Uncategorized

Coinbase CEO, Other Crypto Insiders Billions Richer After Seeking to Steer Elections

This is the third in a series of stories examining the crypto industry’s high-stakes 2024 foray into politics and campaigning. The first explored the electoral track record of Fairshake PAC’s strategy and the second its intense use of a 2010 Supreme Court stance.

The leaders of the companies responsible for the river of money that flooded U.S. political shores this year have already benefited tremendously from the outcome of last month’s election — increasing their personal fortunes by billions of dollars, far outpacing the large spending they devoted to crypto-friendly candidates.

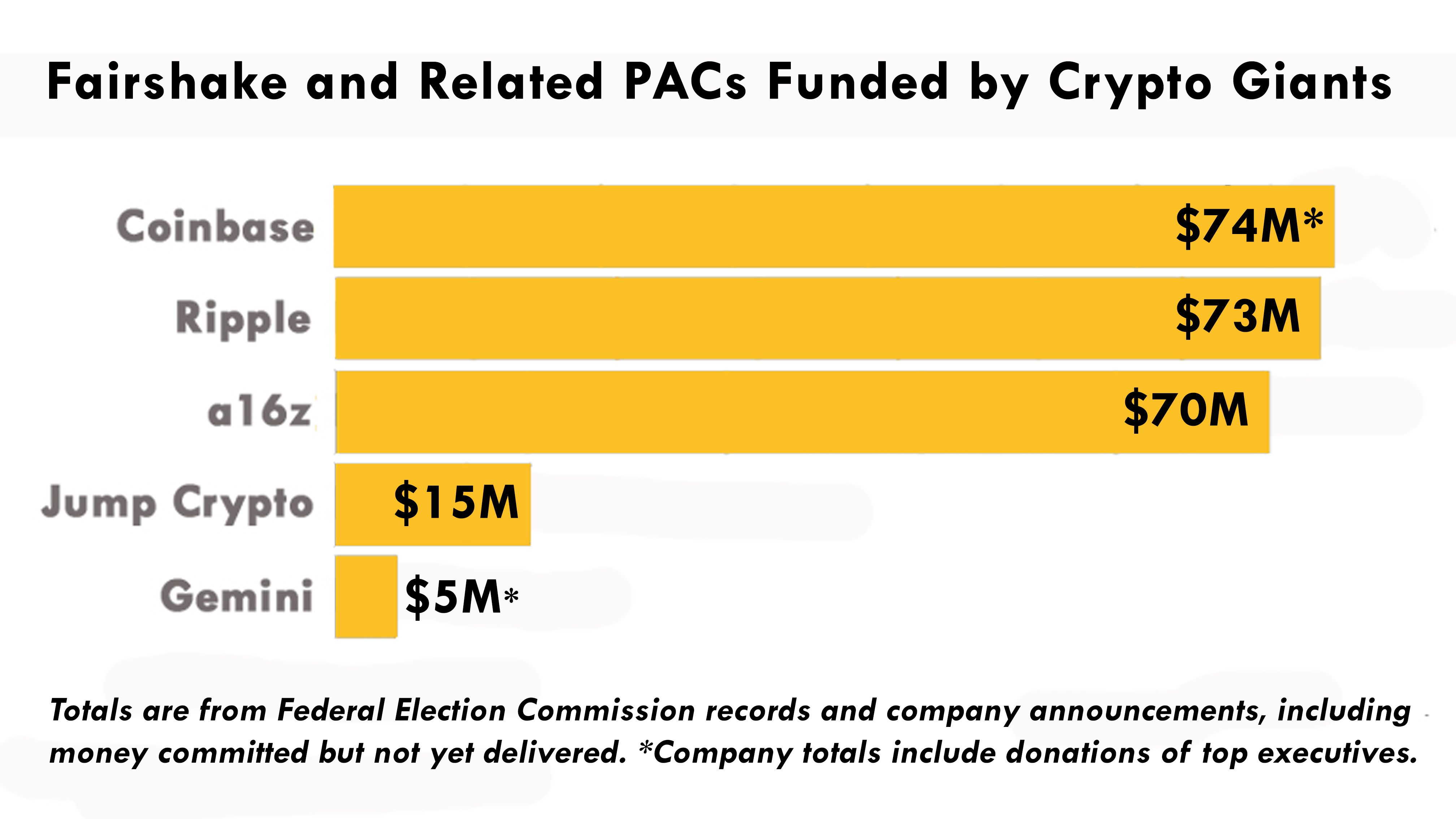

Coinbase Inc. (COIN) CEO Brian Armstrong and his company devoted some $74 million to the industry’s dominant political action committee, Fairshake, putting Armstrong in a close lead over a few other crypto insiders. That’s an especially significant amount of money from a company that booked about $95 million in 2023 profits. But the elections went their way, and the company’s value has ballooned by $21 billion since Nov. 4, the day before in-person voting began and the outcome became clear.

In a pre-programmed series of trades starting less than a week after the election, Armstrong sold $100 million worth of his Coinbase shares. Those same shares on the night before the election had been worth about $39 million less. A week after that, he cashed in about $313 million — all part of a selling strategy he’d set in motion if the price spiked.

Since then, the co-founder and CEO sold smaller amounts week after week, for a total of about $437 million for stock that was worth $308 million before the victories of President-elect Donald Trump and a slate of congressional lawmakers backed by crypto. In other words, the pro-crypto sentiment surging after the election outcome that Armstrong helped shape earned him an additional $129 million in wealth for the shares he sold.

He still owns more than 10% of the largest U.S. crypto exchange, and the value of about 24 million shares tucked into his trust, according to the latest Securities and Exchange Commission filings, is about $6.4 billion — up near $2 billion since Nov. 5.

Armstrong’s stock sales were planned less than three months before the U.S. elections, submitted in a formal strategy meant to distance corporate insiders from accusations of gaming the markets. And the sales haven’t yet reached the halfway point of the SEC-disclosed intent to offload as many as 3.75 million shares, depending on the stock price meeting «certain threshold prices specified in the Armstrong Plan.»

He took to social media site X to explain the plan several days before the elections, saying he was diversifying «to make investments in moonshots» but would be keeping the «vast majority» of his shares. He said he put the price targets so high that he didn’t expect that most of it would sell in the next year «unless we do much better than expected.» COIN’s stock is currently trading around $276, up from around $186 on Nov. 4.

A Coinbase spokesperson referred CoinDesk to that post when asked for comment.

His rivals among crypto leaders who devoted similar levels of cash to the elections included Ripple Labs CEO Brad Garlinghouse and the namesake chiefs of investment firm Andreessen Horowitz (a16z). Ripple gave $73 million, and a16z put in $70 million, including large amounts held over for the next election cycle in 2026.

Garlinghouse reportedly owns more than 6% of Ripple, the company, and a large but unspecified amount of the token tied to it, XRP. Various reports put him high among the list of U.S. billionaires as a result. In the wake of the election, XRP surged to become the third-largest crypto asset by market cap.

While Garlinghouse chose not to weigh in with details on his net worth, he credited excitement over the return of Trump to the White House in a statement to CoinDesk.

«The crypto market is up over $1 trillion since Trump won — that’s the price of Gensler’s foot on the neck of the market, and he’s not even officially gone yet,» Garlinghouse said.

Since the election, Garlinghouse’s holdings of XRP have multiplied more than three times as the price of the token jumped from $0.50 to $2.32. And though the non-public Ripple Labs valuation is uncertain and was last set in the neighborhood of $11 billion earlier this year, the election has almost certainly boosted the worth of his major stake. Garlinghouse’s personal wealth has likely skyrocketed as a result.

The financial status of Mark Andreessen and Ben Horowitz is even murkier, but both men have gained dramatically since last month from their many stakes in crypto companies, likely outpacing the money they devoted to U.S. politics. But the financial figures aren’t available for a16z’s investments in private companies as they are for public Coinbase.

The firm’s vast crypto portfolio includes stakes in Coinbase, Uniswap, Solana, EigenLayer and Anchorage Digital and dozens of others. Virtually all of them became more valuable as the U.S. executive branch will be run by Trump, who says he’ll be the crypto president, and the 535-member Congress includes some 300 predicted to be supportive of digital assets — including the dozens just supported by Fairshake in their elections.

But a company spokesman declined to comment on CoinDesk’s review of the gains for Andreessen and Horowitz as individuals.

A16z’s dip into U.S. politics was aimed «to help advance clear rules of the road that will support American innovation while holding bad actors to account,» according to a post from the firm’s Chris Dixon.

Separately from Fairshake, Andreessen and Horowitz backed Trump’s election effort. And Andreessen has become an adviser to the pro-crypto president-elect as he prepares to start his second term next month.

The crypto benefactors from Coinbase, Ripple and a16z combined to make the Fairshake super PAC and its affiliates into the most powerful corporate campaign-finance effort in the 2024 elections, helping 53 members of next year’s Congress win their races. However, Fairshake didn’t weigh in on the presidential election, which may have had the largest effect on crypto market prices.

Garlinghouse, in a post-election interview on 60 Minutes, said, “I think it’s clear that Donald Trump embraced crypto and crypto embraced Donald Trump.» While he didn’t claim credit for Trump’s success, Garlinghouse said the crypto PACs «absolutely helped supercharge the candidates» and influenced outcomes in congressional contests.

His company pledged $5 million in XRP to Trump’s inauguration — the celebration next month of his return to the presidency — and Coinbase and fellow U.S. crypto exchange Kraken have also raised their hands to fund it.

During the elections, the crypto industry was accused by its critics of being remarkably transactional in its political strategy — putting money into the best places to ensure future pro-crypto votes on legislation and buying more than $130 million in congressional campaign ads with framing across the political spectrum (and without mentioning crypto). Gains for the sector have meant a boost for the three main companies behind Fairshake and for their individual leaders, who are tied to them financially.

The sector’s political effort went in «purely on interests of the specific industry,» said Rick Claypool, the research director at Public Citizen who has examined crypto’s campaign spending. «Short term, obviously this has caused a big bump in crypto.»

The return on investment for industries putting money into politics can «often be pretty good,» said Mark Hays, a senior policy analyst at Americans for Financial Reform, who has also worked on campaign finance issues. «Crypto is newer, and so the opportunity for growth is larger.»

While Armstrong and the others prefer a political narrative that features a grassroots upswell in crypto voters that shifted the elections, he and his company were directly behind establishing Stand With Crypto, the group that’s billed as a grassroots effort to harness the will of crypto voters. And Fairshake’s political influence was based almost entirely on money from Coinbase and the partner companies, plus smaller amounts from Jump Crypto and Gemini.

Gemini’s leaders, Tyler and Cameron Winklevoss, were also among Trump’s loudest fans in crypto.

The day after the voting, Cameron Winklevoss posted on X: «Imagine how much we are going to accomplish in the next 4 years now that the crypto industry won’t be hemorrhaging $ billions on legal fees fighting the SEC and instead investing this money into building the future of money. Amazing awaits.»

On Nov. 11, the day Armstrong began selling large amounts of Coinbase stock, Tyler Winklevoss posted, «The shackles are off, 100k incoming.» Bitcoin hit that mark a month after the election.

Uncategorized

Alpaca Finance, Once a DeFi Giant on BNB Chain, Will Shut Down

Alpaca Finance, once a cornerstone on the BNB Chain and an early leader in leveraged yield farming, will shut down operations by the end of 2025 due to an unsustainable business model amid a more competitive and capital-intensive DeFi landscape.

The protocol said Monday that it will begin winding down all products, including its original yield farming platform, automated vaults, and decentralized perpetuals, over the next few months.

Front-end access will remain available through December 31, 2025, to give users time to withdraw their assets.

“This choice wasn’t made lightly,” the Alpaca team wrote. “But we believe it is the most responsible course of action to safeguard our community and ensure a graceful and secure wind-down.”

Launched during decentralized finance’s (DeFi) 2021 boom, Alpaca quickly rose to prominence on BNB Chain, offering leveraged yield farming strategies that allowed users to amplify returns by borrowing capital to farm liquidity pool (LP) tokens.

At its peak, Alpaca held over $1 billion in total value locked (TVL) and was one of the most-used protocols on the chain.

Internally, Alpaca had been operating at a loss for over two years, according to the team, with revenue tied directly to protocol usage — a challenge compounded by the project’s fair launch structure with no VC backing or pre-mined tokens.

The final blow came in late April, when Binance delisted ALPACA, the protocol’s native token.

While the event triggered a brief 550% price rally due to short liquidations, including $55 million in forced closures in a single day, it also severely restricted liquidity and user access to the token.

That, the team said, made it harder to pursue new initiatives or strategic mergers.

“We explored M&A discussions with several projects, and some progressed meaningfully,” the team said. “But as the market turned downward again in early 2025, those deals fell through.”

ALPACA, the project’s token, was last trading at approximately $0.08, down over 90% from its all-time high in 2021.

Uncategorized

Quantum Computing Could Break Bitcoin-Like Encryption Far Easier Than Intially Thought, Google Researcher Says

A new research paper by Google Quantum AI researcher Craig Gidney shows that breaking widely used RSA encryption may require 20 times fewer quantum resources than previously believed.

The finding did not specifically mention bitcoin BTC or other cryptocurrencies, but took aim at the encryption methods that form the technical backbone used to secure crypto wallets and, in some cases, transactions.

RSA is a public-key encryption algorithm used to encrypt and decrypt data. It relies on two different but linked keys: a public key for encryption and a private key for decryption.

Bitcoin doesn’t use RSA, but relies on elliptic curve cryptography (ECC). However, ECC can also be broken by Shor’s algorithm, a quantum algorithm designed to factor large numbers or solve logarithm problems — which form the heart of public key cryptography.

ECC is a way to lock and unlock digital data using mathematical calculations called curves (which compute only in one direction) instead of big numbers. Think of it as a smaller key that’s just as strong as a larger one.

While 256-bit ECC keys are significantly more secure than 2048-bit RSA keys, quantum threats scale nonlinearly, and research like Gidney’s compresses the timeline by which such attacks become feasible.

“I estimate that a 2048-bit RSA integer could be factored in under a week by a quantum computer with fewer than one million noisy qubits,” Gidney wrote. This was a stark revision from his 2019 paper, which estimated such a feat would require 20 million qubits and take eight hours.

To be clear: no such machine exists yet. IBM’s most powerful quantum processor to date, Condor, clocks in at just over 1,100 qubits, and Google’s Sycamore has 53.

Quantum computing leverages the principles of quantum mechanics, using quantum bits or qubits instead of traditional bits.

Unlike bits, which represent either a 0 or a 1, qubits can represent both 0 and 1 simultaneously due to quantum phenomena like superposition and entanglement. This allows quantum computers to perform multiple calculations at once, potentially solving problems that are currently intractable for classical computers.

“This is a 20-fold decrease in the number of qubits from our previous estimate,” Gidney said in a post.

Researchers, such as the quantum research group Project 11, are actively exploring whether even weakened versions of Bitcoin’s encryption can be broken by today’s quantum hardware.

The group earlier this year launched a public bounty offering 1 BTC (~$85,000) to anyone able to break tiny ECC key sizes — between 1 and 25 bits — using a quantum computer.

The goal isn’t to break Bitcoin today, but to measure how close current systems can be.

Uncategorized

The Blockchain Group Secures $71.9M to Fuel Bitcoin Acquisition

The Blockchain Group (ALTBG), a Paris-listed firm focused on data intelligence and decentralized technologies, has issued a 63.3 million euro ($71.9 million) in convertible bonds to further its bitcoin BTC treasury strategy.

This financing, executed through its Luxembourg subsidiary, highlights a significant push towards expanding the company’s BTC reserves and reinforcing its investor base.

A key component of the deal includes a $5.7 million BTC-denominated bond subscribed by Moonlight Capital, issued at a 30% premium over the May 23 closing price ($4.3/share).

The company also finalized the exercise of all rights for Convertible Bonds B-02 («OCA Tranche 2») initially reserved for strategic investors Fulgur Ventures and UTXO Management at $0.79/share, totaling $66 million.

Notably, investor Adam Back has converted all his OCA Tranche 1 bonds into 14.88 million shares, reinforcing long-term alignment with the company’s vision. These capital inflows are expected to fund the acquisition of 590 BTC, potentially increasing The Blockchain Group’s holdings to approximately 1,437 BTC.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors