Business

Bitcoin Edges Higher, ETH Rebounds Above $4k as Sentiment Slips Into ‘Fear’ Territory

Crypto markets modestly bounced on Friday with bitcoin (BTC) back above $110,000. Ethereum’s ether (ETH) outperformed with a 3.8% gain to cross $4,000, while dogecoin (DOGE) rose 3.4% and Solana (SOL) added 2.5%.

The cautious bid came as fresh inflation data landed squarely in line with forecasts. The Fed’s preferred measure of prices, the Personal Consumption Expenditures (PCE) index, rose 2.7% year-over-year in August, while core PCE excluding food and energy climbed 2.9%.

The data report reinforced the Fed’s narrative of gradually easing price pressures, said Fabian Dori, CIO at Sygnum Bank, but it also leaves policymakers balancing sticky inflation with a softer labor market backdrop.

«For investors, the implications are twofold: if inflation trends lower, risk assets may find support from confidence in the Fed’s easing cycle,» he said. «But any upside surprises in coming data could push back short-term rate cut expectations, weighing on equities and boosting the U.S. dollar.»

Crypto sentiment turns fearful

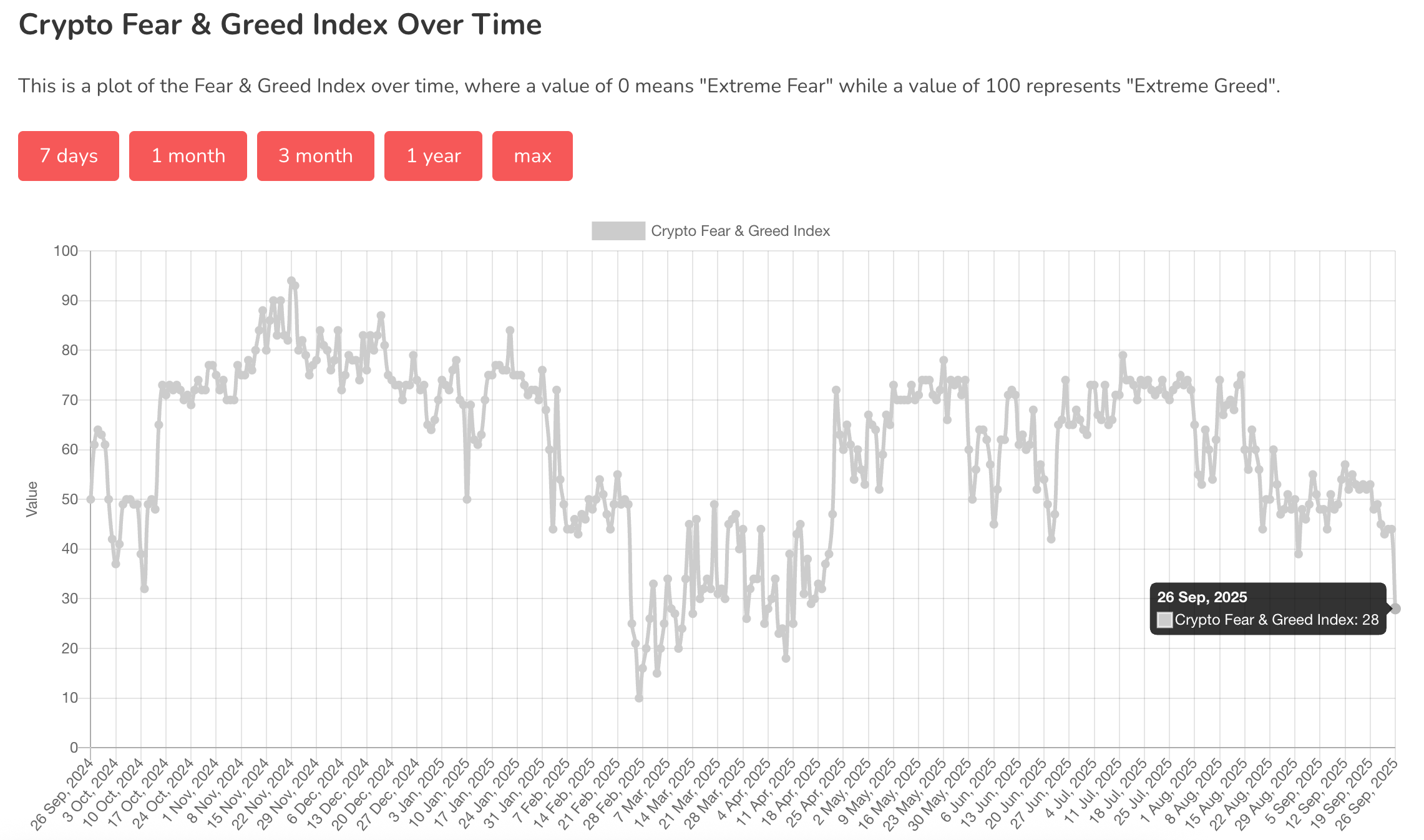

Meanwhile, sentiment in crypto remained fragile. The Fear & Greed Index, a well-followed sentiment indicator, plummeted to 28 on Friday, its most depressed level since mid-April signaling «fear» among traders. That reflected recent volatility after Thursday’s $1.1 billion liquidation wave wiped out leveraged long positions.

«In recent days, roughly $3 billion of levered longs have been liquidated,» noted Matt Mena, strategist at digital asset manager 21Shares. With excess leverage largely flushed out, he said positioning has swung to an extreme bearish, Mena noted: popular tokens such as BTC, SOL, and DOGE now show a long-to-short ratio of just one-to-nine.

That, combined with the Fear & Greed Index at near extremes lows, «sets the stage for a potential short squeeze,» Mena argued.

Paul Howard, senior director at trading firm Wincent, didn’t share to positive outlook and warned that the market could drift lower before stabilizing. He pointed to BTC dipping below its 100-day moving average under $110,000 and the total crypto market cap sliding under $4 trillion as signs of weakness.

«The market is in a healthy correction without panic or significant uptick in volatility,» he said. «It is likely that we grind lower the coming weeks,” adding he is beginning to question whether crypto revisits record highs in 2025.

Read more: Trump Tariffs, GDP Rattle Markets, ETFs Bleed: Crypto Daybook Americas

Business

Crypto Exchange Ripio Reveals $100M Crypto Treasury, Second Largest in Latin America

The company’s holdings, which include bitcoin and ether, have been managed through trading and hedging strategies since 2017.

Business

Ray Dalio Still Owns Bitcoin, but Says Traceability and Quantum Threat Are Concerns

The billionaire founder of hedge fund Bridgewater believes Bitcoin faces major hurdles before it can become a global reserve currency.

Business

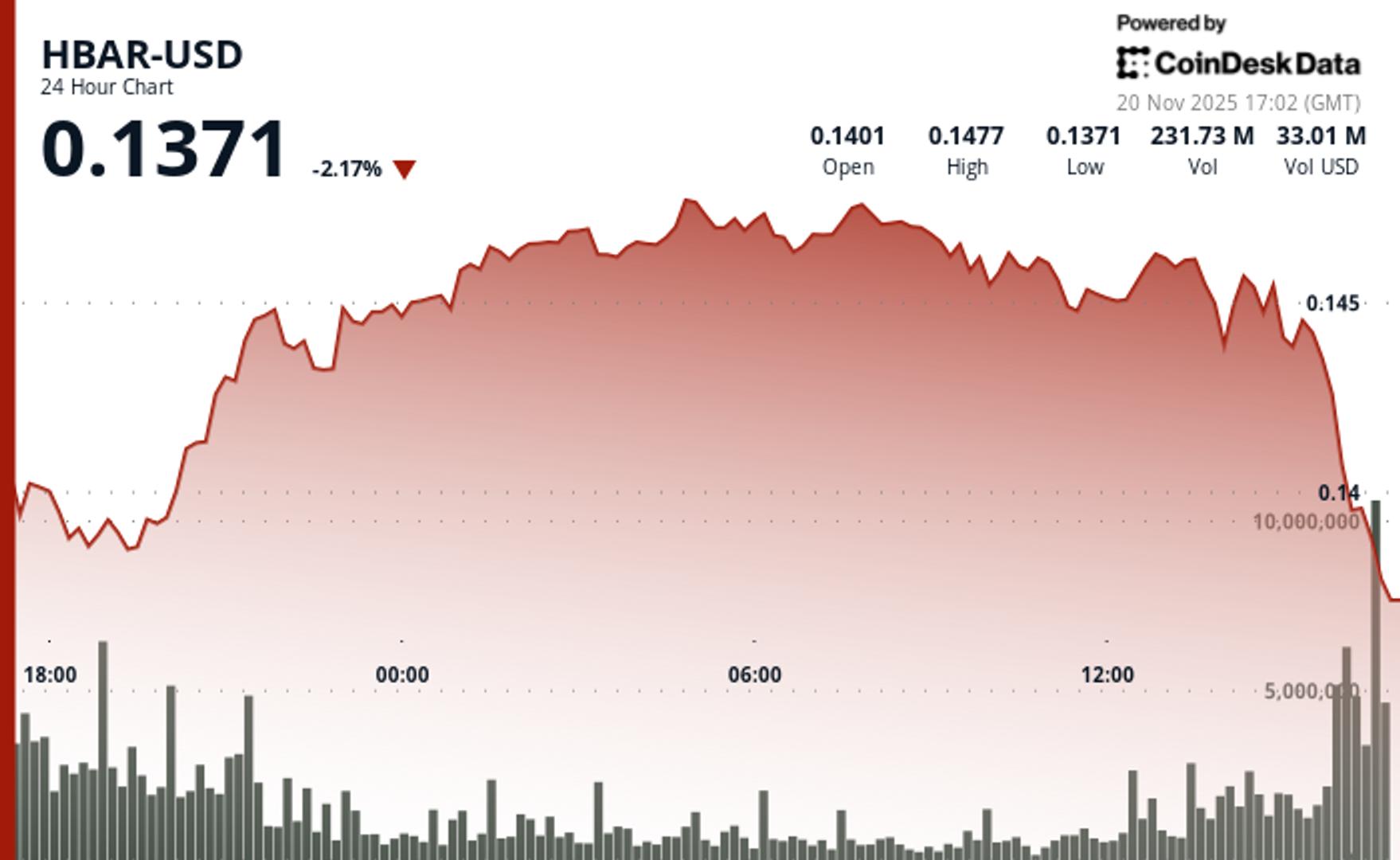

HBAR Faces Fresh Liquidity Alarms After Breakdown to $0.1373

Hedera’s token slipped below key support levels as a late-session trading halt, collapsing volume, and failed recovery attempts point to mounting structural and liquidity stress.

-

Uncategorized5 месяцев ago

Uncategorized5 месяцев agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business1 год ago

Business1 год ago3 Ways to make your business presentation more relatable

-

Fashion1 год ago

Fashion1 год agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment1 год ago

Entertainment1 год ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment1 год ago

Entertainment1 год ago10 Artists who retired from music and made a comeback

-

Business1 год ago

Business1 год ago15 Habits that could be hurting your business relationships

-

Entertainment1 год ago

Entertainment1 год agoNew Season 8 Walking Dead trailer flashes forward in time

-

Entertainment1 год ago

Entertainment1 год agoMeet Superman\’s grandfather in new trailer for Krypton