Uncategorized

BlackRock’s Spot Bitcoin ETF Tops World’s Largest Gold Fund in Inflows This Year

The price of gold has surged almost 29% this year, solidly beating the 3.8% gain in bitcoin (BTC). Even so, that’s failed to deter investors eager to add the largest cryptocurrency to their portfolios.

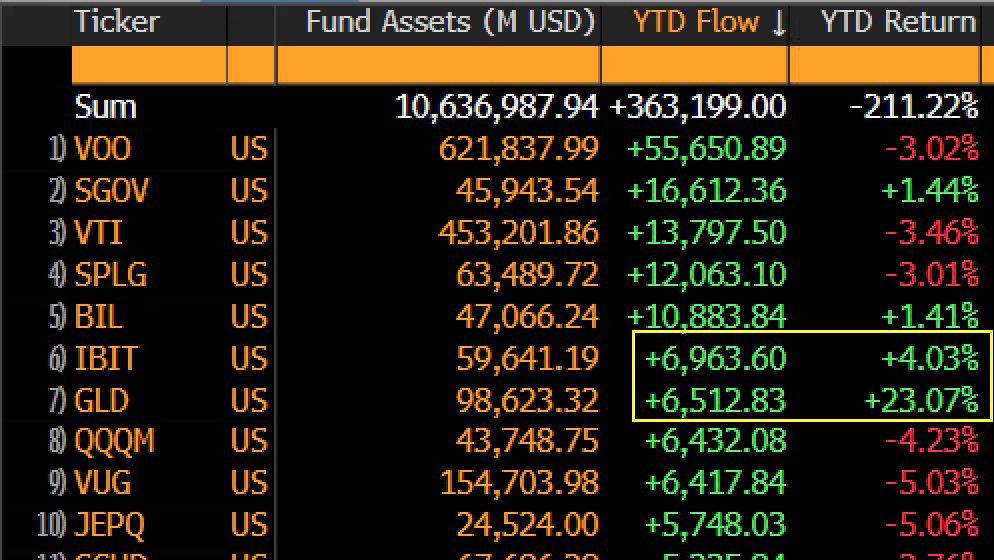

BlackRock’s spot bitcoin ETF (IBIT) has attracted a net $6.96 billion in inflows since the start of the year, the sixth-largest amount of all exchange-traded funds, according to data from Bloomberg’s senior ETF analyst, Eric Balchunas. SPDR Gold Trust (GLD), the world’s largest physically backed gold ETF, slipped to the number seven position Monday with net inflows of $6.5 billion.

IBIT’s outperformance indicates institutions’ persistent confidence in bitcoin’s long-term prospects despite the relatively dour price performance. Gold has climbed $3,384, largely due to wrangles over international trade, renewed inflation concerns and geopolitical tensions. While BTC, called by some as digital gold, hit a record high in January, it’s now more than 10% below that level.

«To take in more cash in that scenario is really good sign for long term, and inspires confidence in our call that BTC ETFs will have triple gold’s aum in 3-5yrs,» Balchunas said on X.

Uncategorized

VivoPower Raises $121M to Launch XRP Treasury Strategy With Saudi Royal Backing

VivoPower International (VVPR), a Nasdaq-listed energy company, said on Wednesday it has secured $121 million in a private share placement to fund its pivot to digital asset treasury focusing on XRP XRP, the fourth largest cryptocurrency by market capitalization.

The raise was led by Saudi Prince Abdulaziz bin Turki Abdulaziz Al Saud, investing $100 million, a spokesperson to the company told CoinDesk. The company sold 20 million ordinary shares priced at $6.05 per share.

Adam Traidman, a former Ripple executive who led the SBI Ripple Asia, is joining the company as chairman of the board of advisors, according to the press release. Ripple is an enterprise-focused blockchain service provider closely related to the XRP Ledger.

VivoPower shares surged as much as 26% on the news before giving back some of the gains. Recently, they were up over 11%, trading around $6.75.

The move is the latest example of public firms raising money to purchase and add digital assets to their treasuries, a playbook popularized by Michael Saylor’s Strategy (MSTR) that has become the largest corporate holder of bitcoin BTC. While BTC has been the most sought-after asset among these firms, recent newcomers like DeFi Development and SharpLink Gaming directed their focus to Solana’s SOL SOL and Ethereum’s ether ETH, respectively.

VivoPower, founded in 2014, aims to be the first publicly traded company with a crypto treasury strategy centered around XRP. It also plans to spin off its legacy business.

«After reviewing a number of listed vehicles seeking to embrace a digital asset treasury model, we selected VivoPower given its strategic focus on XRP and its objective to contribute to building out of the XRPL ecosystem,» Prince Abdulaziz said in a statement. «We have been investors in the digital asset sector for a decade and have been long-term holders of XRP.»

Read more: Dubai Unveils Real Estate Tokenization Platform on XRP Ledger Amid $16B Initiative

Uncategorized

NYC Mayor Eric Adams Calls For the End of NYDFS’ BitLicense, Proposes ‘BitBond’

LAS VEGAS, Nevada — Eric Adams, the mayor of New York City, called for the end of the BitLicense in a speech at Bitcoin 2025 in Las Vegas on Wednesday.

During his speech, Adams encouraged crypto businesses to return to the U.S. and set up shop in New York, echoing comments he made last week at the city’s first-ever crypto summit held at Gracie Mansion, the mayor’s official home in Manhattan.

«New York is the Empire State. We don’t break empires. We build empires. We’re saying to you, come back home,» Adams said. «[I’m] the Bitcoin mayor, and I want you back in the City of New York, where you won’t be attacked and criminalized. Let’s get rid of the [Bit]License and allow us to have the free flow of bitcoin in our city.»

Adams has previously criticized the BitLicense, the notoriously difficult-to-obtain license issued by New York’s top financial regulator, the New York Department of Financial Services (NYDFS). However, when asked about the impact of the BitLicense and NYDFS’s reputation as a tough regulator during a press conference earlier this month, Adams hedged, saying it was «good to know the city is going to have safe regulations in place for those who are investing and there’s not going to be any abuses, but at the same time, we can over regulate.»

Adams also promised to fight for the creation of a so-called BitBond, probably referring to a municipal bond backed by bitcoin.

Such a bond could potentially allow residents of New York to gain exposure to the top cryptocurrency in a tax-advantaged way. The instrument would also enable the city to raise capital.

Adams did not provide details about the city’s potential BitBond. However, the Bitcoin Policy Institute released a policy brief in March advocating for BitBonds that would use 90% of their proceeds to fund government and 10% to purchase bitcoin.

Holders of the bond would receive 1% interest annually for 10 years. Upon maturity of the bond, they would also receive 100% of bitcoin’s upside up to 4.5% compounded return, then 50% of all remaining upside. Any remaining bitcoin gains would be used to constitute the government’s bitcoin reserve.

Adams, who was first elected as a Democrat, is currently running for re-election as an independent.

Uncategorized

JD Vance Calls Crypto Market Structure Bill a ‘Priority’ for Trump Administration

LAS VEGAS, Nevada — Establishing a clear and pro-innovation regulatory framework for the crypto industry via a market structure bill is a priority for U.S. President Donald Trump’s administration, Vice President J.D. Vance said Wednesday.

Speaking to a massive crowd at Bitcoin 2025 in Las Vegas, Vance said that a regulatory framework is necessary to fully incorporate cryptocurrency into the mainstream U.S. economy, as well as to prevent future governments from rolling back the Trump administration’s crypto-friendly policies.

“I hope that our party is in charge for a long time, but nothing is ever guaranteed in politics. So the best way to ensure that crypto is part of the mainstream economy is through a market structure bill that champions and doesn’t restrict the extraordinary value that bitcoin and other digital assets represent,” Vance said at the event, which organizers said drew about 35,000 attendees. “We have a once-in-a-generation opportunity to unleash innovation and use it to improve the lives of countless American citizens, but if we fail to create regulatory clarity now, we risk chasing this $3 trillion industry offshore in search of a friendlier jurisdiction, and President Trump is going to fight to fight to make sure that does not happen.”

Vance said the Trump administration is hopeful that the GENIUS Act, the Senate’s stablecoin bill, will hit the president’s desk soon, allowing Congress to turn its attention to a market structure bill.

He also said that the administration continues to work to “clean up the wreckage that the [Biden] administration left us,” including the so-called “regulation by enforcement” approach to crypto practiced by the U.S. Securities and Exchange Commission (SEC) under then-Chair Gary Gensler, and the widespread debanking of crypto companies, dubbed by the industry as Operation Chokepoint 2.0.

“Operation Chokepoint 2.0 is dead and it’s not coming back under the Trump administration,” Vance said. “We reject the Biden administration’s legacy of death by a thousand enforcement actions… We fired Gary Gensler, and we’re gonna fire everybody like him,» he added, though Gensler resigned the day Trump was sworn in

Vance thanked the crypto industry, including Gemini’s Tyler and Cameron Winklevoss and Coinbase, for their early support of Trump’s campaign, attributing some of its success — as well as the successful elections of other crypto-friendly politicians like Sen. Bernie Moreno (R-Ohio) — to the crypto industry’s political support.

“Take the momentum of your political involvement in 2024 and carry it forward into 2026 and beyond,” Vance said.

In addition to urging the industry to stay involved in U.S. politics, Vance asked bitcoiners to stay abreast of developments in artificial intelligence (AI).

“Remember that what happens in AI is very much going to affect, in good and bad ways, what happens to bitcoin and, of course, what happens to bitcoin is very much going to affect what happens in AI,” Vance said, adding:

“Make sure you’re keeping tabs on and staying involved in what’s happening in artificial intelligence. I don’t want America to be negatively affected by what’s happening in AI, and the best way to ensure that smart people are at the AI conversation is to ensure that Bitcoin is part of the artificial intelligence conversation.”

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors