Uncategorized

Coinbase’s SEC Documents Reveal NY Attorney General Wanted ETH Declared Security

The New York State Attorney General asked the U.S. Securities and Exchange Commission to openly declare Ethereum’s ether (ETH) was a security, not a commodity, during the state’s prosecution of KuCoin in 2023, according to a document revealed by Coinbase Inc. in a trove of agency communications released on Wednesday.

Shamiso Maswoswe, chief of the Investor Protection Bureau for the New York AG, hoped the federal watchdog would weigh in during the court dispute by filing a brief on its ETH view, according to a document produced through a Freedom of Information Act request Coinbase filed with the SEC.

«We would like to request that the SEC file an amicus in support of the argument that Ether is a security,» she wrote in the request. «Whether it is or not will not be dispositive in our case (we have authority over both securities and commodities) — but I think it would be beneficial to investor protection to get a court to hold that Ether is a security.»

This and other private crypto-related messages sent and received inside the SEC were made available on Wednesday as Coinbase opened online access to more documents it’s gained in legal tussles with federal authorities. The company’s earlier releases of documents included a range of letters from the Federal Deposit Insurance Corp. that backed up industry contentions that U.S. banking regulators actively pressured banks to maintain a distance from crypto.

In New York’s 2023 request, it didn’t get what it asked for as the SEC kept the agency’s ETH views largely locked down. The U.S. agency had signaled an early view that ETH was likely a commodity, then it seemed to waver after the protocol shifted to a proof-of-stake consensus mechanism, but the SEC ultimately fell into a stance implying ETH is a commodity, like bitcoin (BTC).

Read More: New York Attorney General Alleges Ether Is a Security in KuCoin Lawsuit

Such wrestling over jurisdictional definitions is at the heart of the crypto industry’s longstanding dispute with U.S. regulators, which has eased now that President Donald Trump has set a crypto-friendly tone in his administration, including with his choice of the new SEC chairman, Paul Atkins. The agency has been steadily issuing statements about aspects of the digital assets sector it considers outside its securities realm.

For New York’s case, the outcome didn’t matter much, because its Department of Financial Services regulates both securities and commodities under one roof, unlike the federal government’s oversight regime that splits between the SEC and Commodity Futures Trading Commission.

In December of 2023, New York secured a $22 million settlement with KuCoin over its failure to register as an exchange in the state, in which state Attorney General Letitia James noted she would «continue to take action against any company that brazenly disregards the law and jeopardizes New Yorkers’ savings and investments.»

Read More: KuCoin to Pay $22M, Exit New York to Settle State Suit

Other SEC communications show a continued interest in the categorization of crypto assets and the U.S. oversight gaps in digital assets.

One email revealed the agency was thinking in 2021 about Ripple and XRP, and whether the blockchain was centralized or decentralized. The SEC had begun a long-running legal battle with Ripple the year before when it accused the company of operating illegally in the U.S., but that case ended recently in Ripple’s favor — with the company even getting money back from the agency that had been demanded in an earlier fine.

Uncategorized

Solana’s 18 Month Long Bull Run Against Ether is Over; XRP Ends Mini-Uptrend

This is a daily technical analysis by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

Programmable blockchain Solana is on course to flip its rival and leading smart contract blockchain Ethereum in terms of market capitalization, several observers have said it in recent months.

However, for now, Ethereum’s native token ether ETH seems to have an upper hand over Solana’s SOL SOL , according to technical analysis.

The SOL/ETH ratio has dived out of an upward sloping trendline connecting lows in September 2023, June 2024 and December 2024, per data source TradingView. In other words, tables have turned in ETH’s favor and the token could outperform SOL in the near-term.

Additionally, the weekly chart MACD histogram is printing red, indicating a strengthening of the downside momentum.

The immediate support is seen at 0.055 (the Feb. 25 low). The pair needs to move back above the Ichimoku cloud to negate the SOL bearish outlook.

XRP loses uptrend

Another coin showing a shift in market trend is XRP, the cryptocurrency designed for cross-border payments.

XRP has dived out of a bullish ascending channel, marking the recovery from the early April lows near $1.6.

The breakdown has exposed support at $2, which acted as floor several times early this year. Should the buyers fail to defend that, a deeper slide to $1.60 could be seen.

On the higher side, the recent high of $2.65 is the level to beat for the bulls.

Uncategorized

Vaulta, Fosun Team Up to Power Blockchain Infrastructure in Hong Kong

Vaulta, formerly known as EOS Network, and its digital banking platform have teamed up with Fosun Wealth Holdings to bring blockchain infrastructure to Hong Kong’s financial sector, the companies said.

The partnership centers around “FinChain,” a virtual asset business launched by Fosun Wealth Holdings, which is part of the Fosun International conglomerate.

That conglomerate includes various businesses, including regional insurance and healthcare leaders in Europe, Asia, and the Americas.

Vaulta will supply its full BankingOS suite, while exSat, Vaulta’s digital banking platform, will serve as the on-chain banking layer for asset issuance, yield generation, and crypto payments, according to a press release shared with CoinDesk.

The deal allows Vaulta and exSat to tap into Fosun’s existing financial licenses and real-world asset (RWA) issuance capabilities, giving them a regulatory springboard to scale blockchain-native banking services.

For Zhao Chen, Director of Digital Assets at Fosun Wealth, the collaboration brings the necessary infrastructure to roll out next-gen financial products.

«Vaulta and exSat bring the product vision and digital banking capabilities we need to make FinChain a reality,» he said in the announcement.

The initiative is part of Vaulta’s broader rebrand and expansion into institutional-grade blockchain finance. The partnership is expected to lead to more collaborations focused on Web3 financial infrastructure across Asia and beyond.

Uncategorized

Crypto Daybook Americas: Bitcoin, Ether Rise After Court Nixes Trump’s Tariffs

By Omkar Godbole (All times ET unless indicated otherwise)

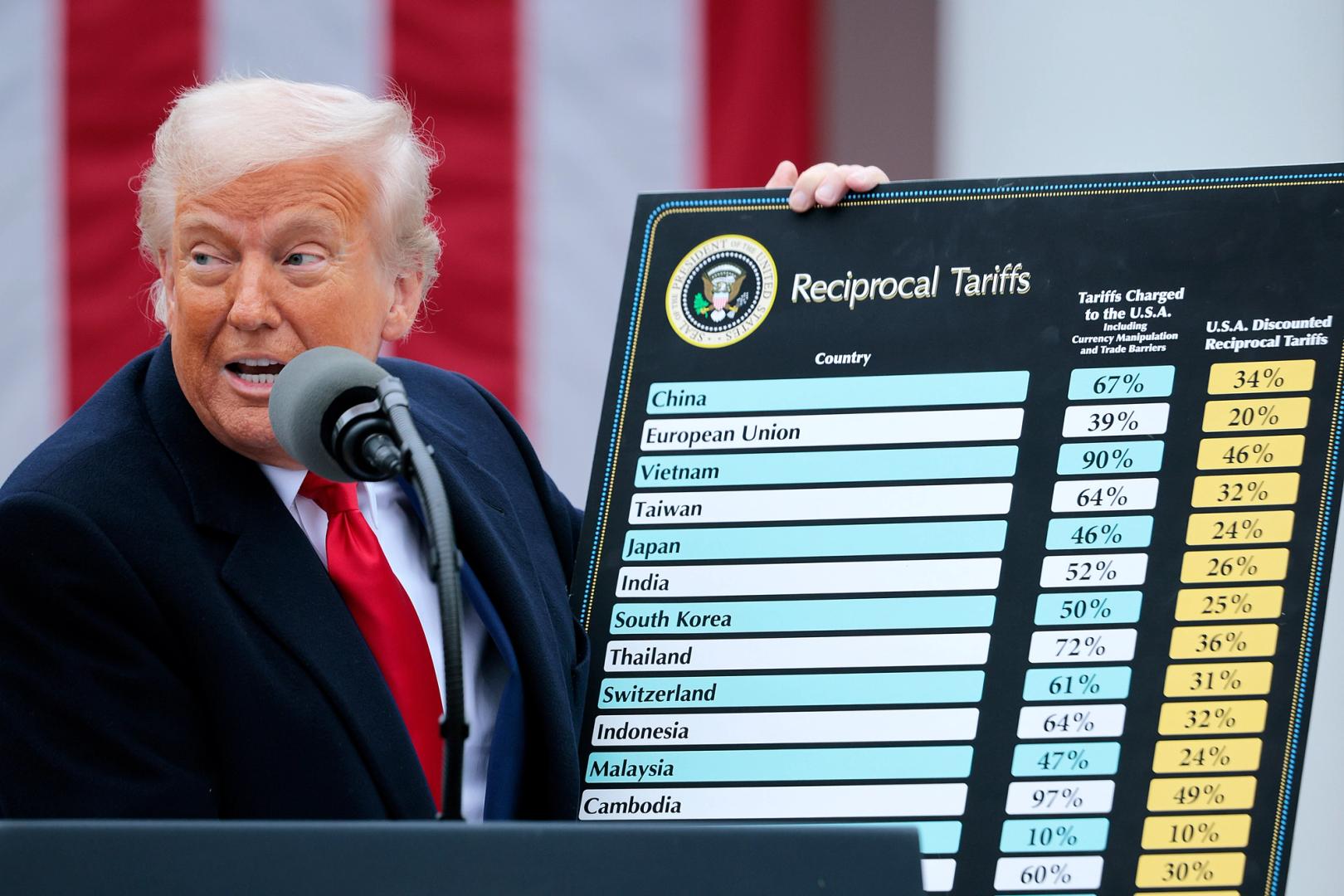

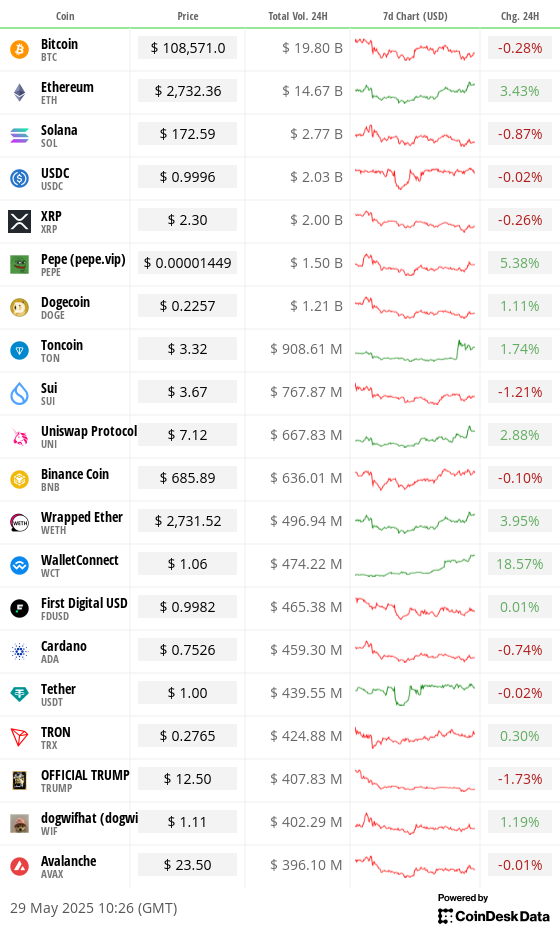

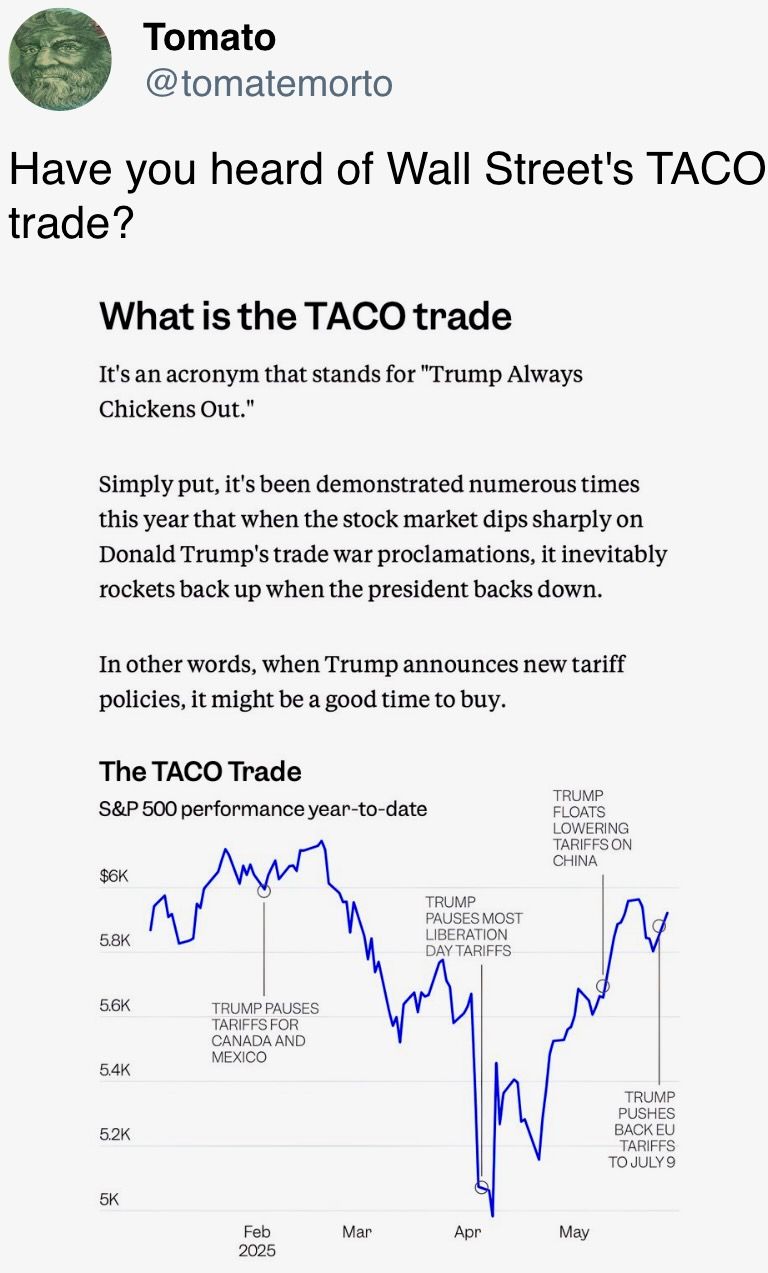

Bitcoin BTC rose and stock index futures surged early Thursday after a U.S. court declared President Donald Trump’s broad-based tariffs regime invalid. The positive sentiment was buoyed by AI giant Nvidia’s upbeat earnings.

On-chain data showed large wallets, those holding over 10,000 BTC, have shifted to selling from buying as the largest cryptocurrency holds close to its record high, with an increase in exchange deposits also pointing to selling pressure. Meanwhile, options market data signaled potential for volatility ahead of Friday’s monthly settlement.

Ether ETH, the second-largest cryptocurrency by market value, jumped to $2,780, the highest since Feb. 24, consistent with the bullish signals from the derivatives market. The token has been bid this week, supposedly on SharpLink’s $425 million Treasury plan. Notably, U.S.-listed spot ether ETFs saw a net inflow of $84.89 million on Wednesday, extending their streak to eight consecutive days.

Canada-listed investment firm Sol Strategies said it filed a preliminary prospectus with local securities regulators to raise up to $1 billion to boost its investment in the Solana ecosystem. Still, SOL was flattish at around $170.

In the broader market, TON, PEPE and FLOKI led other coins higher while FARTCOIN, PI and JUP nursed most losses. Open interest in TON perpetual futures surged 33% to $190 million, clocking the highest since Feb. 18.

Stablecoin issuer Circle froze wallets connected to the Libra token containing millions of dollars worth of USDC. Metaplanet issued $21M in bonds to finance more bitcoin purchases.

In traditional markets, some investment banks said Trump has other tools to sidestep the court ruling on tariffs. Yields on the longer duration Treasury notes ticked higher, suggesting dollar strength. Stay alert!

What to Watch

- Crypto

- May 30: The second round of FTX repayments starts.

- May 31 (TBC): Mezo mainnet launch.

- June 6, 1-5 p.m.: U.S. SEC Crypto Task Force Roundtable on «DeFi and the American Spirit«

- Macro

- May 29, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases April unemployment rate data.

- Unemployment Rate Est. 6.9% vs. Prev. 7%

- May 29, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases Q1 GDP data.

- GDP Growth Rate QoQ (2nd estimate) Est. -0.3% vs. Prev. 2.4%

- GDP Price Index QoQ (2nd estimate) Est. 3.7% vs. Prev. 2.3%

- GDP Sales QoQ (2nd estimate) Est. -2.5% vs. Prev. 3.3%

- May 29, 2 p.m.: Fed Governor Adriana D. Kugler will deliver a speech at the 5th Annual Federal Reserve Board Macro-Finance Workshop (virtual). Livestream link.

- May 30, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases Q1 GDP data.

- GDP Growth Rate QoQ Est. 1.4% vs. Prev. 0.2%

- GDP Growth Rate YoY Est. 3.2% vs. Prev. 3.6%

- May 30, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases April unemployment rate data.

- Unemployment Rate Est. 2.5% vs. Prev. 2.2%

- May 30, 8:30 a.m.: Statistics Canada releases Q1 GDP data.

- GDP Growth Rate Annualized Est. 1.7% vs. Prev. 2.6%

- GDP Growth Rate QoQ Prev. 0.6%

- May 30, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases April consumer income and expenditure data.

- Core PCE Price Index MoM Est. 0.1% vs. Prev. 0%

- Core PCE Price Index YoY Est. 2.5% vs. Prev. 2.6%

- PCE Price Index MoM Est. 0.1% vs. Prev. 0%

- PCE Price Index YoY Est. 2.2% vs. Prev. 2.3%

- Personal Income MoM Est. 0.3% vs. Prev. 0.5%

- Personal Spending MoM Est. 0.2% vs. Prev. 0.7%

- May 30, 10 a.m.: The University of Michigan releases (final) May U.S. consumer sentiment data.

- Michigan Consumer Sentiment Est. 51 vs. Prev. 52.2

- May 29, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases April unemployment rate data.

- Earnings (Estimates based on FactSet data)

- None in the near future.

Token Events

- Governance votes & calls

- Arbitrum DAO is voting on a constitutional AIP to upgrade Arbitrum One and Arbitrum Nova to ArbOS 40 “Callisto,” bringing them in line with Ethereum’s May 7 Pectra upgrade. The proposal schedules activation for June 17, and voting ends on May 29.

- Sui DAO is voting on moving to recover approximately $220 million in funds stolen from the Cetus Protocol hack via a protocol upgrade. Voting ends June 3.

- May 29, 8 a.m.: NEAR Protocol to host a House of Stake Ask Me Anything (AMA) session.

- May 29, 2 p.m.: Wormhole to host an ecosystem call.

- June 4, 6:30 p.m.: Synthetic to host a community call.

- June 10, 10 a.m.: Ether.fi to host an analyst call followed by a Q&A session.

- Unlocks

- May 31: Optimism (OP) to unlock 1.89% of its circulating supply worth $24.43 million.

- June 1: Sui (SUI) to unlock 1.32% of its circulating supply worth $160.58 million.

- June 1: ZetaChain (ZETA) to unlock 5.34% of its circulating supply worth $11.18 million.

- June 12: Ethena (ENA) to unlock 0.7% of its circulating supply worth $15.83 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $60.96 million.

- Token Launches

- June 1: Staking rewards for staking ERC-20 OM on MANTRA Finance end.

- June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends.

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN), & Synapse (SYN)

Conferences

- Day 3 of 3: Bitcoin 2025 (Las Vegas)

- Day 3 of 4: Web Summit Vancouver (Vancouver, British Columbia)

- May 29: Stablecon (New York)

- Day 1 of 2: Litecoin Summit 2025 (Las Vegas)

- Day 1 of 4: Balkans Crypto 2025 (Tirana, Albania)

- June 2-7: SXSW London

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26-27: Istanbul Blockchain Week

Token Talk

By Oliver Knight

- Markets on the Ethereum-based Cork Protocol remain paused after Wednesday’s $12 million smart-contract exploit.

- The attacker manipulated the smart contact’s exchange-rate function by issuing fake tokens, stealing 3,761.8 wrapped staked ether (wstETH) in the process.

- The exploit marked another attack on the decentralized finance (DeFi) industry just days after Sui-based Cetus Protocol lost $223 million to an exploit.

- TRM Labs estimates that $2.2 billion was stolen in crypto exploits and hacks in 2024.

- Ether remains unperturbed by the exploit, leading the market today on the back of renewed institutional interest and spot ETF flows. It is up 3.8% in the past 24 hours while bitcoin is down by 0.17%.

Derivatives Positioning

- TRX, XMR, ETH, LTC and BNB led major cryptocurrencies’ growth in perpetual futures open interest.

- Funding rates for majors, except TON, signal bullish sentiment, but nothing extraordinary.

- On the CME, ETH annualized one-month futures basis topped 10%, while BTC lagged at 8.7%.

- Signs of caution emerged on Deribit, with front-end BTC skew flipping to puts and ETH’s call skew softening. Block flows on Paradigm featured demand for short-dated BTC puts.

Market Movements

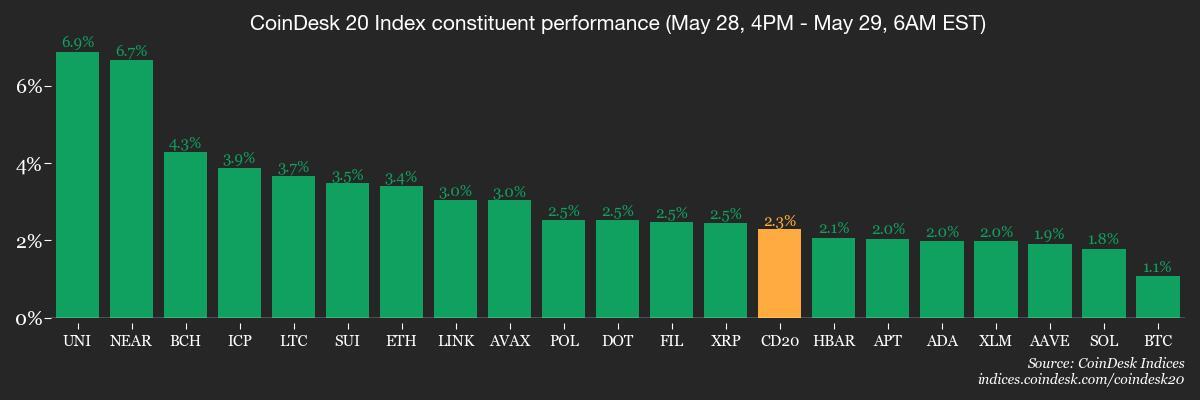

- BTC is up 1.15% from 4 p.m. ET Wednesday at $108,594.41 (24hrs: -0.29%)

- ETH is up 3.9% at $2,738.04 (24hrs: +3.63%)

- CoinDesk 20 is up 2.21% at 3,278.84 (24hrs: +0.66%)

- Ether CESR Composite Staking Rate is unchanged at 3.1%

- BTC funding rate is at 0.0057% (6.3006% annualized) on Binance

- DXY is up 0.12% at 99.99

- Gold is up 0.32% at $3,304.20/oz

- Silver is up 1.24% at $33.41/oz

- Nikkei 225 closed +1.88% at 38,432.98

- Hang Seng closed +1.35% at 23,573.38

- FTSE is unchanged at 8,724.05

- Euro Stoxx 50 is unchanged at 5,378.39

- DJIA closed on Wednesday -0.58% at 42,098.70

- S&P 500 closed -0.56% at 5,888.55

- Nasdaq closed -0.51% at 19,100.94

- S&P/TSX Composite Index closed unchanged at 26,283.50

- S&P 40 Latin America closed -0.76 at 2,599.53

- U.S. 10-year Treasury rate is up 6 bps at 4.54%

- E-mini S&P 500 futures are up 1.53% at 5,993.25

- E-mini Nasdaq-100 futures are up 2.03% at 21,814.25

- E-mini Dow Jones Industrial Average Index futures are up 0.96% at 42,576.00

Bitcoin Stats

- BTC Dominance: 63.71 (-0.06%)

- Ethereum to bitcoin ratio: 0.02517 (1.12%)

- Hashrate (seven-day moving average): 910 EH/s

- Hashprice (spot): $57.0

- Total Fees: 8.03 BTC / $868,310

- CME Futures Open Interest: 152,995 BTC

- BTC priced in gold: 32.8 oz

- BTC vs gold market cap: 9.30%

Technical Analysis

- The VIRTUAL token has topped the 38.2% Fibonacci retracement of the January-April crash.

- The break out above the widely tracked resistance could entice more buyers, yielding a bigger rally.

Crypto Equities

- Strategy (MSTR): closed on Wednesday at $364.25 (-2.14%), +2.43% at $373.09 in pre-market

- Coinbase Global (COIN): closed at $254.29 (-4.55%), +3.01% at $261.95

- Galaxy Digital Holdings (GLXY): closed at C$28 (-6.57%)

- MARA Holdings (MARA): closed at $14.86 (-9.61%), +4.04% at $15.46

- Riot Platforms (RIOT): closed at $8.38 (-8.32%), +2.86% at $8.62

- Core Scientific (CORZ): closed at $10.78 (-4.43%), +2.97% at $11.10

- CleanSpark (CLSK): closed at $9.11 (-7.61%), +3.62% at $9.44

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $17.27 (-5.32%)

- Semler Scientific (SMLR): closed at $41.32 (-4.77%), +2.95% at $42.54

- Exodus Movement (EXOD): closed at $25.94 (-25.35%), +11.6% at $28.95

ETF Flows

Spot BTC ETFs

- Daily net flow: $432.7 million

- Cumulative net flows: $45.31 billion

- Total BTC holdings ~ 1.21 million

Spot ETH ETFs

- Daily net flow: $84.9 million

- Cumulative net flows: $2.9 billion

- Total ETH holdings ~ 3.57 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The MOVE index, which measures the volatility in U.S. Treasury notes, has dropped to the lowest level since March.

- If it drops further, a continued decline is likely to ease financial conditions, greasing the bitcoin bull run.

While You Were Sleeping

- U.S. Trade Court Strikes Down Trump’s Global Tariffs (The Wall Street Journal): Judges said economic deficits don’t meet the legal threshold for a national emergency, and said unchecked executive authority over levies violates the constitutional separation of powers.

- Solana Scores Twin Institutional Wins With $1B Raise and First Public Liquid Staking Strategy (CoinDesk): Sol Strategies aims to raise $1 billion to expand Solana ecosystem exposure, while DeFi Development said it is the first public firm to hold Solana-based liquid staking tokens.

- Bitcoin Whales Seem to Be Calling a Top as BTC Price Consolidates (CoinDesk): Large holders are offloading BTC and sending it to exchanges after a period of accumulation, while smaller investors continue buying.

- XRP Army Is Truly Global as CME Data Reveals Nearly Half of XRP Futures Trading Occurs in Non-U.S. Hours (CoinDesk): These contracts recorded $86.6 million in volume over six days across 4,032 trades, with 46% of activity logged during overseas sessions.

- Goldman Urges Investors to Buy Gold and Oil as Long-Term Hedges (Bloomberg): Goldman Sachs said surging U.S. debt and concerns over monetary and fiscal governance have eroded trust in long-term Treasuries, making gold and oil essential hedges against inflation and supply shocks.

- UK Seeks to Speed Up Implementation of U.S. Trade Deal (Financial Times): The U.K. business secretary will meet the U.S. Trade Representative in Paris next week to discuss implementation timelines for the bilateral trade deal announced on May 8.

In the Ether

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors