Business

Chainlink Chosen by Privacy-Focused Blockchain Canton to Push Institutional Adoption

Canton Network, a blockchain built for regulated finance, has struck a strategic partnership with Chainlink to broaden institutional adoption.

The agreement, announced Wednesday, will see Canton integrate Chainlink’s suite of services, including Data Streams, Proof of Reserve, and its Cross-Chain Interoperability Protocol. Canton has also joined the Chainlink Scale program, which helps cover the costs of running oracle nodes that feed external data into blockchains.

Chainlink Labs will take on the role of Super Validator in Canton’s Global Synchronizer, a system designed to keep transactions across the network in sync. That places Chainlink alongside a roster of more than 30 super validators and 500 validators already supporting Canton, which processes $280 billion in daily repo transactions and secures over $6 trillion in tokenized real-world assets.

For institutions, the deal could mean faster access to tokenized securities, stablecoins, and digital identity tools without sacrificing compliance or privacy. Imagine a bank issuing tokenized bonds on Canton and relying on Chainlink to confirm collateral values in real time—a scenario designed to cut costs while reducing counterparty risk.

Chainlink already secures more than $100 billion across decentralized finance and has helped facilitate $25 trillion in transaction value. Its entry into Canton aligns with growing demand from financial firms exploring tokenized assets and cross-chain applications.

“The collaboration brings together Canton’s focus on regulated finance with Chainlink’s infrastructure, paving the way for real-world institutional use cases,” Chainlink co-founder Sergey Nazarov said in the release.

Business

Crypto Exchange Ripio Reveals $100M Crypto Treasury, Second Largest in Latin America

The company’s holdings, which include bitcoin and ether, have been managed through trading and hedging strategies since 2017.

Business

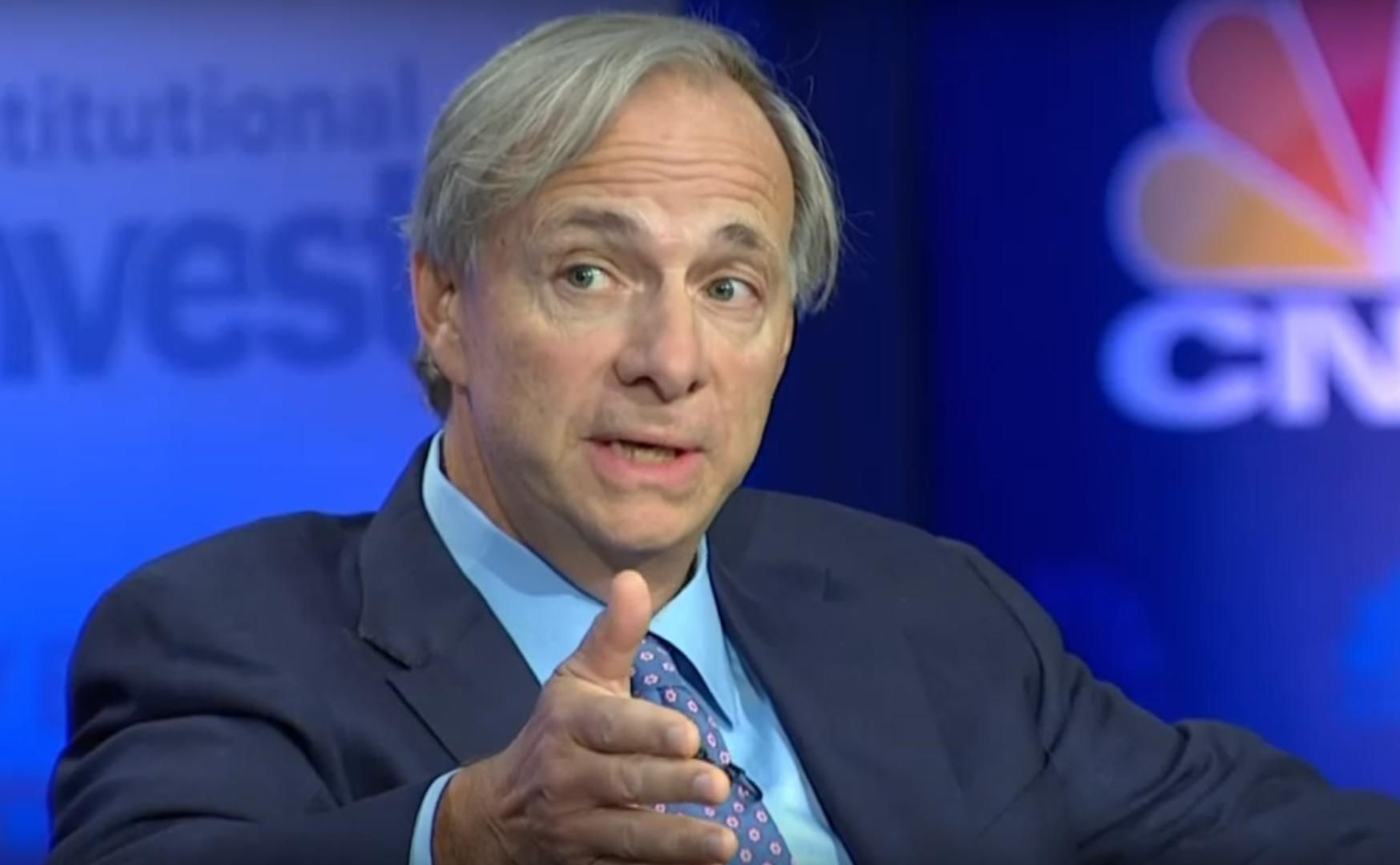

Ray Dalio Still Owns Bitcoin, but Says Traceability and Quantum Threat Are Concerns

The billionaire founder of hedge fund Bridgewater believes Bitcoin faces major hurdles before it can become a global reserve currency.

Business

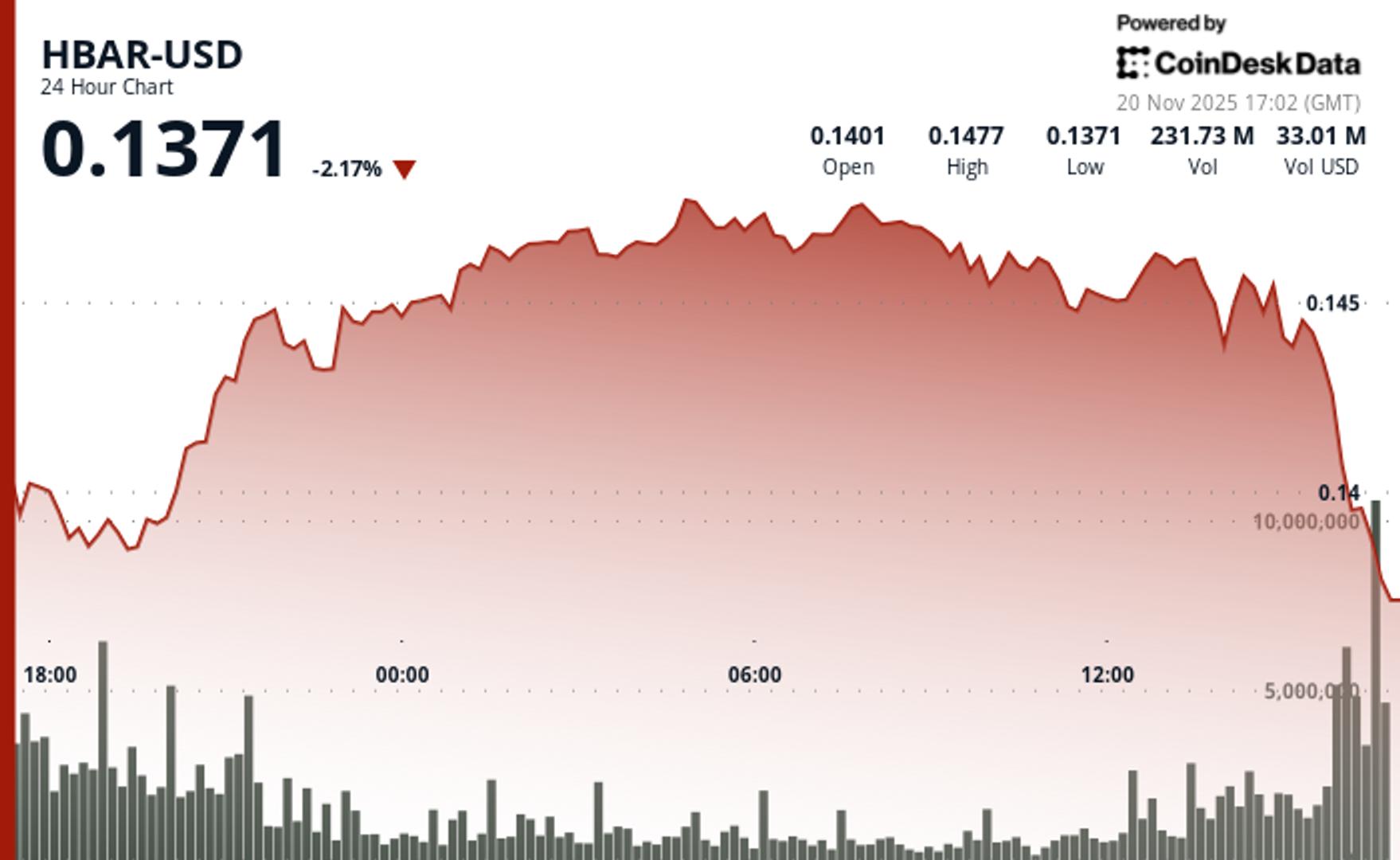

HBAR Faces Fresh Liquidity Alarms After Breakdown to $0.1373

Hedera’s token slipped below key support levels as a late-session trading halt, collapsing volume, and failed recovery attempts point to mounting structural and liquidity stress.

-

Uncategorized5 месяцев ago

Uncategorized5 месяцев agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business1 год ago

Business1 год ago3 Ways to make your business presentation more relatable

-

Fashion1 год ago

Fashion1 год agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment1 год ago

Entertainment1 год ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment1 год ago

Entertainment1 год ago10 Artists who retired from music and made a comeback

-

Business1 год ago

Business1 год ago15 Habits that could be hurting your business relationships

-

Entertainment1 год ago

Entertainment1 год agoNew Season 8 Walking Dead trailer flashes forward in time

-

Entertainment1 год ago

Entertainment1 год agoMeet Superman\’s grandfather in new trailer for Krypton