Uncategorized

Can Ethereum Be Truly Private? Developers Push for Encrypted Mempool, Default Privacy

When the U.S. government sanctioned the Ethereum-based crypto mixing service Tornado Cash in 2022, it ignited a debate within the crypto community that continues three years later.

Tornado enabled users to transfer crypto anonymously. The government contended that the service facilitated money laundering, prompting some of Ethereum’s validators and block builders to take steps to avoid engaging with Tornado-linked transactions, which made the service slower and costlier to use.

Advocates argued that complying with the sanctions amounted to censorship — undermining a fundamental cypherpunk principle. President Donald Trump supported the cypherpunks and lifted the sanctions on Tornado Cash in March of this year, but for some Ethereum developers, the situation highlighted a flaw within the network that still exists today: Why should users depend on third-party apps to transact privately on the network?

«Publicly accessible transaction graphs allow anyone to trace the flow of funds between accounts, and balances are visible to all participants in the network, undermining financial privacy,» crypto security researcher Pascal Caversaccio explained in a blog post on Wednesday. «While the Ethereum network’s transparency fosters trustlessness, it also opens the door to potential surveillance, targeting, and exploitation.»

Perhaps emboldened by the recent Tornado Cash developments, Ethereum developers and researchers have once again begun discussing ideas for making the Ethereum network private at its core.

«Privacy must not be an optional feature that users must consciously enable — it must be the default state of the network,» said Caversaccio, whose post outlined his vision for a privacy-oriented Ethereum roadmap. «Ethereum’s architecture must be designed to ensure that users are private by default, not by exception.»

Caversaccio’s post identified several potential interventions — some new, some old — that could, according to him, would make Ethereum more private for end-users. One idea is to encrypt Ethereum’s public mempool — where transactions are sent before they’re recorded permanently. Another involves making Ethereum transactions confidential through zero-knowledge cryptography, new transaction formats, and other methods.

«Today, Ethereum operates in a partial, opt-in privacy model, where users must take deliberate steps to conceal their financial activities — often at the cost of usability, accessibility, and even effectiveness,» wrote Caversaccio. «This paradigm must shift. Privacy-preserving technologies should be deeply integrated at the protocol level, allowing transactions, smart contracts, and network interactions to be inherently confidential.»

In response to Caversaccio’s post, Ethereum co-founder Vitalik Buterin left a comment on the network’s main developer forum with his own much shorter privacy-oriented Ethereum roadmap.

Buterin suggested focusing on privacy for on-chain payments, anonymizing on-chain activity within applications, making communication on the network anonymous, and privatizing on-chain reads.

To achieve all of this, Buterin listed various steps like integrating certain third-party privacy features into the core network.

One of the more substantial interventions suggested by Buterin involves moving the network towards a “one address per application” model — a departure from today’s system, where a single application may employ dozens of wallets for different features. “This is a major step, and it entails significant convenience sacrifices, but IMO this is a bullet that we should bite, because this is the most practical way to remove public links between all of your activity across different applications,” Buterin wrote.

According to Buterin, if all of his suggestions are implemented, private transactions could be the default on Ethereum.

The privacy discussion comes a few weeks before Ethereum’s next major upgrade, Pectra, which doesn’t have a major focus on privacy. Ethereum developers are also currently planning the network’s following upgrade to Fusaka. The changes to be included in that hard fork are not yet set in stone.

Read more: Vitalik Buterin Disappointed With Embrace of Blockchain “Casinos”

Uncategorized

Bitcoin Nears Golden Cross Weeks After ‘Trapping Bears’ as U.S. Debt Concerns Mount

Bitcoin’s BTC price chart is echoing a bullish pattern that foreshadowed the late 2024 price surge from $70,000 to $100,000 amid mounting concerns over the sustainability of the U.S. debt.

The leading cryptocurrency by market value appears on track to confirm a «golden cross» in the coming days, according to charting platform TradingView. The pattern occurs when the 50-day simple moving average (SMA) of prices crosses above the 200-day SMA to suggest that the short-term trend is outperforming the broader trend, with the potential to evolve into a major bull run.

The moving average-based golden cross has a mixed record of predicting price trends. The impending one, however, is worth noting because it’s about to occur weeks after its ominous-sounding opposite, the death cross, trapped bears on the wrong side of the market.

A similar pattern unfolded from August through September 2024, setting the stage for a convincing move above $70,000 in early November. Prices eventually set a record high above $109K in January this year.

The chart on the left shows that BTC bottomed out at around $50,000 in early August last year as the 50-day SMA moved below the 200-day SMA to confirm the death cross.

In other words, the death cross was a bear trap, much like the one in early April this year. Prices turned higher in subsequent weeks, eventually beginning a new uptrend after the appearance of the golden cross in late October 2024.

The bullish sequence is being repeated since early April, and prices could begin the next leg higher following the confirmation of the golden cross in the coming days.

Past performance does not guarantee future results, and technical patterns do not always deliver as expected. That said, macro factors seem aligned with the bullish technical setup.

Moody’s amplifies U.S. debt concerns

On Friday, credit rating agency Moody’s downgraded the U.S. sovereign credit rating from the highest ”Aaa” to ”Aa1”, citing concerns over the increasing national debt, which has now reached $36 trillion.

The bond market has been pricing fiscal concerns for some time. Last week, CoinDesk detailed how persistent elevated Treasury yields reflected expectations for continued fiscal splurge and sovereign risk premium, both bullish for bitcoin.

Uncategorized

XRP Price Surges After V-Shaped Recovery, Targets $3.40

Global economic tensions and regulatory developments continue to influence XRP’s price action, with the digital asset showing remarkable resilience despite recent volatility.

After experiencing a significant dip to $2.307 on high volume, XRP has established an upward trajectory with a series of higher lows, suggesting continued momentum as it approaches resistance levels.

Technical indicators point to a potential bullish breakout, with multiple analysts highlighting critical support at $2.35-$2.40 that must hold for upward continuation.

Technical Analysis Highlights

- Price experienced a 3.76% range ($2.307-$2.396) over 24 hours with a sharp sell-off at 16:00 dropping to $2.307 on high volume (77.9M).

- Strong support emerged at $2.32 level with buyers stepping in during high-volume periods, particularly during the 13:00-14:00 recovery.

- Asset established upward trajectory, forming higher lows from the bottom, with resistance around $2.39 tested during 07:00 session.

- In the last hour, XRP climbed from $2.358 to $2.368, representing a 0.42% gain with notable volume spikes at 01:52 and 01:55.

- Price surged past resistance at $2.36 to reach $2.366, later establishing new local highs at $2.369 during 02:03 session on substantial volume (539,987).

- Currently maintaining strength above $2.368 support level with decreasing volatility suggesting potential continuation of upward trajectory.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «XRP price path to $3.40 remains intact — Here is why«, Cointelegraph, published May 16, 2025.

- «XRP Price Watch: Bulls Eye $2.60 as Long-Term Trend Holds«, Bitcoin.com News, published May 17, 2025.

- «XRP Price Explosion To $5.9: Current Consolidation Won’t Stop XRP From Growing«, NewsBTC, published May 17, 2025.

Uncategorized

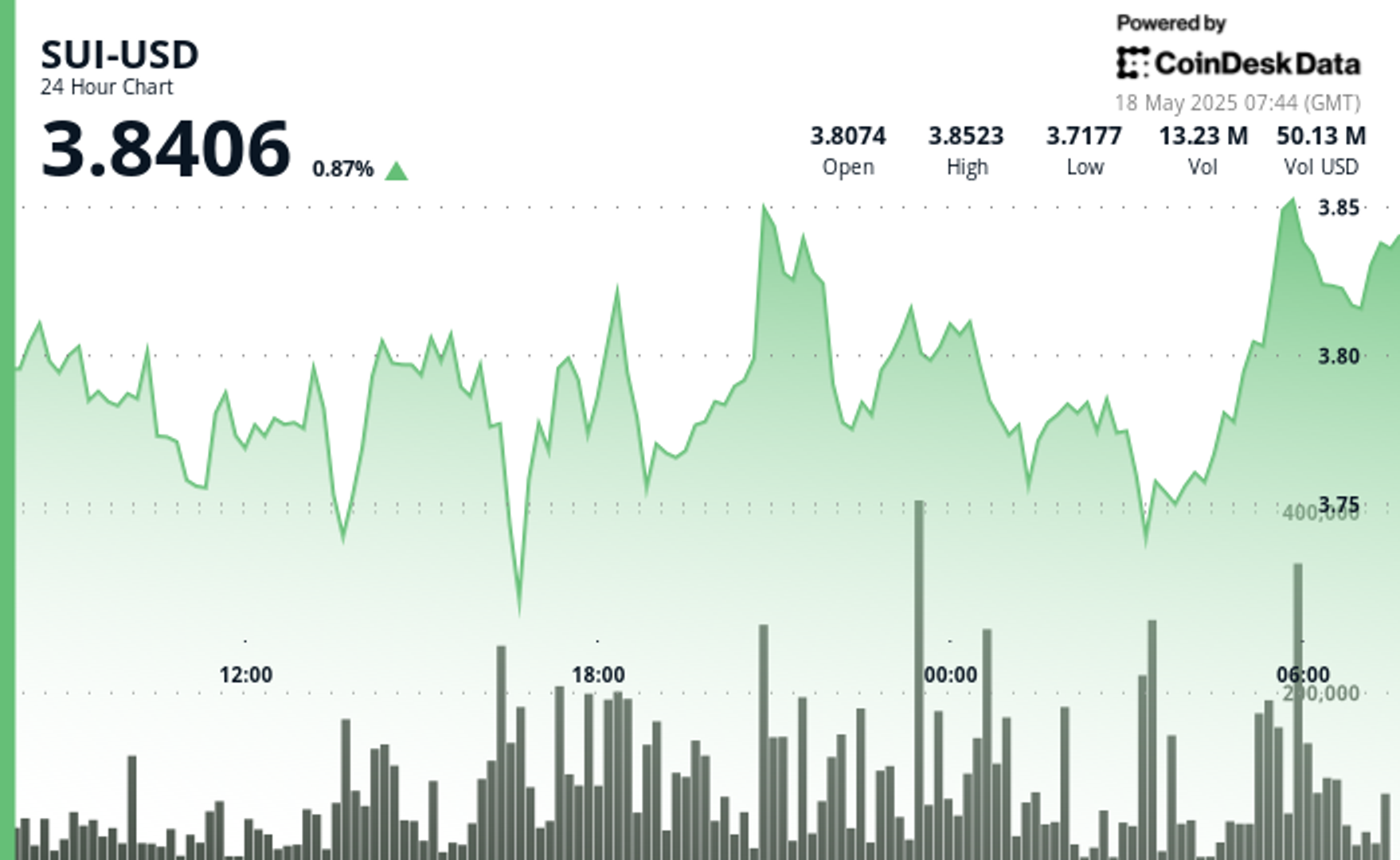

SUI Surges After Finding Strong Support at $3.75 Level

Global economic tensions and shifting trade policies continue to influence cryptocurrency markets, with SUI showing particular resilience.

The asset established a trading range of 4.46% between $3.70 and $3.86, finding strong volume support at the $3.755 level.

A notable bullish momentum emerged with price surging 1.9% on above-average volume, establishing resistance at $3.850.

The formation of higher lows throughout the latter part of the day suggests consolidation above the $3.775 support level.

Technical Analysis Highlights

- SUI established a 24-hour trading range of 0.165 (4.46%) between the low of 3.700 and high of 3.862.

- Strong volume support emerged at the 3.755 level during hours 17-18, with accumulation exceeding the 24-hour volume average by 45%.

- Notable bullish momentum occurred in the 20:00 hour with price surging 7.2 cents (1.9%) on above-average volume.

- Resistance established at 3.850 with higher lows forming throughout the latter part of the day.

- Decreasing volatility in the final hours suggests consolidation above the 3.775 support level.

- Significant buyer interest appeared between 01:27-01:30, forming a strong support zone at 3.756-3.760 with exceptionally high volume (over 300,000 units per minute).

- Decisive bullish reversal began at 01:42, establishing a series of higher lows and higher highs.

- Breakout above 3.780 occurred at 01:55, followed by consolidation near 3.785 with decreasing volume.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «Sui price up 5.16% intra-day: bullish structure remains strong«, crypto.news, published May 16, 2205.

- «SUI Set to Explode, But Don’t Sleep on XRP and Other Altcoins«, CoinPedia, May 16, 2025.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors