Uncategorized

Bitcoin Mining Profitability Fell in April as Network Hashrate Rose: Jefferies

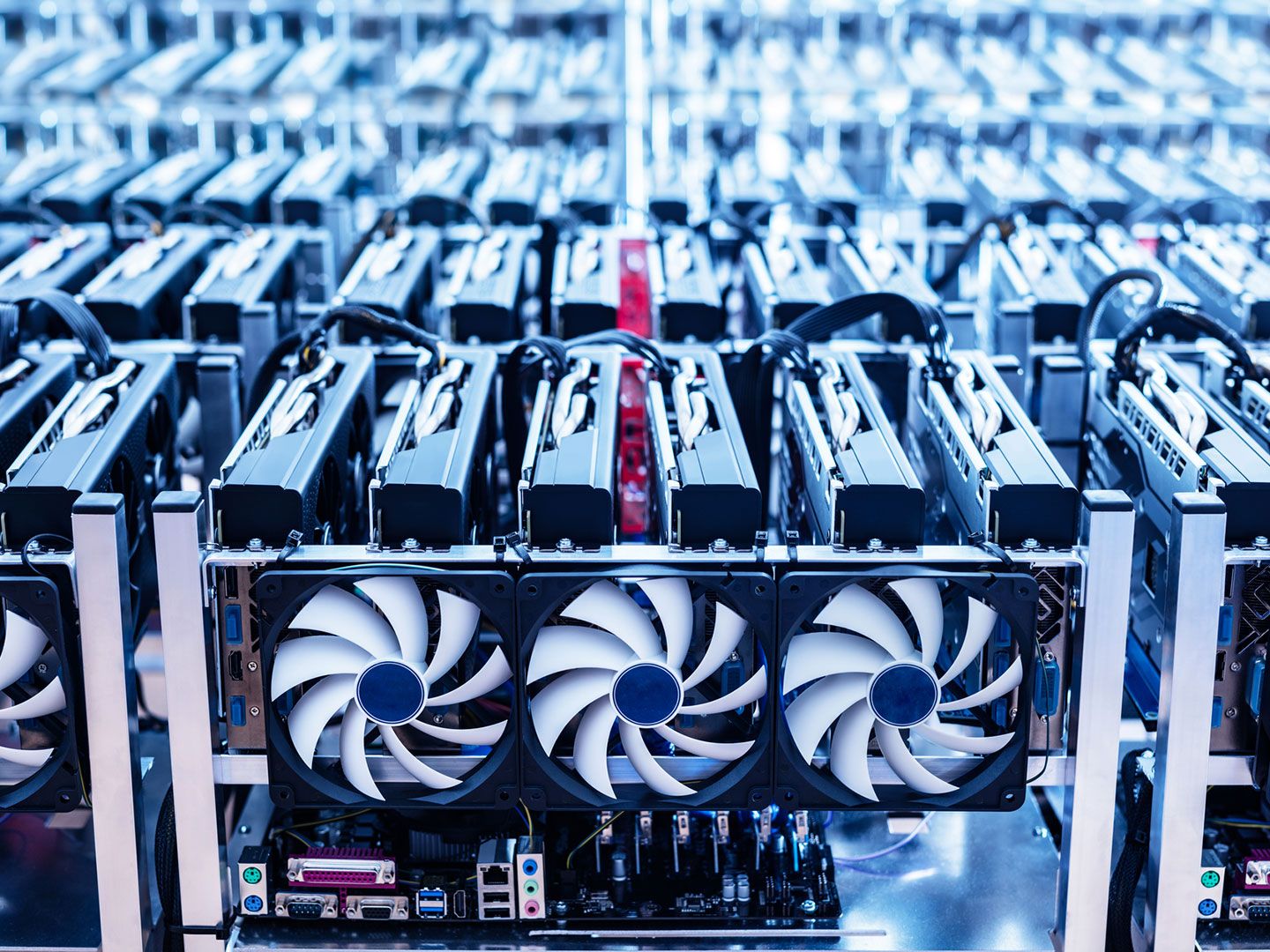

Bitcoin BTC mining profitability fell in April as the network hashrate rose, investment bank Jefferies said in a research report Tuesday.

«BTC mining profitability decreased by 6.6% in April, driven by a 6.7% increase in the network hashrate,» analysts Jonathan Petersen and Jan Aygul wrote.

The hashrate refers to the total combined computational power used to mine and process transactions on a proof-of-work blockchain, and is a proxy for competition in the industry and mining difficulty.

U.S. publicly listed mining companies produced 3,277 bitcoin in April, a drop from the 3,534 coins that were mined in March, the report noted, and these firms accounted for 24.1% of the total network last month, versus 24.8% in the month previous.

MARA Holdings (MARA) mined the most bitcoin, with 705 tokens, followed by CleanSpark (CLSK), which produced 633 BTC, Jefferies said.

MARA’s installed hashrate remained the highest at 57.3 exahashes per second (EH/s), with CleanSpark second with 42.4 EH/s, the bank noted.

IREN (IREN) had the highest implied uptime at around 97%, followed by HIVE Digital Technologies (HIVE) at about 96%, the report added.

Read more: Bitcoin Network Hashrate Rose Slightly in First Two Weeks of May: JPMorgan

Uncategorized

Jack Ma’s Ant International Seeks Stablecoin Licenses in Hong Kong, Singapore: Bloomberg

The international unit of Alipay owner Ant Group plans to seek stablecoin licenses in Hong Kong and Singapore, Bloomberg reported on Thursday.

Ant International will apply for a stablecoin issuer’s license once the regulatory regime comes into effect in August, according to the report, citing people familiar with the matter. The firm is also planning to apply for a similar license in its native Singapore, as well as Luxembourg.

Hong Kong has been establishing a stablecoin regime since 2023, with the legislation expected to go into effect in August.

Stablecoins are tokens pegged to the value of a traditional financial asset, such as a fiat currency, providing a counterweight to the volatility of BTC, ETH and other cryptos.

As such they may represent an entry point to the digital asset market for major financial or technological companies. Progress toward stablecoin regulation in the world’s most prominent markets, particularly the U.S., should help accelerate this trend.

Alipay is referred to as the largest mobile payment platform in the world with over a billion users, thanks to being the most dominant provider in China, where it holds a share of 55% in the third-party payment market.

Ant International did not immediately respond to CoinDesk’s request for further comment.

Read More: Sam Altman’s World Chain Adds Native USDC Stablecoin and Circle’s Cross-Chain Service

Uncategorized

Mercurity Fintech Plans $800M Bitcoin Treasury, Eyes Russell 2000 Inclusion

Mercurity Fintech Holding (MFH) is raising $800 million to establish a bitcoin BTC treasury, the company announced in a press release.

The New York-based fintech group said the funds will support a multi-pronged strategy: acquiring bitcoin, storing it in blockchain-native custodial infrastructure, and integrating it into a system that includes tokenized treasury tools and staking services.

That means Mercurity isn’t just betting on a BTC treasury, but it’s trying to move into a “yield-generating, blockchain-aligned reserve structure.”

“Bitcoin will become an essential component of the future financial infrastructure,” CEO Shi Qiu said in the release. “We are positioning our company to be a key player in the evolving digital financial ecosystem.»

The company did not disclose whether the funds would be raised through debt, equity, or other financing mechanisms.

The fundraising announcement coincides with news that Mercurity is slated for inclusion in the Russell 2000 and Russell 3000 indexes.

MFH operates cryptocurrency mining facilities focusing on bitcoin and filecoin. It also develops liquid cooling solutions for AI data centers, and offers financial services to institutions and high-net-worth individuals.

The company’s shares went up 1.9% in yesterday’s trading session but dropped 2.84% in after-hours trading.

Uncategorized

Strong Uptake at 10-Year U.S. Debt Sale Eases Demand Concerns, 30-Year Sale’s Up Next

Wednesday’s auction of 10-year U.S. Treasury notes undermined the narrative that investors are moving away from U.S. government debt, the bedrock of global finance, and pouring money instead into bitcoin BTC and gold.

Thursday’s sale of $22 billion of 30-year bonds may provide further clues to investor confidence in the fiscal policies of U.S. President Donald Trump since he initiated the global trade war in early April and help signal whether the notes are losing their shine as the premier fixed-income instrument backed by the deepest liquidity and low credit risk.

At the June 11 auction, demand for the $39 billion of 10-year notes, which offered a yield of 4.421%, outstripped supply by more than 2.5 times, according to Exante Data, and the primary dealer takedown was reportedly just 9%, the fourth-lowest on record. That’s a sign investors did most of the heavy buying. Primary dealers are the institutions authorized by the central bank to trade government bonds, and the takedown refers to the amount of newly issued debt they absorb themselves.

Worsening debt situation

As of June, the U.S. total gross national debt is over $36 trillion, more than 120% of the country’s gross domestic product (GDP).

The deficit, or the excess of government expenditure over revenue, was $1.8 trillion in 2024. The figure is expected to increase by $2.4 trillion in the coming years due to Trump’s tax cut plans. As of now, the U.S. pays $1 trillion as the cost of servicing the debt.

The new issuance, therefore, is more likely to exacerbate the problem and has several analysts pointing to bitcoin and gold as a hedge against the fiscal crisis.

-

Business8 месяцев ago

Business8 месяцев ago3 Ways to make your business presentation more relatable

-

Entertainment8 месяцев ago

Entertainment8 месяцев ago10 Artists who retired from music and made a comeback

-

Fashion8 месяцев ago

Fashion8 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment8 месяцев ago

Entertainment8 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Business8 месяцев ago

Business8 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Tech8 месяцев ago

Tech8 месяцев ago5 Crowdfunded products that actually delivered on the hype

-

Entertainment8 месяцев ago

Entertainment8 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time