Business

Crypto Adoption in Emerging Markets Poses Risks to Financial Resilience: Moody’s

Cryptocurrency adoption in emerging markets poses risks to monetary sovereignty and financial resilience, credit ratings giant Moody’s Ratings said in a report on Thursday.

The risks are most acute in areas where crypto’s use extends beyond investment into savings and remittances, according to the report. Moody’s suggests that higher penetration of stablecoins pegged to the U.S. dollar weaken monetary transmission when it leads to pricing and settlement increasingly occurring outside a market’s domestic currency.

Stablecoins are crypto tokens pegged to the value of a traditional financial asset, such as a fiat currency, with the U.S. dollar comfortably the most prevalent.

«This creates ‘cryptoization’ pressures analogous to unofficial dollarization, but withgreater opacity and less regulatory visibility,» Moody’s said.

Cryptocurrency can also provide new ways of for capital flight, through pseudonymous wallets and offshore exchange, allowing individuals to move wealth abroad discreetly, undermining exchange rate stability, according to the report.

Moody’s also highlighted how increased ownership of cryptocurrency has been concentrated in emerging markets, particularly in Southeast Asia, Africa and parts of Latin America. Here, adoption is often driven by inflationary pressure, currency pressured and limited access to banking services. In contrast, adoption in more advanced economies, adoption is driven by institutional integration and regulatory clarity.

Crypto ownership expanded to an estimated 562 million people by 2024, an increase of 33% from 2023, the report said.

Read More: Stablecoin Adoption Set to Surge After GENIUS Act, Hit $4T in Cross-Border Volume: EY Survey

Business

Crypto Exchange Ripio Reveals $100M Crypto Treasury, Second Largest in Latin America

The company’s holdings, which include bitcoin and ether, have been managed through trading and hedging strategies since 2017.

Business

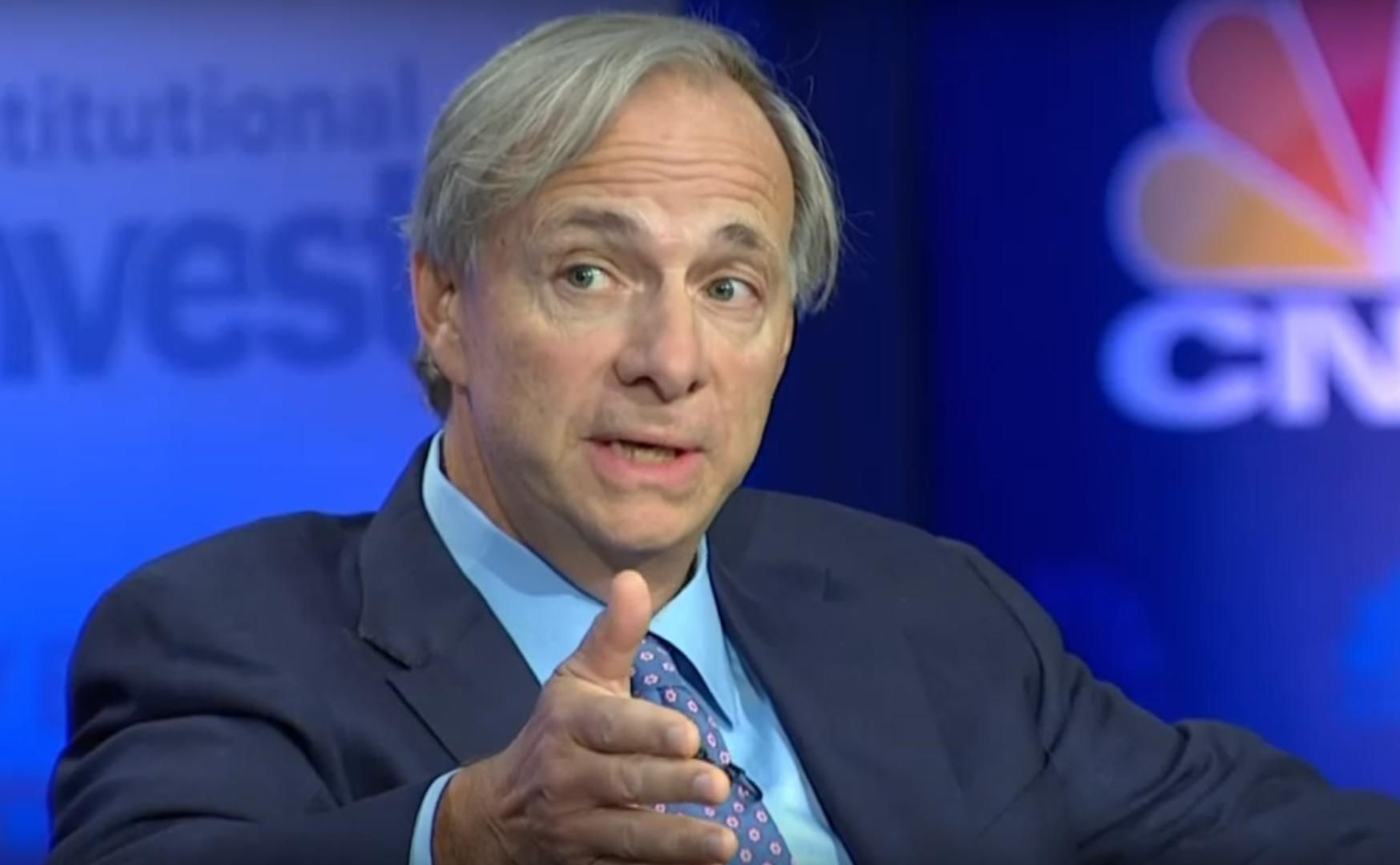

Ray Dalio Still Owns Bitcoin, but Says Traceability and Quantum Threat Are Concerns

The billionaire founder of hedge fund Bridgewater believes Bitcoin faces major hurdles before it can become a global reserve currency.

Business

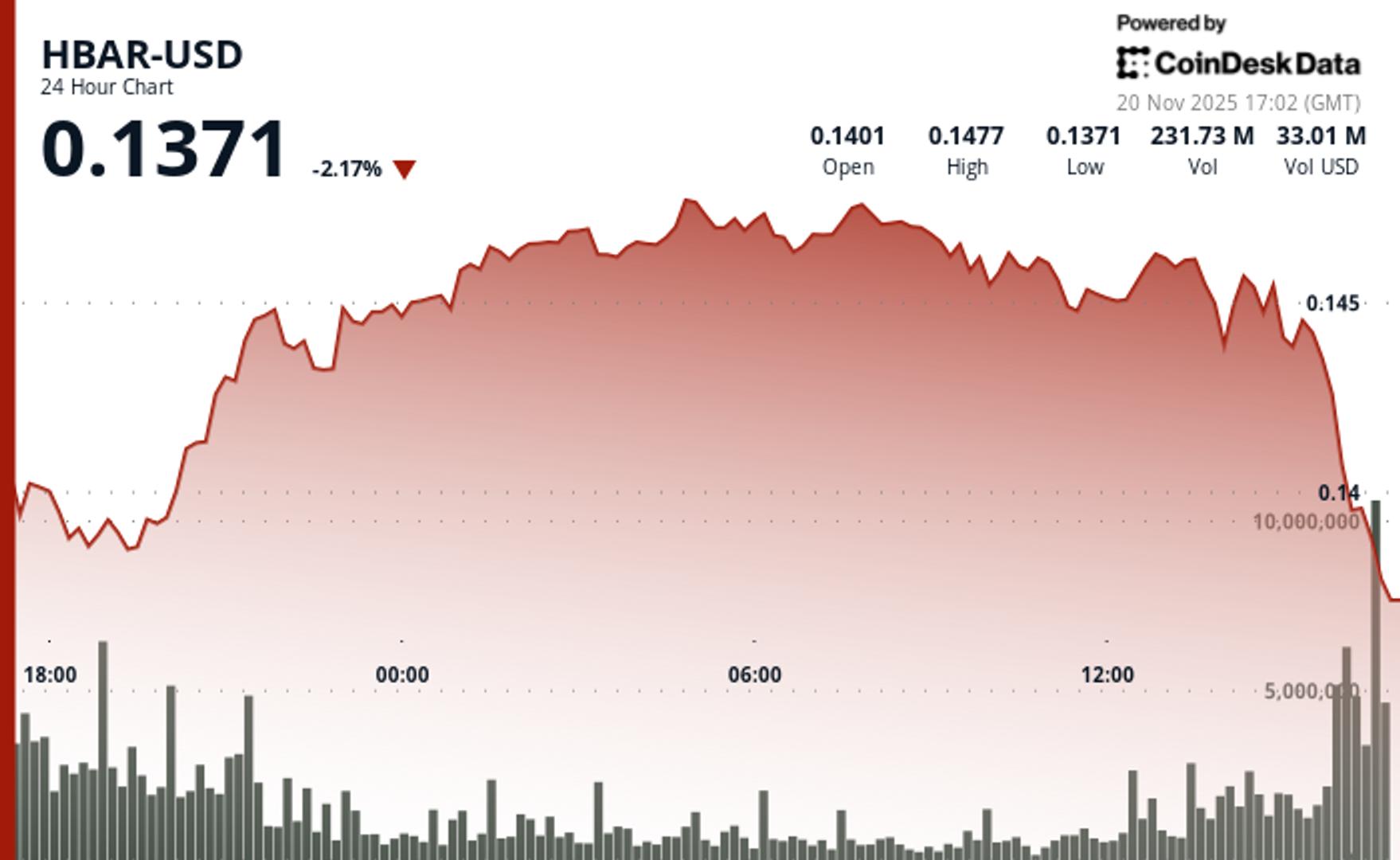

HBAR Faces Fresh Liquidity Alarms After Breakdown to $0.1373

Hedera’s token slipped below key support levels as a late-session trading halt, collapsing volume, and failed recovery attempts point to mounting structural and liquidity stress.

-

Uncategorized5 месяцев ago

Uncategorized5 месяцев agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business1 год ago

Business1 год ago3 Ways to make your business presentation more relatable

-

Fashion1 год ago

Fashion1 год agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment1 год ago

Entertainment1 год ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment1 год ago

Entertainment1 год ago10 Artists who retired from music and made a comeback

-

Business1 год ago

Business1 год ago15 Habits that could be hurting your business relationships

-

Entertainment1 год ago

Entertainment1 год agoNew Season 8 Walking Dead trailer flashes forward in time

-

Entertainment1 год ago

Entertainment1 год agoMeet Superman\’s grandfather in new trailer for Krypton