Uncategorized

AI-Powered Court System Is Coming to Crypto With GenLayer

What if there were a crypto protocol that specialized in arbitrating on-chain disputes?

Imagine if, whenever prediction markets like Polymarket settled in a controversial manner, users had a formal way to appeal through a sort of neutral on-chain court system. Or if decentralized autonomous organizations (DAOs) could rely on an efficient, knowledgeable third party to help them make decisions. Or if insurance contracts could automatically execute payouts when specific real-world events occurred.

That’s essentially what Albert Castellana Lluís and his team are building with GenLayer, a crypto project that markets itself as a decision-making system, or trust infrastructure.

“We’re using a blockchain that has multiple AIs coordinate and reach agreement on subjective decisions, as if they were a judge,» Castellana, co-founder and CEO of YeagerAI told CoinDesk in an interview. «We’re basically building a global synthetic jurisdiction that has an embedded court system that doesn’t sleep, that’s super cheap, and that’s super fast.”

The demand for such an arbitration project may spike in the coming years with the development of AI agents — sophisticated programs powered by artificial intelligence that are capable of carrying out complex tasks in an autonomous manner.

When it comes to crypto markets, AI agents can be used in all kinds of ways: for trading memecoins, arbitraging bitcoin on exchanges, monitoring the security of DeFi protocols, or providing market insights through in-depth analysis, to cite only a few use-cases. AI agents will also be able to hire other AI agents in order to complete even more complex assignments.

Such agents may proliferate at an unexpected rate, Castellana said. In his view, most crypto market participants could be managing a handful of them by the end of 2025.

“These agents, they work super fast, they don’t sleep, they don’t go to jail. You don’t know where they are. Are they going to pass anti-money laundering rules? Are they going to have a bank account? Can they even use a Visa card?” Castellana said. “How can we enable fast transactions between them? And how can trust happen in a world like this?”

Thanks to its unique architecture, GenLayer could provide a solution by allowing entities — human or AI — to get a reliable, neutral opinion to weigh in on any decision in record time. “Anywhere where you normally would have a third party made of a bunch of humans… We replace them with a global network that provides a consensus between different AIs, a network that can make decisions in a way that is as correct and as unbiased as possible,” Castellana said.

Synthetic court system

GenLayer doesn’t seek to compete with other blockchains like Bitcoin, Ethereum or Solana — or even DeFi protocols such as Uniswap or Compound. Rather, the idea is for any existing crypto protocol to be able to connect to GenLayer and make use of its infrastructure.

GenLayer’s chain is powered by ZKsync, an Ethereum layer 2 solution. Its network counts 1,000 validators, each one connected to a large language model (LLM) such as OpenAI’s ChatGPT, Google’s Bert or Meta’s Llama.

Let’s say a market on Polymarket settles in a controversial manner. If Polymarket is connected to GenLayer, users of the prediction market have the ability to raise the issue (or, as Castellana put it, to create a “transaction”) with its synthetic court system.

As soon as the transaction comes in, GenLayer picks five validators at random to rule on it. These five validators query an LLM of their choice in order to find information on the topic at hand, and then vote on a solution. That produces a ruling.

But the Polymarket users, in our example, don’t necessarily need to be satisfied with the ruling: they can decide to appeal the decision. In which case, GenLayer picks another set of validators — except this time, their number jumps to 11. Just like before, the validators issue a ruling based on the information they gather from LLMs. That decision can also be appealed, which makes GenLayer pick 23 validators for another ruling, then 47 validators, then 95, and so on and so forth.

The idea is to rely on Condorcetʼs Jury Theorem, which according to GenLayer’s pitch deck states that “when each participant is more likely than not to make a correct decision, the probability of a correct majority outcome increases significantly as the group grows larger.” In other words, GenLayer finds wisdom in the crowd. The more validators are involved, the more likely they are to zero in on an accurate answer.

“What this means is that we can start small and very efficiently, but also we can escalate to a point where something very, very tricky, they can still get right,” Castellana said.

The average transaction takes roughly 100 seconds to process, Castellana said, and the court’s decision becomes final after 30 minutes — a timeframe that can be elongated if multiple appeals occur. But that means the protocol can reach a decision on major issues in a very short period of time, day or night, instead of going through arduous real-world litigation processes which may take months or even years.

Looking at incentives

GenLayer’s mission naturally raises a question: is it possible to game the system? For example, what if all of the validators select the same AI (say, ChatGPT) to solve a given proposal? Wouldn’t that mean that ChatGPT will have essentially issued the ruling?

Every time you query an LLM, you generate a new seed, Castellana said, so you obtain a different answer. On top of that, validators have the freedom of choosing which LLM to use based on the topic at hand. If it’s a relatively easy question, perhaps there’s no need to use an expensive LLM; on the other hand, if the question is particularly complex, the validator may opt for a higher-quality AI model.

Validators may even end up in a situation where they feel like they’ve seen a certain type of question so many times that they can pre-train a small model for a specific purpose. “We think that, over time, there’s just going to be endless new models,” Castellana said.

There’s a strong incentive for validators to be on the winning side of the decision-making process, because they’re financially rewarded for it — while the losing side ends up incurring costs associated with using computation, without collecting any rewards.

In other words, the question is not whether one’s validator is providing a correct answer, but whether it manages to side with the majority.

Since validators have no idea what other validators are voting, the goal is for them to use the necessary resources to provide accurate information with the expectation that other validators will converge on that information as well — because arriving at the same incorrect answer would probably require rigorous coordination.

And if that gambit doesn’t work out, the appeal system is ready to kick in.

“If I know that I’m reusing a good LLM, and I think that other people are using a bad LLMs and that’s why I lost, then I have quite a big incentive to appeal, because I know that with more people, there’s going to be an incentive for them to be using better LLMs as well” since other validators will want to earn the rewards from a successful appeal, Castellana said.

The system makes it hard for validators to collude, because they only have 100 seconds to reach a decision, and they don’t know whether they will be picked to settle specific questions. An entity would need to control between 33% and 50% of the network to be able to attack it, Castellana said.

Like Ethereum, GenLayer will be using a native token for its financial incentives. With a testnet already launched, the project should go live by the end of the year, according to Castellana. “There’s going to be a very big incentive for people to come and build things on top,” he said.

Uncategorized

Crypto Rebounds From Early Declines Alongside Reversal in U.S. Stocks

There was a bit of volatility in crypto on Wednesday, but most of the market continued the weeks’ trend of trading in a very tight range.

Shortly after the close of the U.S. stock market, bitcoin (BTC) was changing hands at $94,700, down just 0.4% over the past 24 hours. BTC was lower by nearly 2% at one point alongside a sizable early decline in stocks.

Hit harder during the early decline, altcoins also rebounded, but underperformed bitcoin The CoinDesk 20 slumped 2% in the last 24 hours, with litecoin (LTC), ripple (XRP), avalanche (AVAX) and chainlink (LINK) all dropping roughly 4%.

Crypto equities were modestly lower, but bitcoin miner Hut 8 (HUT) was a notable underperformer, falling 5.7%.

The major U.S. stock averages tumbled 2% or more early in the session following less than stellar economic news. They retook ground throughout the day though, with the S&P 500 closing slightly in the green and the Nasdaq dipping just 0.1%.

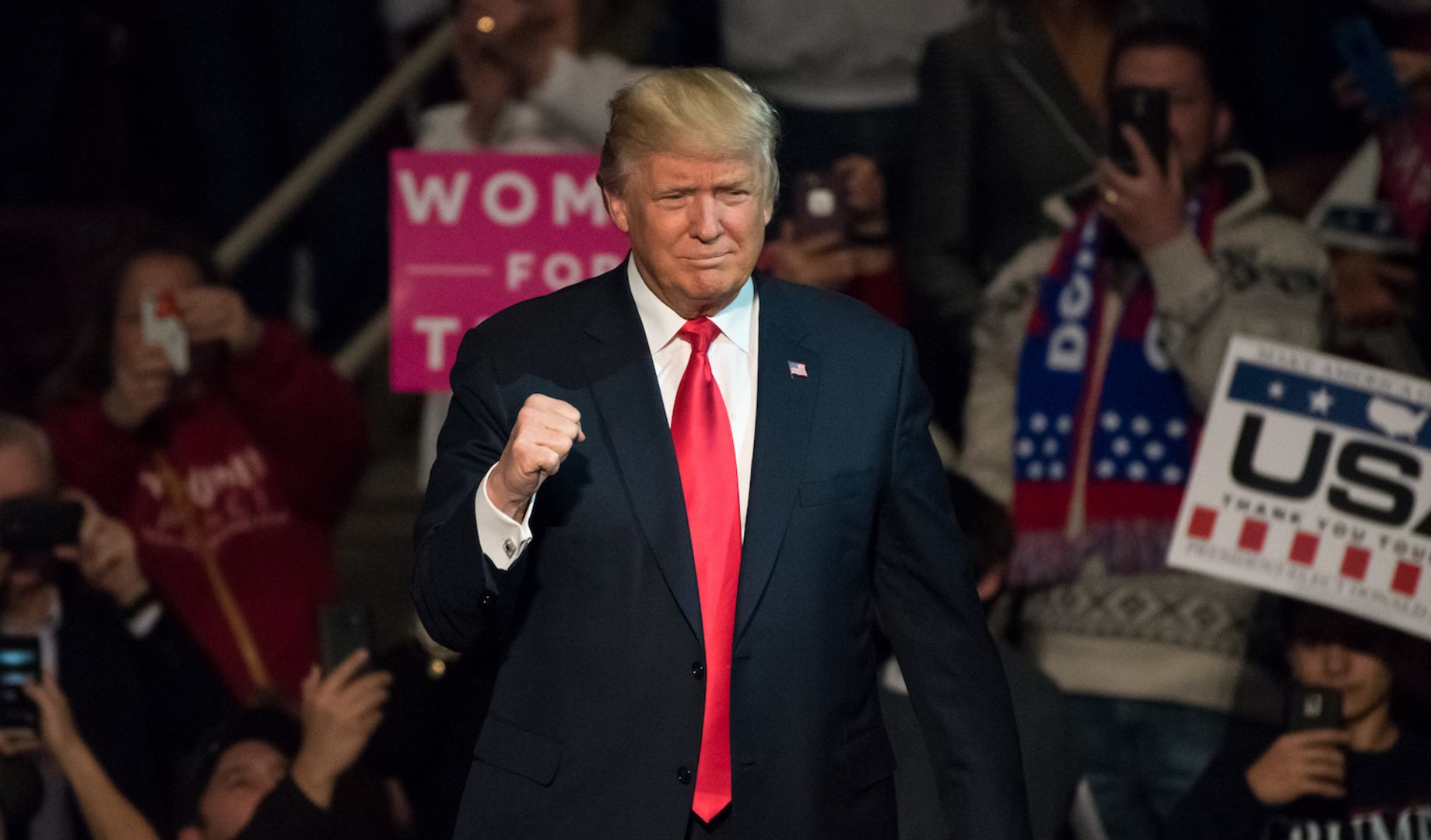

The continuing string of lame economic data, however, has not seemed to deter U.S. President Trump from his tariff policies.

“Somebody said all the shelves are going to be open,” Trump said early Wednesday. “Well, maybe the children will have two dolls instead of 30 dolls, and maybe the two dolls will cost a couple of bucks more than they would normally. … They have ships that are loaded up with stuff, much of which we don’t need.”

Uncategorized

Robinhood Tops Q1 Earnings Estimates, Boosts Buyback Authorization by $500M

Robinhood (HOOD) topped tempered analyst estimates in the first quarter of 2025, reporting adjusted earnings per share of $0.37 against forecasts for $0.33.

The popular trading platform reported $927 million in total revenue, down from $1 billion in the fourth-quarter, but beating Street expectations of $920.1 million. Crypto-related revenue was $252 million, up 100% from year-ago levels.

Transaction-based revenue of $583 million slipped 13% from $672 million in the fourth quarter.

Robinhood had seen explosive numbers in the fourth quarter, in part thanks to a surge in crypto trading amid euphoria stemming from U.S. President Donald Trump’s presidential win. But the froth in crypto and traditional markets quickly reversed following Trump’s inauguration.

The company added $500 million to its existing $1 billion share repurchase program. To date, HOOD has bought back $667 million, leaving another$833 million under the authorization.

Robinhood’s monthly crypto volumes have historically shown high correlation with Coinbase’s (COIN) retail volumes, but Barclays analyst Benjamin Buddish believes the COIN will have seen a less meaningful decline in trading volumes in the first quarter.

Coinbase is reporting earnings on May 8 and is expected to post a slight decline in revenue to $2.1 billion from $2.27 billion in the previous quarter, while exchange volume is expected to have dropped to $403.8 from $439 billion, according to analysts at FactSet.

HOOD shares are down 2.2% in after hours action.

Uncategorized

Visa and Baanx Launch USDC Stablecoin Payment Cards

Cryptocurrency debit card firm Baanx has partnered with Visa to launch stablecoin payment cards tied to self-custodial wallets, starting in the U.S. with Circle’s USDC dollar pegged token, the companies said.

The Visa cards enable holders to spend USDC directly from their crypto wallets, using smart contracts to move a stablecoin balance upon card authorization from the consumer to Baanx in real time, with Baanx converting the balance into fiat for payment, according to a press release on Wednesday.

Allowing people to manage their money on-chain with the help of major card networks like Visa and Mastercard is a fast growing segment within crypto. Baanx, a firm that specializes in crypto debit cards, is also working with Mastercard on a card linked to MetaMask wallets.

The stablecoin payments is also heating up with Circle recently announcing its own payment network focused initially on cross-border payments and remittances.

Baanx’s stablecoin-linked Visa cards promise a global reach with low-cost cross border payments in the mix, according to the release.

“In many regions, access to stable currency is a luxury. We’re giving people the ability to hold and spend USD-backed stablecoins seamlessly — in a self-custodial, real-time way — anywhere Visa is accepted. This is what the future of finance looks like,” said Simon Jones, chief commercial officer at Baanx in a statement.

“We know the payments ecosystem is still in the early innings of stablecoin adoption, but real-world utility is coming to the forefront, and we’re excited for what’s next,” said Rubail Birwadker, Visa’s head of growth products and partnerships in a statement.

-

Fashion7 месяцев ago

Fashion7 месяцев agoThese \’90s fashion trends are making a comeback in 2017

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe final 6 \’Game of Thrones\’ episodes might feel like a full season

-

Fashion7 месяцев ago

Fashion7 месяцев agoAccording to Dior Couture, this taboo fashion accessory is back

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoThe old and New Edition cast comes together to perform

-

Business7 месяцев ago

Business7 месяцев agoUber and Lyft are finally available in all of New York State

-

Sports7 месяцев ago

Sports7 месяцев agoPhillies\’ Aaron Altherr makes mind-boggling barehanded play

-

Entertainment7 месяцев ago

Entertainment7 месяцев agoDisney\’s live-action Aladdin finally finds its stars

-

Sports7 месяцев ago

Sports7 месяцев agoSteph Curry finally got the contract he deserves from the Warriors