Uncategorized

Bitcoin May Be More Vulnerable to Negative News Near $100K, Data Suggests

Yes, you read the title correctly, and it does appears contradictory. As bitcoin (BTC) nears the $100,000 milestone – a clear sign of strength – the reality is that its actually quite vulnerable to potential negative news.

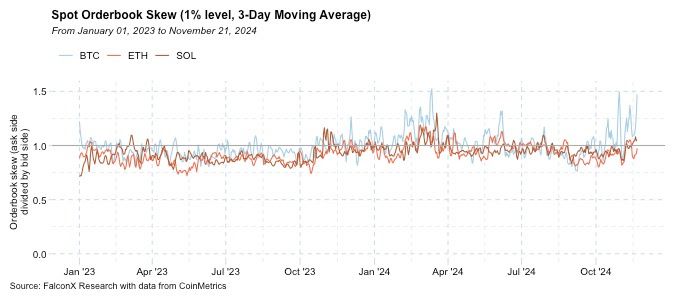

That’s according to the «order book skew ratio,» which shows that buyers have surprisingly pulled back their firepower as prices near six digits. The ratio measures the number of people wanting to sell, or the ask side, relative to those on the buy or the bid side.

The three-day moving average of the 1% skew, which measures the ask-bid imbalance within 1% of the mid-price, is now elevated, approaching levels seen only three times since 2022, according to data tracked by cryptocurrency prime broker FalconX.

Its a sign that the bullish momentum that brought prices to near $100,000 from $68,000 since the U.S. election early this month is not being replenished by new buying interest, leaving sellers in a more dominant position. As such, a slightest of negative news could lead to a notable price correction.

«As we near $100K, the skew approaches levels seen only three times since 2022. While this doesn’t threaten the medium-term rally, it suggests that the struggle to break above the $100K level could be intense,» FalconX said in the newsletter.

Bitcoin’s uptrend stalled slightly over the weekend, since it peaked at $99,500 on Friday. Over the past three days, the cryptocurrency’s dominance rate—its share of the total crypto market capitalization—has dropped sharply from 59% from 61.5%. The decline indicates a rotation of funds out of bitcoin and into alternative cryptocurrencies, supporting the case for price correction.

In any case, a potential correction or eventual breakout above $100,000 could be violent one as the overall market depth or liquidity has declined amid the price rally despite an increase in trading volumes, according to FalconX.

Liquidity refers to the market’s ability to absorb large trading orders at stable prices. The recent drop in liquidity means few large orders can have an outsized impact on the going market, potentially engineering rapid price swings.

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton