Uncategorized

Bitcoin to Hit Record Around $185K in 2025 as Nation States Buy: Galaxy Research

Bitcoin (BTC), the world’s largest cryptocurrency, is likely to reach new highs next year and will «test or best» $185,000 in the fourth quarter of 2025, Galaxy Research said in a report last week.

Ether (ETH), the second-largest crypto, is predicted to rise above $5,500 in the next 12 months, the report said.

«A combination of institutional, corporate and nation state adoption will propel bitcoin to new heights in 2025,» wrote Alex Thorn, Galaxy’s head of research.

Galaxy said it expects five Nasdaq-100 companies and five nation states to say they have added bitcoin to their balance sheets or sovereign wealth funds next year, and competition among these countries will drive the next wave of adoption, the report said.

The total assets under management (AUM) of U.S. spot bitcoin exchange-traded funds (ETFs) is expected to surpass $250 billion in 2025, Galaxy forecast, and at least one leading wealth management platform will announce a bitcoin allocation of 2% or higher next year.

Bitcoin decentralized finance (DeFi) is also expected to boom, Galaxy said. The total amount of BTC locked in DeFi is forecast to double next year from the current $11 billion.

The trend of miners pivoting to high-performance computing (HPC) is expected to continue, and more than half of the 20 largest listed bitcoin mining firms will announce deals with artificial intelligence firms (AI) or hyperscalers in 2025, the report added.

Bitcoin will reach 20% of gold’s market cap next year, the report predicted.

Read more: Crypto Markets Have Benefited From a Positive Environment Since U.S. Election: Citi

Uncategorized

Can Bitcoin Break Conference Curse at This Week’s Las Vegas Event?

As bitcoin BTC enters this week’s Bitcoin Conference in Las Vegas priced at roughly a record high above $109,000, traders and analysts are closely watching whether it what’s become a trend of poor performance after these events.

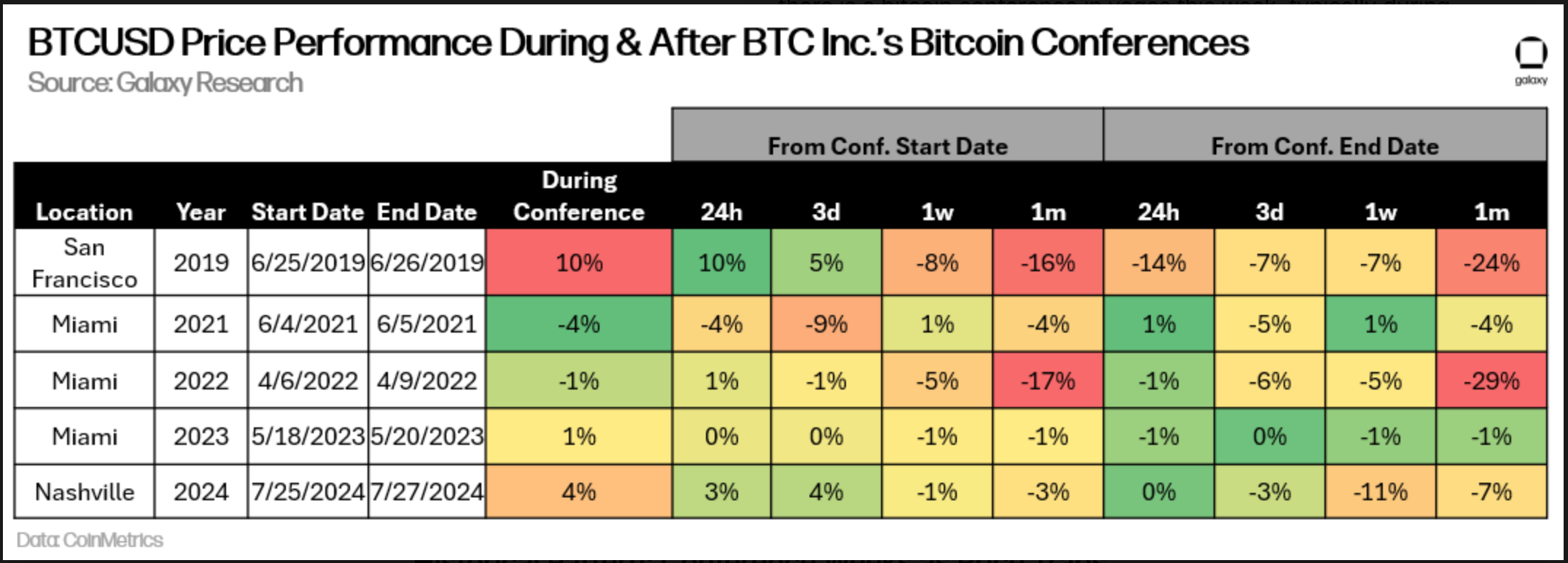

Historical data compiled by Galaxy Research across five prior conferences from San Francisco in 2019 to Nashville in 2024 reveals that bitcoin has generally fared poorly both during and especially after these gatherings.

For example, the 2019 event saw a 10% decline during the conference and BTC went on to tumble 24% over the following month. The 2022 conference in Miami showed a similar trajectory: down 1% during the event and a steep 29% slide in the month after. Both of those instances, however, occurred in the middle of bear markets.

Even in bull market years like 2023, though, price action remained flat or slightly negative.

The most recent 2024 conference in Nashville in July — which featured then-presidential candidate Donald Trump promising a strategic bitcoin reserve — posted a 4% gain during the event, but a fast 20% decline shortly after, coinciding with the unwinding of the yen carry trade that triggered a broader risk-off move across global markets.

The setup this year — which is set to feature current Vice President J.D. Vance — could be materially different as institutional engagement is rising. Still, with historical data stacked against it, bitcoin faces a psychological hurdle as much as a technical one. Conference weeks have become sell-the-news moments.

Uncategorized

Ethereum Surges 4% on Massive Volume as Institutional Interest Grows

Ethereum ETH has staged an impressive recovery in the past 24 hours, climbing 3.8% amid significant market volatility. The second-largest cryptocurrency found solid support at $2,530, where exceptional trading volume (242,521 ETH) created a clear bottoming pattern.

This was followed by a decisive breakout during the early trading hours, supported by massive volume surges exceeding 550,000 ETH that pushed prices above key resistance levels.

The recent price action confirms a short-term trend reversal, with ETH now trading above $2,575 after establishing new local highs. Institutional interest remains robust, with spot Ethereum ETFs recording $248 million in total net inflows over the past week, suggesting growing confidence from larger investors despite relatively subdued retail participation.

Market analysts point to the $2,800 level as a critical resistance zone where many investors who previously bought at that level may look to exit at break-even. However, with ETH breaking out of its recent consolidation pattern and the broader crypto market showing signs of strength, bulls are now targeting the $2,650-$2,745 range as the next significant hurdle.

Technical Analysis

- A clear bottoming pattern formed during the 01:00 hour with exceptionally high volume (242,521 ETH), establishing strong volume support.

- A decisive breakout occurred during the 06:00-07:00 hours with massive volume surges (553,348 ETH and 221,502 ETH respectively).

- The price action showed three distinct phases: initial consolidation (07:04-07:29), powerful breakout (07:30-07:32) with high volume spikes exceeding 7,000 ETH per minute, and sustained uptrend.

- The $2,600 level is now established as a new support zone with momentum indicators suggesting potential for further upside toward $2,650.

- High-volume support at $2,530 now serves as a critical floor for any retracements.

This technical analysis was conducted according to CoinDesk s research model analysing CoinDesk Data

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

External References

- Bitcoin Sistemi, Ethereum (ETH) Continues Bullish Momentum – What’s Next? Here Are the Details, published May 26, 2025.

- CryptoPotato, Interesting Ethereum (ETH) Price Predictions as of Late, published May 26, 2025.

- CryptoPotato, Ethereum’s (ETH) Quiet Rally – Where Are the Retail Investors?, published May 26, 2025.

- NewsBTC, Ethereum Above $2,500 – Here’s Why Analysts Think $3,000 May Be Next, published May 27, 2025.

- CoinEdition, Ethereum Price Prediction for May 28, published May 27, 2025.

Uncategorized

SharpLink Gaming Soars 400% as Joseph Lubin’s Consensys Leads $425M Funding for ETH Treasury Strategy

Shares of sports marketing company SharpLink (SBET) rose 412% on Tuesday after it announced plans to create an Ethereum ETH treasury reserve strategy with involvement from the blockchain’s own co-founder, Joseph Lubin.

The Minneapolis-based firm, founded in 1995, is currently trading at $34.45, up from $7 Friday, with a market cap now of $23 million.

The company is raising roughly $425 million though a private investment in public equity (PIPE) offering. The proceeds will be used to buy ether, which will then serve as the primary treasury reserve asset.

Ethereum software developer Consensys, which was also co-founded by Lubin, was the lead investor with further participation by Pantera Capital, Galaxy Digital, and Ondo, among smaller names.

The offering is expected to close on May 29th, according to the release. Lubin will become chairman of the board of directors upon the closing.

SharpLink joins an increasing number of microcap companies trying to mimic the success of Strategy (MSTR), the first company to adopt a bitcoin BTC treasury strategy, resulting in an over 3,000% increase of its share price over the past five years.

Along those lines, Trump Media & Technology Group (DJT) Tuesday morning announced a $2.5 billion capital raise to begin a bitcoin treasury strategy.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors