Uncategorized

Bitcoin Difficulty Hits New Highs as Key Metric Signals Miner Capitulation and Possible Bottom

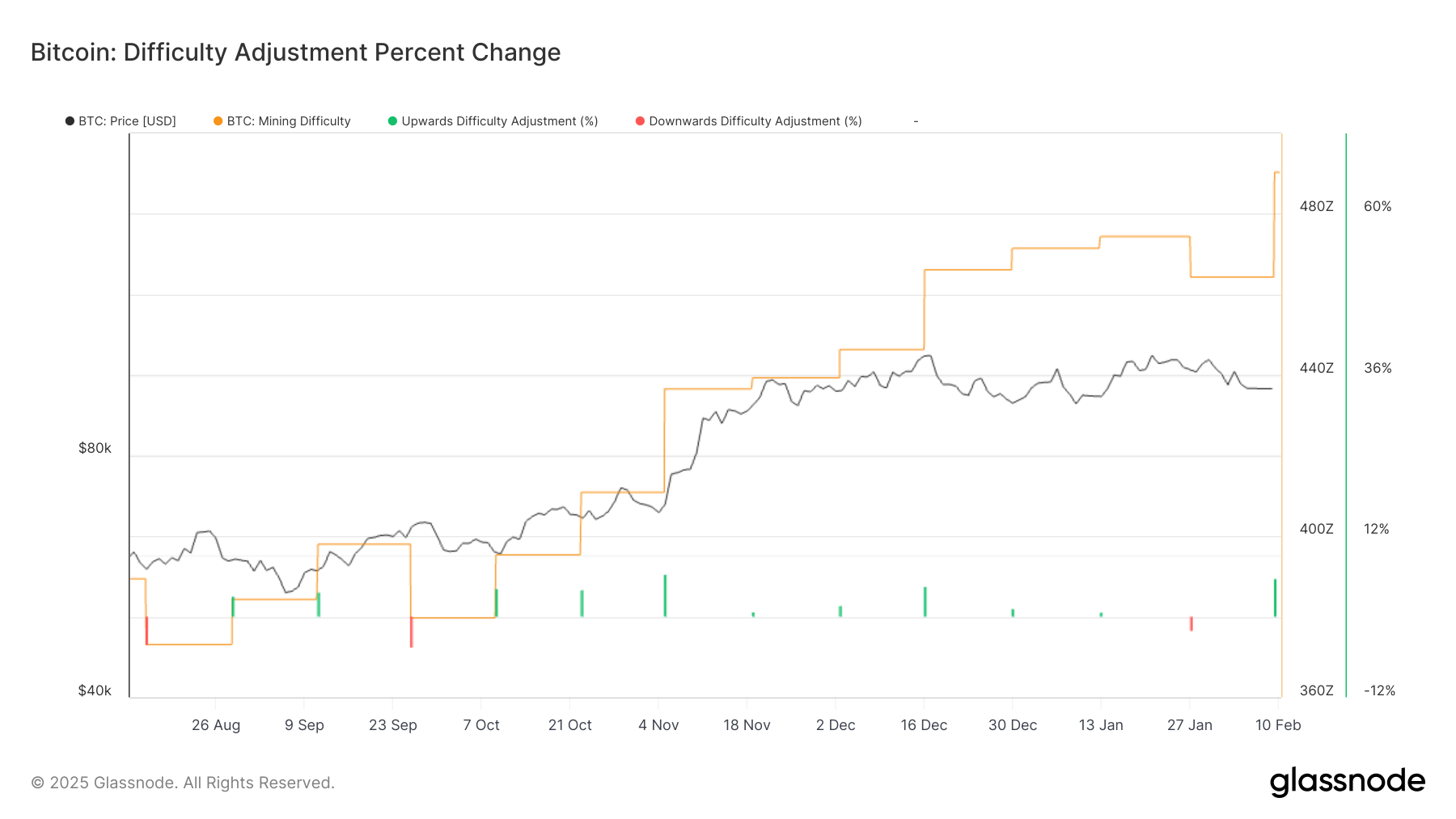

Bitcoin (BTC) difficulty hit an all-time high of 114.7 trillion (T) following a 5.6% upward adjustment over the weekend, according to CoinWarz.

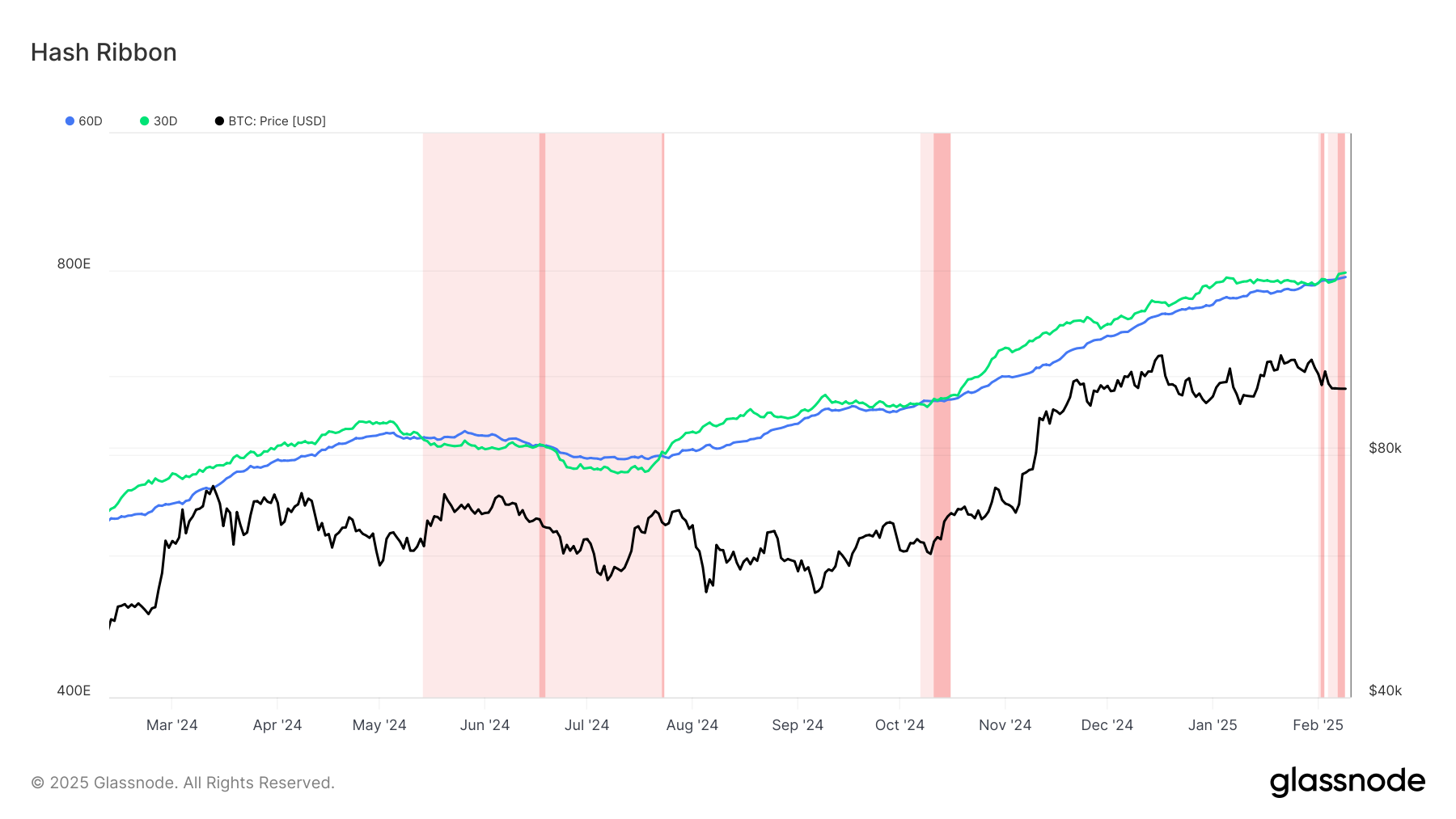

This coincides with the Hash Ribbon metric signaling a miner capitulation. Hash Ribbon, is a market indicator, which hints at a local bottom for bitcoin (BTC) and often forms when miners capitulate — when mining costs exceed profitability.

According to Glassnode data, miner capitulation began in early February. Bitcoin is down over 4% month-to-date. Historically, when this metric signals capitulation, it has marked local price bottoms.

If this pattern holds, bitcoin’s bottom could be around $91,000. The last capitulation signal occurred in October 2024, just before BTC surged 50%.

This rise in difficulty is due to bitcoin’s rising hash rate, which hit an all-time high on Feb. 4. Mining difficulty adjusts every 2,016 blocks, targeting an average block time of 10 minutes.

As difficulty increases, mining becomes more competitive, placing additional pressure on miners. January’s production data reflects this, with Riot Platforms (RIOT) being the only major public miner to report a month-over-month production increase.

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoDisney\’s live-action Aladdin finally finds its stars