation

Geopolitical tensions and evolving trade policies continue to influence cryptocurrency markets, with Dogecoin showing resilience amid broader economic uncertainty.

Despite macroeconomic headwinds, DOGE has maintained support above key moving averages while forming a potential bull flag pattern that could target $0.35 if validated by continued buying pressure.

Technical Analysis Highlights

- DOGE experienced significant volatility with a 4.3% range (0.211-0.220) over the past 24 hours, forming a key support zone around 0.212 validated by high volume rebounds at 13:00 and 22:00.

- The price action reveals a bullish recovery pattern from the 16:00 low, with resistance emerging at 0.217-0.220.

- The 20:00 candle’s strong volume surge above the 24-hour average confirms renewed buying interest, suggesting potential upward momentum if DOGE can maintain its position above the established support level.

- In the past hour, DOGE has demonstrated significant bullish momentum, climbing from 0.215 to 0.216 with notable volume spikes at 01:17, 01:21, and 01:54-01:55.

- The price established a strong support zone around 0.215 during the early minutes, followed by a decisive breakout at 01:16-01:17 where volume surged over 8 million.

- The uptrend continued with higher lows forming a clear ascending pattern, culminating in a new resistance test at 0.216-0.217 range.

- The final minutes saw particularly heavy trading activity with volumes exceeding 7 million at 02:01-02:02, confirming strong buyer interest and suggesting potential for further upside movement.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «Dogecoin Eyes $0.35 as Whale Accumulation Signals Bull Flag Breakout«, The Crypto Basic, published May 16, 2025.

- «Dogecoin Hovers at $0.22 Following Weeks of Gains, Analysts Share Mixed Outlooks«, NewsBTC, published May 17, 2025.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors