Uncategorized

Crypto Daybook Americas: Bitcoin ETFs, Frog-Themed Tokens See Renewed Interest

By Omkar Godbole (All times ET unless indicated otherwise)

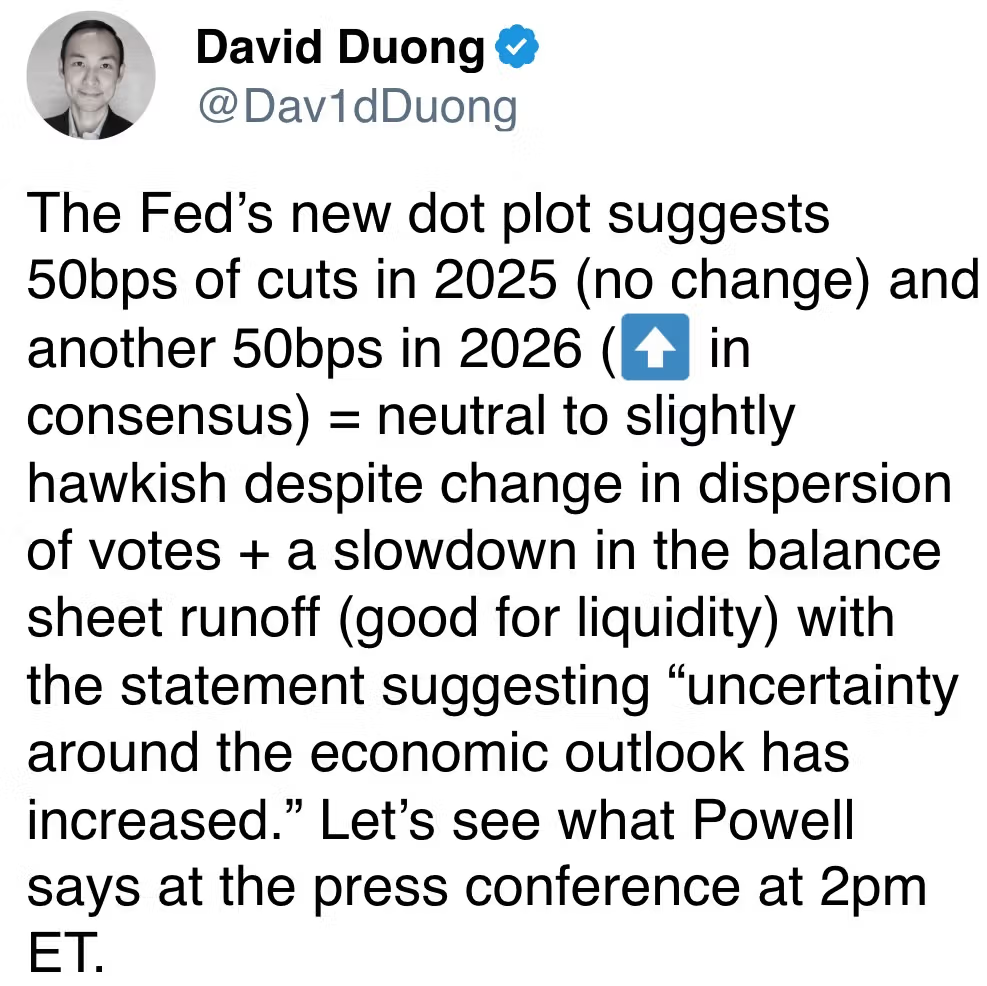

Bitcoin (BTC), ether (ETH) and the broader crypto market are facing renewed pressure, reversing some of gains made after Federal Reserve Chairman Jerome Powell downplayed concerns about tariff-driven inflation .

President Donald Trump is reportedly scheduled to speak at Blockworks’ Digital Asset Summit in New York later, with traders keen to hear how the administration plans to acquire BTC in a budget-neutral manner. Don’t get too excited, the likelihood of such an announcement remains low.

Trump is more likely to reiterate his aspiration to make America the «crypto capital of the world,» and even this may overwhelm markets.

On a more positive note, renewed interest in U.S.-listed spot ETFs supports market strength. On Wednesday, bitcoin ETFs experienced a total net inflow of $11.8 million, a fourth consecutive day of positive flows, according to Farside Investors. In contrast, ether spot ETFs recorded a net outflow of $11.7 million, extending a streak of withdrawals to 11 straight days.

«Several catalysts continue to support a bullish outlook,» Blockhead Research Network said. «The U.S. government exploring budget-neutral ways to accumulate bitcoin could be a game-changing factor for this cycle. Additionally, solana futures being added to the CME is a major bullish indicator for altcoins, potentially increasing institutional exposure to SOL.»

Speaking of on-chain flows, data from IntoTheBlock reveals that whales now hold some 62,000 more BTC than they did at the beginning of the month, indicating a resurgence in accumulation following nearly a year of declining balances. XRP whales have also been buying over the past two months.

For its part, the SUI token has remained resilient, looking to build on its Wednesday gains in the wake of Canary Capital Group, an institutional crypto trading and management firm, filing for a Sui exchange-traded fund (ETF) with the SEC.

In wider market news, a domain claim page for Hyperlane, an open interoperability framework, surfaced, sparking speculation of a potential token airdrop on social media.

Traditional markets offered mixed cues, with dollar-yen staring at a death cross pattern, teasing a major surge ahead in the Japanese currency, which is seen as an anti-risk holding. Meanwhile, copper neared a record high in a positive sign for risky assets. Stay alert!

What to Watch

Crypto:

March 20, 9:30 a.m.: Bitnomial to debut what it claims are the first-ever CFTC-regulated XRP futures in the U.S.

March 20, 9:30 a.m.: Volatility Shares is introducing two Solana (SOL) futures ETFs: Volatility Shares Solana ETF (SOLZ) and Volatility Shares 2X Solana ETF (SOLT).

March 20, 10:40 a.m.: President Trump is expected to address Blockworks’ Digital Asset Summit in New York in a recording.

March 21, 1:00 p.m.: The SEC’s Crypto Task Force hosts a roundtable, open to the public, that will focus on the definition of a security.

March 24 (before market open): Bitcoin miner CleanSpark (CLSK) will join the S&P SmallCap 600 index.

March 24, 11:00 a.m.: Bugis network upgrade goes live on Enjin Matrixchain mainnet.

March 25: The Mimir upgrade goes live on Chromia (CHR) mainnet.

March 26, 3:37 a.m.: Ethereum’s Hoodi testnet will activate the Pascal hard fork network upgrade at epoch 2048.

Macro

March 20, 8:00 a.m.: The Bank of England announces its interest rate decision.

Bank Rate Est. 4.5% vs. Prev. 4.5%

March 20, 8:30 a.m.: The U.S. Department of Labor releases employment data for the week ended March 15.

Initial Jobless Claims Est. 224K vs. Prev. 220K

Continuing Jobless Claims Est. 1890K vs. Prev. 1870K

March 20, 3:00 p.m.: Argentina’s National Institute of Statistics and Census releases Q4 employment data.

Unemployment Rate Prev. 6.9%

March 20, 7:30 p.m.: Japan’s Ministry of Internal Affairs & Communications releases February consumer price index (CPI) data.

Core Inflation Rate YoY Est. 2.9% vs. Prev. 3.2%

Inflation Rate MoM Prev. 0.5%

Inflation Rate YoY Prev. 4%

March 21, 6:30 a.m.: The Bank of Russia is expected to announce its interest rate decision.

Key Rate Est. 21% vs. Prev. 21%

Earnings (Estimates based on FactSet data)

March 27: KULR Technology Group (KULR), post-market, $-0.02

March 28: Galaxy Digital Holdings (GLXY), pre-market, C$0.38

Token Events

Governance votes & calls

DYdX DAO is voting on implementing a buyback program that would allocate 25% of the dYdX protocol revenue to it.

Balancer DAO is discussing migrating the ProtocolFeeController to introduce off-chain protocol fee tracking, improved contract storage and resolve other shortcomings.

March 21, 11:30 a.m.: Flare to host an X Spaces session on Flare 2.0.

March 25, 1 a.m.: Crypto.com to hold an Ask Me Anything (AMA) session with co-founder and CEO Kris Marszalek.

Unlocks

March 21: Immutable (IMX) to unlock 1.39% of circulating supply worth $14.13 million.

March 23: Metars Genesis (MRS) to unlock 11.87% of its circulating supply worth $240.90 million.

March 31: Optimism (OP) to unlock 1.93% of its circulating supply worth $28.06 million.

April 1: Sui (SUI) to unlock 2.03% of its circulating supply worth $158.56 million.

April 3: Wormhole (W) to unlock 47.64% of its circulating supply worth $117.81 million.

April 7: Kaspa (KAS) to unlock 0.59% of its circulating supply worth $12.31 million.

Token Listings

March 20: Jupiter (JUP) to be listed on Binance.US.

March 31: Binance to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 3 of 3: Digital Asset Summit 2025 (New York)

Day 3 of 3: Fintech Americas Miami 2025

Day 2 of 2: Next Block Expo (Warsaw)

March 24-26: Merge Buenos Aires

March 25-26: PAY360 2025 (London)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

March 26-28: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

Token Talk

By Shaurya Malwa

Frog-themed tokens jumped Thursday, with a KEKIUS MAXIMUS token zooming 96% after Elon Musk posted a picture housing a «Kekius Maximus» portrait on X.

He responded «ok» to a user’s suggestion that he change his display name to «Kekius Maximus,» amplifying attention on frog-related memes and tokens. The name is linked to existing frog-themed coins like pepe, featuring a frog dressed up as a Roman gladiator.

Musk’s endorsement sparked speculation about whether he’s hinting at backing the existing KEKIUS token or just joining the day’s festivities — albeit creating volatility in such tokens.

The phrase surged in visibility when Musk first made Kekius Maximus his display name on X on Dec. 31.

The Kek connection also nods to the «Cult of Kek,» a tongue-in-cheek internet phenomenon linking the term to an ancient Egyptian frog-headed deity of chaos and darkness.

The eponymous token issued at the time jumped to a market capitalization of nearly $200 million shortly after issuance only to crater more than 95% after the initial hype subsided.

Memecoins tend to surge when Musk references them due to his massive influence and cult-like following. Such tokens are often sentiment-driven and thrive on such attention turning Musk’s playful nods — like a mere mention — into price catalysts.

Derivatives Positioning

BTC global futures open interest has increased to $13.3 billion, the highest since March 4, Coinglass data show. ETH open interest remains below $2 billion.

Basis in the CME’s BTC one-month futures has dropped below an annualized 5% despite overnight price gains, suggesting a lack of participation from institutional traders. ETH basis remains around 5%.

DOGE, APT, XMR, BCH, XRP, LTC, ADA and NEAR see negative cumulative volume delta, implying net selling amid the price bounce.

Deribit’s BTC options have flipped bullish, with front and near-dated calls now trading pricier than puts. ETH, however, lags in sentiment.

Market Movements:

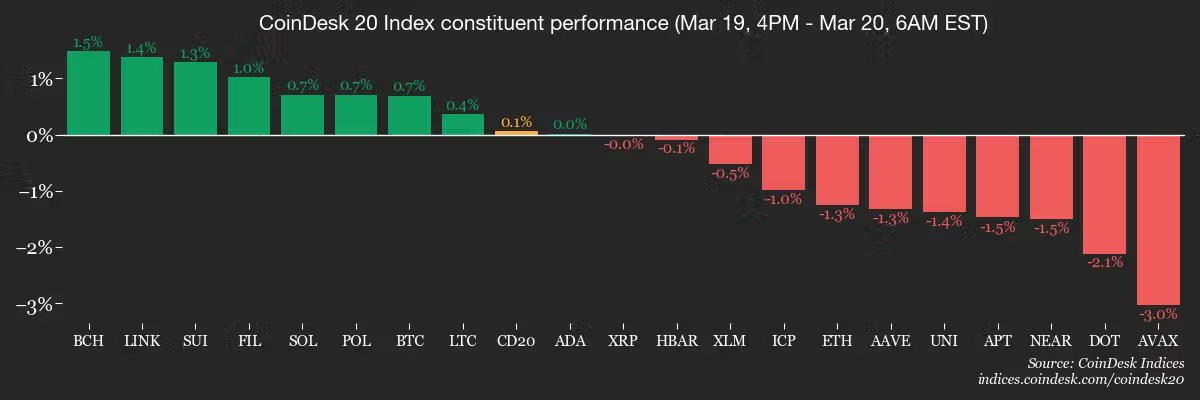

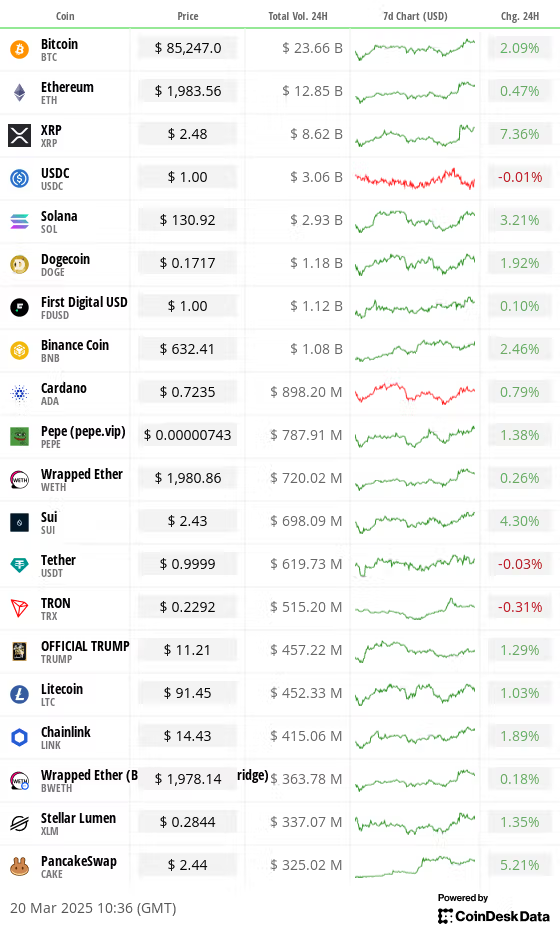

BTC is down 0.26% from 4 p.m. ET Wednesday at $83,576.60 (24hrs: +2.07%)

ETH is down 2.85% at $1,980.15 (24hrs: +0.3%)

CoinDesk 20 is down 0.96% at 2,711.65 (24hrs: +3.04%)

Ether CESR Composite Staking Rate is up 5 bps at 3.02%

BTC funding rate is at 0.0043% (4.74% annualized) on Binance

DXY is up 0.46% at 103.90

Gold is up 0.19% at $3,039.20/oz

Silver is down 0.19% at $33.49/oz

Nikkei 225 closed on Wednesday -0.25% at 37,751.88

Hang Seng closed on Thursday -2.23% at 24,219.95

FTSE is down 0.33% at 8,678.09

Euro Stoxx 50 is down 0.92% at 5,456.82

DJIA closed on Wednesday +0.92% at 41,964.63

S&P 500 closed +1.08% at 5,675.29

Nasdaq closed +1.41% at 17,750.79

S&P/TSX Composite Index closed +1.47% at 25,069.21

S&P 40 Latin America closed +0.77% at 2,495.85

U.S. 10-year Treasury rate is down 2 bps at 4.22%

E-mini S&P 500 futures are down 0.1% at 5,724.00

E-mini Nasdaq-100 futures are down 0.16% at 19,919.00

E-mini Dow Jones Industrial Average Index futures are unchanged at 42,290.00

Bitcoin Stats:

BTC Dominance: 61.60 (0.04%)

Ethereum to bitcoin ratio: 0.02327 (-1.90%)

Hashrate (seven-day moving average): 804 EH/s

Hashprice (spot): $48.76

Total Fees: 5.28 BTC / $453,536

CME Futures Open Interest: 154,690 BTC

BTC priced in gold: 27.9 oz

BTC vs gold market cap: 7.91%

Technical Analysis

Nvidia (NVDA), the Nasdaq heavyweight, has triggered a head-and-shoulders breakdown, hinting at a bullish-to-bearish trend change.

The breakdown offers bearish cues to risk assets.

The 90-day correlation between NVDA and bitcoin is 0.6.

Crypto Equities

Strategy (MSTR): closed on Wednesday at $304.23 (+7.43%), down 2.58% at $296 in pre-market

Coinbase Global (COIN): closed at $189.75 (+4.75%), down 2.16% at $185.20

Galaxy Digital Holdings (GLXY): closed at C$17.70 (+3.57%)

MARA Holdings (MARA): closed at $12.53 (+3.81%), down 1.68% at $12.32

Riot Platforms (RIOT): closed at $7.78 (+5.14%), up 0.39% at $7.75

Core Scientific (CORZ): closed at $8.68 (+8.23%), down 0.12% at $8.67

CleanSpark (CLSK): closed at $8.01 (+5.53%), down 1.12% at $7.92

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $15.20 (+6.67%), down 6.12% at $14.27

Semler Scientific (SMLR): closed at $40.04 (+12.82%), down 3.25% at $38.74

Exodus Movement (EXOD): closed at $40.75 (+34.67%)

ETF Flows

Spot BTC ETFs:

Daily net flow: $11.8 million

Cumulative net flows: $35.88 billion

Total BTC holdings ~ 1,119 million.

Spot ETH ETFs

Daily net flow: -$11.7 million

Cumulative net flows: $2.46 billion

Total ETH holdings ~ 3.450 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

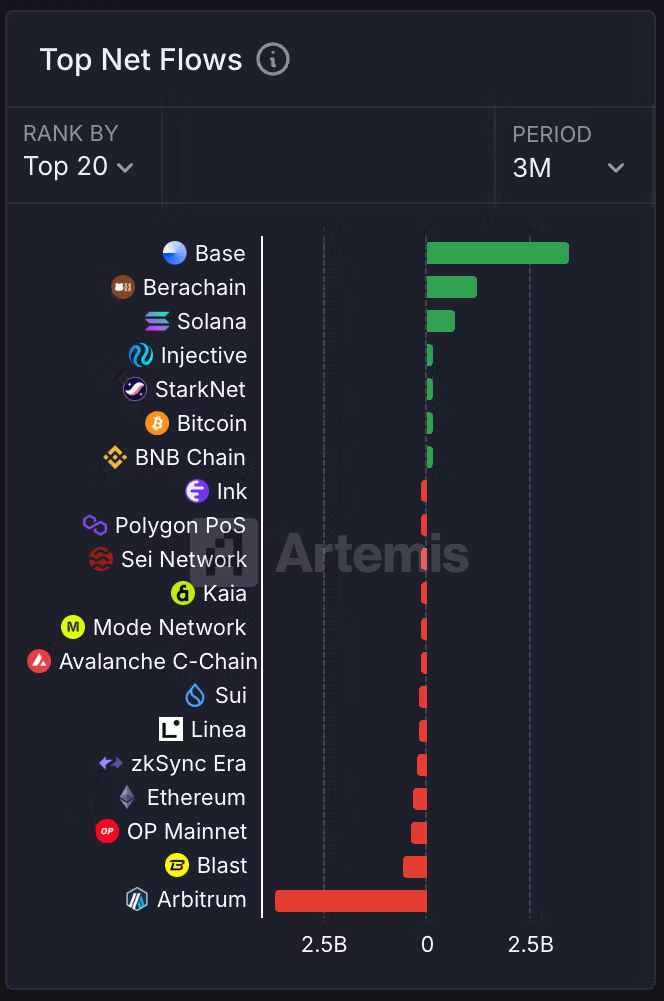

Coinbase’s layer 2 scaling solution Base maintains its lead over other chains as the platform with the highest dollar value of coins received through crypto bridges.

Berachain and Solana take the No. 2 and No. 3 positions with Arbitrum at the bottom with most outflows.

While You Were Sleeping

Bitcoin Traders Seek Topside Option Plays After Powell Remark, Ether Lags in Sentiment (CoinDesk): Bitcoin options signal renewed bullishness after the Fed decision, while ether options stay cautious.

XRP Whales Boost Coin Stash by Over 6% in Two Months, Blockchain Data Shows (CoinDesk): XRP fell 20% to $2.45 in two months, yet Santiment data shows large traders increased holdings by 6.5% to 46.4 billion XRP. Network activity surged sixfold in March.

Lagarde Says Rising Uncertainty Means ECB Can’t Commit on Rates (Bloomberg): The ECB president said a 25% U.S. tariff on European imports could weaken eurozone growth and create inflation uncertainty, as retaliation and a weaker euro may push prices higher.

Trump Considers Extending Chevron License to Pump Oil in Venezuela (The Wall Street Journal): The Trump administration is reportedly working on a plan to allow Chevron to stay in Venezuela while penalizing countries that buy oil from the South American country.

Berlin Debt Splurge Turns Screws on Flagging German Property (Reuters): Germany’s 500 billion euro ($540 billion) borrowing plan is pushing up bond yields, worsening financing conditions for property firms already hit by falling prices and weak demand.

In the Ether

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Gemini Shares Slide 6%, Extending Post-IPO Slump to 24%

Gemini Space Station (GEMI), the crypto exchange founded by Cameron and Tyler Winklevoss, has seen its shares tumble by more than 20% since listing on the Nasdaq last Friday.

The stock is down around 6% on Tuesday, trading at $30.42, and has dropped nearly 24% over the past week. The sharp decline follows an initial surge after the company raised $425 million in its IPO, pricing shares at $28 and valuing the firm at $3.3 billion before trading began.

On its first day, GEMI spiked to $45.89 before closing at $32 — a 14% premium to its offer price. But since hitting that high, shares have plunged more than 34%, erasing most of the early enthusiasm from public market investors.

The broader crypto equity market has remained more stable. Coinbase (COIN), the largest U.S. crypto exchange, is flat over the past week. Robinhood (HOOD), which derives part of its revenue from crypto, is down 3%. Token issuer Circle (CRCL), on the other hand, is up 13% over the same period.

Part of the pressure on Gemini’s stock may stem from its financials. The company posted a $283 million net loss in the first half of 2025, following a $159 million loss in all of 2024. Despite raising fresh capital, the numbers suggest the business is still far from turning a profit.

Compass Point analyst Ed Engel noted that GEMI is currently trading at 26 times its annualized first-half revenue. That multiple — often used to gauge whether a stock is expensive — means investors are paying 26 dollars for every dollar the company is expected to generate in sales this year. For a loss-making company in a volatile sector, that’s a steep price, and could be fueling investor skepticism.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars