Uncategorized

Bitcoin Steady, Gold Tokens Shine as XAU Hits Record High; Inflation in Tokyo Rises

So close yet so far – that’s the story for bitcoin (BTC) this Friday morning, as its price rally has stalled just shy of record highs amidst a continued rally in gold (XAU), a traditional risk asset, and crypto tokens associated with it.

BTC, the leading cryptocurrency by market value, changed hands near $104,400 at press time. Bitcoin prices are just 4.7% short of setting a new lifetime high, according to CoinDesk data.

President Trump’s reiteration of the tariffs threat looks to have clipped BTC’s wings. While some fear an extended sell-off before the next big bullish wave unfolds, action in the onchain derivatives market suggests otherwise.

«While some crypto leaders are betting on BTC to fall before rallying towards $250K later this year, the Derive.xyz market remains skeptical. In fact, there’s a 9.7% chance of BTC falling below $75K before March and an even less likely 4.4% chance that it will swing over $250K before September 26,» Nick Forster, founder at the leading decentralized onchain options AI-powered platform Derive.xyz, told CoinDesk.

Flows on Deribit and the CME remain bullish as momentum looks to be building for state-level BTC reserves in the U.S. That said, gold, a traditional safe haven, and tokens tied to gold are on the rise, and the latest uptick in Tokyo inflation supports the bullish case in the anti-risk yen.

Gold hits lifetime high

Gold rose to a record high of $2,799 per ounce early Friday, taking the month-to-date gain to 6.5%. The lifetime high comes as participants in the London bullion market rush to borrow the yellow metal from central banks, motivated by reports of heightened gold deliveries to the U.S. The flurry of activity is reportedly driven by worries over possible import tariffs, according to Reuters.

According to Blokland Smart Multi-Asset Fund’s Founder, Jeroen Blokland, gold’s rally to record highs against major fiat currencies hints at currency debasement. The intentional devaluation of paper money could also source demand for alternative investments like cryptocurrencies.

Gold-backed tokens are already drawing strength from the XAU price rise, although they continue to trade at a discount to the yellow metal. Tether gold (XAUT) rose to its lifetime high of $2,796 on Bitfinex early today, TradingView data show. Meanwhile, PAXG also teased a move to record highs above $2,800.

Tokyo inflation surges, AUD/JPY looks south

Consumer inflation in Tokyo, which tends to lead nationwide trends, sped up slightly in January, government data showed. Notably, the core figure, which excludes the volatile food and energy component, rose 2.5% in January from a year earlier, compared with the 2.4% increase seen in December.

The fastest annual increase is conducive to more Bank of Japan (BOJ) rate hikes and yen strength. Last week, the central bank raised the policy rate to 0.5%, the highest in over 16 years.

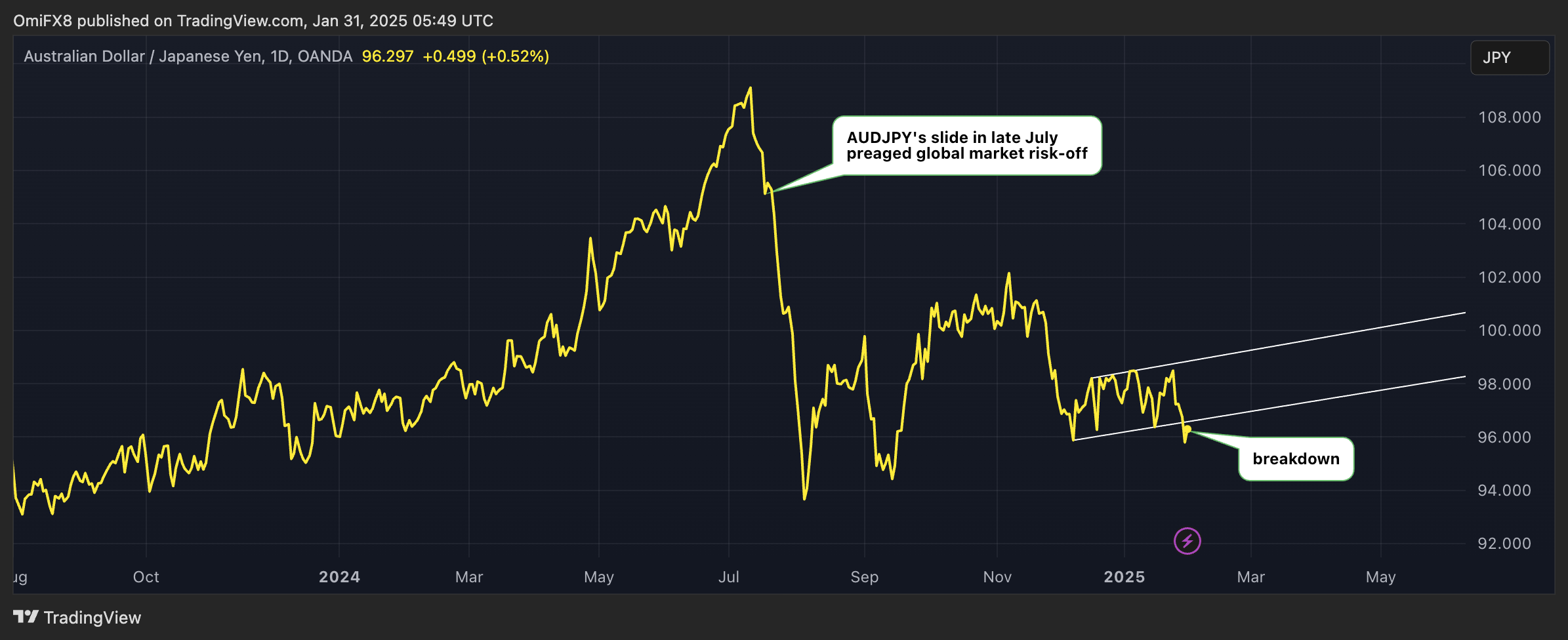

A potential surge in the yen could destabilize riskier assets, as seen in August of last year. AUD/JPY, the FX market’s risk barometer, has dived out of a consolidation pattern, hinting at more losses and broad-based risk-off ahead.

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoDisney\’s live-action Aladdin finally finds its stars

binance

5 сентября, 2025 at 3:27 дп

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.