Uncategorized

Crypto Daybook Americas: Bitcoin Holds Above $100K as Iran, Israel Trade Blows

By Omkar Godbole (All times ET unless indicated otherwise)

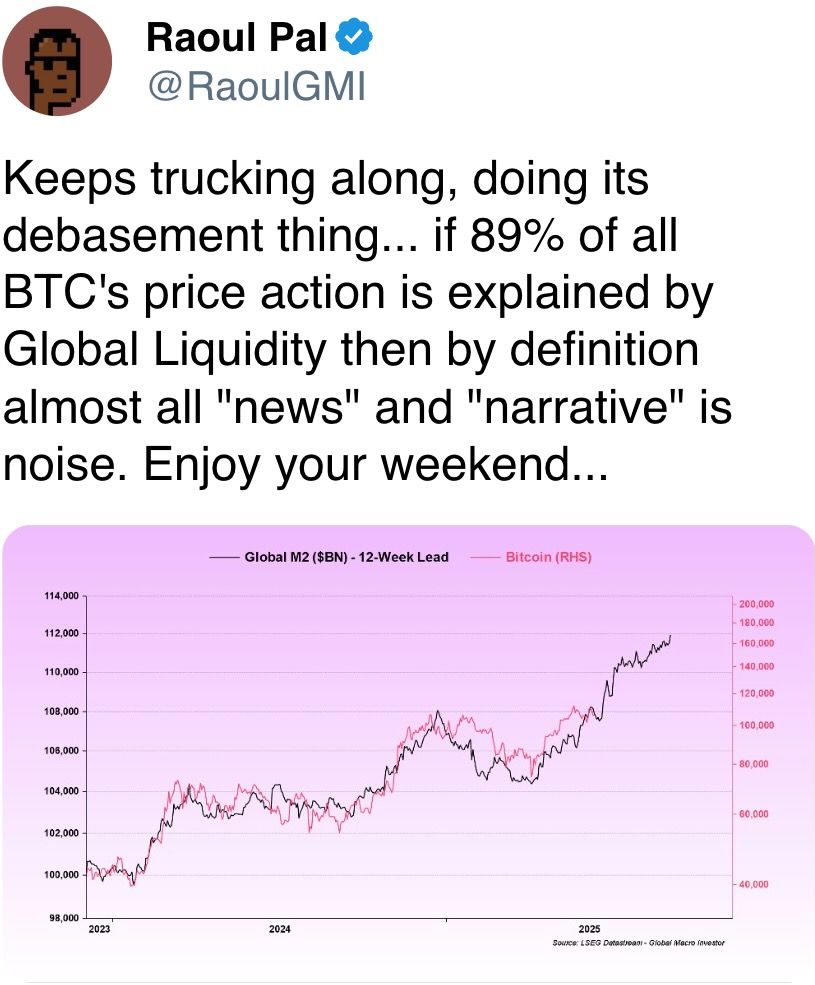

Bitcoin’s BTC continued choppy trading near January’s highs of around $110,000 has some observers drawing parallels with 2021, when the bull market ended with twin peaks closer to $70,000. Not everyone agrees.

«The market dynamics between 2021 and today are completely different,» Jeff Anderson, head of Asia at STS Digital, told CoinDesk. «BTC is evolving into a treasury asset, so it is very difficult to extrapolate chart patterns onto an asset undergoing massive structural changes.»

The price action over the weekend was «encouraging,» Anderson said, noting bitcoin’s stability at around $105,000 even as Iran and Israel traded blows. As the old saying goes: If a market does not fall too much on bad news, it indicates big players are probably going long.

According to Singapore-based QCP Capital, BTC’s resilient price is underpinned by continued institutional adoption.

«The market seems to have rediscovered its footing, particularly after BTC held above the key psychological threshold of $100K despite the initial shock,» QCP said. «Crucially, Friday’s modest 3% pullback paled in comparison to April last year, when BTC fell more than 8% amid similar Iran-Israel turmoil.»

The market composure is evident from Volmex’s 30-day implied volatility index (BVIV), which has declined to an annualized 42.7%, reversing Friday’s spike to 46.12%.

Meanwhile, the spread between ether and bitcoin implied volatilities continues to widen, a sign that ether options are becoming costlier relative to bitcoin on Deribit. The relative richness of ether options presents a good opportunity for ether holders to generate additional yield by writing or selling options, according to Anderson.

Hong Kong-listed company Meme Strategy’s share price surged over 20% after the company announced the acquisition of 2,440 Solana (SOL) tokens for approximately HK$2.9 million ($370,000). Corporate adoption of cryptocurrencies is rapidly moving beyond bitcoin and into other coins, such as ether ETH, sol SOL, and XRP XRP. However, last week, shares in Nasdaq-listed SharpLink dropped sharply after the company disclosed that it had bought ether.

The outlook for the broader altcoin market does not look so rosy as large unlocks loom.

«In the next 7 days, tokens with large one-time unlocks (over $5 million) include FTN, ZK, ARB, S, ID, APE, MELANIA, LISTA, and ZKJ. Tokens with large daily linear unlocks (over $1 million per day) include SOL, WLD, TIA, DOGE, TAO, AVAX, SUI, DOT, IP, MORPHO, ETHFI, and JTO,» newsletter service LondonCryptoClub said.

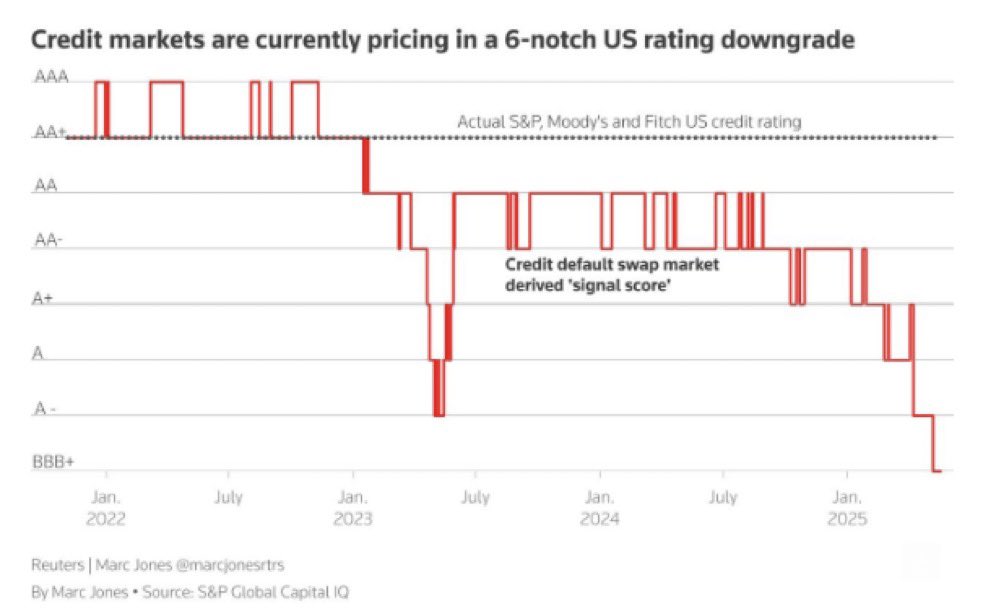

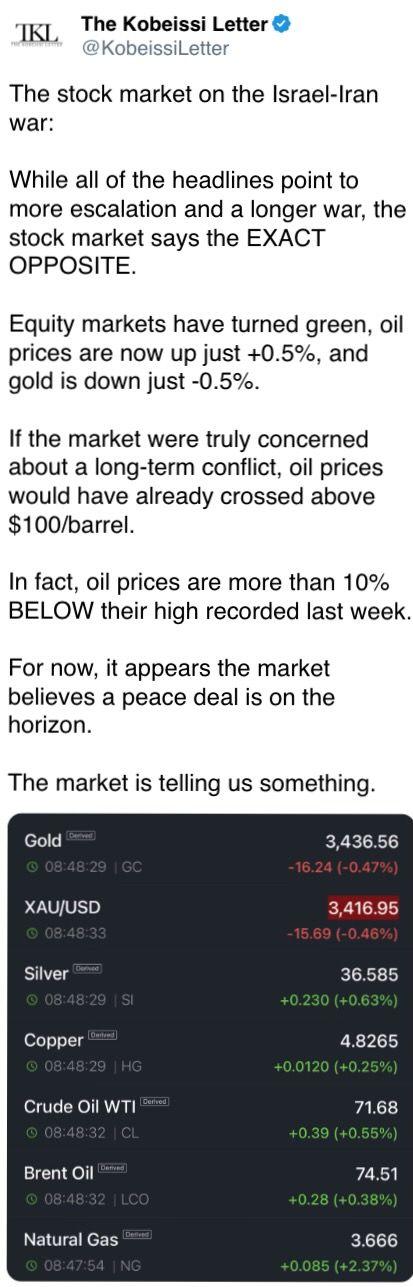

In traditional markets, futures tied to the S&P 500 signaled a steady start to the week with gains as oil prices stabilized following Friday’s surge. According to Barchart.com, credit markets are pricing in a six-level credit downgrade for the U.S., equating to a rating of BBB, just a notch above investment grade. Stay alert!

What to Watch

- Crypto

- June 16: 21Shares executes a 3-for-1 share split for the ARK 21Shares Bitcoin ETF (ARKB) on NYSE Arca; ticker and NAV remain unchanged.

- June 16: Brazil’s B3 exchange launches USD-settled ether (0.25 ETH) and solana (5 SOL) futures contracts, approved by Brazil’s securities regulator, the Comissão de Valores Mobiliários (CVM) and benchmarked to Nasdaq indices.

- June 18: At about 9:28 p.m. IoTeX L1 v2.2.0 hard fork will activate at block 36,893,881. It will halve block time to 2.5s and launch System Staking v3.

- June 20: Proof-of-stake blockchain BlackCoin (BLK) activates SegWit on mainnet, improving security and performance; mandatory upgrade to node and wallet v26.2.0 required.

- Macro

- Day 2 of 3: G7 2025 Summit (Kananaskis, Alberta, Canada)

- June 16, 11 p.m.: Bank of Japan announces monetary policy decision.

- Key Rate Est. 0.5% vs. Prev. 0.5%

- June 17, 8:30 a.m.: The U.S. Census Bureau releases May retail sales data.

- Retail Sales MoM Est. -0.7% vs. Prev. 0.1%

- Retail Sales YoY Prev. 5.2%

- June 17, 10 a.m.: National Association of Home Builders (NAHB) releases U.S. housing market data for June.

- NAHB Housing Market Index Est. 36 vs. Prev. 34

- June 17: The U.S. Senate will vote on the final passage of the bill Guiding and Establishing National Innovation for US Stablecoins (the GENIUS Act of 2025).

- Earnings (Estimates based on FactSet data)

- June 23 (TBC): HIVE Digital Technologies (HIVE), post-market, $-0.12

Token Events

- Governance votes & calls

- Compound DAO is set to vote on a proposal to create the Compound Foundation, a non-profit to drive protocol growth and strategy. It calls for an 18-month plan and requests $9 million in COMP, with voting set to begin in one day. Voting ends June 20.

- Arbitrum DAO is voting on a proposal to launch DRIP, an $80M incentives program targeting specific DeFi activity. Managed by a foundation-led committee, DRIP would reward users directly and allow the DAO to shut it down via vote. Voting ends June 20.

- ApeCoin DAO is voting on whether to sunset the decentralized autonomous organization and launch ApeCo, a new entity established by Yuga Labs with a mission to “supercharge the APE ecosystem.” Voting ends June 24.

- June 17, 12 p.m.: Lido to hist its 29th Node Operator Community Call.

- Unlocks

- June 16: Arbitrum (ARB) to unlock 1.91% of its circulating supply worth $31.45 million.

- June 17: ZKsync (ZK) to unlock 20.91% of its circulating supply worth $39.55 million.

- June 17: ApeCoin (APE) to unlock 1.95% of its circulating supply worth $10.73 million.

- June 18: Fasttoken (FTN) to unlock 4.65% of its circulating supply worth $16.81 million.

- June 30: Optimism (OP) to unlock 1.83% of its circulating supply worth $19.08 million.

- July 1: Sui (SUI) to unlock 1.3$ of its circulating supply worth $136.39 million.

- Token Launches

- June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight.

- June 16: The Future of Finance Digital Money Event 2025 (London)

- June 18-19: Canadian Blockchain Consortium’s 2nd Annual Policy Summit (Ottawa)

- June 18-19: SuperAI (Singapore)

- June 19-21: BTC Prague 2025

- June 24-26: Blockworks’ Permissionless IV (New York)

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26: The Injective Summit (New York)

- June 26-27: Istanbul Blockchain Week

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

Token Talk

By Oliver Knight

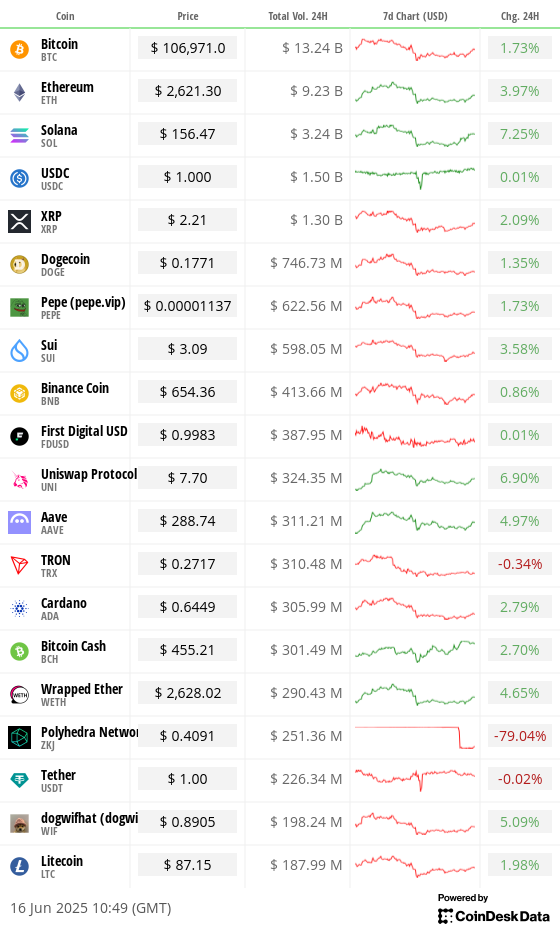

- The launch of AI blockchain Polyhedra’s ZKJ token was steeped in controversy over the weekend after the token lost 80% of its value shortly after going live.

- The token was rolled out on the Binance Alpha platform, with the exchange saying that it «experienced significant price volatilities» that was due to large holders removing on-chain liquidity to spark a liquidation cascade.

- More than $100 million worth of ZKJ derivative positions were liquidated following the sell-off, including six individual traders who lost more than $1 million each, according to Coinglass data.

- Polyhedra said in a tweet that the fundamentals of the project remains strong and that it is «closely reviewing the situation.»

- ZKJ currently trades at $0.40 after debuting at the $2.00 mark, according to CoinMarketCap.

Derivatives Positioning

- BTC, ETH perpetual funding rates have stabilized above zero over the weekend, signaling renewed confidence in bullish price prospects.

- Annualized basis in the BTC CME futures remains locked in the 5%-10% range.

- On Deribit, short-term and near-term puts traded at a premium to calls, signaling immediate downside fears.

- BTC front-end (short-term) implied volatilities remain below 40, while the S&P 500 VIX hovers near 20, both hinting at market calm despite the volatile situation in the Middle East.

Market Movements

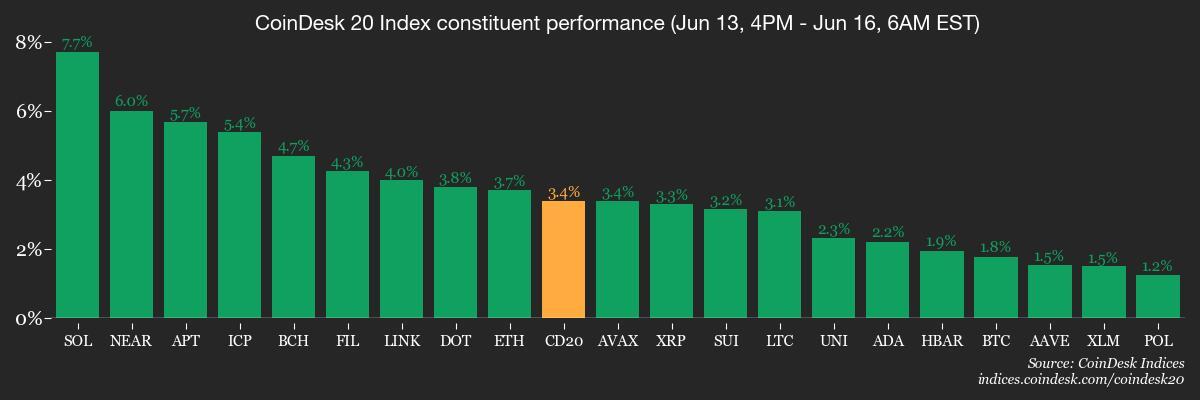

- BTC is up 2.12% from 4 p.m. ET Friday at $106,800 (24hrs: 1.56%)

- ETH is 4.75% at $2,612.88 (24hrs: 3.62%)

- CoinDesk 20 is up 3.5% at 3,116.85 (24hrs: +3.5%)

- Ether CESR Composite Staking Rate is down 22 bps at 2.87%

- BTC funding rate is at 0.0055% (6.0367% annualized) on Binance

- DXY is down 0.21% at 97.98

- Gold futures are down 0.46% at $3,437.00

- Silver futures are up 0.37% at $36.49

- Nikkei 225 closed up 1.26% at 38,311.33

- Hang Seng closed up 0.70% at 24,060.99

- FTSE is up 0.40% at 8,886.23

- Euro Stoxx 50 is up 0.46% at 5,314.97

- DJIA closed on Friday down 1.79% at 42,197.79

- S&P 500 closed down 1.13% at 5,976.97

- Nasdaq Composite closed down 1.30% at 19,406.83

- S&P/TSX Composite closed down 0.42% at 26,504.35

- S&P 40 Latin America closed up NA NA

- U.S. 10-Year Treasury rate is up NA NA

- E-mini S&P 500 futures are up 0.48% at 6,007.75

- E-mini Nasdaq-100 futures are up 0.55% at 21,762.50

- E-mini Dow Jones Industrial Average Index are up 0.41% at 42,381.00

Bitcoin Stats

- BTC Dominance: 64.6 (-0.18%)

- Ethereum to bitcoin ratio: 0.02454 (1.70%)

- Hashrate (seven-day moving average): 928 EH/s

- Hashprice (spot): $53.55

- Total Fees: 2.63 BTC / $277,146

- CME Futures Open Interest: 150,970

- BTC priced in gold: 30.9 oz

- BTC vs gold market cap: 8.76%

Technical Analysis

- A new green brick appeared on bitcoin’s three-line break chart on June 9, signaling bullish momentum is still intact.

- In other words, the path of least resistance is to the higher side despite tensions in the Middle East.

Crypto Equities

- Strategy (MSTR): closed on Friday at $382.87 (+0.82%), pre-market up 1.6% at $389

- Coinbase Global (COIN): closed at $242.71 (+0.69%), pre-market up 2.7% at $249.27

- Circle (CRCL): closed at $133.56 (+25.36%), pre-market up 8.7% at $145.50

- Galaxy Digital Holdings (GLXY): closed at C$25.58 (-3.25%)

- MARA Holdings (MARA): closed at $15.04 (-4.93%), pre-market up 1.66% at $15.29

- Riot Platforms (RIOT): closed at $9.72 (-4.8%), pre-market up 1.85% at $9.90

- Core Scientific (CORZ): closed at $11.89 (-2.06%), pre-market up 2.87% at $12.23

- CleanSpark (CLSK): closed at $9.3 (-4.22%), pre-market up 2.37% at $9.52

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $18.86 (-3.82%)

- Semler Scientific (SMLR): closed at $29.58 (-3.77%), pre-market up 3.28% at $30.55

- Exodus Movement (EXOD): closed at $31.37 (-0.79%)

ETF Flows

Spot BTC ETFs

- Daily net flow: $301.7 million

- Cumulative net flows: $45.59 billion

- Total BTC holdings ~ 1.21 million

Spot ETH ETFs

- Daily net flow: -$2.1 million

- Cumulative net flows: $3.87 billion

- Total ETH holdings ~ 3.96 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart shows the sovereign signal score derived from the credit default swap markets.

- It shows the markets are expecting major rating agencies to downgrade the U.S. sovereign rating to BBB in the coming months.

While You Were Sleeping

- Metaplanet Overtakes Coinbase With 10K BTC, Becomes No. 9 Bitcoin Holder (CoinDesk): The firm bought 1,112 BTC for $117.2 million, raising its total stash to $947 million at an average cost of $94,697 per bitcoin.

- Bitcoin Price Volatility Signal Goes Off – Is a Surge Ahead? (CoinDesk): A narrowing Bollinger band gap is expected to widen as the MACD flips positive, signaling a possible return of volatility that has historically preceded strong price rallies.

- Vietnam Passes Landmark Law Recognizing Crypto Assets (CoinDesk): Vietnam’s Digital Technology Industry Law distinguishes crypto from other digital assets by its use of encryption to validate creation and transfers. It takes effect Jan. 1, 2026.

- Israel Takes Control of Iran’s Skies—a Feat That Still Eludes Russia in Ukraine (The Wall Street Journal): After knocking out air defenses in western Iran, Israel has shifted to using older F-15 and F-16 jets and inexpensive guided bombs to sustain its air campaign more efficiently.

- Oil Options Attract Bulls in Heavy Trade as Mideast Risks Expand (Bloomberg): Thousands of Brent crude $80–$100 calls traded early Monday as volatility surged, with traders bracing for escalation and potential supply shocks if Iran disrupts flows through the Strait of Hormuz.

- China’s Factories Slow, Consumers Unexpectedly Perk Up (Reuters): Although China’s industrial output grew just 5.8% in May, its slowest pace in six months, retail sales jumped 6.4% on subsidies and an early start to the «618» shopping festival.

In the Ether

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Gemini Shares Slide 6%, Extending Post-IPO Slump to 24%

Gemini Space Station (GEMI), the crypto exchange founded by Cameron and Tyler Winklevoss, has seen its shares tumble by more than 20% since listing on the Nasdaq last Friday.

The stock is down around 6% on Tuesday, trading at $30.42, and has dropped nearly 24% over the past week. The sharp decline follows an initial surge after the company raised $425 million in its IPO, pricing shares at $28 and valuing the firm at $3.3 billion before trading began.

On its first day, GEMI spiked to $45.89 before closing at $32 — a 14% premium to its offer price. But since hitting that high, shares have plunged more than 34%, erasing most of the early enthusiasm from public market investors.

The broader crypto equity market has remained more stable. Coinbase (COIN), the largest U.S. crypto exchange, is flat over the past week. Robinhood (HOOD), which derives part of its revenue from crypto, is down 3%. Token issuer Circle (CRCL), on the other hand, is up 13% over the same period.

Part of the pressure on Gemini’s stock may stem from its financials. The company posted a $283 million net loss in the first half of 2025, following a $159 million loss in all of 2024. Despite raising fresh capital, the numbers suggest the business is still far from turning a profit.

Compass Point analyst Ed Engel noted that GEMI is currently trading at 26 times its annualized first-half revenue. That multiple — often used to gauge whether a stock is expensive — means investors are paying 26 dollars for every dollar the company is expected to generate in sales this year. For a loss-making company in a volatile sector, that’s a steep price, and could be fueling investor skepticism.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars