Uncategorized

As Lutnick Faces U.S. Senate, Elizabeth Warren Scrutinizes His Tether Ties

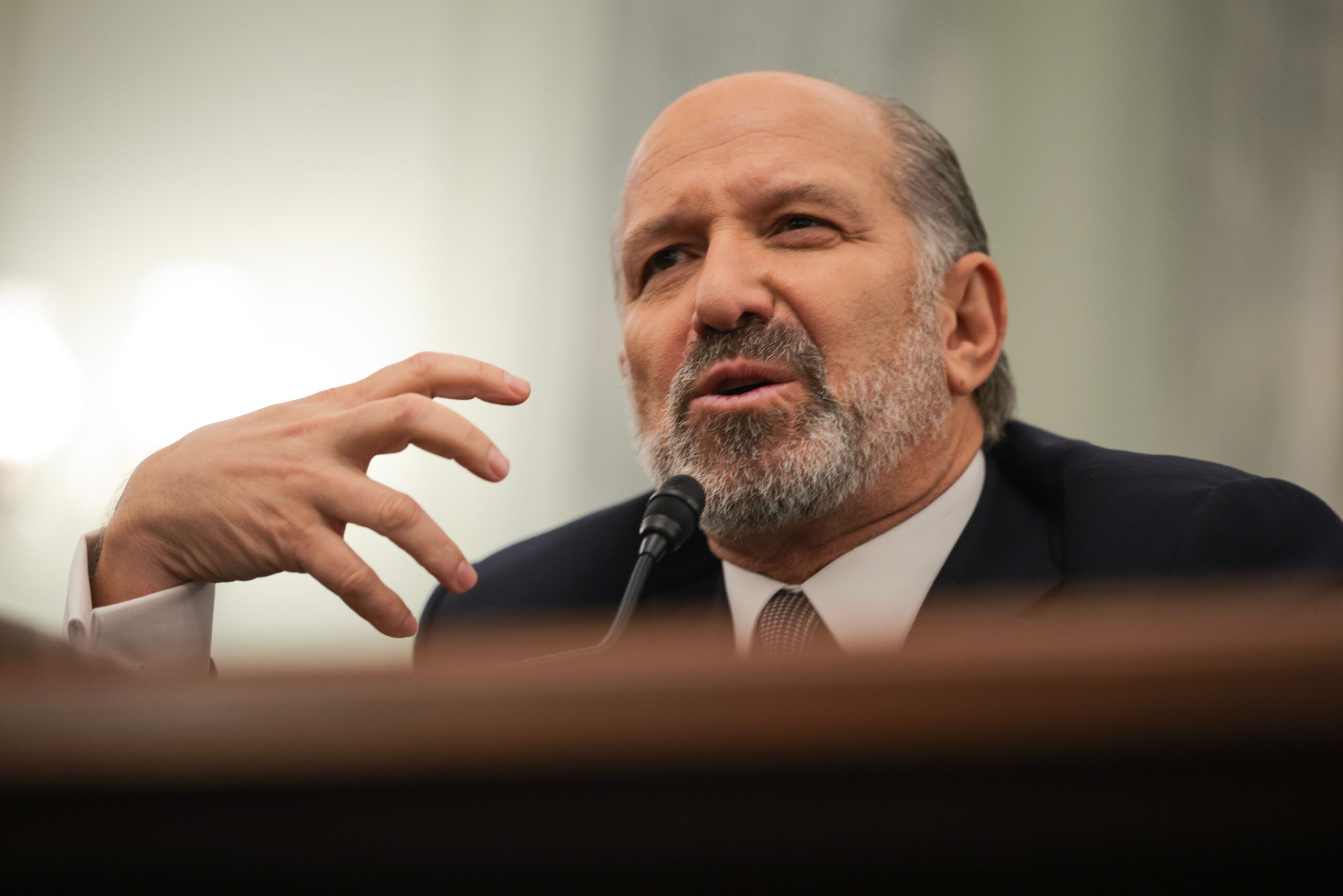

Howard Lutnick, who is President Donald Trump’s nominee to be secretary of Commerce, is drawing scrutiny on his relationship with Tether from Senator Elizabeth Warren — the ranking Democrat on the Senate Banking Committee and one of Congress’ most reliable critics of the digital asset sector.

As CEO of Cantor Fitzgerald, the Wall Street firm that acts as the U.S. banker for leading global stablecoin issuer Tether, the Massachusetts Democrat said Lutnick backed a crypto operation with «clear ties to criminal activity.»

«You played a critical role in the rise of Tether, a shadowy crypto firm with profits exceeding $7.7 billion in 2024,» Warren wrote in a letter to Lutnick, who is making his case Wednesday to the Senate Commerce Committee that’s considering his confirmation to Trump’s cabinet.

As Tether’s U.S. Treasuries dealer and the main custodian of its Treasury reserves, she suggested Lutnick’s firm shares responsibility for illicit abuse of its stablecoin (USDT) by criminals and terrorists. She also contended that Cantor Fitzgerald owns part of Tether, though Lutnick testified on Wednesday that the firm has a convertible bond but not a direct equity stake.

«The use of Tether’s stablecoin has been the subject of over 150 investigations across four continents, including here with the Department of Justice and the Department of the Treasury,» Warren wrote to Lutnick, who led Trump’s transition team as he returned to the White House.

Tether CEO Paolo Ardoino has sought to defend his company’s reputation and said of the political rise of Lutnick, «We don’t expect any political favors by anyone.»

Lutnick said in the confirmation hearing that he supports greater U.S. auditing demands on stablecoin issuers. He also said U.S. law-enforcement artificial intelligence tools should be deployed.

«Our AI tools will rip illicit activity out of stablecoins within a year or two,» he said. «Our technology on their blockchain will end it, and that’s what we should require.»

The only reason the government is able to detect and track illicit activity on Tether is because of its inherent transparency, Lutnick argued.

«When these same illicit characters use dollars or euros, we don’t know about it,» he said. He contended that U.S.-backed stablecoins «must allow U.S. law enforcement and our AI tools into their models so that we can go find and catch illicit activity.»

Read More: Howard Lutnick: Tether’s Big Backer

UPDATE (January 29, 2025, 18:22 UTC): Adds additional comments from Lutnick.

Uncategorized

Elon Musk vs. the regulators

Welcome back to TechCrunch Mobility, your hub for all things “future of transportation.”

Uncategorized

Nvidia’s AI empire: A look at its top startup investments

Over the last two years, Nvidia has used its ballooning fortunes to invest in over 100 AI startups. Here are the giant semiconductor’s largest investments.

Uncategorized

Dating app Cerca will show how Gen Z really dates at TechCrunch Disrupt 2025

Cerca is a dating app that sets users up with mutual friends.

-

Business12 месяцев ago

Business12 месяцев ago3 Ways to make your business presentation more relatable

-

Fashion12 месяцев ago

Fashion12 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago10 Artists who retired from music and made a comeback

-

Entertainment12 месяцев ago

Entertainment12 месяцев ago\’Better Call Saul\’ has been renewed for a fourth season

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoNew Season 8 Walking Dead trailer flashes forward in time

-

Business12 месяцев ago

Business12 месяцев ago15 Habits that could be hurting your business relationships

-

Entertainment12 месяцев ago

Entertainment12 месяцев agoMeet Superman\’s grandfather in new trailer for Krypton

-

Uncategorized4 месяца ago

Uncategorized4 месяца agoRobinhood Launches Micro Bitcoin, Solana and XRP Futures Contracts

Thng gii thiu binance

9 сентября, 2025 at 8:10 дп

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. Create a free account