Uncategorized

Bitcoin, XRP Open Interest Nears Record High as Bull Market Pullback Unfolds

This is a daily analysis of top tokens with CME futures by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

Bitcoin: Bull Market Pullback Underway

The bitcoin (BTC) market rally has stalled in the past 24 hours as expected, but instead of consolidation, prices have pulled back over 5% to $116,800 from record highs in a move typical of a bull market pullback. Reports suggest that profit-taking by long-term holders is weighing on the cryptocurrency’s price.

It’s common for markets to revisit breakout points, in this case, the May 22 high of around $111,960, and test the underlying buying interest before chalking out bigger rallies. A similar dynamic played out earlier this year as prices dropped from over $100,000 of $75,000, revisiting the breakout point from late 2024.

From a technical analysis perspective, the broader bullish bias will prevail while prices remain locked in the ascending channel on the daily chart. Over the next 24 hours, the focus will be on the hourly chart, which shows a steep corrective trend lower, with prices trading below the Ichimoku cloud to suggest bearish momentum.

However, the RSI on the hourly chart has dropped below 30, indicating an oversold condition – a stark contrast to the above-70 or overbought reading seen a day ago. So, a bounce cannot be ruled out. The probability of a pullback to $111,960 would weaken if the potential recovery ends the downward-trending channel. Such a move will likely result in fresh record highs.

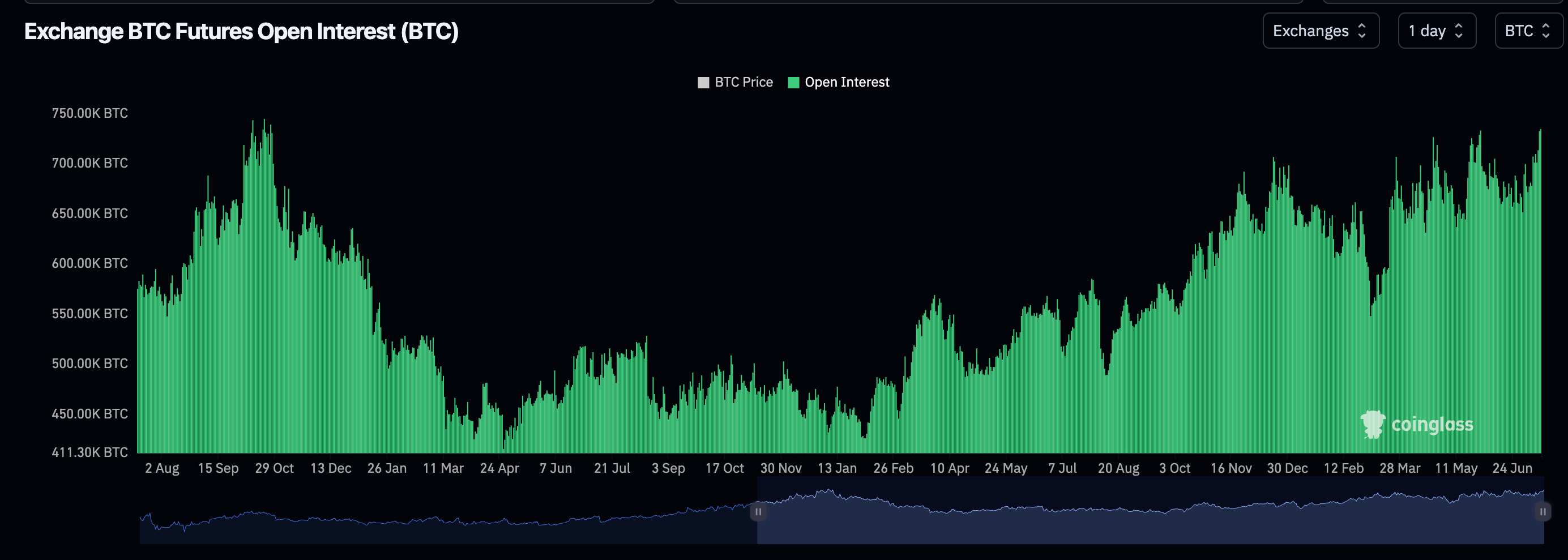

Open interest nears record high

Volatility could remain high as cumulative open interest in onshore and offshore futures and offshore perpetual futures has increased to 734.82K BTC, which is just shy of the record 744K BTC in October 2022, according to data source CoinGecko.

The growth in open interest is likely being led by offshore exchanges as the number of active contracts on the CME remains below the May high, with the three-month annualized basis still below 10%. Conversely, annualized funding rates on offshore perpetuals have topped 11%, indicating a growing demand for the bullish exposure.

MOVE Index turns higher

The MOVE index, which gauges 30-day implied volatility in U.S. Treasury notes, has rebounded from a critical level that has consistently foreshadowed sharp spikes in market volatility since 2024.

That’s a cause for concern for the bulls because volatility spikes in the Treasury market tend to lead to financial tightening, a risk-off development. Moreover, since 2024, bottoms in MOVE have marked interim BTC price tops.

Watch out for the history to repeat itself, leading to a deeper BTC bull market pullback.

- AI’s take: Bitcoin’s 5% pullback is a healthy bull market feature, aiming to retest the key breakout level of $111,960 before potentially initiating a stronger rally.

- Resistance: $118,000-118,500, $120,000, $123,181

- Support: $113,688 (the 38.2% Fib retracement of the rally from June 22 lows), $111,965, $107,823 (the 61.8% Fib)

XRP: Holds 100-hour MA and cloud support

XRP (XRP) has dropped from $3 and appears to be trapped in a downward-trending channel on the hourly chart, mirroring BTC. Still, XRP appears relatively better off, holding the confluence of the 100-hour simple moving average (SMA) and the Ichimoku cloud at $2.81.

A breakout from here would imply an end to the correction and resumption of the broader uptrend toward the yearly peak of $3.4. On the way higher, bulls will likely be tested again at around $3.

Watch out for the move below the Ichimoku cloud, as that would strengthen the immediate bear case, shifting focus to the 200-hour SMA at $2.6.

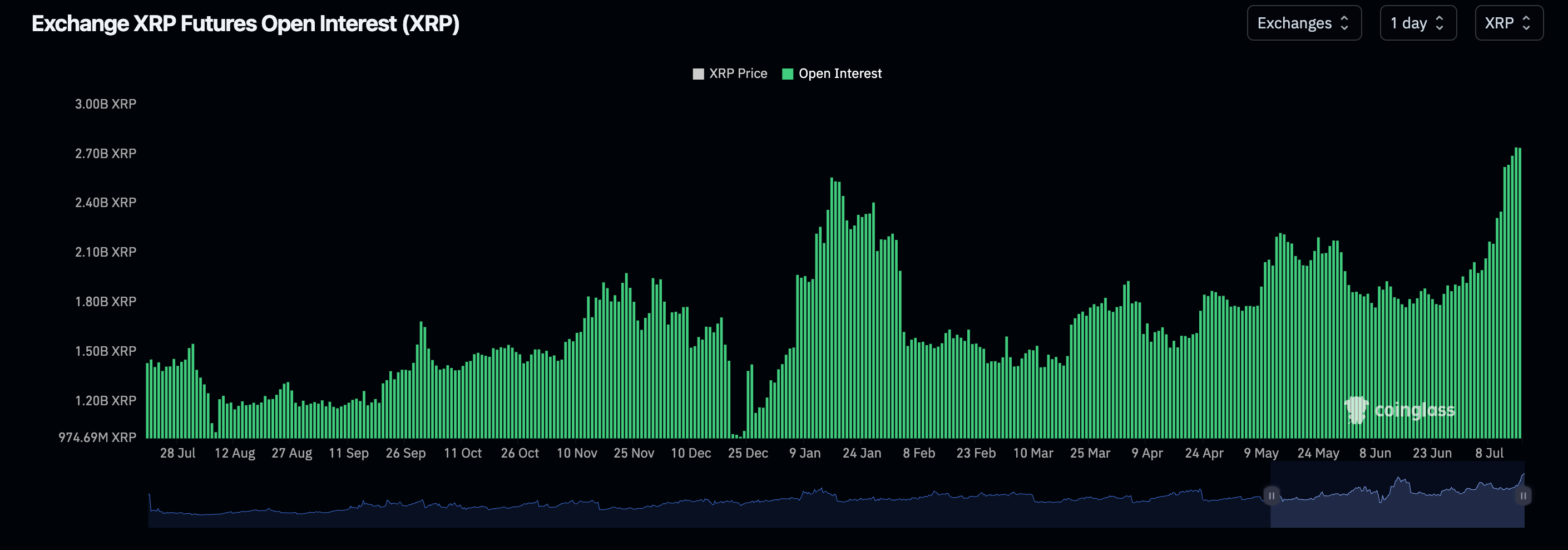

Again, volatility could be elevated with perpetual futures open interest hitting a record high of 2.74 billion XRP, according to Coinglass. The annualized XRP funding rates hover at 15%, indicating a growing bias for leveraged bullish plays.

- AI’s take: Despite XRP’s hourly chart showing a BTC-mirroring downtrend from $3, its strong hold above the 100-hour SMA and Ichimoku cloud at $2.81 signals underlying support. Record perpetual futures open interest and high funding rates indicate significant leveraged bullish demand, making a breakout above $3, towards $3.4, likely if current support holds.

- Resistance: $3, $3.4

- Support: $2.81, $2.6-$2.65, $2.38

ETH: Awaiting breakout

Ether (ETH) remains trapped in an expanding triangle, with the daily stochastic flashing an overbought reading, pointing to stretched upward momentum, which weakens the case for a firm breakout in the short term. A consolidation around the resistance looks likely as prices are firmly above the Ichimoku cloud on the daily chart and short-term SMAs point north, indicating a bullish bias. An eventual breakout would shift focus to $3,400, a level targeted by options traders.

- AI’s take: The daily stochastic being overbought indicates that momentum is stretched, making a convincing push above the upper trendline unlikely in the short term.

- Resistance: $3,067 (the 61.8% Fib retracement), $3,500, $3,570, $4,000.

- Support: $2,905, $2,880, $2,739, $2,600

SOL: $168 is the new resistance level

SOL’s upside remains elusive despite the dual breakout on the daily chart. Since Friday, the bulls have failed at least twice to chew through bearish pressures at around $168, as evidenced by the long upper wicks attached to the candles for Monday and Friday. So, a break above $168 is now needed to confirm bullishness.

On the downside, $157 is the level to watch as it marks the neckline support of the double top pattern on the hourly chart. A breakdown of the support line would imply potential for a deeper decline to $146, per the measured move method.

- AI’s take: Traders should watch for a definitive break above $168 to confirm bullish continuation; otherwise, a loss of the $157 neckline support could trigger a deeper decline towards $146.

- Resistance: $168, $180-$190, $200.

- Support: $157, $145, $125.

Uncategorized

Asia Morning Briefing: Fragility or Back on Track? BTC Holds the Line at $115K

Good Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

Bitcoin (BTC) traded just above $115k in Asia Tuesday morning, slipping slightly after a strong start to the week.

The modest pullback followed a run of inflows into U.S. spot ETFs and lingering optimism that the Federal Reserve will cut rates next week. The moves left traders divided: is this recovery built on fragile foundations, or is crypto firmly back on track after last week’s CPI-driven jitters?

That debate is playing out across research desks. Glassnode’s weekly pulse emphasizes fragility. While ETF inflows surged nearly 200% last week and futures open interest jumped, the underlying spot market looks weak.

Buying conviction remains shallow, Glassnode writes, funding rates have softened, and profit-taking is on the rise with more than 92% of supply in profit.

Options traders have also scaled back downside hedges, pushing volatility spreads lower, which Glassnode warns leaves the market exposed if risk returns. The core message: ETFs and futures are supporting the rally, but without stronger spot flows, BTC remains vulnerable.

QCP takes the other side.

The Singapore-based desk says crypto is “back on track” after CPI confirmed tariff-led inflation without major surprises. They highlight five consecutive days of sizeable BTC ETF inflows, ETH’s biggest inflow in two weeks, and strength in XRP and SOL even after ETF delays.

Traders, they argue, are interpreting regulatory postponements as inevitability rather than rejection. With the Altcoin Season Index at a 90-day high, QCP sees BTC consolidation above $115k as the launchpad for rotation into higher-beta assets.

The divide underscores how Bitcoin’s current range near $115k–$116k is a battleground. Glassnode calls it fragile optimism; QCP calls it momentum. Which side is right may depend on whether ETF inflows keep offsetting profit-taking in the weeks ahead.

Market Movement

BTC: Bitcoin is consolidating near the $115,000 level as traders square positions ahead of expected U.S. Fed policy moves; institutional demand via spot Bitcoin ETFs is supporting upside

ETH: ETH is trading near $4500 in a key resistance band; gains are being helped by renewed institutional demand, tightening supply (exchange outflows), and positive technical setups.

Gold: Gold continues to hold near record highs, underpinned by expectations of Fed interest rate cuts, inflation risk, and investor demand for safe havens; gains tempered somewhat by profit‑taking and a firmer U.S. dollar

Nikkei 225: Japan’s Nikkei 225 topped 45,000 for the first time Monday, leading Asia-Pacific gains as upbeat U.S.-China trade talks and a TikTok divestment framework lifted sentiment.

S&P 500: The S&P 500 rose 0.5% to close above 6,600 for the first time on Monday as upbeat U.S.-China trade talks and anticipation of a Fed meeting lifted stocks.

Elsewhere in Crypto

Uncategorized

Wall Street Bank Citigroup Sees Ether Falling to $4,300 by Year-End

Wall Street giant Citigroup (C) has launched new ether (ETH) forecasts, calling for $4,300 by year-end, which would be a decline from the current $4,515.

That’s the base case though. The bank’s full assessment is wide enough to drive an army regiment through, with the bull case being $6,400 and the bear case $2,200.

The bank analysts said network activity remains the key driver of ether’s value, but much of the recent growth has been on layer-2s, where value “pass-through” to Ethereum’s base layer is unclear.

Citi assumes just 30% of layer-2 activity contributes to ether’s valuation, putting current prices above its activity-based model, likely due to strong inflows and excitement around tokenization and stablecoins.

A layer 1 network is the base layer, or the underlying infrastructure of a blockchain. Layer 2 refers to a set of off-chain systems or separate blockchains built on top of layer 1s.

Exchange-traded fund (ETF) flows, though smaller than bitcoin’s (BTC), have a bigger price impact per dollar, but Citi expects them to remain limited given ether’s smaller market cap and lower visibility with new investors.

Macro factors are seen adding only modest support. With equities already near the bank’s S&P 500 6,600 target, the analysts do not expect major upside from risk assets.

Read more: Ether Bigger Beneficiary of Digital Asset Treasuries Than Bitcoin or Solana: StanChart

Uncategorized

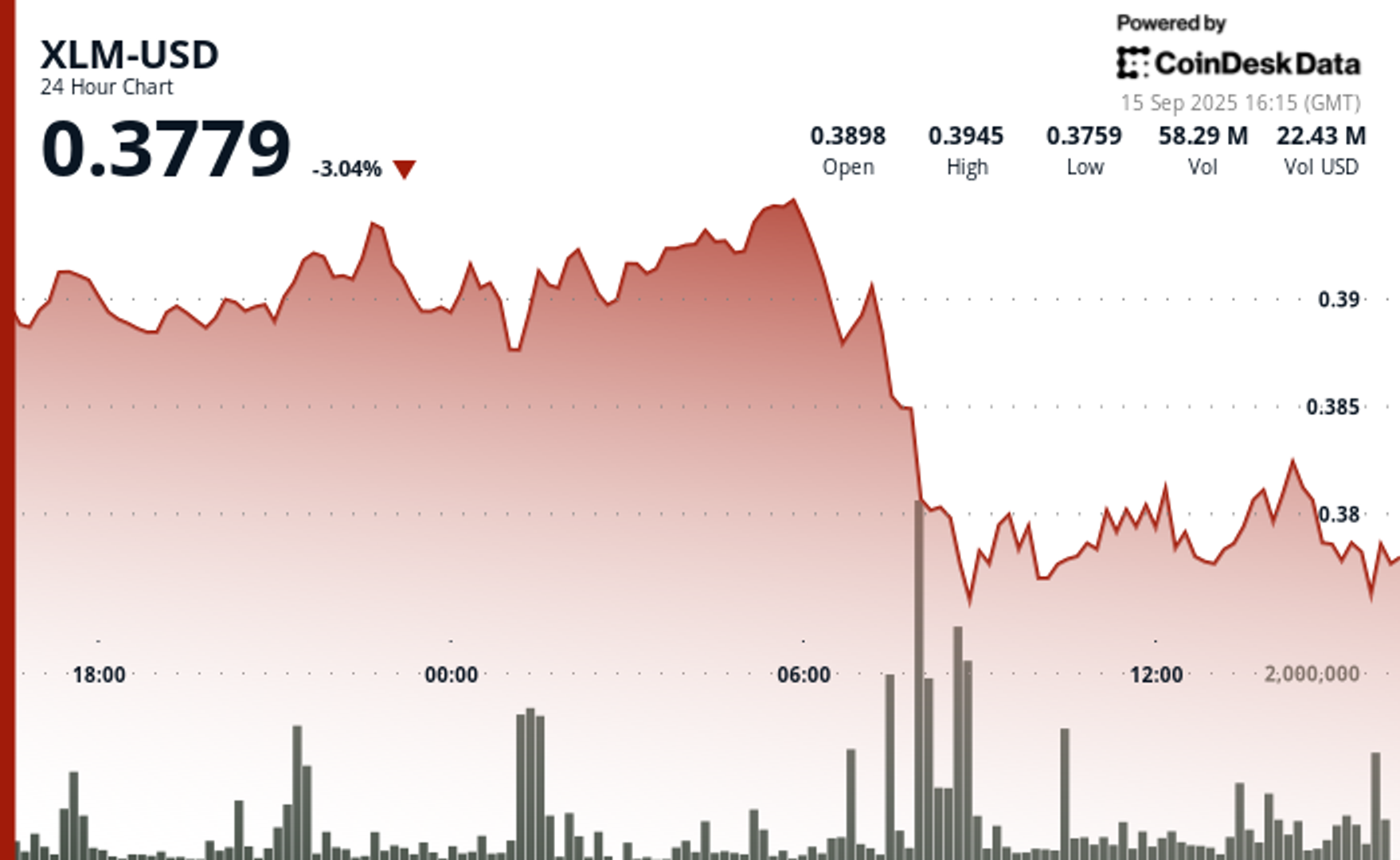

XLM Sees Heavy Volatility as Institutional Selling Weighs on Price

Stellar’s XLM token endured sharp swings over the past 24 hours, tumbling 3% as institutional selling pressure dominated order books. The asset declined from $0.39 to $0.38 between September 14 at 15:00 and September 15 at 14:00, with trading volumes peaking at 101.32 million—nearly triple its 24-hour average. The heaviest liquidation struck during the morning hours of September 15, when XLM collapsed from $0.395 to $0.376 within two hours, establishing $0.395 as firm resistance while tentative support formed near $0.375.

Despite the broader downtrend, intraday action highlighted moments of resilience. From 13:15 to 14:14 on September 15, XLM staged a brief recovery, jumping from $0.378 to a session high of $0.383 before closing the hour at $0.380. Trading volume surged above 10 million units during this window, with 3.45 million changing hands in a single minute as bulls attempted to push past resistance. While sellers capped momentum, the consolidation zone around $0.380–$0.381 now represents a potential support base.

Market dynamics suggest distribution patterns consistent with institutional profit-taking. The persistent supply overhead has reinforced resistance at $0.395, where repeated rally attempts have failed, while the emergence of support near $0.375 reflects opportunistic buying during liquidation waves. For traders, the $0.375–$0.395 band has become the key battleground that will define near-term direction.

Technical Indicators

- XLM retreated 3% from $0.39 to $0.38 during the previous 24-hours from 14 September 15:00 to 15 September 14:00.

- Trading volume peaked at 101.32 million during the 08:00 hour, nearly triple the 24-hour average of 24.47 million.

- Strong resistance established around $0.395 level during morning selloff.

- Key support emerged near $0.375 where buying interest materialized.

- Price range of $0.019 representing 5% volatility between peak and trough.

- Recovery attempts reached $0.383 by 13:00 before encountering selling pressure.

- Consolidation pattern formed around $0.380-$0.381 zone suggesting new support level.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars