Uncategorized

Bitcoin’s Coinbase Premium Indicator Shows Overseas BTC Buyers Taking the Lead Ahead of CPI Release

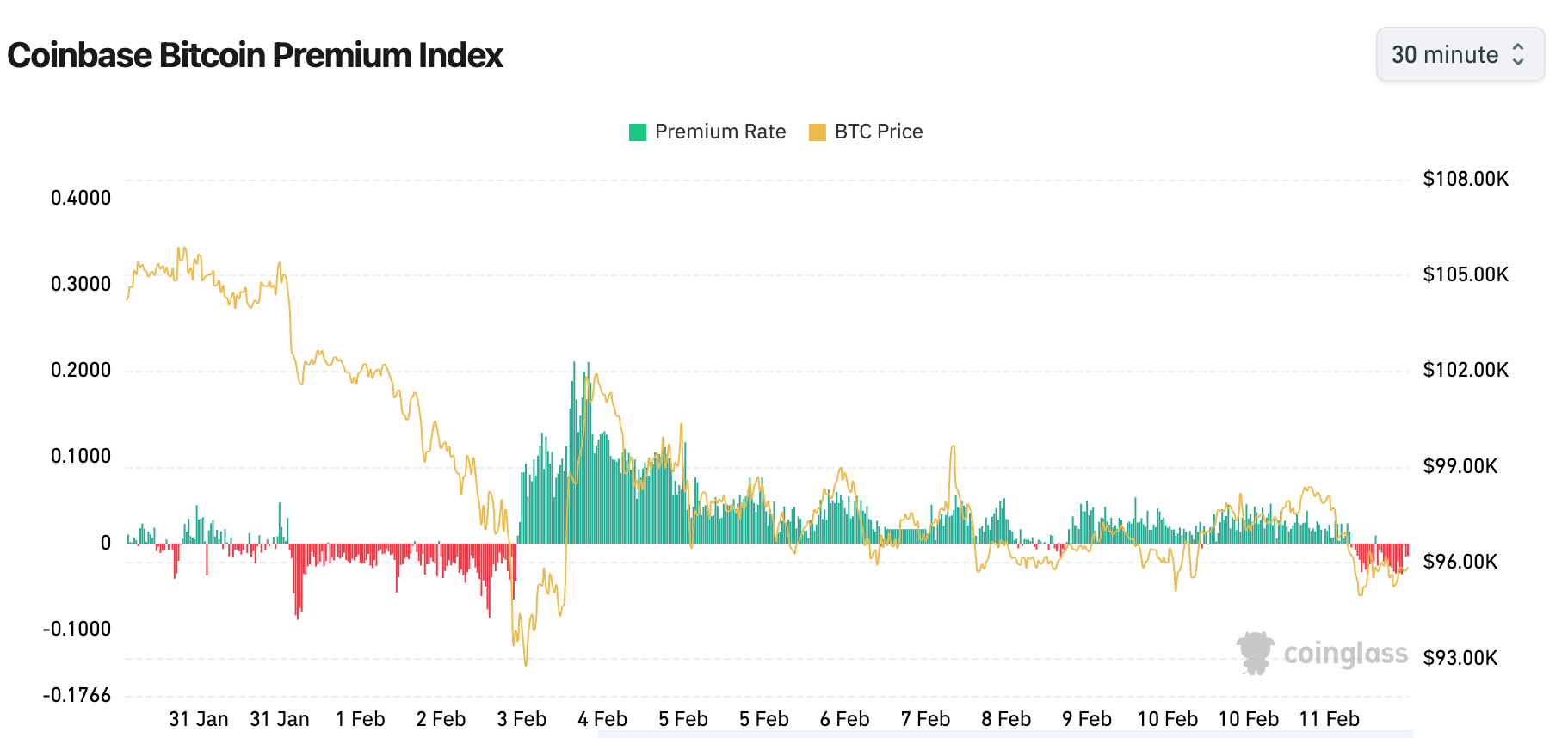

Bitcoin’s (BTC) Coinbase premium indicator, which measures the spread between BTC’s dollar-denominated price on the Coinbase exchange and tether-denominated price on Binance, has flipped negative for the first time since the Feb. 3 crash, according to data source Coinglass.

It’s a sign that traders over the Nasdaq-listed exchange have turned cautious ahead of Wednesday’s U.S. CPI release, and their offshore counterparts have led the price recovery from overnight lows near $94,900 to $96,000.

Historically, bull runs have been marked by prices trading at a premium on Coinbase, indicating strong leadership from U.S. investors. The premium soared to two-month highs in early November as BTC rose into its the-then uncharted territory above $70,000.

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts