Uncategorized

Bitcoin Eyes $105K as Coinbase Surges 24%; Rally Has More Room, Says Analyst

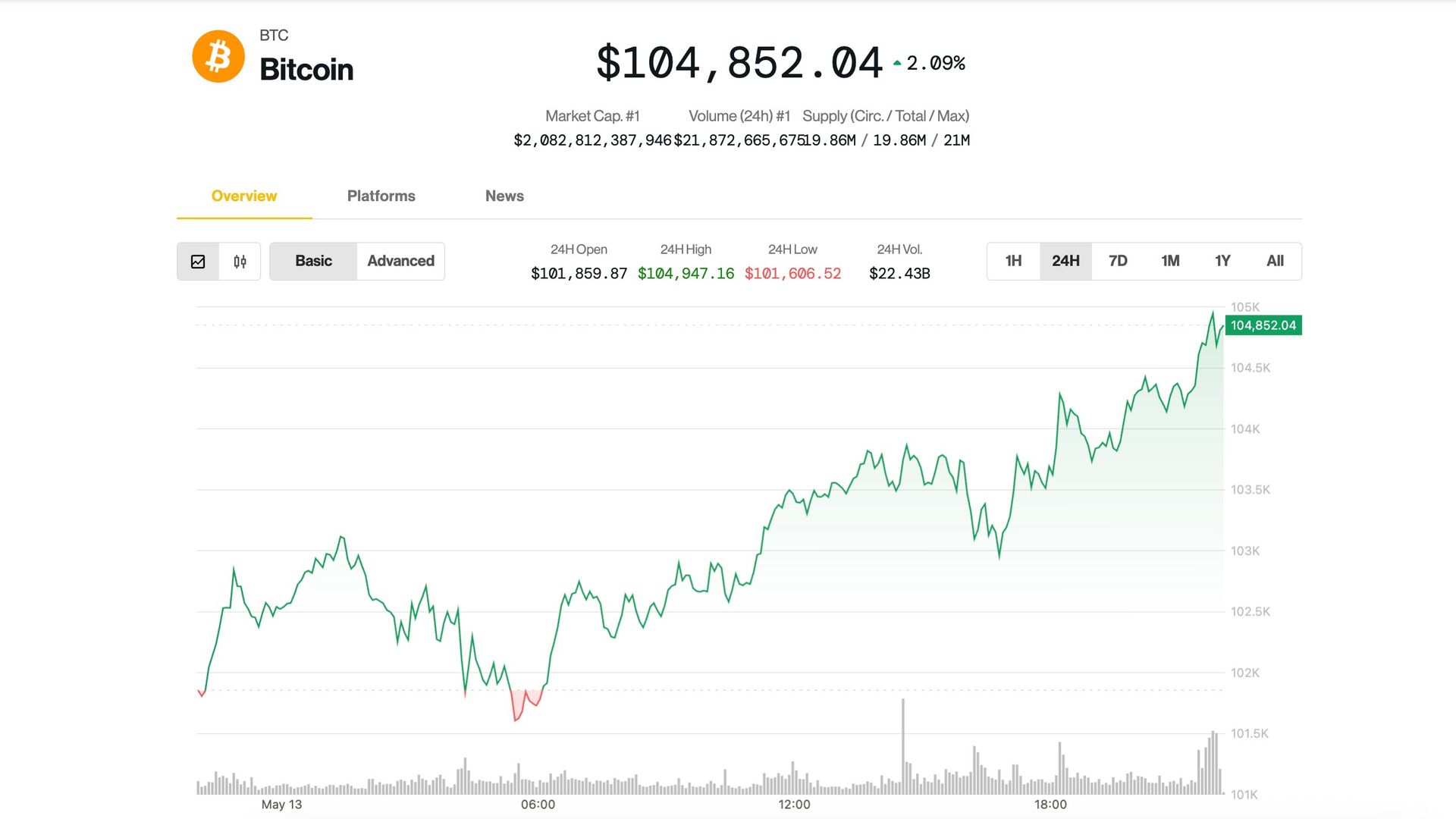

Bitcoin BTC climbed back above $104,000 on Tuesday with welcome fresh inflation data, President Trump’s bullish outlook on financial markets, and Coinbase’s inclusion into the S&P 500 among catalysts for the advance.

April’s Consumer Price Index (CPI) came in cooler than anticipated, which may allay pressure on the Federal Reserve anxious about inflation due to tariffs. Fed Chair Jerome Powell’s scheduled speech on Thursday could provide further policy guidance.

The upbeat mood was further lifted by Donald Trump, who told attendees at the Saudi–U.S. Investment Forum in Riyadh that markets «could go a lot higher,.».

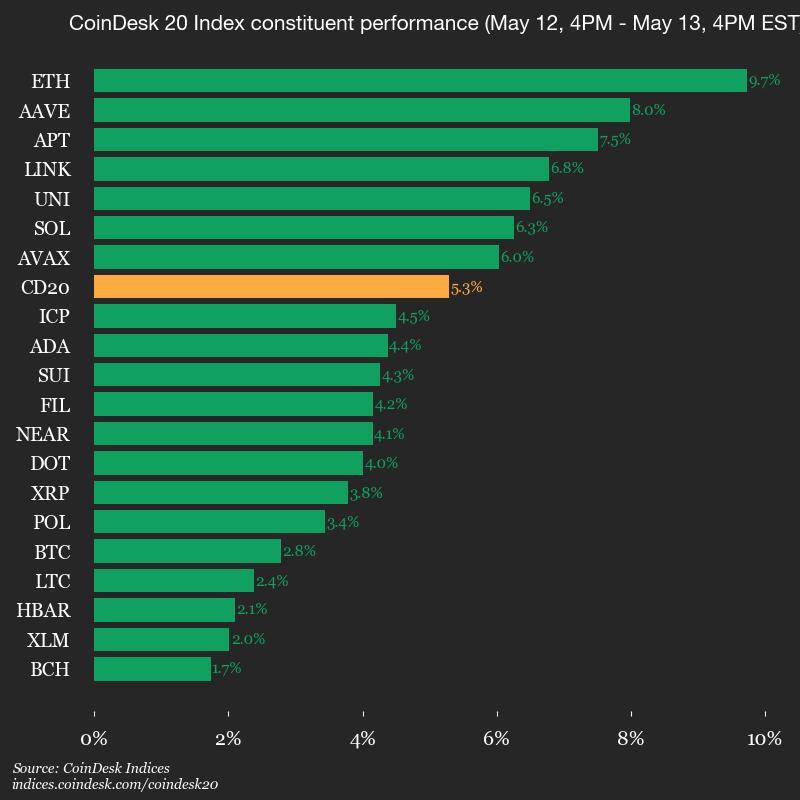

Bitcoin (BTC) nearly touched $105,000 before pulling back, at press time trading 2.4% higher over the past 24 hours at around $104,400. Most altcoins in the CoinDesk 20 Index outperformed. Ethereum’s ether ETH continued its resurgence advancing over 9% to $2,700. Restaking protocol Eigenlayer’s governance token EIGEN and decentralized finance (DeFi) protocol EtherFi’s native token ETHFI booked more than 20-30% daily gains.

Stocks added to their recent gains, with the Nasdaq and S&P 500 up 1.6% and 0.75%, respectively, at the session close. Nasdaq-listed crypto exchange Coinbase (COIN) surged 24% during the day as the stock is set to benefit from being included in the S&P 500 index. The change could unleash $16 billion in buying pressure for shares, Jefferies forecasted.

Joel Kruger, market strategist at LMAX Group, said that the crypto market is still digesting last week’s gains, but the rally has further momentum. “Currently, the market appears to be pausing for breath, yet the prevailing sentiment in recent headlines suggests this rally still has room to grow,” Kruger said.

He pointed to a rebound in global risk appetite and a growing number of institutional tailwinds. “One notable factor is the increasing mainstream adoption of cryptocurrency, as evidenced by developments in U.S. financial markets. Coinbase’s inclusion in the S&P 500 marks a historic milestone, establishing it as the first crypto-native company to join this prestigious index,” Kruger said.

He also cited improving sentiment around regulation. SEC Chair Paul Atkins has pledged to make the U.S. a hub for cryptocurrency innovation, which Kruger believes could unlock a new wave of institutional interest if followed by meaningful policy clarity.

Paul Howard, senior director at trading firm Wincent, echoed that view, saying that while altcoins are tracking the broader rally, institutional capital is likely to become more selective. “This evolving landscape appears to be laying the groundwork for increased institutional participation,” he said in a Telegram message. “The more resilient altcoin projects could benefit, while weaker ones may gradually phase out.”

New BTC record next month?

While bitcoin is less than 5% from its January record prices, Bitfinex analysts noted that neutral funding rates and stable trading volumes show no signs of market froth.However, BTC is facing resistance at around the $104,000-$106,000 zone, making a short-term consolidation likely with key support level at around $98,000, they added.»BTC has moved up sharply in the past few weeks and we expect a period of consolidation, meaning a new all-time high could be delayed to June as supply/demand stabilises above $100,000,» Bitfinex analysts wrote.

Zooming out for the next months, Bitfinex analysts said medium and long-term setups remain decisively bullish, setting a $150,000-$180,000 price target for 2025-2026.

«Bitcoin’s long-term outlook is the strongest it has ever been,» they wrote. «With sovereign and institutional adoption advancing, ETF rails expanding globally, and the US framing crypto policy more positively, BTC is evolving into a global macro reserve asset.»

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Crypto Trading Firm Keyrock Buys Luxembourg’s Turing Capital in Asset Management Push

Crypto trading firm Keyrock said it’s expanding into asset and wealth management by acquiring Turing Capital, a Luxembourg-registered alternative investment fund manager.

The deal, announced on Tuesday, marks the launch of Keyrock’s Asset and Wealth Management division, a new business unit dedicated to institutional clients and private investors.

Keyrock, founded in Brussels, Belgium and best known for its work in market making, options and OTC trading, said it will fold Turing Capital’s investment strategies and Luxembourg fund management structure into its wider platform. The division will be led by Turing Capital co-founder Jorge Schnura, who joins Keyrock’s executive committee as president of the unit.

The company said the expansion will allow it to provide services across the full lifecycle of digital assets, from liquidity provision to long-term investment strategies. «In the near future, all assets will live onchain,» Schnura said, noting that the merger positions the group to capture opportunities as traditional financial products migrate to blockchain rails.

Keyrock has also applied for regulatory approval under the EU’s crypto framework MiCA through a filing with Liechtenstein’s financial regulator. If approved, the firm plans to offer portfolio management and advisory services, aiming to compete directly with traditional asset managers as well as crypto-native players.

«Today’s launch sets the stage for our longer-term ambition: bringing asset management on-chain in a way that truly meets institutional standards,» Keyrock CSO Juan David Mendieta said in a statement.

Read more: Stablecoin Payments Projected to Top $1T Annually by 2030, Market Maker Keyrock Says

Business

Gemini Shares Slide 6%, Extending Post-IPO Slump to 24%

Gemini Space Station (GEMI), the crypto exchange founded by Cameron and Tyler Winklevoss, has seen its shares tumble by more than 20% since listing on the Nasdaq last Friday.

The stock is down around 6% on Tuesday, trading at $30.42, and has dropped nearly 24% over the past week. The sharp decline follows an initial surge after the company raised $425 million in its IPO, pricing shares at $28 and valuing the firm at $3.3 billion before trading began.

On its first day, GEMI spiked to $45.89 before closing at $32 — a 14% premium to its offer price. But since hitting that high, shares have plunged more than 34%, erasing most of the early enthusiasm from public market investors.

The broader crypto equity market has remained more stable. Coinbase (COIN), the largest U.S. crypto exchange, is flat over the past week. Robinhood (HOOD), which derives part of its revenue from crypto, is down 3%. Token issuer Circle (CRCL), on the other hand, is up 13% over the same period.

Part of the pressure on Gemini’s stock may stem from its financials. The company posted a $283 million net loss in the first half of 2025, following a $159 million loss in all of 2024. Despite raising fresh capital, the numbers suggest the business is still far from turning a profit.

Compass Point analyst Ed Engel noted that GEMI is currently trading at 26 times its annualized first-half revenue. That multiple — often used to gauge whether a stock is expensive — means investors are paying 26 dollars for every dollar the company is expected to generate in sales this year. For a loss-making company in a volatile sector, that’s a steep price, and could be fueling investor skepticism.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars