Business

Chainlink Poised to Power TradFi Shift to Blockchain, Jefferies Says

Chainlink could become a foundational layer for traditional finance as capital markets increasingly embrace blockchain infrastructure, according to a report from investment bank Jefferies following a call with Chainlink co-founder Sergey Nazarov.

The decentralized oracle network connects smart contracts to real-world data and off-chain systems, enabling advanced use cases like tokenized asset settlement, parametric insurance and cross-chain messaging.

Jefferies said LINK (LINK), Chainlink’s native token, will benefit as tokenization accelerates.

As of September, Chainlink secured $103 billion in assets through its oracle feeds, up from $23 billion in early 2024, supporting over 2,500 projects. Partnerships with institutions such as Swift, DTCC, Euroclear and JPMorgan (JPM) underscore its role in bridging crypto and TradFi, wrote analysts Andrew Moss and Matthew Molta.

Tokenization, converting real-world assets into programmable digital tokens, is driving demand for infrastructure that can securely link on-chain and off-chain environments. Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and Decentralized Oracle Networks (DONs) address this challenge, supporting real-time settlement and automation across finance, insurance, and supply chains, the analysts wrote.

Jefferies said digital asset adoption remains early, but tokenization pilots are moving quickly toward production. With LINK used to pay for services, node operations and staking, growing demand for Chainlink’s infrastructure could provide token holders a call on future cash flows.

While rivals like LayerZero and Pyth exist, Chainlink’s network effects and first-mover advantage may give it a durable moat in blockchain infrastructure, the bank said.

The analysts estimated that tokenized asset value has reached $30 billion excluding stablecoins, a 253% increase year to date.

As tokenization reduces operational costs and increases liquidity, Jefferies said it expects institutional investors to migrate toward blockchain-based settlement layers, placing Chainlink at the center of the transition.

Read more: Polymarket Connects to Chainlink to Cut Tampering Risks in Price Bets

Business

Crypto Exchange Ripio Reveals $100M Crypto Treasury, Second Largest in Latin America

The company’s holdings, which include bitcoin and ether, have been managed through trading and hedging strategies since 2017.

Business

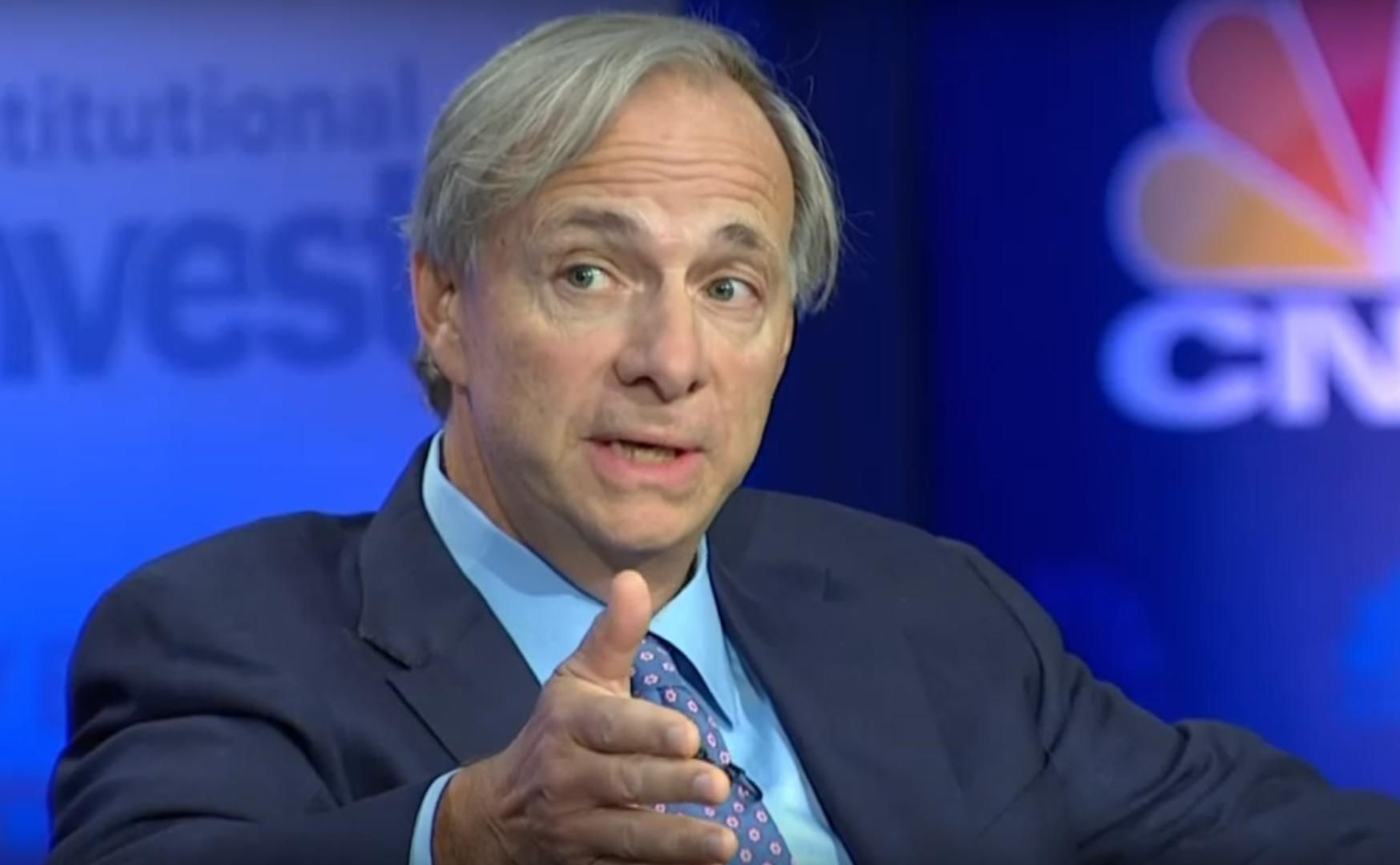

Ray Dalio Still Owns Bitcoin, but Says Traceability and Quantum Threat Are Concerns

The billionaire founder of hedge fund Bridgewater believes Bitcoin faces major hurdles before it can become a global reserve currency.

Business

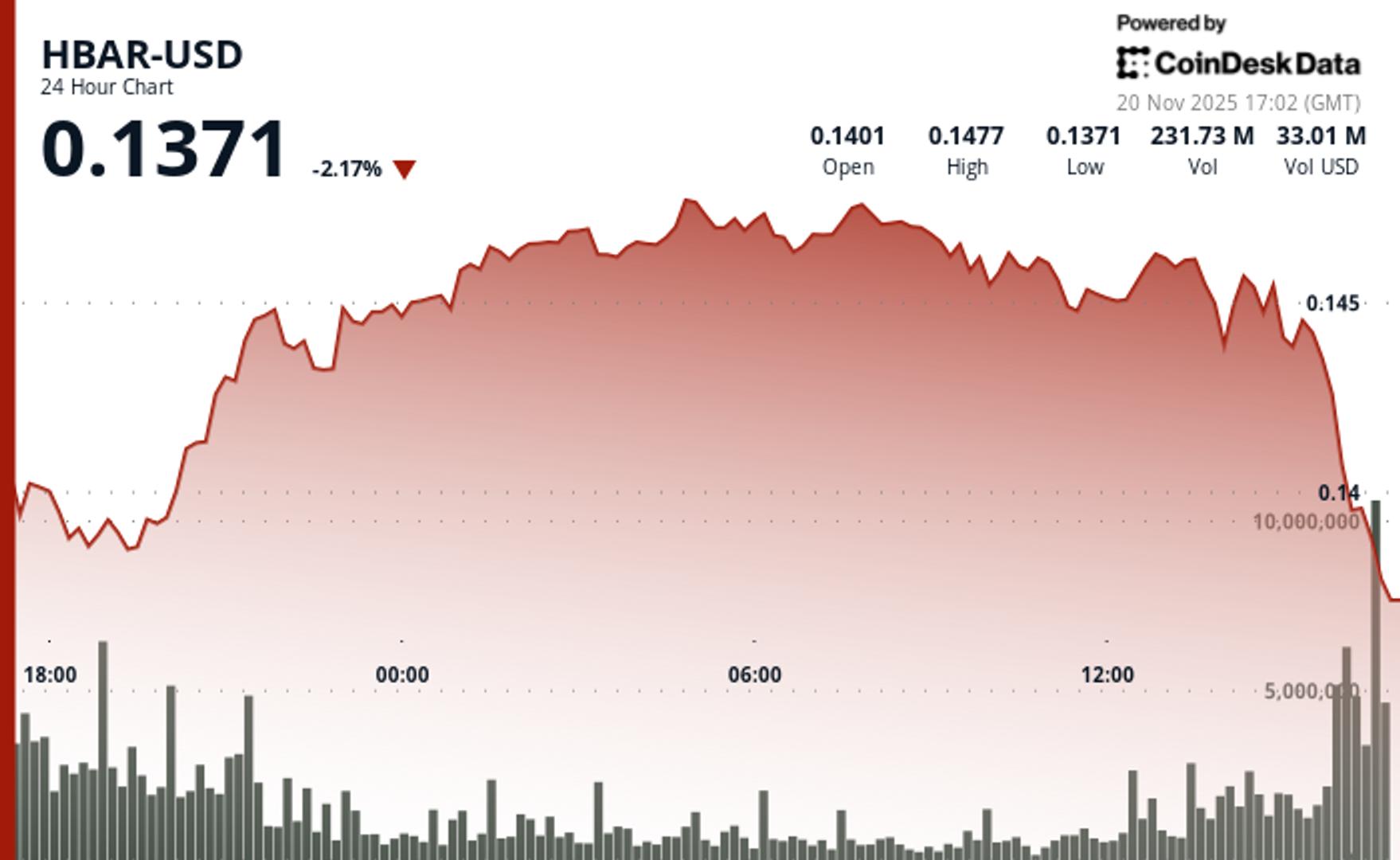

HBAR Faces Fresh Liquidity Alarms After Breakdown to $0.1373

Hedera’s token slipped below key support levels as a late-session trading halt, collapsing volume, and failed recovery attempts point to mounting structural and liquidity stress.

-

Uncategorized5 месяцев ago

Uncategorized5 месяцев agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business1 год ago

Business1 год ago3 Ways to make your business presentation more relatable

-

Fashion1 год ago

Fashion1 год agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment1 год ago

Entertainment1 год ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment1 год ago

Entertainment1 год ago10 Artists who retired from music and made a comeback

-

Business1 год ago

Business1 год ago15 Habits that could be hurting your business relationships

-

Entertainment1 год ago

Entertainment1 год agoNew Season 8 Walking Dead trailer flashes forward in time

-

Entertainment1 год ago

Entertainment1 год agoMeet Superman\’s grandfather in new trailer for Krypton