Uncategorized

Bitcoin Trails Gold in 2025 but Dominates Long-Term Returns Across Major Asset Classes

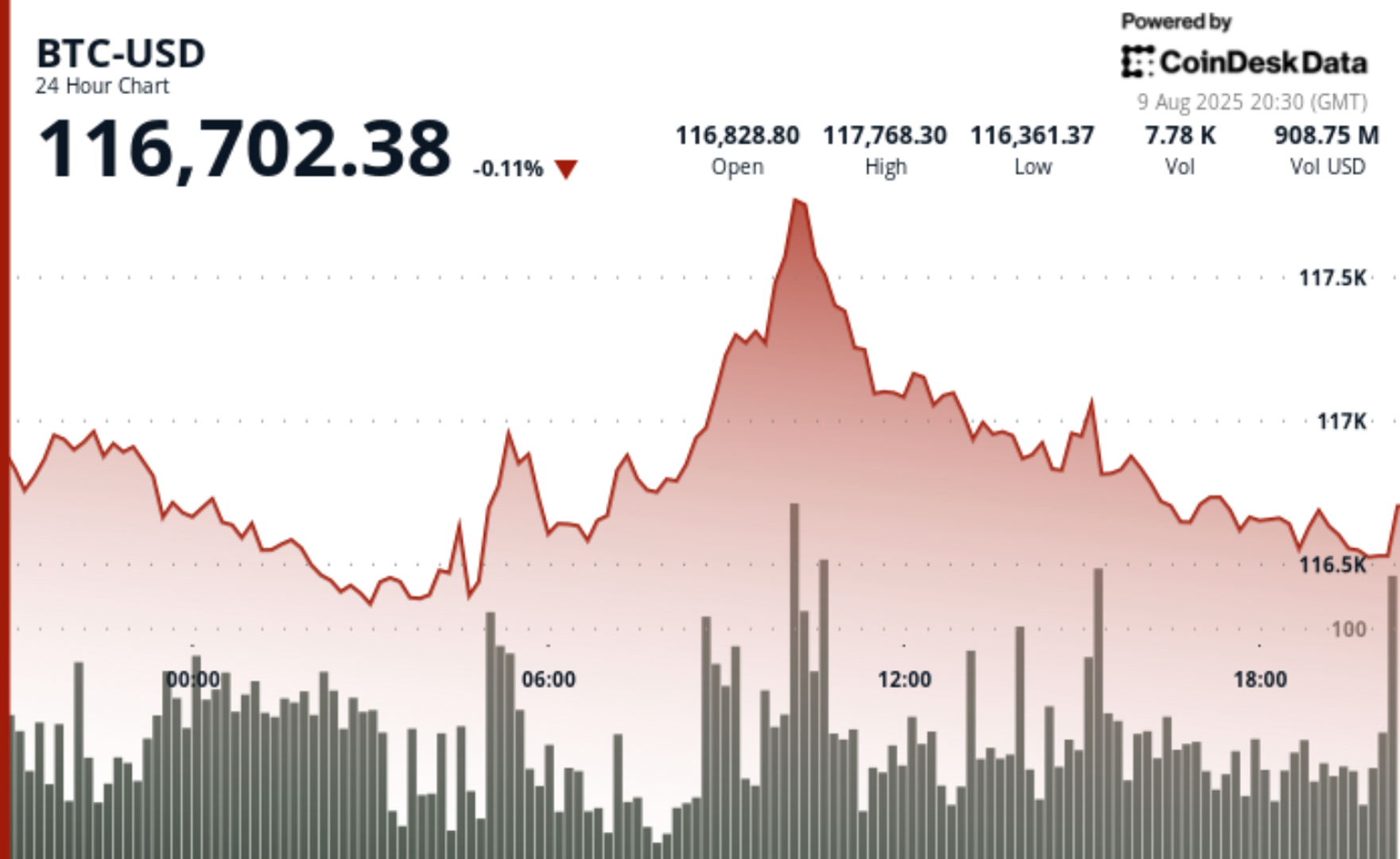

Bitcoin slipped 0.11% in the past 24 hours to $116,702, according to CoinDesk Data, but remains up 25% year to date, second only to gold’s 29% gain among major asset classes, according to data shared by financial strategist Charlie Bilello on X.

2025 Performance so far

As of Aug. 8, bitcoin’s 25% year-to-date return ranked behind only gold’s 29.3% advance. Other major asset classes have posted more modest gains, with emerging market stocks (VWO) up 15.6%, the Nasdaq 100 (QQQ) up 12.7% and U.S. large caps (SPY) rising 9.4%. Meanwhile, U.S. mid caps (MDY) and small caps (IWM) 0.2% have only gained 0.8%, respectively. This marks the first time gold and bitcoin have occupied the top two positions in Bilello’s annual asset class rankings since records began.

2011–2025 Cumulative returns

Over the longer term, bitcoin has delivered an extraordinary 38,897,420% total return since 2011 — a figure that dwarfs all other asset classes in the dataset. Gold’s 126% cumulative return over the same period puts it in the middle of the pack, trailing equity benchmarks like the Nasdaq 100 (1101%) and U.S. large caps (559%), as well as mid caps (316%), small caps (244%) and emerging market stocks (57%). Based on Bilello’s figures, bitcoin’s total return has exceeded gold’s by more than 308,000 times over the past 14 years.

2011–2025 Annualized returns

When measured on an annualized basis, bitcoin’s dominance is equally clear. The flagship cryptocurrency has delivered a 141.7% average annual gain since 2011, compared with 5.7% for gold, 18.6% for the Nasdaq 100, 13.8% for U.S. large caps and 4.4% to 16.4% for other major equity and real estate indexes. Gold’s long-term stability has made it a valuable hedge in certain market cycles, but its pace of appreciation has been far slower than bitcoin’s exponential climb.

Gold vs. bitcoin, according to Peter Brandt

Renowned trader Peter Brandt weighed in on Aug. 8, contrasting gold’s merits as a store of value with bitcoin’s potential to surpass all fiat alternatives. “Some think gold is a great store of value — and it is. But the ultimate store of value will prove to be bitcoin,” he said on X, sharing a long-term chart of the U.S. dollar’s purchasing power. His comments echo the growing narrative that bitcoin’s scarcity and decentralization make it uniquely positioned to outperform traditional hedges over time.

Technical Analysis Highlights

- According to CoinDesk Research’s technical analysis data model, between Aug. 8 at 21:00 UTC and Aug. 9 at 20:00 UTC, bitcoin traded within a $1,534.42 range (1.31%) from $116,352.52 to $117,886.44.

- Price opened near $116,900 and moved sideways before surging during Asian hours, climbing from $116,440 to $117,886 between 05:00 UTC and 10:00 UTC on Aug. 9, with 24-hour trading volume exceeding 9,000 BTC during these intervals.

- Strong buying emerged near $116,420 at 05:00 UTC, while selling pressure intensified around the $117,886 high.

- Bitcoin closed the session at $116,517, down 0.32% from the open, with defined support at $116,400–$116,500 and resistance at $117,400–$117,900

- In the final hour of the analysis period (Aug. 9, 19:06–20:05 UTC), bitcoin remained under downward pressure within a $195.11 band, sliding from $116,629.40 to $116,519.29 (-0.09%).

- The largest final-hour volume spike occurred at 19:27 UTC, when 296.43 BTC changed hands as price tested $116,547 support.

- Recovery attempts were repeatedly capped near $116,600–$116,713, in line with earlier intraday resistance.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts