Business

Chainlink Teams With Major Financial Institutions to Fix $58B Corporate Actions Problem

Decentralized oracle network Chainlink is working with 24 of the world’s largest financial institutions to overhaul how corporate actions, such as dividends, stock splits, and mergers, are processed across global markets.

Chainlink ran a pilot with SWIFT, DTCC, Euroclear and six other financial institutions. It leveraged a combination of its blockchain-based and artificial intelligence (AI) to ingest and validate real corporate action events in multiple languages.

That led to the production of unified data containers, known as golden records, in near real time, according to a press release shared with CoinDesk.

These records were distributed simultaneously to blockchain networks and legacy systems like the interbank messaging system SWIFT, significantly reducing manual work and the risk of error.

The process used a blend of large language models, including OpenAI’s GPT, Google’s Gemini, and Anthropic’s Claude, to extract structured data from unstructured corporate action announcements. These were then published as unified gold records on-chain to create a “single source of truth that all participants can easily access, verify, and build upon.”

Chainlink’s Runtime Environment (CRE) validated model outputs, while its interoperability protocol (CCIP) relayed data to blockchains, including Avalanche and DTCC’s private network.

Data attesters cryptographically attested the outputs and contributed to potentially missing data fields. According to Chainlink, the system achieved a near 100% data consensus across all test events.

The current system for processing corporate actions is costly. Citi’s 2025 Asset Servicing report shows that the average corporate action touches 110,000 interactions and costs $34 million to process. The global financial industry is now spending an estimated $58 billion annually in processing corporate actions.

Business

Crypto Exchange Ripio Reveals $100M Crypto Treasury, Second Largest in Latin America

The company’s holdings, which include bitcoin and ether, have been managed through trading and hedging strategies since 2017.

Business

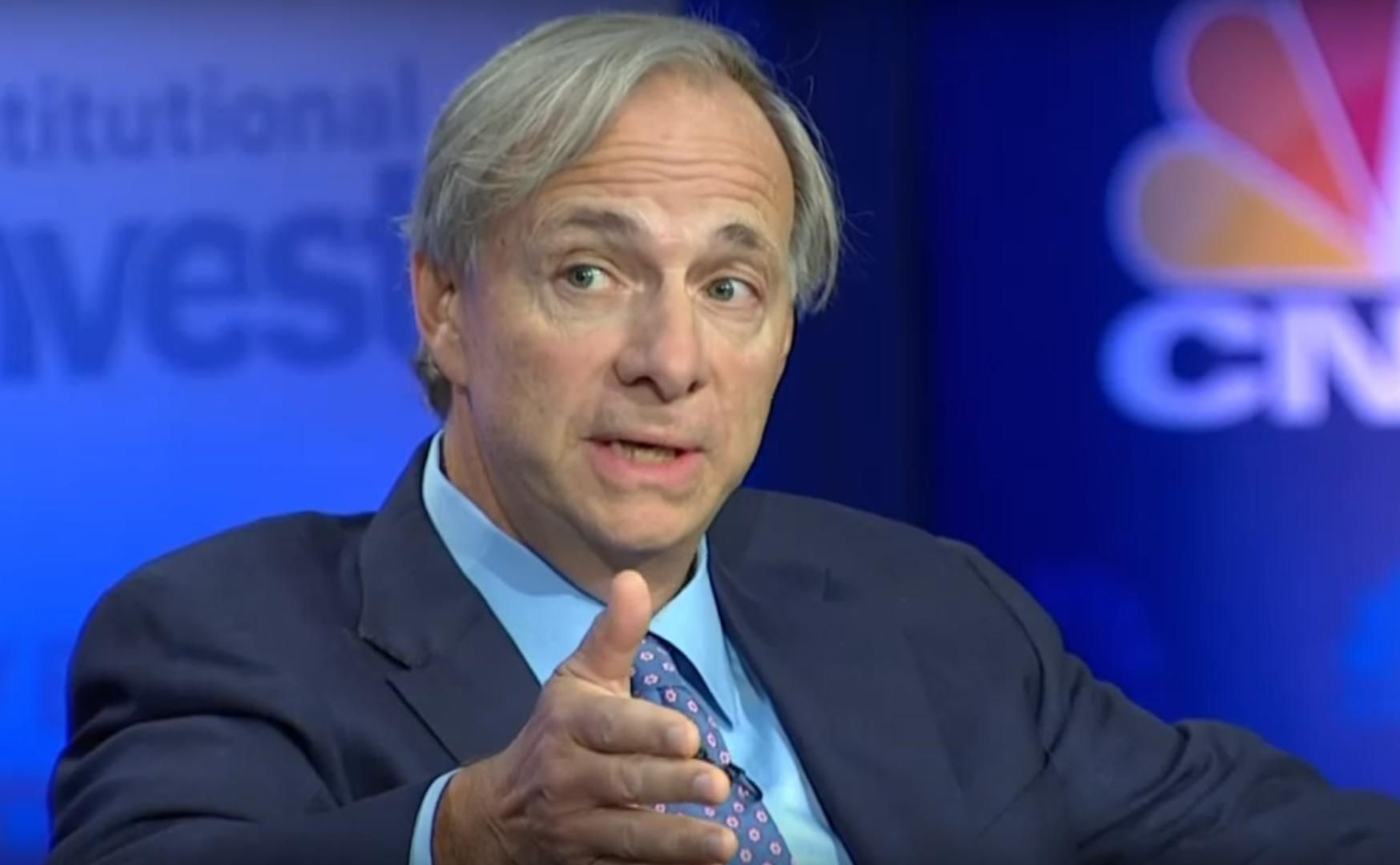

Ray Dalio Still Owns Bitcoin, but Says Traceability and Quantum Threat Are Concerns

The billionaire founder of hedge fund Bridgewater believes Bitcoin faces major hurdles before it can become a global reserve currency.

Business

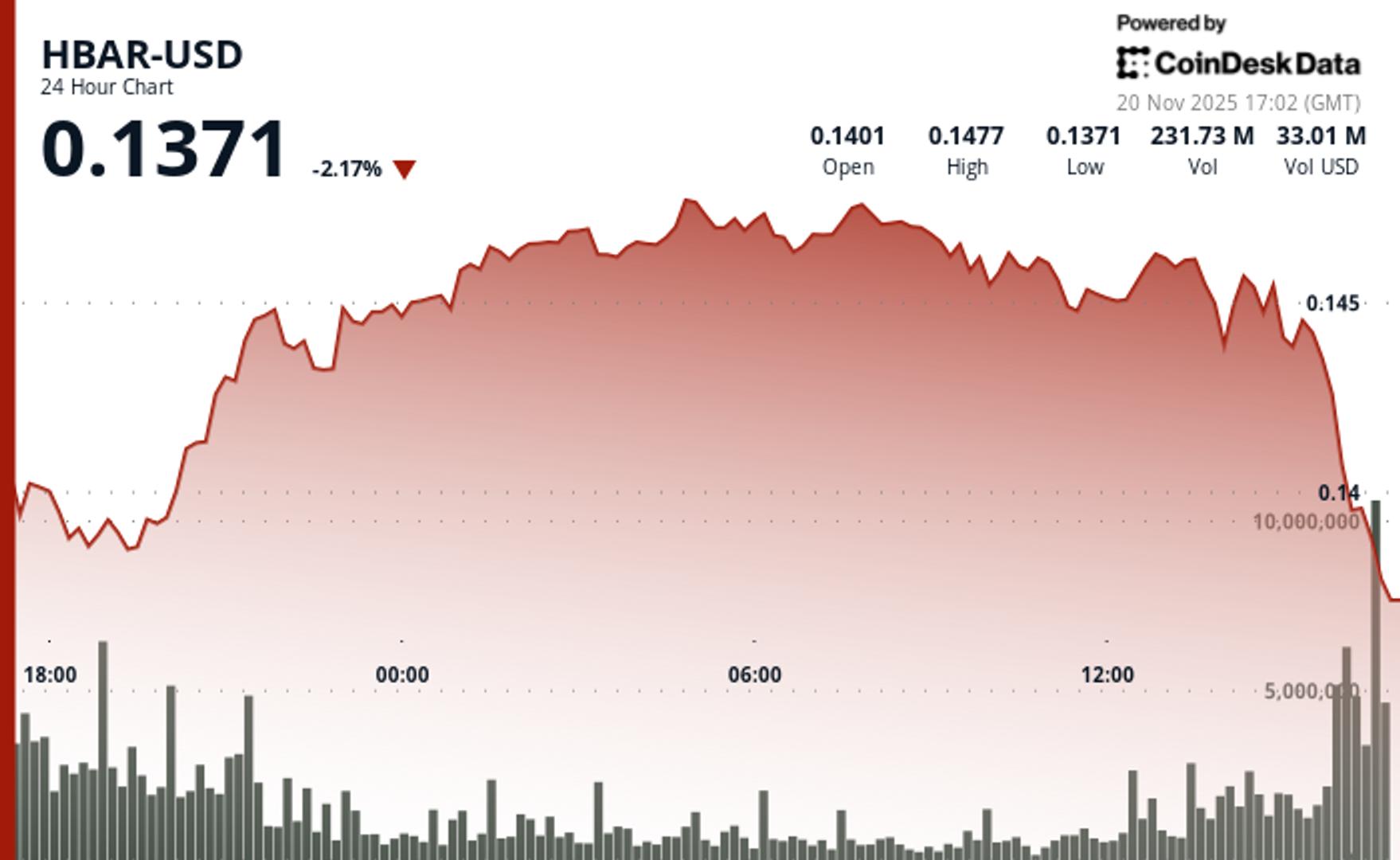

HBAR Faces Fresh Liquidity Alarms After Breakdown to $0.1373

Hedera’s token slipped below key support levels as a late-session trading halt, collapsing volume, and failed recovery attempts point to mounting structural and liquidity stress.

-

Uncategorized5 месяцев ago

Uncategorized5 месяцев agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business1 год ago

Business1 год ago3 Ways to make your business presentation more relatable

-

Fashion1 год ago

Fashion1 год agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment1 год ago

Entertainment1 год ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment1 год ago

Entertainment1 год ago10 Artists who retired from music and made a comeback

-

Business1 год ago

Business1 год ago15 Habits that could be hurting your business relationships

-

Entertainment1 год ago

Entertainment1 год agoNew Season 8 Walking Dead trailer flashes forward in time

-

Entertainment1 год ago

Entertainment1 год agoMeet Superman\’s grandfather in new trailer for Krypton