Uncategorized

Asia Morning Briefing: Animoca Exec Says U.S. Heat Is Pushing China’s Stablecoin Agenda

Good Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

In 2021, China’s central bank warned that global stablecoins could bring risks and challenges to the «international monetary system, payment and clearing system, monetary policies, [and] cross-border capital flow management.» That quote, from the People’s Bank of China’s white paper on its e-CNY project, reflected the PBOC’s deep skepticism toward private-sector digital currencies, particularly Facebook’s Libra.

As it turns out, Libra never launched. But stablecoins like Tether’s USDT and Circle’s USDC are now deep inside the financial plumbing around the world, especially in Asia, making processes like supply-chain financing more efficient than ever.

As a result, Beijing’s caution on stablecoins is giving way to a sense of urgency. They’re on the agenda because they are seen as just another way the U.S. dollar is cementing itself in Asia’s financial pipework, and that’s not something the Chinese authorities are happy with.

Animoca Group President Evan Ayuang said in an interview with CoinDesk that China’s interest in stablecoins has been accelerating. It’s been that way for a while, but now it’s only increasing as they go mainstream on Wall Street.

“Right now, stablecoins are making a comeback for policymakers and interested issuers. The question is why?” he told CoinDesk. “It really has to do with the Trump presidency … all the signals that the U.S. is coming out and giving out, they’re actually pressuring China to act a lot faster.”

Animoca is a Hong Kong-based Web3 fund that has its hands in all things crypto.

The pressure point, he argues, is the recently enacted GENIUS Act which, for the first time, provides U.S. federal regulatory clarity on fiat-backed stablecoins and cements their role in the global financial system. Effectively, it could be seen as a digital extension of dollar hegemony, one that China can’t afford to ignore.

Animoca has its own stablecoin interests. It’s part of a consortium that includes Standard Chartered Bank and Hong Kong Telecom working on a Hong Kong dollar (HKD)-denominated stablecoin.

“When China looks at the GENIUS Act, the way they look at it is that the U.S. is going after the space,” Auyang said. “And if [the] dollar right now is the dominant reserve currency … it’s always about these regular stablecoins that flow in the financial system to settle currency in light of trade tensions and direct bilateral trade deals. That matters.”

There’s a clear contrast from the tone of the PBOC’s 2021 white paper, which portrayed stablecoins as destabilizing and speculative, lumping them alongside volatile cryptocurrencies. But, as Auyang noted, the conversation has shifted.

Beijing now sees the need to compete on blockchain rails, particularly through regulated, offshore yuan (CNH) stablecoins, which could help make the country’s currency — the reminbi (RMB), or, colloquially, the yuan — a more practical choice for offshore settlement.

“If you are trying to make RMB more internationalized, but in a controlled way, this is it. The offshore CNH is it,” Auyang said. “That stablecoin is the way to internationalize it that allows you to have the currency control still in place, but allows you to have offshore.”

A regulated stablecoin, be it HKD or CNH, can be connected to onshore Chinese assets that could be put onto public blockchains, thereby creating new and important financial rails for the country. While e-CNY use cases have typically revolved around central banks and institutions. The HKD or CNH stablecoin, issued in Hong Kong or through public blockchain infrastructure, offers a vehicle for internationalizing the currency while still respecting Beijing’s capital controlss.

Another option could be liquidity pools in Hong Kong that provide places for HKD, CNH, and e-CNY transactions to settle. Of course, he said, Beijing has its eye on HKD stablecoins as the City, with its autonomous legal framework, is China’s sandbox.

“At some point in time, it’s going to be the stablecoin,” he said, predicting that even international business-to-business payments will favor tokenized fiat over permissioned central bank digital currencies (CBDCs).

And this shift isn’t limited to China.

“Everybody’s going to do this after the U.S. passes the GENIUS Act. Every country is going to think about this. Every country will have a regulated stablecoin at some point in time,” he said.

This isn’t about overthrowing the dollar, which is an impossible task considering the liquidity it has.

“When I’m trading with my partners in Southeast Asia, there is deep enough liquidity out there in non-USD stablecoin pairs for that trade to happen,” he said.

The PBOC’s 2021 white paper framed stablecoins as threats. Four years later, Beijing seems to be warming up to the idea that they have a role to play in the financial order of the future.

Market Movements

BTC: Bitcoin is consolidating around $118,000 after last week’s $123,000 all-time high, with analysts warning of a potential dip to $115,000 amid fragile sentiment, profit-taking, and minor bearish signals, though onchain data suggests the uptrend could soon resume.

ETH: ETH remains in a strong uptrend above key moving averages, trading at $3,619 after a rally that pushed prices near $3,800, with $3,300 now acting as key support to maintain the bullish structure.

Gold: Gold prices fell 0.6% to $3,410.26 on Wednesday as a US-Japan trade deal eased trade war fears and dampened safe haven demand, though longer-term support remains from de-dollarization and central bank buying.

Nikkei 225: The Nikkei 225 rose 1.09% on Thursday, extending gains as optimism over trade deals with the U.S. and potential progress with the EU lifted Asia-Pacific markets.

S&P 500: U.S. stocks rose solidly on Wednesday—driven by optimism over the U.S.-Japan trade deal—with the Dow up over 1%, the S&P 500 gaining more than 0.75%, and the Nasdaq adding around 0.6%.

Elsewhere in Crypto:

Uncategorized

Wall Street Bank Citigroup Sees Ether Falling to $4,300 by Year-End

Wall Street giant Citigroup (C) has launched new ether (ETH) forecasts, calling for $4,300 by year-end, which would be a decline from the current $4,515.

That’s the base case though. The bank’s full assessment is wide enough to drive an army regiment through, with the bull case being $6,400 and the bear case $2,200.

The bank analysts said network activity remains the key driver of ether’s value, but much of the recent growth has been on layer-2s, where value “pass-through” to Ethereum’s base layer is unclear.

Citi assumes just 30% of layer-2 activity contributes to ether’s valuation, putting current prices above its activity-based model, likely due to strong inflows and excitement around tokenization and stablecoins.

A layer 1 network is the base layer, or the underlying infrastructure of a blockchain. Layer 2 refers to a set of off-chain systems or separate blockchains built on top of layer 1s.

Exchange-traded fund (ETF) flows, though smaller than bitcoin’s (BTC), have a bigger price impact per dollar, but Citi expects them to remain limited given ether’s smaller market cap and lower visibility with new investors.

Macro factors are seen adding only modest support. With equities already near the bank’s S&P 500 6,600 target, the analysts do not expect major upside from risk assets.

Read more: Ether Bigger Beneficiary of Digital Asset Treasuries Than Bitcoin or Solana: StanChart

Uncategorized

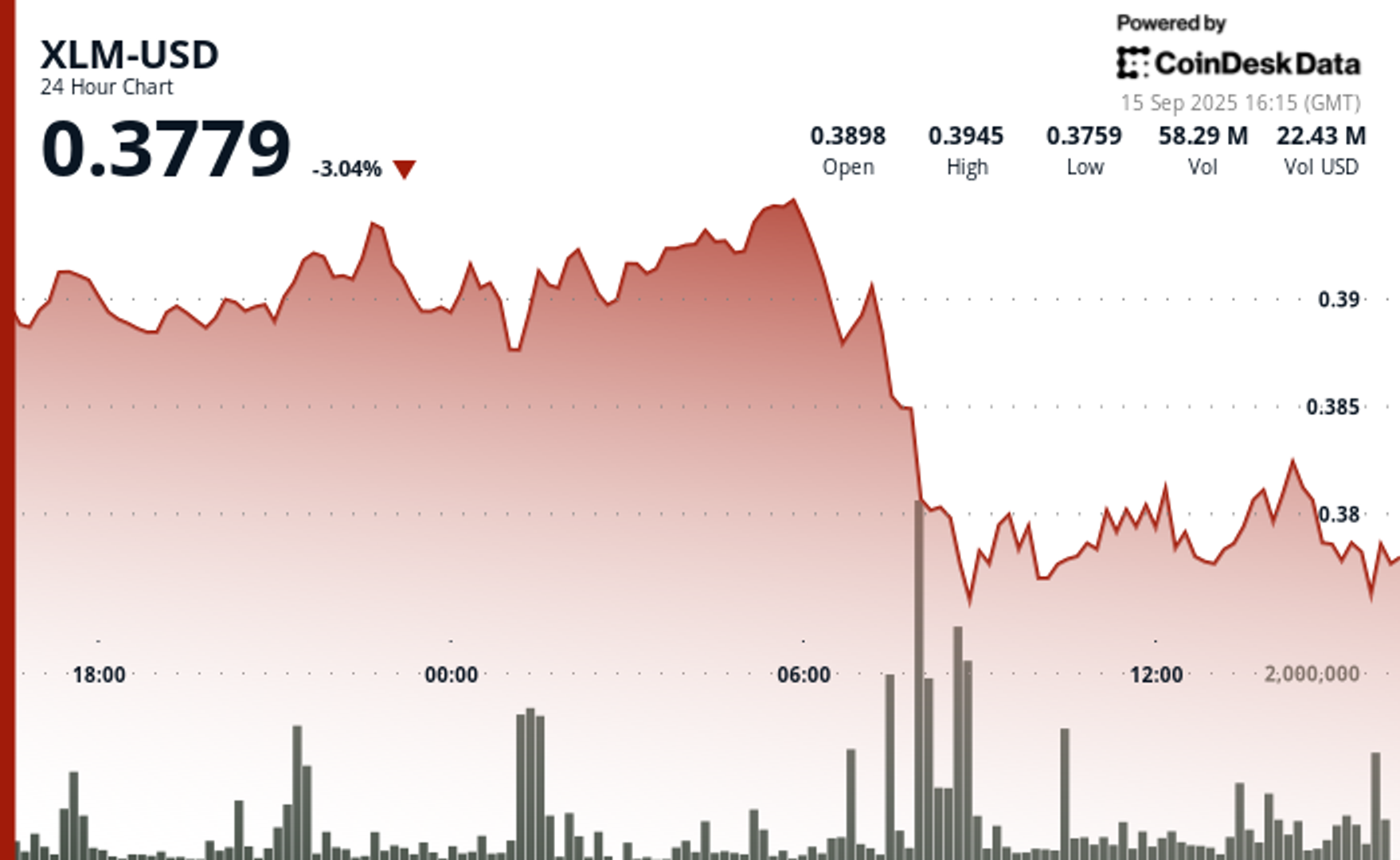

XLM Sees Heavy Volatility as Institutional Selling Weighs on Price

Stellar’s XLM token endured sharp swings over the past 24 hours, tumbling 3% as institutional selling pressure dominated order books. The asset declined from $0.39 to $0.38 between September 14 at 15:00 and September 15 at 14:00, with trading volumes peaking at 101.32 million—nearly triple its 24-hour average. The heaviest liquidation struck during the morning hours of September 15, when XLM collapsed from $0.395 to $0.376 within two hours, establishing $0.395 as firm resistance while tentative support formed near $0.375.

Despite the broader downtrend, intraday action highlighted moments of resilience. From 13:15 to 14:14 on September 15, XLM staged a brief recovery, jumping from $0.378 to a session high of $0.383 before closing the hour at $0.380. Trading volume surged above 10 million units during this window, with 3.45 million changing hands in a single minute as bulls attempted to push past resistance. While sellers capped momentum, the consolidation zone around $0.380–$0.381 now represents a potential support base.

Market dynamics suggest distribution patterns consistent with institutional profit-taking. The persistent supply overhead has reinforced resistance at $0.395, where repeated rally attempts have failed, while the emergence of support near $0.375 reflects opportunistic buying during liquidation waves. For traders, the $0.375–$0.395 band has become the key battleground that will define near-term direction.

Technical Indicators

- XLM retreated 3% from $0.39 to $0.38 during the previous 24-hours from 14 September 15:00 to 15 September 14:00.

- Trading volume peaked at 101.32 million during the 08:00 hour, nearly triple the 24-hour average of 24.47 million.

- Strong resistance established around $0.395 level during morning selloff.

- Key support emerged near $0.375 where buying interest materialized.

- Price range of $0.019 representing 5% volatility between peak and trough.

- Recovery attempts reached $0.383 by 13:00 before encountering selling pressure.

- Consolidation pattern formed around $0.380-$0.381 zone suggesting new support level.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Uncategorized

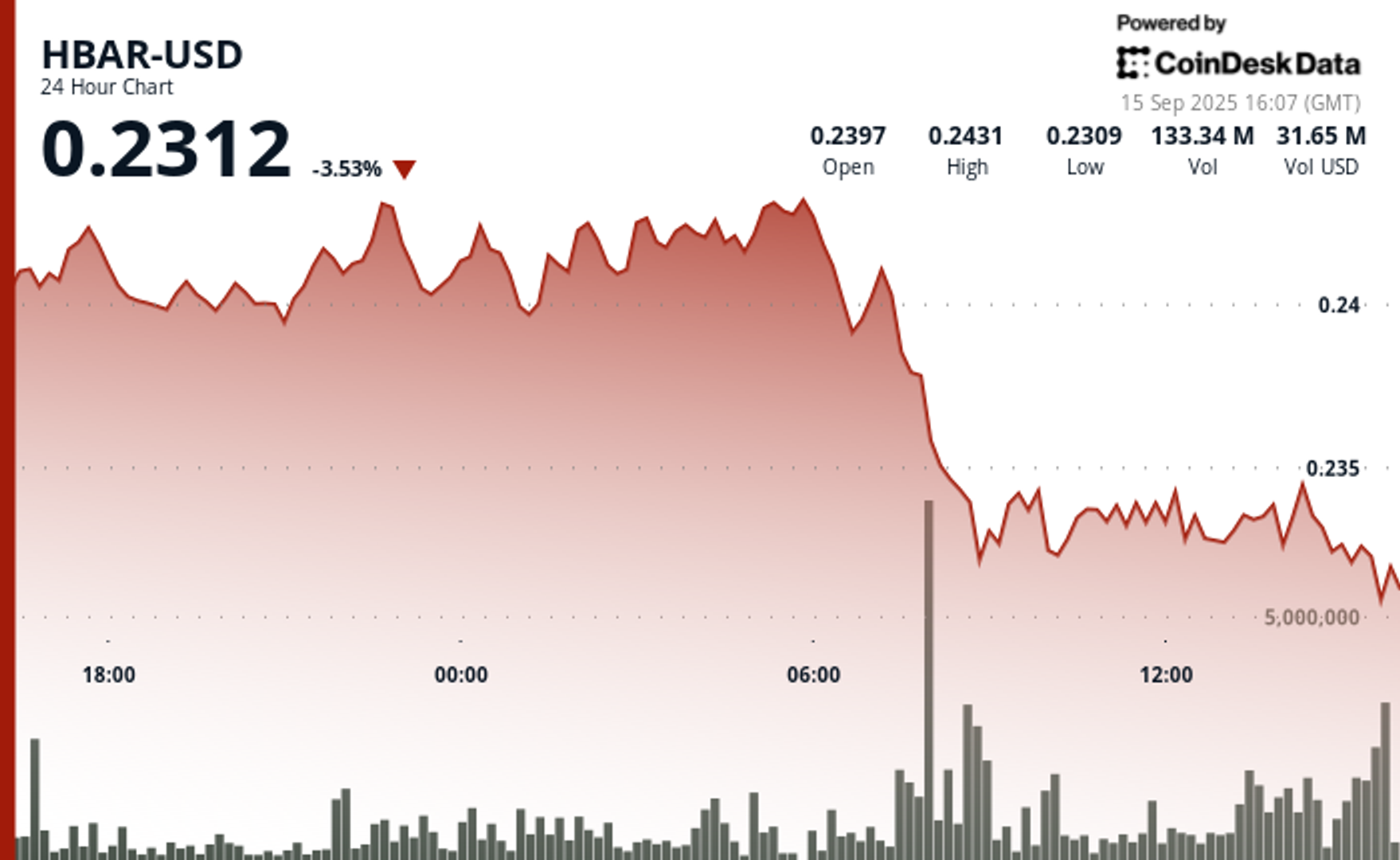

HBAR Tumbles 5% as Institutional Investors Trigger Mass Selloff

Hedera Hashgraph’s HBAR token endured steep losses over a volatile 24-hour window between September 14 and 15, falling 5% from $0.24 to $0.23. The token’s trading range expanded by $0.01 — a move often linked to outsized institutional activity — as heavy corporate selling overwhelmed support levels. The sharpest move came between 07:00 and 08:00 UTC on September 15, when concentrated liquidation drove prices lower after days of resistance around $0.24.

Institutional trading volumes surged during the session, with more than 126 million tokens changing hands on the morning of September 15 — nearly three times the norm for corporate flows. Market participants attributed the spike to portfolio rebalancing by large stakeholders, with enterprise adoption jitters and mounting regulatory scrutiny providing the backdrop for the selloff.

Recovery efforts briefly emerged during the final hour of trading, when corporate buyers tested the $0.24 level before retreating. Between 13:32 and 13:35 UTC, one accumulation push saw 2.47 million tokens deployed in an effort to establish a price floor. Still, buying momentum ultimately faltered, with HBAR settling back into support at $0.23.

The turbulence underscores the token’s vulnerability to institutional distribution events. Analysts point to the failed breakout above $0.24 as confirmation of fresh resistance, with $0.23 now serving as the critical support zone. The surge in volume suggests major corporate participants are repositioning ahead of regulatory shifts, leaving HBAR’s near-term outlook dependent on whether enterprise buyers can mount sustained defenses above key support.

Technical Indicators Summary

- Corporate resistance levels crystallized at $0.24 where institutional selling pressure consistently overwhelmed enterprise buying interest across multiple trading sessions.

- Institutional support structures emerged around $0.23 levels where corporate buying programs have systematically absorbed selling pressure from retail and smaller institutional participants.

- The unprecedented trading volume surge to 126.38 million tokens during the 08:00 morning session reflects enterprise-scale distribution strategies that overwhelmed corporate demand across major trading platforms.

- Subsequent institutional momentum proved unsustainable as systematic selling pressure resumed between 13:37-13:44, driving corporate participants back toward $0.23 support zones with sustained volumes exceeding 1 million tokens, indicating ongoing institutional distribution.

- Final trading periods exhibited diminishing corporate activity with zero recorded volume between 13:13-14:14, suggesting institutional participants adopted defensive positioning strategies as HBAR consolidated at $0.23 amid enterprise uncertainty.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

-

Business11 месяцев ago

Business11 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion11 месяцев ago

Fashion11 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment11 месяцев ago

Entertainment11 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business11 месяцев ago

Business11 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Entertainment11 месяцев ago

Entertainment11 месяцев agoDisney\’s live-action Aladdin finally finds its stars