Uncategorized

Bitcoin Returns Above $100K as Early 2025 Crypto Rebound Continues

Bitcoin’s (BTC) price is back in the six-digit territory as the largest cryptocurrency extended its early 2025 bounce on Monday.

BTC advanced towards $100,000 earlier during the trading session, then broke sharply above the threshold, rising 2.5% in an hour as traditional U.S. markets opened. It was changing hands at around $102,000 recently, its strongest level since December 19 and up 4.3% over the past 24 hours.

The broad-market benchmark CoinDesk 20 was up 3.5% during the same period, with all the twenty crypto majors posting positive returns. Ethereum’s ether (ETH) climbed 2.8% to $3,700, while Solana’s SOL advanced 4.5% to above $220.

Bitcoin and the broader crypto market ended 2024 with a correction, paring some of the gains of the massive rally since Donald Trump’s election victory as investors took profits. Prices and trading volumes declined during the holiday lull, coupled with outflows from spot BTC and ETH exchange-traded funds. BTC reached a local bottom near $91,000 on December 30, a nearly 15% retreat from its record highs.

Demand returns as leverage remains muted

With the start of the first full business week of the year and traders returning to their desks after the holiday season, headlines of corporate BTC purchases continued. MicroStrategy announced on Monday purchase of another 1,020 BTC, while Texas-based energy management firm KULR Technology Group added $21 million worth of BTC to its treasury, doubling its holdings.

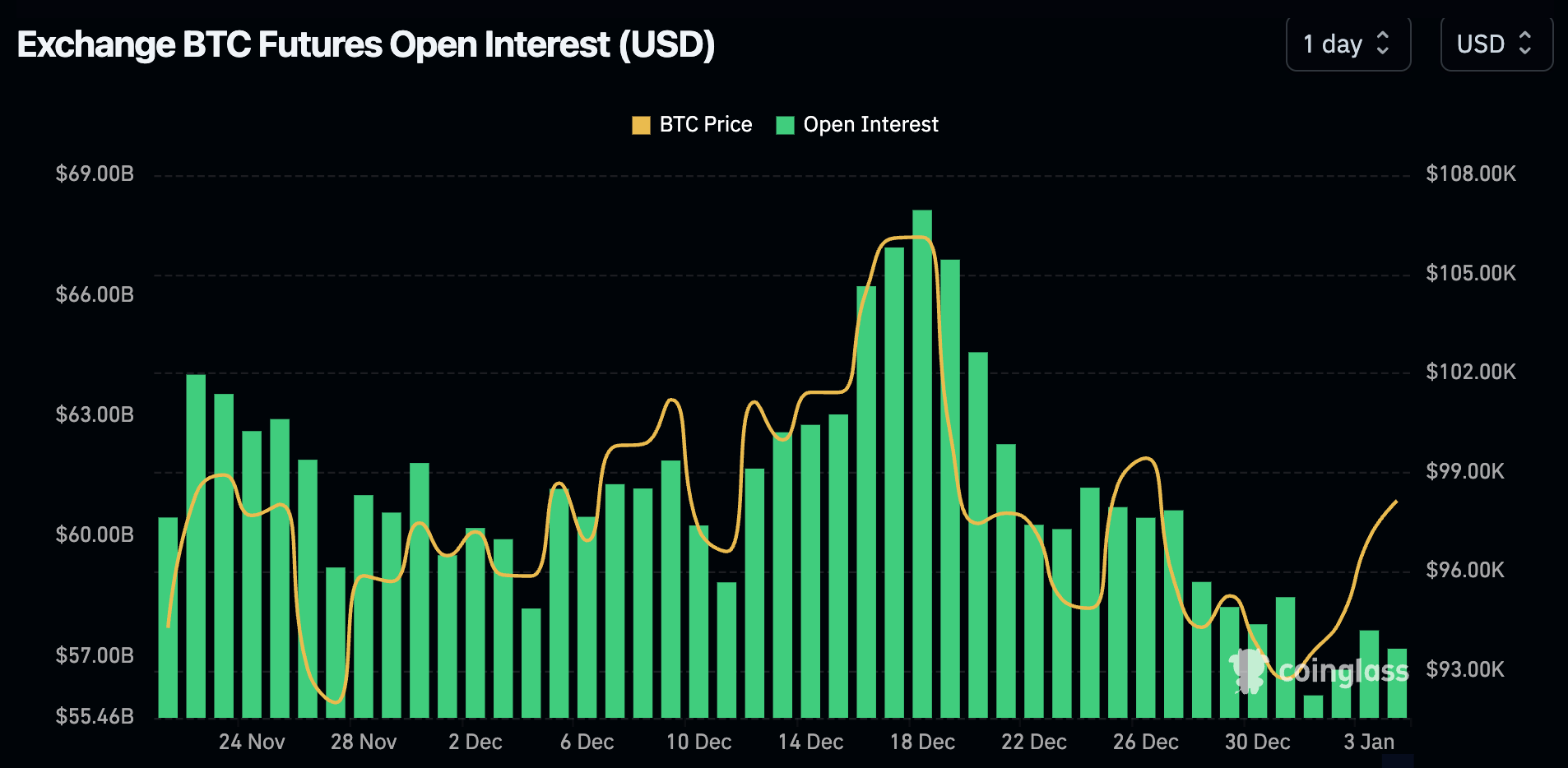

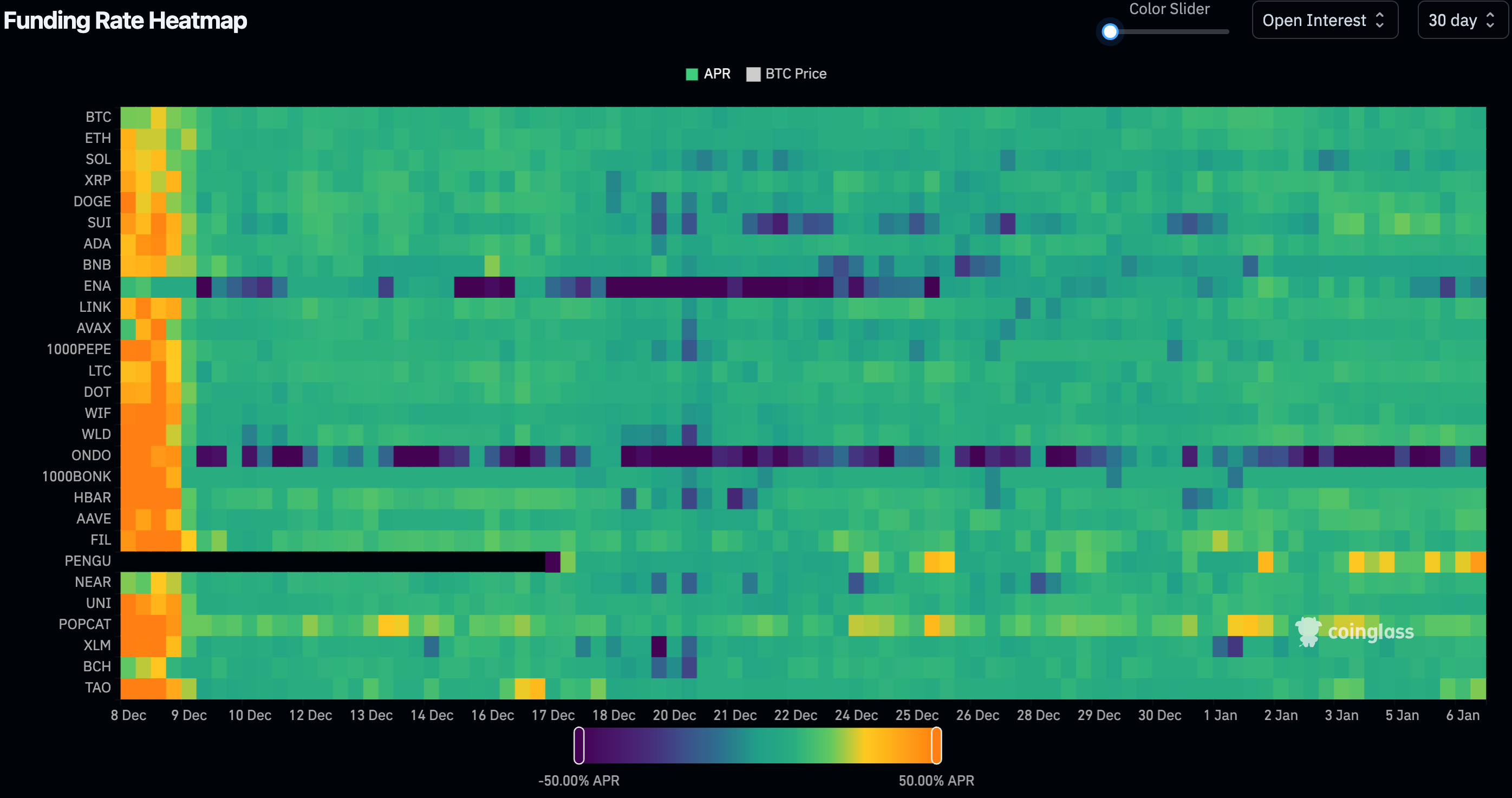

Spot BTC ETFs saw $908 million in inflows on Friday as a sign of demand returning. Meanwhile, open interest on BTC futures is significantly lower than in mid-December on the institutional-focused marketplace CME and on an aggregate basis, indicating that the recent bounce in prices was primarily driven by spot buying rather than leverage, noted James Van Straten, senior analyst at CoinDesk. Funding rates were also at neutral levels across the board, CoinGlass data shows, indicating a lack of froth during the rally.

Fed risk

«Just as we saw institutions window dressing with their balance sheets mindful of risk assets for year-end and de-risking ahead of holidays, it’s expected we see price action and demand recouping especially as we head into what we expect will be a positive year for the asset class and upcoming U.S. administration,» Paul Howard, senior director of crypto trading firm Wincent, told CoinDesk in a Telegram message.

«My personal view is not to read too much into these levels [BTC over $100,000] as we can expect volatility to increase in the coming fortnight,» Howard added.

Crypto analytics firm 10x Research also forecasted a rebound in crypto prices in early January heading into President-elect Trump’s inauguration in a Monday report, but warned of a month-end sell-off ahead of the Federal Reserve’s January meeting.

Hawkish comments from Fed Chair Jerome Powell at the December meeting marked the start of a pullback for risk assets, and 10x Research noted it would take time for the Fed to reverse its stance even if inflation cools further in the coming months.

«The primary risk remains the Federal Reserve’s communication, especially if renewed concerns about inflation emerge,» Markus Thielen, founder of 10x Research said. «We anticipate lower inflation this year, though it may take some time for the Federal Reserve to recognize and respond to this shift formally.»

«While some enthusiasm is expected at the start of the new year, this is not the time for the same level of bullishness we experienced from late January to March 2024 or late September to mid-December,» he added.

Uncategorized

ORQO Debuts in Abu Dhabi With $370M in AUM, Sets Sight on Ripple USD Yield

ORQO Group, a new institutional asset manager with $370 million in assets under management, has launched on Tuesday with plans to build out a yield platform for Ripple’s RLUSD stablecoin.

The group, headquartered in Abu Dhabi, consolidates four entities from both traditional finance and digital assets: Mount TFI, a private debt specialist and licensed fund manager in Poland, Monterra Capital, a multi-strategy digital hedge fund in Malta, blockchain engineering studio Nextrope and decentralized finance (DeFi) protocol Soil compliant with MiCA, the EU’s crypto framework.

Already licensed in Poland and Malta, the group is seeking approval from the Financial Services Regulatory Authority at Abu Dhabi Global Market to expand services in the Middle East, a region it sees as a hub for regulated digital asset growth.

«It’s an opportunity to become a global on-chain asset manager,» ORQO CEO Nicholas Motz said in an interview with CoinDesk. «We have all the pieces: the off-chain asset management, and on-chain, too.»

ORQO’s effort is part of a larger trend that’s been reshaping crypto markets: moving traditional financial instruments like private credit, U.S. Treasuries, or trade finance deals onto blockchain networks. The process is also known as tokenization of real-world assets (RWAs). Data from rwa.xyz shows that the RWA market has grown into a nearly $30 billion sector, though it remains tiny compared to traditional finance markets such as the $2 trillion private credit sector. Still, the growth potential is immense: the tokenized RWA market could reach $18.9 trillion by 2033, a joint report by Ripple and BCG projected.

Yield platform Soil is a key piece in ORQO’s gameplan, connecting the firm’s RWA access with crypto capital capital. It aims to provide returns on stablecoins deposits from tokenized private credit, real estate and hedge fund strategies.

As part of the next stage, the firm plans to open several credit pools targeting holders of Ripple’s RLUSD stablecoin in the near future, allowing investors such as institutional treasuries or protocol reserves to earn a yield on their holdings.

Read more: Tokenization of Real-World Assets is Gaining Momentum, Says Bank of America

Uncategorized

Coinbase Policy Chief Pushes Back on Bank Warnings That Stablecoins Threaten Deposits

Contrary to claims from the U.S. banking industry, stablecoins do not pose a risk to the financial system, according to the chief policy officer at crypto exchange Coinbase (COIN), Faryar Shirzad. Banks’ claims that they do are are myths crafted to defend their revenues, he wrote in a Tueday blog post.

«The central claim — that stablecoins will cause a mass outflow of bank deposits — simply doesn’t hold up,» Shirzad wrote. «Recent analysis shows no meaningful link between stablecoin adoption and deposit flight for community banks and there’s no reason to believe big banks would fare any worse.»

Larger lenders still hold trillions of dollars at the Federal Reserve and if deposits were really at risk, he argued, they would be competing harder for customer funds by offering higher interest rates rather than parking cash at the central bank

According to Shirzad, the real reason for banks’ opposition is the payments business. Stablecoins, digital tokens whose value is pegged to a real-life asset such as the dollar, offer faster and cheaper ways to move money, threatening an estimated $187 billion in annual swipe-fee revenue for traditional card networks and banks.

He compared the current pushback to earlier battles against ATMs and online banking, when incumbents warned of systemic dangers but, he said, were ultimately trying to protect entrenched profits.

Shirzad also dismissed reports predicting trillions in potential outflows from deposits into stablecoins, whose total market cap is around $290 billion, according to data from CoinGecko. He stressed that stablecoins are primarily used as payment tools — for trading digital assets or sending funds abroad — not as long-term savings products.

Someone purchasing stablecoins to settle with an overseas supplier, he argued, is opting for a more efficient transaction method the going through their bank, not pulling money from a savings account.

He urged banks to embrace the technology instead of resisting it, saying stablecoin rails could cut settlement times, lower correspondent banking costs and provide round-the-clock payments. Those institutions willing to adapt, he wrote, stand to benefit from the shift.

The U.K., too, faces concerns about the effect of stablecoins on the financial industry.

The Financial Times reported Monday that the Bank of England is considering setting limits on how many «systemic» stablecoins people and companies can hold — setting thresholds as low as 10,000 pounds ($13,600) for individuals and about 10 million pounds for businesses.

Officials define systemic stablecoins as those already widely used for U.K. payments or expected to become so, and say the caps are needed to prevent sudden deposit outflows that could weaken lending and financial stability.

Uncategorized

Deutsche Börse’s Crypto Finance Unveils Connected Custody Settlement for Digital Assets

Crypto Finance, a subsidiary of Deutsche Börse Group, unveiled AnchorNote, a system designed for institutional clients who want to trade digital assets without moving them out of regulated custody.

The system integrates BridgePort, a network of crypto exchanges and custodians, enabling off-exchange settlement and connectivity to multiple trading venues. By keeping assets in custody while allowing real-time collateral movement, AnchorNote aims to improve capital efficiency and reduce counterparty risk, according to a press release.

The service allows clients to set up dedicated trading lines, with BridgePort handling messaging between venues and Crypto Finance acting as collateral custodian, the press release said. Institutions can manage collateral through a dashboard or integrate the service directly into their existing infrastructure using APIs, it said. APIs, or application programming interfaces, allow software programs to communicate directly with one another.

“Institutional clients face a constant tradeoff between security and capital efficiency,” said Philipp E. Dettwiler, head of custody and settlement at Crypto Finance. “AnchorNote is designed to bridge that gap.”

For traders, the setup eliminates the need for pre-funding exchanges while providing immediate access to liquidity across platforms. In practice, a Swiss bank could pledge bitcoin held in custody and deploy it instantly across multiple trading venues without moving the coins on-chain.

The rollout begins in Switzerland, with Crypto Finance planning to expand across Europe.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars