Uncategorized

Bitcoin Likely to Head Even Lower, but Seeds of Next Bull Move Are Being Sown

«I wouldn’t even be in this situation if it wasn’t for you. You brought down so much f—ing heat on me.» Robert De Niro as Ace Rothstein to Joe Pesci’s Nicky Santoro in Martin Scorsese’s Casino.

Bitcoiners could be forgiven for blaming the rest of crypto for the bear move that took the price of BTC down more than 20% from a record high above $109,000 just five weeks ago to as low as $87,000 earlier on Tuesday.

Bitcoin touched that record a day ahead of the presidential inauguration amid a speculative frenzy in memecoins that hit its dénouement as the Trump team thought it a good idea to launch tokens associated with the incoming president and first lady. The tokens initially rocketed higher before quickly crashing and leaving just about everyone except insiders with massive losses.

SOL, the native token of the Solana blockchain on which much of the memecoins were created, is down more than 50% since then, leading the plunge in the major cryptos since that January weekend.

Bitcoin bulls were promised a Strategic Bitcoin Reserve and instead got TRUMP and MELANIA.

Bybit hack delivers blow

Even with the evisceration in memecoins and associated carnage in the broader crypto market over the past weeks, bitcoin managed to mostly stay in a tight range not that far below its record. As recently as 96 hours ago, the world’s largest crypto was on the rise and seemed set to retake the $100,000 level.

Then the Bybit hack hit.

While bitcoiners were quick to point out the exploit had noting to do with Bitcoin and instead once again demonstrated the inherent weaknesses in Ethereum’s technology, the plunge in ETH (down 15% and counting since) and the rest of crypto spread to BTC.

Bulls turn bear

«Our expectations for this cycle are much higher than $108,000, so we tell ourselves we couldn’t possibly have peaked already,» wrote self-described permabull StackHodler on X Tuesday. «We have to go higher in 2025, right,» he continued. «The truth is, nobody knows for sure. We just went through the short term holder realized price of $92,000 … We may need to revisit the 200 day moving average around $82,000.»

«DO NOT buy the dip yet, a move to the low $80s is on,» wrote Standard Chartered’s Geoff Kendrick, who previously has forecast $200,000 BTC by year-end. «Before buying the dip is attractive I think we get a $1B ETF outflow day (current worst ever day -$583M).»

Seeds of next bull move being sown

Though not getting hit nearly as hard as crypto, traditional markets have been stumbling as well. As measured by the S&P 500 Index, U.S. stocks last week had their worst week since the Trump inauguration. The tech-heavy Nasdaq peaked in December and today sits 5% below that level.

Pick your excuse: Tariffs, DOGE (not the token, the Musk-led government cost-cutting regime), or just a cooling in previously very perky animal spirits, but rate markets have taken notice.

The U.S. 10-year Treasury yield has pulled all the way back to 4.32% from 4.80% just ahead of Trump taking office. And expectations for easier monetary Federal Monetary policy have surged. The chances of a May rate cut have more than doubled to 30% over the past week and the chances of two rate cuts by June have more than tripled to 15%, according to CME FedWatch.

«Lower U.S. Treasury yields are a huge longer-term positive for BTC,» concluded Kendrick.

Business

Strategy Bought $27M in Bitcoin at $123K Before Crypto Crash

Strategy (MSTR), the world’s largest corporate owner of bitcoin (BTC), appeared to miss out on capitalizing on last week’s market rout to purchase the dip in prices.

According to Monday’s press release, the firm bought 220 BTC at an average price of $123,561. The company used the proceeds of selling its various preferred stocks (STRF, STRK, STRD), raising $27.3 million.

That purchase price was well above the prices the largest crypto changed hands in the second half of the week. Bitcoin nosedived from above $123,000 on Thursday to as low as $103,000 on late Friday during one, if not the worst crypto flash crash on record, liquidating over $19 billion in leveraged positions.

That move occurred as Trump said to impose a 100% increase in tariffs against Chinese goods as a retaliation for tightening rare earth metal exports, reigniting fears of a trade war between the two world powers.

At its lowest point on Friday, BTC traded nearly 16% lower than the average of Strategy’s recent purchase price. Even during the swift rebound over the weekend, the firm could have bought tokens between $110,000 and $115,000, at a 7%-10% discount compared to what it paid for.

With the latest purchase, the firm brought its total holdings to 640,250 BTC, at an average acquisition price of $73,000 since starting its bitcoin treasury plan in 2020.

MSTR, the firm’s common stock, was up 2.5% on Monday.

Business

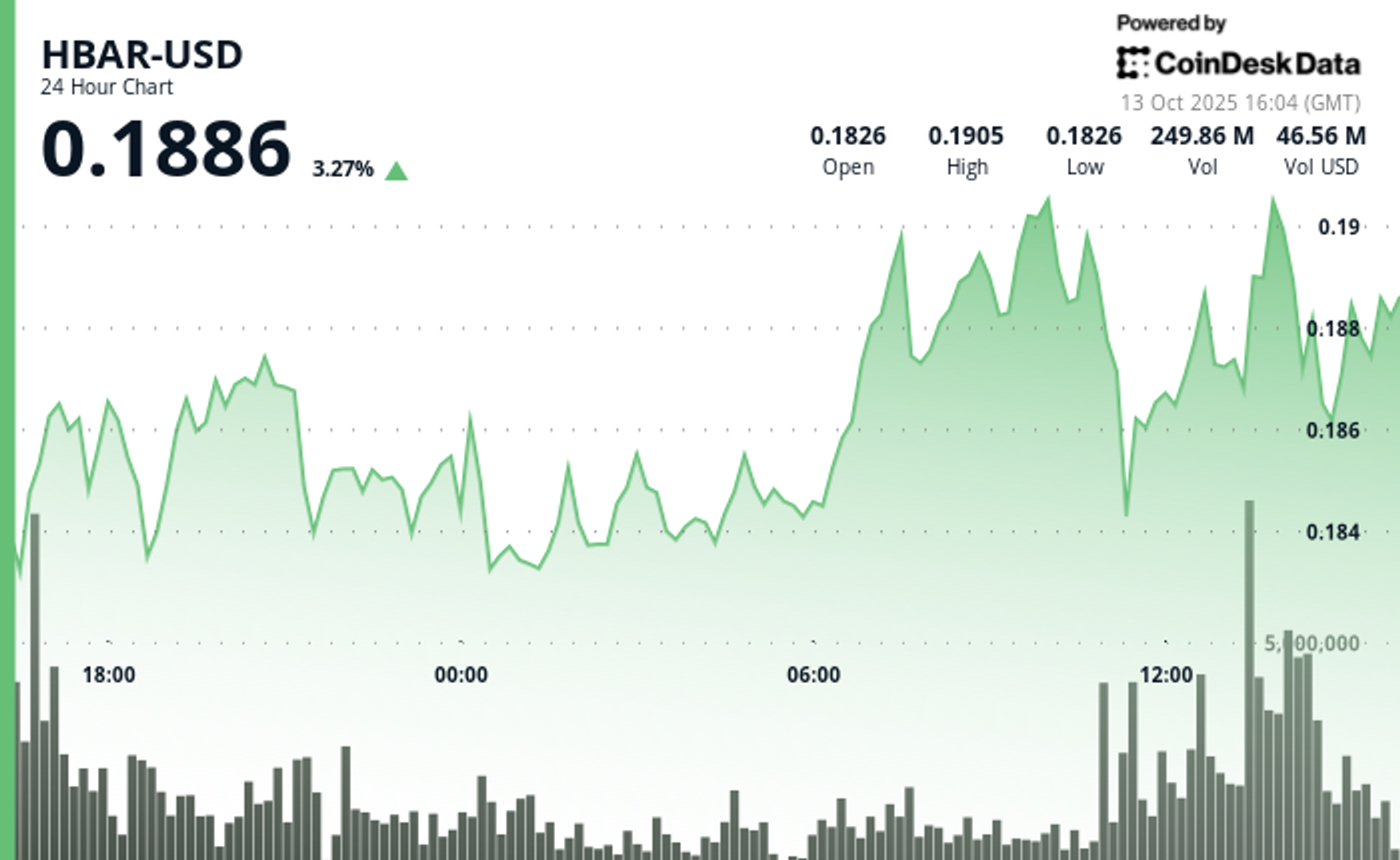

HBAR Rises Past Key Resistance After Explosive Decline

HBAR (Hedera Hashgraph) experienced pronounced volatility in the final hour of trading on Oct. 13, soaring from $0.187 to a peak of $0.191—a 2.14% intraday gain—before consolidating around $0.190.

The move was driven by a dramatic surge in trading activity, with a standout 15.65 million tokens exchanged at 13:31, signaling strong institutional participation. This decisive volume breakout propelled the asset beyond its prior resistance range of $0.190–$0.191, establishing a new technical footing amid bullish momentum.

The surge capped a broader 23-hour rally from Oct. 12 to 13, during which HBAR advanced roughly 9% within a $0.17–$0.19 bandwidth. This sustained upward trajectory was characterized by consistent volume inflows and a firm recovery from earlier lows near $0.17, underscoring robust market conviction. The asset’s ability to preserve support above $0.18 throughout the period reinforced confidence among traders eyeing continued bullish action.

Strong institutional engagement was evident as consecutive high-volume intervals extended through the breakout window, suggesting renewed accumulation and positioning for potential continuation. HBAR’s price structure now shows resilient support around $0.189–$0.190, signaling the possibility of further upside if momentum persists and broader market conditions remain favorable.

Technical Indicators Highlight Bullish Sentiment

- HBAR operated within a $0.017 bandwidth (9%) spanning $0.174 and $0.191 throughout the previous 23-hour period from 12 October 15:00 to 13 October 14:00.

- Substantial volume surges reaching 179.54 million and 182.77 million during 11:00 and 13:00 sessions on 13 October validated positive market sentiment.

- Critical resistance materialized at $0.190-$0.191 thresholds where price movements encountered persistent selling activity.

- The $0.183-$0.184 territory established dependable support through volume-supported bounces.

- Extraordinary volume explosion at 13:31 registering 15.65 million units signaled decisive breakout event.

- High-volume intervals surpassing 10 million units through 13:35 substantiated significant institutional engagement.

- Asset preserved support above $0.189 despite moderate profit-taking activity.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Business

Crypto Markets Today: Bitcoin and Altcoins Recover After $500B Crash

The crypto market staged a recovery on Monday following the weekend’s $500 billion bloodbath that resulted in a $10 billion drop in open interest.

Bitcoin (BTC) rose by 1.4% while ether (ETH) outperformed with a 2.5% gain. Synthetix (SNX, meanwhile, stole the show with a 120% rally as traders anticipate «perpetual wars» between the decentralized trading venue and HyperLiquid.

Plasma (XPL) and aster (ASTER) both failed to benefit from Monday’s recovery, losing 4.2% and 2.5% respectively.

Derivatives Positioning

- The BTC futures market has stabilized after a volatile period. Open interest, which had dropped from $33 billion to $23 billion over the weekend, has now settled at around $26 billion. Similarly, the 3-month annualized basis has rebounded to the 6-7% range, after dipping to 4-5% over the weekend, indicating that the bullish sentiment has largely returned. However, funding rates remain a key area of divergence; while Bybit and Hyperliquid have settled around 10%, Binance’s rate is negative.

- The BTC options market is showing a renewed bullish lean. The 24-hour Put/Call Volume has shifted to be more in favor of calls, now at over 56%. Additionally, the 1-week 25 Delta Skew has risen to 2.5% after a period of flatness.

- These metrics indicate a market with increasing demand for bullish exposure and upside protection, reflecting a shift away from the recent «cautious neutrality.»

- Coinglass data shows $620 million in 24 hour liquidations, with a 34-66 split between longs and shorts. ETH ($218 million), BTC ($124 million) and SOL ($43 million) were the leaders in terms of notional liquidations. Binance liquidation heatmap indicates $116,620 as a core liquidation level to monitor, in case of a price rise.

Token Talk

By Oliver Knight

- The crypto market kicked off Monday with a rebound in the wake of a sharp weekend leverage flush. According to data from CoinMarketCap, the total crypto market cap climbed roughly 5.7% in the past 24 hours, with volume jumping about 26.8%, suggesting those liquidated at the weekend are repurchasing their positions.

- A total of $19 billion worth of derivatives positions were wiped out over the weekend with the vast majority being attributed to those holding long positions, in the past 24 hours, however, $626 billion was liquidated with $420 billion of that being on the short side, demonstrating a reversal in sentiment, according to CoinGlass.

- The recovery has been tentative so far; the dominance of Bitcoin remains elevated at about 58.45%, down modestly from recent highs, which implies altcoins may still lag as capital piles back into safer large-cap names.

- The big winner of Monday’s recovery was synthetix (SNX), which rose by more than 120% ahead of a crypto trading competition that will see it potentially start up «perpetual wars» with HyperLiquid.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton