Uncategorized

Avalanche Blockchain’s Largest-Ever Upgrade Goes Live on Testnet

Avalanche, the eighth-largest blockchain by total value locked (TVL), is moving ahead with a major technical makeover.

The Avalanche9000 upgrade went live in a test network environment (testnet) Monday, bringing the changes one step closer to the main network (mainnet), the Avalanche Foundation said.

Avalanche9000 will be the largest upgrade that Avalanche has seen. It is designed to cut the costs of sending transactions, operating validators and building apps on the network, whose native token {{AVAX}} is the 11th-largest cryptocurrency, with a $16 billion market cap.

The foundation is trying to attract developers to Avalanche and encourage users to create customized blockchains using its technology, known as subnets. Somewhat confusingly, subnets are now officially referred to in the Avalanche community as «L1s,» even though they are roughly analogous to the layer-2, or L2, networks that augment Ethereum and other blockchains. (Avalanche’s «primary network,» the equivalent of a layer-1 in other ecosystems, is considered a subnet.)

The team is hoping to bring Avalanche9000 to mainnet by yearend. Also known as the Etna Upgrade, Avalanche9000 consists of seven proposals, but the two most significant changes are ACP-77 and ACP-125.

Roll your own

The ACP-77 proposal would allow for a new type of validator with which users can launch their own subnets. The new validators will be significantly cheaper to operate, lowering the barrier to entry. The validators will also be permissionless, meaning anyone, from the operator of a decentralized exchange to the developers of another blockchain, can spin one up.

“Before this upgrade, it wasn’t possible for a dYdX or Monad to use Avalanche to launch their own L1. And that was because all the chains were permissioned, and that was the only functionality that was available,” said Luigi D’Onorio Demeo, the chief operation officer of Ava Labs, the main developer firm behind Avalanche, in an interview with CoinDesk. “So after this upgrade, we can have a chain with thousands of validators that wasn’t possible before.”

The ACP-125 proposal would lower the base fee, or minimum cost of running computations, on the primary Avalanche network’s C-chain, the main chain that runs smart contracts, from 25 nAVAX (about $0.00000098) to 1 nAVAX ($0.00000004.) One nAVAX equals one-billionth of one AVAX. (Avalanche also has a P-chain where users can stake AVAX and operate validators and an X-chain which is used for sending and receiving funds.)

“This basically puts C-chain fees equivalent to Arbitrum and Polygon,” D’Onorio Demio said, referring to two of the leading L2s on the Ethereum chain.

Referral grants

In addition to Avalanche9000 going live on testnet, the blockchain’s grants program, Retro9000, opened up Monday for developers to register and start building subnets in the testing environment. The foundation will reward them retroactively when they launch those subnets on mainnet.

“We’d love to see people experiment with different types of infrastructure like staking contracts. We’d love to see people experiment by building their own L1s,” D’Onorio Demio told CoinDesk. “If you’re more in the market for building a chain, this is a great way to start.”

Retro9000 has $40 million in rewards to distribute, with $2 million designated for business development executives, influencer-investors («key opinion leaders«) and the like who refer others to build on Avalanche.

“For the referral component: the idea there is if you’re a KOL or a BD person, and you know people that are potentially viable to build this kind of stuff, they can list you as a referral. And you will be eligible to also receive parts of the $2 million as well in retroactive grants,” D’Onorio Demio said.

Read more: Avalanche Unveils $40M Grant Program Ahead of ‘Avalanche9000’ Upgrade

Business

Strategy Bought $27M in Bitcoin at $123K Before Crypto Crash

Strategy (MSTR), the world’s largest corporate owner of bitcoin (BTC), appeared to miss out on capitalizing on last week’s market rout to purchase the dip in prices.

According to Monday’s press release, the firm bought 220 BTC at an average price of $123,561. The company used the proceeds of selling its various preferred stocks (STRF, STRK, STRD), raising $27.3 million.

That purchase price was well above the prices the largest crypto changed hands in the second half of the week. Bitcoin nosedived from above $123,000 on Thursday to as low as $103,000 on late Friday during one, if not the worst crypto flash crash on record, liquidating over $19 billion in leveraged positions.

That move occurred as Trump said to impose a 100% increase in tariffs against Chinese goods as a retaliation for tightening rare earth metal exports, reigniting fears of a trade war between the two world powers.

At its lowest point on Friday, BTC traded nearly 16% lower than the average of Strategy’s recent purchase price. Even during the swift rebound over the weekend, the firm could have bought tokens between $110,000 and $115,000, at a 7%-10% discount compared to what it paid for.

With the latest purchase, the firm brought its total holdings to 640,250 BTC, at an average acquisition price of $73,000 since starting its bitcoin treasury plan in 2020.

MSTR, the firm’s common stock, was up 2.5% on Monday.

Business

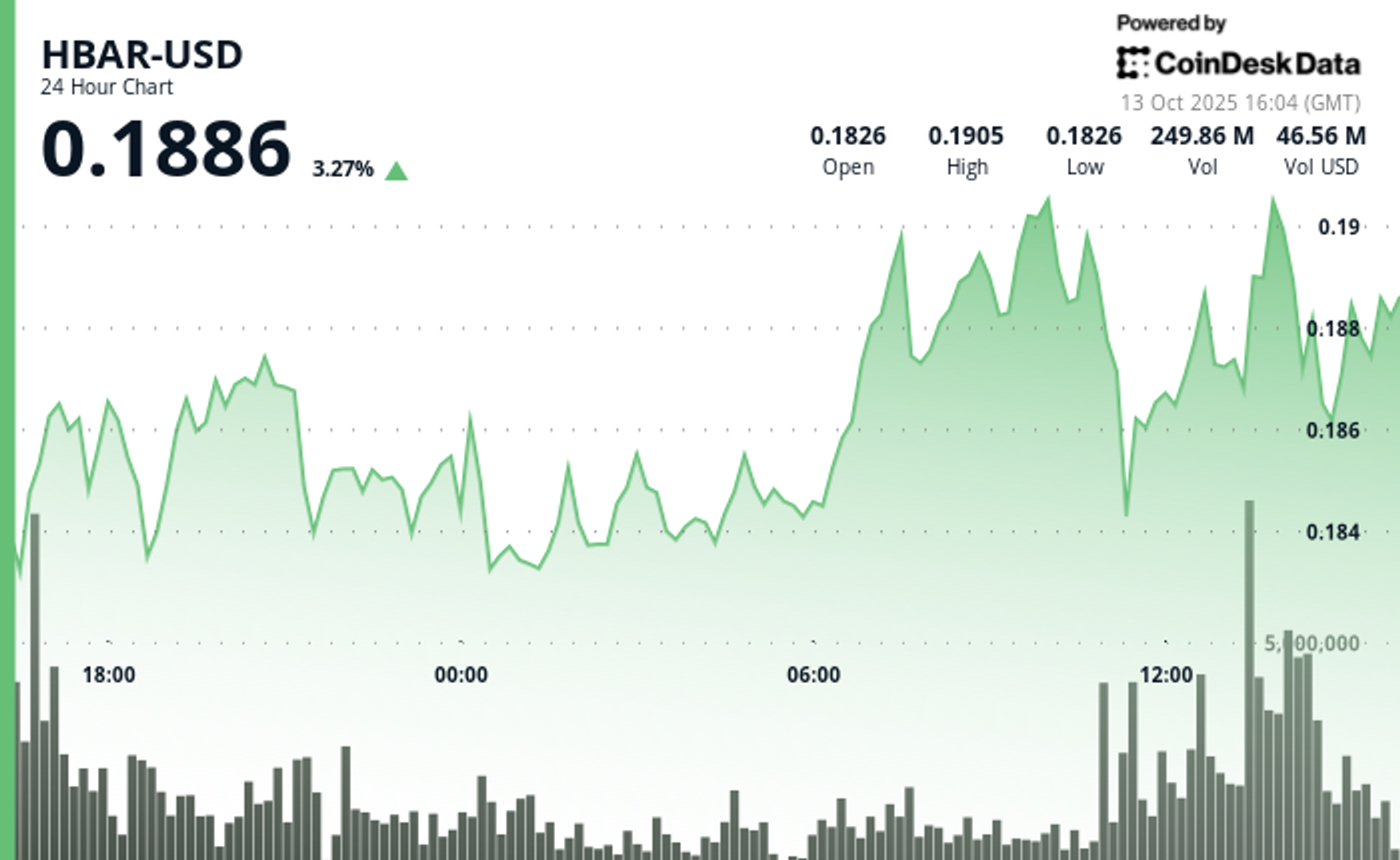

HBAR Rises Past Key Resistance After Explosive Decline

HBAR (Hedera Hashgraph) experienced pronounced volatility in the final hour of trading on Oct. 13, soaring from $0.187 to a peak of $0.191—a 2.14% intraday gain—before consolidating around $0.190.

The move was driven by a dramatic surge in trading activity, with a standout 15.65 million tokens exchanged at 13:31, signaling strong institutional participation. This decisive volume breakout propelled the asset beyond its prior resistance range of $0.190–$0.191, establishing a new technical footing amid bullish momentum.

The surge capped a broader 23-hour rally from Oct. 12 to 13, during which HBAR advanced roughly 9% within a $0.17–$0.19 bandwidth. This sustained upward trajectory was characterized by consistent volume inflows and a firm recovery from earlier lows near $0.17, underscoring robust market conviction. The asset’s ability to preserve support above $0.18 throughout the period reinforced confidence among traders eyeing continued bullish action.

Strong institutional engagement was evident as consecutive high-volume intervals extended through the breakout window, suggesting renewed accumulation and positioning for potential continuation. HBAR’s price structure now shows resilient support around $0.189–$0.190, signaling the possibility of further upside if momentum persists and broader market conditions remain favorable.

Technical Indicators Highlight Bullish Sentiment

- HBAR operated within a $0.017 bandwidth (9%) spanning $0.174 and $0.191 throughout the previous 23-hour period from 12 October 15:00 to 13 October 14:00.

- Substantial volume surges reaching 179.54 million and 182.77 million during 11:00 and 13:00 sessions on 13 October validated positive market sentiment.

- Critical resistance materialized at $0.190-$0.191 thresholds where price movements encountered persistent selling activity.

- The $0.183-$0.184 territory established dependable support through volume-supported bounces.

- Extraordinary volume explosion at 13:31 registering 15.65 million units signaled decisive breakout event.

- High-volume intervals surpassing 10 million units through 13:35 substantiated significant institutional engagement.

- Asset preserved support above $0.189 despite moderate profit-taking activity.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Business

Crypto Markets Today: Bitcoin and Altcoins Recover After $500B Crash

The crypto market staged a recovery on Monday following the weekend’s $500 billion bloodbath that resulted in a $10 billion drop in open interest.

Bitcoin (BTC) rose by 1.4% while ether (ETH) outperformed with a 2.5% gain. Synthetix (SNX, meanwhile, stole the show with a 120% rally as traders anticipate «perpetual wars» between the decentralized trading venue and HyperLiquid.

Plasma (XPL) and aster (ASTER) both failed to benefit from Monday’s recovery, losing 4.2% and 2.5% respectively.

Derivatives Positioning

- The BTC futures market has stabilized after a volatile period. Open interest, which had dropped from $33 billion to $23 billion over the weekend, has now settled at around $26 billion. Similarly, the 3-month annualized basis has rebounded to the 6-7% range, after dipping to 4-5% over the weekend, indicating that the bullish sentiment has largely returned. However, funding rates remain a key area of divergence; while Bybit and Hyperliquid have settled around 10%, Binance’s rate is negative.

- The BTC options market is showing a renewed bullish lean. The 24-hour Put/Call Volume has shifted to be more in favor of calls, now at over 56%. Additionally, the 1-week 25 Delta Skew has risen to 2.5% after a period of flatness.

- These metrics indicate a market with increasing demand for bullish exposure and upside protection, reflecting a shift away from the recent «cautious neutrality.»

- Coinglass data shows $620 million in 24 hour liquidations, with a 34-66 split between longs and shorts. ETH ($218 million), BTC ($124 million) and SOL ($43 million) were the leaders in terms of notional liquidations. Binance liquidation heatmap indicates $116,620 as a core liquidation level to monitor, in case of a price rise.

Token Talk

By Oliver Knight

- The crypto market kicked off Monday with a rebound in the wake of a sharp weekend leverage flush. According to data from CoinMarketCap, the total crypto market cap climbed roughly 5.7% in the past 24 hours, with volume jumping about 26.8%, suggesting those liquidated at the weekend are repurchasing their positions.

- A total of $19 billion worth of derivatives positions were wiped out over the weekend with the vast majority being attributed to those holding long positions, in the past 24 hours, however, $626 billion was liquidated with $420 billion of that being on the short side, demonstrating a reversal in sentiment, according to CoinGlass.

- The recovery has been tentative so far; the dominance of Bitcoin remains elevated at about 58.45%, down modestly from recent highs, which implies altcoins may still lag as capital piles back into safer large-cap names.

- The big winner of Monday’s recovery was synthetix (SNX), which rose by more than 120% ahead of a crypto trading competition that will see it potentially start up «perpetual wars» with HyperLiquid.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton