Uncategorized

Bitcoin Traders Eye Long Term BTC Accumulation by Selling Put Options

Would you offer insurance when expecting low odds of a claim being made? Most likely, you would, while pocketing the premium without a second thought. Bitcoin (BTC) traders are doing something similar in the Deribit-listed BTC options market, hinting at bullish price expectations.

Recently, an increasing number of traders have been selling (writing) BTC put options, likened to providing insurance against price drops in exchange for a small upfront premium.

They are implementing this strategy in a cash-secured manner by holding a corresponding amount in stablecoins, ensuring they can buy BTC if the market declines and the put buyer decides to exercise his right to sell BTC at the predetermined higher price.

This strategy enables traders to collect premiums (paid by put buyers) while potentially accumulating bitcoin if the options are exercised. In other words, it’s the expression of a long-term bullish sentiment.

«There is a notable increase in cash-secured put selling using stablecoins—another sign of a more mature, long-term approach to BTC accumulation and a continued expression of bullish sentiment,» Deribit’s Asia Business Development Head Lin Chen told CoinDesk.

Chen said BTC holders are also selling higher strike call options to collect premiums and generate additional yield on top of their coin stash, which is weighing over Deribit’s DVOL index, which measures the 30-day BTC implied volatility. The index has dropped from 63 to 48 since the April 7 panic selling in BTC to $75K, according to data from the charting platform TradingView.

«We observe that investors remain long-term bullish on BTC, particularly among crypto-native “holders” who are willing to hold through market cycles,» Chen said.

Bitcoin’s price has risen to over $92,000 since the early month slide to $75,000, supposedly on the back of haven demand and renewed institutional adoption narrative.

The sharp price recovery has seen BTC options risk reversals reset to suggest a bias for call options across time frames, according to data source Amberdata. Over the past two days, traders have specifically snapped up calls at strike $95,000, $100,000 and $135,000 via the over-the-counter tech platform Paradigm. As of writing, the $100,000 strike call was the most popular option play on Deribit, with a notional open interest of over $1.6 billion.

$9 billion in delta

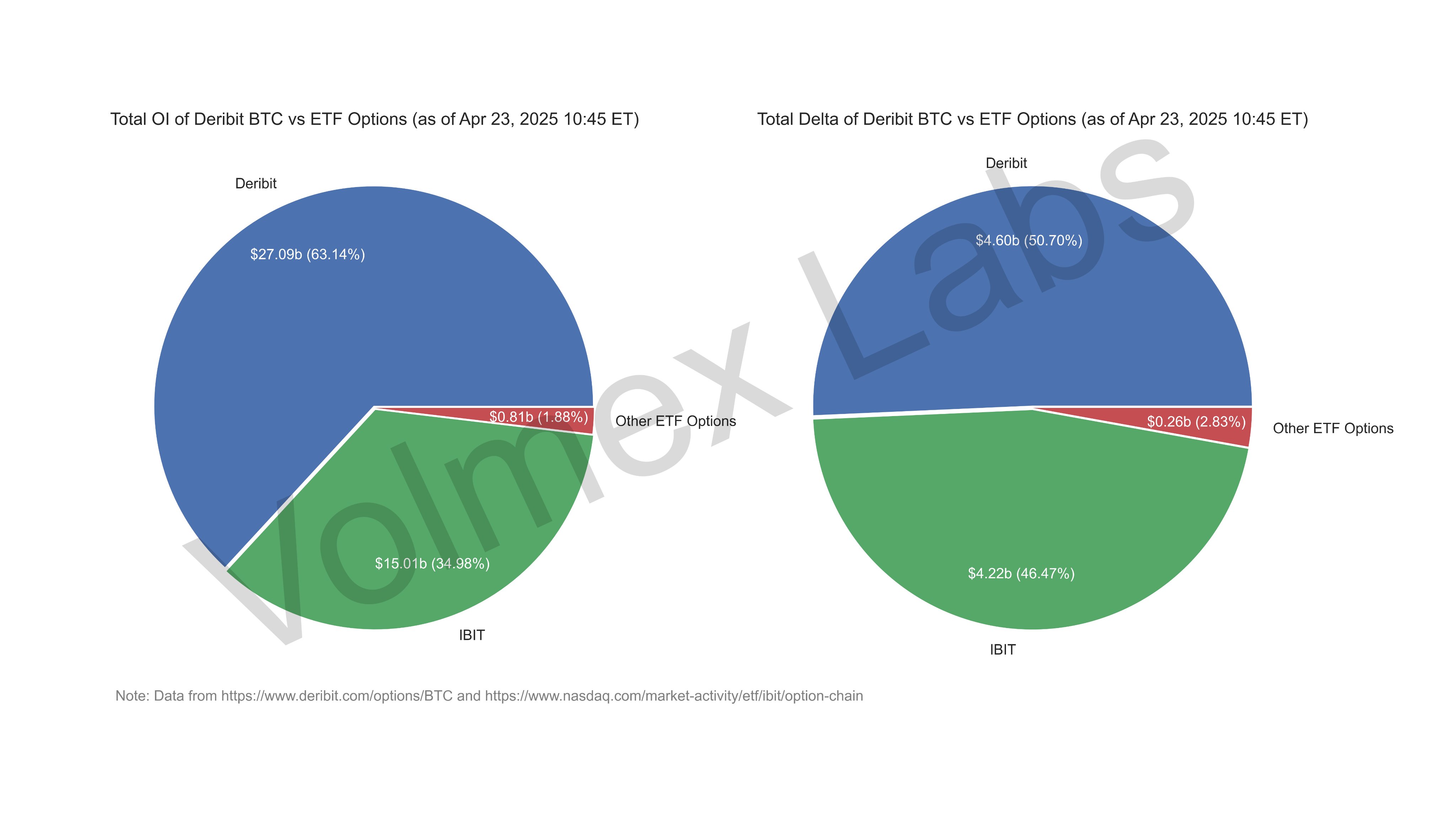

Just how important it is to track flows in the options market can be explained by the fact that the cumulative delta in Deribit’s BTC options and options tied to the U.S.-listed BlackRock spot bitcoin ETF (IBIT) and its peers was $9 billion as of Wednesday, according to data tracked by Volmex.

The data indicates heightened sensitivity of options to changes in BTC’s price, suggesting potential for price volatility.

Delta, one of the metrics used by sophisticated market participants to manage risk, measures how much the price (premium) of an options contract is likely to change in response to the $1 chance in the price of the underlying asset, in this case, BTC.

So, the cumulative delta of $9 billion represents the total sensitivity of all outstanding BTC and bitcoin ETF options to changes in the spot price. As of Wednesday, the total notional value of all outstanding options contracts was $43 billion.

Such large data or sensitivity to price swings in the underlying asset means market makers and traders actively engage in hedging strategies to mitigate their risks. Market makers, or those mandated to provide order book liquidity, are known to add to price volatility through their constant effort to maintain a net directional neutral exposure.

«Option deltas have increased to record levels as open interest grew and strike deltas shifted significantly. Option market makers are actively hedging this delta exposure, driven by substantial new positions and notable shifts in strike pricing,» Volmex noted on X.

According to Volmex, crypto-native options traders over Deribit are positioned more bullishly than those trading options tied to IBIT.

Uncategorized

XRP Price Surges After V-Shaped Recovery, Targets $3.40

Global economic tensions and regulatory developments continue to influence XRP’s price action, with the digital asset showing remarkable resilience despite recent volatility.

After experiencing a significant dip to $2.307 on high volume, XRP has established an upward trajectory with a series of higher lows, suggesting continued momentum as it approaches resistance levels.

Technical indicators point to a potential bullish breakout, with multiple analysts highlighting critical support at $2.35-$2.40 that must hold for upward continuation.

Technical Analysis Highlights

- Price experienced a 3.76% range ($2.307-$2.396) over 24 hours with a sharp sell-off at 16:00 dropping to $2.307 on high volume (77.9M).

- Strong support emerged at $2.32 level with buyers stepping in during high-volume periods, particularly during the 13:00-14:00 recovery.

- Asset established upward trajectory, forming higher lows from the bottom, with resistance around $2.39 tested during 07:00 session.

- In the last hour, XRP climbed from $2.358 to $2.368, representing a 0.42% gain with notable volume spikes at 01:52 and 01:55.

- Price surged past resistance at $2.36 to reach $2.366, later establishing new local highs at $2.369 during 02:03 session on substantial volume (539,987).

- Currently maintaining strength above $2.368 support level with decreasing volatility suggesting potential continuation of upward trajectory.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «XRP price path to $3.40 remains intact — Here is why«, Cointelegraph, published May 16, 2025.

- «XRP Price Watch: Bulls Eye $2.60 as Long-Term Trend Holds«, Bitcoin.com News, published May 17, 2025.

- «XRP Price Explosion To $5.9: Current Consolidation Won’t Stop XRP From Growing«, NewsBTC, published May 17, 2025.

Uncategorized

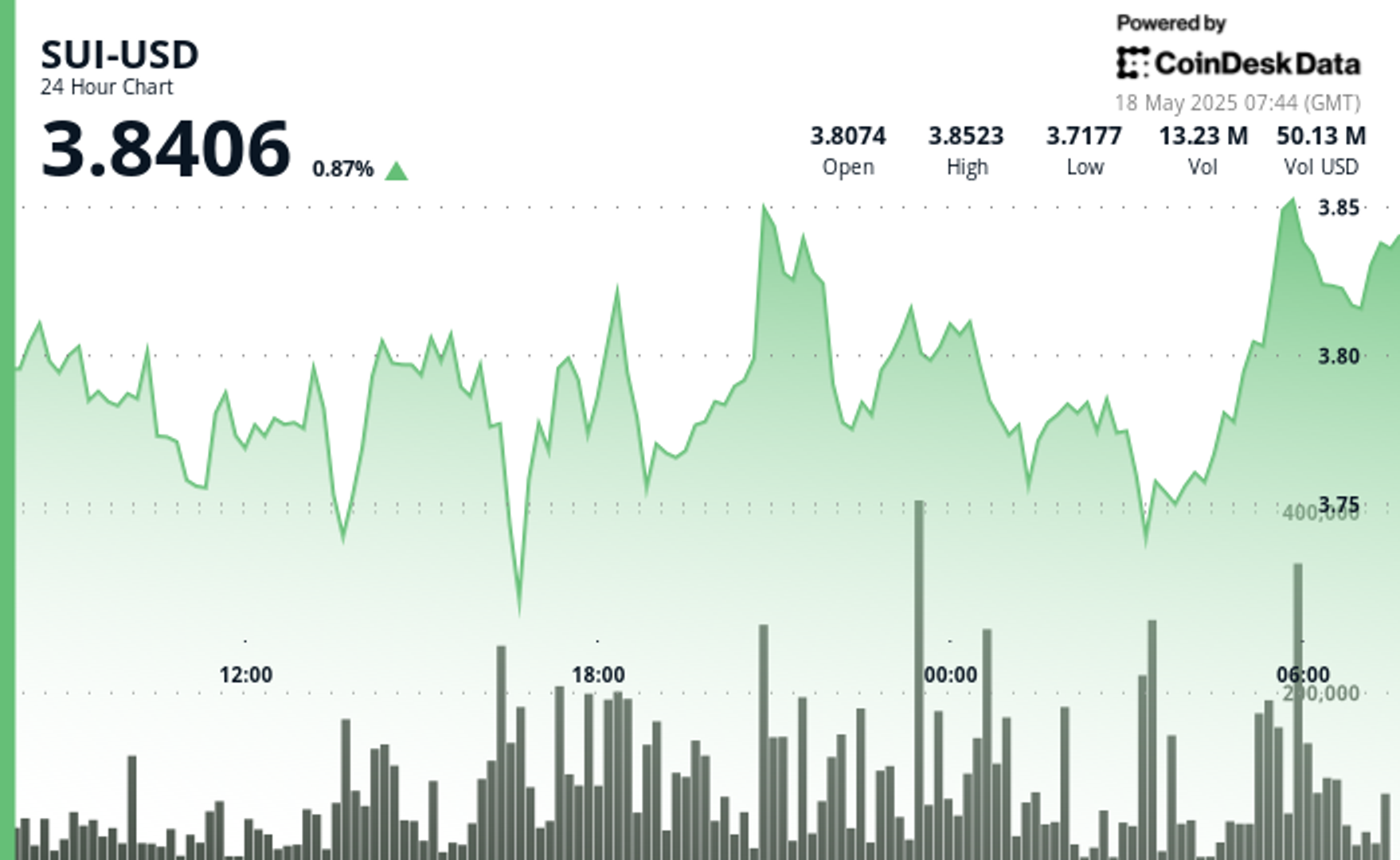

SUI Surges After Finding Strong Support at $3.75 Level

Global economic tensions and shifting trade policies continue to influence cryptocurrency markets, with SUI showing particular resilience.

The asset established a trading range of 4.46% between $3.70 and $3.86, finding strong volume support at the $3.755 level.

A notable bullish momentum emerged with price surging 1.9% on above-average volume, establishing resistance at $3.850.

The formation of higher lows throughout the latter part of the day suggests consolidation above the $3.775 support level.

Technical Analysis Highlights

- SUI established a 24-hour trading range of 0.165 (4.46%) between the low of 3.700 and high of 3.862.

- Strong volume support emerged at the 3.755 level during hours 17-18, with accumulation exceeding the 24-hour volume average by 45%.

- Notable bullish momentum occurred in the 20:00 hour with price surging 7.2 cents (1.9%) on above-average volume.

- Resistance established at 3.850 with higher lows forming throughout the latter part of the day.

- Decreasing volatility in the final hours suggests consolidation above the 3.775 support level.

- Significant buyer interest appeared between 01:27-01:30, forming a strong support zone at 3.756-3.760 with exceptionally high volume (over 300,000 units per minute).

- Decisive bullish reversal began at 01:42, establishing a series of higher lows and higher highs.

- Breakout above 3.780 occurred at 01:55, followed by consolidation near 3.785 with decreasing volume.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «Sui price up 5.16% intra-day: bullish structure remains strong«, crypto.news, published May 16, 2205.

- «SUI Set to Explode, But Don’t Sleep on XRP and Other Altcoins«, CoinPedia, May 16, 2025.

Uncategorized

Dogecoin (DOGE) Whales Accumulate 1 Billion DOGE Amid Critical Support Formation

Geopolitical tensions and evolving trade policies continue to influence cryptocurrency markets, with Dogecoin showing resilience amid broader economic uncertainty.

Despite macroeconomic headwinds, DOGE has maintained support above key moving averages while forming a potential bull flag pattern that could target $0.35 if validated by continued buying pressure.

Technical Analysis Highlights

- DOGE experienced significant volatility with a 4.3% range (0.211-0.220) over the past 24 hours, forming a key support zone around 0.212 validated by high volume rebounds at 13:00 and 22:00.

- The price action reveals a bullish recovery pattern from the 16:00 low, with resistance emerging at 0.217-0.220.

- The 20:00 candle’s strong volume surge above the 24-hour average confirms renewed buying interest, suggesting potential upward momentum if DOGE can maintain its position above the established support level.

- In the past hour, DOGE has demonstrated significant bullish momentum, climbing from 0.215 to 0.216 with notable volume spikes at 01:17, 01:21, and 01:54-01:55.

- The price established a strong support zone around 0.215 during the early minutes, followed by a decisive breakout at 01:16-01:17 where volume surged over 8 million.

- The uptrend continued with higher lows forming a clear ascending pattern, culminating in a new resistance test at 0.216-0.217 range.

- The final minutes saw particularly heavy trading activity with volumes exceeding 7 million at 02:01-02:02, confirming strong buyer interest and suggesting potential for further upside movement.

Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy. This article may include information from external sources, which are listed below when applicable.

External References

- «Dogecoin Eyes $0.35 as Whale Accumulation Signals Bull Flag Breakout«, The Crypto Basic, published May 16, 2025.

- «Dogecoin Hovers at $0.22 Following Weeks of Gains, Analysts Share Mixed Outlooks«, NewsBTC, published May 17, 2025.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors